Attached files

| file | filename |

|---|---|

| 8-K - KAMAN CORPORATION FORM 8-K - KAMAN Corp | form8-k.htm |

1

Investor Presentation

May 19, 2014

2

Forward Looking Statements

FORWARD-LOOKING STATEMENTS

This presentation contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements also may be included in other publicly available documents issued by the company and in oral statements made by our officers and

representatives from time to time. These forward-looking statements are intended to provide management's current expectations or plans for our future operating and

financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as "anticipate," "intend," "plan," "goal,"

"seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "would," "could," "will" and other words of similar meaning in connection with

a discussion of future operating or financial performance. Examples of forward looking statements include, among others, statements relating to future sales, earnings,

cash flows, results of operations, uses of cash and other measures of financial performance.

Forward-looking statements also may be included in other publicly available documents issued by the company and in oral statements made by our officers and

representatives from time to time. These forward-looking statements are intended to provide management's current expectations or plans for our future operating and

financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as "anticipate," "intend," "plan," "goal,"

"seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "would," "could," "will" and other words of similar meaning in connection with

a discussion of future operating or financial performance. Examples of forward looking statements include, among others, statements relating to future sales, earnings,

cash flows, results of operations, uses of cash and other measures of financial performance.

Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause the company's actual results

and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among

others: (i) changes in domestic and foreign economic and competitive conditions in markets served by the company, particularly the defense, commercial aviation and

industrial production markets; (ii) changes in government and customer priorities and requirements (including cost-cutting initiatives, government and customer shut-

downs, the potential deferral of awards, terminations or reductions of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts

resulting from Congressional actions or automatic sequestration); (iii) changes in geopolitical conditions in countries where the company does or intends to do business;

(iv) the successful conclusion of competitions for government programs and thereafter contract negotiations with government authorities, both foreign and domestic; (v)

the existence of standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; (vi) the conclusion to

government inquiries or investigations regarding government programs, including the resolution of the Wichita subpoena matter; (vii) risks and uncertainties associated

with the successful implementation and ramp up of significant new programs; (viii) potential difficulties associated with variable acceptance test results, given sensitive

production materials and extreme test parameters; (ix) the receipt and successful execution of production orders for the JPF U.S. government contract, including the

exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill impairment evaluations; (x) the

continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; (xi) the accuracy of current cost estimates associated

with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities; (xii) the profitable integration of acquired

businesses into the company's operations; (xiii) the ability to implement our ERP systems in a cost-effective and efficient manner, limiting disruption to our business, and

to capture their planned benefits while maintaining an adequate internal control environment; (xiv) changes in supplier sales or vendor incentive policies; (xv) the effects

of price increases or decreases; (xvi) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future contributions; (xvii) future

levels of indebtedness and capital expenditures; (xviii) the continued availability of raw materials and other commodities in adequate supplies and the effect of increased

costs for such items; (xix) the effects of currency exchange rates and foreign competition on future operations; (xx) changes in laws and regulations, taxes, interest rates,

inflation rates and general business conditions; (xxi) future repurchases and/or issuances of common stock; and (xxii) other risks and uncertainties set forth herein and in

our 2013 Form 10-K.

and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among

others: (i) changes in domestic and foreign economic and competitive conditions in markets served by the company, particularly the defense, commercial aviation and

industrial production markets; (ii) changes in government and customer priorities and requirements (including cost-cutting initiatives, government and customer shut-

downs, the potential deferral of awards, terminations or reductions of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts

resulting from Congressional actions or automatic sequestration); (iii) changes in geopolitical conditions in countries where the company does or intends to do business;

(iv) the successful conclusion of competitions for government programs and thereafter contract negotiations with government authorities, both foreign and domestic; (v)

the existence of standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; (vi) the conclusion to

government inquiries or investigations regarding government programs, including the resolution of the Wichita subpoena matter; (vii) risks and uncertainties associated

with the successful implementation and ramp up of significant new programs; (viii) potential difficulties associated with variable acceptance test results, given sensitive

production materials and extreme test parameters; (ix) the receipt and successful execution of production orders for the JPF U.S. government contract, including the

exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill impairment evaluations; (x) the

continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; (xi) the accuracy of current cost estimates associated

with environmental remediation activities at the Bloomfield, Moosup and New Hartford, CT facilities and our U.K. facilities; (xii) the profitable integration of acquired

businesses into the company's operations; (xiii) the ability to implement our ERP systems in a cost-effective and efficient manner, limiting disruption to our business, and

to capture their planned benefits while maintaining an adequate internal control environment; (xiv) changes in supplier sales or vendor incentive policies; (xv) the effects

of price increases or decreases; (xvi) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future contributions; (xvii) future

levels of indebtedness and capital expenditures; (xviii) the continued availability of raw materials and other commodities in adequate supplies and the effect of increased

costs for such items; (xix) the effects of currency exchange rates and foreign competition on future operations; (xx) changes in laws and regulations, taxes, interest rates,

inflation rates and general business conditions; (xxi) future repurchases and/or issuances of common stock; and (xxii) other risks and uncertainties set forth herein and in

our 2013 Form 10-K.

