Attached files

| file | filename |

|---|---|

| 8-K - CUSTOMERS BANCORP, INC. FORM 8-K - Customers Bancorp, Inc. | customers8k.htm |

Exhibit 99.1

Highly Focused, Low Risk, High Growth Bank Holding Company

Investor Presentation

May 2014

NASDAQ: CUBI

2

This presentation as well as other written or oral communications made from time to time by us, may contain certain forward-looking information within the meaning of

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including

events or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,”

“may,” “will,” “should,” “plan,” “intend,” “on condition,” “target,” “estimates,” “preliminary,” or “anticipates” or the negative thereof or comparable terminology, or by

discussion of strategy or goals or other future events, circumstances or effects. These forward-looking statements regarding future events and circumstances involve

known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, financial condition, performance or achievements to be

materially different from any future results, levels of activity, financial condition, performance or achievements expressed or implied by such forward-looking

statements. This information is based on various assumptions, estimates or judgments by us that may not prove to be correct.

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including

events or predictions relating to our future financial performance, and are generally identifiable by the use of forward-looking terminology such as “believes,” “expects,”

“may,” “will,” “should,” “plan,” “intend,” “on condition,” “target,” “estimates,” “preliminary,” or “anticipates” or the negative thereof or comparable terminology, or by

discussion of strategy or goals or other future events, circumstances or effects. These forward-looking statements regarding future events and circumstances involve

known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, financial condition, performance or achievements to be

materially different from any future results, levels of activity, financial condition, performance or achievements expressed or implied by such forward-looking

statements. This information is based on various assumptions, estimates or judgments by us that may not prove to be correct.

Important factors to consider and evaluate in such forward-looking statements include:

§availability and adequacy of cash flow to meet our debt service requirements under the notes;

§changes in competitive and market factors might affect our results or operations;

§changes in laws and regulations, including without limitation changes in capital requirements under the Basel III capital proposals;

§changes in our business strategy or an inability to execute our strategy due to the occurrence of unanticipated events;

§our ability to identify potential candidates for, and consummate, acquisition or investment transactions;

§the timing and results of acquisitions or investment transactions;

§our failure to complete any or all of the transactions described herein on the terms currently contemplated;

§local, regional, national, and international economic conditions and events and the impact they may have on us and our customers, including our operations and

investments, both in the United States and contemplated in India;

investments, both in the United States and contemplated in India;

§targeted or estimated returns on assets and equity, growth rates and future asset levels;

§our ability to attract deposits and other sources of liquidity and capital;

§changes in the financial performance and/or condition of our borrowers, and issuers of securities we hold;

§changes in the level of non-performing and classified assets and charge-offs;

§changes in estimates of future loan loss reserve requirements based upon the periodic review thereof under relevant regulatory and accounting requirements, as well

as changes in borrowers’ payment behavior and creditworthiness;

as changes in borrowers’ payment behavior and creditworthiness;

§changes in our capital structure resulting from future capital offerings or acquisitions;

§inflation, interest rate, securities market and monetary and foreign currency fluctuations, both in the United States, and internationally, especially in India due to our

pending strategic investment

pending strategic investment

§the effects on our mortgage warehouse lending and retail mortgage businesses of changes in the mortgage origination markets, including changes due to changes in

monetary policies, interest rates and the regulation of mortgage originators, services and securitizers;

monetary policies, interest rates and the regulation of mortgage originators, services and securitizers;

§timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

§changes in consumer spending, borrowing and saving habits;

§technological changes;

§our ability to grow, increase market share and control expenses, and maintain sufficient liquidity;

Forward Looking Statements

3

§ timely development and acceptance of new banking products and services and perceived overall value of these products and services by users;

§ volatility in the credit and equity markets and its effect on the general economy;

§ the potential for customer fraud, especially in our mortgage warehouse lending business;

§ effects of changes in accounting policies and practices, as may be adopted by the regulatory agencies, as well as the Public Company Accounting Oversight Board,

the Financial Accounting Standards Board and other accounting standard setters;

the Financial Accounting Standards Board and other accounting standard setters;

§ the businesses of the Bank and any acquisition targets, merger partners or strategic investments, and their subsidiaries not integrating successfully or such

integration being more difficult, time-consuming or costly than expected;

integration being more difficult, time-consuming or costly than expected;

§ our ability to integrate currently contemplated and future acquisition targets and investments may be unsuccessful, or may be more difficult, time-consuming or

costly than expected;

costly than expected;

§ material differences in the actual financial results of merger, acquisition, and investment activities compared with expectations;

§ investments in new markets, domestic or foreign, where we have little or no experience;

§ the levels of activity and revenue from referrals from contractual or investment arrangements; and

§ the liquidity and values of our strategic investments, including foreign strategic investments in India.

