Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CAESARS HOLDINGS, INC. | d721775d8k.htm |

Exhibit 99.1

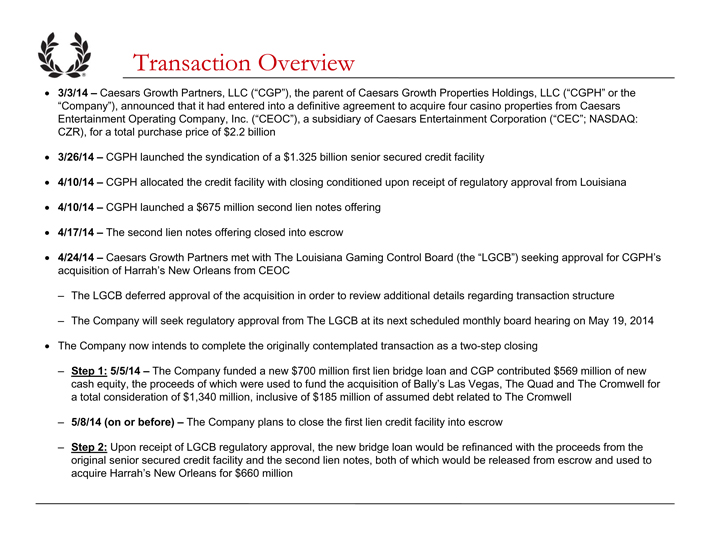

Transaction Overview 3/3/14 – Caesars Growth Partners, LLC (“CGP”), the parent of Caesars Growth Properties Holdings, LLC (“CGPH” or the “Company”), announced that it had entered into a definitive agreement to acquire four casino properties from Caesars Entertainment Operating Company, Inc. (“CEOC”), a subsidiary of Caesars Entertainment Corporation (“CEC”; NASDAQ: CZR), for a total purchase price of $2.2 billion 3/26/14 – CGPH launched the syndication of a $1.325 billion senior secured credit facility 4/10/14 – CGPH allocated the credit facility with closing conditioned upon receipt of regulatory approval from Louisiana 4/10/14 – CGPH launched a $675 million second lien notes offering 4/17/14 – The second lien notes offering closed into escrow 4/24/14 – Caesars Growth Partners met with The Louisiana Gaming Control Board (the “LGCB”) seeking approval for CGPH’s acquisition of Harrah’s New Orleans from CEOC – The LGCB deferred approval of the acquisition in order to review additional details regarding transaction structure – The Company will seek regulatory approval from The LGCB at its next scheduled monthly board hearing on May 19, 2014 The Company now intends to complete the originally contemplated transaction as a two-step closing – Step 1: 5/5/14 – The Company funded a new $700 million first lien bridge loan and CGP contributed $569 million of new cash equity, the proceeds of which were used to fund the acquisition of Bally’s Las Vegas, The Quad and The Cromwell for a total consideration of $1,340 million, inclusive of $185 million of assumed debt related to The Cromwell – 5/8/14 (on or before) – The Company plans to close the first lien credit facility into escrow – Step 2: Upon receipt of LGCB regulatory approval, the new bridge loan would be refinanced with the proceeds from the original senior secured credit facility and the second lien notes, both of which would be released from escrow and used to acquire Harrah’s New Orleans for $660 million

