Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Radius Health, Inc. | a14-11420_18k.htm |

| EX-99.2 - EX-99.2 - Radius Health, Inc. | a14-11420_1ex99d2.htm |

| EX-10.1 - EX-10.1 - Radius Health, Inc. | a14-11420_1ex10d1.htm |

Exhibit 99.1

BUSINESS

OVERVIEW

We are a science-driven biopharmaceutical company focused on developing novel differentiated therapeutics for patients with osteoporosis as well as other serious endocrine-mediated diseases. Our lead product candidate is abaloparatide (BA058), a bone anabolic for the treatment of osteoporosis delivered via subcutaneous injection, which we refer to as Abaloparatide-SC. We are currently in Phase 3 development of Abaloparatide-SC and expect to announce top-line data from this study in late 2014. If the results are positive, we plan to submit a new drug application, or NDA, in the United States, and a marketing authorization application, or MAA, in Europe, in mid-2015. We hold worldwide commercialization rights to Abaloparatide-SC, other than in Japan, and with a favorable regulatory outcome, we anticipate our first commercial sales of Abaloparatide-SC will take place in 2016. We are leveraging our investment in Abaloparatide-SC to develop Abaloparatide-TD. We expect this line extension will provide improved patient convenience by enabling administration of abaloparatide through a short-wear-time transdermal patch. We have recently completed a successful Phase 2 proof of concept study.

Our current clinical product portfolio also includes a novel oral agent, RAD1901, a selective estrogen receptor down-regulator/degrader, or SERD. We are developing RAD1901 at higher doses for the treatment of breast cancer brain metastases, or BCBM, and at lower doses as a selective estrogen-receptor modulator, or SERM, for the treatment of vasomotor symptoms such as hot flashes. In 2014, we expect to commence a Phase 1 clinical trial to evaluate RAD1901 for the treatment of BCBM, and we previously completed a successful Phase 2 clinical trial of RAD1901 for the treatment of vasomotor symptoms.

Abaloparatide

Abaloparatide is a novel synthetic peptide analog of parathyroid hormone-related protein, or PTHrP, that we are developing as a bone anabolic treatment for osteoporosis. Osteoporosis is a disease that affects nearly 10 million people in the United States, with an additional approximately 43 million people at increased risk for the disease. It is characterized by low bone mass and structural deterioration of bone tissue, which leads to greater fragility and an increase in fracture risk. Anabolic agents, like Forteo (teriparatide), are used to increase bone mineral density, or BMD, and to reduce the risk of fracture. We believe abaloparatide has the potential to increase BMD and bone quality to a greater degree and at a faster rate than other approved drugs for the treatment of osteoporosis. We are developing two formulations of abaloparatide:

· Abaloparatide-SC is an injectable subcutaneous formulation of abaloparatide. In August 2009, we announced positive Phase 2 data that showed Abaloparatide-SC produced faster and greater BMD increases at the spine and the hip with substantially less hypercalcemia than Forteo (teriparatide), which is the only approved subcutaneous injectable anabolic agent for the treatment of osteoporosis in the United States. A subsequent Phase 2 clinical

trial announced in January 2014 also confirmed the results of our first clinical trial by demonstrating that Abaloparatide-SC produces BMD increases from baseline in the spine and hip that are comparable to our earlier Phase 2 trial. In April 2011, we commenced a Phase 3 clinical trial of Abaloparatide-SC. Enrollment was completed in March 2013, and we expect to announce top-line data at the end of the fourth quarter of 2014. Assuming a favorable outcome, we plan to use the results from this Phase 3 clinical trial to support a new drug application, or NDA, with the U.S. Food and Drug Administration, or FDA, and believe we could obtain approval of the NDA in 2016.

· Abaloparatide-TD is a line extension of Abaloparatide SC in the form of a convenient, short-wear-time (approximately five minutes) transdermal patch. In a recent Phase 2 clinical trial, Abaloparatide-TD demonstrated a statistically significant mean percent increase from baseline in BMD as compared to placebo at the lumbar spine and at the hip. These results demonstrated a clear proof of concept by achieving a dose dependent increase in BMD. Following additional formulation development work, we intend to advance an optimized Abaloparatide-TD product in additional clinical studies and to a Phase 3 bridging study and to subsequently submit for approval. We hold worldwide commercialization rights to Abaloparatide-TD technology.