These forward-looking statements are subject to significant uncertainties and contingencies, many of which are beyond our control. Although we believe that the

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, financial condition, performance or

achievements. Accordingly, there can be no assurance that actual results and cash flows will meet our expectations or will not be materially lower than the results,

cash flows, or financial condition contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents. We do not

undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or

to reflect the occurrence of unanticipated events.

expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, financial condition, performance or

achievements. Accordingly, there can be no assurance that actual results and cash flows will meet our expectations or will not be materially lower than the results,

cash flows, or financial condition contemplated in this presentation. You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents. We do not

undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this document or

to reflect the occurrence of unanticipated events.

This presentation is for discussion purposes only, and shall not constitute any offer to sell or the solicitation of an offer to buy any security, nor is it intended to give

rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a recommendation to buy any securities or

enter into any transaction with the Company. The information contained herein is preliminary and material changes to such information may be made at any time.

If any offer of securities is made, it shall be made pursuant to a definitive offering memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf

of the Company, which would contain material information not contained herein and which shall supersede, amend and supplement this information in its entirety.

rise to any legal relationship between Customers Bancorp, Inc. (the “Company”) and you or any other person, nor is it a recommendation to buy any securities or

enter into any transaction with the Company. The information contained herein is preliminary and material changes to such information may be made at any time.

If any offer of securities is made, it shall be made pursuant to a definitive offering memorandum or prospectus (“Offering Memorandum”) prepared by or on behalf

of the Company, which would contain material information not contained herein and which shall supersede, amend and supplement this information in its entirety.

Any decision to invest in the Company’s securities should be made after reviewing an Offering Memorandum, conducting such investigations as the investor deems

necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an independent determination of the

suitability and consequences of an investment in such securities. No offer to purchase securities of the Company will be made or accepted prior to receipt by an

investor of an Offering Memorandum and relevant subscription documentation, all of which must be reviewed together with the Company’s then-current financial

statements and, with respect to the subscription documentation, completed and returned to the Company in its entirety. Unless purchasing in an offering of

securities registered pursuant to the Securities Act of 1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United

States before they can invest in the Company.

necessary or appropriate, and consulting the investor’s own legal, accounting, tax, and other advisors in order to make an independent determination of the

suitability and consequences of an investment in such securities. No offer to purchase securities of the Company will be made or accepted prior to receipt by an

investor of an Offering Memorandum and relevant subscription documentation, all of which must be reviewed together with the Company’s then-current financial

statements and, with respect to the subscription documentation, completed and returned to the Company in its entirety. Unless purchasing in an offering of

securities registered pursuant to the Securities Act of 1933, as amended, all investors must be “accredited investors” as defined in the securities laws of the United

States before they can invest in the Company.

Forwarding Looking Statements cont.

4

Investment Proposition

§ ~$5.0 billion asset bank

§ Well capitalized at 11% + total risk based capital and 9% + tier 1 leverage

§ Target market from Boston to Washington D.C. along interstate 95

§ ROA goal of 1% + and ROE of 12% + within 3-5 years

§ 3.00% net interest margin goal; Targeting efficiency ratio in the 40’s

§ 97% compounded annual growth in loans since 2009

§ DDA and total deposits compounded annual growth of 115% and 78% respectively since 2009

§ 300% compounded annual growth in core earnings since 2011

§ No charge-offs on loans originated after 2009

§ 0.32% non-performing assets (non-FDIC covered loans)

§ Total reserves to non-performing loans of 165.4%

Strong, High Growth, Low Risk, Branch Lite Bank in Attractive Markets

Profitability

Strong Credit Quality

* Includes mortgage warehouse

5

Investment Proposition

§ Over half of the loan portfolio will re-price within one year

§ 40% of loans have an average life of 3.8 years

§ ~ 20% of deposits are non-interest bearing

§ Extending liabilities at this time

§ $150 million in forward starting swaps

§ Current share price ($21.85) is 13.0x estimated 2014 earnings, and 11.1x estimated 2015 earnings

