Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HOOPER HOLMES INC | a50865166ex99_1.htm |

| 8-K - HOOPER HOLMES, INC. 8-K - HOOPER HOLMES INC | a50865166.htm |

Exhibit 99.2

1 Hooper Holmes, Inc. May

14, 2014 Earnings Presentation Speakers: Henry Dubois, Chief Executive

Officer Tom Collins, Chief Financial Officer

2 Safe Harbor Statement 2

The presentation contains forward-looking statements concerning plans,

objectives, goals, strategies, future events or performances, which are

not statements of historical fact. The forward-looking statements

contained in this release reflect our current beliefs and expectations.

Actual results or performance may differ materially from what is

expressed in the forward-looking statements. You are referred to the

documents filed by us with the SEC, specifically reports on Form 10-K

and Form 10- Q including risk factors that could cause actual results to

differ from forward-looking statements. These reports are available at

www.sec.gov. This presentation should be used in conjunction with the

earnings call dated May 14, 2014. This presentation contains information

from third-party sources, including data from studies conducted by

others and market data and industry forecasts obtained from industry

publication. Although Hooper Holmes Inc. believes that such information

is reliable, Hooper Holmes Inc. has not independently verified any of

this information and Hooper Holmes Inc. does not guarantee the accuracy

or completeness of this information.

