Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROWAN COMPANIES PLC | v379185_8k.htm |

Execution Year Investor Presentation May, 2014

Forward - Looking Statements 2 This report contains f orward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, as well as statements as to the expectations, beliefs and future expected business, financial performance and prospects of the Company that are based on current expectations and are subject to certain risks, assumptions, trends and uncertainties that could cause actual results to differ materially from those projected by the Company. Among the factors that could cause actual results to differ materially include oil and natural gas prices, the level of offshore expenditures by energy companies, variations energy demand, changes in day rates, cancellation by our customers of drilling contracts, letter agreements or letters of intent or the exercise of early termination provisions, risks associated with fixed cost drilling operations, cost overruns or delays on shipyard repair, construction or transportation of drilling units, maintenance and repair costs, costs or delays for conversion or upgrade projects, operating hazards and equipment failure, risks of collision and damage, casualty losses and limitations on insurance coverage, customer credit and risk of customer bankruptcy,, the general economy and energy industry, weather conditions in the Company’s operating areas, increasing complexity and costs of compliance with environmental and other laws and regulations, changes in tax laws and interpretations by taxing authorities, civil unrest and instability, terrorism and hostilities in our areas of operations that may result in loss or seizure of assets, the outcome of disputes and legal proceedings, effects of the change in our corporate structure, and other risks disclosed in the Company's filings with the U.S. Securities and Exchange Commission. Each forward - looking statement speaks only as of the date hereof, and the Company expressly disclaims any obligation to update or revise any forward - looking statements, except as required by law.

Rowan’s Strategic Transitions And Achievements June 2011 Sold manufacturing business for $1.1 bn in cash June 2011 Initiated 4 rig, $ 3 bn UDW drillship expansion September 2011 Sold Land business for $510 mm in cash December 2011 Completed jack - up newbuild program $3 bn over 5 years 11 high - spec rigs 3 May 2012 Redomesticated to UK and maintained listing on the S&P 500 Index

Following A Clear Strategic Path And Focused On: 4 Continued low operating downtime Execution Successful UDW entry Continued strong safety results Reduced jack - up out of service time Capital Allocation Potential for share buybacks or fleet expansion as free cash flow develops Reinstating quarterly dividend Speculative rig additions unlikely Maintain investment grade balance sheet Cost Effectiveness Reduced off rig costs Improved shipyard project management Reduced Norwegian operating costs

Rowan Is Reinstating A Quarterly Dividend • Initiating a $0.10 per share dividend in Q2 2014 » Confident in the earnings growth expected from Rowan’s well positioned jack - up fleet and ultra - deepwater entry » Expect to be able to sustain and potentially grow the dividend over time » Committed to maintaining an investment grade balance sheet 5

Rowan’s Fleet Is Geographically Diversified 6 6 / North Sea 10 / Middle East 4 / SE Asia 7 / US GOM Drillship #1 19 High - spec Jack - ups 8 Premium Jack - ups 3 Commodity Jack - ups with Skid - base Capability (2) 4 Ultra - Deepwater Drillships (1) 1 / Med 2 / Trinidad Drillship #2 Jack - up Rigs UDW Drillships Drillship #3 (1) Three ultra - deepwater drillships currently under construction; drillship #4 location TBD. (2) Two cold - stacked.

7 Strong Backlog Growth And Diversified Customer Base $1.2 Bn $1.5 Bn 2010 2011 2012 Current $2.2 Bn $5.0 Bn 22% 24% 40% 5% 3% 1% 1% 1% 5% Norway Middle East Deepwater UK SEA Egypt Trinidad Growing Backlog Distributed By Geography Rowan’s Diverse Customer Base GOM As of 04/23/2014 Morrocco