Any forward-looking information provided in this presentation should be considered with these factors in mind. We assume no obligation to update any forward-looking

statements contained in this presentation.

statements contained in this presentation.

Contact: Eric Remington

V.P., Investor Relations

(860) 243-6334

Eric.Remington@kaman.com

3

Non-GAAP Figures

Certain measures presented in this presentation are “Non-GAAP”

items. These figures are denoted with an asterisk (*).

items. These figures are denoted with an asterisk (*).

Reconciliations from GAAP measures to the Non-GAAP measures are

presented in Appendix I to this presentation and our recent earnings

releases filed with the U.S. Securities and Exchange Commission.

presented in Appendix I to this presentation and our recent earnings

releases filed with the U.S. Securities and Exchange Commission.

4

Aerospace

37%

21%

42%

Kaman Corporation - 2013 Sales Overview

63%

37%

Distribution

Aerospace

$1.7B Revenues

12%

5

Kaman Corporation Overview

|

AEROSPACE

|

DISTRIBUTION

|

||

|

Aerosystems

|

Specialty Bearings &

Engineered Products |

Fuzing & Precision

Products |

|

|

|

|

|

|

|

• Engineering design and

testing • Tooling design & manufacture

• Advanced machining and

composite aerostructure manufacturing • Complex assembly

• Helicopter MRO and support

|

• Self-lube airframe

bearings • Traditional airframe

bearings • Flexible drive systems

|

• Bomb safe and arm

fuzing devices • Missile safe and arm

fuzing devices • High precision measuring

systems • Memory products

|

• Bearing and power

transmission products • Fluid power products

• Automation, control and

energy products • Systems and services

across all product groups |

|

• Global commercial and defense OEM’s

• Super Tier I’s to subcontract manufacturers

• Aircraft operators and MRO

• Specialized aerospace distributors

|

• U.S. and allied militaries

• Weapon system OEMs

|

• Virtually every industry in

North America |

|

|

• “One Kaman” approach combining design and build

capabilities provide customers with a global integrated solution • Bearing product lines have a mostly commercial

customer base, which is expected to provide growth from new program wins and increasing build rates |

• Exclusivity and

significant backlog are expected to provide a stable revenue base |

• Offers customers single-

source responsibility and accountability for a comprehensive portfolio of complimentary product lines |