Progress Since March 26

Continuing to deliver the Finest Biometric Screenings in the Industry

Quality Partnership April 29: Rounded out new management team by

appointing: • SVP Health & Wellness Products and Operations • General

Counsel & Corp Secty April 16: Announced Strategic Alliance with

Clinical Reference Laboratory, Inc. (CRL) Working closely with customer

partners to attract new employers for services *Health & Wellness

segment growth H&W Growth* 3

4 Strategic Alliance with

CRL Accelerates Growth in Health Care services Health & Wellness is Sole

Hooper Focus at Close Shareholder Value Partnership Industry Leadership

• CRL to acquire Hooper Holmes’ Lab & Services businesses for $3.7mm •

Late 2Q/early 3Q14 closing • Additional capital to support H&W growth •

Retain H&W supply chain capabilities • Hooper will join CRL’s preferred

provider network for Wellness • Access to CRL’s state-of-the-art lab

testing capabilities • Will be exclusive provider of Lab testing

services to Hooper • Will expand CRL life insurance industry leadership

• Increased Lab testing market share

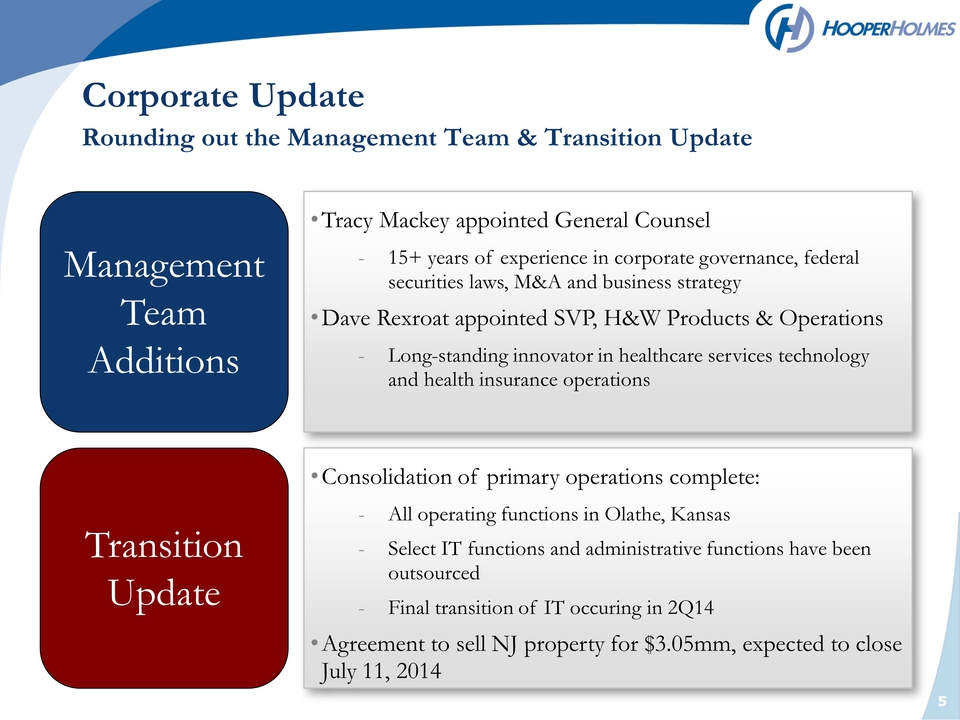

5 Corporate Update Rounding