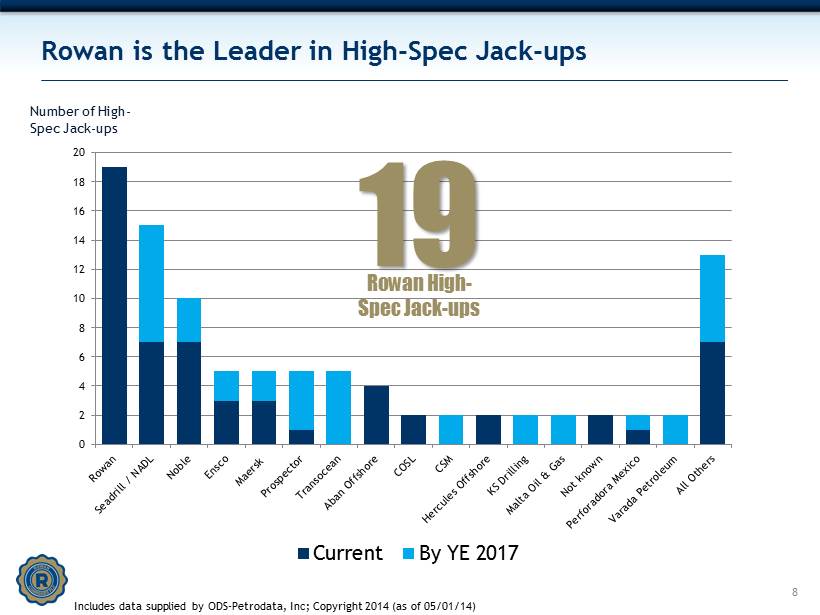

0 2 4 6 8 10 12 14 16 18 20 Current By YE 2017 Rowan is t he Leader in High - Spec Jack - ups Number of High - Spec Jack - ups 19 Rowan High - Spec Jack - ups Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/01/14) 8

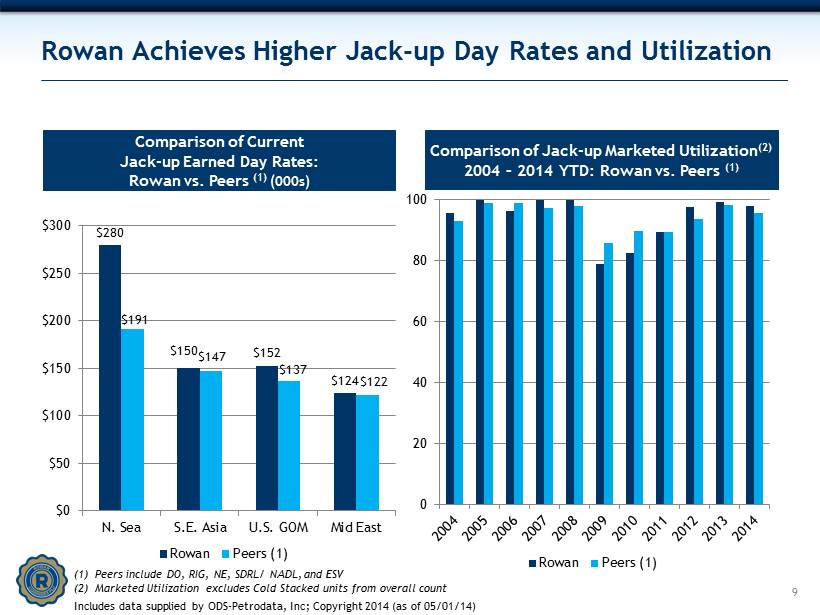

Rowan Achieves Higher Jack - up Day Rates and Utilization Comparison of Current Jack - up Earned Day Rates: Rowan vs. Peers (1) (000s) Comparison of Jack - up Marketed Utilization (2) 2004 – 2014 YTD: Rowan vs. Peers (1) 0 20 40 60 80 100 Rowan Peers (1) (1) Peers include DO, RIG, NE, SDRL/ NADL, and ESV (2) Marketed Utilization excludes Cold Stacked units from overall count $280 $150 $152 $124 $191 $147 $137 $122 $0 $50 $100 $150 $200 $250 $300 N. Sea S.E. Asia U.S. GOM Mid East Rowan Peers (1) 9 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/01/14)

