Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Spectrum Brands Holdings, Inc. | d726501d8k.htm |

| EX-99.3 - EX-99.3 - Spectrum Brands Holdings, Inc. | d726501dex993.htm |

| EX-99.1 - EX-99.1 - Spectrum Brands Holdings, Inc. | d726501dex991.htm |

| EX-99.5 - EX-99.5 - Spectrum Brands Holdings, Inc. | d726501dex995.htm |

| EX-99.4 - EX-99.4 - Spectrum Brands Holdings, Inc. | d726501dex994.htm |

Exhibit 99.2

Offer to Exchange

By Harbinger Group Inc. (“HGI,” the “Company,” “we,” “us” and “our”)

up to $350,000,000 aggregate principal amount of

7.750% Senior Notes due 2022 (the “Additional Senior Notes”) (CUSIP 41146AAH9)

for up to an aggregate principal amount described herein of its outstanding

7.875% Senior Secured Notes due 2019 (the “Senior Secured Notes”) (CUSIP 41146AAE6)

| The Offer (as defined below) includes an early tender period which will expire at 5:00 pm, New York City time, on Wednesday, May 28, 2014, unless extended or earlier terminated (such date and time, as the same may be extended or earlier terminated, the “Early Tender Time”). The Offer will expire at 11:59 pm, New York City time, on Wednesday, June 11, 2014, unless extended or earlier terminated (such date and time, as the same may be extended or earlier terminated, the “Expiration Time”). Tendered Senior Secured Notes may be withdrawn in accordance with the terms of the Offer prior to 5:00 pm, New York City time, on Wednesday, May 28, 2014, but not thereafter, other than as required by applicable law, unless such time is extended or earlier terminated by us in our sole discretion (such time, as the same may be extended or earlier terminated, the “Withdrawal Deadline”). Holders (as defined below) must validly tender their Senior Secured Notes at or prior to the Early Tender Time in order to receive the Total Consideration (as defined herein) for such Senior Secured Notes, which includes the Early Tender Payment (as defined below). Holders who tender their Senior Secured Notes after the Early Tender Time but by the Expiration Time will only be eligible to receive, if the Offer is not fully subscribed as of the Early Tender Time, the Offer Consideration (as defined below). If the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange. The Offer is being made upon the terms and subject to the conditions set forth in the Offer Documents (as defined below) and subject to the Tender Cap (as defined below) and any required proration. |

HGI hereby offers (the “Offer”), upon the terms and subject to the conditions set forth in this offering memorandum (as it may be supplemented and amended from time to time, this “Offering Memorandum”) and related letter of transmittal (as it may be supplemented and amended from time to time, the “Letter of Transmittal” and, together with this Offering Memorandum, the “Offer Documents”), to exchange up to $350,000,000 aggregate principal amount (the “Tender Cap”) of its Additional Senior Notes for a portion of its outstanding Senior Secured Notes. As of the date of this Offering Memorandum, the aggregate outstanding principal amount of the Senior Secured Notes is $925.0 million. Upon our acceptance of the Senior Secured Notes validly tendered (and not validly withdrawn) as of the Early Tender Time pursuant to the Offer, subject to the Tender Cap and any required proration, the Senior Secured Indenture Amendments (as defined herein) to the indenture governing the Senior Secured Notes (the “Senior Secured Indenture”) will become operative. For more information on the Senior Secured Indenture Amendments, see “Summary—Recent Developments—Supplemental Indenture.”

Subject to the terms and conditions set forth in the Offer Documents and subject to the Tender Cap and any required proration, we hereby offer to issue to each registered holder of the Senior Secured Notes (each, a “Holder”) who validly tenders Senior Secured Notes at or prior to the Early Tender Time, who does not validly revoke such tender prior to the Withdrawal Deadline and whose Senior Secured Notes are accepted for exchange by us in the Offer, the Total Consideration for each $1,000 principal amount of Senior Secured Notes. Holders who do not validly tender their Senior Secured Notes by the Early Tender Time will not receive the Total Consideration and will only be eligible to receive, if the Offer is not fully subscribed as of the Early Tender Time, the Offer Consideration. If the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will

not have any of their Senior Secured Notes accepted for exchange. The Total Consideration provides Holders who validly tender by the Early Tender Time $1,092.50 principal amount of Additional Senior Notes (which includes the “Early Tender Payment” of $50 principal amount of Additional Senior Notes) per $1,000 principal amount of Senior Secured Notes, and the Offer Consideration provides Holders who validly tender after the Early Tender Time but by the Expiration Time $1,042.50 principal amount of Additional Senior Notes per $1,000 principal amount of Senior Secured Notes, in each case adjusted for accrued and unpaid interest on the Senior Secured Notes tendered and prefunded accrued interest on the Additional Senior Notes issued, to but not including the applicable settlement date. For more information on how the Total Consideration and the Offer Consideration will be calculated, see “The Offer—Consideration.”

The Additional Senior Notes will be issued as additional notes under the indenture governing our 7.750% Senior Notes due 2022 that were issued on January 21, 2014 (the “Existing Senior Notes” and, together with the Additional Senior Notes, the “Senior Notes”), pursuant to which we issued $200,000,000 aggregate principal amount of the Senior Notes. The Additional Senior Notes offered hereby will vote together with the Existing Senior Notes as a single class under the indenture governing the Senior Notes (the “Senior Indenture”) and will have the same terms as those of the Existing Senior Notes.

We will pay interest on the Senior Notes on January 15 and July 15 of each year, commencing on July 15, 2014 with respect to the Additional Senior Notes. Interest on the Additional Senior Notes will accrue from and including January 21, 2014, the issue date of the Existing Senior Notes. The Senior Notes will mature on January 15, 2022. We have the option to redeem all or a portion of the Senior Notes at any time before January 15, 2017 at a redemption price equal to 100% plus a make-whole premium, or on or after January 15, 2017 at the redemption prices set forth herein. In addition, before January 15, 2017, we may redeem up to 35% of the aggregate principal amount of the Senior Notes with the net proceeds of certain equity offerings at the redemption price set forth herein.

Upon the occurrence of certain change of control events, holders of the Senior Notes may require us to repurchase some or all of their Senior Notes at a repurchase price equal to 101% of their principal amount plus accrued and unpaid interest. For a more detailed description of the Senior Notes, see the section entitled “Description of Notes” of the Senior Notes Prospectus (as defined below), which is incorporated by reference herein.

We do not intend to apply for listing of the Senior Notes on any securities exchange or for inclusion of the Senior Notes in any automated quotation system.

Before participating in the Offer, you should carefully read and consider the risk factors described under “Risk Factors” commencing on page 16 of this Offering Memorandum and in the documents incorporated by reference herein.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this Offering Memorandum is truthful or complete. Any representation to the contrary is a criminal offense.

The Additional Senior Notes will be issued pursuant to the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), provided by Section 3(a)(9) of the Securities Act and the exemption from state securities law requirements provided by Section 18(b)(4)(C) of the Securities Act. We have made no arrangements for and have no understanding with any dealer, salesman or other person regarding the solicitation or recommendation of tenders hereunder. Any such solicitation or recommendation of tenders by persons other than HGI must not be relied upon by you as having been authorized by HGI.

May 14, 2014

TABLE OF CONTENTS

| Where You Can Find More Information |

iv | |||

| Special Note Regarding Forward-Looking Statements |

v | |||

| Summary |

1 | |||

| Risk Factors |

16 | |||

| Use of Proceeds |

24 | |||

| Capitalization |

25 | |||

| The Offer |

28 | |||

| Certain U.S. Federal Income Tax Considerations |

42 |

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy these documents at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the public reference room. Our SEC filings are also available over the Internet at the SEC’s website at http://www.sec.gov.

