Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PANTRY INC | a03272014-form8xk.htm |

| EX-99.1 - PRESS RELEASE - PANTRY INC | a03272014-pressrelease.htm |

The Pantry, Inc. Fiscal Year 2014 Second Quarter Earnings Call Thursday, May 1, 2014 Exhibit 99.2

Slide 2 Safe Harbor Statement Some of the statements in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than those of historical facts included herein, including those related to the company’s financial outlook, goals, business strategy, projected plans and objectives of management for future operations and liquidity, are forward-looking statements. These forward-looking statements are based on the company’s plans and expectations and involve a number of risks and uncertainties that could cause actual results to vary materially from the results and events anticipated or implied by such forward-looking statements. Please refer to the company’s Annual Report on Form 10-K and its other filings with the SEC for a discussion of significant risk factors applicable to the company. In addition, the forward-looking statements included in this presentation are based on the company’s estimates and plans as of the date of this presentation. While the company may elect to update these forward-looking statements at some point in the future, it specifically disclaims any obligation to do so. In this presentation, we will refer to certain non-GAAP financial measures that we believe are helpful in understanding our financial performance. A reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure is included in the appendix of this presentation.

Second Quarter Business Overview and FY14 Outlook Performance summary Merchandise trends Merchandising and brand awareness Fuel trends Focus On Managing Costs And Improving Productivity Store upgrades/Quick Service Restaurants (“QSRs”)/New stores FY14 priorities Slide 3

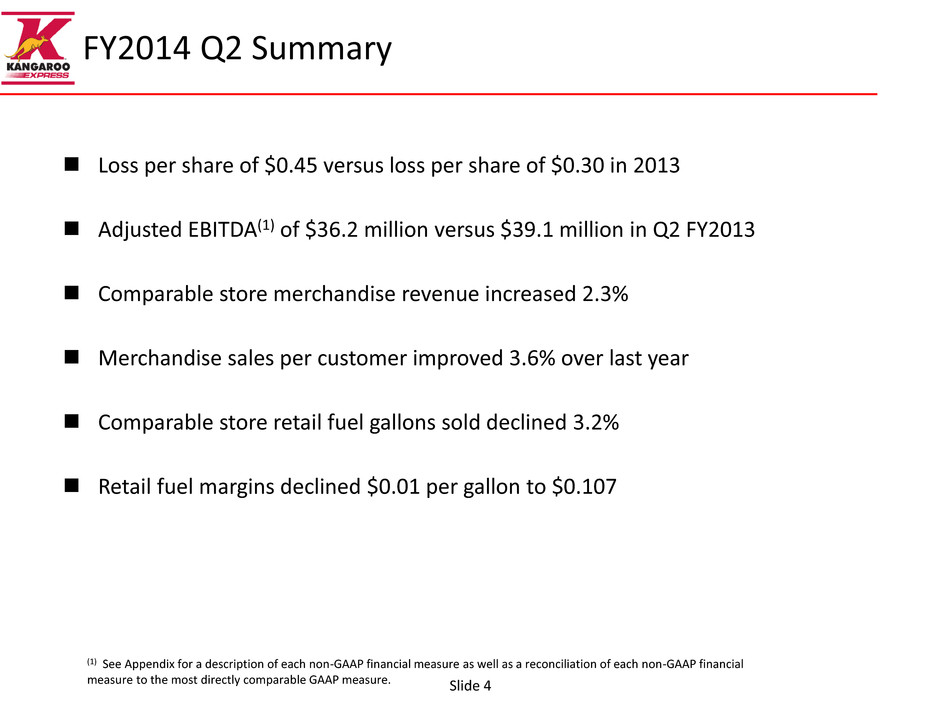

FY2014 Q2 Summary Loss per share of $0.45 versus loss per share of $0.30 in 2013 Adjusted EBITDA(1) of $36.2 million versus $39.1 million in Q2 FY2013 Comparable store merchandise revenue increased 2.3% Merchandise sales per customer improved 3.6% over last year Comparable store retail fuel gallons sold declined 3.2% Retail fuel margins declined $0.01 per gallon to $0.107 (1) See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. Slide 4