RAD1901

RAD1901 is a SERD that we believe crosses the blood-brain barrier and that we are evaluating for the treatment of BCBM. RAD1901 has been shown to bind with good selectivity to the estrogen receptor and to have both estrogen-like and estrogen-antagonistic effects in different tissues. In many cancers, hormones, like estrogen, stimulate tumor growth and a desired therapeutic goal is to block this estrogen-dependent growth while inducing apoptosis of the cancer cells. SERDs are an emerging class of endocrine therapies that directly induce estrogen-receptor, or ER, degradation, enabling them to remove the estrogen growth signal in ER-dependent tumors without allowing ligand-independent resistance to develop. There is currently only one SERD, Faslodex (fulvestrant), approved for the treatment of hormone-receptor positive metastatic breast cancer; however, for patients with brain metastases (BCBM), there are no approved targeted therapies that cross the blood-brain barrier. We believe there is a significant opportunity for RAD1901 to be the first ER-targeted therapy that crosses the blood-brain barrier to more effectively treat ER-positive BCBM and potentially reduce both intracranial and extracranial BCBM tumors. We intend to commence a Phase 1 clinical trial in 2014 to evaluate high-dose RAD1901 for the treatment of BCBM. In March 2014, we submitted to the FDA an application for orphan medicinal product designation of RAD1901 for the treatment of BCBM.

We are also developing RAD1901 at lower doses as a selective estrogen receptor modulator, or SERM, for the treatment of vasomotor symptoms. Historically, hormone replacement therapy, or HRT, with estrogen or progesterone was considered the most efficacious approach to relieving menopausal symptoms such as hot flashes. However, because of the concerns about the potential long-term risks and contraindications associated with HRT, we believe a significant need exists

for new therapeutic treatment options to treat vasomotor symptoms. In a Phase 2 proof of concept study, RAD1901 at lower doses demonstrated a reduction in the frequency and severity of moderate and severe hot flashes. We believe RAD1901 is an attractive candidate for advancement into Phase 2b development as a treatment for vasomotor symptoms.

Additional information regarding our clinical trials, their designs and the results of previously completed clinical trials is contained in or incorporated by reference into our public filings with the Securities and Exchange Commission. The U.S. National Institutes of Health also provides a database of human clinical trials, that includes our Phase 2 or later clinical trials, which can be found at www.clinicaltrials.gov. The information contained in, or that can be accessed through, this website is not part of, and is not incorporated into, this filing and should not be considered part of this filing.

OUR OPPORTUNITY

Osteoporosis

Osteoporosis is a disease characterized by low bone mass and structural deterioration of bone tissue, which leads to greater fragility and an increase in fracture risk. All bones become more fragile and susceptible to fracture as the disease progresses. People tend to be unaware that their bones are getting weaker, and a person with osteoporosis can fracture a bone from even a minor fall. The debilitating effects of osteoporosis have substantial costs. Loss of mobility, admission to nursing homes and dependence on caregivers are all common consequences of osteoporosis. The prevalence of osteoporosis is growing and, according to the National Osteoporosis Foundation, or NOF, is significantly under-recognized and under-treated in the population. While the aging of the population is a primary driver of an increase in cases, osteoporosis is also increasing from the use of drugs that induce bone loss, such as chronic use of glucocorticoids and aromatase inhibitors that are increasingly used for breast cancer and the hormone therapies used for prostate cancer.

The NOF has estimated that 10 million people in the United States, composed of eight million women and two million men, already have osteoporosis, and another approximately 43 million have low bone mass placing them at increased risk for osteoporosis. In addition, the NOF has estimated that osteoporosis is responsible for more than two million fractures in the United States each year resulting in an estimated $19 billion in costs annually. The NOF expects that the number of fractures in the United States due to osteoporosis will rise to three million by 2025, resulting in an estimated $25.3 billion in costs each year. Worldwide, osteoporosis affects an estimated 200 million women according to the International Osteoporosis Foundation, or IOF, and causes more than 8.9 million fractures annually, which is equivalent to an osteoporotic fracture occurring approximately every three seconds. The IOF has estimated that 1.6 million hip fractures occur worldwide each year, and by 2050 this number could reach between 4.5 million

and 6.3 million. The IOF estimates that in Europe alone, the annual cost of osteoporotic fractures could surpass €76 billion by 2050.

There are two main types of osteoporosis drugs currently available in the United States, anti-resorptive agents and anabolic agents. Anti-resorptive agents act to prevent further bone loss by inhibiting the breakdown of bone, whereas anabolic agents stimulate bone formation to build new, high-quality bone. According to industry sources, sales of these drugs in the United States, Japan and the five major markets in Europe exceeded $6 billion in 2011. We believe there is a large unmet need in the market for osteoporosis treatment because existing therapies have shortcomings in efficacy, tolerability and convenience. For example, one current standard of care, bisphosphonates, an anti-resorptive agent, has been associated with infrequent but serious adverse events, such as osteonecrosis of the jaw and atypical fractures, especially of long bones. These side effects, although uncommon, have created increasing concern with physicians and patients. Many physicians are seeking alternatives to bisphosphonates. The two primary alternatives to bisphosphonates that are approved for the treatment of osteoporosis, Lilly’s Forteo and Amgen’s Prolia, had reported sales of approximately $1.2 billion and $700 million, respectively, in 2013. Forteo, a 34 amino acid recombinant peptide of human parathyroid hormone, is the only anabolic drug approved in the United States for the treatment of osteoporosis. We believe there is a significant opportunity for an anabolic agent that is able to increase BMD to a greater degree and at a faster rate than other approved drugs for the treatment of osteoporosis with added advantages in convenience and safety.

