Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek US Holdings, Inc. | dk-8kxinvestorpresentation.htm |

Investor Presentation – May 2014 Delek US Holdings

Safe Harbor Provision 2 Delek US Holdings and Delek Logistics Partners, LP are traded on the New York Stock Exchange in the United States under the symbols “DK” and ”DKL” respectively, and, as such, are governed by the rules and regulations of the United States Securities and Exchange Commission. This presentation may contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning our current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: risks and uncertainties with the respect to the quantities and costs of crude oil, the costs to acquire feedstocks and the price of the refined petroleum products we ultimately sell; losses from derivative instruments; management's ability to execute its strategy through acquisitions and transactional risks in acquisitions; our competitive position and the effects of competition; the projected growth of the industry in which we operate; changes in the scope, costs, and/or timing of capital projects; general economic and business conditions, particularly levels of spending relating to travel and tourism or conditions affecting the southeastern United States; and other risks contained in our filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Neither Delek US nor Delek Logistics Partners undertakes any obligation to update or revise any such forward- looking statements.

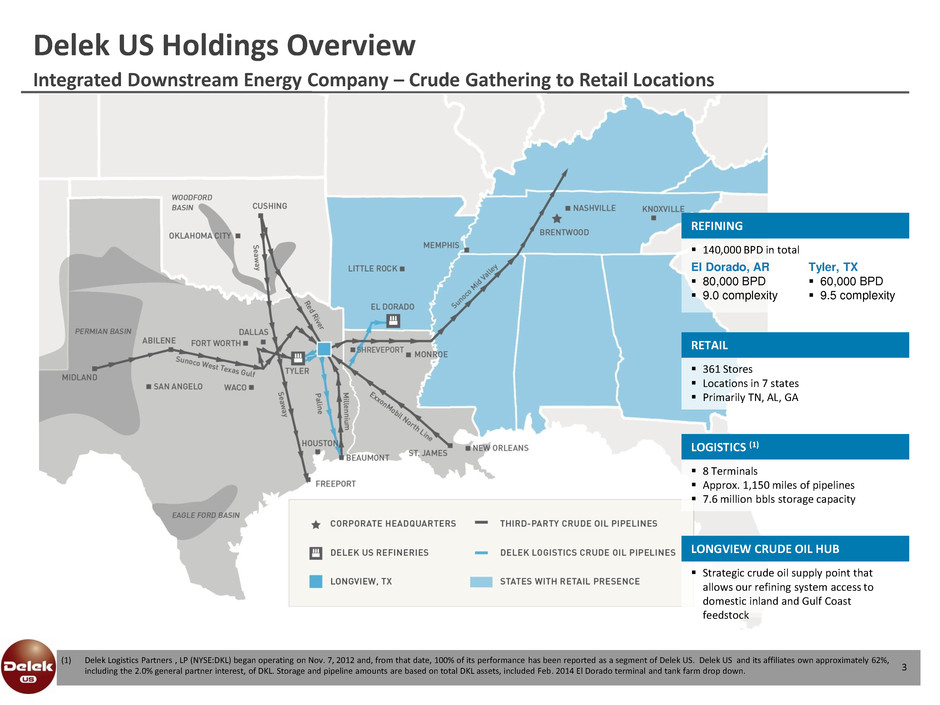

REFINING Delek US Holdings Overview Integrated Downstream Energy Company – Crude Gathering to Retail Locations (1) Delek Logistics Partners , LP (NYSE:DKL) began operating on Nov. 7, 2012 and, from that date, 100% of its performance has been reported as a segment of Delek US. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL. Storage and pipeline amounts are based on total DKL assets, included Feb. 2014 El Dorado terminal and tank farm drop down. 140,000 BPD in total El Dorado, AR 80,000 BPD 9.0 complexity Tyler, TX 60,000 BPD 9.5 complexity 361 Stores Locations in 7 states Primarily TN, AL, GA RETAIL 8 Terminals Approx. 1,150 miles of pipelines 7.6 million bbls storage capacity LOGISTICS (1) Strategic crude oil supply point that allows our refining system access to domestic inland and Gulf Coast feedstock LONGVIEW CRUDE OIL HUB 3