|

Product

Business

Dynamic

Customer

6

Business Strengths

• Secular trends helping to drive significant long-term growth opportunities

in both Aerospace and Distribution segments

in both Aerospace and Distribution segments

• Improved balance across the Aerospace segment between commercial

and defense programs

and defense programs

– Increasing content of bearing products on new platforms

– Higher commercial build rates driving bearing and aerostructure sales

– New program ramp ups and wins provide offset to lower defense

spending

spending

• Distribution business gaining scale and capabilities via acquisitions and

enhancing complementary product platforms

enhancing complementary product platforms

• Investing in new product development and applications, acquisitions and

technology for long-term growth

technology for long-term growth

• Strong balance sheet to drive growth and strategic initiatives

• Experienced management team

7

2013 Sales: $614 million

Aerospace

37%

8

Aerospace Business Drivers

• Kaman is well positioned to further penetrate Commercial OEM’s and

Super Tier 1’s

Super Tier 1’s

– Proactive “One Kaman” business development efforts have increased

bid activity

bid activity

– Proven capability to provide flexible low cost solutions

– Broadening geographic footprint to better serve customers and to

provide lower cost option manufacturing alternatives

provide lower cost option manufacturing alternatives

• Achieve cost synergies through deeper shared services across the

organization with a common ERP system as a critical enabler

organization with a common ERP system as a critical enabler

• Increasing production levels at Boeing and Airbus and A350 launch will

support near term specialty bearing & aerostructures growth

support near term specialty bearing & aerostructures growth

• Defense platforms provide exposure to key vertical lift and reset programs

• Sole source long-term contractual position and solid backlog on key

fuzing program provides stable revenue base

fuzing program provides stable revenue base

9

Aerospace Strategy

• DEPTH - Size/financial strength to address larger, integrated work

packages from primes/OEMs and Tier 1s

packages from primes/OEMs and Tier 1s

• DIVERSITY - Balance portfolio through increased commercial

content

content

• DIFFERENTIATION - Continue to move from build-to-print to design-

and-build for higher margins and more defensible positions

and-build for higher margins and more defensible positions

• DEVELOPMENT - Increased, focused investments in our people and

infrastructure to increase capabilities and drive improved

performance

infrastructure to increase capabilities and drive improved

performance

10

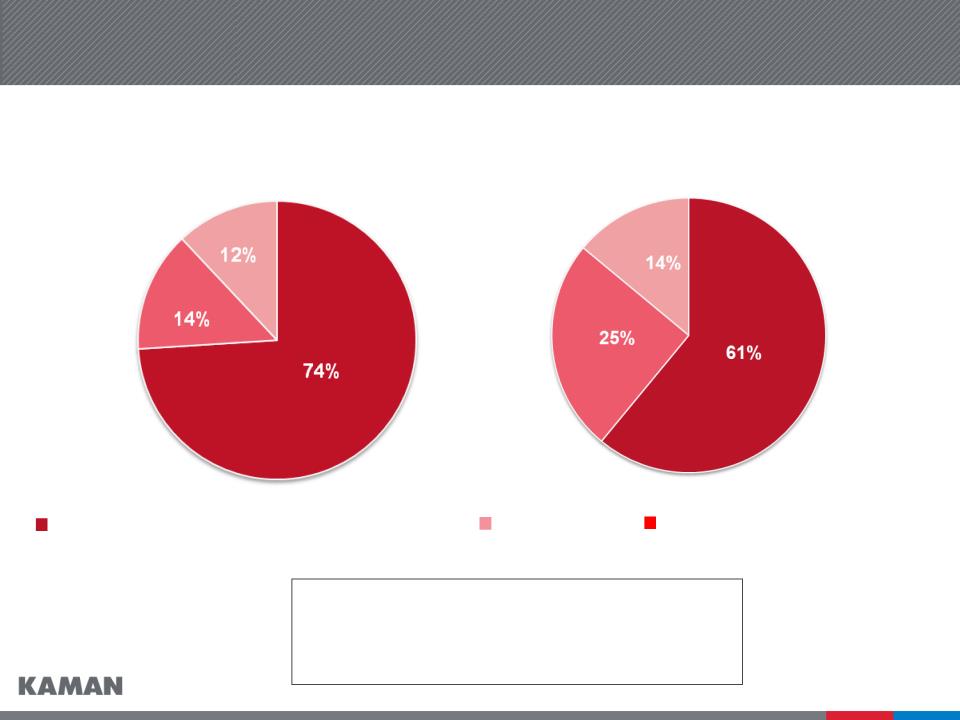

Aerospace Sales Mix 2009 vs. 2013

2009

Sales = $501 million

2013

Sales = $614 million

Defense Aerospace

31%

48%

21%

37%

42%

21%

Fuzing

Commercial Aerospace

Significantly higher relative growth rates in our commercial aerospace portfolio have

resulted in improved balance. Commercial sales increased by 46% from 2009 to

2013.

resulted in improved balance. Commercial sales increased by 46% from 2009 to

2013.

11

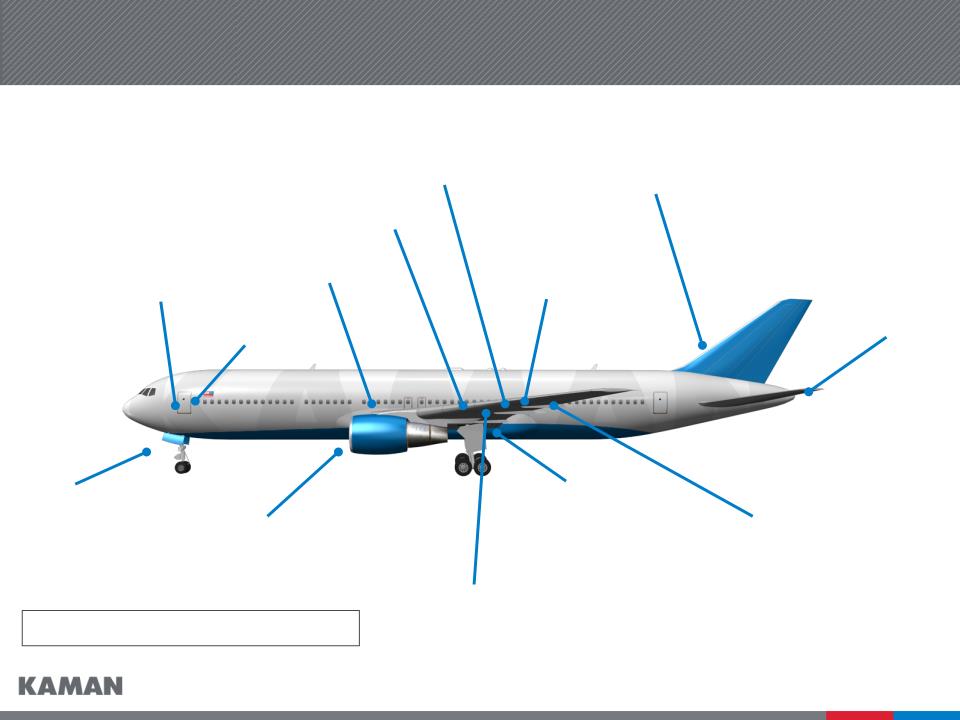

Fixed trailing edge

Access doors

Top covers

Red denotes bearing products

Nose landing gear

Horizontal

stabilizer

stabilizer

Main landing gear

Flaps

Rudder

Door assemblies

Engine/thrust reverser

Aircraft Programs/Capabilities

Flight controls

Doors

Fixed leading edge

12

Manufacture of cockpit

Manufacture and assembly

of tail rotor pylon

of tail rotor pylon

Manufacture

subassembly

subassembly

Blade manufacture,

repair and overhaul

repair and overhaul

Driveline couplings

Bushings

Flight control bearings

Aircraft Programs/Capabilities

Red denotes bearing products

13

Market leading self lube airframe bearing product lines

• Content on virtually every aircraft manufactured today with a growing

installed base

installed base

• Approximately 75% of sales are for commercial applications

• Proprietary technology:

– KAron® bearing liner system

– KAflex® and Tufflex® flexible couplings

• Approximately 95% of sales are for custom engineered applications

• Operational excellence through lean manufacturing

14

Fuzing Products

HARPOON

MAVERICK

FMU-139

TOMAHAWK

JPF

STANDARD

MISSILE

MISSILE

SLAM-ER

SLAM-ER

AMRAAM

TOMAHAWK

STANDARD

MISSILE

MISSILE

AGM-65M

KPP Fuzes are on a majority of major U.S.

weapons systems

weapons systems

AMRAAM

15

• USAF bomb fuze of choice

• USAF inventory levels are less than half

desired quantity

desired quantity

• Recently awarded USAF contract

extends sole source position into 2017

extends sole source position into 2017

• Backlog of $131 million as of 3/28/2014

• 27 foreign customers

• System reliability exceeds 98% and

operational reliability is greater than 99%

operational reliability is greater than 99%

Bomb Compatibility

- JDAM

- Paveway II and III

- GBU-10, 12, 16, 24, 27, 28, 31,

32, 38, 54

32, 38, 54

- BLU-109, 110, 111, 113, 117,

121, 122, 126

121, 122, 126

- MK82/BSU-49, MK83/BSU-85,

MK84/BSU-50

MK84/BSU-50

JPF Program

16

• 747-8 wing-to-body fairing

• A350 airframe bearings

• G280 winglet

• G7000/G8000 fixed leading

edge

edge

• AH-1Z cabin

• Learjet 85 composite door

• Trent 700 nacelle panels

• P-8 composite operator

stations

stations

New Programs

Provides growth, improves customer balance, and increases program diversity.

Leverages core competencies and broadening areas of expertise.

17

Leveraging Customer Relationships - Bell/Textron Case Study

|

Early

1980’s

|

Developed a driveshaft for the U.S. Army’s UH-1 helicopter

|

|

Mid

1980’s

|

Developed technology to replace driveshaft's across the Bell

fleet of commercial and military aircraft |

|

2009

|

Awarded a five year $53M contract to build composite helo.

blade skins and skin core assemblies for eight Bell models |

|

2011

|

Awarded a contract with a potential value of more than $200

million to manufacture and assemble cabins for the AH-1Z - the largest structure ever outsourced by Bell

|

|

2013

|

Delivered significant structural components for the recently

introduced Textron AirLand Scorpion prototype aircraft |

Continually providing quality value added solutions has led to a growing relationship

that is projected to exceed $40 million in sales annually

18

New Global Aerospace Growth Investments

1. Lancashire, UK - new tooling facility

2. Höchstadt, Germany - new bearing manufacturing facility

3. Goa, India - composites manufacturing joint venture

19

Aerospace - Impact of Defense Spending

• We believe the diversity of our defense programs positions us well

to weather potential budget cuts

to weather potential budget cuts

– Joint Programmable Fuze - under contract through 2015, foreign

demand, continued sole source

demand, continued sole source

– A-10 re-wing program for Boeing - under contract through

shipset 173, 72% of the total program

shipset 173, 72% of the total program

– AH-1Z integrated fuselage for Bell/USMC - new business

• Improved commercial balance provides more stable Aerospace

revenue base

revenue base

20

New Zealand SH-2G(I)

• Have entered into a $120 million

contract with the New Zealand

Ministry of Defence for the sale of

ten Kaman SH-2G(I) aircraft

contract with the New Zealand

Ministry of Defence for the sale of

ten Kaman SH-2G(I) aircraft

• Three year delivery schedule

• Work under this program has begun

and more than $20 million in

revenue was recognized in 2013

and more than $20 million in

revenue was recognized in 2013

• Program is expected to generate

$60-65 million in cash over three

years

$60-65 million in cash over three

years

21

Unmanned K-MAX®

• Kaman/Lockheed teamed to provide

an unmanned military version of the

K-MAX helicopter

an unmanned military version of the

K-MAX helicopter

• K-MAX aircraft began performing

unmanned cargo resupply missions

in Afghanistan during December

2011 and have completed more than

1,700 missions and delivered more

than 4 million pounds of cargo

unmanned cargo resupply missions

in Afghanistan during December

2011 and have completed more than

1,700 missions and delivered more

than 4 million pounds of cargo

• “It’s kind of the rock star of the

Marine Corps unmanned aviation in

the past year,” - Major Dave

Funkhouser, Unmanned Aviation

Capabilities Integration Officer, US

Marine Corps

Marine Corps unmanned aviation in

the past year,” - Major Dave

Funkhouser, Unmanned Aviation

Capabilities Integration Officer, US

Marine Corps

Photograph by Corporal Lisa Tourtelot, United States Marine Corps.