Merchandise Trends Slide 5 Q1 Q2 Q3 Q4 Q1 Q2 Cigarettes -2.8% -6.4% -3.3% -2.0% -0.7% -2.9% Other Packaged Goods 4.3% 0.2% 3.0% 3.8% 5.5% 4.2% Packaged Goods 1.6% -2.3% 0.7% 1.8% 3.3% 1.6% Proprietary Foodservice 8.6% 3.3% 6.9% 3.3% 6.5% 7.8% QSR -1.9% -5.9% -2.4% -0.7% 4.1% 5.8% Foodservice 4.2% -0.7% 3.0% 1.7% 5.6% 7.0% Services 12.0% 0.7% 9.2% 9.7% 2.1% 3.2% Total Comparable Store Merchandise Revenue 2.2% -2.0% 1.3% 2.0% 3.5% 2.3% Total Excluding Cigarettes 4.6% 0.1% 3.3% 3.7% 5.4% 4.5% Sales Comps FY14FY13

Merchandising and Brand Awareness Improving our price position on cigarettes ̶ Traffic driver ̶ Attachment sales Continue developing E-Cig opportunity Beverage merchandising improvements – Single-serve alcoholic beverages – “Alternative” beverages – Single-serve refrigerated beverages at sales counter (maximize impulse sales) – Promotional activity Proprietary Foods – Continued growth in the grill category – Increasing percent of merchandise sales – RooMug promotion transitioning to RooCup Social media and mobile applications building customer engagement Slide 6

Fuel Trends Slide 7 FY14 fuel comp performance improving vs FY13 ̶ YTD FY14 @ -3.6%; FY13 -4.8% ̶ Targeting ongoing improvement Second quarter FY14 CPG 1.0 cents below last year FY13 = 11.5 cpg CPG Fuel Gallon Comp FY13 = -4.8% YTD FY14 = 11.3 cpg YTD FY14 = -3.6%

Focus On Managing Costs And Improving Productivity Slide 8 Store level productivity initiatives Improved employee training and development – Customer service – Sales growth (e.g. foodservice, in-stock performance, etc.) G&A cost control Evaluate remodeled stores during Spring/Summer ̶ Optimize performance of completed remodels ̶ Minimize disruption during high-traffic period ̶ Refine approach to future investments (capital and expense)

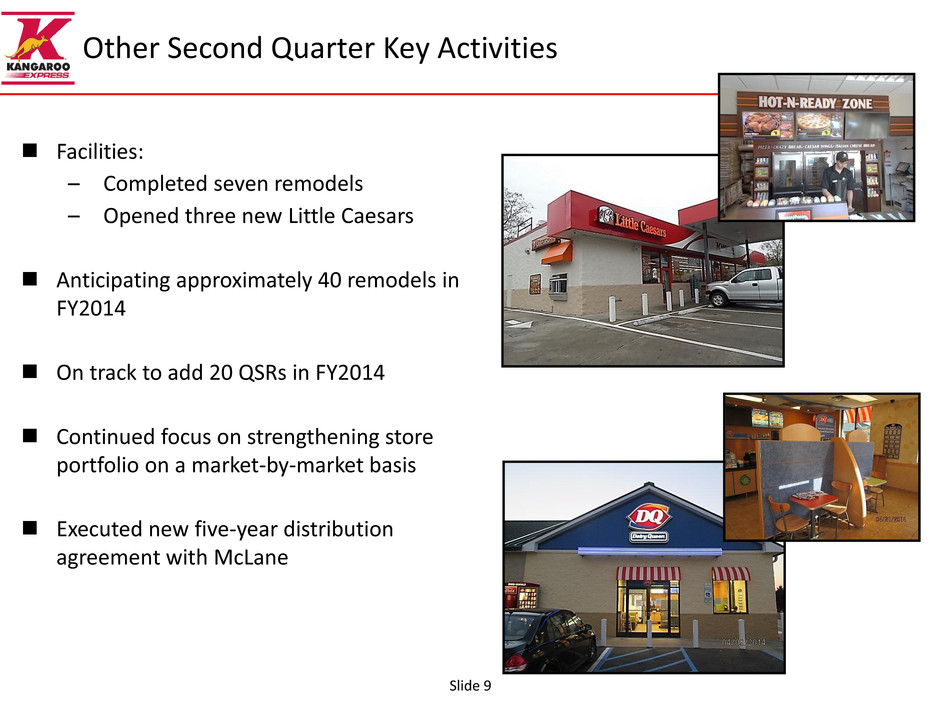

Other Second Quarter Key Activities Facilities: – Completed seven remodels – Opened three new Little Caesars Anticipating approximately 40 remodels in FY2014 On track to add 20 QSRs in FY2014 Continued focus on strengthening store portfolio on a market-by-market basis Executed new five-year distribution agreement with McLane Slide 9

