Attached files

| file | filename |

|---|---|

| 8-K - HORIZON BANCORP INC /IN/ | hb_8k0508.htm |

Exhibit 99.1

Welcome to Horizon Bancorp’s 2014 Annual Meeting A NASDAQ Traded Company - Symbol HBNC

This presentation may contain forward-looking statements regarding the financial performance, business, and future operations of Horizon Bancorp and its affiliates (collectively, “Horizon”). For these statements, Horizon claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide current expectations or forecasts of future events and are not guarantees of future results or performance. As a result, undue reliance should not be placed on these forward-looking statements, which speak only as of the date hereof. We have tried, wherever possible, to identify such statements by using words such as “anticipate,” “estimate,” “project,” “intend,” “plan,” “believe,” “will” and similar expressions, and although management believes that the expectations reflected in such forward-looking statements are accurate and reasonable, actual results may differ materially from those expressed or implied in such statements. Risks and uncertainties that could cause our actual results to differ materially include those set forth in Horizon’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K. Statements in this presentation should be considered in conjunction with such risk factors and the other information publicly available about Horizon, including the information in the filings we make with the Securities and Exchange Commission. Horizon does not undertake, and specifically disclaims any obligation, to publicly release any updates to any forward-looking statement to reflect events or circumstances occurring or arising after the date on which the forward-looking statement is made, or to reflect the occurrence of unanticipated events, except to the extent required by law. Forward-Looking Statements

Company Profile and Performance Review Mark E. Secor EVP & Chief Financial Officer

Northwest Indiana/Southwest Michigan… The Right Side of Chicago

* Headquartered in Michigan City, IN 31 Locations and Considerable Opportunity for Growth $1.8 Billion in Assets 14 Years of Record Earnings Market Cap. of $184 million Stock Ownership 9% Insiders 13% Employee Benefit Plans 31% Institutional Company Profile * Market data as of May 5, 2014; financial data as of March 31, 2014

Source: U.S. Bureau of Labor Statistics, seasonally adjusted Indiana, Michigan and National Unemployment Rates Lower Unemployment Creates Loan Growth *

Complementary Revenue Streams Diversifies Risk Retail Banking Business Banking Mortgage Banking Wealth Management Complementary Revenue Streams that are Counter-Cyclical to Varying Economic Cycles *

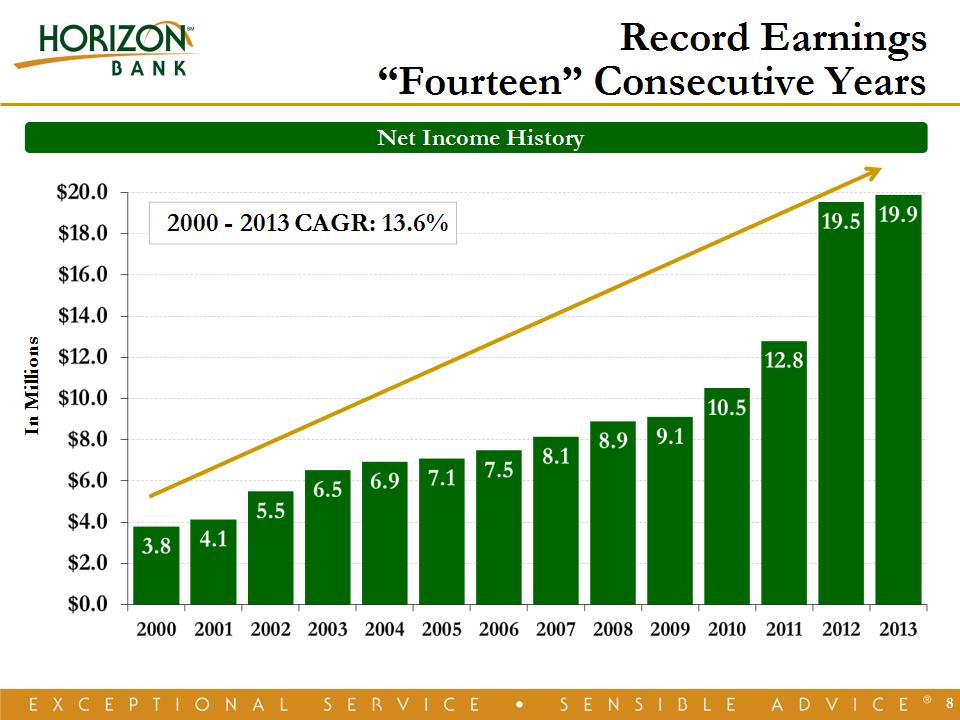

Record Earnings “Fourteen” Consecutive Years 2000 – 2013 CAGR: 13.6% In Millions Net Income History *

* Gain on Sale of Loans & Net Income Earnings Growth Resilient to Mortgage Volatility