Our Solution — Abaloparatide

Abaloparatide is a novel synthetic peptide analog of PTHrP that we are developing as a bone anabolic treatment for osteoporosis. PTHrP, unlike parathyroid hormone, is critical in the formation of the skeleton, is involved in the regulation of bone formation and is able to rebuild bone with low associated risk of inducing the presence of too much calcium in the blood, known as hypercalcemia, as a side effect. We believe that abaloparatide is the most advanced PTHrP analog in clinical development for the treatment of osteoporosis and that it can provide the following advantages over other current standard of care treatments for osteoporosis:

· improved efficacy — greater bone build at hip and spine;

· faster benefit for building bone;

· shorter treatment duration;

· less hypercalcemia;

· no additional safety risks; and

· no refrigeration required in use.

Abaloparatide-SC. In August 2009, we announced positive Phase 2 data that showed Abaloparatide-SC produced faster and greater BMD increases at the spine and the hip with substantially less hypercalcemia than Forteo, the only approved anabolic agent for the treatment

of osteoporosis in the United States. Specifically, our study demonstrated that total hip BMD showed a more than five-fold benefit of Abaloparatide-SC at a dose of 80µg over Forteo after 24 weeks. Abaloparatide-SC at 80µg increased mean lumbar spine BMD by 6.7% at 24 weeks, compared to 5.5% with Forteo, and by 12.9% at 48 weeks, compared to 8.6% with Forteo. A subsequent Phase 2 clinical trial announced in January 2014 also confirmed the results of the first clinical trial by demonstrating that Abaloparatide-SC produces increases in BMD from baseline in the spine and hip that are comparable to the earlier Phase 2 trial. In April 2011, we began dosing patients in a pivotal, multinational Phase 3 clinical trial designed to show that Abaloparatide-SC prevents new vertebral fracture compared to placebo. We completed enrollment in this Phase 3 clinical study in March 2013 and expect to report top-line 18-month fracture data at the end of the fourth quarter of 2014. If the data from this Phase 3 clinical trial are positive, we plan to submit the NDA and the MAA for Abaloparatide-SC in mid-2015. We expect commercial launch to follow in 2016 in the United States, if and when the FDA approves the NDA for Abaloparatide-SC, and in the EU if and when an MAA for Abaloparatide-SC is approved.

Abaloparatide-TD. Abaloparatide-TD is a convenient, short-wear-time transdermal patch formulation of abaloparatide with Phase 2 clinical results suggesting efficacy, safety and tolerability in the treatment of osteoporosis. In January 2014, we reported positive results from a Phase 2 clinical trial of Abaloparatide-TD which showed at each dose there was a statistically significant mean percent increase from baseline in BMD, as compared to placebo, at the lumbar spine. Additionally, at the 100 µg and 150 µg doses, there was a statistically significant mean percent increase from baseline in BMD, as compared to placebo, at the hip. In addition, there was a consistent dose effect observed with increasing doses of Abaloparatide-TD, with a statistically significant dosing trend seen for changes in both spine and total hip BMD. As a result, we believe that by offering an alternative to daily injections, Abaloparatide-TD, if approved, could further improve patient outcomes by increasing patient acceptance.

We currently plan to optimize Abaloparatide-TD to achieve efficacy comparable to that of Abaloparatide-SC. If Abaloparatide-SC is approved by the FDA, we believe that we will only need to conduct a single non-inferiority Phase 3 clinical trial comparing the change in lumbar spine BMD at 12 months for patients dosed with Abaloparatide-TD to patients dosed with Abaloparatide-SC to show that the effect of Abaloparatide-TD treatment is comparable to that of Abaloparatide-SC. If our clinical trials of Abaloparatide-SC and Abaloparatide-TD are successful, we expect to seek marketing approval of Abaloparatide-TD as a line extension of Abaloparatide-SC. The FDA approval of Abaloparatide-TD, and the timing of any such approval, is dependent upon the approval of Abaloparatide-SC.

Metastatic Breast Cancer

According to the World Health Organization, breast cancer is the second most common cancer in the world and the most prevalent cancer in women, accounting for 16% of all female cancers.

