Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - InfuSystem Holdings, Inc | d730430d8k.htm |

Exhibit 99.1

Leading Supplier of Infusion Services

A Letter from our CEO

| Eric K. Steen

|

InfuSystem’s 2013 was a year of growth and strategic focus. Developing and implementing our strategic plan allowed InfuSystem to take advantage of trends in the marketplace, particularly in the areas of electronic medical record integration and expansion of our iPad initiative. Positioning ourselves for further growth, we expanded our geographic footprint, opening a larger Los Angeles facility and adding a new Houston location, each offering same-day delivery of equipment to both our direct pay and 3rd party payor customers.

For the year ended December 31, 2013, net income was $1.7 million, or 8 cents per diluted share, versus a net loss of $1.5 million in 2012. Revenue grew to $62.3 million, compared to $58.8 million in 2012. InfuSystem increased our total number of payor contracts, and increased our sales efforts in both pain management and in smart pumps. We reduced general and administrative costs by $1.4 million while our selling costs improved as a percentage of revenue, decreasing from 17% to 16%. Also in 2013, InfuSystem won Centers for Medicare & Medicaid Services (CMS) bids to provide infusion pumps through 2016 in nine Metropolitan Statistical Areas (MSA). We are one of only three national providers to win bids in all nine MSA. These winning bids reflect our expertise in the reimbursement pricing environment. |

Since joining as CEO on April 1, 2013, I’ve immensely enjoyed working with the InfuSystem team. My appreciation and thanks go out to each and every colleague. They embraced change enthusiastically, contributing many new ideas to help transform our company.

My new management team is a collection of veterans and new hires who are collaborating and cooperating on issues that impact both sides of the business. The team now includes Chief Operating Officer Jan Skonieczny, who has been with InfuSystem for over 20 years and led our successful CMS bidding in 2013. Jonathan Foster joined as Chief Financial Officer in 2013 after serving on an interim basis the previous year. He led financial stability initiatives in 2013, including debt restructuring, improved liquidity and advanced depreciation analysis, and moved InfuSystem’s various entities to a single financial software platform providing even greater analytical access. Mike McReynolds, Chief Information Officer, joined in 2013 and leads an enhanced and expanded IT group that is working to automate processes and improve internal efficiencies. Mike is delivering innovative electronic connectivity solutions to both business units. With IT innovation, and enhanced customer and partner connectivity, comes efficiency and increased profitability. The long-term goal is 100% electronic data exchange making our company and our customers more efficient.

While 2013 was a year of improvements, both operationally and financially, 2014 will be a year with even more IT advancements designed to gain share and reduce costs, with continued expansion of our product portfolio, therapy offering, and geographic footprint.

During my first earnings call with investors in April, 2013, I said, “InfuSystem is a leader in IV oncology, and oncology is the fastest growing segment in IV therapy. The population is growing, cancer rates are increasing; IV chemotherapeutic agents are a proven treatment method. I find it a privilege to dedicate my professional energies to helping people lead healthy lives.” As I begin my second year of service as Chief Executive Officer of InfuSystem, those sentiments still resonate.