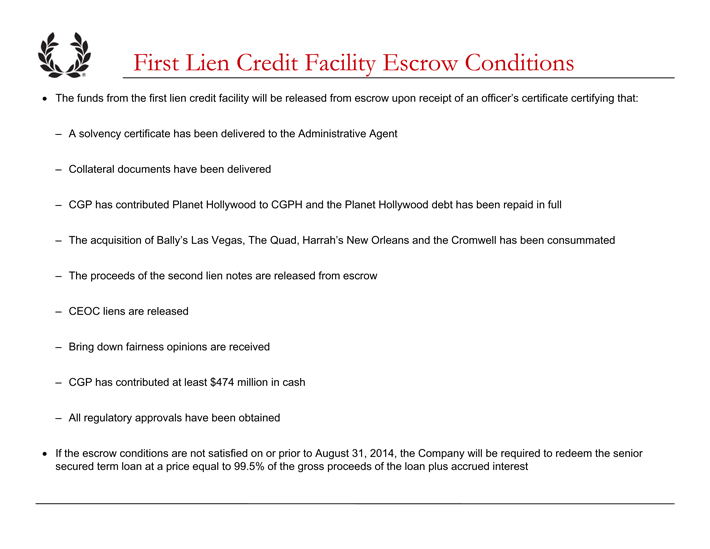

First Lien Credit Facility Escrow Conditions The funds from the first lien credit facility will be released from escrow upon receipt of an officer’s certificate certifying that: – A solvency certificate has been delivered to the Administrative Agent – Collateral documents have been delivered – CGP has contributed Planet Hollywood to CGPH and the Planet Hollywood debt has been repaid in full – The acquisition of Bally’s Las Vegas, The Quad, Harrah’s New Orleans and the Cromwell has been consummated – The proceeds of the second lien notes are released from escrow – CEOC liens are released – Bring down fairness opinions are received – CGP has contributed at least $474 million in cash – All regulatory approvals have been obtained If the escrow conditions are not satisfied on or prior to August 31, 2014, the Company will be required to redeem the senior secured term loan at a price equal to 99.5% of the gross proceeds of the loan plus accrued interest

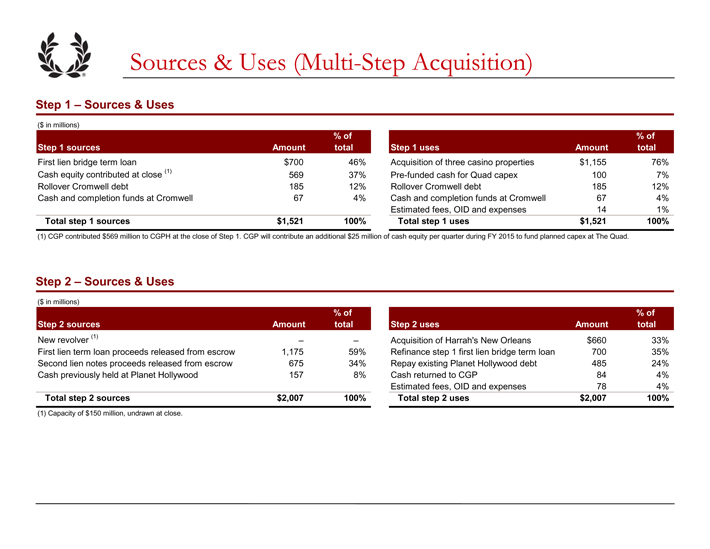

Sources & Uses (Multi-Step Acquisition) Step 1 – Sources & Uses Step 2 – Sources & Uses ($ in millions) % of % of Step 1 sources Amount total Step 1 uses Amount total First lien bridge term loan $700 46% Acquisition of three casino properties $1,155 76% Cash equity contributed at close (1) 569 37% Pre-funded cash for Quad capex 100 7% Rollover Cromwell debt 185 12% Rollover Cromwell debt 185 12% Cash and completion funds at Cromwell 67 4% Cash and completion funds at Cromwell 67 4% Estimated fees, OID and expenses 14 1% Total step 1 sources $1,521 100% Total step 1 uses $1,521 100% (1) CGP contributed $569 million to CGPH at the close of Step 1. CGP will contribute an additional $25 million of cash equity per quarter during FY 2015 to fund planned capex at The Quad. ($ in millions) % of % of Step 2 sources Amount total Step 2 uses Amount total New revolver (1) – – Acquisition of Harrah’s New Orleans $660 33% First lien term loan proceeds released from escrow 1,175 59% Refinance step 1 first lien bridge term loan 700 35% Second lien notes proceeds released from escrow 675 34% Repay existing Planet Hollywood debt 485 24% Cash previously held at Planet Hollywood 157 8% Cash returned to CGP 84 4% Estimated fees, OID and expenses 78 4% Total step 2 sources $2,007 100% Total step 2 uses $2,007 100% (1) Capacity of $150 million, undrawn at close.

