Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ENCORE CAPITAL GROUP INC | encoreform8-kxearningsslid.htm |

Encore Capital Group, Inc. Q1 2014 EARNINGS CALL Exhibit 99.1

PROPRIETARY 2 CAUTIONARY NOTE ABOUT FORWARD-LOOKING STATEMENTS The statements in this presentation that are not historical facts, including, most importantly, those statements preceded by, or that include, the words “will,” “may,” “believe,” “projects,” “expects,” “anticipates” or the negation thereof, or similar expressions, constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). These statements may include, but are not limited to, statements regarding our future operating results, earnings per share, and growth. For all “forward-looking statements,” the Company claims the protection of the safe harbor for forward-looking statements contained in the Reform Act. Such forward-looking statements involve risks, uncertainties and other factors which may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors are discussed in the reports filed by the Company with the Securities and Exchange Commission, including its most recent report on Form 10-K, and its subsequent reports on Form 10-Q, each as it may be amended from time to time. The Company disclaims any intent or obligation to update these forward-looking statements.

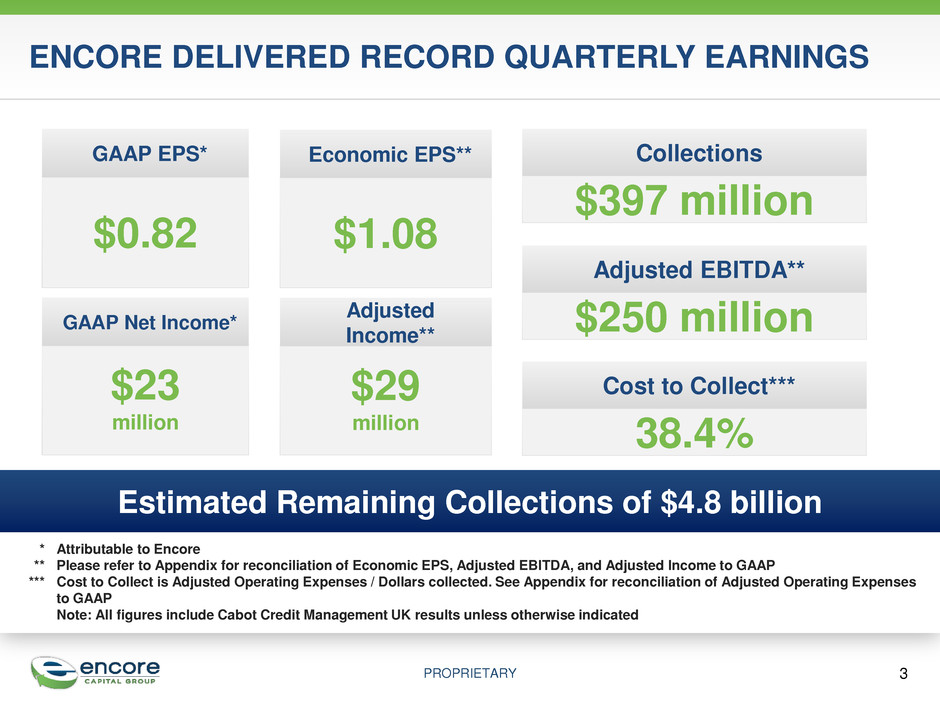

PROPRIETARY 3 ENCORE DELIVERED RECORD QUARTERLY EARNINGS Economic EPS** $1.08 GAAP EPS* $0.82 GAAP Net Income* $23 million Adjusted Income** $29 million Estimated Remaining Collections of $4.8 billion * Attributable to Encore ** Please refer to Appendix for reconciliation of Economic EPS, Adjusted EBITDA, and Adjusted Income to GAAP *** Cost to Collect is Adjusted Operating Expenses / Dollars collected. See Appendix for reconciliation of Adjusted Operating Expenses to GAAP Note: All figures include Cabot Credit Management UK results unless otherwise indicated Adjusted EBITDA** $250 million Collections $397 million Cost to Collect*** 38.4%

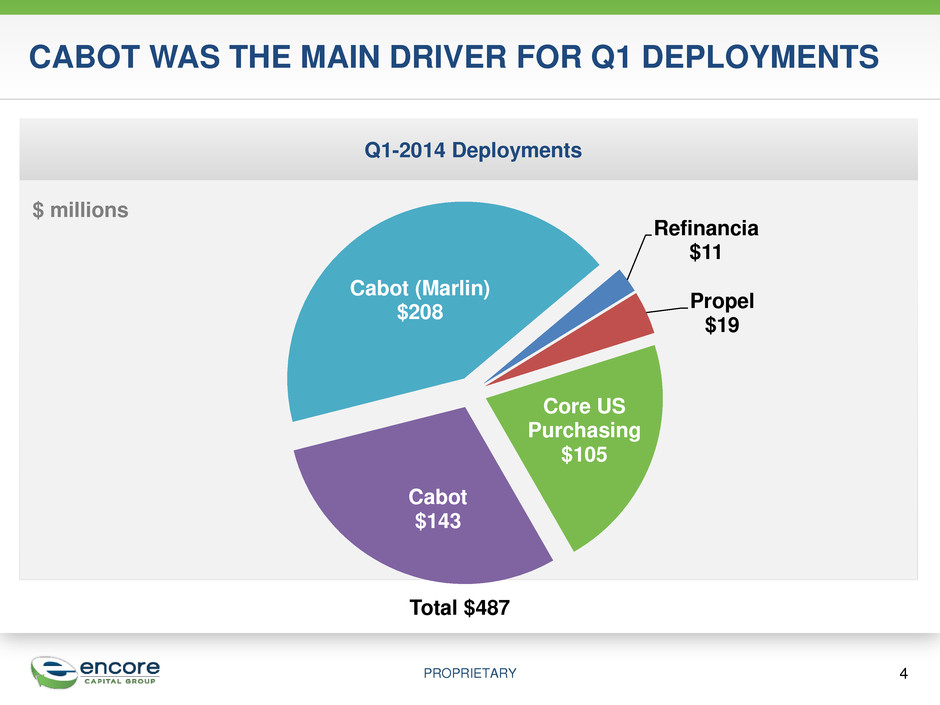

PROPRIETARY 4 CABOT WAS THE MAIN DRIVER FOR Q1 DEPLOYMENTS Q1-2014 Deployments $ millions Refinancia $11 Propel $19 Core US Purchasing $105 Cabot $143 Cabot (Marlin) $208 Total $487