We “incorporate by reference” information into this Offering Memorandum, which means that we may disclose important information to you by referring to those documents. We hereby “incorporate by reference” the documents listed below, which means that we are disclosing important business and financial information to you by referring you to those documents.

| • | Our (i) Annual Report on Form 10-K for the year ended September 30, 2013, filed with the SEC on November 27, 2013 (as amended, the “2013 Annual Report”); and (ii) Amendment Number 1 to the 2013 Annual Report on Form 10-K/A, filed with the SEC on December 6, 2013; |

| • | Our Quarterly Reports on Form 10-Q for the quarter ended December 31, 2013, filed on February 7, 2014, and for the quarter ended March 31, 2014 filed on May 12, 2014; |

| • | Our Current Reports on Form 8-K filed on December 20, 2013, December 23, 2013, December 26, 2013, January 15, 2014, January 21, 2014, February 14, 2014, February 27, 2014 and March 19, 2014 (other than the information furnished therein under Item 7.01 and Item 9.01); |

| • | Our Current Reports on Form 8-K/A filed on March 4, 2014 (other than Exhibit 99.2) and May 3, 2013 (other than Exhibit 99.2); |

| • | the sections describing the Senior Secured Notes entitled “Description of Notes,” and “Risk Factors—Risks Related to the Notes,” contained in the prospectus |

iv

| dated December 31, 2013, filed with the SEC in accordance with Rule 424(b) of the Securities Act on January 3, 2014; |

| • | the sections describing the Additional Senior Notes entitled “Description of Notes,” “Risk Factors—Risks Related to the Notes” and “Book-Entry, Delivery and Form of Securities,” contained in the prospectus dated March 14, 2014, filed with the SEC in accordance with Rule 424(b) of the Securities Act on March 14, 2014 (the “Senior Notes Prospectus”); and |

| • | Future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), (other than the portions of those made pursuant to Item 2.02 or Item 7.01 of Form 8-K or other information “furnished” and not filed with the SEC) after the date of this Offering Memorandum and before the termination of the Offer; |

Upon your oral or written request, we will provide you with a copy of any of these filings at no cost. Requests should be directed to Thomas A. Williams, Executive Vice President and Chief Financial Officer, Harbinger Group Inc., 450 Park Avenue, 30th Floor, New York, NY 10022, Telephone No. (212) 906-8555.

Except as expressly provided above, no other information, including none of the information on our website, is incorporated by reference into this Offering Memorandum.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The Offer Documents contain, and documents incorporated by reference and certain oral statements made by our representatives from time to time may contain, forward-looking statements that are subject to risks and uncertainties that could cause actual results, events and developments to differ materially from those set forth in or implied by such statements. These statements are based on the beliefs and assumptions of HGI’s management and the management of HGI’s subsidiaries, including target businesses. Generally, forward-looking statements include information concerning possible or assumed future actions, events, results, strategies and expectations and are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “plans,” “seeks,” “estimates,” “projects,” “may,” “will” “could,” “might,” or “continues” or similar expressions. Factors that could cause actual results, events and developments to differ include, without limitation: the ability of HGI’s subsidiaries (including, target businesses following their acquisition) to generate sufficient net income and cash flows to make upstream cash distributions, capital market conditions, HGI’s and its subsidiaries’ ability to identify any suitable future acquisition opportunities, efficiencies/cost avoidance, cost savings, income and margins, growth, economies of scale, combined operations, future economic performance, conditions to, and the timetable for, completing the integration of financial reporting of acquired or target businesses with HGI or HGI subsidiaries, completing future acquisitions and dispositions, litigation and other regulatory matters, potential and contingent liabilities, management’s plans, changes in regulations and taxes and other factors described in the Offer Documents or incorporated by reference therein.

v

We claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 for all forward-looking statements.

Forward-looking statements are not guarantees of performance. You should understand that many important factors, in addition to those discussed in the section entitled “Risk Factors” in this Offering Memorandum, under Part I: Item 1A. “Risk Factors” in our 2013 Annual Report, which is incorporated by reference herein, and in the other documents incorporated by reference herein, could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in the forward-looking statements.

vi

SUMMARY

The following summary highlights basic information about us and the Offer and the Additional Senior Notes. It may not contain all of the information that is important to you. For a more comprehensive understanding of our business, the Offer, the Senior Secured Notes and the Additional Senior Notes, you should read this entire Offering Memorandum and the documents incorporated by reference herein, including the sections entitled “Risk Factors” included or incorporated by reference herein and the historical and pro forma financial statements and the accompanying notes to those statements of HGI, Spectrum Brands, FGL, HGI Funding, the HHI Business and the EXCO/HGI JV (each as defined below). Certain statements in this summary are forward-looking statements. See “Special Note Regarding Forward-Looking Statements.”

Our Company

We are a diversified holding company focused on acquiring businesses with attractive assets that we consider to be undervalued or fairly valued and growing our acquired businesses. Our principal holdings include the following: (i) Spectrum Brands Holdings, Inc. (together with its consolidated subsidiaries, “Spectrum Brands”), our subsidiary that provides global branded consumer products; (ii) Fidelity & Guaranty Life (together with its consolidated subsidiaries, “FGL”), our subsidiary that provides life insurance and annuity products; (iii) Front Street Re (Cayman) Ltd. and Front Street Re Ltd., our subsidiaries engaged in the business of providing long-term reinsurance, including reinsurance to the specialty insurance sector of fixed, deferred and payout annuities; (iv) Salus Capital Partners, LLC (together with its consolidated subsidiaries, “Salus”), our subsidiary engaged primarily in the business of providing secured asset-based loans across a variety of industries; and (v) HGI Energy (“HGI Energy”), our subsidiary that holds our interests in the oil and gas joint venture owned by it and EXCO Resources, Inc., a joint venture engaged in owning and operating producing conventional oil and gas assets (“EXCO/HGI JV”). We hold certain of our assets, manage a portion of our available cash and acquire interests in possible acquisition targets through our wholly-owned subsidiary, HGI Funding, LLC (together with its consolidated subsidiaries, “HGI Funding”).

We were incorporated in Delaware in 1954 under the name Zapata Corporation and reincorporated in Nevada in April 1999 under the same name. On December 23, 2009, we reincorporated in Delaware under the name Harbinger Group Inc. Our common stock trades on the New York Stock Exchange under the symbol “HRG.”

For a description of our business, financial condition, results of operations and other important information regarding us, we refer you to our filings with the SEC incorporated by reference in this Offering Memorandum. For instructions on how to find copies of these documents, see “Where You Can Find More Information.”

1

Recent Developments

Supplemental Indenture

On May 14, 2014, HGI announced that it had received commitments from beneficial holders of its Senior Secured Notes to consent to certain amendments (the “Senior Secured Indenture Amendments”) to the Senior Secured Indenture that, among other things, would give HGI greater flexibility to repurchase or redeem its outstanding common stock. The Senior Secured Indenture Amendments will be included in a supplemental indenture by and between HGI and Wells Fargo Bank, National Association, as trustee (the “Supplemental Indenture”), substantially in the form attached hereto as Annex A, which will become effective upon execution. The Supplemental Indenture will provide that the Senior Secured Indenture Amendments will become operative upon HGI’s acceptance of the Senior Secured Notes validly tendered (and not validly withdrawn) as of the Early Tender Time pursuant to the Offer, subject to the Tender Cap and any required proration. HGI will not pay a consent fee to the consenting holders of the Senior Secured Notes for providing such consents and such consenting holders will have the right to participate pro rata in the Offer with other holders of Senior Secured Notes.

If the Senior Secured Indenture Amendments become operative, HGI will have the required authority to purchase up to $100 million of HGI’s Common Stock pursuant to a new share repurchase program authorized by HGI’s board of directors. The repurchase program authorizes purchases to be made from time to time in one or more open market or private transactions. The manner of purchase, the number of shares to be purchased and the timing of purchases will be based on the price of the HGI’s common stock, general business and market conditions and applicable legal requirements, and is subject to the discretion of HGI’s management. The program does not require HGI to purchase any specific number of shares or any shares at all, and may be suspended, discontinued or re-instituted at any time without prior notice. HGI may fund any such repurchase with cash on hand or other borrowings.

Conversion of Preferred Stock

On May 9, 2014, HGI announced that it was exercising its option to convert (the “Preferred Stock Conversion”) its issued and outstanding shares of Series A Participating Convertible Preferred Stock (“Series A Preferred Shares”) and Series A-2 Participating Convertible Preferred Stock (“Series A-2 Preferred Shares” and, together with the Series A Preferred Shares, the “Preferred Shares”) into common stock of the Company, par value $0.01 (“Common Stock”). The Preferred Stock Conversion will be effective May 15, 2014 (the “Conversion Date”).

