Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AutoWeb, Inc. | abtl8k_may12014.htm |

| EX-99.1 - PRESS RELEASE DATED MAY 1, 2014 - AutoWeb, Inc. | ex99-1.htm |

Exhibit 99.2

Autobytel Inc.

Moderator: Jeffrey Coats

May 1, 2014

5:00 p.m. (Eastern Time)

|

Operator:

|

Good day ladies and gentlemen, and welcome to the Autobytel Announces 2014 First Quarter Financial Results conference call. At this time all participants are in a listen only mode, but later we will have a question and answer session, and instructions will be given at that time.

|

If anyone should require assistance during today’s conference, that’s star and then zero to reach an operator. As a reminder, this call is being recorded. I would now like to turn the call over to Laurie Berman, Investor Relations for Autobytel.

|

Laurie Berman:

|

Thank you, Nicholas, and hello everyone. Welcome to Autobytel’s 2014 First Quarter conference call. Presenting today are Jeff Coats, President and Chief Executive Officer, and Curt DeWalt, Senior Vice President and Chief Financial Officer.

|

Before I introduce to Jeff, I would like to remind you that during today’s call, including the question and answer session, any projections and forward-looking statements made regarding future events or Autobytel's future financial performance are covered by the Safe Harbor Statements contained in today's press release, the slides accompanying this presentation and the company's public filings with the SEC. Actual events may differ materially from those forward-looking statements.

Specifically, please refer to the company’s Form 10-Q for the period ended March 31, 2014, which was filed just prior to this call, as well as other filings made from time to time by Autobytel with the SEC. These filings identify factors that could cause results to differ materially from those forward-looking statements.

There are slides included with today’s presentation to help illustrate some of the points being made and discussed during the call. The slides can be accessed by clicking on the link in today’s press release or by visiting Autobytel’s website at www.autobytel.com. When there, go to “Investor Relations” and then click on “Events & Presentations.”

Please also note that during this call, management will be discussing EBITDA, adjusted EBITDA and adjusted EBITDA per diluted share, which are non-GAAP financial measures as defined by SEC Regulation G. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures are included in today’s press release and in the slides which are posted on the company’s website.

And with that, I'll now turn the call over to Jeff.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 2

|

Jeff Coats:

|

Thank you, Laurie. Good afternoon everyone.

|

We had a very strong first quarter, 48% growth in total revenues. This success was driven by continued expansion in our core business and the contribution from our recent AutoUSA acquisition. Excluding AutoUSA, revenues grew 25%, solidly outpacing U.S. retail auto sales, which grew only 3.6% during the quarter. Lead volume grew 44% for the first quarter, reaching an all time quarterly high. We also exceeded our previous forecast on both the top and bottom lines.

The team is executing well as reflected by our quarterly results. Based on our success, we plan to continue along the same path to drive future growth for Autobytel, our customers and our shareholders.

After Curt’s financial review, I will update you on our ongoing progress.

|

Curt DeWalt:

|

Thank you, Jeff.

|

On Slide 4, you’ll see that total revenue grew 48% to $27.0 million for the first quarter of 2014, up from $18.3 million last year. Although we didn’t own AutoUSA for a full quarter, they generated $5.3 million of total revenues. We recognized $4.2 million of that amount after eliminations related to intercompany transactions and direct delivery to wholesale channels. Jeff will provide additional details in his comments.

Automotive lead revenues increased 55% from last year’s first quarter, with retail channel sales rising 77%, wholesale channel sales growing 38%. Excluding AutoUSA, retail channel sales grew 18%, and wholesale channel sales increased 37%.

Moving to Slide 5, you can see that we delivered 1.7 million automotive leads during the 2014 first quarter, a 44% increase over last year. 65% of the leads were delivered to the wholesale channel customers and the remaining 35% to the retail channel customers.

We delivered 88,000 specialty finance leads during the 2014 first quarter, versus 86,000 last year. The increase in volume reflects ongoing efforts to ease supply constraints. Specialty finance lead revenue was $1.6 million for the first quarters of 2014 and 2013.