out the Management Team & Transition Update •Tracy Mackey appointed

General Counsel - 15+ years of experience in corporate governance,

federal securities laws, M&A and business strategy •Dave Rexroat

appointed SVP, H&W Products & Operations- Long-standing innovator in

healthcare services technology and health insurance operations

Management Team Additions • Consolidation of primary operations

complete: - All operating functions out of Olathe, Kansas - Select IT

functions and administrative functions have been outsourced - Final

transition of IT occuring in 2Q14 • Letter of intent to sell NJ property

for $3.05mm, expected to close July 11, 2014 Transition Update

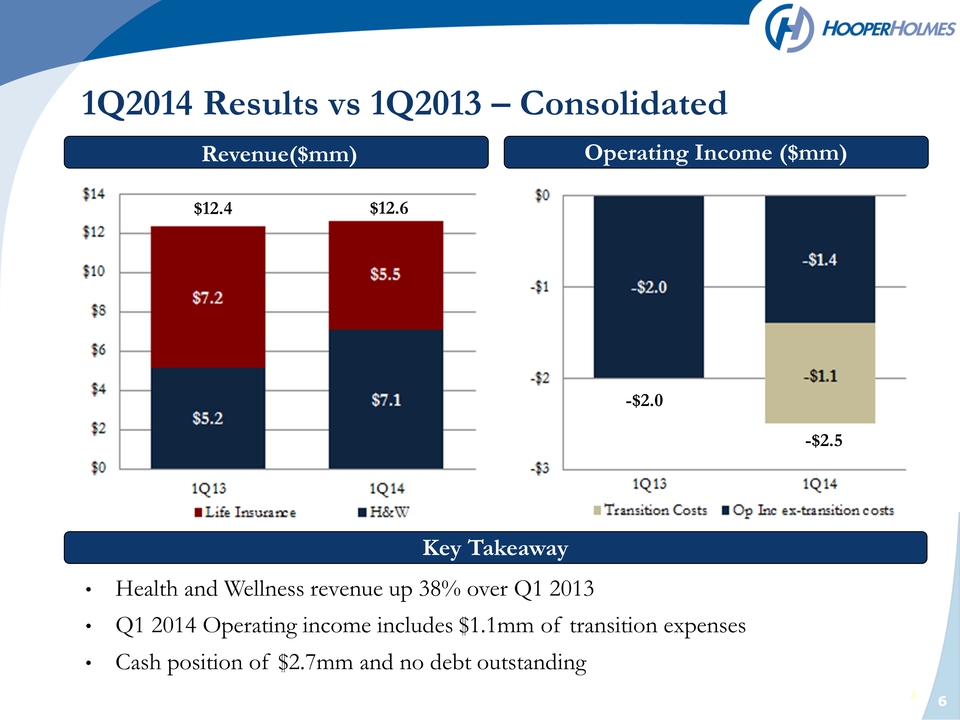

6 1Q2014 Results vs 1Q2013

– Consolidated 6 Revenue($mm) Operating Income ($mm) • Health and

Wellness revenue up 38% over Q1 2013 • Q1 2014 Operating income includes

$1.1mm of transition expenses • Cash position of $2.7mm and no debt

outstanding Key Takeaway $12.4 $12.6 -$2.0 -$2.5

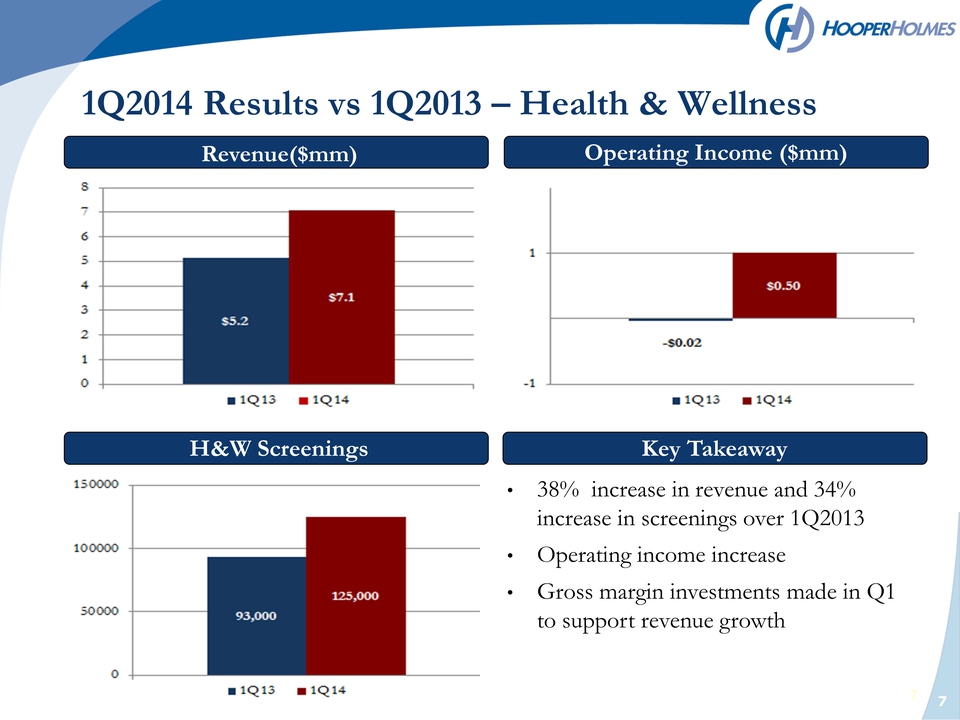

7 1Q2014 Results vs 1Q2013

– Health & Wellness 7 Revenue($mm) H&W Screenings Operating Income ($mm)