4 Integrated Business Model Flexible Crude Sourcing and Market Driven Production Enhance Performance Flexible Crude Oil Sourcing •Pipeline access to Midland; Gulf Coast; Cushing • Increasing Gathering – Texas and Arkansas •Access to Canadian crude Crude Logistics •Crude oil pipelines supporting refineries •600 mile gathering system in Arkansas •Rail access at El Dorado Refining •140,000 bpd crude throughput •Crude slate flexibility Product Logistics •8 light product terminals • Light product pipelines Retail Locations •361 locations • Synergies with logistics and refining

Mid-Continent Refining System 5 Strategic Location Allows Access to Cost-Advantaged Feedstocks and Niche Markets Note: During 1Q14, the El Dorado refinery completed a turnaround in Jan./Feb. which lowered throughput for the quarter. Also, Midland and local crude was stored during turnaround allowing the crude slate to be weighted to these sources during the quarter. (1) Rail supplied light crude capability consists of 25,000 bpd of light crude or 12,000 bpd heavy crude offloading that is available at a company owned facility at the El Dorado refinery . In addition, 20,000 bpd light crude capability is currently available via a third party facility adjacent to the El Dorado refinery. • Pipeline Access: Midland (87,000 bpd in system) Gulf Coast Cushing • Gathered Barrels: Local barrels in Arkansas East and West Texas • Rail Capability at El Dorado Up to 45,000 BPD of light crude(1) Ability to offload heavy Canadian crude • Synergies Refinery locations allow ability to optimize the system Benefited 1Q14 during El Dorado turnaround Crude Logistics Provides Options for the Refining System Local AR, 13% Midland, 75% Other Domestic, 10% Rail, 1% Refining System Crude Slate (1Q14)

Refining Segment Operational Update

U.S. Refining Environment Trends Refined Product Margins and WTI-Linked Feedstock Favor Delek US (1) Source: Platts; 2014 data is as of May 9, 2014; quarterly averages shown.; 5-3-2 crack spread based on HSD (2) Crack Spreads: (+/-) Contango/Backwardation -$30 -$20 -$10 $0 $10 $20 $30 $40 $50 J a n -1 0 F e b -1 0 M a r- 1 0 A pr -1 0 M a y -1 0 J u n -1 0 J u l- 1 0 A u g -1 0 S e p -1 0 O c t- 1 0 No v -1 0 De c -1 0 J a n -1 1 F e b -1 1 M a r- 1 1 A pr -1 1 M a y -1 1 J u n -1 1 J u l- 1 1 A u g -1 1 S e p -1 1 O c t- 1 1 No v -1 1 De c -1 1 J a n -1 2 F e b -1 2 M a r- 1 2 A pr -1 2 M a y -1 2 J u n -1 2 J u l- 1 2 A u g -1 2 S e p -1 2 O c t- 1 2 No v -1 2 De c -1 2 J a n -1 3 F e b -1 3 M a r- 1 3 A pr -1 3 M a y -1 3 J u n -1 3 J u l- 1 3 A u g -1 3 S e p -1 3 O c t- 1 3 No v -1 3 De c -1 3 J a n -1 4 F e b -1 4 M a r- 1 4 A pr -1 4 M a y -1 4 Brent-WTI Cushing Spread Per Barrel WTI 5-3-2 Gulf Coast Crack Spread Per Barrel LLS 5-3-2 Gulf Coast Crack Spread Per Barrel 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 (1) (2) (2) WTI 5-3-2 Gulf Coast Crack Spread Per Barrel $24.06 $25.88 $30.39 $27.20 $27.38 $20.19 2Q13 3Q13 $11.82 4Q13 $12.87 1Q14 $15.01 7 2Q14 $18.06

WTI Midland vs. WTI Cushing Crude Pricing ($14.00) ($12.00) ($10.00) ($8.00) ($6.00) ($4.00) ($2.00) $0.00 ` Access to Midland Crudes Benefits Margins 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 3Q13 4Q13 ($ per barrel) 1Q14 87,000 bpd of Midland crude in DK system 8 2Q14 Source: Argus – June MTD as of trading through May 9, 2014