Advertising revenues equaled $673,000 for the first quarter of 2014, versus $715,000 last year.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 3

On Slide 6, you’ll note a 53% improvement in gross profit, which was $10.1 million for the 2014 first quarter, versus $6.6 million last year. Gross margin was 37.4% of total revenues for the most recent first quarter, up from 36.1% of total revenues one year ago. I’d like to remind you that as a result of our acquisition of AutoUSA, gross margin will fluctuate in the mid-to-high 30% range through the end of this year since the historical AutoUSA gross margin was in the 25-27% range. We are working to continue expanding margins and volumes.

Total operating expenses were $9.3 million, or 34.6% of total revenues, for the 2014 first quarter, compared with $6.6 million, or 36.1% of total revenues, for the same quarter last year. The expected increase principally related to additional operating expenses associated with AutoUSA, which equaled approximately $1.2 million. In addition, there was early $1.0 million in acquisition-related expenses.

As you’ll see on Slide 7, non-cash stock-based compensation totaled $286,000, compared with $186,000 in the 2013 first quarter. The increase resulted mainly from higher share price this year versus last year and the related Black Scholes values used for expensing. Depreciation and amortization was $527,000, versus $538,000 last year.

Net income was $370,000, or $0.04 per diluted share, compared with $334,000, or $0.04 per diluted share, for last year’s first quarter. Please note there were approximately 13% more diluted weighted average shares outstanding during 2014 first quarter compared with last year. The increase in share count related to higher share price and the impact it had on the acquisition-related warrants being included in the diluted share calculation. The diluted share calculation can also be influenced quarter-to-quarter by the interplay between net income and interest expense on the acquisition-related convertible debt in determining whether those shares are included.

As discussed last quarter, we now have a higher effective tax rate provision for book purposes than we have in the past. This is the result of the valuation allowance reversal on the deferred tax assets. This increase will not have any impact on our cash due to the utilization of our NOL tax credits.

We’ll also be providing some additional information to help investors better understand the business, given the taxes and the level of acquisition-related expenses this quarter. On Slide 7, you’ll see that EBITDA was $1.3 million for the first quarter of 2014, up from $1.0 million even last year. You’ll also see a two-step calculation for adjusted EBITDA. The first, which is in the middle of the table, adds back non-cash stock-based compensation. The second, adds back to that one-time acquisition-related expenses. That brings us to adjusted EBITDA, excluding acquisition expenses, of $2.6 million, or $0.25 per diluted share, which grew from $1.2 million, or $0.13 per diluted share, one year ago. It is important to note that acquisition-related expenses during the 2014 first quarter had a positive impact of $0.10 per diluted share on the adjusted EBITDA excluding acquisition expenses. Going forward, absent additional acquisitions, this impact will not be nearly as significant in the future.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 4

Cash and cash equivalents balance grew to $19.3 million for the March 31, 2014, up from $18.9 million at the end of 2013.

Cash provided by operations for the 2014 first quarter was $875,000, compared with cash used in operations of $372,000 for the prior-year quarter.

Now, I'll turn the call back to Jeff.

|

Jeff Coats:

|

Thanks Curt.

|

I’ll start today with a brief update on AutoUSA.

The integration is going well. As noted on Slide 8, our financial and operating systems were fully integrated on schedule as of last night. I’d like to take a moment now to thank the dedicated and hardworking teams of people at Autobytel, AutoUSA and AutoNation who accomplished this integration on schedule and with no disruptions. We also closed AutoUSA’s Fort Lauderdale office on April 25th. Of the 37 employees we acquired on January 14th, 5 have been retained, including 4 field sales people and AutoUSA’s president, Phil DuPree, who now oversees our dealer-facing sales and customer service teams. Even though we did open several additional mostly customer service positions here in Irvine, elimination of the overlapping costs – the bulk of which have now been completed – put us on track to surpass the 30% cost elimination target we shared with you in February. The remaining integration items are scheduled for completion by the end of the second quarter, after which we expect to have removed $3.3 million, or 55%, of AutoUSA’s $6 million of operating expense.

