Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KUBOTA PHARMACEUTICAL HOLDINGS CO LTD | acucela-20140519x8k.htm |

Acucela is a clinical-stage biotechnology company that specializes in discovering and developing novel therapeutics to treat and slow the progression of sight-threatening ophthalmic diseases affecting millions of individuals worldwide. 2014 Q1 Announcement Tokyo, JAPAN May 20-21, 2014

DISCLAIMER This presentation contains forward-looking statements concerning our approved products and product development, our technology, our competitors, our intellectual property, our financial condition and our plans for research and development programs that involve risks, uncertainties and assumptions. These statements are based on the current estimates and assumptions of the management of Acucela as of the date of this presentation and are subject to uncertainty and changes in circumstances. Given these uncertainties, you should not place undue reliance upon these forward-looking statements. Such forward-looking statements are subject to risks, uncertainties, assumptions and other factors that may cause the actual results of Acucela to be materially different from those reflected in such forward-looking statements. Important factors that could cause actual results to differ materially from those indicated by such forward- looking statements include, among others, those set forth in our reports on file with the Tokyo Securities Exchange and the United States Securities and Exchange Commission. The Company does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. All statements contained in this presentation are made only as of the date of this presentation. 2014 Q1 Results 2

Introduction

Acucela’s Vision and Mission Vision: Innovative ophthalmology company focused on developing therapies to treat sight- threatening diseases Mission: • To address unmet medical needs in sight-threatening diseases through scientific innovations • To build a unique company with continuous value creation for society • To create an excellent working environment and quality of life for employees 2014 Q1 Results 4

2014 Q1 and Recent Highlights • February: Completed IPO on Mothers Board of Tokyo Stock Exchange (4589) • March: Completed enrollment in Phase 2b/3 “SEATTLE” study ahead of schedule; no financial impact to 2014 estimates • May: Held formal meeting with the FDA to discuss ongoing Phase 2b/3 “SEATTLE” study in patients with GA associated with dry AMD; provided update via May 9, 2014 press release − Acucela intends to continue the study through the original 24-month treatment; and − Depending on the results of the study, which are anticipated to be announced in mid-2016, Acucela will conduct at least one additional confirmatory Phase 3 clinical trial in patients. 2014 Q1 Results 5

Pipeline Chart 2014 Q1 Results 6 Drug PRE-CLINICAL PHASE 1 PHASE 2 PHASE 3 Product Origin (2) Acucela Territory IP Expiration Date Emixustat HCI Acucela North America (joint), EU, South America and Africa, Nov 2029 (Subject to extension)(3) Other VCM and retina product candidates Global OPA-6566 Otsuka US (Joint)(4) April 2025 (5) Stargardt Disease, Retinitis Pigmentosa, Retinopathy of Prematurity Glaucoma AMD V C M Stargardt Disease, Retinitis Pigmentosa, Retinopathy of Prematurity (1) DR/DME (1) Refers to back-up compounds (2) Refers to the party who identified the product candidate. (3) Excludes the potential for additional years of patent protection due to the Hatch-Waxman Act and additional use patents. (4) Following completion of the Phase 2 and Phase 3 clinical trials, subject to our election to co-develop and co-promote OPA-6566. (5) Otsuka, as the originator, may have the ability to apply for an extension of up to five years to increase the patent life for OPA-6566.