§ Price/tangible book estimated at 1.3x and 1.2x for 2014 and 2015 respectively

Low Interest Rate Risk

Valuation

* Includes mortgage warehouse

6

Execution Timeline

§ We invested in and

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

took control of a $270

million asset

Customers Bank (FKA

New Century Bank)

§ Identified existing

credit problems,

adequately reserved

and recapitalized the

bank

credit problems,

adequately reserved

and recapitalized the

bank

§ Actively worked out

very extensive loan

problems

very extensive loan

problems

§ Recruited experienced

management team

management team

§ Enhanced credit and risk

management

management

§ Developed infrastructure

for organic growth

for organic growth

§ Built out warehouse

lending platform and

doubled deposit and loan

portfolio

lending platform and

doubled deposit and loan

portfolio

§ Completed 3 small

acquisitions:

acquisitions:

– ISN Bank (FDIC-

assisted) ~ $70 mm

assisted) ~ $70 mm

– USA Bank (FDIC-

assisted) ~ $170 mm

assisted) ~ $170 mm

– Berkshire Bancorp

(Whole bank) ~ $85

mm

(Whole bank) ~ $85

mm

§ Recruited proven lending

teams

teams

§ Built out Commercial and

Multi-family lending

platforms

Multi-family lending

platforms

§ De Novo expansion;4-6

sales offices or teams

added each year

sales offices or teams

added each year

§ Continue to show strong

loan and deposit growth

loan and deposit growth

§ Built a “branch lite” high

growth Community Bank

and model for future

growth

growth Community Bank

and model for future

growth

§ Goals to ~12%+ ROE;

~1% ROA

~1% ROA

2009

Assets: $350M

Equity: $22M

2010-2011

Assets: $2.1B

Equity: $148M

2012-2013

Assets: ~$4.2B

Equity: ~$400M

1Q 2014

Assets: ~$5.0B

Equity: ~$401M

§ Single Point of Contact

Private Banking model

executed - commercial

focus

Private Banking model

executed - commercial

focus

§ Introduce bankmobile -

banking of the future

for consumers

banking of the future

for consumers

§ Continue to show

strong loan and

deposit growth

strong loan and

deposit growth

§ ~12%+ ROE; ~1%

ROA

ROA

§ ~$6 billion asset bank

by end of 2014

by end of 2014

§ ~$9 billion asset bank

by end of 2019

by end of 2019

7

What Customers Bank Stands For

Vision ( our dream)

“We want to build a highly successful bank that makes our customers say “WOW”

Mission (the path)

“We achieve our Visions by taking pride in delivering”:

•Absolutely memorable service to our customers

•High-touch personal or private banking supported by high-tech for all our customers

•Concierge Banking by meeting our customers 7 days a week - wherever and whenever

•Helping our customers succeed

Critical Success Factors (what we consider most important in running a strong bank)

“We will never deviate from the following five critical success factors”:

•We will always put our customers first and execute that strategy by having the best people

on our team

on our team

•Always attempt to maintain the highest quality loans and investments on our books

•Have best systems, practices and team in place to manage all risks we encounter as we run

a profitable bank

a profitable bank

•Strive to grow our revenues 2X create than expenses

•Maintain strong capital levels

8

Disciplined Model for Increasing Shareholder Value

§ Strong organic revenue growth + scalable infrastructure =

sustainable double digit EPS growth

sustainable double digit EPS growth

§ A clear and simple risk management driven business strategy

§ Build tangible book value per share each quarter via earnings

§ Any book value dilution from any acquisitions must be overcome

within 1-2 years

within 1-2 years

§ Superior execution through proven management team

Disciplined Model for Superior Shareholder Value Creation

9

Banking Strategy

Consumer Banking Strategy

• Principal focus is getting deposits in a highly efficient and

unique model

unique model

• Introduce Bank Mobile and Prepaid business for Gen Y

and under-banked; strategic partnerships for credit

services

and under-banked; strategic partnerships for credit

services

Business Banking Strategy

• Loan and deposit business through these segments:

• Banking Privately Held Businesses

• Banking High Net Worth Families

• Banking Mortgage Companies

10

Consumer Deposit Strategy - High Touch, High Tech

§ Organic deposit growth goals of 20%+ a year from consumers

§ Implementation of

technology suite

allows for unique

product offerings:

technology suite

allows for unique

product offerings:

§ Remote account

opening &

deposit capture

opening &

deposit capture

§ Internet/mobile

banking

banking

§ Free ATM

deployment in

U.S.

deployment in

U.S.