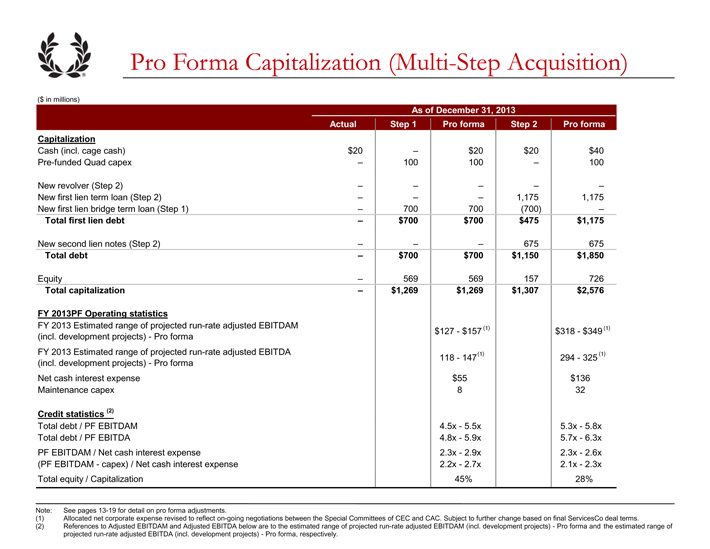

Pro Forma Capitalization (Multi-Step Acquisition) ($ in millions) As of December 31, 2013 Actual Step 1 Pro forma Step 2 Pro forma Capitalization Cash (incl. cage cash) $20 – $20 $20 $40 Pre-funded Quad capex – 100 100 – 100 New revolver (Step 2) – – – – – New first lien term loan (Step 2) – – – 1,175 1,175 New first lien bridge term loan (Step 1) – 700 700 (700) – Total first lien debt – $700 $700 $475 $1,175 New second lien notes (Step 2) – – – 675 675 Total debt – $700 $700 $1,150 $1,850 Equity – 569 569 157 726 Total capitalization – $1,269 $1,269 $1,307 $2,576 FY 2013PF Operating statistics FY 2013 Estimated range of projected run-rate adjusted EBITDAM (incl. development projects) - Pro forma $127 - $157 $318 - $349 FY 2013 Estimated range of projected run-rate adjusted EBITDA (incl. development projects) - Pro forma 118 - 147 294 - 325 Net cash interest expense $55 $136 Maintenance capex 8 32 Credit statistics (2) Total debt / PF EBITDAM 4.5x - 5.5x 5.3x - 5.8x Total debt / PF EBITDA 4.8x - 5.9x 5.7x - 6.3x PF EBITDAM / Net cash interest expense 2.3x - 2.9x 2.3x - 2.6x (PF EBITDAM - capex) / Net cash interest expense 2.2x - 2.7x 2.1x - 2.3x Total equity / Capitalization 45% 28% (1) (1) (1) (1) Note: See pages 13-19 for detail on pro forma adjustments. (1) Allocated net corporate expense revised to reflect on-going negotiations between the Special Committees of CEC and CAC. Subject to further change based on final ServicesCo deal terms. (2) References to Adjusted EBITDAM and Adjusted EBITDA below are to the estimated range of projected run-rate adjusted EBITDAM (incl. development projects) - Pro forma and the estimated range of projected run-rate adjusted EBITDA (incl. development projects) - Pro forma, respectively.