As we’ve previously mentioned, AutoUSA had revenues approaching $30 million last year. However, that revenue was declining during the year due to accelerated dealer churn and an annual run rate more indicative of $25-$26 million.

Accordingly, AutoUSA generated approximately $5.3 million in revenue in the first quarter, and as Curt discussed, we recognized $4.2 million of that revenue due to eliminations related to intercompany transactions and direct delivery to wholesale channels. You will recall that we were the second largest supplier of leads to AutoUSA prior to the acquisition and that this revenue number only includes the 11 weeks we owned AutoUSA out of the 13-week quarter. The approximately $1.1 million in AutoUSA revenues we eliminated is in line with the 20-25% eliminations forecast we provided in February. And, as I said earlier, we have removed more costs from the business than originally planned and in line with the amount of revenue we expect to retain.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 5

Dealer count, which is shown on Slide 9, includes the dealers we acquired through AutoUSA. At the time of the acquisition, we added an incremental 1,400 dealers and expanded our relationships with 900 dealers that worked with both AutoUSA and Autobytel. We believe we now have one of the largest dealer networks in the country. As of March 31st, we had 5,035 dealer franchises, down from the 5,200 at the time of the acquisition.

As I have previously noted, AutoUSA’s dealer churn is more than two times that of Autobytel’s; therefore, it will take us a few quarters to implement our successful retention and rewind procedures to reduce and ultimately reverse the current AutoUSA trend. Accordingly, we expect to see some fluctuation in our retail dealer counts and revenue during this time. We are out in the field educating dealers, especially AutoUSA dealers who don’t know us as well, about our outstanding lead quality by providing them with the data we receive through our collaboration with IHS Automotive, which purchased R.L. Polk in 2013. We feel very good about opportunities to retain and rewind more of these dealers in the months ahead.

I’d like to note that as a result of the acquisition, AutoNation is no longer one of our largest customers because most of the leads we were selling to them were for sale to AutoUSA member dealers.

To summarize, the acquisition of AutoUSA has given us a significantly larger retail footprint, which helps reinforce our focus on Autobytel’s original mission of improving the retail automotive environment for dealers and consumers. This gives us a solid competitive edge, and we believe we should strongly benefit from our increased size and stature within the industry. This exciting and accretive acquisition sets us up very nicely for the future.

As you know, Autobytel was founded by a car dealer, so we have always been somewhat unique in that we focus on bringing dealers and consumers together. Recent feedback from our dealers shows that, in many cases, consumers generated by Autobytel are generally more concerned about their car buying experience versus getting the absolute lowest price. The end result is a better experience for the consumer and the opportunity for a stronger long-term relationship between dealers and consumers. Anecdotally, we have also heard that some of Autobytel’s dealer customers are seeing higher gross on vehicles sold as a result of our leads, versus what they see from some of our competitors.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 6

To better help dealers and manufacturers sell our cars, we are continuing to market our high quality products to our customers. Autobytel Mobile, which is highlighted on Slide 10, is being well accepted in the marketplace as dealers continue to seek the best and most effective ways to communicate with customers using their preferred method, which is increasingly via mobile. Our TextShield product, for example, enables dealers to have a two-way text conversation with customers in a centralized, controlled and regulatory compliant environment. Our mobile dealer websites help convert web traffic into real-time leads. Send2Phone allows visitors to a dealer’s website to send vehicle listing information from their desktop to their cell phone via SMS while allowing the dealer to capture consumer’s details as leads.

Another innovative product is SaleMove, which is shown on Slide 11. As the exclusive provider of this exciting product to the automotive industry, we are delivering tools to dealers that improve the online car shopping experience. By allowing dealers to interact with consumers using live video, audio, text-based chat or phone, SaleMove moves the dealer’s website into a virtual showroom. As we mentioned last quarter, this is important as more and more consumers do their shopping online as opposed to visiting a physical dealership. To reiterate what we said on our last quarterly call, the average consumer now physically visits 1.9 automotive dealerships, on average, before purchasing a vehicle. This continues the trend down from the historical average of 3.2 visits. A dealer’s website, or virtual showroom, is now more important than ever, and SaleMove makes certain that this virtual showroom is not left unattended.