Emixustat Hydrochloride

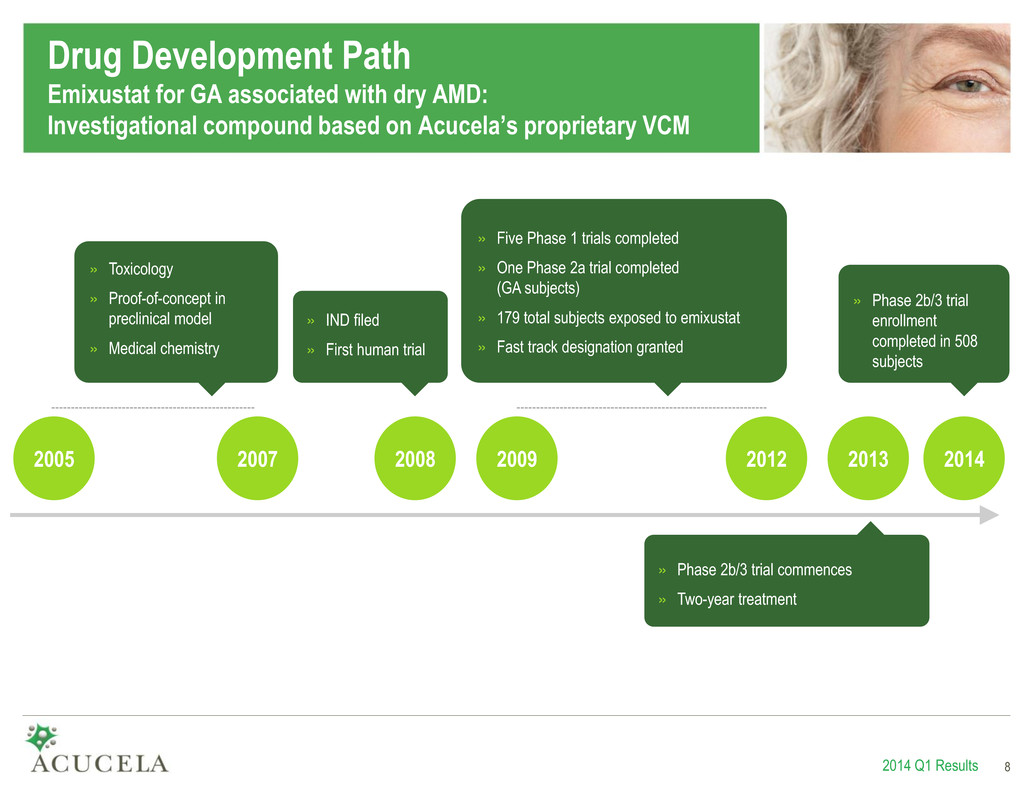

Drug Development Path Emixustat for GA associated with dry AMD: Investigational compound based on Acucela’s proprietary VCM 2014 Q1 Results 8 2005 2007 2009 2012 2013 » Phase 2b/3 trial commences » Two-year treatment » Toxicology » Proof-of-concept in preclinical model » Medical chemistry » Five Phase 1 trials completed » One Phase 2a trial completed (GA subjects) » 179 total subjects exposed to emixustat » Fast track designation granted » IND filed » First human trial 2008 8 2014 » Phase 2b/3 trial enrollment completed in 508 subjects

Phase 2b/3 Emixustat Clinical Trial 2014 Q1 Results 9 • Design − Randomized, double-masked, dose-ranging study comparing the safety and efficacy of emixustat with placebo in patients with GA associated with dry AMD • Objectives − Primary objective – Determine if emixustat reduces the rate of GA lesion progression compared to placebo − Secondary objectives – Evaluate safety and tolerability – Assess changes in best-corrected visual acuity – Evaluate the effect on the development of choroidal neovascularization (wet AMD) • Status − Enrollment completed (N=508) − Top-line 24-month clinical trial results anticipated in mid-2016

Summary of the May 9th Press Release 2014 Q1 Results 10 Recent update on Emixustat Hydrochloride Clinical Development Program • Key Takeaways and Next Steps - Emixustat Hydrochloride Phase 2b/3 “SEATTLE” Study in Patients with GA Associated with Dry AMD − Acucela intends to continue the study through the original 24-month treatment duration without access to interim results − Top-line results of the study are anticipated to be announced in mid-2016 − Depending on the results of the study, at least one confirmatory Phase 3 clinical is expected to be conducted − Depending on the results of the Phase 3 study/studies, an NDA may be filed with the FDA − If an NDA is filed, FDA will assess if the data package for emixustat meets the regulatory requirements for review and approval/marketing clearance • What's Important − There has been no change to the design of the Phase 2b/3 “SEATTLE” study − FDA's recommendations are not based on ANY data review by FDA

Financial Overview

Financial Arrangements with Otsuka Pharmaceutical • Key points on financial arrangements − Emixustat Agreement is a co-development and collaboration agreement to develop and commercialize emixustat and/or other back-up compounds for the treatment of dry AMD and other potential ophthalmic indications − Otsuka paid Acucela a $5.0 million initial license fee and agreed, among other things, to fund up to $40.0 million of all development costs and provide us with a three year $15.0 million cooperative research program relating to emixustat’s other potential indications and its backup compounds − Since 2011, Acucela and Otsuka have been equally sharing the development costs in excess of $40.0 million. Otsuka loans funds to Acucela for the payment of our share of development costs under the agreement, which are repayable(1) from our share of the profits from the commercialization of emixustat, if any, or sale or licensing proceeds, if any − Provides the opportunity for Acucela to earn up to $257.5 million in milestone payments from Otsuka based on the achievement of various development, regulatory and sales objectives 2014 Q1 Results 12 Emixustat Agreement (1) For details regarding payment method to Otsuka, please see Form 10-Q. Please note that there are no financial covenant requirements under our arrangement with Otsuka. There were outstanding advances, including accrued interest, of $33.1 million and $32.9 million under this arrangement as of March 31, 2014 and December 31, 2013, respectively. Source: Acucela Inc. Form S-1 and Form 10-K