New Store Development Slide 10 Four new stores opened in calendar 2013 performing well Focusing investments in high- potential markets Developing pipeline of high quality sites to support accelerated new store growth

FY14 Priorities Slide 11 Hire, train and develop the best and most energized people Continue implementation of local merchandising programs throughout our store portfolio Optimize remodels Expand food service ̶ Accelerate QSR rollout ̶ Enhance proprietary food service offering Balance fuel profitability and volumes Improve productivity and control costs Continue market-by-market analysis and new store site identification to support future growth

First Quarter Financial Review Slide 12 Financial Summary Financial Details Capital Expenditures Store Count Capital Structure And Liquidity Fiscal 2014 Outlook

Second Quarter Financial Summary ($ millions except per share data) Slide 13 (1) Includes impairment charges of $0.9 million and $0.9 million in 2013 and 2014, respectively. (2) See Appendix for a description of each non-GAAP financial measure as well as a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP measure. (1) (2) 2013 2014 Percent Change Total revenues $ 1,892.2 $ 1,767.2 -6.6% Total costs and operating expenses (1) 1,883.5 1,760.9 -6.5% Income from operations $ 8.7 $ 6.3 -27.6% Interest expense 22.2 21.3 -4.1% Loss before income taxes $ (13.5) $ (15.0) -11.1% Income tax benefit (6.6) (4.7) 28.8% Net Loss $ (6.9) $ (10.3) -49.3% Loss per share $ (0.30) $ (0.45) -50.0% Adjusted EBITDA $ 39.1 36.2$ -7.4% Second Quarter

2013 2014 Percent Change Merchandise revenue $ 418.9 $ 426.1 1.7% Fuel revenue 1,473.3 1,341.1 -9.0% Total revenues $ 1,892.2 $ 1,767.2 -6.6% Merchandise cost of goods sold $ 277.8 $ 281.3 1.3% Fuel cost of goods sold 1,424.8 1,298.6 -8.9% Store operating 125.3 125.5 0.2% General and administrative 25.2 25.7 2.0% Impairment charges 0.9 0.9 0.0% Depreciation and amortization 29.5 28.9 -2.0% Income from operations $ 8.7 $ 6.3 -27.6% Selected financial data: Comparable store merchandise sales % -2.0% 2.3% Weighted-average store count 1,571 1,537 Merchandise margin 33.7% 34.0% Comparable store retail fuel gallons % -7.9% -3.2% Retail fuel margin per gallon $ 0.117 $ 0.107 Second Quarter Second Quarter Financial Details ($ millions) Slide 14

Q2 YTD Q2 YTD Q2 YTD Capital expenditures 17.1$ 37.6$ 23.1$ 54.9$ 6.0$ 17.3$ Proceeds from asset dispositions (0.1) (2.3) (0.6) (2.7) (0.5)$ (0.4)$ Capital expenditures, net 17.0$ 35.3$ 22.5$ 52.2$ 5.5$ 16.9$ 2013 2014 Change FY2014 Capital Expenditures ($ millions) Slide 15

Store Count Summary Slide 16 Ending Stores - FY2013 1,548 New 1 Closed (11) Ending Stores - Q1 FY2014 1,538 Closed (4) Ending Stores - Q2 FY2014 1,534