Tyler Refinery Overview 9 Inland PADD III light product refinery located in East Texas Planning underway for 1Q15 turnaround Serves a niche market in the Tyler, TX area; priced above Gulf Coast markets Currently 60,000 bpd, 9.5 complexity; demonstrated 64,000 bpd ability Products shipped across truck terminal at refinery Crude Access: Cost advantaged refinery primarily processing Midland sourced crude (92% in 1Q14) 52,000 bpd of Midland crude via pipeline increased from 35,000 bpd in 2Q13; replaced higher cost east Texas and other crudes Niche Refinery with Access to WTI Midland Based Crude Supply Total Production, bpd 54% 56% 54% 57% 56% 38% 37% 39% 37% 38% 8% 7% 7% 6% 6% 59,697 59,185 62,304 58,990 65,854 54,000 56,000 58,000 60,000 62,000 64,000 66,000 68,000 0% 20% 40% 60% 80% 100% 120% 2011 2012 2013 1Q13 1Q14 Gasoline Diesel Petro/Other 80% 81% 89% 84% 92% 17% 19% 12% 16% 8% 3% 56,028 56,426 58,327 52,604 58,276 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 0% 20% 40% 60% 80% 100% 120% 2011 2012 2013 1Q13 1Q14 Midland WTI East TX Midland WTS Crude Throughput and Source, bpd (1) Note: Crude sourcing benefited from an integrated refining system that allowed primarily Midland crude to be processed at Tyler while El Dorado was in a turnaround in Jan./Feb. 2014.

Improving Niche Market Position with a Crude Slate Weighted to WTI-Linked Crude El Dorado Refinery Overview 10 Inland PADD III refinery located in Southern Arkansas 80,000 bpd, 9.0 complexity (1Q14 configured to run light and medium sour crude) Improved flexibility during 1Q14 turnaround; FCC reactor replaced; DHT expanded; Pre-flash tower project completed Flexible crude sourcing Associated gathering system positioned for Brown Dense development in Northern Louisiana and Southern Arkansas Crude access: 35,000 bpd of Midland crude via pipeline increased from 10,000 bpd as of June 2013 Local Arkansas gathered crude supply Rail offloading ability domestic and Canada Pipeline access to Gulf Coast 42% 47% 49% 48% 52% 34% 38% 38% 36% 38% 19% 10% 11% 13% 7% 6% 5% 3% 3% 3% 79,443 71,372 71,642 67,024 80,519 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 0 0 0 1 1 1 1 2011 2012 2013 1Q13 Mar. 2014 Gasoline Diesel Asphalt Petro/Other Total Production, bpd 38% Note: March 2014 production used due to turnaround in Jan./Feb. 2014; for the first quarter 2014 total production was 43,430 bpd and crude throughput was 37,459 bpd. The crude sources for March were weighted to inland/local due to inventory positions. 33% 79% 86% 81% 97% 56% 17% 3% 5% 1% 11% 3% 1% 2% 1% 1% 10% 11% 2% 73,796 65,375 65,887 63,908 77,029 - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 90,000 0% 20% 40% 60% 80% 100% 120% 2011 2012 2013 1Q13 Mar. 2014 Inland/Local Gulf Coast Foreign Canada Crude Throughput and Source, bpd