Financial Arrangements with Otsuka Pharmaceutical • Key points on financial arrangements − The Glaucoma Agreement provides us the right to exercise our option (“opt-in right”) to co-develop and co-promote OPA-6566 in the US upon the success of Phase 2 and/or Phase 3 clinical trials − Otsuka will fund all development costs prior to our election to opt -in − If we elect to exercise the opt-in right, we are obligated to pay an opt-in fee ranging from $10.0 million to $55.0 million depending on the timing and participation level of co -development and co- promotion (either 25% or 35%) − The Glaucoma Agreement provides for potential milestone payments to Otsuka Pharmaceutical of up to $75.0 million, based upon various clinical and sales objectives for the treatment of glaucoma 2014 Q1 Results 13 Glaucoma Agreement (OPA-6566) Source: Acucela Inc. Form S-1 and Form 10-K

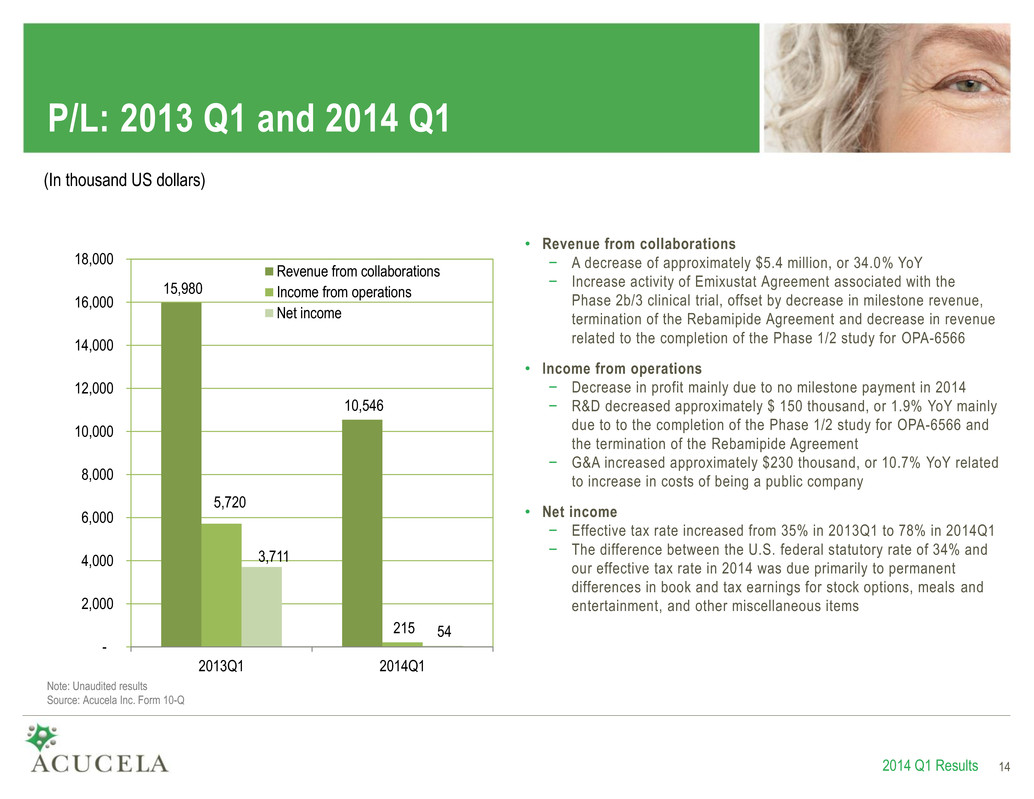

P/L: 2013 Q1 and 2014 Q1 15,980 10,546 5,720 215 3,711 54 - 2,000 4,000 6,000 8,000 10,000 12,000 14,000 16,000 18,000 2013Q1 2014Q1 Revenue from collaborations Income from operations Net income 2014 Q1 Results 14 (In thousand US dollars) Note: Unaudited results Source: Acucela Inc. Form 10-Q • Revenue from collaborations − A decrease of approximately $5.4 million, or 34.0% YoY − Increase activity of Emixustat Agreement associated with the Phase 2b/3 clinical trial, offset by decrease in milestone revenue, termination of the Rebamipide Agreement and decrease in revenue related to the completion of the Phase 1/2 study for OPA-6566 • Income from operations − Decrease in profit mainly due to no milestone payment in 2014 − R&D decreased approximately $ 150 thousand, or 1.9% YoY