22

Aerospace - Key 2014 Operational Objectives

• Begin production in new German bearing and UK tooling facilities

• Transition start up programs to full rate production to improve cash

flow generation

flow generation

• Build on the growth and profitability of bearing and fuzing product

lines

lines

• Continue successful execution of the New Zealand SH-2(G)I contract

• Transition production of the 747-8 wing-to-body fairing program to

Kaman’s facilities from Boeing Winnipeg

Kaman’s facilities from Boeing Winnipeg

• Build upon our “One Kaman” strategy that offers customers a one stop

solution for their aerosystems needs

solution for their aerosystems needs

• Continue deployment of common ERP system across Aerosystem

business units

business units

23

Distribution

2013 Sales: $1.07 Billion

63%

24

Distribution Overview

• Industrial distribution firm with $35 billion served market via three product

platforms

platforms

– Bearings and mechanical power transmission

– Fluid power

– Automation, control and energy

• Major product categories

– Bearings

– Mechanical and electrical power transmission

– Fluid Power

– Motion control

– Automation

– Material handling

– Electrical control and power distribution

• 256 locations and 5 distribution centers

• Executing growth strategy to achieve long-term sales and profit objectives

25

Distribution Business Drivers

• The addition of hydraulic, automation and motion control products

adds content to MRO customers and meets the continued trend of

customers transitioning to higher-technology applications, sensing

equipment, energy efficiency and productivity solutions

adds content to MRO customers and meets the continued trend of

customers transitioning to higher-technology applications, sensing

equipment, energy efficiency and productivity solutions

• Manufacturers are increasing their use of national contracts to

consolidate supply of MRO goods to production facilities and are

driving compliance to its contracted suppliers

consolidate supply of MRO goods to production facilities and are

driving compliance to its contracted suppliers

• Increased municipal investment in water, wastewater, and

supporting control system infrastructure will benefit Kaman, which

has unique products to service this sector

supporting control system infrastructure will benefit Kaman, which

has unique products to service this sector

• Improved residential construction fundamentals are anticipated to

drive increased demand across numerous industries served by

Kaman

drive increased demand across numerous industries served by

Kaman

26

Distribution Strategy

• SCALE THROUGH GROWTH - Broaden and diversify product

offering organically and through acquisitions. Expand geographic

footprint to enhance position in the national accounts market

offering organically and through acquisitions. Expand geographic

footprint to enhance position in the national accounts market

• PRODUCTIVITY - Recognize benefits from organizational

realignment and implement multi-faceted technology investments

realignment and implement multi-faceted technology investments

• PROFITABILITY - Recognize sales and cost synergies from the

thirteen acquisitions completed from 2010 to 2013. Enhance margins

through new higher margin product lines, a focus on pricing

management and leverage increased purchasing scale

thirteen acquisitions completed from 2010 to 2013. Enhance margins

through new higher margin product lines, a focus on pricing

management and leverage increased purchasing scale

27

Product Platform Transformation

Bearings and Mechanical Power Transmission

Fluid Power

Automation, Control and Energy

2009

Sales = $630 million

2013

Sales = $1,068 million

Sales increase since 2009

Automation, Control and Energy ~ 200%

Fluid Power ~ 100%

Bearings and Power Transmission ~ 40%

28

Distribution Major Product Platforms

|

Product Platform

|

Bearings & Mechanical

Power Transmission (BPT)

|

Fluid Power

|

Automation, Control and

Energy (ACE) |

|

% of 2013 Sales

(approximate)

|

61%

|

14%

|

25%

|

|

Market Size

|

$12.5 Billion

|

$7.2 Billion

|

$15.0 Billion

|

|

Acquisitions since 2008

|

• Industrial Supply Corp.

• Allied Bearings Supply

• Plains Bearing

• Fawick de Mexico

• Florida Bearings

• Ohio Gear and Transmission

|

• Catching Fluidpower

• INRUMEC

• Northwest Hose

• Western Fluid Comp.