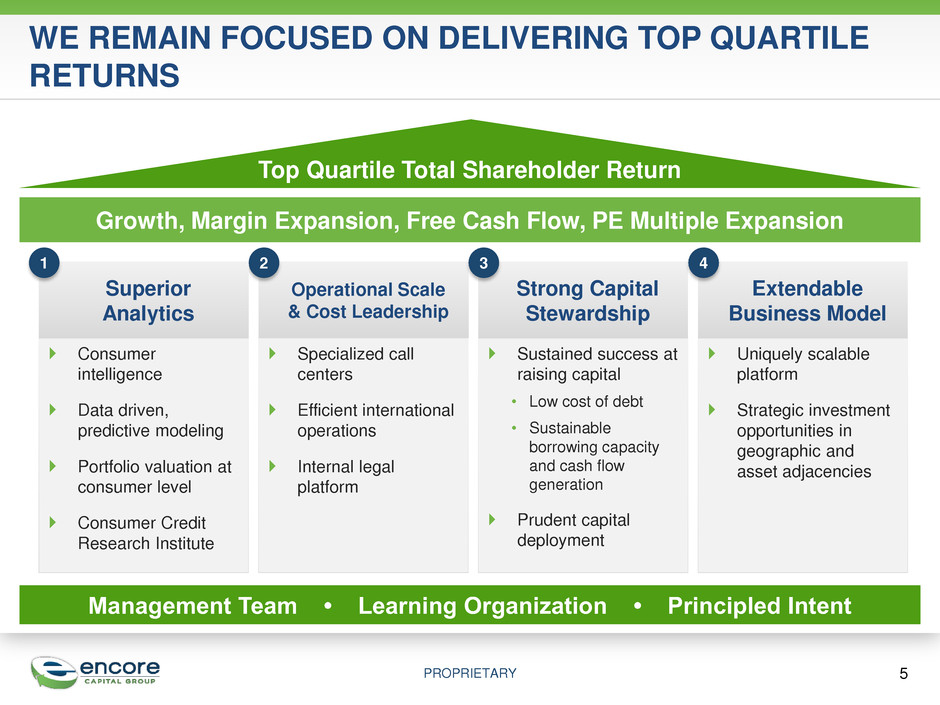

PROPRIETARY 5 WE REMAIN FOCUSED ON DELIVERING TOP QUARTILE RETURNS Management Team • Learning Organization • Principled Intent Growth, Margin Expansion, Free Cash Flow, PE Multiple Expansion Top Quartile Total Shareholder Return Specialized call centers Efficient international operations Internal legal platform Operational Scale & Cost Leadership 2 Sustained success at raising capital • Low cost of debt • Sustainable borrowing capacity and cash flow generation Prudent capital deployment Strong Capital Stewardship 3 Consumer intelligence Data driven, predictive modeling Portfolio valuation at consumer level Consumer Credit Research Institute Superior Analytics 1 Uniquely scalable platform Strategic investment opportunities in geographic and asset adjacencies Extendable Business Model 4

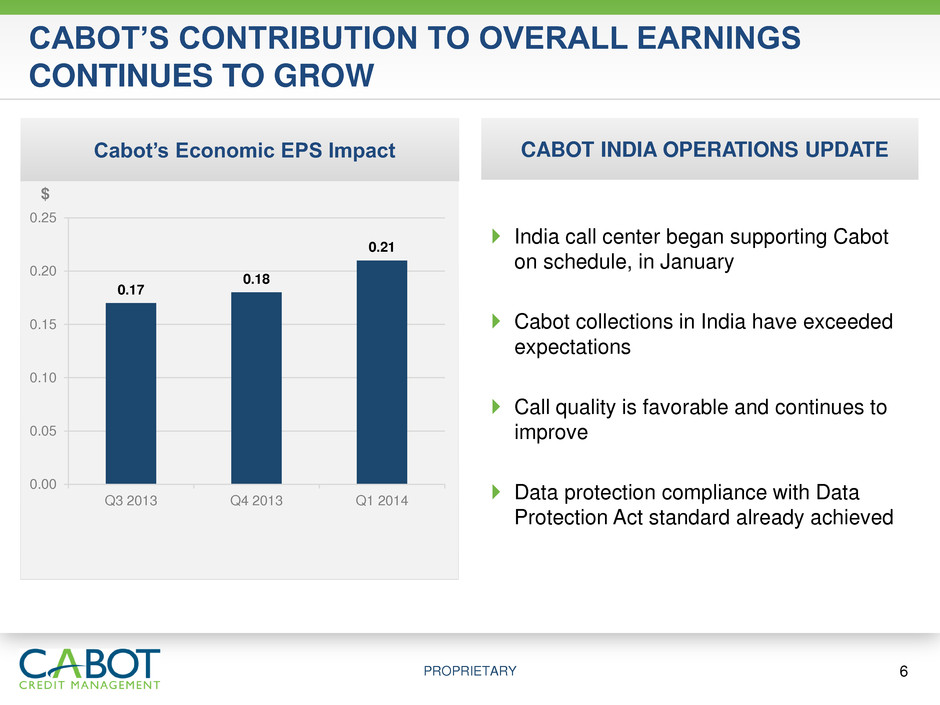

PROPRIETARY Cabot’s Economic EPS Impact CABOT’S CONTRIBUTION TO OVERALL EARNINGS CONTINUES TO GROW 6 CABOT INDIA OPERATIONS UPDATE 0.17 0.18 0.21 0.00 0.05 0.10 0.15 0.20 0.25 Q3 2013 Q4 2013 Q1 2014 $ India call center began supporting Cabot on schedule, in January Cabot collections in India have exceeded expectations Call quality is favorable and continues to improve Data protection compliance with Data Protection Act standard already achieved

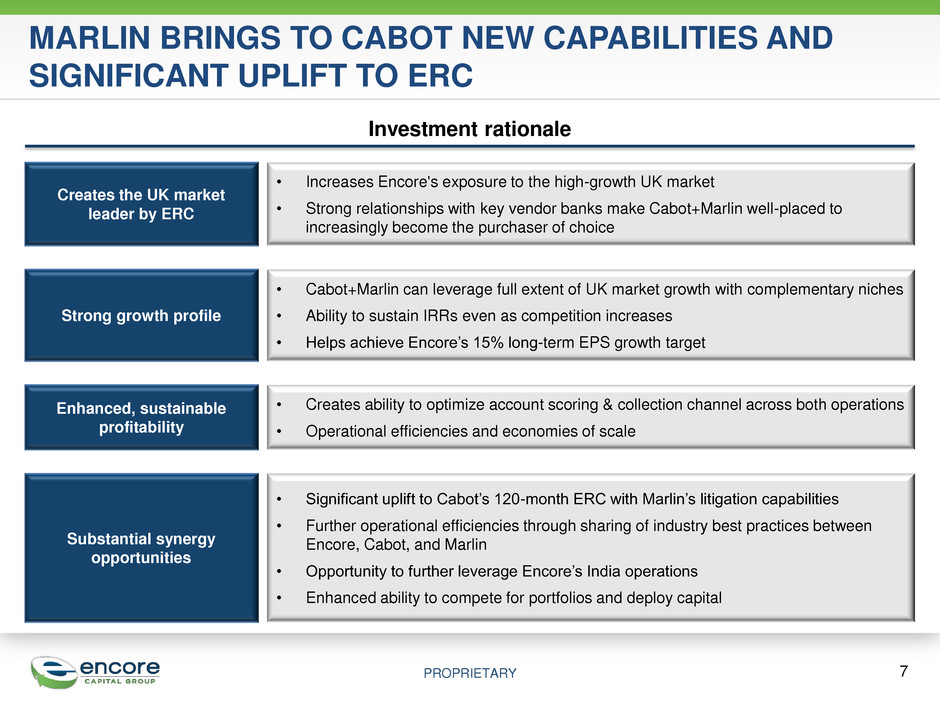

PROPRIETARY Investment rationale Creates the UK market leader by ERC Strong growth profile Enhanced, sustainable profitability • Increases Encore's exposure to the high-growth UK market • Strong relationships with key vendor banks make Cabot+Marlin well-placed to increasingly become the purchaser of choice • Creates ability to optimize account scoring & collection channel across both operations • Operational efficiencies and economies of scale • Cabot+Marlin can leverage full extent of UK market growth with complementary niches • Ability to sustain IRRs even as competition increases • Helps achieve Encore’s 15% long-term EPS growth target • Significant uplift to Cabot’s 120-month ERC with Marlin’s litigation capabilities • Further operational efficiencies through sharing of industry best practices between Encore, Cabot, and Marlin • Opportunity to further leverage Encore’s India operations • Enhanced ability to compete for portfolios and deploy capital Substantial synergy opportunities MARLIN BRINGS TO CABOT NEW CAPABILITIES AND SIGNIFICANT UPLIFT TO ERC 7