Both products are designed to move us further in the direction of delivering buyers directly to dealers versus simply providing a lead.

We are also continuing to drive traffic through our YouTube channel, which as shown on Slide 12, now includes more than 900 videos and approximately 32 million views. Our original content encompasses interesting and valuable topics, including test drives, reviews, sneak previews from major auto shows around the country, interviews with auto designers and car care how-to videos.

Our core auto leads business continues to show strength. As I mentioned, lead volume grew 44% for the quarter compared with last year.

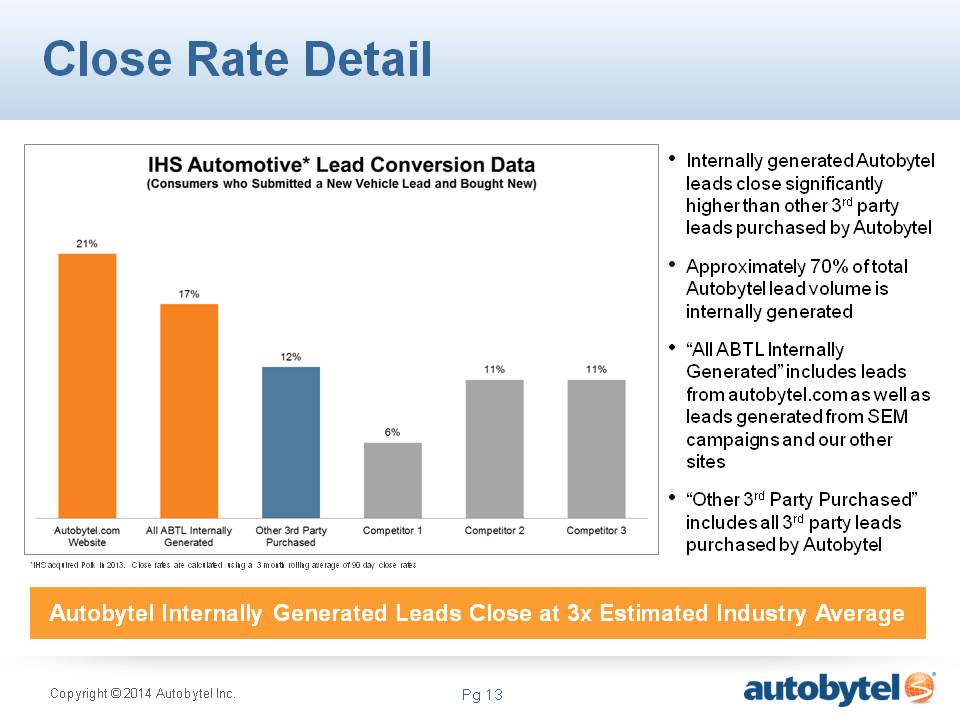

High converting sales leads remain the staple of our business. As you’ll see on Slide 13, the leads we generate from Autobytel.com currently convert to sales on average at a rate of approximately 21%. All leads internally-generated by Autobytel currently convert to sales, on average, at a rate of approximately 17%. Again, these figures have been validated by IHS Automotive using actual vehicle registration data and are based on a rolling three-month average, which will fluctuate on a month-to-month and quarter-to-quarter basis.

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 7

The quality of our leads is evident in the influence Autobytel had again in 2013 on vehicle sales. On Slide 14, you can see that consumers submitting leads sold by Autobytel accounted for more than 500,000 new vehicle retail sales, or nearly 4% of all new vehicle retail sales in the United States in 2013. From 2011 through 2013, consumers submitting leads sold by Autobytel accounted for more than 2.7 million new and used vehicle sales. For many OEMs, as you can see on Slide 15, consumers who submitted leads through Autobytel were responsible for 5% or more of total sales by manufacturer. This percentage varies by OEM and is largely a result of the robustness of our direct relationships with each manufacturer. We believe these numbers validate the importance of independent third-party automotive websites for consumers who rely on unbiased information to help them make better informed car buying choices and that third-party leads continue to be a main driver of business for dealerships throughout the United States.

