Attached files

| file | filename |

|---|---|

| 8-K - 8-K - II-VI INC | d729549d8k.htm |

A Global Leader in Engineered Materials

& Opto-electronic Components

NASDAQ Global Select: IIVI

B. Riley 15

th

Annual Investor Conference

Francis J. Kramer, President and Chief Executive Officer

May 20, 2014

Exhibit 99.1 |

2

•

Matters discussed in this presentation may contain forward-looking

statements that are subject to risks and uncertainties. These risks and

uncertainties could cause the forward-looking statements and II-VI

Incorporated’s (the Company’s) actual results to differ materially.

In evaluating these forward-looking statements, you should specifically

consider the “Risk Factors”

in the Company’s most recent Form 10-K and

Form 10-Q. Forward-looking statements are only estimates and actual

events or results may differ materially.

•

II-VI Incorporated disclaims any obligation to update information contained

in any forward-looking statement.

•

This presentation contains certain non-GAAP financial measures.

Reconciliations of non-GAAP financial measures to their most comparable

GAAP financial measures are presented at the end of this presentation.

Safe Harbor Statement |

Financial

information for all periods presented reflects Pacific Rare Specialty Metals &

Chemicals Inc.’s tellurium product line as a discontinued operation. Non U.S.

56%

Infrared

Optics

37%

Near –

Infrared

28%

Military &

Materials

Advanced

Products Group

Geography

Segments

FY13 Revenues of $551M by

Markets, Geography and Segments

Founded:

1971

Headquarters:

Saxonburg

Pennsylvania, USA

Profitability:

41 consecutive years since

1973, and counting

Listing:

October 1987

on NASDAQ: IIVI

Locations:

Worldwide presence in over

14 countries

Businesses:

14

businesses

organized

into

5

reportable

segments

Focus:

Growth; AACGR of 17% in

revenues and 18% in

earnings since 1987

EBITDA Margin:

21% to 26%, FY10-FY13

History and Overview

18%

17%

U.S.

44%

At a Glance

3

Industrial

46%

Military

Optical

Communication

Life Sciences:

4%

Markets

20%

22%

Semi. Cap. Equip.: 4%

All Other: 4% |

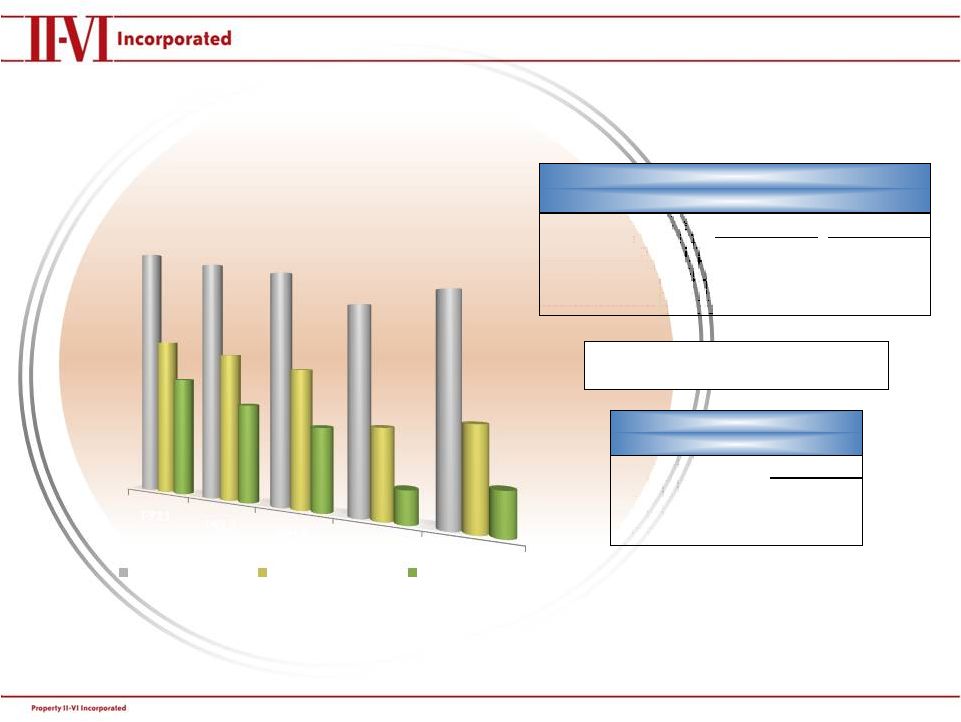

FY15

Planned

Business

Reorganization

Forecasted FY14 Revenues

Under

Current

Structure

$M

Forecasted FY14 Revenues

Under

New

Structure

$M

Reasons for Reorganization

1.