First Quarter Earnings Volatility First Quarter Net Income *

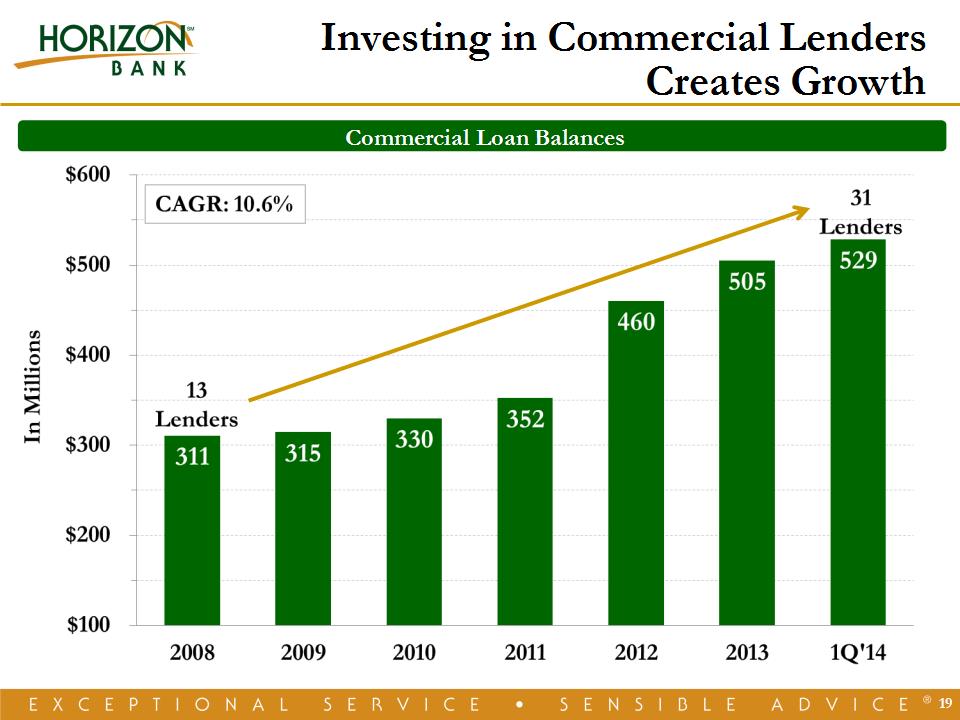

March 31, 2014 Loan Composition December 31, 2008 Loan Composition In Millions 2008 1Q’14 CAGR Commercial $311 $529 10.6% Real Estate $291 $292 0.1% Consumer $280 $280 0.0% * Shift to Commercial

December 31, 2008 Deposit Composition March 31, 2014 Deposit Composition Strong Low Cost Deposit Growth 2008 – 1Q’14 CAGR 2008 – 1Q’14 CAGR Nonint. Bearing 22.1% MMDA & Savings 17.9% IB Demand 11.9% CDs (3.2%) *

* Summit Community Bank Acquisition Adds Value Acquisition Metrics(1)(2) Acquisition Metrics(1)(2) Deal Value (“DV”) $18.9 mil. DV/ Tg. Book Value 120.5% DV/ LTM Earnings 11.1x Core Deposit Prem. 2.8% Closed on April 3, 2014, Successful Conversion on April 26, 2014 Illustrates Horizon’s Focus on Larger Markets with Growth Potential Chris Nugent - Market President Four Experienced Lenders to Drive Loan Growth Accretive to EPS, Reasonable TBV Dilution Earnback Period Deal value as of April 3, 2014 Financial data for SCB Bancorp at or for the year ended December 31, 2013

* Summit Contribution In Millions(1) Horizon Summit Combined Assets $1,807 $154 $1,961 Commercial Loans $529 $75 $604 Loans, net $1,090 $129 $1,219 Deposits $1,356 $119 $1,475 Common Shares 8.7 .6 (2) 9.3 Financial data as of March 31, 2014; does not include purchase accounting adjustments Horizon Bancorp shares issued in the transaction

Horizon’s Growth Story Thomas H. Edwards President *

A Company on the Move Organic Expans. (8) St. Joseph South Bend Elkhart Lake County Kalamazoo Indianapolis Carmel Grand Rapids M&A (6) Anchor Mortgage Alliance Bank American Trust Heartland 1st Mortgage Summit * Total Assets ($mm) $721 $1,807 Full Service Branches 7 31

Growth on the Horizon 1Q’14 Commercial Loan Growth 18.6% Annualized Acquired Summit Community Bank, East Lansing, Michigan Acquired 1st Mortgage of Indiana, Indianapolis, Indiana Downtown Indianapolis Branch Opened Branch Expansion Plans *

