Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AMERIGAS PARTNERS LP | apumar2014er.htm |

| EX-99.1 - EXHIBIT 99.1 - AMERIGAS PARTNERS LP | a991_marx2014.htm |

May 8, 2014 2014 Q2 Earnings Conference Call May 8, 2014

May 8, 2014 2 This presentation contains certain forward-looking statements that management believes to be reasonable as of today’s date only. Actual results may differ significantly because of risks and uncertainties that are difficult to predict and many of which are beyond management’s control. You should read AmeriGas’s Annual Report on Form 10-K and quarterly reports on Form 10-Q for a more extensive list of factors that could affect results. Among them are adverse weather conditions, cost volatility and availability of propane, increased customer conservation measures, the impact of pending and future legal proceedings, political, regulatory and economic conditions, the timing and success of our commercial initiatives and investments to grow our business, and our ability to successfully integrate acquired businesses and achieve anticipated synergies. AmeriGas undertakes no obligation to release revisions to its forward-looking statements to reflect events or circumstances occurring after today. About This Presentation

May 8, 2014 Jerry Sheridan CEO of AmeriGas

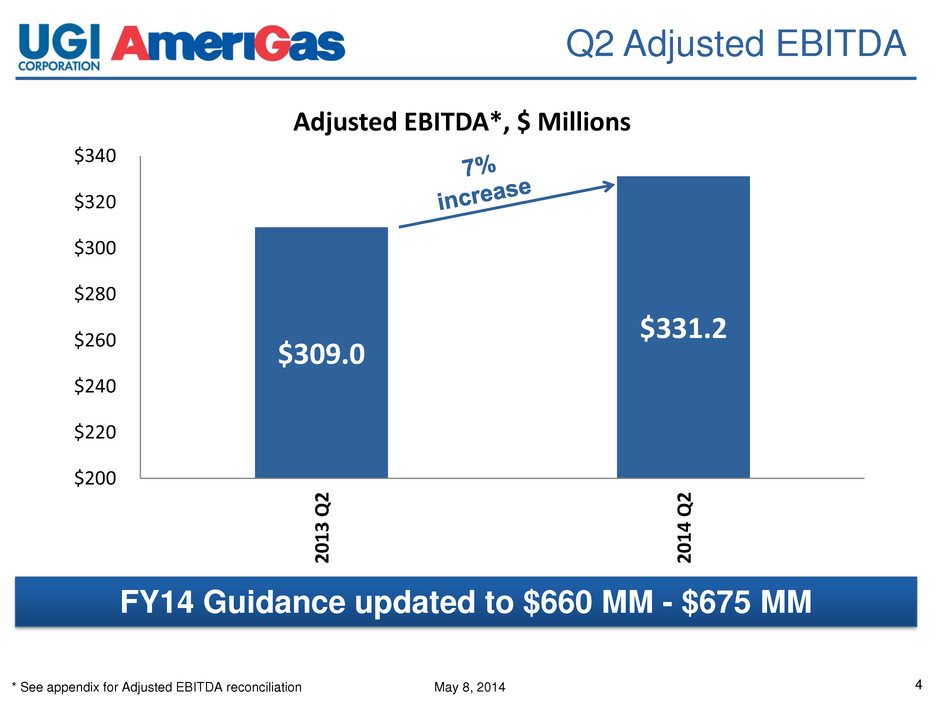

May 8, 2014 4 Q2 Adjusted EBITDA $309.0 $331.2 $200 $220 $240 $260 $280 $300 $320 $340 2 0 1 3 Q 2 2 0 1 4 Q 2 Adjusted EBITDA*, $ Millions * See appendix for Adjusted EBITDA reconciliation FY14 Guidance updated to $660 MM - $675 MM

May 8, 2014 5 Operational Update Operations • Volume increased 2.3% versus last year’s second quarter on weather that was 9.7% colder than last year • Western states experienced much warmer weather than normal; Large parts of CA and AZ saw the warmest Jan-Mar period since 1895 • The West represents nearly one-third of our business Q2 Weather vs Normal

May 8, 2014 6 Operational Update Operations • Supply shortages and a 51% increase in wholesale prices at Mt. Belvieu created a difficult operating environment for many of our locations • However, we redeployed significant assets and personnel in order to keep customers in gas. This includes our “AmeriGas Airborne” division • These resources and relationships with suppliers allowed AmeriGas to outperform many of our competitors who ran out of gas • However, we also saw higher uncollectible accounts expense, and higher repair and maintenance costs • Although costs and expenses rose quickly during the quarter, Adjusted EBITDA per gallon was $0.70 versus $0.67 last year

May 8, 2014 7 Operational Update Growth Initiatives • AmeriGas Cylinder Exchange (ACE): Volume growth of 16% from the prior-year quarter • National Accounts: Added 22 new accounts year to date representing 2.2 million additional annual gallons • Acquisitions: Two small acquisitions closed year-to-date Distribution • Distribution increased on 4/28/14 to $0.88 per quarter or $3.52 annualized • 10th consecutive year of distribution increases and 8th consecutive year of 5% or greater distribution increases

May 8, 2014 Q&A

May 8, 2014 Appendix

May 8, 2014 10 AmeriGas Supplemental Information: Footnotes The enclosed supplemental information contains a reconciliation of earnings before interest expense, income taxes, depreciation and amortization ("EBITDA") and Adjusted EBITDA to Net Income. EBITDA and Adjusted EBITDA are not measures of performance or financial condition under accounting principles generally accepted in the United States ("GAAP"). Management believes EBITDA and Adjusted EBITDA are meaningful non-GAAP financial measures used by investors to compare the Partnership's operating performance with that of other companies within the propane industry. The Partnership's definitions of EBITDA and Adjusted EBITDA may be different from those used by other companies. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income (loss) attributable to AmeriGas Partners, L.P. Management uses EBITDA to compare year-over-year profitability of the business without regard to capital structure as well as to compare the relative performance of the Partnership to that of other master limited partnerships without regard to their financing methods, capital structure, income taxes or historical cost basis. Management uses Adjusted EBITDA to exclude from AmeriGas Partners’ EBITDA gains and losses that competitors do not necessarily have to provide additional insight into the comparison of year-over-year profitability to that of other master limited partnerships. In view of the omission of interest, income taxes, depreciation and amortization from EBITDA and Adjusted EBITDA, management also assesses the profitability of the business by comparing net income attributable to AmeriGas Partners, L.P. for the relevant years. Management also uses EBITDA to assess the Partnership's profitability because its parent, UGI Corporation, uses the Partnership's EBITDA to assess the profitability of the Partnership, which is one of UGI Corporation’s industry segments. UGI Corporation discloses the Partnership's EBITDA in its disclosures about its industry segments as the profitability measure for its domestic propane segment.

May 8, 2014 11 AmeriGas Partners EBITDA Reconciliation 2014 2013 Net income attributable to AmeriGas Partners, L.P. 240,103$ 213,208$ Income tax (benefit) expense (74) (52) Interest expense 42,046 41,776 Depreciation 38,353 37,607 Amortization 10,804 11,022 EBITDA 331,232$ 303,561$ Heritage Propane acquisition and transition expense - 5,396 Gain on extinguishments of debt - - Adjusted EBITDA 331,232$ 308,957$ March 31, Three Months Ended

May 8, 2014 Investor Relations: 610-337-1000 Simon Bowman (x3645) bowmans@ugicorp.com