Attached files

| file | filename |

|---|---|

| 8-K - GULFSLOPE ENERGY, INC. | gspe8k051414.htm |

EXHIBIT 99.1

GulfSlope Energy Exploring the Gulf of Mexico Investor Presentation GulfSlope Energy is a team of oil and gas industry veterans utilizing 2.2 million acres of 3D seismic data in the exploration for large oil and gas fields in the underexplored Shelf Miocene play in water depths of less than 1,000 ft. We estimate 2 Billion2 boe of potential recoverable resources are associated with the 22 federal OCS offshore blocks1 for which we are the high bidder. We anticipate initial drilling in 2015. May 15th, 2014 OTC BB: GSPE www.GulfSlope.com 1. Pending BOEM lease award from OCS Sale 231, March 19, 2014 2. Based on internal company estimates of potential recoverable resources that do not comply with SEC Oil & Gas Industry Disclosures

Forward Looking Statement This presentation may contain forward-looking statements about the business, financial condition and prospects of the Company. Forward-looking statements can be identified by the use of forward-looking terminology such as “believes,” “projects,” “expects,” “may,” “goal,” “estimates,” “should,” “plans,” “targets,” “intends,” “could,” or “anticipates,” or the negative thereof, or other variations thereon, or comparable terminology, or by discussions of strategy or objectives. Forward-looking statements relate to anticipated or expected events, activities, trends or results including BOEM lease awards based on apparent high bids. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties. Forward-looking statements in this presentation include, without limitation, the Company’s expectations of oil and oil equivalents, barrels of oil and gas resources in an underexplored region, prospects leased, profitable prospects, dollar amounts of value creation, undiscovered resources, drilling success rates, resource information , superior economics, consistent value growth and other performance results. The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves, i.e. Items 1201 through 1208 of Regulations S-K (“SEC Oil and Gas Industry Disclosures”) . The estimates of recoverable resources used in this presentation do not comply the SEC Oil and Gas Industry Disclosures, nor should it be assumed that any recoverable resources will be classified as proved, probable or possible reserves consistent with the SEC Oil and Gas Industry Disclosures. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, there can be no assurances that such expectations will prove to be accurate. Security holders are cautioned that such forward-looking statements involve risks and uncertainties. The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company expressly disclaims any obligation or undertaking to report any updates or revisions to any such statement to reflect any change in the Company’s expectations or any change in events, conditions or circumstances on which any such statement is based. Certain factors may cause results to differ materially from those anticipated by some of the statements made in this presentation. Please carefully review our filings with the SEC as we have identified many risk factors that impact our business plan. U.S. Investors are urged to consider closely the disclosures in our Forms 10-K, 10-Q, 8-K and other filings with the SEC, which can be electronically accessed from our website or the SEC's website at http://www.sec.gov/. Abbreviations: MM million $ United States dollar B billion RTM Reverse time migration boe barrel of oil equivalent GSPE GulfSlope Energy, Inc.

Introduction GulfSlope applies seismic imaging technologies proven in other sub-salt plays Team Management team with Fortune 500 CEO and proven exploration success Highly specialized & experienced technical team selected specifically for this play Majority independent board of seasoned E&P CEOs with Gulf of Mexico leadership experience Focus Area Selection Priority Objective Proven oil & gas provinceReduce risk Area we already know Reduce learning curve to accelerate drilling Large scale + profitable prospects Must displace other E&P opportunities (deepwater, unconventional, international) Prospect rich area Focused, manageable, and scalable Oil prone Improve economics Low competitionFirst mover advantage (low entry costs) Shallow water depths Jack-up rigs available up to 450’ which reduces drilling costs by ~75% vs deepwater Infrastructure Proximity to existing pipelines and platforms will accelerate time to first production and reduce overall development costs

Assets Prospects 22 Gulf of Mexico OCS lease blocks1 2 Billion boe of estimated potential recoverable resources2 Seismic 2.2 Million acres of 3D seismic (~440 blocks) 1 Million acres reprocessed RTM 3D seismic data (~200 Blocks) Acquisition Area: 22 GulfSlope blocks highlighted Tanzanite ~30 MMboe Hickory ~53 MMboe Mahogany ~45 MMboe Enchilada ~24 MMboe Conger ~200 MMboe GulfSlope blocks shown in yellow 1. Pending BOEM lease award from OCS Sale 231, March 19, 2014 2. Based on internal company estimates of potential recoverable resources that do not comply with SEC Oil & Gas Industry Disclosures 3. Reserves (MMboe) for fields mentioned include production to date and estimated volumes to be produced