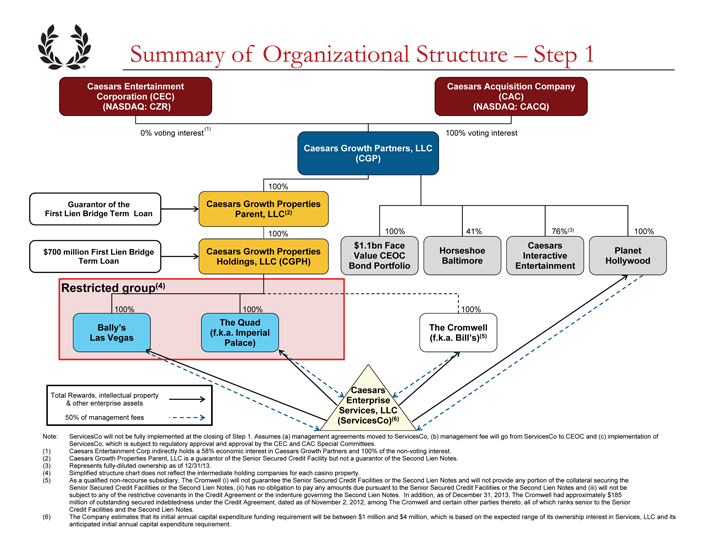

Summary of Organizational Structure – Step 1

Caesars Entertainment Corporation (CEC) (NASDAQ: CZR)

(1)

0% voting interest

Caesars Acquisition Company (CAC) (NASDAQ: CACQ)

100% voting interest

Guarantor of the First Lien Bridge Term Loan

100%

Caesars Growth partners, LLC (CGP)

Caesars Growth Properties Parent, LLC(2)

$700 million First Lien Bridge Term Loan

100%

Caesars Growth Properties Holdings, LLC (CGPH)

100% 41% 76%(3) 100% $1.1bn Face Caesars Horseshoe Planet Value CEOC Interactive Baltimore Hollywood Bond Portfolio Entertainment

Restricted group(4)

100%

Bally’s Las Vegas

100%

The Quad (f.k.a. Imperial Palace)

100%

The Cromwell (f.k.a. Bill’s)(5)

Total Rewards, intellectual property & other

enterprise assets

50% of management fees

Caesars Enterprise Services, LLC

(ServicesCo)(6)

Note: ServicesCo will not be fully implemented at the closing of Step 1. Assumes (a) management agreements moved to ServicesCo, (b) management fee

will go from ServicesCo to CEOC and (c) implementation of ServicesCo, which is subject to regulatory approval and approval by the CEC and CAC Special Committees.

(1) Caesars Entertainment Corp indirectly holds a 58% economic interest in Caesars Growth Partners and 100% of the non-voting interest. (2) Caesars Growth

Properties Parent, LLC is a guarantor of the Senior Secured Credit Facility but not a guarantor of the Second Lien Notes. (3) Represents fully-diluted ownership as of 12/31/13.

(4) Simplified structure chart does not reflect the intermediate holding companies for each casino property.

(5) As a qualified non-recourse subsidiary, The Cromwell (i) will not guarantee the Senior Secured Credit Facilities or the Second Lien Notes and will not provide any portion of

the collateral securing the Senior Secured Credit Facilities or the Second Lien Notes, (ii) has no obligation to pay any amounts due pursuant to the Senior Secured Credit Facilities or the Second Lien Notes and (iii) will not be subject to any of

the restrictive covenants in the Credit Agreement or the indenture governing the Second Lien Notes. In addition, as of December 31, 2013, The Cromwell had approximately $185 million of outstanding secured indebtedness under the Credit Agreement,

dated as of November 2, 2012, among The Cromwell and certain other parties thereto, all of which ranks senior to the Senior Credit Facilities and the Second Lien Notes.

(6) The Company estimates that its initial annual capital expenditure funding requirement will be between $1 million and $4 million, which is based on the expected range of its

ownership interest in Services, LLC and its anticipated initial annual capital expenditure requirement.