The major cause of death from breast cancer is metastases, most commonly to the bone, liver, lung and brain. About 5% of patients have distant metastases at the time of diagnoses, and these patients have a 5-year survival rate of only 24%, compared with a greater than 98% survival rate for patients with only local disease. Importantly, even patients without metastases at diagnosis are at risk for developing metastases over time.

Approximately, 70% of breast cancers express the estrogen receptor, or ER, and depend on estrogen signaling for growth and survival. There are three main classes of therapies for ER-positive tumors available: aromatase inhibitors, or AIs; SERMs; and SERDs. AIs, which block the generation of estrogen, and SERMs, which selectively inhibit an ER’s ability to bind estrogen, both block ER-dependent signaling but leave functional ERs present on breast cancer cells. For this reason, although these classes of drugs are effective as adjuvants for breast cancer, patients’ tumors often acquire resistance to them by developing the ability to signal through the ER in a ligand-independent manner. SERDs, in contrast, are an emerging class of endocrine therapies that directly induce ER degradation. Therefore, these agents should be able to treat ER-dependent tumors without allowing ligand-independent resistance to develop, and they should also be able to act on AI- and SERM-resistant ER-positive tumors. Symptomatic BCBM occur in 10% to 16% of patients with metastatic breast cancer and are associated with particularly high morbidity and mortality. Current standard of care involves a combination of whole-brain radiotherapy, surgery or stereotactic radiosurgery, depending on the clinical context. These treatments are often only marginally effective, and are themselves associated with significant morbidity and mortality.

There is currently only one SERD approved for the treatment of ER-positive metastatic breast cancer, but there are no approved targeted therapies that cross the blood-brain barrier and can treat patients with ER-positive BCBM. We believe a significant opportunity exists for a SERD that can cross the blood-brain barrier to more effectively treat ER-positive BCBM and potentially delay or eliminate the need for radiation or surgery.

Our Solution — RAD1901

We are developing RAD1901 as a high-dose SERD in an oral formulation in Phase 1 clinical development for the treatment of BCBM. RAD1901 has been shown to bind with good selectivity to the estrogen hormone receptor and to have both estrogen-like and estrogen-antagonist effects in different tissues. In cell culture, RAD1901 does not stimulate replication of breast cancer cells, and antagonizes the stimulating effects of estrogen on cell proliferation. Furthermore, in breast cancer cell lines a dose dependent down regulation of ER, has been observed, a process we have shown to involve proteosomal mediated degradation pathway. In a model of breast cancer in which human breast cancer cells are implanted in mice and allowed to establish tumors in response to estrogen treatment, we have shown that treatment with RAD1901 results in decreased tumor growth. Studies with RAD1901 have established the pharmacokinetic profile, including demonstration of good oral bioavailability and the ability of RAD1901 to cross

the blood-brain barrier, with therapeutic levels detectable in the brain. We believe that RAD1901 could offer the following advantages over other current standard of care treatments for BCBM:

· ability to penetrate the blood-brain barrier;

· oral administration; and

· treatment of hormone-resistant breast cancers.

In late 2014, we intend to advance the development of high-dose RAD1901 for the treatment of ER-positive BCBM with the initiation of a Phase 1b clinical trial.

Vasomotor symptoms

Vasomotor symptoms, such as hot flashes and night sweats, are common during menopause, with up to 85% of women experiencing them during the menopause transition, for a median duration of four years. In 2010, approximately 11.5 million women in the United States were in the 45 to 49 year age range upon entering perimenopause/menopause. In addition, most women receiving systemic therapy for breast cancer suffer hot flashes, often with more severe or prolonged symptoms than women experiencing natural menopause. These symptoms can disrupt sleep and interfere with quality of life. An estimated two million women go through menopause every year in the United States, with a total population of 50 million postmenopausal women.

Historically, hormone replacement therapy, or HRT, with estrogen and/or progesterone was considered the most efficacious approach to relieving menopausal symptoms such as hot flashes. However, data from the Women’s Health Initiative, or WHI, identified increased risks for malignancy and cardiovascular disease associated with estrogen therapy. Sales of HRT declined substantially after the release of the initial WHI data, but HRT remains the current standard of care for many women suffering from hot flashes. However, due to concerns about the potential long-term risks and contraindications associated with HRT, we believe that there is a significant need for new therapeutic options to treat vasomotor symptoms.