On the Conversion Date, holders of the Series A Preferred Shares will receive approximately 160.95 shares of Common Stock per Series A Preferred Share converted and holders of Series A-2 Preferred Shares will receive approximately 148.11 shares of Common Stock per Series A-2 Preferred Share converted. The holders will also receive cash in lieu of fractional shares and for any and all accrued but unpaid dividends.

2

Following the Conversion Date, all rights of the Preferred Shareholders, including rights to dividends, will terminate except that, in accordance with and for so long as required by the certificate of designation governing the Series A Preferred Shares, a Preferred Share held by CF Turul LLC (“CF Turul”), an affiliate of Fortress Investment Group LLC, will not be converted in order to preserve CF Turul’s continuing rights under the certificate of designation governing the Series A Preferred Shares. The Preferred Share held by CF Turul following the Conversion Date will not be entitled to receive dividends and distributions. It is HGI’s understanding that prior to the Conversion Date, CF Turul obtained required insurance regulatory approvals and as a result the limitation on voting previously applicable to CF Turul is no longer applicable.

3

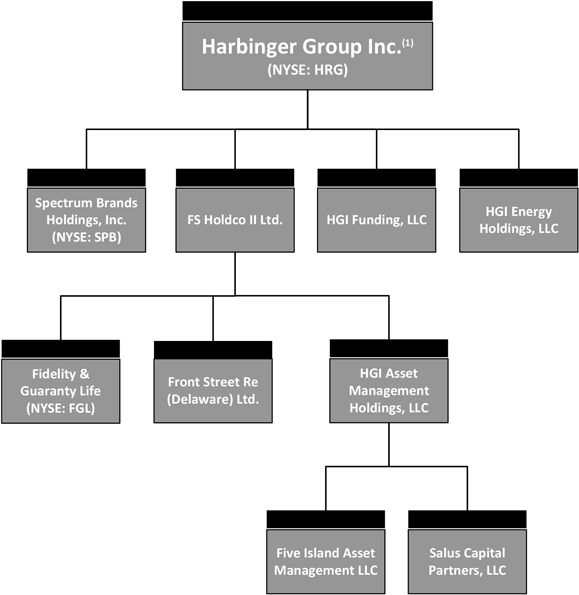

Corporate Structure

The following diagram represents our current corporate structure, and depicts only our material subsidiaries:

4

Summary of the Terms of the Offer

The following summary is provided solely for the convenience of Holders. This summary highlights selected information contained in the Offer Documents and may not contain all of the information that is important to you. For a complete understanding of the Offer, you should read this entire Offering Memorandum and the Letter of Transmittal.

| The Company | Harbinger Group Inc., a Delaware corporation. | |

| The Offer | The Company is offering to exchange up to $350.0 million aggregate principal amount of its Additional Senior Notes for its outstanding Senior Secured Notes validly tendered in the Offer (including, if the Offer is earlier terminated or extended or amended, the terms and conditions of such earlier termination or extension or amendment). | |

| Holders who validly tender and do not validly withdraw their Senior Secured Notes by the Early Tender Time will receive the Total Consideration on the Early Settlement Date (as defined below). Holders who validly tender their Senior Secured Notes after the Early Tender Time but by the Expiration Time will receive, if the Offer is not fully subscribed as of the Early Tender Time, only the Offer Consideration on the Final Settlement Date (as defined below). If the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange. | ||

| See “The Offer.” | ||

| Total Consideration | The Total Consideration for each $1,000 principal amount of Senior Secured Notes provides Holders who validly tender Senior Secured Notes $1,092.50 principal amount of Additional Senior Notes (which includes the Early Tender Payment of $50 principal amount of Additional Senior Notes), adjusted for accrued and unpaid interest on the Senior Secured Notes tendered and prefunded accrued interest on the Additional Senior Notes issued, in each case to but not including the Early Settlement Date. For more information on how the Total Consideration will be calculated, see “The Offer—Consideration.” | |

| The Total Consideration will be paid in respect of Senior Secured Notes validly tendered and not validly withdrawn by the Early Tender Time that are accepted for exchange. See “—Tender Cap” and “—Proration.” | ||

5

| Offer Consideration | The Offer Consideration for each $1,000 principal amount of Senior Secured Notes provides Holders who validly tender Senior Secured Notes $1,042.50 principal amount of Additional Senior Notes, adjusted for accrued and unpaid interest on the Senior Secured Notes tendered and prefunded accrued interest on the Additional Senior Notes issued, in each case to but not including the Final Settlement Date. For more information on how the Offer Consideration will be calculated, see “The Offer—Consideration.” | |

| The Offer Consideration will be paid in respect of Senior Secured Notes validly tendered and not validly withdrawn after the Early Tender Time but by the Expiration Time that are accepted for exchange. If the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange. See “—Tender Cap” and “—Proration.” | ||

| Accrued Interest | The Company will not be required to pay participating Holders accrued and unpaid interest on the Senior Secured Notes exchanged for Additional Senior Notes in cash, and participating Holders will not be required to pay the Company prefunded accrued interest on the Additional Senior Notes issued in exchange for Senior Secured Notes in cash. However, each of the Total Consideration and the Offer Consideration includes an adjustment to the principal amount of Additional Senior Notes issued per $1,000 principal amount of Senior Secured Notes to give participating Holders the benefit of such accrued and unpaid interest and to give the Company the benefit of such prefunded accrued interest. | |

| Conditions to the Offer | Notwithstanding any other provision of the Offer, the Company’s obligation to accept for exchange, and to issue the Additional Senior Notes for, Senior Secured Notes validly tendered and not validly withdrawn, subject to the Tender Cap, is conditioned upon satisfaction of the General Conditions discussed in detail under “The Offer—Conditions of the Offer.” The Offer is not conditioned upon any minimum amount of Senior Secured Notes being tendered. | |

6

| Early Tender Time | The Early Tender Time is 5:00 pm, Eastern Time, on May 28, 2014, unless earlier terminated by the Company, or, if the Early Tender Time is extended, the latest time and date to which the Early Tender Time is so extended. If the Company extends the Early Tender Time, it will issue a press release announcing the new Early Tender Time. | |

| Expiration Time | The Expiration Time of the Offer is 11:59 pm, Eastern Time, on June 11, 2014, unless earlier terminated by the Company, or, if the Offer is extended, the latest time and date to which the Offer is so extended. If the Company extends the Offer, it will issue a press release on the next business day no later than 9:00 am following the previously scheduled Expiration Time announcing the new Expiration Time. | |

| Tender Cap | If Senior Secured Notes are accepted in the Offer, we will exchange up to an aggregate principal amount of the outstanding Senior Secured Notes that would result in us issuing not more than $350,000,000 Additional Senior Notes. | |

| The Company reserves the right, but is under no obligation, to increase the Tender Cap. If the Company increases the Tender Cap, the Company does not expect to extend the Withdrawal Deadline, subject to applicable law. The amount of Senior Secured Notes accepted for exchange will be prorated based on the aggregate principal amount validly tendered and not withdrawn as of the Early Tender Time or the Expiration Time, as applicable. See “—Proration.” | ||

| Proration | With respect to the Senior Secured Notes, if the acceptance of all validly tendered Senior Secured Notes would cause us to issue a principal amount of Additional Senior Notes greater than the Tender Cap, then the Offer will be oversubscribed and, if we accept any Senior Secured Notes, we will accept for exchange tendered Senior Secured Notes only on a prorated basis, with the aggregate principal amount of each Holder’s validly tendered Senior Secured Notes accepted for exchange determined by multiplying each Holder’s tender by the applicable proration factor, and rounding the product down to the nearest $1,000 to avoid acceptance of Senior Secured Notes in principal amounts other than integral multiples of $1,000. Senior Secured Notes not accepted due to proration will be promptly returned or credited to the Holder’s account. | |