With regard,

Eric K. Steen

Chief Executive Officer

Opportunity for Growth…

Year over Year

|

InfuSystem Holdings, Inc. and Subsidiaries

|

|||||||||

| Consolidated Statements of Operations and Comprehensive |

12 Months Ended | |||||||||

| Dec. 31, 2013 | Dec. 31, 2012 | |||||||||

| Net revenues: |

||||||||||

| Rentals |

$ | 55,962 | $ | 53,471 | ||||||

| Product sales |

6,318 | 5,357 | ||||||||

| Net revenues |

62,280 | 58,828 | ||||||||

|

|

|

|

|

|||||||

| Cost of revenues: |

||||||||||

| Cost of revenues - Product, service and supply costs |

11,274 | 9,165 | ||||||||

| Cost of revenues - Pump depreciation and loss on disposal |

7,327 | 6,752 | ||||||||

| Gross profit |

43,679 | 42,911 | ||||||||

|

|

|

|

|

|||||||

| Selling, general and administrative expenses: |

||||||||||

| Provision for doubtful accounts |

6,534 | 5,251 | ||||||||

| Amortization of intangible assets |

2,618 | 2,734 | ||||||||

| Selling and marketing |

9,658 | 9,864 | ||||||||

| General and administrative |

18,973 | 23,062 | ||||||||

| Total selling, general and administrative: |

37,783 | 40,911 | ||||||||

|

|

|

|

|

|||||||

| Operating income |

5,896 | 2,000 | ||||||||

|

|

|

|

|

|||||||

| Other Income (loss): |

||||||||||

| Interest expense |

(3,497 | ) | (3,340 | ) | ||||||

| Loss on extinguishment of long-term debt |

(671 | ) | ||||||||

| Other income (expense) |

301 | (141 | ) | |||||||

| Total other loss |

(3,196 | ) | (4,152 | ) | ||||||

|

|

|

|

|

|||||||

| Income (loss) before income taxes |

2,700 | (2,152 | ) | |||||||

|

|

|

|

|

|||||||

| Income tax (expense) benefit |

(1,031 | ) | 663 | |||||||

| Net income (loss) |

1,669 | (1,489 | ) | |||||||

|

|

|

|

|

|||||||

| Net Income (loss) per share: |

||||||||||

| Basic |

$ | 0.08 | $ | (0.07 | ) | |||||

| Diluted |

$ | 0.08 | $ | (0.07 | ) | |||||

| Weighted average shares outstanding: |

||||||||||

| Basic |

21,868,379 | 21,430,012 | ||||||||

| Diluted |

22,074,513 | 21,430,012 | ||||||||

| Comprehensive Income (loss): |

||||||||||

| Net income (loss) |

1,669 | (1,489 | ) | |||||||

| Reclassification of hedging losses, net of taxes |

136 | |||||||||

| Comprehensive income (loss) |

$ | 1,669 | $ | (1,353 | ) | |||||

|

|

|

|

|

|||||||

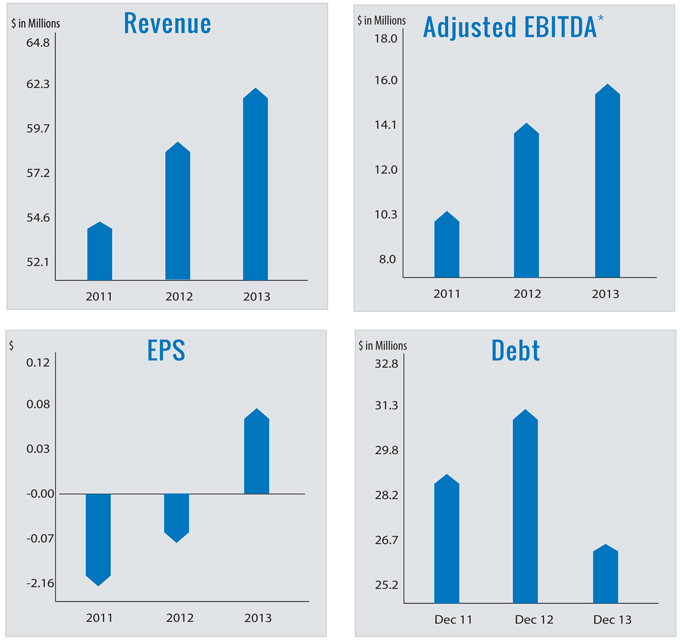

Past Performance Graphs

Overview of 2011-2013

About InfuSystem

InfuSystem Holdings, Inc. is a leading provider of infusion pumps and related services to hospitals, oncology practices and other alternate site healthcare providers. Headquartered in Madison Heights, Michigan, the Company delivers local, field-based customer support and also operates Centers of Excellence in Michigan, Kansas, California, Texas and Ontario, Canada. The Company’s stock is traded on the NYSE MKT under the symbol INFU.