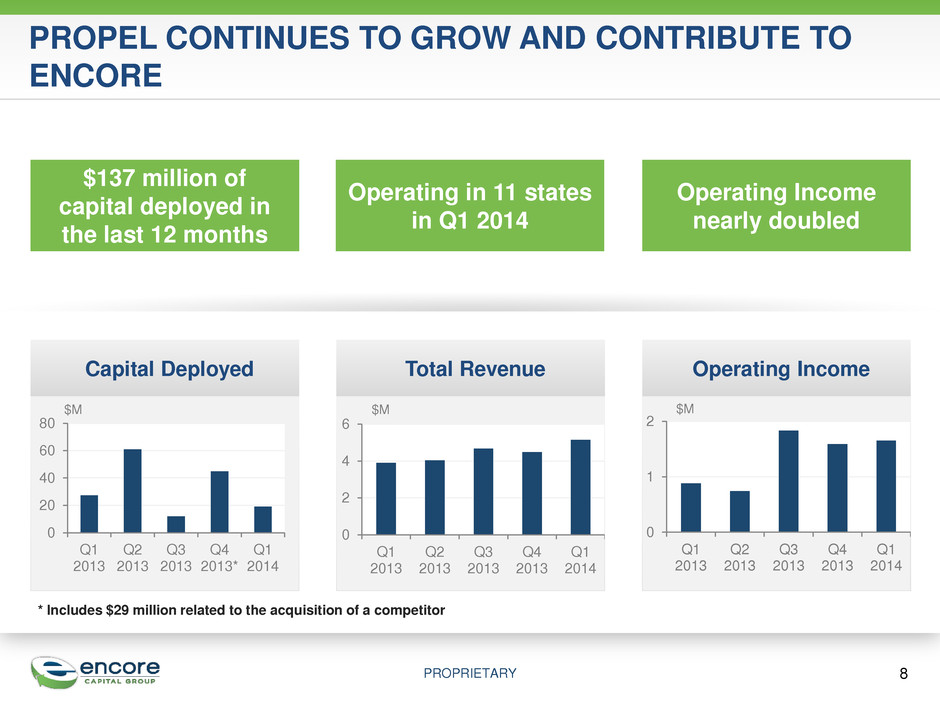

PROPRIETARY PROPEL CONTINUES TO GROW AND CONTRIBUTE TO ENCORE Capital Deployed 0 20 40 60 80 Q1 2013 Q2 2013 Q3 2013 Q4 2013* Q1 2014 Total Revenue 0 2 4 6 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Operating Income 0 1 2 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 8 $137 million of capital deployed in the last 12 months Operating in 11 states in Q1 2014 Operating Income nearly doubled $M $M $M * Includes $29 million related to the acquisition of a competitor

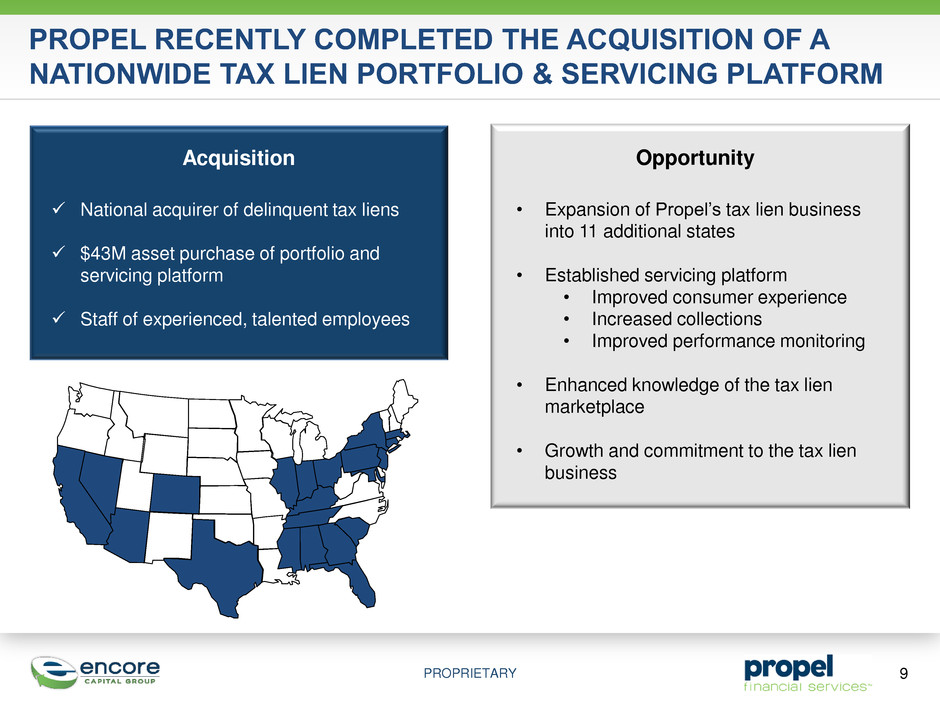

PROPRIETARY 9 PROPEL RECENTLY COMPLETED THE ACQUISITION OF A NATIONWIDE TAX LIEN PORTFOLIO & SERVICING PLATFORM Acquisition National acquirer of delinquent tax liens $43M asset purchase of portfolio and servicing platform Staff of experienced, talented employees Opportunity • Expansion of Propel’s tax lien business into 11 additional states • Established servicing platform • Improved consumer experience • Increased collections • Improved performance monitoring • Enhanced knowledge of the tax lien marketplace • Growth and commitment to the tax lien business

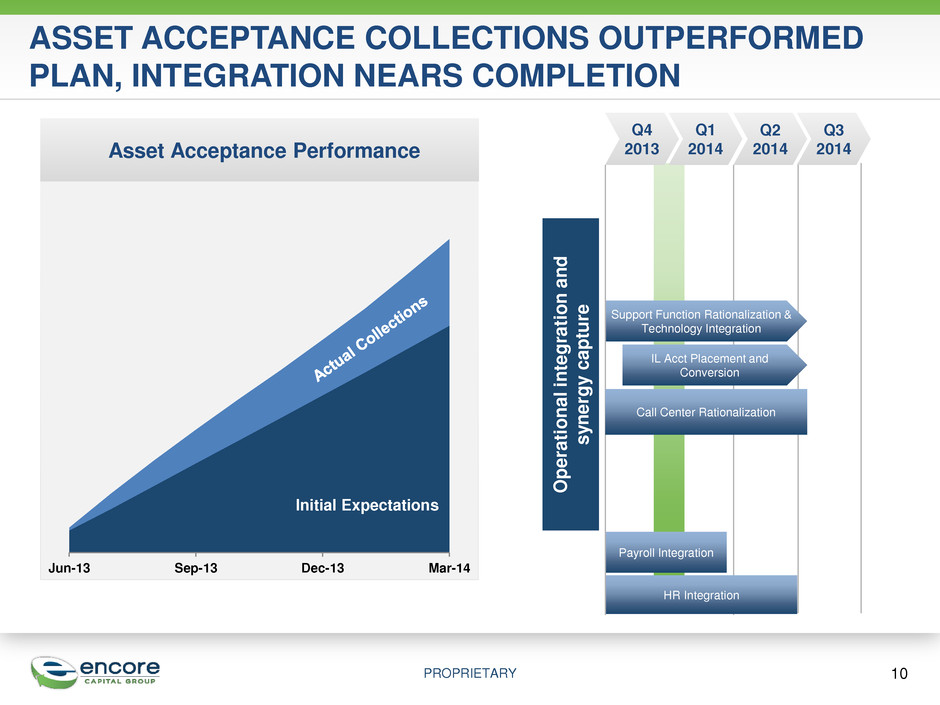

PROPRIETARY Asset Acceptance Performance ASSET ACCEPTANCE COLLECTIONS OUTPERFORMED PLAN, INTEGRATION NEARS COMPLETION 10 O p e rat io n a l in te g rat io n a n d s y n e rg y ca p tu re Q4 2013 Q1 2014 HR Integration Q2 2014 Q3 2014 Payroll Integration Support Function Rationalization & Technology Integration IL Acct Placement and Conversion Call Center Rationalization Jun-13 Sep-13 Dec-13 Mar-14 Initial Expectations