2.

3.

Performance

Products

Photonics

Laser

Solutions

4

APG

M&M

NIR

IR

AOP

205

145

100

120

110

250

215

215

Better

focus

on

end

markets

and

customers

Better

align

business

and

technical

processes

Improve

line

of

sight

on

profitability

and

cash

usage |

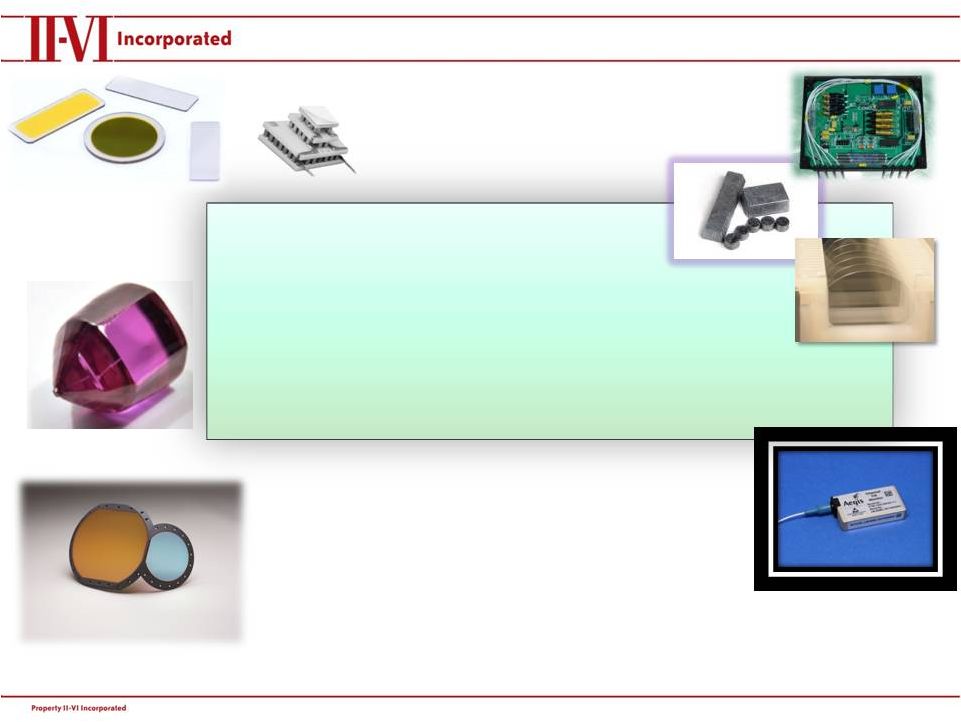

Financial

information for all periods presented reflects Pacific Rare Specialty Metals &

Chemicals Inc.’s tellurium product line as a discontinued operation.

Growth History

Organic Growth + Timely Acquisitions = Strong Financial Results

5

Fiscal Year Revenues ($M)

Fiscal Year Cash Flow from

Operations ($M)

Forecast

Forecast |

Financial

information for all periods presented reflects Pacific Rare Specialty Metals &

Chemicals Inc.’s tellurium product line as a discontinued operation. EBITDA is

defined as earnings before interest, taxes, depreciation and amortization.