• B.W. Rogers

|

• Zeller

• Minarik

• Automation Technology

• Target Electronic Supply

• B.W. Rogers

|

|

Major Suppliers

|

29

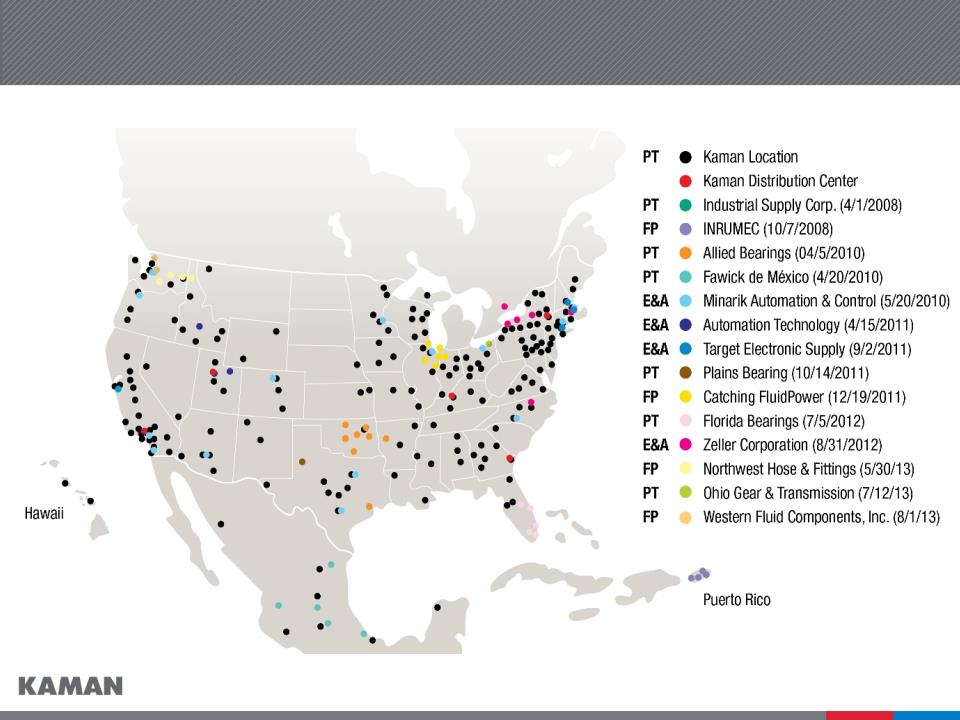

Executing Strategy and Building Network

30

Distribution ERP Technology Investments

• Technology investments will consolidate twelve disparate Distribution

systems and numerous sub-systems to one state of the art enterprise

-wide business system

systems and numerous sub-systems to one state of the art enterprise

-wide business system

• Infor Distribution SX.e is the leading distribution ERP solution

Benefits

• CRM tool will provide critical info to sales teams driving higher sales

volume

volume

• Reduced transaction and response times will drive productivity gains

– Quotes and orders

– Support expediting requirements

– Electronic document exchange with customers and suppliers

• Ability to consolidate and analyze purchasing requirements will lower

procurement costs and increase profitability

procurement costs and increase profitability

31

• Our largest acquisition in Distribution, closed April 25, 2014

• Broad line distributor of fluid power and automation products

• Sales of approximately $100 million

• Adds exposure in steel, life sciences, food & beverage, power

generation and automotive industries

generation and automotive industries

• Strong product knowledge and experience in all Parker fluid power

products

products

• The addition of sales from B.W. Rogers makes Kaman the sixth largest

fluid power distributor in the U.S. (currently ninth largest)

fluid power distributor in the U.S. (currently ninth largest)