11 Detailed Financial Discussion

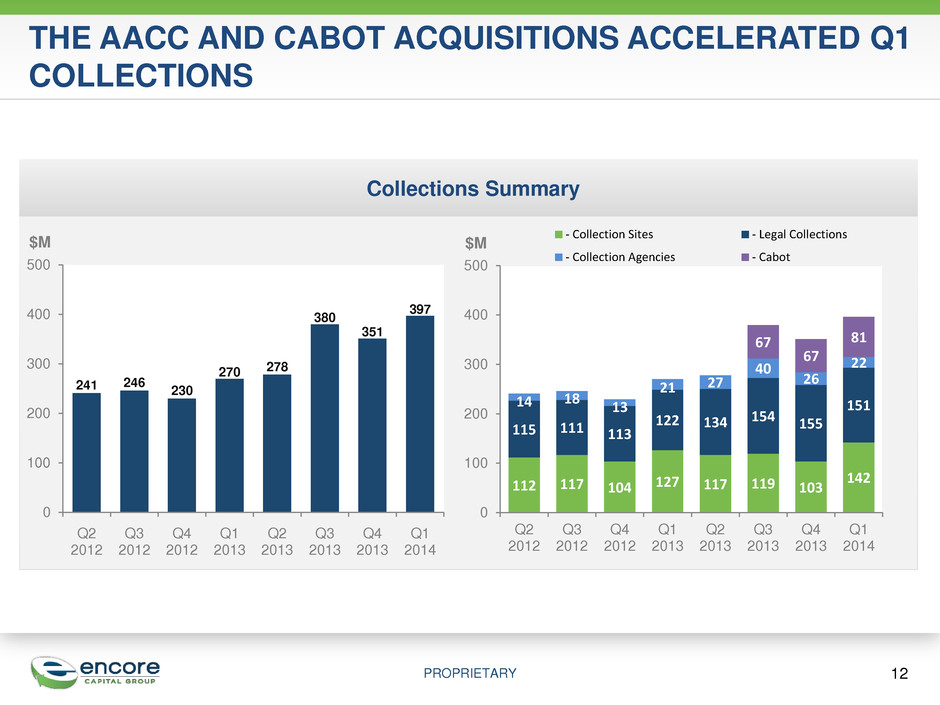

PROPRIETARY 12 THE AACC AND CABOT ACQUISITIONS ACCELERATED Q1 COLLECTIONS 241 246 230 270 278 380 351 397 0 100 200 300 400 500 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 $M Collections Summary 112 117 104 127 117 119 103 142 115 111 113 122 134 154 155 151 14 18 13 21 27 40 26 22 67 67 81 0 100 200 300 400 500 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 - Collection Sites - Legal Collections - Collection Agencies - Cabot $M

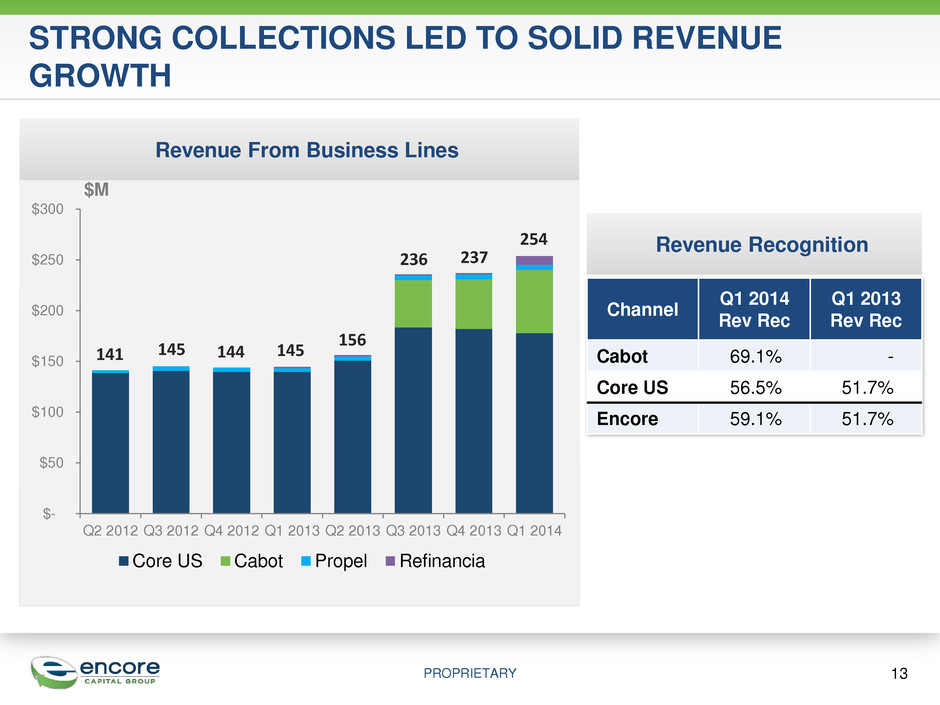

PROPRIETARY STRONG COLLECTIONS LED TO SOLID REVENUE GROWTH Revenue From Business Lines 13 $- $50 $100 $150 $200 $250 $300 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Core US Cabot Propel Refinancia $M 141 145 144 145 156 236 237 254 Channel Q1 2014 Rev Rec Q1 2013 Rev Rec Cabot 69.1% - Core US 56.5% 51.7% Encore 59.1% 51.7% Revenue Recognition

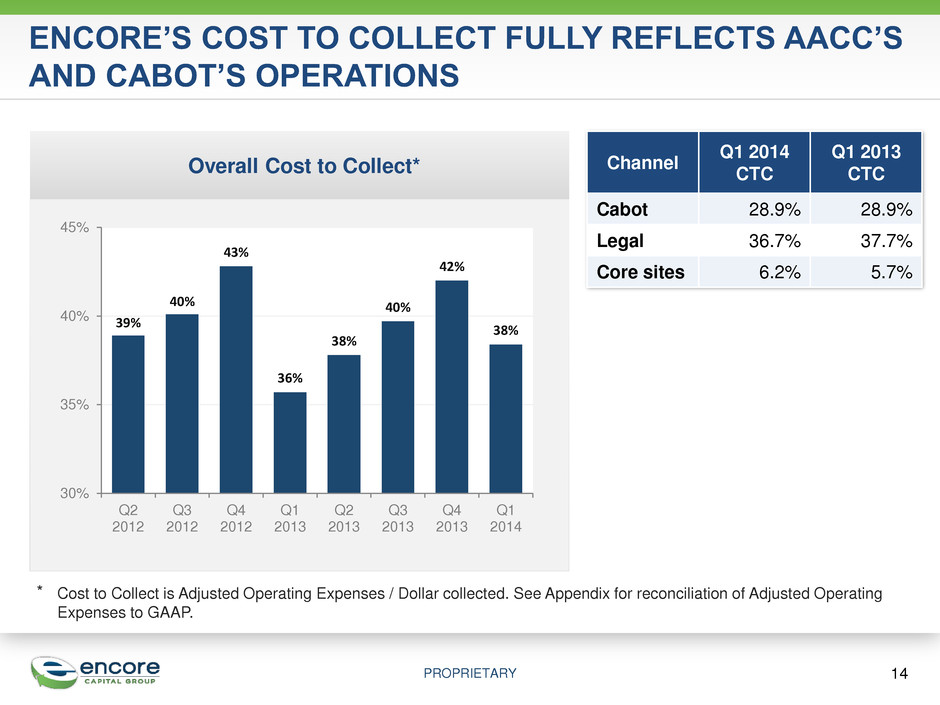

PROPRIETARY ENCORE’S COST TO COLLECT FULLY REFLECTS AACC’S AND CABOT’S OPERATIONS 14 Overall Cost to Collect* 39% 40% 43% 36% 38% 40% 42% 38% 30% 35% 40% 45% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 ⃰ Cost to Collect is Adjusted Operating Expenses / Dollar collected. See Appendix for reconciliation of Adjusted Operating Expenses to GAAP. Channel Q1 2014 CTC Q1 2013 CTC Cabot 28.9% 28.9% Legal 36.7% 37.7% Core sites 6.2% 5.7%