7

| So long as the other terms and conditions described herein are satisfied and subject to the Tender Cap, we intend to accept for exchange all Senior Secured Notes validly tendered at or prior to the Early Tender Time, and will only prorate such Senior Secured Notes if the aggregate principal amount of Additional Senior Notes issuable upon exchange of Senior Secured Notes validly tendered and not withdrawn exceeds the Tender Cap. If the Offer is not fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes in the Offer after the Early Tender Time may be subject to proration, whereas Holders who validly tender Senior Secured Notes at or prior to the Early Tender Time will not be subject to proration. Furthermore, if the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange. | ||

| The Company will not accept any tender that would result in the issuance of less than $2,000 principal amount of Additional Senior Notes to a participating holder. The aggregate principal amount of Additional Senior Notes issued to each participating holder for all Senior Secured Notes properly tendered (and not withdrawn) and accepted by the Company will be rounded down, if necessary, to $2,000 or the nearest whole multiple of $1,000 in excess thereof. This rounded amount will be the principal amount of Additional Senior Notes you will receive, and no additional cash will be paid in lieu of any principal amount of Additional Senior Notes not received as a result of rounding down. | ||

| Early Settlement Date | The Early Settlement Date in respect of the Senior Secured Notes that are validly tendered at or prior to the Early Tender Time and not validly withdrawn prior to the Withdrawal Deadline and accepted for exchange (subject to the Tender Cap and after any required proration) will be promptly after the Early Tender Time, but prior to the Expiration Time, and is expected to be on or about May 30, 2014, two business days following the Early Tender Time, unless the Early Tender Time is extended by the Company in its sole discretion. | |

| Final Settlement Date | The Final Settlement Date in respect of Senior Secured Notes that are validly tendered after the Early Tender Time but at or prior to the Expiration Time and accepted for exchange will be promptly (subject to the Tender Cap and | |

8

| after any required proration) after the Expiration Time and is expected to be on or about June 13, 2014, two business days following the Expiration Time, unless the Expiration Time is extended by the Company in its sole discretion. | ||||

| How to Tender Notes | To validly tender Senior Secured Notes pursuant to the Offer, Holders must deliver the tendered Senior Secured Notes, the Letter of Transmittal and the related documents to the Information and Exchange Agent (as defined below) (or comply with the ATOP procedures (as defined below)) by the Early Tender Time to receive the Total Consideration, or after the Early Tender Time but by the Expiration Time to receive the Offer Consideration. If the Offer is fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange. See “—Proration.” | |||

| • |

A Holder whose Senior Secured Notes are held by a broker, dealer, commercial bank, trust company or other nominee must contact such custodial entity promptly and instruct such custodial entity to tender the Senior Secured Notes on such Holder’s behalf. | |||

| • | Holders who are DTC participants must tender their beneficial interest in the Senior Secured Notes through ATOP. | |||

| The Company is not offering a guaranteed delivery procedure in connection with the Offer; consequently, if a Holder is unable to complete the above procedures for tendering Senior Secured Notes by the Expiration Time, such Holder will not be able to tender Senior Secured Notes in the Offer. | ||||

| See “The Offer—Procedures for Tendering Notes.” | ||||

| Untendered Notes | Senior Secured Notes that are not validly tendered will remain outstanding and may represent a materially smaller aggregate principal amount of Senior Secured Notes than were outstanding before the Offer, which may adversely affect the market price for, and liquidity and credit ratings of, such outstanding Senior Secured Notes.

In addition, upon our acceptance of the Senior Secured Notes validly tendered (and not validly withdrawn) as of the Early Tender Time pursuant to the Offer, subject to the | |||

9

| Tender Cap and any required proration, the Senior Secured Indenture Amendments to the Senior Secured Indenture will become operative. If the Senior Secured Indenture Amendments become operative, HGI, among other things, will have greater flexibility to repurchase or redeem its outstanding common stock. For more information on the Senior Secured Indenture Amendments, see “—Recent Developments—Supplemental Indenture.” | ||

| See “Risk Factors” for a discussion of some of the risks associated with the Offer. | ||

| Withdrawal and | ||

| Revocation Rights | The Withdrawal Deadline is 5:00 pm, Eastern Time, on May 28, 2014 (unless extended or earlier terminated by the Company). Senior Secured Notes tendered may be validly withdrawn at any time by the Withdrawal Deadline by following the procedures described herein, but not thereafter, unless the Company amends the Offer to permit such withdrawal or revocation or the Company is required by law to permit such withdrawal or revocation. If the Company extends the Withdrawal Deadline, it will issue a press release announcing the new Withdrawal Deadline. See “The Offer—Withdrawal of Tenders.” While initially the Early Tender Time is also the deadline for Holders to withdraw previously tendered Senior Secured Notes, the Company reserves the right to extend the Early Tender Time without extending the right to withdraw previously tendered Senior Secured Notes. See “The Offer—Withdrawal of Tenders” herein. | |

| Extension, Amendment |

||

| and Termination | The Company may, in its discretion and subject to applicable law, extend, amend or terminate the Offer at any time as described herein. See “The Offer—Extension, Termination or Amendment.” | |

| Material U.S. Federal |

||

| Income Tax Consequences | For a discussion of material U.S. federal income tax considerations and consequences with respect to the Offer see “Certain U.S. Federal Income Tax Considerations.” | |

| Trustee | Wells Fargo Bank, National Association. | |

| Information and Exchange Agent | D.F. King & Co., Inc. | |

| Financial Advisor | Credit Suisse Securities (USA) LLC (“Credit Suisse”). | |

10

| No Recommendation | None of the Company, the Financial Advisor, the Information and Exchange Agent, if any, the Trustee or any of their respective affiliates, directors, officers or employees is making any recommendation as to whether Holders should tender their Senior Secured Notes in the Offer. | |

| Additional Copies; |

||

| Further Information | Additional copies of the Offer Documents may be obtained by contacting the Information and Exchange Agent at its address and telephone numbers set forth on the back cover page of this Offering Memorandum. Questions about the terms of the Offer should be directed to the Information and Exchange Agent at its address and telephone numbers set forth on the back cover page of this Offering Memorandum. | |

11

Summary of the Terms of the Additional Senior Notes

The following is a summary of the terms of the Additional Senior Notes. For a more complete description of these Additional Senior Notes as well as the definitions of certain capitalized terms used below, see the section entitled “Description of Notes” of the Senior Notes Prospectus, which is incorporated by reference herein.

| Issuer | Harbinger Group Inc. | |

| Securities Offered | Up to $350,000,000 aggregate principal amount of 7.750% Senior Notes due 2022. The Additional Senior Notes offered by us are being issued as additional 7.750% Senior Notes due 2022 under the Senior Indenture, dated as of January 21, 2014, between the Company and Wells Fargo National Association, as trustee. Before the Exchange Offer, there are $200.0 million of 7.750% Senior Secured Notes outstanding under the Senior Indenture. The Additional Senior Notes we are offering constitute “additional notes” under the indenture and will vote together with the Existing Senior Notes as a single class under the Senior Indenture. | |

| Maturity | January 15, 2022. | |

| Interest | Interest will be payable in cash on January 15 and July 15 of each year. The first interest payment date for the Additional Senior Notes offered hereby will be July 15, 2014. Interest on the Additional Senior Notes will accrue from and including January 21, 2014, the issue date of the Existing Senior Notes. | |

| Optional Redemption | On or after July 15, 2017, we may redeem some or all of the Senior Notes at any time at the redemption prices set forth in the section entitled “Description of Notes” of the Senior Notes Prospectus, which is incorporated by reference herein. In addition, prior to July 15, 2017, we may redeem the Senior Notes at a redemption price equal to 100% of the principal amount of the Senior Notes plus a “make-whole” premium. | |

| Before July 15, 2017, we may redeem up to 35% of the Senior Notes, including further additional notes, with the proceeds of equity sales at a price of 107.750% of principal plus accrued and unpaid interest, provided that at least 65% of the original aggregate principal amount of the Senior Notes issued under the Senior Indenture remains outstanding after the redemption, as further described in the section entitled “Description of Notes” of the Senior Notes Prospectus, which is incorporated by reference herein. | ||