| Board of Directors | Executive Management | |

| Eric Steen | Jonathan Foster | |

| Chief Executive Officer | Chief Financial Officer | |

| Ryan Morris | Mike McReynolds | |

| Chairman | Chief Information Officer | |

| David C. Dreyer | Jan Skonieczny | |

| Director | Chief Operating Officer | |

| Joseph Whitters | David Haar | |

| Director | Sr. VP Sales & Marketing - Oncology | |

| Wayne Yetter | Tom Ruiz | |

| Director | Sr. VP Biomedical Sales | |

| John Haggerty | ||

| VP Biomedical Services | ||

Investment Overview

| Share Statistics | Transfer Agent | |

| Shares outstanding as of | Mellon Investor Services LLC | |

| December 31, 2013: 21,960,351 | 480 Washington Blvd. | |

|

Issue Type: Common Stock

Sector: Healthcare |

Jersey City, New Jersey 07310 800-522-6645 | |

| Industry: Healthcare Services | Auditors: BDO USA LLP | |

InfuSystem, Inc.

31700 Research Park Drive, Madison Heights, MI 48071

Cautionary Statement about Forward-Looking Statements

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained in this Annual Report on Form 10-K, including statements regarding the future financial position, liquidity, business strategy, plans, and objectives of management for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “should,” “plan,” “expect,” “strategy,” “future,” “likely,” and similar expressions, as they relate to us, are intended to identify forward-looking statements. We have based these forward-looking statements largely on current expectations and projections about future events and financial trends that we believe may affect financial condition, results of operations, business strategy and financial needs. We undertake no obligation to update any forward-looking statement. Important factors that could cause our actual results and financial condition to differ materially from the forward-looking statements include, without limitation, those described in “Risk Factors” and elsewhere in this Annual Report on Form 10-K, and the following:

| • | our expectations regarding financial condition or results of operations in future periods; |

| • | our expectations regarding potential legislative and regulatory changes impacting, among other things, the level of reimbursement received from the Medicare and state Medicaid programs including CMS competitive bidding; |

| • | our expectations regarding the size and growth of the market for our products and services; |

| • | our ability to execute our business strategies grow our business including our ability to introduce new products and services; |

| • | our ability to hire and retain key employees; |

| • | our ability to remain in compliance with our credit facility; |

| • | our dependence on our Medicare Supplier Number; |

| • | changes in third-party reimbursement processes and rates; |

| • | availability of chemotherapy drugs used in our infusion pump systems; |

| • | physicians’ acceptance of infusion pump therapy over alternative therapies; |

| • | our dependence on a limited number of third party payors; |

| • | our ability to maintain relationships with health care professionals and organizations; |

| • | the adequacy of our allowance for doubtful accounts; |

| • | our ability to comply with changing health care regulations; |

| • | sequestration; |

| • | natural disasters affecting us, our customers or our suppliers; |

| • | industry competition; |

| • | our ability to implement information technology improvements and to respond to technological changes; and |

| • | dependence upon our suppliers. |

These risks are not exhaustive. Other sections of this Annual Report on Form 10-K include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for us to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements. Although we believe that the expectations reflected in the forward looking-statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Therefore you should not rely on any of the forward-looking statements. In addition, with respect to all of our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

| * | Adjusted EBITDA is a non-GAAP financial measure defined as net income, adjusted for interest expense, income tax expense (benefit), depreciation, amortization, Concerned Stockholder Group and retention expenses, early extinguishment of debt, share-based compensation, strategic alternatives and transition expense. For a reconciliation of Adjusted EBITDA to net income, please see the heading “Reconciliation of GAAP to Non-GAAP Financial Measure” in Exhibit 99.1 to the Company’s current report on Form 8-K filed with the Securities and Exchange Commission on March 11, 2014. |

InfuSystem, Inc.

31700 Research Park Drive

Madison Heights, MI 48071

www.InfuSystem.com

800.962.9656