Our Solution — RAD1901

We are developing RAD1901 as a low dose SERM in an oral formulation for the treatment of vasomotor symptoms. We conducted a Phase 2 proof of concept study in 100 healthy perimenopausal women using four doses of RAD1901 — 10 mg, 25 mg, 50 mg and 100 mg — and placebo. While a classic dose-response effect was not demonstrated, at the 10 mg dose level RAD1901 achieved a statistically significant reduction in the frequency of moderate and severe hot flashes both by linear trend test and by comparison to placebo and in overall hot flashes at either the two-, three- or four-week time-points. A similar reduction in composite score — frequency × severity of hot flashes — was identified at all time-points, with a statistically significant difference from placebo achieved at the two-, three- or four-week time-points.

We anticipate our next clinical study will be a Phase 2b study conducted in approximately 200 perimenopausal women experiencing a high frequency of hot flashes at baseline. The main study endpoints would be an assessment of the change in the frequency and severity of moderate and severe hot flashes.

OUR STRATEGY

Our goal is to become a leading provider of therapeutics for osteoporosis and other serious endocrine-mediated diseases. To achieve this goal we plan to:

· Advance the development and obtain regulatory approval of Abaloparatide-SC. We are evaluating Abaloparatide-SC in an ongoing Phase 3 clinical trial for the treatment of osteoporosis and expect to report top-line 18-month fracture data at the end of the fourth quarter of 2014. If the results are positive, we plan to submit an NDA for Abaloparatide-SC in the United States, and an MAA in the European Union, in mid-2015.

· Extend the lifecycle of abaloparatide through the continued development of Abaloparatide-TD. We are developing Abaloparatide-TD as a short-wear-time transdermal patch and we anticipate, pending a favorable regulatory outcome, commercial launch two to three years after the first commercial sale of Abaloparatide-SC. If Abaloparatide-SC is approved by the FDA, we believe that we will only need to conduct a single non-inferiority Phase 3 clinical trial comparing the change in BMD for patients dosed with Abaloparatide-TD as compared to patients dosed with Abaloparatide-SC. If our clinical trials of Abaloparatide-SC and Abaloparatide-TD are successful, we expect to seek marketing approval of Abaloparatide-TD as a line extension of Abaloparatide-SC.

· Establish internal sales and marketing capabilities to commercialize our product candidates in the United States. We currently plan to commercialize any of our approved product candidates by developing an internal sales force focused on specialists in core strategic markets in the United States. We believe that we can effectively target those markets using a sales force of approximately 150 representatives and that by doing so we can achieve a greater return on our product investment than if we license our products to third parties for sale. We plan to expand the use of our products to primary care physicians through selective co-promotion partnerships. Our management team has experience commercializing products in these core strategic markets, and understands the relevant sales, marketing and reimbursement requirements.

· Selectively pursue collaborations to commercialize our product candidates outside the United States. We intend to seek to enter into one or more collaborations for the commercialization of our approved product candidates in strategic markets in Europe and in other countries worldwide.

· Continue to expand our product portfolio. We plan to leverage our drug development expertise to discover and develop additional product candidates focused on serious endocrine-related diseases and conditions, including the development of RAD1901 as a potential treatment for ER-positive BCBM. We may also consider opportunistically expanding our product portfolio through in-licensing, acquisitions or partnerships.

OUR PRODUCT CANDIDATES

The following table identifies the product candidates in our current product portfolio, their proposed indication and stage of development:

Abaloparatide

Overview

Abaloparatide is a novel synthetic peptide analog of parathyroid hormone-related protein, or PTHrP, that we are developing as a bone anabolic treatment for osteoporosis. PTHrP, unlike PTH, is critical in the formation of the skeleton, is involved in the regulation of bone formation and is able to rebuild bone with low associated risk of inducing the presence of too much calcium in the blood, known as hypercalcemia, as a side effect. Human PTHrP (a protein of 139 to 173 amino acids) is different from PTH (a protein of 84 amino acids) in its structure and role. In 2009, the medical journal, Nature Chemical Biology, published the results of a study

indicating that PTH (which primarily regulates calcium homeostasis and bone resorption) and PTHrP activate the same parathyroid hormone receptor, or PTHR1, but produce divergent effects in bone due to differences in receptor conformation selectivity, receptor localization and downstream cell signaling. Forteo is a 34 amino acid recombinant peptide of human parathyroid hormone. We believe that abaloparatide is the most advanced PTHrP analog in clinical development for the treatment of osteoporosis. We acquired and maintain exclusive worldwide rights, excluding Japan, to certain patents, data and technical information related to abaloparatide through a license agreement with an affiliate of Ipsen Pharma SAS, or Ipsen.