12

| Change of Control | Upon a change of control (as defined in the Senior Indenture and as described in the section entitled “Description of Notes” of the Senior Notes Prospectus, which is incorporated by reference herein), we are required to make an offer to purchase the Senior Notes. The purchase price will equal 101% of the principal amount of the Senior Notes on the date of purchase plus accrued and unpaid interest. We may not have sufficient funds available at the time of any change of control to make any required debt repayment (including repurchases of the notes). See “Risk Factors—We may be unable to repurchase the Senior Notes upon a change of control” included in the Senior Notes Prospectus, which is incorporated by reference herein. | |||

| Guarantors | Any subsidiary that guarantees our debt will guarantee the Senior Notes. You should not expect that any subsidiaries will guarantee the Senior Notes. | |||

| Ranking | The Senior Notes are our unsecured unsubordinated obligations and: | |||

| • | rank equally in right of payment to all of our existing and future unsubordinated debt; | |||

| • | are effectively subordinated to all our secured debt to the extent of the value of the collateral securing that debt; | |||

| • | are effectively subordinated to all liabilities of our subsidiaries; and | |||

| • | rank senior in right of payment to all of our and our guarantors’ future debt that expressly provides for its subordination to the Senior Notes and the note guarantees. | |||

| As of March 31, 2014, HGI had no debt other than the Senior Secured Notes and the Senior Notes. All of the Senior Secured Notes will be effectively senior to the Additional Senior Notes to the extent of the value of the collateral securing such indebtedness. As of March 31, 2014, the total liabilities of Spectrum Brands were approximately $4.7 billion, including trade payables. As of March 31, 2014, the total liabilities of FGL were | ||||

13

| approximately $21.9 billion, including approximately $16.0 billion in annuity contractholder funds, approximately $3.5 billion in future policy benefits and approximately $300.0 million of indebtedness under Fidelity & Guaranty Life Holdings, Inc.’s 6.375% Senior Notes due 2021 (the “FGH Notes”). As of March 31, 2014, the total liabilities of HGI Asset Management Holdings, LLC were approximately $0.3 million and were approximately $619.1 million when consolidated with Salus and Five Island Asset Management, LLC (“Five Island”). As of March 31, 2014, the total liabilities of HGI Energy were approximately $412.0 million. As a result of HGI’s holding company structure, claims of creditors of HGI’s subsidiaries will generally have priority as to the assets of HGI’s subsidiaries over claims of HGI and over claims of the holders of HGI’s indebtedness, including the exchange notes. | ||||

| As of March 31, 2014, our total liabilities on an unconsolidated and consolidated basis would have been $1.6 billion and $27.6 billion, respectively. | ||||

| Certain Covenants | The Senior Indenture contains covenants, subject to specified exceptions, limiting our ability and, in certain cases, our subsidiaries’ ability to: | |||

| • | incur additional indebtedness; | |||

| • | create liens or engage in sale and leaseback transactions; | |||

| • | pay dividends or make distributions in respect of capital stock; | |||

| • | make certain restricted payments; | |||

| • | sell assets; | |||

| • | engage in transactions with affiliates, except on an arms’-length basis; or | |||

| • | consolidate or merge with, or sell substantially all of our assets to, another person. | |||

| We are also required to maintain compliance with a minimum liquidity covenant. | ||||

| You should read the section entitled “Description of Notes—Certain Covenants” of the Senior Notes Prospectus, which is incorporated by reference herein, for a description of these covenants. | ||||

14

| Transfer Restrictions | The Offer is being made to you in reliance on an exemption from registration provided by Section 3(a)(9) of the Securities Act. The Additional Senior Notes to be issued in the Offer have not been and will not be registered with the SEC. However, the Additional Senior Notes that you receive in the Offer are expected to be freely tradable as that term is defined in the Securities Act, to the same extent as the Senior Secured Notes exchanged therefor. | |

| Limited Trading Market | Neither the Additional Senior Notes nor the Existing Senior Notes are listed on any securities exchange or on any automated dealer quotation system. We cannot assure you that an active or liquid trading market for the Senior Notes will develop. If an active or liquid trading market for the Senior Notes does not develop, the market price and liquidity of the Senior Notes may be adversely affected. | |

| Form and Denominations | The Additional Senior Notes will be book-entry only and registered in the name of a nominee of DTC. The Additional Senior Notes will be issued in minimum denominations of $2,000 and higher integral multiples of $1,000. The aggregate principal amount of Additional Senior Notes issued to each participating holder for all Senior Secured Notes properly tendered (and not withdrawn) and accepted by the Company will be rounded down, if necessary, to $2,000 or the nearest whole multiple of $1,000 in excess thereof. This rounded amount will be the principal amount of Additional Senior Notes you will receive, and no additional cash will be paid in lieu of any principal amount of Additional Senior Notes not received as a result of rounding down. | |

| Use of Proceeds | We will not receive any proceeds from the Offer or issuance of the Additional Senior Notes. | |

| Risk Factors | Investing in the Senior Notes involves substantial risks and uncertainties. See the sections entitled “Risk Factors” in this Offering Memorandum and in the Senior Notes Prospectus, which is incorporated by reference herein, and other information included in or incorporated by reference in this Offering Memorandum for a discussion of factors you should carefully consider before deciding to invest in the Senior Notes. | |

15

RISK FACTORS

Before investing in the Senior Notes, you should carefully consider the risk factors discussed below and the risk factors incorporated by reference into this Offering Memorandum. See “Where You Can Find More Information.” Any of these risk factors could materially and adversely affect our or our subsidiaries’ business, financial condition and results of operations. These risk factors are not the only risks that we or our subsidiaries may face. Additional risks and uncertainties not presently known to us or our subsidiaries or that are not currently believed to be material also may adversely affect us or our subsidiaries. These risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

Risks Related to Participating in the Offer

There are conditions to the consummation of the Offer.

The consummation of the Offer is subject to the satisfaction or waiver of certain conditions. See “The Offer—Conditions of the Offer.” There can be no assurance that the Offer will be consummated or that any failure to consummate the Offer will not have a negative effect on the market price and liquidity of the Senior Notes.

The Company may subsequently redeem or purchase Senior Secured Notes, including at higher prices than are being offered in the Offer.

Whether or not the Offer is completed, the Company and its affiliates may from time to time acquire Senior Secured Notes, other than pursuant to the Offer, and Senior Notes through redemptions, open market purchases, privately negotiated transactions, tender offers, exchange offers or otherwise, subject to the terms of the Senior Secured Indenture and the Senior Indenture, as applicable, and applicable law, upon such terms and at such prices as the Company or its affiliates may determine, which may be more or less than the consideration to be received by participating Holders in the Offer and, in either case, could be for cash or other consideration. There can be no assurance as to which, if any, of these alternatives or combinations thereof the Company or its affiliates may choose to pursue in the future.

Nothing contained in the Offer will prevent the Company from exercising its rights under the Senior Secured Indenture or the Senior Indenture to redeem the Senior Secured Notes or Senior Notes, as applicable, or to defease or satisfy and discharge its obligations under the Senior Secured Indenture or the Senior Indenture.

The Company cannot assure you as to which, if any, of these alternatives, or combinations thereof, the Company or its affiliates will pursue.

There may be a more limited trading market for the Senior Secured Notes following the consummation of the Offer.

To the extent that the Senior Secured Notes are traded, prices of the Senior Secured Notes may fluctuate widely depending on trading volume, the balance between buy and sell orders, prevailing interest rates, the Company’s operating results and the market for similar securities. To the extent such information is available, Holders are urged to obtain current market quotations for the Senior Secured Notes before making any decision with respect to the Offer.