I’d also like to quickly comment on our advertising business. We believe we will begin to see a meaningful benefit from our relationship to Jumpstart during the second quarter when all fiscal year ad campaigns are up and running. This agreement is valuable because the revenue we generate through it is 100% margin business. Before working with Jumpstart our advertising revenue historically generated approximately 80% margins. For 2014, we do expect advertising revenue to grow compared with last year.

The healthy state of the automotive market continues to provide us with opportunities for growth. As you can see on Slide 16, April retail seasonally adjusted annual run rate was projected at approximately 13.3 million units, up from 13.0 million in March, during which retail U.S. light vehicle sales were up 7%.

Based on current business trends, we estimate that 2014 second quarter revenue growth will be in the range of 47% to 53%, as compared with the 2013 second quarter. We also expect earnings per diluted share to be in the range of $0.04 to $0.06 based on 11.5 million diluted weighted average shares outstanding.

Our ongoing business initiatives are summarized on Slide 17. As we continue to grow our core leads business, we are also being opportunistic about strategic investments and acquisitions that could further strengthen our company. However, we currently have no plans for raising additional capital.

Before I close, I want to reiterate something important that Curt also discussed earlier. There is no cash impact from the increase in our effective tax rate provision as the result of our NOL utilization.

We remain upbeat about our business and industry and believe Autobytel’s future is bright.

Nicholas, we’re now ready to take questions.

|

Operator:

|

Ladies and gentlemen, if you have a question over the phone at this time, that’s star and then the one key on your touch tone telephone. If your question has been answered or you wish to remove yourself from the cue at a later time, please press the pound key.

|

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 8

Once again, to ask a question, that’s star and then one.

Our first question comes from the line of Eric Martinuzzi with Lake Street Capital Markets. Your line is now open. Please proceed with your question.

|

Eric Martinuzzi:

|

Thanks, and congratulations on the solid start to the beginning of the year. I have a question about the -- you talked about the advertising revenue. I was scribbling as fast as a I could, but I was wondering if you could pause and go through that again, just how it changes with Jumpstart this year versus how it was last year.

|

|

Jeff Coats:

|

Historically, you know, we’ve done our own advertising sales, Eric, and obviously there were costs associated with that, so that ended up resulting in about an 80% gross margin business for us. The relationship with Jumpstart – Jumpstart provides all of the advertising sales. They bundle us with their other customers, so we would expect our website this year to essentially be sold out as a result of the additional sales that they will generate.

|

They take their cut off the top, so the advertising revenue that we will show in our books will be after they’ve taken their cut and will basically be 100% margin as a result.

|

Eric Martinuzzi:

|

Okay, so, starting with 2013 as a frame of reference here, we had advertising revenue of $3.3 million, and that was roughly an 80% gross margin. You’re saying whatever we choose to model here for 2014, and beginning with Q1 at roughly $700,000, that revenue this year, that’s 100% gross margin. Correct?

|

|

Jeff Coats:

|

Correct.

|

|

Eric Martinuzzi:

|

Okay, and then shifting over to a line that is not typically not talked about on the earnings call, at least historically we haven’t dived into it, but I’m curious to know, the other revenue line this quarter was $273,000. That was up from really no value a year ago and then it was up sequentially from Q4. What are the components of that line? What do you expect from it for the year?

|

|

Jeff Coats:

|

It’s primarily revenue from our mobile products currently.

|

|

Eric Martinuzzi:

|

Okay, so that’s TextShield?

|

|

Jeff Coats:

|

Yes. It’s all the products we purchased as part of the Advanced Mobile acquisition – TextShield, Send2Phone, Mobile websites, mobile apps.

|

|

Eric Martinuzzi:

|

Okay, and what type of margin does that business have?

|

|

Jeff Coats:

|

It’s a 60 plus percent margin.

|

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 9

|

Eric Martinuzzi:

|

Okay, and then just one housekeeping item for me – the CAPEX for the quarter, and then were there any cash taxes paid in the quarter?