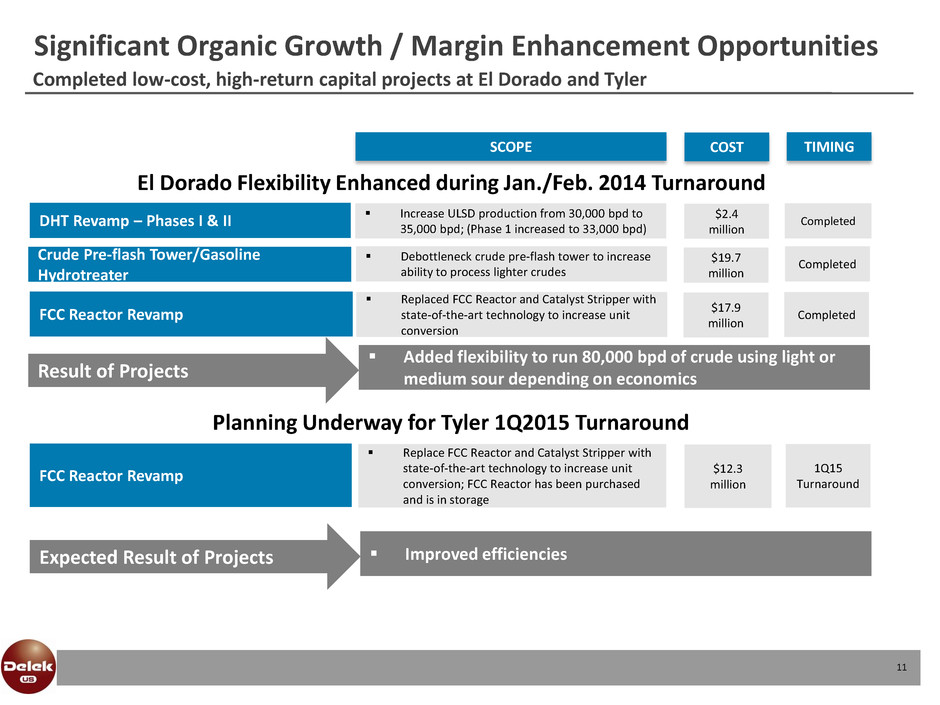

Significant Organic Growth / Margin Enhancement Opportunities 11 DHT Revamp – Phases I & II Increase ULSD production from 30,000 bpd to 35,000 bpd; (Phase 1 increased to 33,000 bpd) Completed low-cost, high-return capital projects at El Dorado and Tyler SCOPE COST TIMING $2.4 million Completed Crude Pre-flash Tower/Gasoline Hydrotreater Debottleneck crude pre-flash tower to increase ability to process lighter crudes $19.7 million Completed FCC Reactor Revamp Replace FCC Reactor and Catalyst Stripper with state-of-the-art technology to increase unit conversion; FCC Reactor has been purchased and is in storage $12.3 million 1Q15 Turnaround El Dorado Flexibility Enhanced during Jan./Feb. 2014 Turnaround FCC Reactor Revamp Replaced FCC Reactor and Catalyst Stripper with state-of-the-art technology to increase unit conversion $17.9 million Completed Planning Underway for Tyler 1Q2015 Turnaround Added flexibility to run 80,000 bpd of crude using light or medium sour depending on economics Result of Projects Improved efficiencies Expected Result of Projects

Logistics Operational Update

Strategic Partner in Delek Logistics Partners, LP (NYSE: DKL) 13 Delek Logistics Partners , LP (NYSE:DKL) began operating on Nov. 7, 2012 and 100% of its performance is reported as a segment of Delek US beginning 4Q12. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL. Note: Storage and pipeline amounts based on the pipeline and transportation segment including the El Dorado drop down in February 2014 and wholesale marketing and terminalling segment. ~550 miles of crude/product transportation pipelines, includes the 185 mile crude oil pipeline from Longview to Nederland, TX ~ 600 mile crude oil gathering system in AR Pipelines Assets Storage facilities with 7.6 million barrels of active shell capacity Storage Assets Wholesale and marketing business in Texas 8 light product terminals: TX, TN,AR Wholesale/ Terminal Assets Growing logistics assets support crude sourcing and product marketing

DKL: Several Visible Pathways to Growth 14 Dropdowns from Delek US Organic Growth Acquisitive Growth $5 - $10 Million of potential EBITDA expected to be dropped down over next 12 months in addition to recently completed Tyler and El Dorado asset drop downs 25,000 bpd (light crude) rail offloading facility at El Dorado refinery 300,000 bbl crude oil tank (under construction) at Tyler refinery Paline Pipeline ability to re-contract at a potentially higher rate after 2014 Increasing local Arkansas production, driving growth in gathering system Asset optimization and expansion Potential expansion of the North Little Rock terminal to 17,500 bpd Benefit from any increase in utilization at Delek US’ refineries Potential for 3rd party acquisitions (two completed in 2013) Ability to partner with Delek US to make acquisitions Low cost-of-capital Future dropdown potential from Delek US acquisitions Delek Logistics Partners , LP (NYSE:DKL) began operating on Nov. 7, 2012 and 100% of its performance is reported as a segment of Delek US beginning 4Q12. Delek US and its affiliates own approximately 62%, including the 2.0% general partner interest, of DKL.