Cost of Funds + Branch Operating Expense - Fees = ALL-IN-Cost < Competitors

Goal: All-in cost less than competitors funding cost over the long-term

Technology

§ Low cost banking

model allows for

more pricing

flexibility

model allows for

more pricing

flexibility

§ Significantly lower

overhead costs vs. a

traditional branch

overhead costs vs. a

traditional branch

§ Pricing/profitability

measured across

relationship

measured across

relationship

Pricing

§ Experienced

bankers who own a

portfolio of

customers

bankers who own a

portfolio of

customers

§ Customer

acquisition &

retention strongly

incentivized

acquisition &

retention strongly

incentivized

§ Takes banker to the

customer’s home or

office, 12 hours a

day, 7 days a week

customer’s home or

office, 12 hours a

day, 7 days a week

§ Appointment

banking approach

banking approach

§ Customer access to

private bankers

private bankers

§ “Virtual Branches”

out of sales offices

out of sales offices

Sales Force

Concierge Banking

11

Deposits: Organic Growth With Controlled Costs

Total Deposit Growth ($mm)

Cost of Deposits

Customers strategies of single point of contact and recruiting known teams in target markets produce

rapid deposit growth with low total cost

rapid deposit growth with low total cost

12

Customers Bank Advantage

All Consumer

Products

Products

All Business

Products

Products

All Non-Credit

Products

Products

Client

Makes

One Call

Makes

One Call

Client

Private /

Personal

Bankers

Personal

Bankers

Concierge

Bankers

Bankers

Loan Portfolio Mix ($mm)

(1) Includes C&I and owner occupied CRE loans

(2) Includes Non-owner occupied CRE & Multi Family loans

(3) Includes Mortgage Warehouse loans & purchased

adjustable rate mortgage loans

adjustable rate mortgage loans

Single Point of Contact

High Touch / High Tech

§Creation of solid foundation for future

earnings

earnings

13

Business Banking Strategy

Small Business

§Target companies with less than $5.0 million

annual revenue

annual revenue

§Principally SBA loans originated by small

business relationship managers or branch

network

business relationship managers or branch

network

§Current focus PA & NJ markets

Private & Commercial

§Target companies with up to $100 million

annual revenues

annual revenues

§Very experienced teams

§Single point of contact

§NE, NY, PA & NJ markets

Banking Privately Held Business

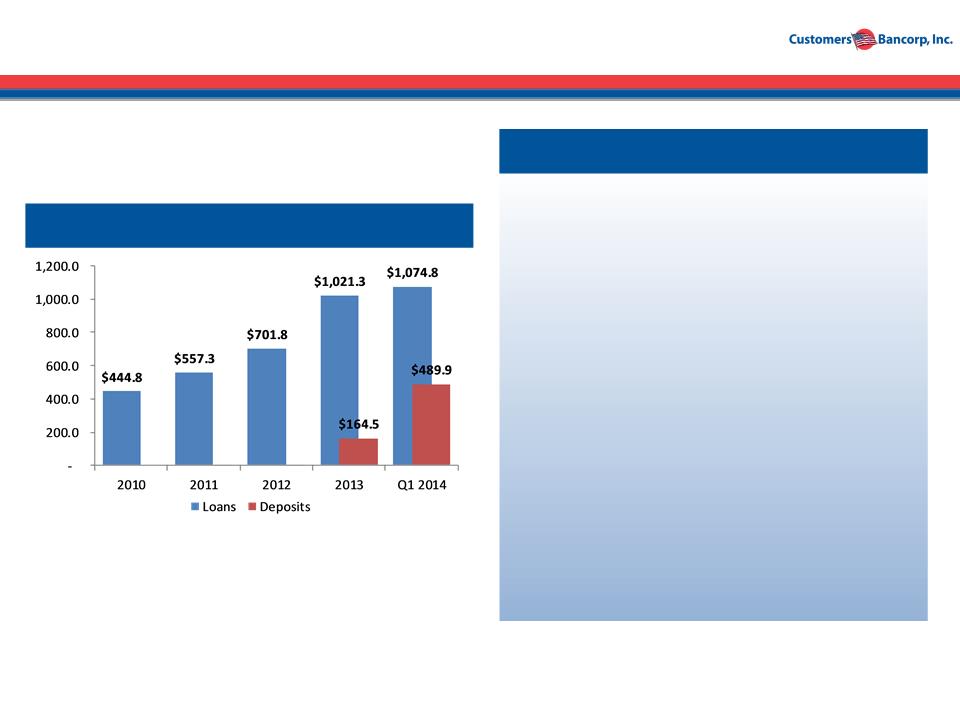

Loan and Deposit Growth ($B)