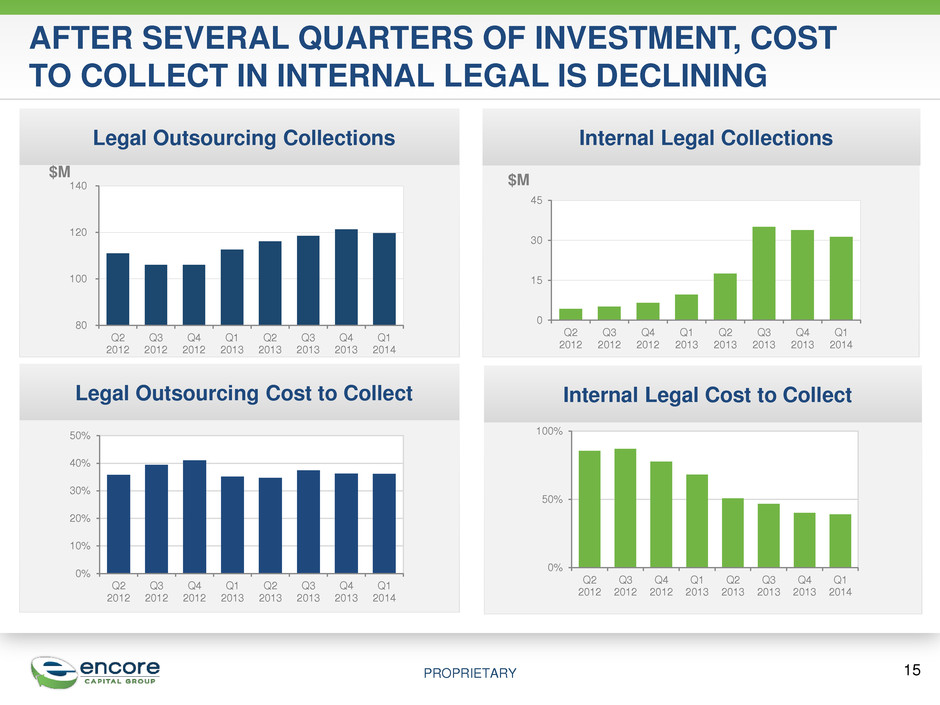

PROPRIETARY AFTER SEVERAL QUARTERS OF INVESTMENT, COST TO COLLECT IN INTERNAL LEGAL IS DECLINING 15 Legal Outsourcing Cost to Collect 0% 10% 20% 30% 40% 50% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Legal Outsourcing Collections 80 100 120 140 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 $M Internal Legal Collections 0 15 30 45 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 $M Internal Legal Cost to Collect 0% 50% 100% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014

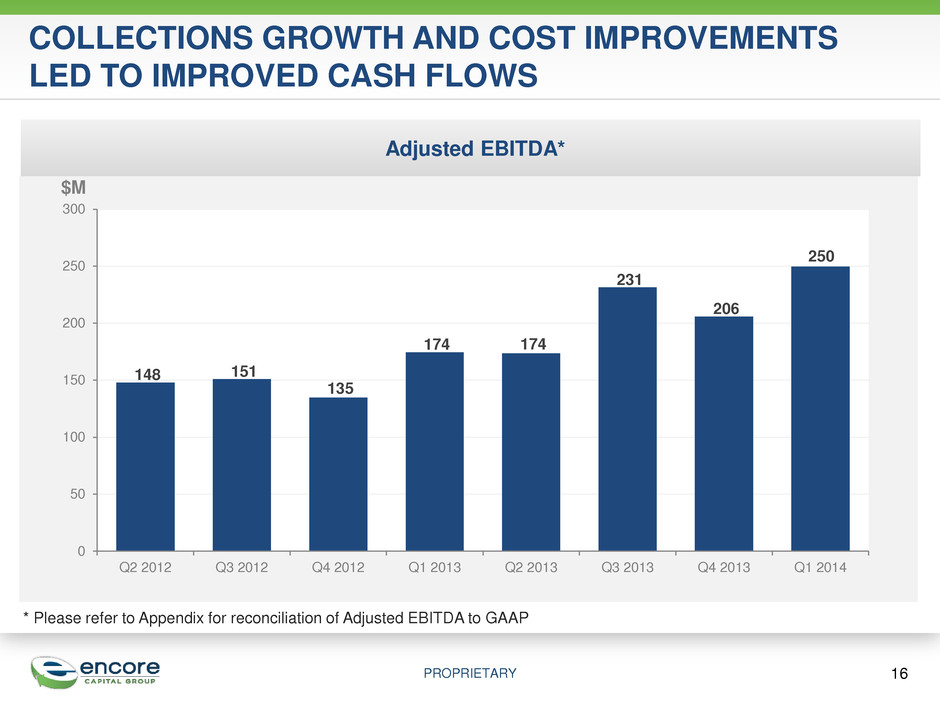

PROPRIETARY COLLECTIONS GROWTH AND COST IMPROVEMENTS LED TO IMPROVED CASH FLOWS 16 148 151 135 174 174 231 206 250 0 50 100 150 200 250 300 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 * Please refer to Appendix for reconciliation of Adjusted EBITDA to GAAP Adjusted EBITDA* $M

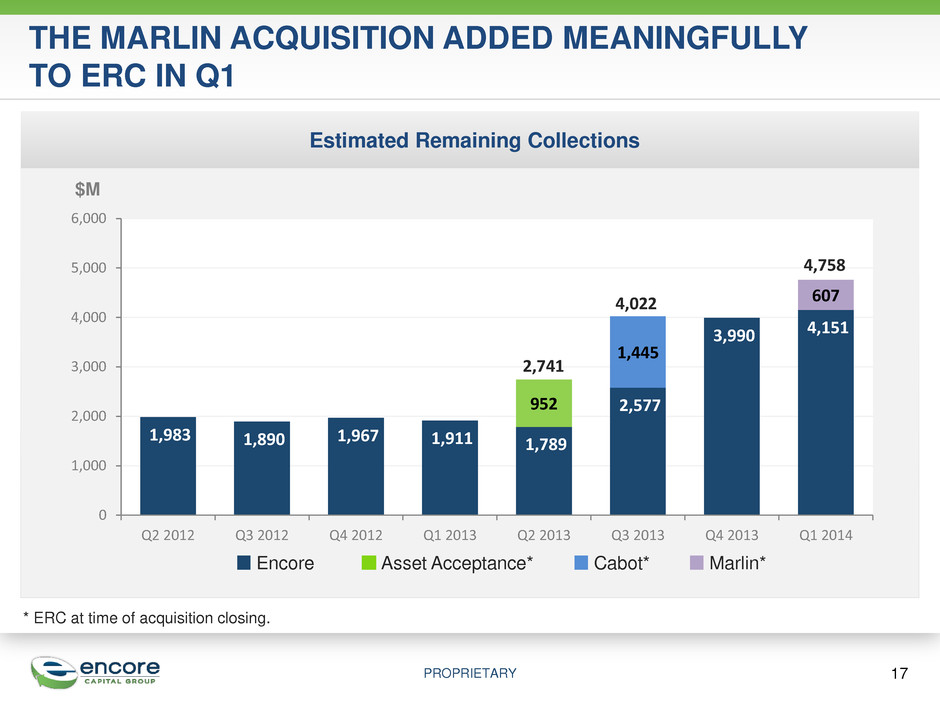

PROPRIETARY Estimated Remaining Collections $M 1,983 1,890 1,967 1,911 1,789 2,577 3,990 4,151 952 1,445 607 0 1,000 2,000 3,000 4,000 5,000 6,000 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014 17 THE MARLIN ACQUISITION ADDED MEANINGFULLY TO ERC IN Q1 Encore Asset Acceptance* 2,741 4,758 Cabot* 4,022 Marlin* * ERC at time of acquisition closing.