• 38% increase in revenue and 34% increase in screenings over 1Q2013 •

Operating income increase • Gross margin investments made in Q1 to

support revenue growth Key Takeaway

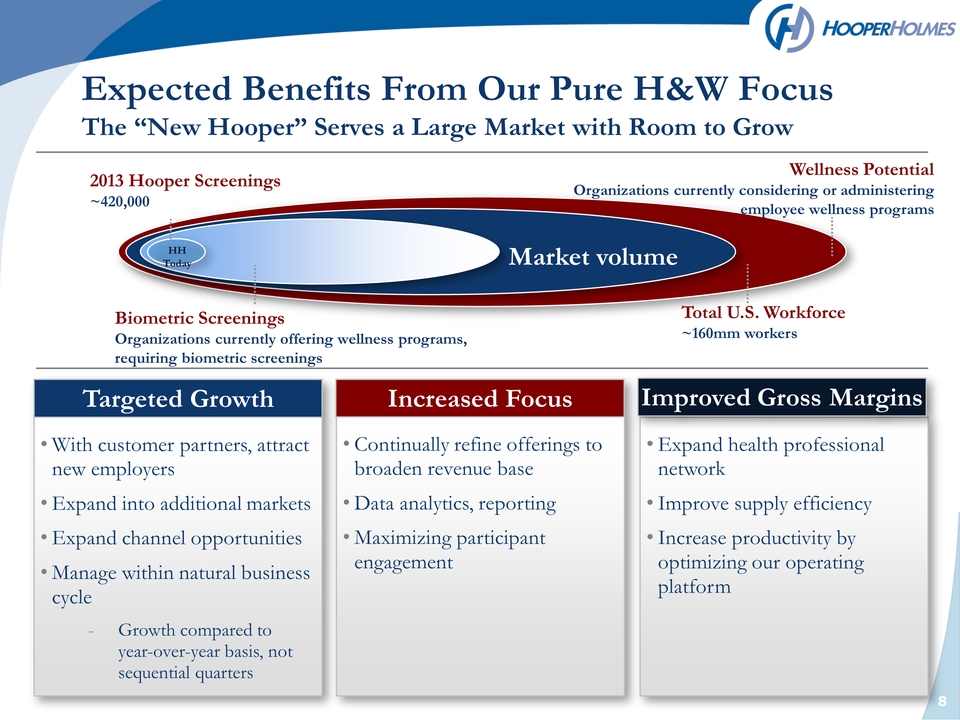

8 Expected Benefits From

Our Pure H&W Focus The “New Hooper” Serves a Large Market with Room to

Grow Targeted Growth Increased Focus • With customer partners, attract

new employers • Expand into additional markets • Expand channel

opportunities • Manage within natural business cycle - Growth compared

to year-over-year basis, not sequential quarters • Continually refine

offerings to broaden revenue base • Data analytics, reporting •

Maximizing participant engagement • Increase health professional and

supply efficiency Improved Gross Margins HH Today Market volume

Biometric Screenings Organizations currently offering wellness programs,

requiring biometric screenings 2013 Hooper Screenings 420,000 Wellness

Potential Organizations currently considering or administering employee

wellness programs Total U.S. Workforce 160mm workers

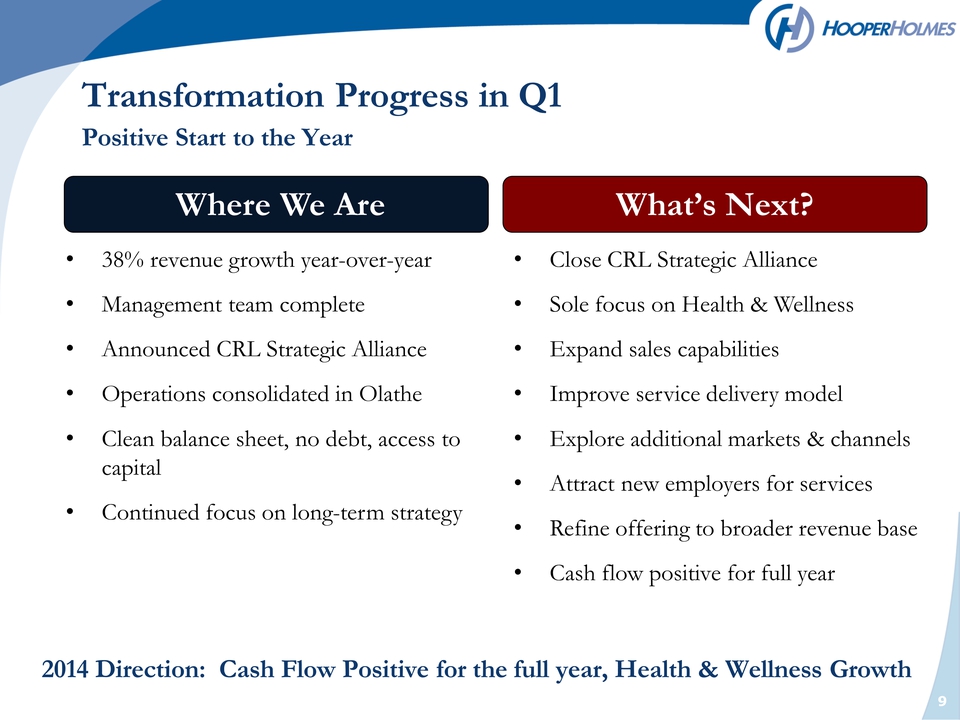

9 Transformation Progress in Q1 Positive Start to the Year • 38% revenue growth year-over-year • Management team complete • Announced CRL Strategic Alliance • Operations consolidated in Olathe • Clean balance sheet, no debt, access to capital • Continued focus on long-term strategy 2014 Direction: Cash Flow Positive for the full year, Health & Wellness Growth Where We Are What’s Next? • Close CRL Strategic Alliance • Sole focus on Health & Wellness • Expand sales capabilities • Improve service delivery model • Explore additional markets & channels • Attract new employers for services • Refine offering to broader revenue base • Cash flow positive for full year