Midstream MLP with long-term contracts providing stable, growing cash flow Supports Delek US’ profitable and strategically located inland refining system Unlocks value of marketing and logistics assets Strategic vehicle for growth Visible asset dropdown opportunities Partner for future acquisitions and organic growth projects Reduces consolidated cost-of-capital Performance Since IPO 15 (1) Current yield reflects NTM anticipated distribution of $1.70 per unit and equity value based on market capitalization as of [May 6, 2014]. (2) Per company filings. (3) Approximately 3.4% of the ownership interest in the general partner is owned by three members of senior management of Delek US. The remaining ownership interest is held by a subsidiary of Delek US. 158% 128% A Powerful Strategic Partner DKL Value Accrues to Delek US Shareholders DKL: Strong Performance & Value Creation Since IPO 25% 50% 75% 100% 125% 150% 175% 11/1/2012 5/3/2013 11/3/2013 5/6/2014 DKL Alerian MLP Index IPO Date: November 2, 2012 IPO Price: $21.00 per unit Current Yield (1): 5.11% Current Price (1): $33.25 per unit LP Equity Value (1): $803.0 million DK Ownership of DKL (2): 60.0% LP interest; 2% GP interest (3) & IDRs

Retail Operational Update

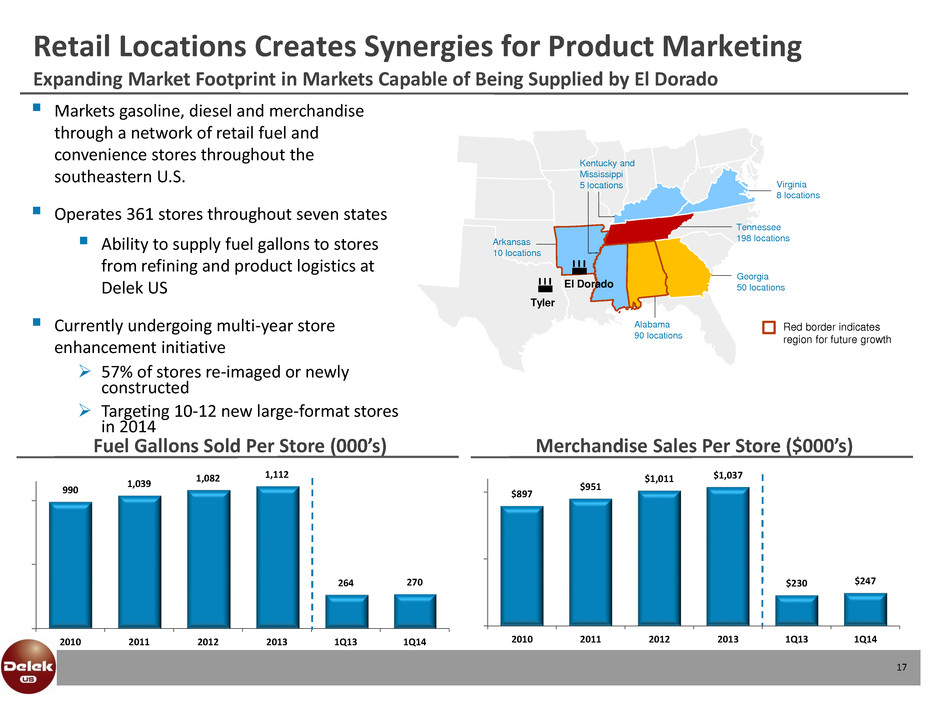

990 1,039 1,082 1,112 264 270 2010 2011 2012 2013 1Q13 1Q14 $897 $951 $1,011 $1,037 $230 $247 2010 2011 2012 2013 1Q13 1Q14 Retail Locations Creates Synergies for Product Marketing 17 Expanding Market Footprint in Markets Capable of Being Supplied by El Dorado Fuel Gallons Sold Per Store (000’s) Merchandise Sales Per Store ($000’s) Tennessee 198 locations Virginia 8 locations Kentucky and Mississippi 5 locations Arkansas 10 locations Tyler Georgia 50 locations El Dorado Red border indicates region for future growth Alabama 90 locations Markets gasoline, diesel and merchandise through a network of retail fuel and convenience stores throughout the southeastern U.S. Operates 361 stores throughout seven states Ability to supply fuel gallons to stores from refining and product logistics at Delek US Currently undergoing multi-year store enhancement initiative 57% of stores re-imaged or newly constructed Targeting 10-12 new large-format stores in 2014