14

Business Banking Strategy

Banking High Net Worth Families

Loan and Deposit Growth ($mm)

§ Focus on families that have income

producing real estate in their portfolios

producing real estate in their portfolios

§ Private banking approach

§ Multi Family and non owner occupied

income CRE loan products

income CRE loan products

§ Focus Markets: New York & Philadelphia

MSAs

MSAs

§ Average Loan Size: $4.0 - $7.0 million

§ Remote banking for deposits and other

relationship based loans

relationship based loans

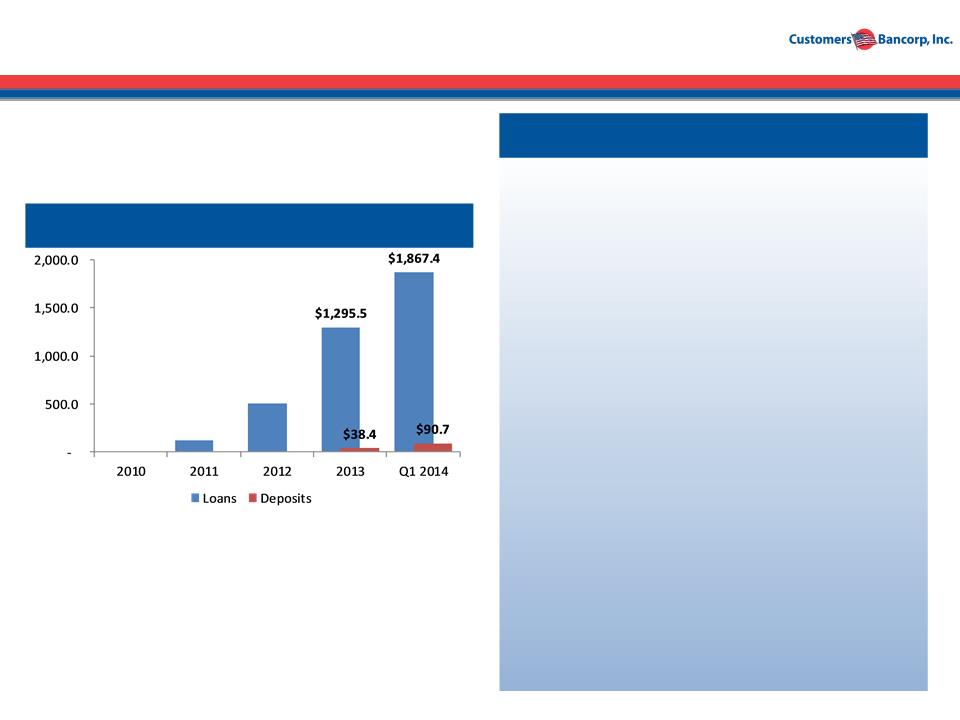

§ 342% compounded annual growth rate since

2011

2011

§ Portfolio grown organically from a start up

with very experienced teams hired in the

past 3 years

with very experienced teams hired in the

past 3 years

§ Strong credit quality niche

§ Interest rate risk managed actively

15

Business Banking Strategy

§Private banking focused on mortgage

companies with $5 to $10 million equity

companies with $5 to $10 million equity

§Lower interest rate and credit risk line of

business

business

§~75 strong warehouse clients

§All warehouse loans classified as held for

sale

sale

§All deposits are non-interest bearing DDA’s

§Balances not expected to be materially

higher in 2014

higher in 2014

§Loan balances below 2011 levels but fees

and deposits remain strong

and deposits remain strong

§Selected lending against servicing portfolios

introduced in 2014

introduced in 2014

§Opportunistic purchases of variable rate

mortgage loans

mortgage loans

Banking Mortgage Companies

Loan and Deposit Growth ($B)

Annual Fee Income ($mm)