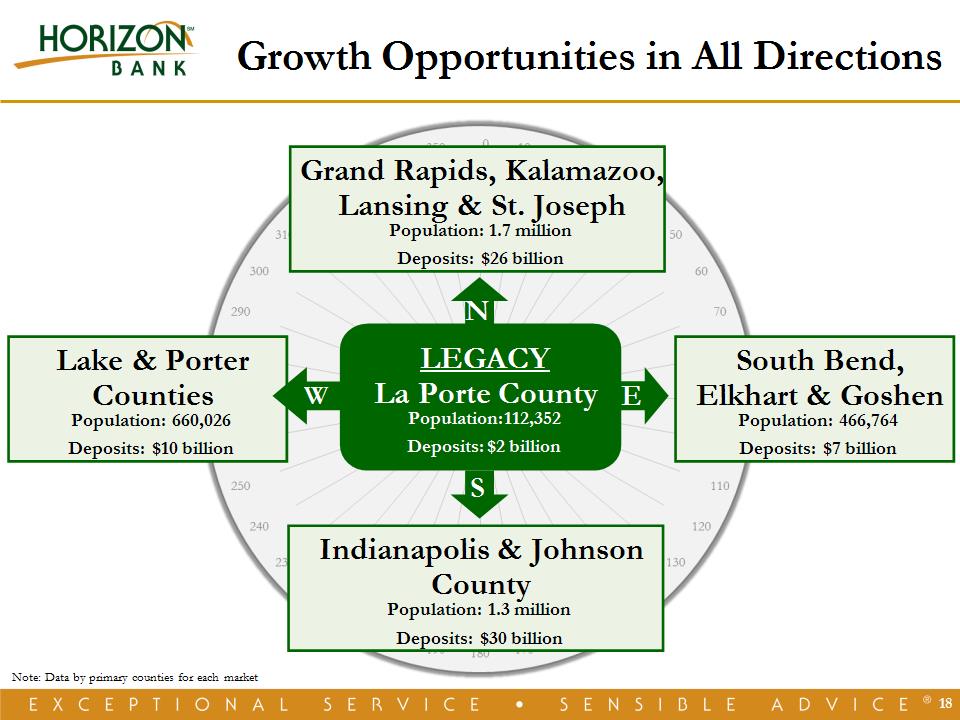

Growth Opportunities in All Directions * Grand Rapids, Kalamazoo, Lansing & St. Joseph Population: 1.7 million Deposits: $26 billion South Bend, Elkhart & Goshen Population: 466,764 Deposits: $7 billion Indianapolis & Johnson County Population: 1.3 million Deposits: $30 billion Lake & Porter Counties Population: 660,026 Deposits: $10 billion LEGACY La Porte County Population: 112,352 Deposits: $2 billion N E S W Note: Data by primary counties for each market

* Investing in Commercial Lenders Creates Growth Commercial Loan Balances

* Balanced Risk In Commercial Portfolio Commercial Loan Composition

Kalamazoo and Indianapolis Loan Balances * Growth Markets Thriving $201 Total

* Balanced Risk In Commercial Portfolio Commercial Loan Composition

Investing in Consumer Loan Growth Experienced Leader Hired to Grow Portfolio Additional Resources Allocated to Indirect Lending Increased Emphasis on Cross Selling Employee Incentive Program – Lots of Loans “LOL” Expanded Product Offerings *

“Exceptional Service” Guarantees Consumer: Loan Decision in 15 Minutes or… Horizon Pays $125 Towards Closing Costs Business(1) Loan Decision by the Next Business Day or… Horizon Pays $250 Towards Closing Costs Mortgage New Purchase Home Loans Closed in 30 Days or… Horizon Pays $500 Towards Closing Costs * (1) Small business loans under $100,000

Horizon’s Story Steady Growth Superior Returns Financial Strength Consistent Performance *

* Why Invest In Horizon Craig M. Dwight Chairman & CEO

Shareholder Value Plan - Since 2001 Steady Growth in Net Book Value & EPS Dividends Uninterrupted Dividends for more than 25 Years Dividend Increases Aligned with Earnings Growth Improving Liquidity Stock Splits in 2001, 2003, 2011 and 2012 Common Stock Issued in Heartland and Summit Acquisitions Russell 2000 Index in 2012 and 2013 *

Highly Regarded For Financial Performance Top 200 Community Banks for Financial Performance Six Consecutive Years, 2008 - 2013 US Banker & ABA Magazines Top 10% of Community Banks Annual Community Bankers Cup, 2012 & 2013 Raymond James KBW Bank Honor Roll 2011 & 2012 *

Highly Regarded In Our Communities * Community Relations Award Urban League of Northwest Indiana, Inc. Nine out of Ten Customers Would Refer a Friend Independent Survey Best Bank - Eleven out of Last Twelve Years The News Dispatch Readers Poll Best Bank for Obtaining a Business Loan Northwest Indiana Business Quarterly Family Friendly Work Policies IU Health / Clarian Award

Horizon Outperforms the Market For Total Shareholder Return As of May 5, 2014 SNL U.S. Bank: Includes all Major Exchange Banks in SNL's coverage universe. SNL U.S. Bank $1B-$5B: Includes all Major Exchange Banks in SNL's coverage universe with $1B to $5B in assets as of most recent financial data. * Horizon Bancorp: 5-Year Total Return Comparison

Thank You for Your Investment in Horizon Bancorp

* A NASDAQ Traded Company - Symbol HBNC