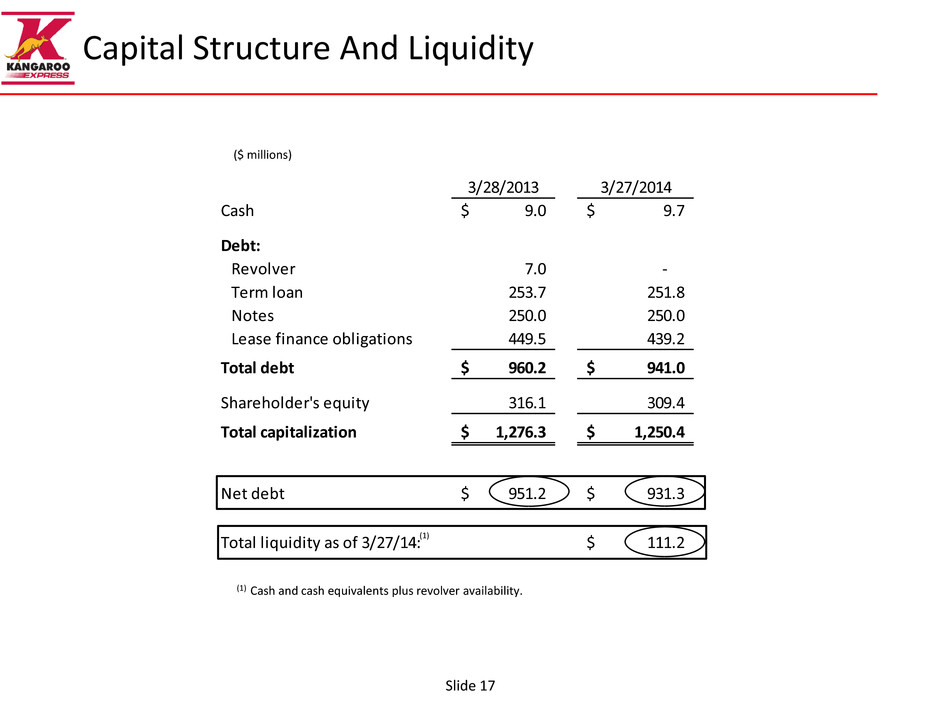

3/28/2013 3/27/2014 Cash 9.0$ 9.7$ Debt: Revolver 7.0 - Term loan 253.7 251.8 Notes 250.0 250.0 Lease finance obligations 449.5 439.2 Total debt 960.2$ 941.0$ Shareholder's equity 316.1 309.4 Total capitalization 1,276.3$ 1,250.4$ Net debt 951.2$ 931.3$ Total liquidity as of 3/27/14: 111.2$ Capital Structure And Liquidity ($ millions) Slide 17 (1) Cash and cash equivalents plus revolver availability. (1)

Fiscal 2014 Outlook Slide 18 (1) Fiscal 2014 guidance assumes closure of approximately 30 stores. Q3 FY13 Q3 FY14 Guidance (1) FY13 FY14 Guidance (1) Actual Low High Actual Low High Merchandise sales ($B) $0.477 $0.480 $0.490 $1.80 $1.82 $1.85 Merchandise gross margin 33.8% 34.0% 34.5% 34.0% 33.8% 34.2% Retail fuel gallons (B) 0.432 0.412 0.422 1.71 1.63 1.66 Retail fuel margin per gallon $0.123 $0.100 $0.130 $0.115 $0.105 $0.125 Store operating and general and administrative expenses ($M) $149 $155 $158 $609 $614 $624 Depreciation & amortization ($M) $29 $28 $29 $118 $112 $117 Effective corporate tax rate 54.9% 33.0% 35.0% 65.8% 32.0% 34.0% Interest expense ($M) $22 $21 $22 $89 $83 $85 Capital expenditures, net ($M) $20 $23 $26 $85 $90 $100

Slide 19

Appendix Slide 20 Selected financial data Use of Non-GAAP measures

Selected Financial Data Slide 21 (1) Fuel margin per gallon represents fuel revenue less cost of product and expenses associated with credit card processing fees and repairs and maintenance on fuel equipment. Fuel margin per gallon as presented may not be comparable to similarly titled measures reported by other companies. ($ thousands, except per gallon) Three Months Ended Six Months Ended March 27, 2014 March 28, 2013 March 27, 2014 March 28, 2013 Revenues: Merchandise $ 426,082 $ 418,949 $ 866,862 $ 847,797 Fuel 1,341,119 1,473,268 2,704,418 2,959,627 Total revenues 1,767,201 1,892,217 3,571,280 3,807,424 Costs and operating expenses: Merchandise cost of goods sold 281,323 277,803 574,324 559,758 Fuel cost of goods sold 1,298,569 1,424,829 2,613,186 2,862,020 Store operating 125,463 125,257 253,532 248,533 General and administrative 25,678 25,215 51,655 49,101 Impairment charges 907 880 1,736 3,179 Depreciation and amortization 28,956 29,538 57,635 58,124 Total costs and operating expenses 1,760,896 1,883,522 3,552,068 3,780,715 Income from operations 6,305 8,695 19,212 26,709 Other expenses: Interest expense 21,311 22,158 42,683 45,259 Total other expenses 21,311 22,158 42,683 45,259 Loss before income taxes (15,006 ) (13,463 ) (23,471 ) (18,550 ) Income tax benefit (4,698 ) (6,598 ) (8,019 ) (8,628 ) Net loss $ (10,308 ) $ (6,865 ) $ (15,452 ) $ (9,922 ) Loss per diluted share: Loss per diluted share $ (0.45 ) $ (0.30 ) $ (0.68 ) $ (0.44 ) Weighted average and potential dilutive shares outstanding 22,859 22,666 22,825 22,641 Selected financial data: Adjusted EBITDA $ 36,168 $ 39,113 $ 78,583 $ 88,012 Payments made for lease finance obligations $ 13,142 $ 12,754 $ 26,478 $ 25,642 Merchandise gross profit $ 144,759 $ 141,146 $ 292,538 $ 288,039 Merchandise margin 34.0 % 33.7 % 33.7 % 34.0 % Retail fuel data: Gallons 393,483 407,923 802,146 834,947 Margin per gallon (1) $ 0.107 $ 0.117 $ 0.113 $ 0.116 Retail price per gallon $ 3.35 $ 3.55 $ 3.32 $ 3.48 Total fuel gross profit $ 42,550 $ 48,439 $ 91,232 $ 97,607