We are developing abaloparatide for the prevention of fractures in postmenopausal women at risk of fracture from severe osteoporosis. Recognizing both the therapeutic potential of abaloparatide in this indication as well as the drawbacks inherent in self-injection therapies in this population, we are also developing Abaloparatide-TD for transdermal administration of the product using a microneedle technology from 3M. We plan to develop and register Abaloparatide-SC as our lead product, with Abaloparatide-TD as a line extension that provides greater patient convenience. We believe the ability of Abaloparatide-TD to capitalize on the more extensive fracture study data of Abaloparatide-SC will allow the patch product to be accelerated through later-phase development without requiring its own fracture study.

Abaloparatide-SC

We are developing Abaloparatide-SC as a once daily sub-cutaneous injection of abaloparatide for the treatment of osteoporosis. We have completed two Phase 2 clinical trials of Abaloparatide-SC. We announced results from our first Phase 2 clinical trial in August 2009, which showed that Abaloparatide-SC produced faster and greater BMD increases at the spine and the hip with substantially less hypercalcemia than Forteo, the only approved anabolic agent for the treatment of osteoporosis in the United States. Specifically, our study demonstrated that total hip BMD showed a more than five-fold benefit of Abaloparatide-SC at a dose of 80µg over Forteo after 24 weeks. Abaloparatide-SC at 80µg increased mean lumbar spine BMD by 6.7% at 24 weeks, compared to 5.5% with Forteo, and by 12.9% at 48 weeks, compared to 8.6% with Forteo. Abaloparatide-SC at 80µg increased mean femoral neck BMD by 3.1% at 24 weeks, compared to 1.1% with Forteo, and 0.8% with a placebo, and by 4.1% at 48 weeks, compared to 2.2% with Forteo. At 24 weeks, 66% of Abaloparatide-SC treated patients had increases in BMD at the lumbar spine, total hip and femoral neck, compared with 29% of placebo treated patients (p=0.0015) and 40% of Forteo treated patients (p=0.0250). In January 2014, we reported positive data from a second Phase 2 clinical trial of abaloparatide. Consistent with our Phase 2 clinical trial of Abaloparatide-SC completed in 2009, our second clinical trial demonstrated that patients who received a 80 µg dose of Abaloparatide-SC experienced increases in BMD from baseline in the lumbar spine (5.8% increase from baseline), total hip (2.7% increase from baseline) and femoral neck (2.7% increase from baseline and 3.1% increase net placebo). In addition to the BMD results, these study results add to the safety data from the prior Phase 2 clinical study with Abaloparatide-SC, which demonstrated that abaloparatide is generally safe and well tolerated.

In April 2011, we commenced our ongoing Phase 3 clinical trial of Abaloparatide-SC, which completed enrollment in March 2013 with 2,463 subjects. The trial was designed to enroll 2,400 subjects that would be randomized equally to receive daily doses of one of the following: 80 µg of abaloparatide, a matching placebo, or the approved dose of 20 µg of Forteo for 18 months. The trial is designed to test our belief that abaloparatide is superior to placebo for the prevention of vertebral fracture and to Forteo for greater BMD improvement at major skeletal sites and for a lower occurrence of hypercalcemia. We believe the trial will also show that BMD gains for abaloparatide patients will occur earlier than for Forteo patients. In 2012 we participated in a Type A meeting with the Division of Reproductive and Urologic Products of the FDA and discussed the Abaloparatide-SC single pivotal placebo-controlled, comparative Phase 3 fracture study. The FDA indicated that it wanted us to provide additional feedback on the design of our ongoing Phase 3 clinical trial so that the data would be adequate for submission of an NDA for the treatment of osteoporosis. Following this meeting, we amended our protocol to incorporate changes in response to our discussions with the FDA, which included the addition of a 6-month extension study during which patients will receive an approved alendronate therapy in order to obtain 24-month fracture data. The FDA determination of the approvability of any NDA is made based on their independent assessment of the totality of the data submitted. Based on our discussions with the FDA, we believe that a successful, single pivotal placebo-controlled, comparative Phase 3 fracture study will be sufficient to support approval of Abaloparatide-SC for the treatment of osteoporosis in the United States. We believe that the use of a single pivotal placebo-controlled comparative Phase 3 fracture study is consistent with the approach taken with Forteo and Prolia, which were each approved by the FDA for the treatment of osteoporosis in the United States on the basis of a single pivotal placebo-controlled Phase 3 fracture study.

Before we submit an NDA to the FDA for Abaloparatide-SC as a treatment for osteoporosis, we must complete our pivotal Phase 3 clinical trial based upon 18-month fracture data, a carcinogenicity study in rats, and bone quality studies in rats and monkeys. We also may need to complete several additional studies including, a thorough QT Phase 1 study, a Phase 1 pharmacokinetic, or PK, study in renal patients, a Phase 1 absolute bioavailability PK study and several drug interaction studies. Assuming we do not encounter any unforeseen delays during the course of developing Abaloparatide-SC, we expect to present top-line 18-month fracture data at the end of the fourth quarter of 2014. If the data from this Phase 3 clinical trial are positive, and we have completed the other necessary trials, we plan to submit the NDA for

Abaloparatide-SC in mid-2015. We expect commercial launch to follow in the United States, if and when the FDA approves the NDA for Abaloparatide-SC.