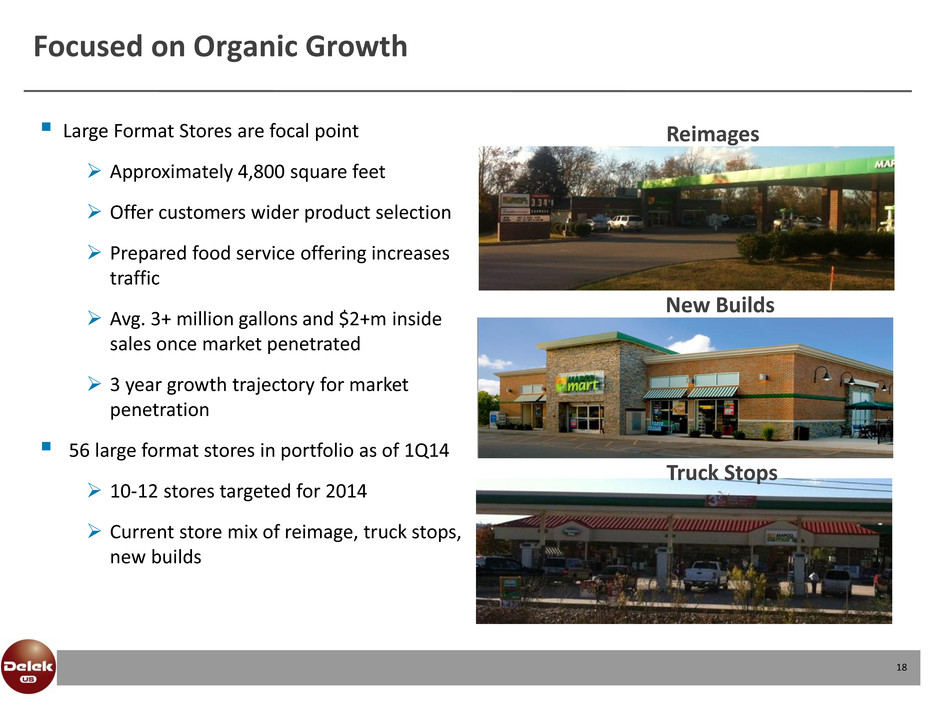

Focused on Organic Growth 18 Large Format Stores are focal point Approximately 4,800 square feet Offer customers wider product selection Prepared food service offering increases traffic Avg. 3+ million gallons and $2+m inside sales once market penetrated 3 year growth trajectory for market penetration 56 large format stores in portfolio as of 1Q14 10-12 stores targeted for 2014 Current store mix of reimage, truck stops, new builds New Builds Reimages Truck Stops

Financial Update

Financial Highlights $164 $151 $130 $445 $659 $448 $386 2008 2009 2010 2011 2012 2013 LTM Mar. 2014 2013 cash flow supported capital program, acquisitions and cash returned to shareholders Ended 2013 with $400 million of cash Strong 2012 cash flow generated from operations and Delek Logistics IPO Returning excess cash to shareholders $95 million returned to shareholders in 2013 through share repurchase ($38 million 1Q 2013) and dividends Increased regular quarterly dividend in May 2013 to $0.15 from $0.10 58% increased in regular and special dividends declared from 2012 Continued investment in the business during 2013 $222 million of capital expenditures $23 million in acquisitions At March 31, 2014 Cash of $392.9 million; Debt of $490.0 million Includes $260.5 million of debt and $4.1 million of cash at Delek Logistics (DKL) Excluding DKL, Delek US net cash position was approximately $159 million Cash Balance ($MM) Solid Financial Performance & Delivering Value to Shareholders 20 (1) Contribution margin is defined as net sales less cost of goods sold, operating expenses and other one-time expenses, excluding depreciation and amortization. (2) Delek US assumed operational control of the El Dorado refinery and related assets through the acquisition of a majority equity interest in Lion Oil on April 29, 2011. (3) Free cash flow reconciliation available in appendix. $68 $49 $226 $602 $400 $393 2009 2010 2011 2012 2013 Mar. 2014 Dividends Declared ($ / share) Historical Contribution Margin ($MM) (1)(2) $0.15 $0.15 $0.15 $0.21 $0.40 $0.10 $0.15 $0.18 $0.39 $0.55 $0.10 $0.10 $0.15 $0.15 $0.33 $0.60 $0.95 $0.20 $0.25 2009 2010 2011 2012 2013 1Q13 1Q14 Regular Special