mainly due to to the completion of the Phase 1/2 study for OPA-6566 and the termination of the Rebamipide Agreement − G&A increased approximately $230 thousand, or 10.7% YoY related to increase in costs of being a public company • Net income − Effective tax rate increased from 35% in 2013Q1 to 78% in 2014Q1 − The difference between the U.S. federal statutory rate of 34% and our effective tax rate in 2014 was due primarily to permanent differences in book and tax earnings for stock options, meals and entertainment, and other miscellaneous items

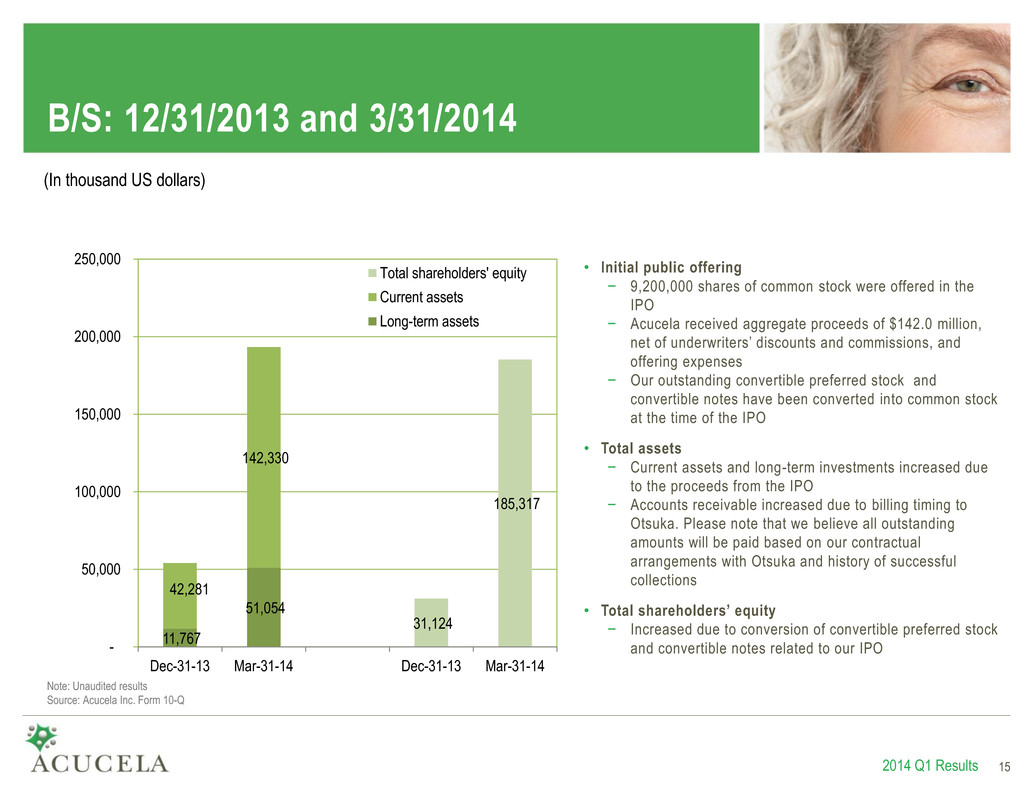

B/S: 12/31/2013 and 3/31/2014 11,767 51,054 42,281 142,330 31,124 185,317 - 50,000 100,000 150,000 200,000 250,000 Dec-31-13 Mar-31-14 Dec-31-13 Mar-31-14 Total shareholders' equity Current assets Long-term assets 2014 Q1 Results 15 (In thousand US dollars) Note: Unaudited results Source: Acucela Inc. Form 10-Q • Initial public offering − 9,200,000 shares of common stock were offered in the IPO − Acucela received aggregate proceeds of $142.0 million, net of underwriters’ discounts and commissions, and offering expenses − Our outstanding convertible preferred stock and convertible notes have been converted into common stock at the time of the IPO • Total assets − Current assets and long-term investments increased due to the proceeds from the IPO − Accounts receivable increased due to billing timing to Otsuka. Please note that we believe all outstanding amounts will be paid based on our contractual arrangements with Otsuka and history of successful collections • Total shareholders’ equity − Increased due to conversion of convertible preferred stock and convertible notes related to our IPO