• Added twelve ParkerStores to Kaman’s network bringing the total to

thirty

thirty

• Geographically located in areas where KIT was under-represented

B.W. Rogers Acquisition - Overview

32

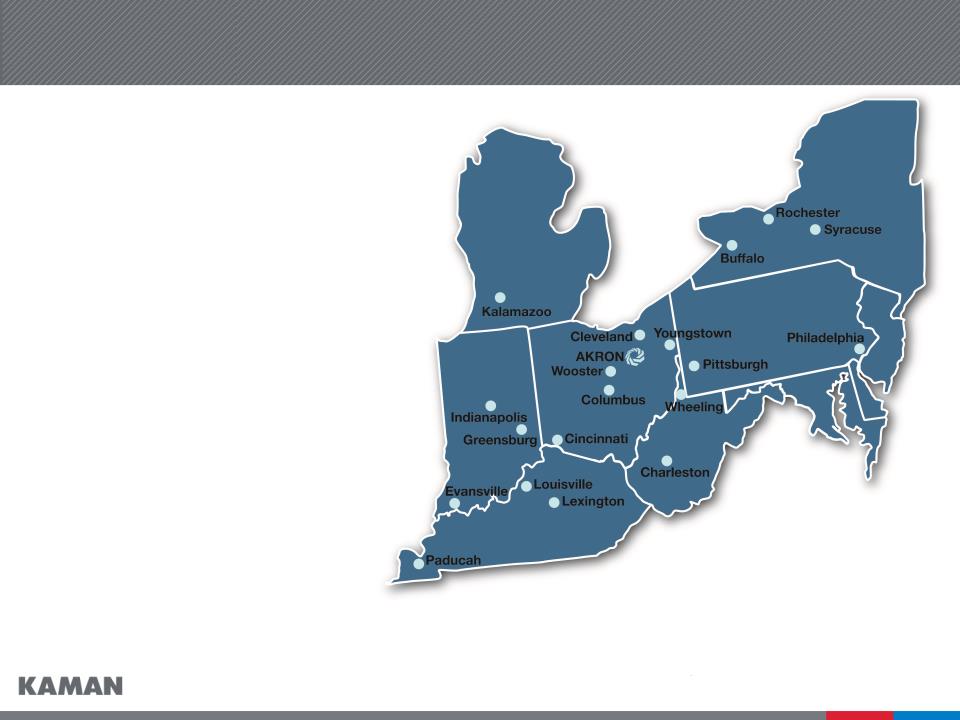

B.W. Rogers - Store Locations

• Twenty-one locations across

seven states

seven states

• Headquartered in Akron, OH

33

B.W. Rogers and Parker

• Tri-motion Parker

Distributor

• Twelve ParkerStores

• The acquisition creates a contiguous Parker territory for Kaman from

Pennsylvania to Chicago

Pennsylvania to Chicago

• A Parker distributor since 1947, one of their longest standing distributors

34

Distribution - Key 2014 Operational Objectives

• Increase organic growth, capitalizing on expense leverage, through

increased customer engagement and broader product offering across

our three business platforms

increased customer engagement and broader product offering across

our three business platforms

• Integrate the B.W. Rogers acquisition

• Begin deployment of new ERP system that will consolidate disparate

systems and drive significant productivity enhancements

systems and drive significant productivity enhancements

• Leverage strong supplier relationships to increase sales of higher

margin product lines

margin product lines

• Continue to pursue accretive acquisitions and gain additional sales

and cost synergies from the twelve acquisitions completed since 2010

and cost synergies from the twelve acquisitions completed since 2010

35

Kaman Investment Merits

• A Leading Market Position in Both Business Segments