16

To the extent that Senior Secured Notes are tendered and accepted in the Offer, such Senior Secured Notes will cease to be outstanding and will be promptly cancelled. As a result, any existing trading market for the remaining Senior Secured Notes may become more limited. A debt security with a smaller outstanding principal amount available for trading, which the financial services industry refers to as a smaller “float,” may command a lower price than would a comparable debt security with a greater float. Therefore, the market price for Senior Secured Notes not exchanged in the Offer may be adversely affected if the amount of Senior Secured Notes exchanged in the Offer reduces the float of the Notes. The reduced float may also tend to make the trading price more volatile. Moreover, there can be no assurance that any trading market will exist for the Senior Secured Notes or the Senior Notes following the Offer. The extent of the public market for the Senior Secured Notes or the Senior Notes, if any, following the completion of the Offer, will depend upon the number of holders of Senior Secured Notes or the Senior Notes, as applicable, the interest in maintaining a market in the Senior Secured Notes or the Senior Notes on the part of securities firms and other factors.

Participation in the Offer and Oversubscription.

If the Offer is oversubscribed, Holders who tender their Senior Secured Notes in the Offer prior to the Early Tender time will be treated more favorably than those who tender after such time. Such early tendering Holders will be given priority under the proration provisions. If the Offer is not fully subscribed as of the Early Tender Time, Holders who validly tender Senior Secured Notes after the Early Tender Time may be subject to proration, whereas Holders who validly tender Senior Secured Notes at or prior to the Early Tender Time will not be subject to proration. Furthermore, if the Offer is fully subscribed as of the Early Tender time, Holders who validly tender Senior Secured Notes in the Offer after the Early Tender Time will not have any of their Senior Secured Notes accepted for exchange.

You must comply with the Offer procedures to receive Additional Senior Notes.

Delivery of Additional Senior Notes in exchange for Senior Secured Notes tendered and accepted for the exchange pursuant to the Offer will be made only after timely receipt by the Information and Exchange Agent of the following:

| • | book-entry confirmation of a book-entry transfer of Senior Secured Notes into the Information and Exchange Agent’s account at DTC, New York, New York as a depositary, including an Agent’s Message (as defined herein), if the tendering holder does not deliver a Letter of Transmittal; |

| • | a complete and signed Letter of Transmittal, or facsimile copy, with any required signature guarantees, or, in the case of a book-entry transfer, an Agent’s Message in place of the Letter of Transmittal; and |

| • | any other documents required by the Letter of Transmittal. |

17

Therefore, Holders who would like to tender Senior Secured Notes in exchange for Additional Senior Notes should be sure to allow enough time for the necessary documents to be timely received by the Information and Exchange Agent. We are not required to notify you of defects or irregularities in tenders of Senior Secured Notes for exchange.

The Senior Secured Indenture Amendments will allow the Company to take certain actions previously prohibited under the Senior Secured Indenture.

The Senior Secured Indenture Amendments will, among other things, give the Company greater flexibility to repurchase or redeem its outstanding common stock under the Senior Secured Indenture. Such ability of the Company to take certain actions previously prohibited could materially increase its credit risk or could otherwise be materially adverse to Holders and could adversely affect the market prices and credit ratings of the remaining Senior Secured Notes. See “Summary—Recent Developments—Supplemental Indenture.”

Participating in the Offer could have tax consequences to Holders.

Participating in the Offer could have tax consequences to Holders. See “Certain U.S. Federal Income Tax Considerations” for a discussion of material U.S. federal income tax considerations and consequences of the Offer.

No recommendation is being made with respect to the Offer.

None of the Company, the Financial Advisor, the Information and Exchange Agent, the Trustee or any of their respective affiliates, directors, officers or employees is making any recommendation to Holders as to whether to tender or refrain from tendering Senior Secured Notes for exchange pursuant to the Offer.

The exchange ratio offered for the Senior Secured Notes does not reflect any independent valuation of the Senior Secured Notes and does not take into account events or changes in financial markets (including interest rates) after the commencement of the Offer. The Company has not obtained or requested a fairness opinion from any banking or other firm as to the fairness of the consideration offered for the Senior Secured Notes. If you tender your Senior Secured Notes, you may or may not receive as much or more value than if you choose to keep them.

Each Holder must make his or her own decision whether to tender his or her Senior Secured Notes, and, if so, the principal amount of Senior Secured Notes to tender, based on such Holder’s assessment of current market value and other relevant factors.

Risks Related to the Additional Senior Notes

We are a holding company and our only material assets are our equity interests in our operating subsidiaries and our other investments; as a result, our principal source of revenue and cash flow is distributions from our subsidiaries; our subsidiaries may be limited by law and by contract in making distributions to us.

As a holding company, our only material assets are our cash on hand, the equity interests in our subsidiaries and other investments. As of March 31, 2014, excluding cash, cash equivalents and short-term investments held by our operating subsidiaries, we had approximately

18

$454.3 million in cash, cash equivalents and short-term investments, which includes $83.7 million held by our wholly-owned subsidiary, HGI Funding. Our principal source of revenue and cash flow is distributions from our subsidiaries. Thus, our ability to service our debt, finance acquisitions and pay dividends to our stockholders in the future is dependent on the ability of our subsidiaries to generate sufficient net income and cash flows to make upstream cash distributions to us. Our subsidiaries are and will be separate legal entities, and although they may be wholly-owned or controlled by us, they have no obligation to make any funds available to us, whether in the form of loans, dividends, distributions or otherwise. The board of directors of our subsidiaries may consider a range of factors and consider their stockholder constituencies (including public shareholders) as a whole when making decisions about dividends. The ability of our subsidiaries to distribute cash to us will also be subject to, among other things, restrictions that are contained in our subsidiaries’ financing agreements, availability of sufficient funds in such subsidiaries and applicable state laws and regulatory restrictions. Claims of creditors of our subsidiaries generally will have priority as to the assets of such subsidiaries over our claims and claims of our creditors and stockholders. To the extent the ability of our subsidiaries to distribute dividends or other payments to us could be limited in any way, our ability to grow, pursue business opportunities or make acquisitions that could be beneficial to our businesses, or otherwise fund and conduct our business could be materially limited.

As an example, our subsidiary Spectrum Brands is a holding company with limited business operations of its own and its main assets are the capital stock of its subsidiaries, principally Spectrum Brands, Inc. (“SBI”). The terms of Spectrum Brands’ indebtedness may limit its ability to pay dividends to us and its other stockholders. See Part I, Item IA. “Risk Factors—Risks Related to Spectrum Brands—SBI’s substantial indebtedness may limit its financial and operating flexibility, and it may incur additional debt, which could increase the risks associated with its substantial indebtedness” and Part I, Item IA. “Risk Factors—Risks Related to Spectrum Brands—Restrictive covenants in SBI’s Senior Secured Facilities and the 2020 Indenture may restrict SBI’s ability to pursue its business strategies” contained in our 2013 Annual Report.

FGL is also a holding company with limited business operations of its own. Its main assets are the capital stock of its subsidiaries, which are principally regulated insurance companies, whose ability to pay dividends is limited by applicable insurance laws. Accordingly, FGL’s ability to pay dividends to us and its other stockholders is dependent, to a significant extent, on the generation of cash flow by its subsidiaries and their ability to make such cash available to FGL, by dividend or otherwise. FGL’s subsidiaries may not be able to, or may not be permitted to, make distributions to enable FGL to meet its obligations and pay dividends. Each subsidiary is a distinct legal entity and legal and contractual restrictions may also limit FGL’s ability to obtain cash from its subsidiaries. See Part I, Item 1. “Business—Our Operating Subsidiaries—FGL—Regulation— Financial Regulation—Dividend and Other Distribution Payment Limitations” and Part I, Item 1A. “Risk Factors—Risks Related to FGL—The indenture governing the FGH Notes imposes significant operating and financial restrictions, which may prevent FGL from capitalizing on business opportunities” contained in our 2013 Annual Report. In addition, upon the completion of the initial public offering of FGL, our proportion of any dividends paid by FGL was proportionally reduced to match our ownership interest in FGL.

19

Additionally, the terms of EXCO/HGI JV’s indebtedness may adversely affect its cash flow and may limit its ability to pay distributions to us and its other equity holders. See Part I, Item 1A. “Risk Factors—Risks Related to EXCO/HGI JV—The EXCO/HGI JV has a substantial amount of indebtedness, which may adversely affect its cash flow and ability to operate its business, remain in compliance with debt covenants and make payments on its debt and distributions to us” contained in our 2013 Annual Report.