Use of Non-GAAP Measures Adjusted EBITDA Adjusted EBITDA is defined by the Company as net income (loss) before interest expense, gain/loss on extinguishment of debt, income taxes, impairment charges and depreciation and amortization. Adjusted EBITDA is not a measure of operating performance or liquidity under generally accepted accounting principles in the United States of America (“GAAP”) and should not be considered as a substitute for net income, cash flows from operating activities or other income or cash flow statement data. The Company has included information concerning Adjusted EBITDA because it believes investors find this information useful as a reflection of the resources available for strategic opportunities including, among others, to invest in the Company’s business, make strategic acquisitions and to service debt. Management also uses Adjusted EBITDA to review the performance of the Company's business directly resulting from its retail operations and for budgeting and compensation targets. Adjusted EBITDA does not include impairment of long-lived assets and other charges. The Company excluded the effect of impairment losses because it believes that including them in Adjusted EBITDA is not consistent with reflecting the ongoing performance of its remaining assets. Adjusted EBITDA does not include gain/loss on extinguishment of debt because it represents financing activities and is not indicative of the ongoing performance of the Company’s remaining stores. Slide 22

Additional Information Regarding Non-GAAP Measures Any measure that excludes interest expense, gain/loss on extinguishment of debt, depreciation and amortization, impairment charges, or income taxes has material limitations because the Company uses debt and lease financing in order to finance its operations and acquisitions, uses capital and intangible assets in its business and must pay income taxes as a necessary element of its operations. Due to these limitations, the Company uses non-GAAP measures in addition to and in conjunction with results and cash flows presented in accordance with GAAP. The Company strongly encourages investors to review its consolidated financial statements and publicly filed reports in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, the measures referenced above, each as defined by the Company, may not be comparable to similarly titled measures reported by other companies. It therefore may not be possible to compare the Company's use of these measures with non-GAAP financial measures having the same or similar names used by other companies. Slide 23

Adjusted EBITDA Slide 24 ($ thousands) Three Months Ended Six Months Ended March 27, 2014 March 28, 2013 March 27, 2014 March 28, 2013 Adjusted EBITDA $ 36,168 $ 39,113 $ 78,583 $ 88,012 Impairment charges (907 ) (880 ) (1,736 ) (3,179 ) Interest expense (21,311 ) (22,158 ) (42,683 ) (45,259 ) Depreciation and amortization (28,956 ) (29,538 ) (57,635 ) (58,124 ) Income tax benefit 4,698 6,598 8,019 8,628 Net loss $ (10,308 ) $ (6,865 ) $ (15,452 ) $ (9,922 ) Adjusted EBITDA $ 36,168 $ 39,113 $ 78,583 $ 88,012 Interest expense (21,311 ) (22,158 ) (42,683 ) (45,259 ) Income tax benefit 4,698 6,598 8,019 8,628 Stock-based compensation expense 805 873 1,729 1,725 Changes in operating assets and liabilities (13,978 ) (20,199 ) (27,054 ) (31,207 ) Benefit for deferred income taxes (4,778 ) (6,475 ) (7,761 ) (8,477 ) Other 1,320 1,424 2,724 2,773 Net cash provided (used) by operating activities $ 2,924 $ (824 ) $ 13,557 $ 16,195 Additions to property and equipment, net $ (22,480 ) $ (16,988 ) $ (52,225 ) $ (35,358 ) Acquisitions of businesses, net — (502 ) — (502 ) Net cash used in investing activities $ (22,480 ) $ (17,490 ) $ (52,225 ) $ (35,860 ) Net cash provided (used) in financing activities $ (3,256 ) $ 2,940 $ (8,806 ) $ (60,519 ) Net decrease in cash $ (22,812 ) $ (15,374 ) $ (47,474 ) $ (80,184 )