Global Jack - up Fleet Utilization Is 89%, Marketed 95% 10 US GOM Indian Ocean North Sea Mediterranean Middle East Southeast Asia Mexico C&S America West Africa Australia 55% 58 Rigs 93% 56 Rigs 82% 17 Rigs 89% 27 Rigs 100% 36 Rigs 100% 1 Rigs 94% 70 Rigs 90% 146 Rigs 94% 18 Rigs 100% 47 Rigs Fleet Total 520 Rigs Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

Only 182 Competitive Jack - ups Less Than 25 Years Old 0 100 200 300 400 500 600 Total Supply CS / OOS China / Iran Competitive Supply 520 Total Jack - ups 35 Cold Stacked / OOS 56 Non - competitive Countries 429 Competitive Jack - ups 58% Older Than 25 Years 11 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

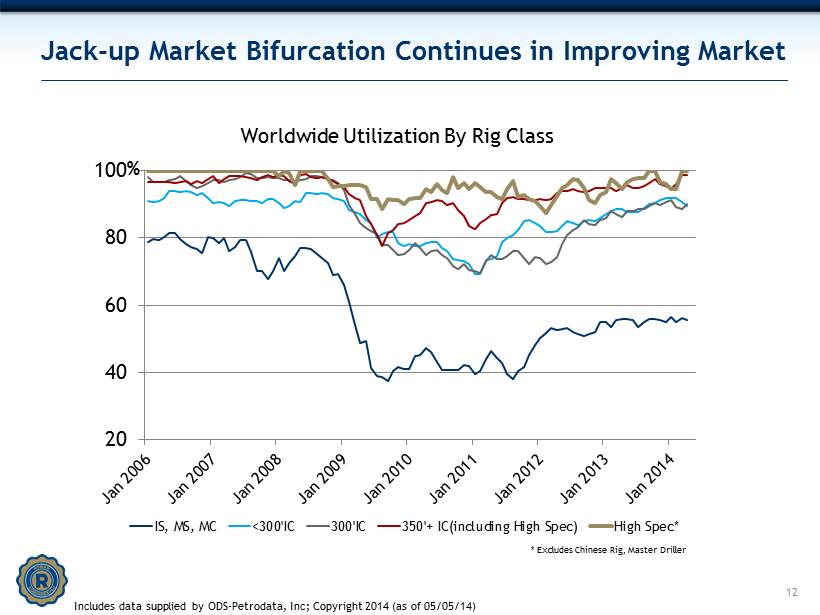

Jack - up Market Bifurcation Continues in Improving Market 20 40 60 80 100 IS, MS, MC <300'IC 300'IC 350'+ IC(including High Spec) High Spec* Worldwide Utilization By Rig Class % * Excludes Chinese Rig, Master Driller 12 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

What’s Driving Bifurcation In The Jack - up Markets? • Operators need greater rig capabilities to drill challenging wellbore designs » Deep shelf gas » Long reach horizontals » HPHT » Large pipe programs/heavy string weights • IOCs and NOCs are focused on achieving lower wellbore costs rather than the lowest day rate • Operators are requiring higher standards post - Macondo 13

0 50 100 150 200 250 300 A Wave Of Jack - up Retirements Could Be Coming 14 World jack - up rig population over 40 years old is growing… # of jack - ups 40+ years JACK - UPS 40+ YEARS IN 10 YEARS 292 26 JACK - UPS 40+ YEARS TODAY Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

Newbuild Jack - ups Needed To Replace Aging Fleet 15 Jack - ups by Year Built JACK - UPS DELIVERED TO - DATE 177 0 10 20 30 40 50 60 70 80 308 JACK - UPS OVER 25 YEARS 322 JACK - UPS IN LATEST CYCLE Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