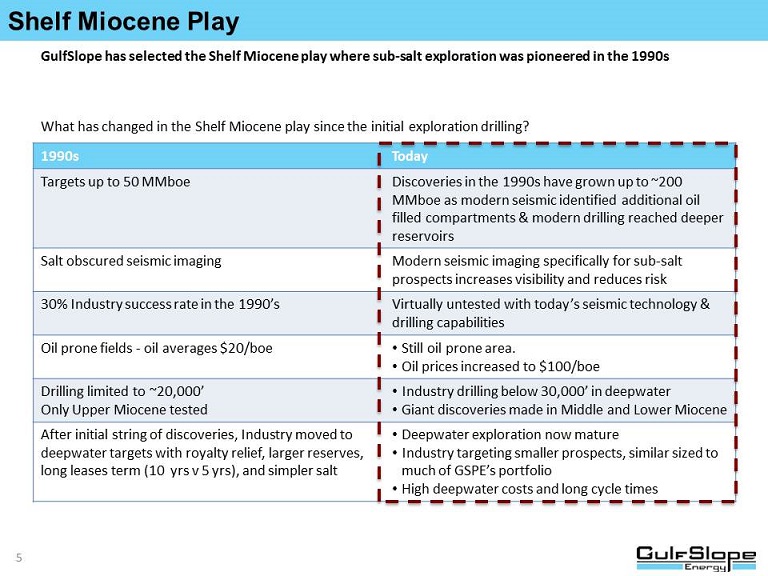

Shelf Miocene Play GulfSlope has selected the Shelf Miocene play where sub-salt exploration was pioneered in the 1990s What has changed in the Shelf Miocene play since the initial exploration drilling? 1990s Today Targets up to 50 MMboe Discoveries in the 1990s have grown up to ~200 MMboe as modern seismic identified additional oil filled compartments & modern drilling reached deeper reservoirs Salt obscured seismic imaging Modern seismic imaging specifically for sub-salt prospects increases visibility and reduces risk 30% Industry success rate in the 1990’s Virtually untested with today’s seismic technology & drilling capabilities Oil prone fields - oil averages $20/boe Still oil prone area. Oil prices increased to $100/boe Drilling limited to ~20,000’ Only Upper Miocene tested Industry drilling below 30,000’ in deepwater Giant discoveries made in Middle and Lower Miocene After initial string of discoveries, Industry moved to deepwater targets with royalty relief, larger reserves, long leases term (10 yrs v 5 yrs), and simpler salt Deepwater exploration now mature Industry targeting smaller prospects, similar sized to much of GSPE’s portfolio High deepwater costs and long cycle times

Superior Economics on the Shelf Shelf Miocene Developments Large fields: ~200 MMboe nearby direct analog All fields produced significant liquids Shallow water drilling depths with 80% within jack-up depth (450’ or less) at far lower cost than deepwater drillships or semi-subs Fixed platform developments 3 Years from discovery to 1st production Developments benefited from existing infrastructure Additional upside potential Modern drilling – access multiple, deeper targets than in the 1990s Subsea completion/tieback to additional facilities serving deepwater Synergies with offset fields – extends offset field’s life and reduces GSPE throughput costs Development Timeline: Exploration Drilling to 1st Production Exploration Drilling Appraisal Drilling Permitting Construction & Development Drilling +/- 9 Years2 +/- 3 Years 1 2 3 4 YEARS 5 6 7 8 9 Deepwater Shelf

Existing Sub-Salt Fields Gulf of Mexico Shelf Miocene Play Mahogany Midas Gemini Thunder Horse Deepwater Hickory Teak Tarantula Enchilada Tanzanite Monazite Conger Shenzi Mad Dog Atlantis Heidelberg North Platte Shenandoah Jack Logan Hadrian Lucius Buckskin Kaskida Tiber Significant Shelf Miocene Fields* (Sub-Salt) Field Year Discovered Year 1st Produced Reserves1 (MMboe) Conger 1997 2000 ~200 Hickory 1998 2000 ~53 Mahogany 1993 1996 ~45 And Growing * Reserves include production to date and estimated volumes to be produced

Strategy: “Organic Growth through Exploration Discoveries” Significant Announcements Planned Leading to Anticipated Drilling in 2015 Operational Financial 4/2013: Acquire Seismic 2013: Build team & infrastructure 2014: Complete Prospect Generation of 2Bboe2 2013: Reprocess 1 million acres of 3D Seismic to RTM 3/13: Acquire OTC vehicle “GSPE” 210/2013: Angel Funding of $10MM Pre-Drill Activity 7/2014: Release 3rd Party Report of Potential Recoverable Resources 3/2014: 2014 Federal OCS Lease Sale (22 Blocks Acquired1) 5/29/2014: Annual Meeting Uplist to NYSE or NASDAQ? 7/2014 or Earlier: Final Block Awards Future Equity Offering Drilling 1. Pending BOEM lease award from OCS Sale 231, March 19, 2014 2. Based on internal company estimates of potential recoverable resources that do not comply with SEC Oil & Gas Industry Disclosures

Why Invest in GulfSlope Energy Pure Gulf of Mexico exploration exposure Multi-year drilling portfolio with 2 Billion boe of potential recoverable resources* Large prospects in shallow water (<1,000 ft of water depth) can generate very attractive returns for shareholders Oil and condensate prone area underexplored Proven executives with strong history of value creation Management & technical team fully aligned with investors GulfSlope is well positioned as industry returns to the shelf sub-salt play * Based on internal company estimates of potential recoverable resources that do not comply with SEC Oil & Gas Industry Disclosures

Thank You Contact for more information Brady Rodgers 281.918.4110 brady.rodgers@gulfslope.com OTC BB: GSPE www.GulfSlope.com