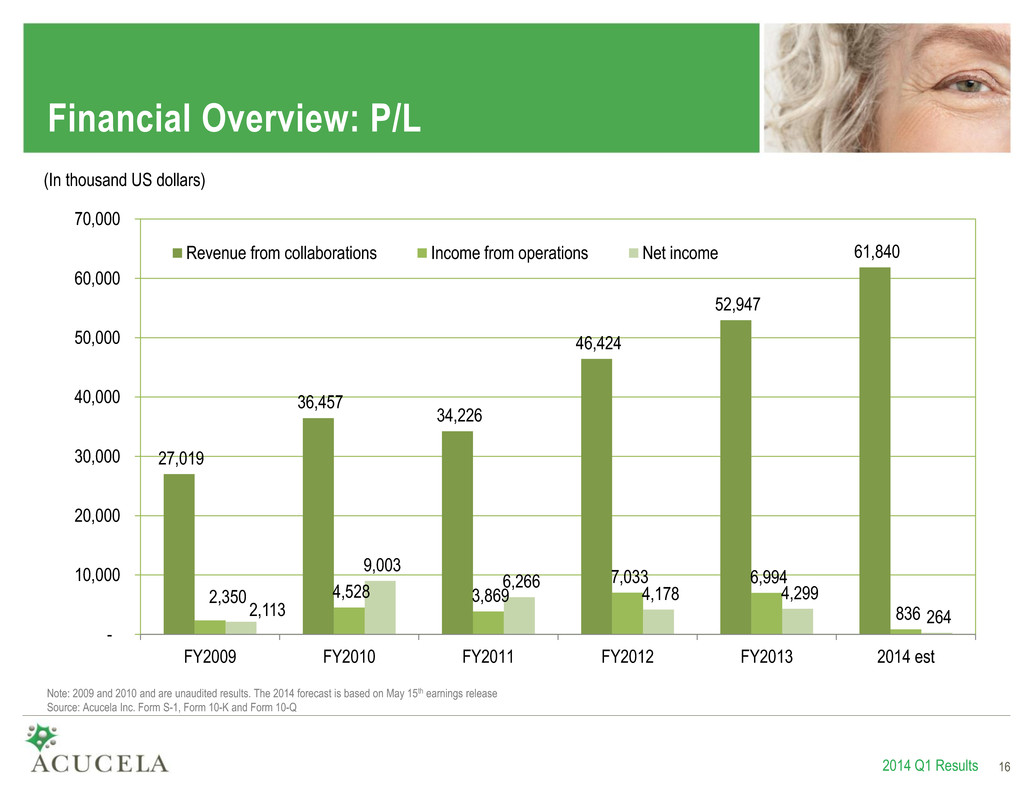

Financial Overview: P/L 27,019 36,457 34,226 46,424 52,947 61,840 2,350 4,528 3,869 7,033 6,994 836 2,113 9,003 6,266 4,178 4,299 264 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 FY2009 FY2010 FY2011 FY2012 FY2013 2014 est Revenue from collaborations Income from operations Net income 2014 Q1 Results 16 (In thousand US dollars) Note: 2009 and 2010 and are unaudited results. The 2014 forecast is based on May 15th earnings release Source: Acucela Inc. Form S-1, Form 10-K and Form 10-Q

Financial Overview: B/S 2014 Q1 Results 17 23,638 34,809 41,495 47,024 54,048 193,384 4,209 14,101 20,840 25,607 31,124 185,317 - 50,000 100,000 150,000 200,000 250,000 FY2009 FY2010 FY2011 FY2012 FY2013 2014 Q1 Total assets Total shareholders' equity (In thousand US dollars) Note: 2009 and 2010 and are unaudited results Source: Acucela Inc. Form S-1, Form 10-K and Form 10-Q

Acucela is a clinical-stage biotechnology company that specializes in discovering and developing novel therapeutics to treat and slow the progression of sight-threatening ophthalmic diseases affecting millions of individuals worldwide.