Going Forward

$19.83 $14.86 $14.20 $7.71 $10.02 $15.02 $14.37 $17.28 $13.88 $13.76 $18.26 $17.29 Q2 2013 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May- 14 Market Fundamentals(1) 22 Improving light product prices 5-3-2 Gulf Coast crack spread improving Midland discount to Cushing widening (1) Source: Platts and Argus; 2014 data is through May 9, 2014. 5-3-2 crack spread based on HSD. $94.14 $105.94 $100.69 $93.95 $97.91 $94.84 $100.46 $100.68 $102.22 $99.84 2Q13 3Q13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 ($ per barrel) ($ per barrel) ($0.14) ($0.28) ($0.31) ($2.73) ($3.93) ($2.42) ($2.42) ($5.67) ($8.68) ($8.89) ($7.43) Q2 2013 Q3 2013 Oct. 2013 Nov. 2013 Dec. 2013 Jan. 2014 Feb. 2014 Mar. 2014 Apr. 2014 May 2014 May Trading ($ per barrel) Improving WTI 5-3-2 Gulf Coast Crack Widening Discount WTI Midland vs. WTI Cushing WTI Cushing Prices Market Highlights Differential set in month prior to crude purchases. May. trading sets June crude differential.

Delek US Focused on Building an Integrated Business Model 23 A core part of Delek US' strategy is to grow via prudent strategic transactions since 2001 (1) Includes logistic assets in purchase price. Purchase price includes working capital for refineries. 2006 Abilene & San Angelo terminals $55.1 mm 2012 Nettleton Pipeline $12.3 mm 2011 Paline Pipeline $50 mm Acquisition Completed 171 retail fuel & convenience stores & related assets $157.3 mm 2005 to 2007 2011 to 2012 2013 to Current Crude Gathering 2013 Biodiesel Facility $5.3 mm 2011 Lion refinery & related pipeline & terminals $228.7 mm(1) 2005 Tyler refinery & related assets $68.1 mm(1) 2011 - 2014 Building new large format convenience stores 2013 Tyler-Big Sandy Pipeline $5.7 mm 2014 Biodiesel Facility $11.1 mm Logistics Segment Retail Segment Refinery Segment Crude Logistics Refining Product Logistics Retail 2012 Big Sandy terminal & pipeline $11.0 mm 2013 North Little Rock Product Terminal $5.0 mm 2011 SALA Gathering Lion Oil acquisition Asset In te gr at io n Increased Gathering East and West Texas

Delek US Asset Base has Grown and Diversified 2010 2013 Crude Gathering Crude Logistics Refining Logistics Retail Total Pipeline Mileage Midland crude, bpd Throughput Capacities: Total Crude, bpd Light crude , bpd DHT, bpd Coker, bpd GHT/LSR, bpd Biodiesel Plants Product Terminals Large format stores Current Future 1Q 2014 (1) Future 1,150 miles 87,000 140,000 140,000 60,000 6,500 21,500 2 8 56 24 (1) Based on first quarter 2014. (2) Includes 3,549 bpd in 1Q14 of transmix, slop and condensate that are transported on the SALA gathering system.. G rowth F oc u se d on In teg ra ted Mo d e l Texas/Arkansas, bpd (2) 27,900

25 Large, Complementary Logistics, Marketing and Retail Systems Significant Organic Growth / Margin Improvement Opportunities Focus on Shareholder Returns Strong Balance Sheet Strategically Positioned Refining Platform Questions and Answers