Margin History and Expectations

FY15

FY16

Gross Margin %

35% to 38%

37% to 40%

EBITDA Margin %

15% to 18%

19% to 21%

Operating Margin %

7% to 10%

9% to 12%

Expectation Ranges:

Current Margin

FY15-16

Gross Margin %

36% to 40%

EBITDA Margin %

18% to 21%

Operating Margin %

11% to 13%

Previous Margin

Expectation Ranges

•

Acquisitions have delayed our margin

improvement by one year

FY11

FY12

FY13

FY14 Q3

FY14 YTD

41.6%

39.0%

36.9%

31.5%

33.2%

26.0%

23.9%

21.7%

13.6%

14.9%

19.6%

15.8%

13.0%

5.0%

6.4%

Gross Margin %

EBITDA Margin %

Operating Margin %

6 |

Financial

information for all periods presented reflects Pacific Rare Specialty Metals &

Chemicals Inc.’s tellurium product line as a discontinued operation.

Quarterly Revenue & Earnings Per Share

($M except per share data)

7

$0.00

$0.05

$0.10

$0.15

$0.20

$0.25

$0.30

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

Quarterly Revenues

Diluted Earnings Per Share

$0.12

$0.13

$0.15

$0.22

$0.20

$0.25

$0.23 |

FY14

Integration of Acquisitions FY14 Integration of Acquisitions

Ongoing Integration Tasks to Help Achieve Positive Earnings of These Acquisitions:

•

Eliminate reliance on Oclaro for certain transition and manufacturing services,

•

Negotiating our own supply agreements with our contract manufacturers,

•

Reduce Laser Enterprise workforce by 20%; close Tucson, AZ operations,

•

Execute cost reduction plans to ensure product cost competitiveness,

•

Increase Fab utilization focusing on large addressable markets, and

•

Evaluate product portfolio from a standpoint of profitability.

8 |

($ in

thousands) As of June 30, 2013

As of March 31, 2014

Cash and cash equivalents

185,433

$

185,691

$

Total assets

863,802

1,090,064

Long-term debt, including current portion

114,036

263,907

Shareholders' equity

636,108

665,241

Strong Cash and Liquidity

Position Strong Cash and Liquidity Position

•

Growing cash flow position,

•

Investments in product and manufacturing technology development and capacity

expansion, and

•

$20 million open share repurchase program. As of March 31, 2014, purchased

750,000 shares for $12 million.

9 |

ZnS

& ZnSe Material Growth Laser Tools

Current Business

FY13 Revenues:

$203M

End Markets:

Industrial

95%

Military

5%

Est. Market Size:

$560M

Infrared Optics

Infrared Optics

10

•

Fiber-coupled beam delivery systems and processing

tools for industrial lasers at 1 micron wavelength,

including fiber lasers

•

CVD Diamond Optics for EUV Lithography systems

Technology Innovations

•

85%

-

90%

of

revenues

come

from

replacement

optics

needed for the worldwide installed base of over 70,000

high

power

(>1kW)

CO

2

lasers

•

Leading

supplier

of

optics,

components

and

materials

to

manufacturers

and

users

of

infrared/CO

2

lasers |

Near-Infrared Optics

Near-Infrared Optics

FY13 Revenues:

$155M

End Markets:

Optical Comm.

70%

Industrial

20%

Other

10%

Est. Market Size:

$1.6B

11

Current Business

Technology Innovations

Tunable Optical Devices

Micro-Optics and Components

Manufacturer of crystal material, optics, microchip

lasers, opto-electronic modules, tunable optical

channel monitors, fiber couplers, fiber combiners

and thin film filters for optical communications

Products include passive optical components such

as WDM modules, dispersion compensation

modules, switches, isolators and wavelength

lockers for wired (10G/40G/100G) and wireless

applications

Development of 40G and 100G transmission modules |

Military & Materials

Military & Materials

12

Financial information for all periods presented reflects

Pacific Rare Specialty Metals & Chemicals Inc.’s tellurium product line as a

discontinued operation. FY13 Revenues:

$97M

Current Businesses

Technology Innovations

Sapphire and IR Window Assemblies / Dome

Assemblies / Optical Assemblies

Infrared Search &Track (IRST)

Precision optical systems and components for

targeting pods, thermal imaging systems,

space telescopes, medical systems and laser-

based systems

Leader in sapphire based products, including

panels for Joint Strike Fighter’s Optical

Targeting System

Produces frequency selective micro grids

enabling EMI protection and stealth for

military aircraft, land vehicles and missiles

“Snap Together”

precision optical alignment

Conformal windows and domes |

Advanced Products Group

SiC Wafer Growth & Fabrication

Ceramic & Metal Matrix Composite Components

Thermoelectric Devices

Current Businesses

Technology Innovations

13

FY13 Revenues:

$96M

End Markets:

Semiconductor

25%

Industrial

15%

Military

20%

Consumer

10%

Optical Comm.