39 Newbuild Jack - ups are High - Spec 16 • 11% Contracted • ~33% Being built by established drilling contractors • NOCs and IOCs require trained and proven operational and safety systems that many speculative newbuild companies will not be able to provide 7 4 5 24 59 46 0 10 20 30 40 50 60 2014 2015 2016+ Contracted Not Contracted 145 Total Newbuilds 63 31 51 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

0 100 200 300 400 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 YTD High - Spec Rates Have Increased Through Newbuild Cycle 17 Average Earned Day Rate Cumulative Jack - ups Delivered * Premium rigs defined as 350’IC+ (inclusive of high - spec jack - ups) 198 17 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/07/14) $0 $50,000 $100,000 $150,000 $200,000 $250,000 Premium* High Spec

Rowan Is Confident About 2014 Jack - up Fleet Rollovers • Currently, 13 of 30 Rowan jack - ups are scheduled to rollover in 2014 (1) • Seven of the 13 jack - ups are high - spec rigs, and demand for high - spec equipment continues to be strong • Locations : Middle East (4 rigs), GOM (5 rigs), SEA (3 rigs), and Med (1 rig) » All four rigs scheduled to rollover in the Middle East are currently contracted with Saudi Aramco, and Saudi Aramco is expected to increase its jack - up fleet » Rowan jack - ups are expected to roll to higher day rates in 2014 18 (1) As of 04/23/2014 Rowan Fleet Status Report

Rowan Is Entering UDW Market With Advantages • High - specification drillship design with built - in redundancies in critical systems • Core team of highly experienced and respected deepwater professionals in place • Contracting success demonstrates customer enthusiasm for Rowan’s design 19

Rowan UDW Construction Program Progressing • Commenced drilling first UDW rig, Rowan Renaissance , on April 22, 2014 • UDW manpower ramp up progressing as planned • Construction on schedule for next three drillships: Rowan Resolute , Rowan Reliance and Rowan Relentless 20

3 of 4 UDW Drillships Contracted 21 Delivered January 2014 3 Year Contract Commenced April 22, 2014 Rowan Renaissance 1 Delivery June 2014 2 Rowan Resolute Delivery October 2014 3 Rowan Reliance Delivery March 2015 4 Rowan Relentless 3 Year Contract Commences September 2014 3 Year Contract Commences January 2015 2014 2015

22 22 USA Indian Ocean North Sea Middle East Far East Southeast Asia S. America West Africa Australia 96% 27 Rigs 100% 26 Rigs 96% 26 Rigs 100% 12 Rigs 100% 2 Rig 67% 6 Rigs 100% 2 Rigs 100% 1 Rig 100% 1 Rig Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14) Mediterranean 0% 1 Rig Total Fleet 104 Rigs Global Drillship Fleet Utilization i s 95%, Marketed 96%

Few Newbuild Drillships Match Rowan Specs 23 9 4 9 15 12 14 5 6 0 5 10 15 20 25 30 2014 2015 2016 2017+ Contracted Not Contracted 18 21 • 74 Total drillships are under construction – 6 under construction are less than 10,000 ’ • 50% contracted • The Rowan Relentless will be delivered in March 2015, and few drillships match the Relentless’ technical specifications 14 Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14) 21

All of Rowan’s Drillships Equipped With Dual BOP Stack 24 Market Share of UDW Drillships equipped* with 2 BOP Stacks and 1250 Hookload : 31 Units 0 2 4 6 8 10 No. of units * Additional units are listed as Dual Stack “capable,” but they are not equipped with the 2 nd BOP (ex. Ensco) Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 04/16/14)

Floater Market Rapidly Bifurcating 25 50 60 70 80 90 100 <5,000' 5,000'-7,499' 7,500'-9,999' 10,000'+ % Worldwide Utilization by Water Depth Floater Market includes drillships and semis. D ata supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/05/14)