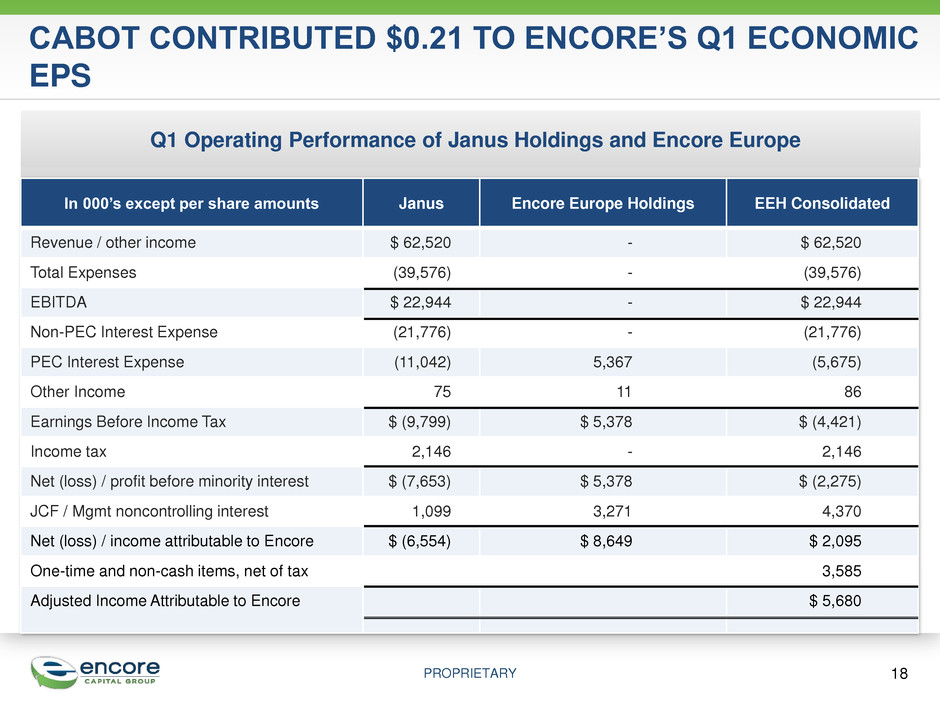

PROPRIETARY CABOT CONTRIBUTED $0.21 TO ENCORE’S Q1 ECONOMIC EPS In 000’s except per share amounts Janus Encore Europe Holdings EEH Consolidated Revenue / other income $ 62,520 - $ 62,520 Total Expenses (39,576) - (39,576) EBITDA $ 22,944 - $ 22,944 Non-PEC Interest Expense (21,776) - (21,776) PEC Interest Expense (11,042) 5,367 (5,675) Other Income 75 11 86 Earnings Before Income Tax $ (9,799) $ 5,378 $ (4,421) Income tax 2,146 - 2,146 Net (loss) / profit before minority interest $ (7,653) $ 5,378 $ (2,275) JCF / Mgmt noncontrolling interest 1,099 3,271 4,370 Net (loss) / income attributable to Encore $ (6,554) $ 8,649 $ 2,095 One-time and non-cash items, net of tax 3,585 Adjusted Income Attributable to Encore $ 5,680 18 Q1 Operating Performance of Janus Holdings and Encore Europe

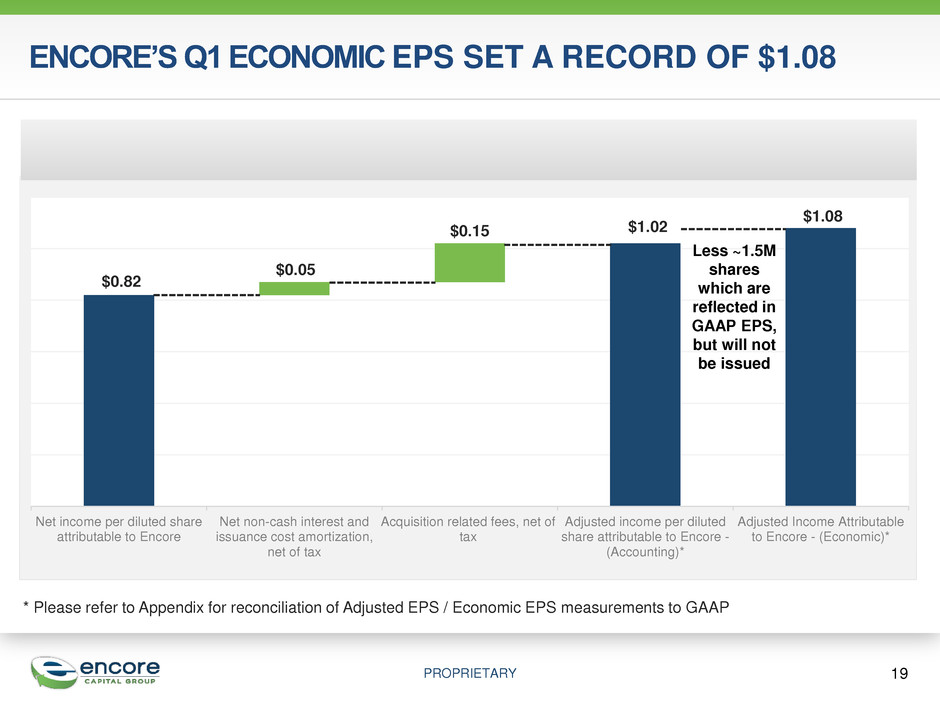

PROPRIETARY ENCORE’S Q1 ECONOMIC EPS SET A RECORD OF $1.08 $0.82 $1.02 $1.08 $0.05 $0.15 Net income per diluted share attributable to Encore Net non-cash interest and issuance cost amortization, net of tax Acquisition related fees, net of tax Adjusted income per diluted share attributable to Encore - (Accounting)* Adjusted Income Attributable to Encore - (Economic)* 19 * Please refer to Appendix for reconciliation of Adjusted EPS / Economic EPS measurements to GAAP Less ~1.5M shares which are reflected in GAAP EPS, but will not be issued