16

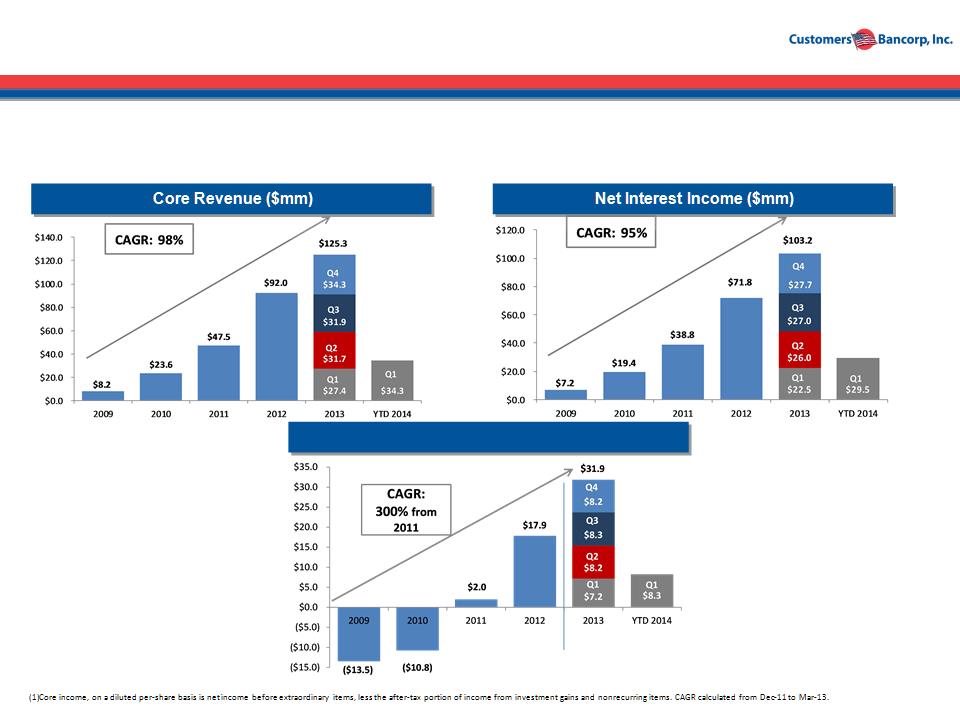

These Deposit and Lending Strategies Results in Disciplined & Profitable Growth

Core Net Income (1)

Source: SNL Financial and Company data.

• Strategy execution has produced superior growth in revenues and earnings

17

Strong Growth Provides for Shareholder Value Creation

§ Per share tangible book value up 31% since December 2010

§ Focused on continuous growth of TBV aligns executive management compensation with

shareholder value creation

shareholder value creation

§ Any tangible book value dilution from acquisition must be recovered within 1 to 2 years

Tangible Book Value Growth

18

Highly Experienced Management Team

|

Name

|

Title

|

Years of Banking

Experience |

Background

|

|

Jay S. Sidhu

|

Chairman & CEO

|

35

|

Chairman and CEO of Sovereign Bank & Sovereign Bancorp, Inc.

|

|

Richard A. Ehst

|

President & COO

|

44

|

EVP, Commercial Middle Market, Regional President (Berks County) and Managing

Director of Corporate Communications at Sovereign Bank |

|

Robert E. Wahlman,

CPA |

Chief Financial Officer

|

32

|

CFO of Doral Financial and Merrill Lynch Banks; various roles at Bank One, US GAO