|

|

Curt DeWalt:

|

For the quarter it was about $250,000 of CAPEX.

|

|

Eric Martinuzzi:

|

Okay. And then were there cash taxes at all?

|

|

Curt DeWalt:

|

Cash taxes were about $20,000.

|

|

Eric Martinuzzi:

|

Okay. Alright, thanks for taking my questions.

|

|

Jeff Coats:

|

Thank you, Eric.

|

|

Operator:

|

Thank you. Our next question comes from the line of Sameet Sinha with B. Riley & Co. Your line is now open.

|

|

Richard Magnusen:

|

Hi. This is Richard Magnusen for Sameet Sinha, and I have three questions. The first one is in terms of AutoNation. They were a top three customer in 2013, and now I understand that they are not this, but our math indicates that they now account for $3 to $4 million in annual revenue. Is that figure in the ballpark?

|

|

Jeff Coats:

|

I’m sorry. You kind of cut out as part of asking the question. I don’t think we heard all of it.

|

|

Richard Magnusen:

|

Okay. I understand that AutoNation is no longer on the top three customer list.

|

|

Jeff Coats:

|

Correct.

|

|

Richard Magnusen:

|

We have an estimate of their current annual revenue as $3-4 million. Is that a correct figure or a correct estimate?

|

|

Jeff Coats:

|

No. I’m not sure where you got that. Most of the lead volume that we have sold to AutoNation for the last several years was actually for delivery to AutoUSA for them to then sell to their member dealers. Now that we have acquired AutoUSA, that volume, of course, no longer goes to AutoNation.

|

I mean, we do continue to do business with AutoNation. We have a good relationship with them, but it is now substantially smaller than it was because AutoUSA is now part of Autobytel.

|

Richard Magnusen:

|

Okay. Also, could you give us a sense of the progress at AutoWeb?

|

|

Jeff Coats:

|

There’s probably not a lot that I can talk about with AutoWeb. They have launched their business. It is growing nicely. We were their first publisher and advertiser. We are generating revenue from that relationship. They are in the process of signing up other participants in the third party business. It’s probably not appropriate for me to disclose who else they’ve signed up, but they are, in fact, signing up most all of the other third party sites, and the business is growing quite nicely.

|

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 10

|

Richard Magnusen:

|

Okay, and then just one more question. According to the data you released this morning about the number of cars sold, we came up with a calculation that it’s costing the OEM dealer about $135 per car, which is way below the $600 number from NADA, and it’s also below the $299 for True Car. In light of these numbers, how much pricing power do you have, and do you think this will unfold in 2014 or over a 2 to 3-year period?

|

|

Jeff Coats:

|

You know, that’s a tricky question to answer on a public call. We do believe that our customers receive an outstanding benefit from the leads that we sell to them based on the cost that we sell at as compared to what other people do as part of their business model. Our dealer and manufacturer customers do achieve an outstanding return on those investments. I think everybody recognizes that over time there are adjustments that need to be made due to rising costs of doing business, so we do think we have some ability to make adjustments as appropriate over time, and we certainly look to do that.

|

|

Richard Magnusen:

|

Thank you very much. That was all my questions.

|

|

Jeff Coats:

|

Thank you.

|

|

Operator:

|

Thank you, and as a reminder, ladies and gentlemen, if you do have a question, that’s star and then the number one key on your touch tone telephone.

|

Our next question comes from the line of Alexander Renker with Sidoti & Company. Your line is now open, please proceed.

|

Alexander Renker:

|

Hey, good afternoon guys. Two quick questions from me. The first is, on the revenue guidance, what are the legacy AutoUSA churn assumptions that are sort of built into that?

|

|

Jeff Coats:

|

I guess if I understand what you are asking, their churn is running at about double our churn.

|

|

Alexander Renker:

|

Right.

|

|

Jeff Coats:

|

So, that is incorporated in the revenue guidance.

|

|

Alexander Renker:

|

Okay, so the revenue guidance doesn’t assume any kind of drastic improvement in that churn from the legacy AutoUSA network.