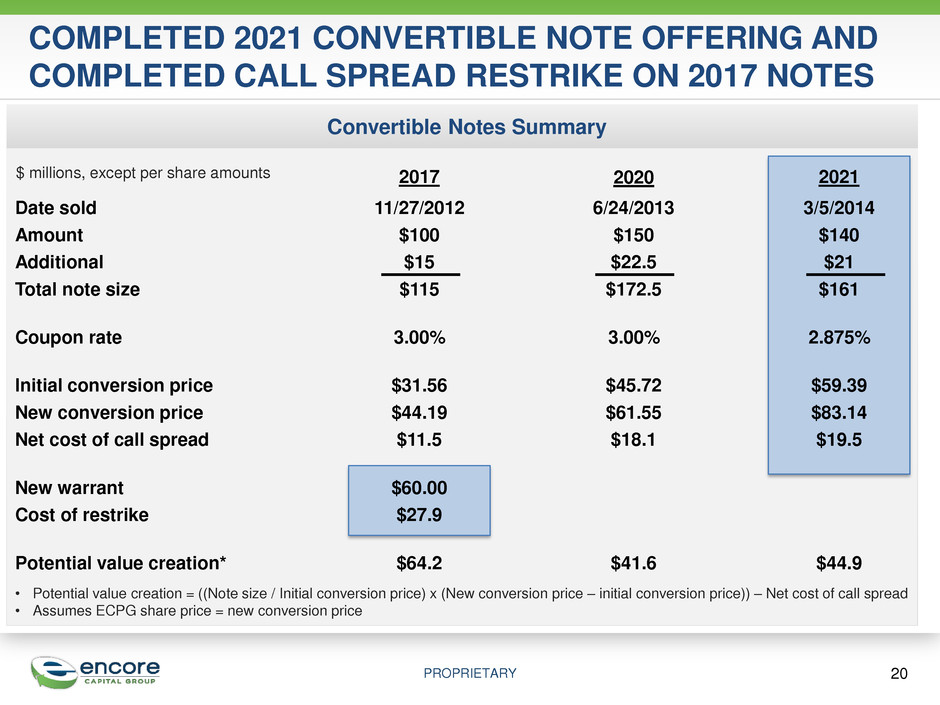

PROPRIETARY COMPLETED 2021 CONVERTIBLE NOTE OFFERING AND COMPLETED CALL SPREAD RESTRIKE ON 2017 NOTES 20 Date sold Amount Additional Total note size Coupon rate Initial conversion price New conversion price Net cost of call spread New warrant Cost of restrike Potential value creation* 11/27/2012 $100 $15 $115 3.00% $31.56 $44.19 $11.5 $60.00 $27.9 $64.2 2017 3/5/2014 $140 $21 $161 2.875% $59.39 $83.14 $19.5 $44.9 2021 6/24/2013 $150 $22.5 $172.5 3.00% $45.72 $61.55 $18.1 $41.6 2020 Convertible Notes Summary • Potential value creation = ((Note size / Initial conversion price) x (New conversion price – initial conversion price)) – Net cost of call spread • Assumes ECPG share price = new conversion price $ millions, except per share amounts

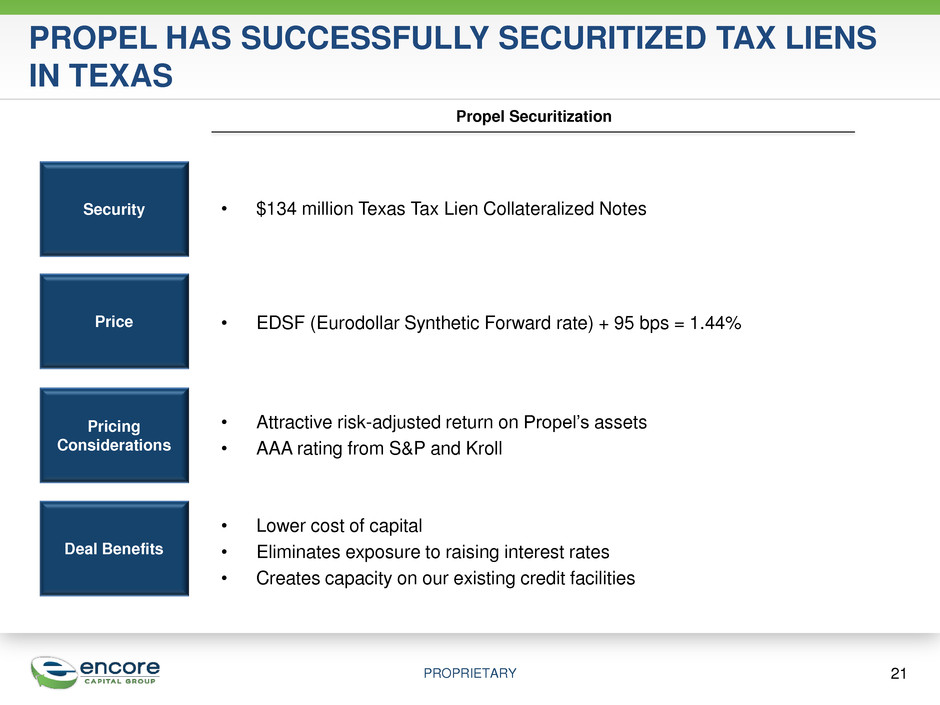

PROPRIETARY 21 PROPEL HAS SUCCESSFULLY SECURITIZED TAX LIENS IN TEXAS Security • $134 million Texas Tax Lien Collateralized Notes Propel Securitization Price • EDSF (Eurodollar Synthetic Forward rate) + 95 bps = 1.44% Pricing Considerations • Attractive risk-adjusted return on Propel’s assets • AAA rating from S&P and Kroll Deal Benefits • Lower cost of capital • Eliminates exposure to raising interest rates • Creates capacity on our existing credit facilities

PROPRIETARY 22 ENCORE’S LONG-TERM PROSPECTS CONTINUE TO BE FAVORABLE Operating Results & Deployment A culture of constant improvement drives improved results Liquidity & Capital Access Strong liquidity and access to capital enhance our ability to take advantage of consolidating markets and new opportunities Solid Cash Flows Additional asset classes and geographies continue to enhance ERC and collections Geographic & Asset Class Diversification We are an international company in several asset classes, positioned for strong earnings growth going forward

23 Appendix

PROPRIETARY 24 NON-GAAP FINANCIAL MEASURES This presentation includes certain financial measures that exclude the impact of certain items and therefore have not been calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company has included information concerning Adjusted EBITDA because management utilizes this information, which is materially similar to a financial measure contained in covenants used in the Company's revolving credit facility, in the evaluation of its operations and believes that this measure is a useful indicator of the Company’s ability to generate cash collections in excess of operating expenses through the liquidation of its receivable portfolios. The Company has included information concerning Adjusted Operating Expenses in order to facilitate a comparison of approximate cash costs to cash collections for the portfolio purchasing and recovery business in the periods presented. The Company has included Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share (also referred to as Economic EPS when adjusted for certain shares associated with our convertible notes that will not be issued but are reflected in the fully diluted share count for accounting purposes) because management uses these measures to assess operating performance, in order highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. Adjusted EBITDA, Adjusted Operating Expenses, Adjusted Income Attributable to Encore and Adjusted Income Attributable to Encore per Share/Economic EPS have not been prepared in accordance with GAAP. These non-GAAP financial measures should not be considered as alternatives to, or more meaningful than, net income, net income per share, and total operating expenses as indicators of the Company’s operating performance. Further, these non-GAAP financial measures, as presented by the Company, may not be comparable to similarly titled measures reported by other companies. The Company has attached to this presentation a reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures.