Furthermore, these restrictions on our subsidiaries to pay dividends may limit our ability to incur additional indebtedness or refinance our existing indebtedness in the future as well. Our ability to refinance our indebtedness will depend on our ability to generate future cash flow, and we are dependent on our subsidiaries’ ability to pay dividends or pay distributions to us.

The Senior Notes are effectively subordinated to HGI’s existing and future secured debt, including the Senior Secured Notes, to the extent of the value of the collateral securing such debt, and are structurally subordinated to all liabilities of our subsidiaries.

The Senior Notes are not secured by any of our assets. The Senior Notes are therefore effectively subordinated to HGI’s secured indebtedness, including the Senior Secured Notes, to the extent of the value of the collateral securing such indebtedness. As of March 31, 2014, on a pro forma basis as adjusted basis to give effect to the Offer, assuming $350.0 million aggregate principal amount of Additional Senior Notes are issued in exchange for Senior Secured Notes accepted by us on the Early Tender Time in the Offer (assuming such original Early Tender Time date is not extended or earlier terminated), and the Preferred Stock Conversion, HGI had $604.4 million of secured indebtedness outstanding.

Further, we may incur future indebtedness, some of which may be secured by liens on our assets, to the extent permitted by the Senior Indenture and terms of our other agreements, including the Senior Secured Indenture. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the Senior Notes. Holders of the Senior Notes will participate ratably with all holders of our senior unsecured indebtedness and potentially with all of our general creditors.

The Senior Notes are our senior unsecured obligations. The Senior Notes are not, and are not expected to be, guaranteed by any of our current or future subsidiaries. As a result of our holding company structure, claims of creditors of our subsidiaries will generally have priority as to the assets of our subsidiaries over our claims and over claims of the holders of our indebtedness, including the Senior Notes. As of March 31, 2014, the total liabilities of Spectrum Brands were approximately $4.7 billion, including trade payables. As of March 31, 2014, the total liabilities of FGL were approximately $21.9 billion, including approximately $16.0 billion in annuity contractholder funds, approximately $3.5 billion in future policy benefits and approximately $300.0 million of indebtedness under the FGH Notes. As of March 31, 2014, the total liabilities of HGI Asset Management Holdings, LLC were approximately $0.3 million and were approximately $619.1 million when consolidated with Salus and Five Island. As of March 31, 2014, the total liabilities of HGI Energy were $412.0 million.

The creditors of our subsidiaries have direct claims on such subsidiaries and their assets and the claims of holders of the Senior Secured Notes and the Senior Notes are “structurally subordinated” to any existing and

20

future liabilities of our subsidiaries. This means that the creditors of our subsidiaries have priority in their claims on the assets of the subsidiaries over our creditors, including the noteholders.

As a result, upon any distribution to the creditors of any subsidiary in bankruptcy, liquidation, reorganization or similar proceedings, or following acceleration of our indebtedness or an event of default under such indebtedness, the lenders or noteholders, as the case may be, of the indebtedness of our subsidiaries will be entitled to be repaid in full by such subsidiaries before any payment is made to HGI. Each of the Senior Indenture and the Senior Secured Indenture does not restrict the ability of our subsidiaries to incur additional indebtedness or grant liens secured by assets of our subsidiaries.

We may and our subsidiaries may incur substantially more indebtedness. This could exacerbate the risks associated with our leverage.

Subject to the limitations set forth in the Senior Indenture and terms of our other agreements, including the Senior Secured Indenture, we and our subsidiaries may incur additional indebtedness (including secured obligations) in the future. If we incur any additional indebtedness that ranks equally with the Senior Notes, the holders of that indebtedness will be entitled to share ratably with the holders of the Senior Notes in any proceeds distributed in connection with any insolvency, liquidation, reorganization, dissolution or other winding-up of us. If we incur additional secured indebtedness, the holders of such indebtedness will be effectively senior to the holders of the Senior Notes to the extent of the value of the collateral securing such indebtedness. This may have the effect of reducing the amount of proceeds paid to holders of the Senior Notes. If new indebtedness is added to our current levels of indebtedness, the related risks that we now face, including our possible inability to service our debt, could intensify. Additionally, if our subsidiaries incur additional debt, the Senior Notes will be structurally subordinated to such debt.

We may be unable to repurchase the Senior Notes upon a change of control.

Under the Senior Indenture, each holder of Senior Notes may require us to repurchase all of such holder’s Senior Notes at a purchase price equal to 101% of the principal amount of the Senior Notes, plus accrued and unpaid interest, if certain “change of control” events occur. However, it is possible that we will not have sufficient funds when required under the Senior Indenture to make the required repurchase of the Senior Notes. If we fail to repurchase Senior Notes in that circumstance, we will be in default under the Senior Indenture. If we are required to repurchase a significant portion of the Senior Notes, we may require third party financing as such funds may otherwise only be available to us through a distribution by our subsidiaries to us. We cannot be sure that we would be able to obtain third party financing on acceptable terms, or at all, or obtain such funds through distributions from our subsidiaries.

An active public market may not develop for the Additional Senior Notes, which may hinder your ability to liquidate your investment.

We do not intend to list the Additional Senior Notes on any securities exchange or to seek approval for quotations through any automated quotation system, and we cannot assure you that:

| • | a liquid market for the Additional Senior Notes will develop; |

21

| • | you will be able to sell your Additional Senior Notes; or |

| • | you will receive any specific price upon any sale of the Additional Senior Notes. |

We also cannot assure you as to the level of liquidity of the trading market for the Additional Senior Notes, if one does develop. If a public market for the Additional Senior Notes develops, the Additional Senior Notes could trade at prices that may be higher or lower than their principal amount or implicit purchase price, depending on many factors, including prevailing interest rates, the market for similar notes and our financial performance. If no active trading market develops, you may not be able to resell your Additional Senior Notes at their fair market value or at all.

Fraudulent transfer statutes may limit your rights as a holder of the Senior Notes.

Federal and state fraudulent transfer laws as previously interpreted by various courts permit a court, if it makes certain findings, to:

| • | avoid all or a portion of our obligations to holders of the Senior Notes; |

| • | subordinate our obligations to holders of the Senior Notes to our other existing and future creditors, entitling such creditors to be paid in full before any payment is made on the Senior Notes; and |

| • | take other action detrimental to holders of the Senior Notes, including invalidating the Senior Notes. |

In that event, we cannot assure you that you would ever be repaid. There is also no assurance that amounts previously paid to you pursuant to the Senior Notes or guarantees (if any) would not be subject to return.

Under federal and state fraudulent transfer laws, in order to take any of those actions, courts will typically need to find that we or the guarantors (if any) received less than fair consideration or reasonably equivalent value for incurring the indebtedness represented by the Senior Notes, and at the time the Senior Notes were issued:

| • | were insolvent or were rendered insolvent by reason of the issuance of the Senior Notes; |

| • | were engaged, or were about to engage, in a business or transaction for which our capital was unreasonably small; |

| • | intended to incur, or believed or should have believed we would incur, indebtedness beyond our ability to pay as such indebtedness matures; or |

| • | were a defendant in an action for money damages, or had a judgment for money damages docketed against us or such guarantor if, in either case, after final judgment, the judgment was unsatisfied. |

A court may also void an issuance of Senior Notes, a guarantee or grant of security, without regard to the above factors, if the court found that we issued the Senior Notes or the guarantors (if any) entered into their respective guaranty with actual intent to hinder, delay or defraud current or future creditors.

22

Many of the foregoing terms are defined in or interpreted under those fraudulent transfer statutes and as judicially interpreted. A court could find that we did not receive fair consideration or reasonably equivalent value for the incurrence of the indebtedness represented by the Senior Notes.

The measure of insolvency for purposes of the foregoing considerations will vary depending on the law of the jurisdiction that is being applied in any such proceeding. Generally, a company would be considered insolvent if, at the time it incurred the indebtedness:

| • | the sum of its indebtedness (including contingent liabilities) is greater than its assets, at fair valuation; |

| • | the present fair saleable value of its assets is less than the amount required to pay the probable liability on its total existing indebtedness and liabilities (including contingent liabilities) as they become absolute and matured; or |

| • | it could not pay its debts as they became due. |

We cannot assure you what standard a court would apply in determining our solvency and whether it would conclude that we were solvent when we incurred our obligations under the Senior Notes.