|

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 11

|

Jeff Coats:

|

The high end assumes that we are starting to get our arms around it. We are beginning to, but, you know, we just spent the last 2 1/2 months or more working on the integration. Now that we’ve gotten that taken care of, we transferred the customer service relationships out here to our facility in Irvine out of the AutoUSA office on Fort Lauderdale.

|

We’re able to work on a little bit more of a focused basis, both here with our customer service people and with our field organization. So, you know, we’ve been very successful historically in getting our churn number down. Churn in our industry, historically, has been around 5%. Autobytel’s churn runs currently between 3 and 3 1/2% -- something we’re quite proud of. AutoUSA is running about double our current churn levels, so we are using the procedures that we have developed over the last few years from a retention and a rewind standpoint so that, you know, even if we get a cancellation notice from a dealer we can go in, sit down with them, talk to them about the Polk information, lead quality, and we’ve been quite successful in being able to rewind dealers as a result of that and, in many cases, keep them from cancelling in the first place.

So, I’d say we’re optimistic that we will be able, over time, to implement our processes and procedures throughout the AutoUSA dealer universe and see some good results.

|

Alexander Renker:

|

Okay, great. And then, the next was, given the increase in retail dealer volume that you guys took on given the AutoUSA acquisition, have there been any new challenges maintaining lead quality while meeting that additional demand?

|

|

Jeff Coats:

|

No, not so far. I mean, our Tampa operation is increasing our volume levels. We still work with our trusted outside partners in terms of the amount of leads that we do buy from some of our outside partners, so we feel pretty good about where we are. We are beginning to increase the percentage of our internally-generated leads that are going to the AutoUSA dealers, and that will continue to increase over time.

|

|

Alexander Renker:

|

Okay, great. Thank you.

|

|

Operator:

|

Thank you. Our next question comes from the line of Jared Schramm with Roth Capital Partners. Your line is now open. Please proceed with your question.

|

|

Jared Schramm:

|

Hi. Good afternoon.

|

|

Jeff Coats:

|

Hi Jared.

|

|

Jared Schramm:

|

One quick one here. Looking at AutoUSA, what are you doing to address those gross margins there, and do you think those can ever get to the level of your core business? Is this a mix issue quality? I’m just curious what your thoughts are there.

|

Autobytel Inc.

Moderator: Jeffrey Coats

05-01-14/5:00 P.M. ET

Confirmation #30905465

Page 12

|

Jeff Coats:

|

It’s a mix issue. We will get those margins up. It’s a function of getting more of our internally-generated leads in that mix, and even with some of the outside customer relationships we were able to buy at a better rate than AutoUSA was, in part because with some of them we were buying larger volumes. So, you know, we believe over time we’ll be able to get that up to the level that we need it to – pretty straight forward from the mix standpoint.

|

|

Jared Schramm:

|

And then, keeping on the AutoUSA theme, what’s your approach to getting those dealers back on the platform who’ve turned off, and is there a timeframe you think from when they’re turning off to when you get them back on?

|

|

Jeff Coats:

|

It’s hard to give you a good rule of thumb. It’s really all over the place. But, you know, we’ve been very successful in doing that ourselves in our core retail business. You know, we’ve been able to grow back from having lost a lot of dealers five years ago when the country went into recession and thousands of dealers went out of business.

|

It’ll take us a little bit of time, but we have people that are very experienced. They know what they are doing, and we’ve been doing it successfully ourselves for the last few years, so, we’re confident we’ll be successful.

|

Jared Schramm:

|

Thank you.

|

|

Operator:

|

Thank you. And I’m not showing any further questions in the queue. I would like to turn the call back over to Mr. Jeff Coats for any further remarks.

|

|

Jeff Coats:

|

Thank you, Nicholas. Folks, thanks again for joining us today. As a reminder, Curt and I look forward to speaking with many of you at the upcoming B. Riley conference in California later this month. Thank you. Goodbye.

|

|

Operator:

|

Ladies and gentlemen, thank you for participating in today’s conference. This does conclude the program, and you may all disconnect. Have a great day everyone.

|

|

END

|