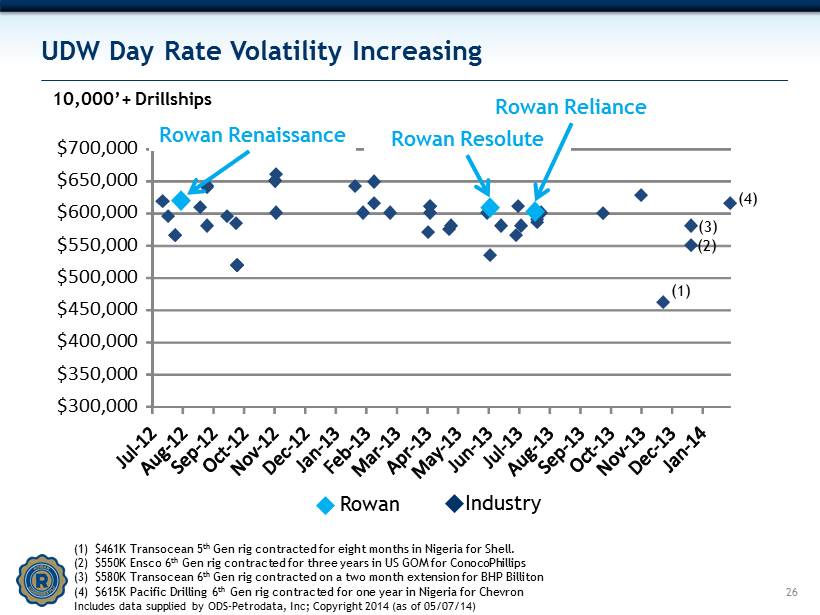

UDW Day Rate Volatility Increasing 26 $619K $608K $602K Rowan Industry Includes data supplied by ODS - Petrodata, Inc; Copyright 2014 (as of 05/07/14) (1) (1) $461K Transocean 5 th Gen rig contracted for eight months in Nigeria for Shell. (2) $550K Ensco 6 th Gen rig contracted for three years in US GOM for ConocoPhillips (3) $580K Transocean 6 th Gen rig contracted on a two month extension for BHP Billiton (4) $615K Pacific Drilling 6 th Gen rig contracted for one year in Nigeria for Chevron $300,000 $350,000 $400,000 $450,000 $500,000 $550,000 $600,000 $650,000 $700,000 (1) 10,000’+ Drillships (2) (3) (4) Rowan Renaissance Rowan Resolute Rowan Reliance

27% 18% - 2% 29% - 24% - 7% 4% 124% 37% 37% 49% - 1% - 2% - 3% 136% 9% 39% 67% - 18% - 5% - 14% -50% 0% 50% 100% 150% 200% 250% RDC NE ATW SDRL DO ESV RIG Estimated Earnings Growth Δ 2013( a) - 2014(e) Δ 2013( a) - 2015(e) Δ 2013( a) - 2016(e) FactSet e stimates as of 05/08/2014 Rowan Drillships Drive Sector Leading EPS Growth 27 Expect further EPS growth in 2016+ when all four drillships operate