Appendix Additional Data

$42.3 $36.0 $65.9 $144.3 $189.9 $0.9 $10.5 $5.1 $18.4 $14.4 $36.5 $29.1 $37.9 $30.3 $0.1 $7.6 $26.5 $35.0 $21.2 2010A 2011A 2012A 2013A 2014E * Refining Logistics (Marketing) Retail Other Historical and Projected Capital Spending 27 $56.8mm $81.0mm $132.0mm $222.3mm Source: Company filings. $259.8mm

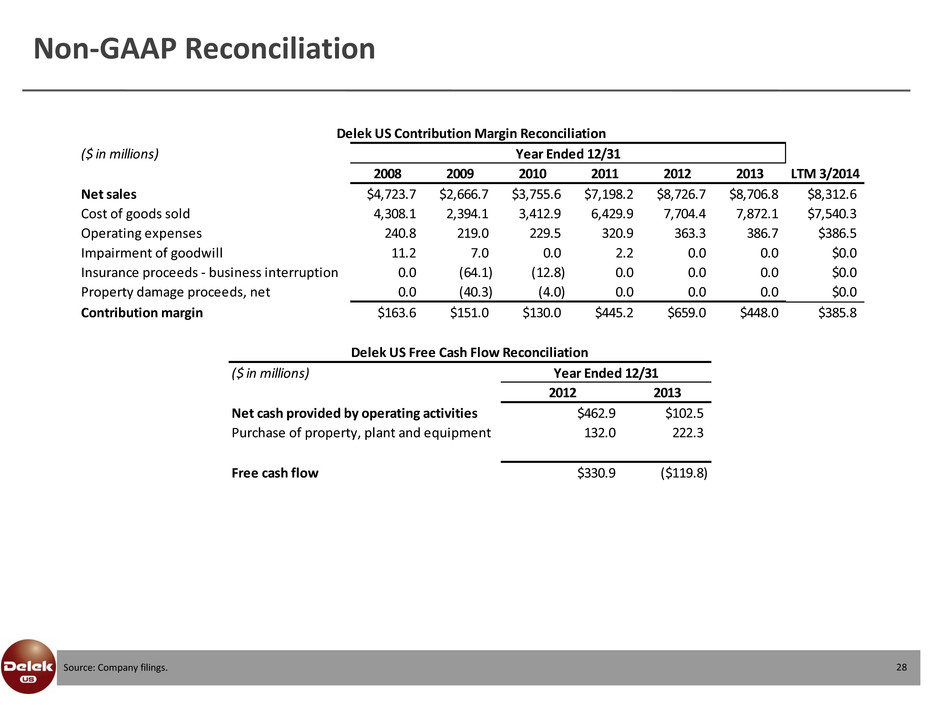

Non-GAAP Reconciliation 28 Source: Company filings. ($ in millions) 2008 2009 2010 2011 2012 2013 LTM 3/2014 Net sales $4,723.7 $2,666.7 $3,755.6 $7,198.2 $8,726.7 $8,706.8 $8,312.6 Cost of goods sold 4,308.1 2,394.1 3,412.9 6,429.9 7,704.4 7,872.1 $7,540.3 Operating expenses 240.8 219.0 229.5 320.9 363.3 386.7 $386.5 Impairment of goodwill 11.2 7.0 0.0 2.2 0.0 0.0 $0.0 Insurance proceeds - business interruption 0.0 (64.1) (12.8) 0.0 0.0 0.0 $0.0 Property damage proceeds, net 0.0 (40.3) (4.0) 0.0 0.0 0.0 $0.0 Contribution margin $163.6 $151.0 $130.0 $445.2 $659.0 $448.0 $385.8 Year Ended 12/31 Delek US Contribution Margin Reconciliation ($ in millions) 2012 2013 Net cash provided by operating activities $462.9 $102.5 Purchase of property, plant and equipment 132.0 222.3 Free cash flow $330.9 ($119.8) Year Ended 12/31 Delek US Free Cash Flow Reconciliation

Investor Relations Contact: Assi Ginzburg Keith Johnson Chief Financial Officer Vice President of Investor Relations 615-435-1452 615-435-1366