We understand that Phase 3 clinical trials with similar size, design and endpoints as our Phase 3 clinical trial have been sufficient to support registration with the European Medicines Agency, or the EMA, for other bone anabolic drugs used to treat women with osteoporosis in the European Union, or the EU. In December 2012, we met with the Swedish Medical Products Agency, or the MPA, to review the design and the overall progress of the Phase 3 clinical trial. The MPA

confirmed that the program, based on the current single pivotal trial design, could support the submission and potential approval of an MAA in the EU, depending on the results of the Phase 3 clinical trial.

Abaloparatide-TD

We are developing Abaloparatide-TD as a line extension of Abaloparatide-SC in a short-wear-time transdermal patch formulation. In January 2014, we reported positive data from our Phase 2 clinical trial of Abaloparatide-TD. The results demonstrated that for each Abaloparatide-TD dose there was a statistically significant mean percent increase from baseline in BMD at the lumbar spine, as compared to placebo. For the 100 µg and 150 µg Abaloparatide-TD doses, there was also a statistically significant mean percent increase from baseline in BMD at the hip, as compared to placebo. The highest Abaloparatide-TD dose of 150 µg produced increases in BMD from baseline in the lumbar spine and total hip of +2.9% and +1.5%, respectively, compared to changes in the placebo group of +0.04% and -0.02%, respectively. In addition, there was a consistent dose effect seen with increasing doses of Abaloparatide-TD, with a statistically significant dosing trend seen for changes in both spine and total hip BMD. Further, the overall tolerability and safety profile was acceptable, there were no clinically significant signs of anti-abaloparatide antibodies, and patient ratings of patch adhesion and local skin response to the transdermal patch technology were also acceptable.

In order to further enhance BMD efficacy, we currently plan to modify the pharmacokinetic profile of Abaloparatide-TD to more closely resemble that of Abaloparatide-SC. If Abaloparatide-SC is already approved by the FDA, we believe that we will only need to conduct a single non-inferiority Phase 3 clinical trial comparing the change in lumbar spine BMD at 12 months for patients dosed with Abaloparatide-TD to patients dosed with Abaloparatide-SC to confirm that the effect of Abaloparatide-TD treatment is comparable to that of Abaloparatide-SC. If our clinical trials of Abaloparatide-SC and Abaloparatide-TD are successful, we expect to seek marketing approval of Abaloparatide-TD as a line extension of Abaloparatide-SC. The FDA approval of Abaloparatide-TD, and the timing of any such approval, is dependent upon the approval of Abaloparatide-SC.

Clinical Development

Pivotal Phase 3 Clinical Trial of Abaloparatide-SC

In April 2011, we commenced our ongoing Phase 3 trial, which completed enrollment in March 2013. The trial completed enrollment with 2,463 patients at 28 medical centers in 10 countries in the United States, Europe, Latin America and Asia. Patients in the trial are randomized equally to receive daily doses of one of the following for 18 months: 80 µg of abaloparatide; a matching placebo or the approved dose of 20 µg of Forteo.

On February 15, 2012, we received a letter from the FDA stating that, after internal consideration, the agency believes that a minimum of 24-month fracture data are necessary for approval of new products for the treatment of postmenopausal osteoporosis. Our ongoing Abaloparatide-SC pivotal Phase 3 clinical study is designed to produce fracture data based on an 18-month primary endpoint. The FDA’s letter solicited a meeting to review the status of our Phase 3 clinical study and discuss options for fulfilling the FDA’s new request for 24-month fracture data in the context of the ongoing Phase 3 study. We subsequently met with the FDA on March 21, 2012 to discuss satisfying the 24-month data request while preserving the current 18-month primary endpoint. Based upon our discussion with the FDA, we believe that continued use of the 18-month primary endpoint will be acceptable, provided that our NDA includes the 24-month fracture data derived from a 6-month extension of the abaloparatide 80 µg and placebo groups in our Phase 3 study that will receive an approved alendronate (generic Fosamax) therapy for osteoporosis management. We intend to submit the NDA with the 24-month fracture data.