2015 Earnings Multiple, Book Value Low 28 As of April 12, 2012 Aggregate Value Price to Share Price to Earnings to EBITDA Book Price 2012 2013 2014 2012 2013 2014 Value ($) (x) (x) (x) (x) (x) (x) Seadrill 50.27 16.7x 10.5x 8.9x 7.4x 6.1x 5.7x 1.1x Transocean 37.27 11.9x 11.0x 9.8x 10.5x 8.4x 2.8x ENSCO 66.02 15.6x 12.9x 10.7x 8.1x 7.0x 6.2x 2.1x Noble 36.53 12.3x 8.7x 6.9x 7.5x 5.9x 5.4x 1.1x Diamond Offshore 53.53 9.7x 8.0x 7.2x 7.7x 6.6x 6.3x 1.1x Rowan 33.99 12.8x 8.8x 7.0x 8.0x 6.0x 5.0x 1.0x Atwood Oceanics 44.03 10.6x 8.5x 7.1x 8.3x 6.4x 5.0x 1.7x Mean 12.8x 9.8x 8.2x 8.2x 6.8x 6.0x 1.6x Median 12.3x 8.8x 7.2x 8.0x 6.4x 5.7x 1.1x As of May 8, 2014 Aggregate Value Price to Share Price to Earnings to EBITDA Book Price 2013 2014 2015 2013 2014 2015 Value ($) (x) (x) (x) (x) (x) (x) $35.97 6.9x 11.0x 9.5x 11.1x 9.2x 8.0x 2.1x $41.47 10.2x 9.6x 10.4x 6.7x 6.6x 6.6x 0.9x $51.26 8.5x 8.9x 8.5x 6.9x 7.0x 6.4x 0.9x $30.49 10.0x 8.9x 7.7x 7.3x 5.9x 5.3x 0.8x $51.81 13.0x 14.2x 10.9x 6.4x 6.6x 5.2x 1.6x $31.14 15.2x 12.9x 7.3x 8.9x 7.1x 4.9x 0.8x $47.43 8.9x 8.3x 6.5x 8.2x 7.2x 5.6x 1.3x 10.4x 10.6x 8.7x 7.9x 7.1x 6.0x 1.2x 10.0x 9.6x 8.5x 7.3x 7.0x 5.6x 0.9x

1.89% 1.65% 3.27% 2.47% 1.37% 0.80% 0.74% 1.32% 1.10% Execution And On Rate Time Top Priorities 11% 11% 14% 10% 9% 8% 13% 10% 13% 10% 6% 5% Out of Service Operational Downtime Includes shipyard, transit and inspection days when: Rigs are on contract and available to earn day rate, but off rate due to operational issues. Rig is mobilizing or undergoing modifications between contracts and often compensated, but revenue is deferred. Rig is undergoing inspections, refurbishments, upgrades and generally not compensated. — — 7 - 9% Est. 10% 12% 29

Rowan Newbuild Drillship Program Fully Financed (in millions) Actual 03/31/2014 Projected 12/31/2014 Cash and available credit $2,440 $1,200 Total Debt $2,808 $2,807 Total Debt - to - Cap 36% 35% Net Debt - to - Cap 22% 33% 30 Investment Grade Balance Sheet (Baa3/BBB - ) Rowan Newbuild Capex With Four Drillships $465 MM 2014 2015 $1,292 MM In January 2014 Rowan completed an $800 million public debt offering and increased its revolver to $1 billion (2) (1) Includes approximately $162 million for mobilization, commissioning, riser gas - handling equipment, software certifications and drillship fleet spares to support deepwater operations expected to incur for the remainder of 2014. (2) Projected 12/31/2014 reflects increase in revolving credit facility from $750 million to $1 billion, currently undrawn. (1)

31 Rowan is One Team built around great equipment, great people, and a shared set of values and purpose.

Appendix 32

Rowan May 6, 2014 Guidance 1Q 2014 Actual 2Q 2014 Projected FY 2014 Projected Jack - up Out of Service Time 13% 10% 7 - 9% Jack - up Operational Downtime (unbillable) 1.1% 2.5% 2.5% Drillship Operational Downtime (1) N/A N/A Slightly higher than 5% Contract Drilling Expenses (excluding rebills) $212 M $245 - $250 M $950 - $965 M SG&A $30 M $35 - $37 M $130 - $140 M Depreciation $71 M $78 - $79 M $310 - $320 M Interest Expense, Net of Capitalized Interest $21 M $27 - $28 M $95 - $100 M Effective Tax Rate 0.7% Low Single Digits Single Digits Capital Expenditures $522 M N/A $2.1 B 33 (1) Rowan expects operational downtime for the drillships to be approximately 5% after approximately six - months up to one year break in period when operational downtime could be somewhat higher.