• Continued Focus on Earnings Growth, Cash Flow Generation and

Strengthening Competitive Position

Strengthening Competitive Position

• Strong Liquidity and Conservative Financial Profile

• Disciplined and Focused Acquisition Strategy

• Experienced Management Team

36

Financial Information

37

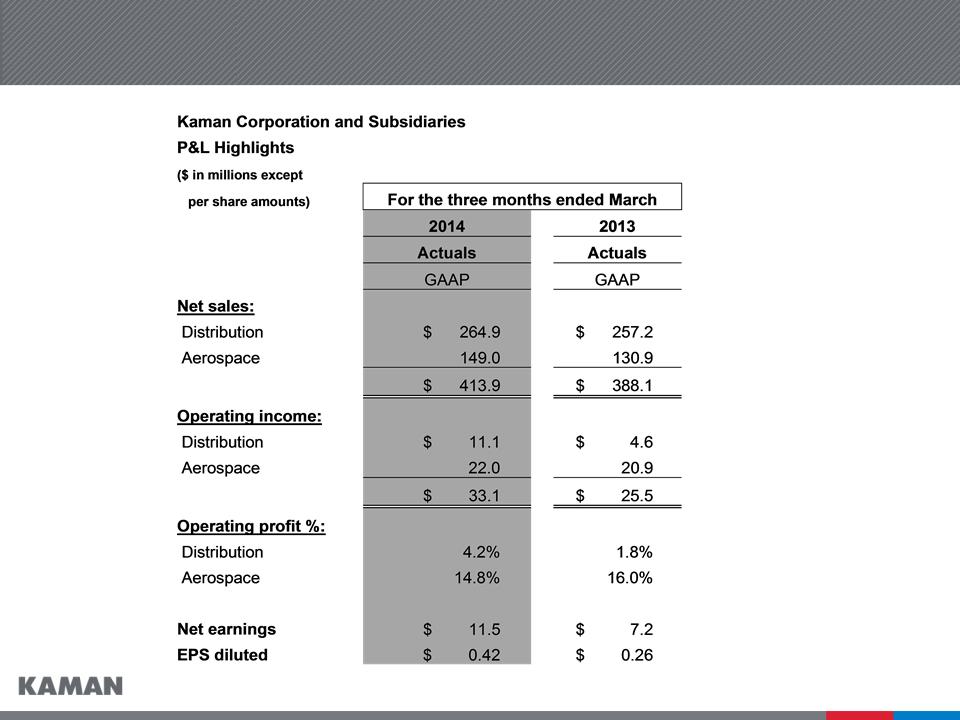

Financial Highlights - Q1 2014

38

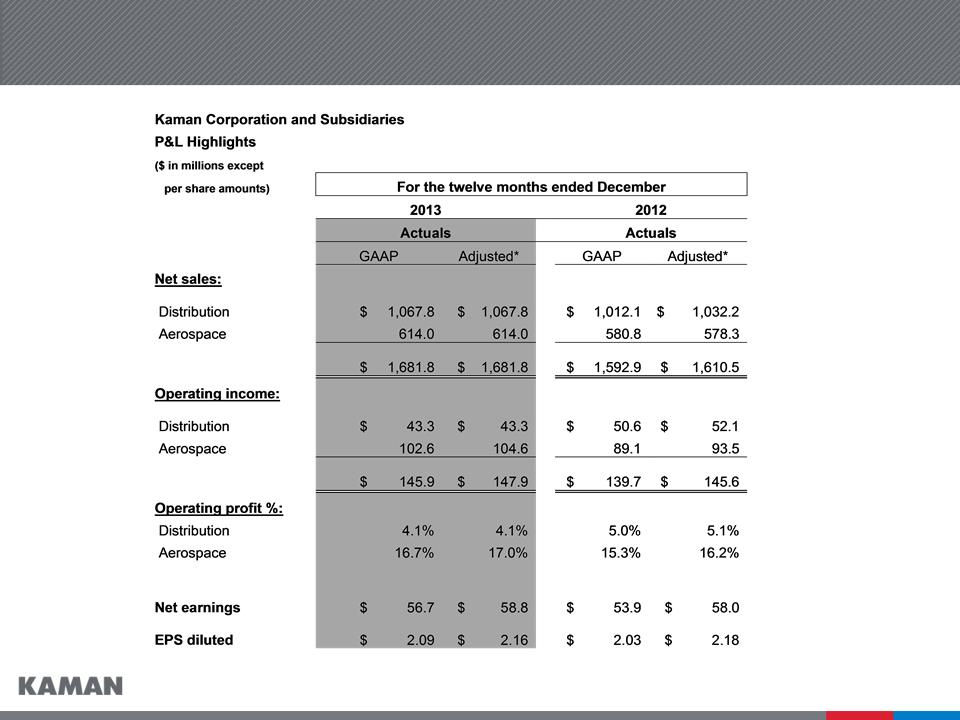

Financial Highlights - Full Year 2013

39

Balance Sheet, Capital Factors, and Cash Flow Items

|

(In Millions)

|

As of 3/28/14

|

As of 12/31/13

|

As of 12/31/12

|

|

Cash and Cash Equivalents

|

$ 8.0

|

$ 10.4

|

$ 16.6

|

|

Notes Payable and Long-term Debt

|

$ 291.6

|

$ 275.2

|

$ 259.6

|

|

Shareholders’ Equity

|

$ 521.6

|

$ 511.3

|

$ 420.2

|

|

Debt as % of Total Capitalization

|

35.9%

|

35.0%

|

38.2%

|

|

Capital Expendituresa

|

$ 11.7

|

$ 40.9

|

$ 32.6

|

|

Depreciation & Amortizationa

|

$ 8.2

|

$ 31.9

|

$ 28.4

|

|

Free Cash Flow*a

|

$ 23.6

|

$ 21.6

|

$ 52.0

|

)

(

aYTD 3/28/2014

40

Appendix I

Non-GAAP Reconciliations

Non-GAAP Reconciliations

41

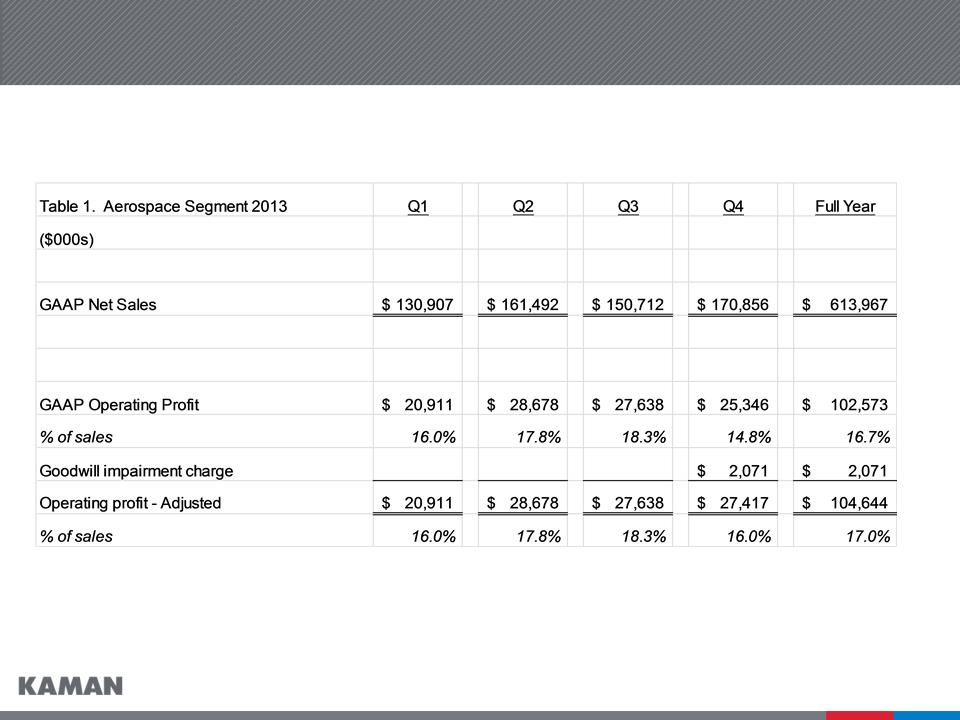

Reconciliation of Non-GAAP Financial Information

42

Reconciliation of Non-GAAP Financial Information

43

Reconciliation of Non-GAAP Financial Information

44

Reconciliation of Non-GAAP Financial Information

45

Reconciliation of Non-GAAP Financial Information

46

Reconciliation of Non-GAAP Financial Information

47

Reconciliation of Non-GAAP Financial Information