and KPMG. |

|

Steve Issa

|

EVP, New England Market President,

Regional Chief Lending Officer |

36

|

EVP, Managing Director of Commercial and Specialty Lending at Flagstar and

Sovereign Bank. |

|

George Maroulis

|

EVP, Head of Private & Commercial

Banking - NY |

21

|

Group Director and SVP at Signature Bank; various positions at Citibank and

Fleet/Bank of America's Global Commercial & Investment Bank |

|

Timothy D. Romig

|

EVP, Regional Chief Lending Officer

|

30

|

SVP and Regional Executive for Commercial Lending (Berks and Montgomery

County), VIST Financial; SVP at Keystone |

|

Ken Keiser

|

EVP, Director CRE and Multi-Family

Housing Lending |

35

|

SVP and Market Manager, Mid-Atlantic CRE Lending at Sovereign Bank; SVP &

Senior Real Estate Officer, Allfirst Bank |

|

Glenn Hedde

|

EVP, President Banking for Mortgage

Companies |

24

|

President of Commercial Operations at Popular Warehouse Lending, LLC; various

positions at GE Capital Mortgage Services and PNC Bank |

|

Warren Taylor

|

EVP, President Community Banking

|

34

|

Division President at Sovereign Bank, responsible for retail banking in various

markets in southeastern PA and central and southern NJ |

|

James Collins

|

EVP, Chief Administrative Officer

|

20

|

Various positions at Sovereign including Director of Small Business Banking

|

|

Thomas Jastrem

|

EVP, Chief Credit Officer

|

33

|

Various positions at First Union Bank and First Fidelity Bank

|

|

Robert B. White

|

EVP, President Special Assets Group

|

24

|

President RBW Financial Consulting; various positions at Citizens Bank and GE

Capital |

|

Glenn Yeager

|

EVP, General Counsel

|

34

|

Private practice financial services law firm. Senior Counsel Meridian Bancorp, Inc.

|

|

Mary Lou Scalese

|

SVP, Chief Risk Officer

|

35

|

Chief Auditor at Sovereign Bank

|

19

Key Financial Targets for the Next 3-5 Years

Focus in future years

•Single point of contact model - “High touch supported by high tech”

•Only superior credit quality niches

•Above average organic growth

•Expense management

Earnings per share growth estimated at ~ 17% year over year

•Assumes no additional common shares are issued during 2014 or 2015

Expecting banking for mortgage companies balances to remain flat and

continue to shrink as a percentage of total assets

continue to shrink as a percentage of total assets

Strategically aligned technology partners

•Core Banking Platform - Fiserv

•Mobile Banking Platform - Malauzai

Unique branch model

•24 hours concierge bankers

•All-In-Cost (interest expense + operating cost)

•Alternative channels emerging in our model

•Use of technology to reduce branch traffic

•Bank Mobile & prepaid cards

Criteria 3 -5 Year Targets

Year EPS Expectations

*Efficiency ratio = non-interest expenses/(net interest income + non-interest

income - securities gains)

income - securities gains)

20

21

Mobile Banking - Creating a Virtual Bank for the Future

§ New banking vertical supplementing Consumer and Community Banking

§ Marketing Strategy

§ Target technology dependent <35 years old and larger depositors >50 years

old segments

old segments

§ Reach markets through Affinity Banking Groups

§ Revenue generation from debit card interchange and margin from low cost

core deposits

core deposits

§ Total investment not to exceed $5.0 million by end of 2015 but expected to be

offset by revenues

offset by revenues

§ Expected to achieve above average ROA and ROE within 5 years

22

Summary

§ Strong high performing ~$5.0 billion bank with significant growth opportunities

§ “High touch, high tech” processes and technologies result in superior growth,

returns and efficiencies

returns and efficiencies

§ Shareholder value results from the combination of increasing tangible book

value with strong and consistent earnings growth

value with strong and consistent earnings growth

§ Attractive risk-reward: growing several times faster than industry average but

yet trading at a significant discount to peers

yet trading at a significant discount to peers

§ Experienced management team delivers with strong results

§ Ranked #1 overall by Bank Director Magazine in the 2012 and 2013 Growth

Leader Rankings

Leader Rankings

§ Introducing among the 1st mobile banking application for account opening and

complete mobile platform based servicing in the USA

complete mobile platform based servicing in the USA

23

Peer Group Comparison

High Performance Regional Peers

Source: SNL Financial, Company documents. Market data as of 12/31/13. Consists of Northeast and Mid-Atlantic banks and thrifts with assets between $2.0 billion and $6.0 billion and most recent quarter core ROAA greater

than 75bps. Excludes merger targets and MHCs.

than 75bps. Excludes merger targets and MHCs.

(1)Customers Bancorp NPAs/Assets calculated as non-covered NPAs divided by total assets. Non-covered NPAs excludes accruing TDRs and loans 90+ days past due and still accruing.

24

Contacts

Company

Robert Wahlman, CFO

Tel: 610-743-8074

rwahlman@customersbank.com

rwahlman@customersbank.com

www.customersbank.com

Investor Relations

Ted Haberfield

President, MZ North America

Tel: 760-755-2716

thaberfield@mzgroup.us

www.mzgroup.us

Appendix

26

Balance Sheet

27

Income Statement

28

Net Interest Margin

29

Asset Quality