Current Rowan Avg. Regional Offshore Rig Operating Costs 34 Region Jack - ups Gulf of Mexico Low – Mid $50s Middle East Mid $50s – Mid $70s U.K. North Sea Mid – High $80s Norway North Sea Low - Mid $160s Southeast Asia Mid – High $50s Trinidad Mid $60s – Low $70s (000’s per day) As of 05/06/2014. Ranges exclude mobilization amortization and rebills. Daily operating costs vary by rig class and region. Hi gher capable rigs generally earn higher day rates and typically have higher operating costs per day. During shipyard stays, crew and other pe rso nnel - related costs are usually capitalized rather than expensed. Region Drillships Gulf of Mexico High $160s – High $170s West Africa Low $210s – Mid $220s

2014 Operating Cost Components 53% 12% 18% 4% 1% 3% 9% Labor & Fringes Employee-related * R&M Insurance Rig moves Rebillables All other ** 35 * Employee - related costs include training, catering and crew transportation ** Other includes rentals, medics, agent commissions, satellite communications and other misc. drilling costs

Outstanding Debt is $2.8B as of March 31, 2014 March 31, 2014 Carrying Value 5% Senior Notes, due 2017 $399,031 7.875% Senior Notes, due 2019 $498,252 4.875% Senior Notes, due 2022 $712,821 4.75% Senior Notes, due 2024 $399,600 5.4% Senior Notes, due 2042 $398,374 5.85% Senior Notes, due 2044 $399,889 $2,807,967 36 weighted - average annual interest rate is 5.6%

Rowan Drillships Built With The Operator In Mind • Two seven - ram BOPs • Equipped with 12,000 ft of riser • DP - 3 compliant with retractable thrusters • Five mud pumps with dual mud systems • Four million pound riser tensioning system • Third load path • Accommodations for 210 people on board 37 Expanded Capabilities And Built - in Redundancies Rowan’s first UDW drillship, Rowan Renaissance , was delivered from HHI in South Korea on January 17, 2014 and is expected to commence on a three - year contract offshore West Africa with Repsol in April 2014.

Glossary of Terms and Acronyms Blowout Preventer (BOP): An emergency shut - off device comprised of a series, or “stack”, of valves that shut the wellbore in the event that hydrocarbons enter the wellbore and pressure containment is compromised. The BOP is intended to serve as a pressure control system of last resort. Cold - stacked Rig: An offshore rig that is not actively marketed and is completely down - manned. Cold stacked rigs generally require significant time and capital expenditures to reactivate. Day rate Contract : A contractual agreement where a drilling contractor is paid a daily rate. Customer carries majority of the operating risk so long as the drilling contractor meets the basic standards of equipment and personnel specified by the contract. Estimated Planned Off Rate Time : Defined by Rowan as those days where a rig will not be available to earn any revenue due to shipyard, transit, inspection periods, or suspension of operations. High - specification Rig : Defined by Rowan as rigs with a two million pound or greater hook - load capacity. Hook - load: A commonly used metric to define the lifting capacity of a rigs drawworks and derrick system. Operational Downtime : When a rig is under contract and unable to conduct planned operations due to equipment breakdowns or procedural failures. Operational downtime will result in a related revenue reduction. The company expects operational downtime to account for approximately 2.5% of in - service days. Out of Service Days: I nclude days for which no revenues are recognized other than operational downtime and stacked days (cold - stacked days or off rate between contracts). The company may be compensated for certain out - of service days, such as for shipyard stays or for transit periods preceding a contract ; however recognition of any such compensation received is deferred and recognized over the period of drilling operations. Utilization : A rate that specifies the percentage of time that a rig (or fleet of rigs) earned day rate in a specified period. 38

Investor Contact: Suzanne M. Spera Director, Investor Relations sspera@rowancompanies.com 713.960.7517 Rowan Companies 2800 Post Oak Blvd. Suite 5450 Houston, TX 77056 713.621.7800 www.rowancompanies.com