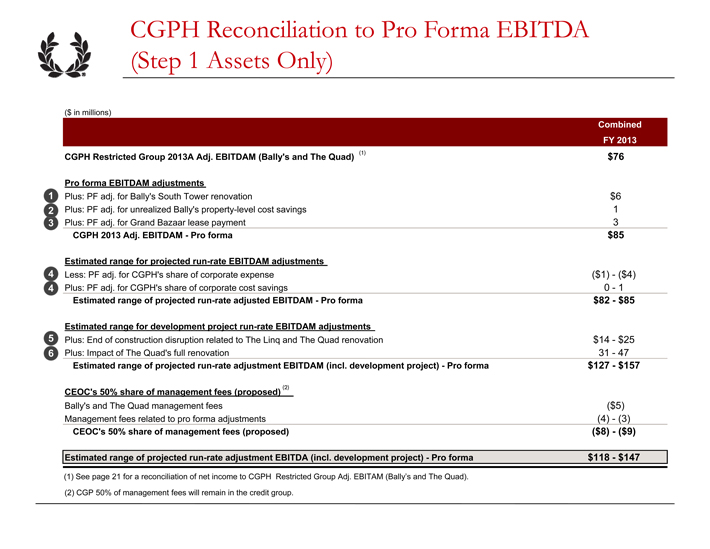

CGPH Reconciliation to Pro Forma EBITDA (Step 1 Assets Only) ($ in millions) Combined FY 2013 CGPH Restricted Group 2013A Adj. EBITDAM (Bally’s and The Quad) (1) $76 Pro forma EBITDAM adjustments Plus: PF adj. for Bally’s South Tower renovation $6 Plus: PF adj. for unrealized Bally’s property-level cost savings 1 Plus: PF adj. for Grand Bazaar lease payment 3 CGPH 2013 Adj. EBITDAM - Pro forma $85 Estimated range for projected run-rate EBITDAM adjustments Less: PF adj. for CGPH’s share of corporate expense ($1) - ($4) Plus: PF adj. for CGPH’s share of corporate cost savings 0 - 1 Estimated range of projected run-rate adjusted EBITDAM - Pro forma $82 - $85 Estimated range for development project run-rate EBITDAM adjustments Plus: End of construction disruption related to The Linq and The Quad renovation $14 - $25 Plus: Impact of The Quad’s full renovation 31 - 47 Estimated range of projected run-rate adjustment EBITDAM (incl. development project) - Pro forma $127 - $157 CEOC’s 50% share of management fees (proposed) (2) Bally’s and The Quad management fees ($5) Management fees related to pro forma adjustments (4) - (3) CEOC’s 50% share of management fees (proposed) ($8) - ($9) Estimated range of projected run-rate adjustment EBITDA (incl. development project) - Pro forma $118 - $147 (1) See page 21 for a reconciliation of net income to CGPH Restricted Group Adj. EBITAM (Bally’s and The Quad). (2) CGP 50% of management fees will remain in the credit group. 1 3 4