20%

Life Sciences

10%

Est. Market Size:

$1B

•

Leader in thermoelectric cooling and power generation

solutions

•

Manufacturer of advanced materials and Metal Matrix

Composites and Reaction Bonded Silicon Carbide

•

Manufactures single crystal silicon carbide substrates

for wireless infrastructure, RF electronics and power

switching industries

•

Diameter expansion for single crystal silicon carbide

•

Product development for 300mm and 450mm

diameter lithography systems |

Active

Optical Products Active Optical Products

II-VI Network Solutions

II-VI Laser Enterprise

End Markets:

Optical Communication

70%

Industrial

30%

Est. Market Size:

$6B

14

Current

Businesses

•

Purchased from Oclaro, Inc. in September and November

2013

•

Manufacturer of GaAs semiconductor lasers with industry

leading reliability and power performance and fiber

amplifiers and

micro-optics

•

Products include: fiber coupled multi-emitter pumps for

fiber lasers, high power direct diode bars and stacks, high-

speed VCSELs, 980 nm terrestrial and submarine pumps

and Erbium Doped and Raman Fiber Amplifiers serving

both industrial and optical communications markets Technology

Innovations •

High-power, high-speed vertical cavity surface emitting

lasers (VCSELs)

•

Low dollar per watt fiber laser pump modules •

Amplifier Arrays

|

•

Diverse End Markets

•

Leading Market Positions

•

Global Manufacturing Footprint

•

Proven Financial Success

•

Growth via Organic and Acquisitions

II-VI Advantages

15 |

($000’s,

except %’s; all periods fiscal year) Non-GAAP Reconciliations

Non-GAAP Reconciliations

16

Reconciliation of EBITDA to Net Earnings

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

EBITDA

33,974

46,389

55,156

67,539

79,699

61,531

72,304

126,609

123,213

119,438

Interest expense

412

945

1,790

1,007

242

178

87

103

212

1,160

Depreciation and amortization

9,632

12,705

15,784

15,849

15,474

15,292

20,954

28,313

34,523

40,792

Income taxes

7,080

8,525

10,541

12,241

24,867

7,378

12,515

18,517

17,760

18,766

Goodwill impairment

-

-

17,630

-

-

-

-

-

-

-

Gain on sale of equity investment

-

-

-

-

(26,455)

-

-

-

-

-

Loss (earnings) on discontinued operations, net of taxes

(487)

959

(1,383)

476

(122)

(228)

13

(3,342)

9,443

6,789

Net earnings

17,337

23,255

10,794

37,966

65,693

38,911

38,735

83,018

61,275

51,931

Revenues

142,679

187,242

223,626

254,684

309,747

280,040

333,046

486,638

516,403

551,075

Reconciliation of EBITDA Margin to Return on Sales

2009

2010

2011

2012

2013

EBITDA margin

22.0%

21.7%

26.0%

23.9%

21.7%

As a % of revenues:

Interest expense

0.0%

0.0%

0.0%

0.1%

0.2%

Depreciation and amortization

5.5%

6.3%

5.8%

6.7%

7.4%

Income taxes

2.6%

3.8%

3.8%

3.4%

3.4%

Goodwill impairment

-

-

-

-

-

Gain on sale of equity investment

0.0%

-

-

-

-

Loss on discontinued operations, net of taxes

0.0%

-

-0.7%

1.8%

1.3%

Return on sales

13.9%

11.6%

17.1%

11.9%

9.4%

Reconciliation of Free Cash Flow to Cash Flow from Operations

2009

2010

2011

2012

2013

Free cash flow

35,705

58,487

38,157

47,781

85,267

Capital expenditures

15,439

13,665

40,186

42,797

25,205

Cash flow from operations

51,144

72,152

78,343

90,578

110,472

|