In addition, the guarantees of the Senior Notes (if any) may also be subject to review under various laws for the protection of creditors. A court would likely find that we or a guarantor did not receive reasonably equivalent value or fair consideration for the Senior Notes or the guarantees, respectively, if we or a guarantor did not substantially benefit directly from the issuance of the Senior Notes. If a court were to void an issuance of the Senior Notes or the guarantees, you would no longer have a claim against us or the guarantors. Sufficient funds to repay the Senior Notes (or the related exchange notes) may not be available from other sources, including the remaining guarantors, if any. In addition, the court might direct you to repay any amounts that you already received from us or the guarantors. In addition, any payment by us pursuant to the Senior Notes made at a time we were found to be insolvent could be voided and required to be returned to us or to a fund for the benefit of our creditors if such payment is made to an insider within a one-year period prior to a bankruptcy filing or within 90 days for any outside party and such payment would give the creditors more than such creditors would have received in a distribution under the bankruptcy code.

Changes in credit ratings issued by nationally recognized statistical ratings organizations could adversely affect our cost of financing and the market price of our securities, including the Senior Notes.

Credit rating agencies rate our debt securities and our subsidiaries’ debt securities on factors that include our operating results, actions that we take, their view of the general outlook for our industry and their view of the general outlook for the economy. Actions taken by the rating agencies can include maintaining, upgrading, or downgrading the current rating or placing us or our subsidiaries on a watch list for possible future downgrading. Downgrading the credit rating of our debt securities or our subsidiaries’ debt securities or placing us or our subsidiaries on a watch list for possible future downgrading would likely increase our cost of financing, limit our access to the capital markets and have an adverse effect on the market price of our securities, including the Senior Notes offered hereby.

23

USE OF PROCEEDS

We will not receive any proceeds from the Offer or issuance of the Additional Senior Notes.

24

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents, short-term investments and consolidated capitalization as of March 31, 2014:

| • | on an actual basis; and |

| • | on a pro forma as adjusted basis to give effect to the Offer, assuming $350.0 million aggregate principal amount of Additional Senior Notes are issued in exchange for Senior Secured Notes accepted by us on the Early Tender Time in the Offer (assuming such original Early Tender Time is not extended or earlier terminated), and the Preferred Stock Conversion. |

This table should be read together with the financial statements and related notes of each of us, the hardware and home improvement business currently owned by Spectrum Brands and previously owned by Stanley Black & Decker, Inc. and certain of its subsidiaries (the “HHI Business”) and the EXCO/HGI JV included or incorporated by reference into this Offering Memorandum.

| (In millions) | HGI as of March 31, 2014 |

Pro Forma as Adjusted HGI as of March 31, 2014 |

||||||

| Cash and cash equivalents |

$ | 1,319.8 | $ | 1,319.8 | ||||

| Debt: |

||||||||

| HGI Debt: |

||||||||

| HGI Senior Secured Notes due 2019(1) |

$ | 925.0 | $ | 604.4 | ||||

| HGI Senior Notes due 2022 |

200.0 | 550.0 | ||||||

| SBI Debt: |

||||||||

| SBI Term Loans (2)(3) |

1,732.9 | 1,732.9 | ||||||

| SBI Senior Notes (4)(5) |

1,390.0 | 1,390.0 | ||||||

| SBI ABL Facility (6) |

167.5 | 167.5 | ||||||

| Other notes and obligations |

50.4 | 50.4 | ||||||

| Capital leases and other |

97.0 | 97.0 | ||||||

| FGL Debt: |

||||||||

| FGH Notes(7) |

300.0 | 300.0 | ||||||

| EXCO/HGI JV Debt: |

||||||||

| Revolving Credit Facility (8) |

250.6 | 250.6 | ||||||

| Salus Debt: |

||||||||

| Unaffiliated long term debt of consolidated variable interest entity |

191.8 | 191.8 | ||||||

| Secured borrowings under non-qualifying loan participations |

100.0 | 100.0 | ||||||

|

|

|

|

|

|||||

| Total |

5,405.2 | 5,434.6 | ||||||

| Original issuance net premium (discount) on debt |

(8.9 | ) | (8.9 | ) | ||||

|

|

|

|

|

|||||

| Total debt |

5,396.3 | 5,425.7 | ||||||

| Redeemable preferred stock (9) |

319.3 | — | ||||||

| Total HGI stockholders’ equity |

693.5 | 1,377.6 | ||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 6,409.1 | $ | 6,803.3 | ||||

|

|

|

|

|

|||||

25

| (1) | Consists of $700.0 million and $225.0 million aggregate principal amount of notes that were issued at a price equal to 99.362% and 101.50%, respectively, of the principal amount thereof. |

| (2) | On December 17, 2012, SBI entered into a term loan facility (the “Term Loan Facility”). The Term Loan Facility provided for borrowings in an aggregate principal amount of $800.0 million, with $100.0 million in Canadian dollar equivalents to be made available to one of the borrower’s Canadian subsidiaries. The terms of the Term Loan Facility allowed SBI, subject to certain conditions, to increase the commitments under the Term Loan Facility, in an aggregate incremental amount not to exceed $350.0 million plus an additional amount subject to compliance with certain secured net leverage ratio requirements. The Term Loan Facility has a seven-year term. On September 4, 2013 (the “Term Loan Closing Date”), SBI closed on $1.15 billion of term loans (the “September SBI Loans”) and entered into an amendment to the Term Loan Facility (as amended, the “Amended Term Loan Facility”). The September SBI Loans comprise two new tranches under the Amended Term Loan Facility: (i) tranche A term loans in aggregate principal amount of $850 million (the “Tranche A Loans”) and (ii) tranche C term loans in an aggregate amount of $300 million (the “Tranche C Loans”). The existing term loans outstanding on the Term Loan Facility are referred to as the “Tranche B Loans.” Tranche A Loans will mature four years from the Term Loan Closing Date and Tranche C Loans will mature on the sixth anniversary of the Term Loan Closing Date. As of September 30, 2013, SBI had $850 million Tranche A Loans, $595 million Tranche B Loans and $300 million Tranche C Loans outstanding. |

| (3) | On December 18, 2013, SBI entered into the First Restatement Agreement, pursuant to which SBI amended and restated its existing credit agreement, dated as of December 17, 2012 (as amended, the “Restated Credit Agreement”). Pursuant to the First Restatement Agreement and the restated Term Credit Agreement, on December 18, 2013, SBI closed on $215 million term loans (the “New U.S. Term Loan”) and a wholly-owned subsidiary of SBI, Spectrum Brands Europe GmbH, closed on €225 million term loans (the “Euro Term Loan” and, together with the New U.S. Term Loan, the “New Term Loans”). |

The Restated Credit Agreement, among other things, shortens the maturity date of the outstanding Canadian term loans from December 17, 2019 to September 4, 2019. Upon the incurrence of the New Term Loans and the repayment of existing term loans with the proceeds thereof, SBI currently has Tranche A Term Loans, Tranche C Term Loans, Initial Canadian Term Loans and Initial Euro Term Loans as defined in, and under the Restated Credit Agreement.

The New U.S. Term Loan has identical terms as, and is made fungible with, the existing Tranche C Term Loans. All outstanding amounts of the Euro Term Loans will bear interest at a rate per annum equal to the Euribor rate with a 0.75% per annum floor, plus a margin equal to 3.00% per annum. The issue price for the New Term Loans is 99.875% of the principal amount thereof, which original issue discount will be amortized over the life of the New Term Loans. The New Term Loans will mature on September 4, 2019.

| (4) | On March 15, 2012, SBI issued $300.0 million aggregate principal amount of 6.75% Senior Notes due 2020 at a price of 100% of the par value. The 6.75% Notes are unsecured and guaranteed by SBI’s parent company, SB/RH Holdings, LLC, as well as by existing and future domestic restricted subsidiaries. |