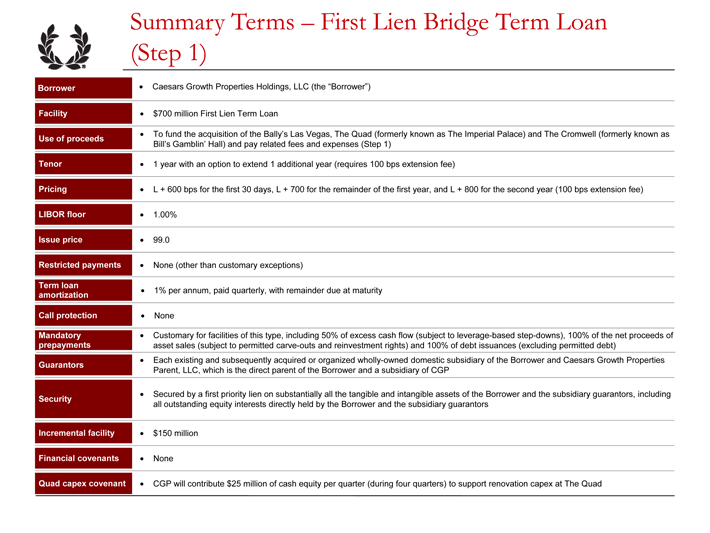

1 year with an option to extend 1 additional year (requires 100 bps extension fee) Borrower Facility $700 million First Lien Term Loan Guarantors Each existing and subsequently acquired or organized wholly-owned domestic subsidiary of the Borrower and Caesars Growth Properties Parent, LLC, which is the direct parent of the Borrower and a subsidiary of CGP Security Secured by a first priority lien on substantially all the tangible and intangible assets of the Borrower and the subsidiary guarantors, including all outstanding equity interests directly held by the Borrower and the subsidiary guarantors Tenor Pricing LIBOR floor Call protection 1% per annum, paid quarterly, with remainder due at maturity Mandatory prepayments Customary for facilities of this type, including 50% of excess cash flow (subject to leverage-based step-downs), 100% of the net proceeds of asset sales (subject to permitted carve-outs and reinvestment rights) and 100% of debt issuances (excluding permitted debt) Incremental facility $150 million L + 600 bps for the first 30 days, L + 700 for the remainder of the first year, and L + 800 for the second year (100 bps extension fee) 1.00% Issue price 99.0 Caesars Growth Properties Holdings, LLC (the “Borrower”) Term loan amortization None Financial covenants None Restricted payments None (other than customary exceptions) Quad capex covenant CGP will contribute $25 million of cash equity per quarter (during four quarters) to support renovation capex at The Quad To fund the acquisition of the Bally’s Las Vegas, The Quad (formerly known as The Imperial Palace) and The Cromwell (formerly known as Bill’s Gamblin’ Hall) and pay related fees and expenses Use of proceeds penses (Step 1) Summary Terms – First Lien Bridge Term Loan (Step 1)

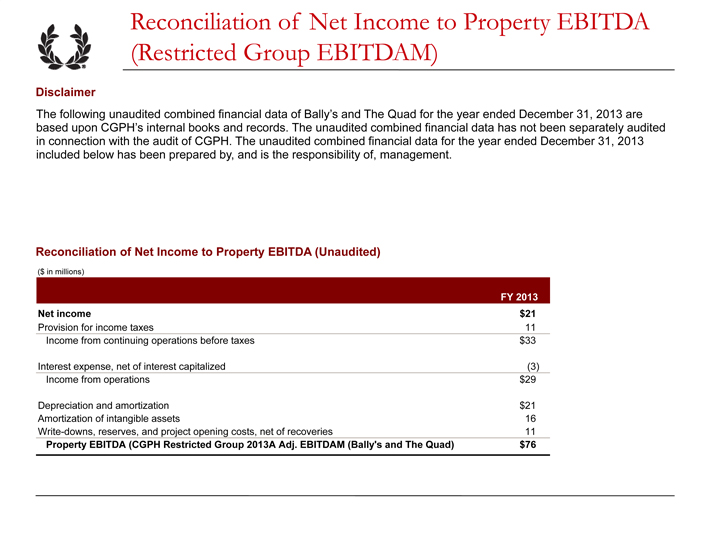

Reconciliation of Net Income to Property EBITDA (Restricted Group EBITDAM)

Disclaimer

The following unaudited combined financial data of Bally’s and The Quad for

the year ended December 31, 2013 are based upon CGPH’s internal books and records. The unaudited combined financial data has not been separately audited in connection with the audit of CGPH. The unaudited combined financial data for the year

ended December 31, 2013 included below has been prepared by, and is the responsibility of, management.

Reconciliation of Net Income to Property EBITDA (Unaudited)

($ in millions)

FY 2013

Net income $21

Provision for income taxes 11

Income from continuing operations before taxes $ 33

Interest expense, net of interest

capitalized (3)

Income from operations $ 29

Depreciation and amortization $

21

Amortization of intangible assets 16

Write-downs, reserves, and project

opening costs, net of recoveries 11

Property EBITDA (CGPH Restricted Group 2013A Adj. EBITDAM (Bally’s and The Quad) $76