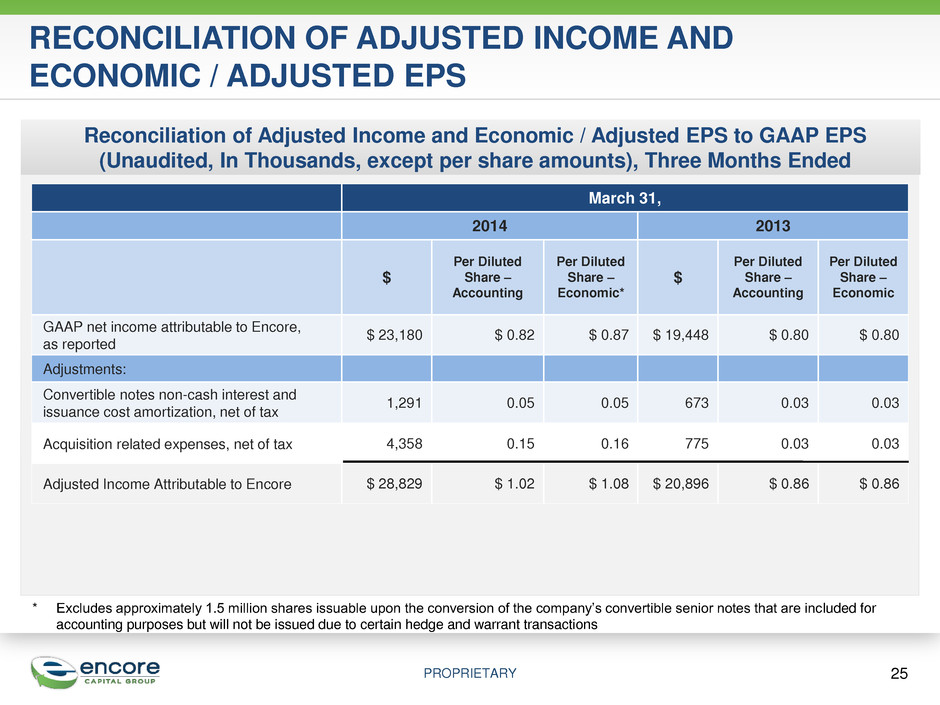

PROPRIETARY 25 RECONCILIATION OF ADJUSTED INCOME AND ECONOMIC / ADJUSTED EPS Reconciliation of Adjusted Income and Economic / Adjusted EPS to GAAP EPS (Unaudited, In Thousands, except per share amounts), Three Months Ended March 31, 2014 2013 $ Per Diluted Share – Accounting Per Diluted Share – Economic* $ Per Diluted Share – Accounting Per Diluted Share – Economic GAAP net income attributable to Encore, as reported $ 23,180 $ 0.82 $ 0.87 $ 19,448 $ 0.80 $ 0.80 Adjustments: Convertible notes non-cash interest and issuance cost amortization, net of tax 1,291 0.05 0.05 673 0.03 0.03 Acquisition related expenses, net of tax 4,358 0.15 0.16 775 0.03 0.03 Adjusted Income Attributable to Encore $ 28,829 $ 1.02 $ 1.08 $ 20,896 $ 0.86 $ 0.86 * Excludes approximately 1.5 million shares issuable upon the conversion of the company’s convertible senior notes that are included for accounting purposes but will not be issued due to certain hedge and warrant transactions

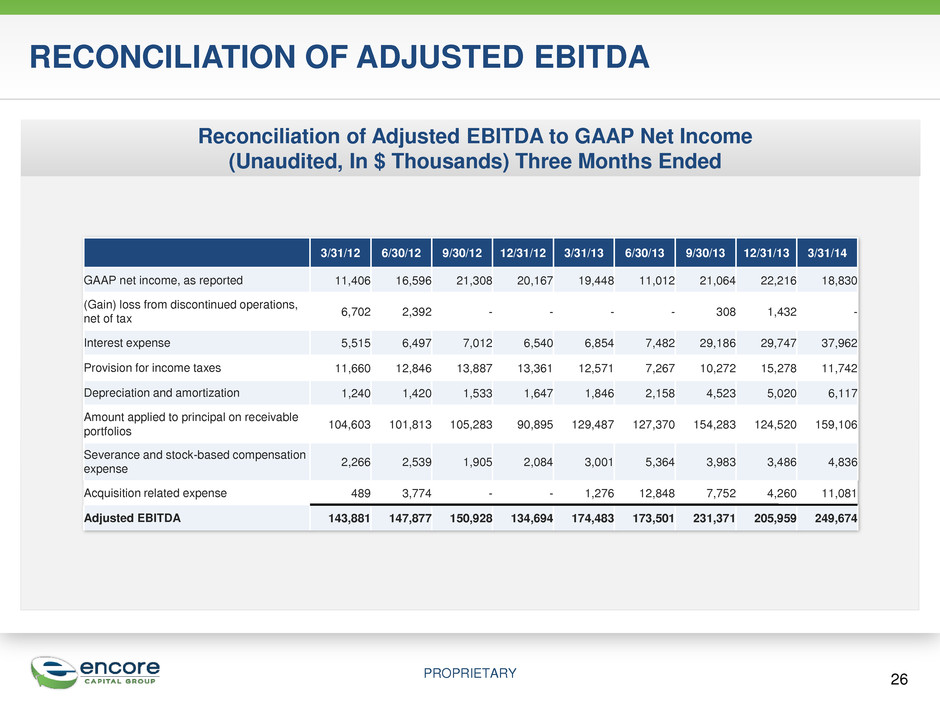

PROPRIETARY Reconciliation of Adjusted EBITDA to GAAP Net Income (Unaudited, In $ Thousands) Three Months Ended 26 3/31/12 6/30/12 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 3/31/14 GAAP net income, as reported 11,406 16,596 21,308 20,167 19,448 11,012 21,064 22,216 18,830 (Gain) loss from discontinued operations, net of tax 6,702 2,392 - - - - 308 1,432 - Interest expense 5,515 6,497 7,012 6,540 6,854 7,482 29,186 29,747 37,962 Provision for income taxes 11,660 12,846 13,887 13,361 12,571 7,267 10,272 15,278 11,742 Depreciation and amortization 1,240 1,420 1,533 1,647 1,846 2,158 4,523 5,020 6,117 Amount applied to principal on receivable portfolios 104,603 101,813 105,283 90,895 129,487 127,370 154,283 124,520 159,106 Severance and stock-based compensation expense 2,266 2,539 1,905 2,084 3,001 5,364 3,983 3,486 4,836 Acquisition related expense 489 3,774 - - 1,276 12,848 7,752 4,260 11,081 Adjusted EBITDA 143,881 147,877 150,928 134,694 174,483 173,501 231,371 205,959 249,674 RECONCILIATION OF ADJUSTED EBITDA

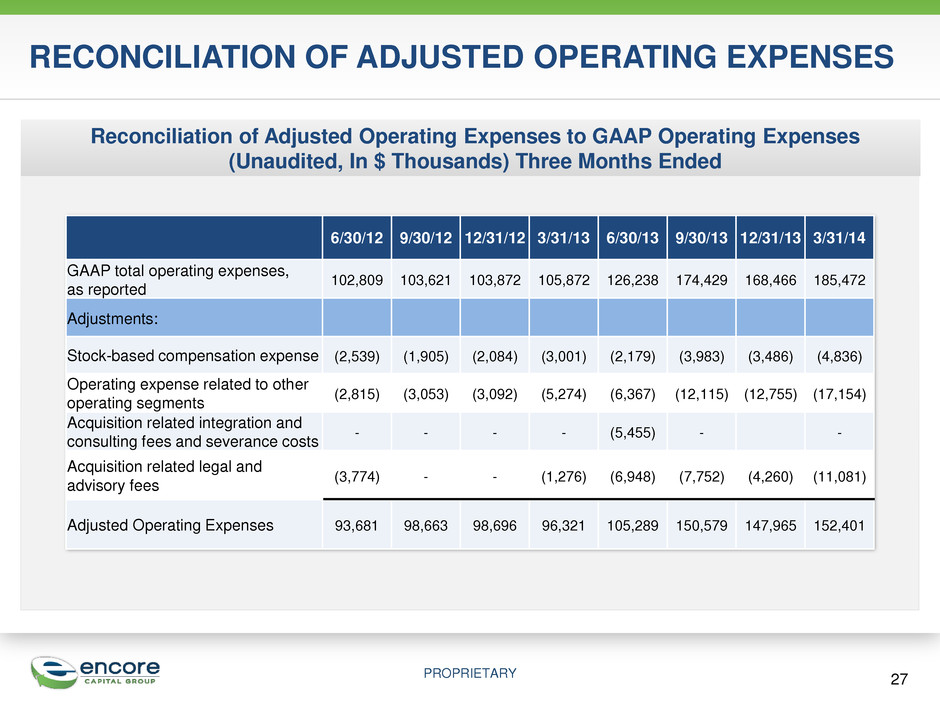

PROPRIETARY Reconciliation of Adjusted Operating Expenses to GAAP Operating Expenses (Unaudited, In $ Thousands) Three Months Ended 27 RECONCILIATION OF ADJUSTED OPERATING EXPENSES 6/30/12 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13 3/31/14 GAAP total operating expenses, as reported 102,809 103,621 103,872 105,872 126,238 174,429 168,466 185,472 Adjustments: Stock-based compensation expense (2,539) (1,905) (2,084) (3,001) (2,179) (3,983) (3,486) (4,836) Operating expense related to other operating segments (2,815) (3,053) (3,092) (5,274) (6,367) (12,115) (12,755) (17,154) Acquisition related integration and consulting fees and severance costs - - - - (5,455) - - Acquisition related legal and advisory fees (3,774) - - (1,276) (6,948) (7,752) (4,260) (11,081) Adjusted Operating Expenses 93,681 98,663 98,696 96,321 105,289 150,579 147,965 152,401

Encore Capital Group, Inc. Q1 2014 EARNINGS CALL