Study population — The study enrolled otherwise healthy ambulatory women aged 50 to 85 (inclusive) who had been postmenopausal for at least five years, met the study entry criteria and had provided written informed consent. Osteoporosis is defined as when a patient’s t-score is less than or equal to -2.5, meaning that the patient has a BMD that is two and a one-half standard deviations below the mean BMD of an ethnically matched thirty year old man or woman, as applicable. The women enrolled in the study have a BMD t-score < -2.5 and >-5.0 at the lumbar spine or hip (femoral neck) by dual-energy X-ray absorptiometry, or DXA, and radiological evidence of two or more mild or one or more moderate lumbar or thoracic vertebral fractures, or history of low trauma forearm, humerus, sacral, pelvic, hip, femoral or tibial fracture within the past five years. Postmenopausal women older than 65 who met the above fracture criteria but had a t-score of < -2.0 and >-5.0 could also be enrolled. Women older than 65 who did not meet the fracture criteria could also be enrolled if their t-score was < -3.0 and >-5.0. All patients were to be in good general health as determined by medical history, physical examination (including vital signs) and clinical laboratory testing. We believe this study population contains a patient population reflective of the type of severe osteoporosis patients that specialists will treat in their practices.

Study design

The 2,463 eligible patients were randomized equally to receive one of the following for 18 months:

· abaloparatide at a dose of 80 µg;

· a matching placebo; or

· Forteo at a dose of 20 µg.

The study drug was blinded to patients and medical personnel until the randomization process was completed. Treatment with abaloparatide at a dose of 80 µg or placebo will remain blinded to all parties throughout the study. Forteo comes as a proprietary prefilled drug and device combination that cannot be repackaged. Therefore, its identity cannot be blinded to treating physicians and patients once use begins. Study medication will be self-administered daily by subcutaneous injection for a maximum of 18 months. All enrolled patients will also receive calcium and vitamin D supplementation from the time of enrollment until the end of the treatment period. It will be recommended to patients that they also continue these supplements through the one month follow-up period.

Primary efficacy endpoints — The primary efficacy endpoint will be the number of patients treated with Abaloparatide-SC that show new vertebral fractures at end-of-treatment when compared to placebo as evaluated by a blinded assessor according to a standardized graded scale of severity of the vertebral deformity. The sample size per treatment arm provides 90% power at

a two-sided alpha to detect a superiority difference on vertebral fracture incidence between placebo patients and those who receive Abaloparatide-SC at a dose of 80 µg.

Secondary efficacy endpoints — Secondary efficacy parameters will also include reduction in the incidence of non-vertebral fractures to the wrist, hip and rib, for example, and reduction in moderate and severe vertebral fractures from baseline to end-of-treatment. Other secondary efficacy endpoints will include changes in BMD of the spine, hip, femoral neck and wrist from baseline to end-of-treatment as assessed by DXA and as compared to Forteo, as well as the number of hypercalcemic events in Abaloparatide-SC treated patients when compared to Forteo at end-of-treatment.

Additional secondary endpoints will include change in standing height and changes in serum bone formation markers across treatment, such as P1NP, osteocalcin and bone-specific alkaline phosphatase.

Extension study design.

Each of the abaloparatide 80 µg and placebo groups in our Phase 3 study will be eligible to continue in an extension study and will receive an approved alendronate (generic Fosamax) therapy for osteoporosis management. A key endpoint of the extension study will be the reduction in new vertebral fractures at up to 24 months in all randomized patients, including abaloparatide-treated and placebo-treated patients who are treated with alendronate at the end of treatment.

Safety outcomes — Safety evaluations to be performed will include physical examinations, vital signs, 12-lead electrocardiograms, or ECGs, clinical laboratory tests and monitoring and recording of adverse events. Specific safety assessments will include post-dose (four hours) determination of serum calcium, determination of creatinine clearance, post-dose ECG assessments at selected visits and assessments of postural hypotension (60 minutes post-dose) at selected clinic visits.

Bone biopsy of the iliac crest will be performed in a subset of patients receiving abaloparatide at a dose of 80 µg and placebo for assessment of bone quality and quantitative bone histomorphometry which is the quantitative study of the microscopic organization and structure of the bone tissue, and will be read blinded to treatment by an independent blinded assessor. Renal safety will be further evaluated in a subset of approximately 100 patients in each treatment group by renal computed tomography, or CT, scan.

Overall study safety is being monitored by an independent DSMB.

Abaloparatide-SC Phase 2 Clinical Trial

We conducted a randomized, placebo-controlled, parallel group dose-finding Phase 2 study (Study BA058-05-002) in the United States, Argentina, India and the United Kingdom. A total of 270 patients (mean age: 65 years) entered the pretreatment period, 222 patients were randomized, and 221 patients received study treatment and were analyzed in the intent-to-treat, or ITT, population with 55 continuing into an additional 24 weeks of treatment. A total of 155 patients were included in the efficacy population (per protocol) in the initial 24 weeks of treatment. The purpose of the study was to evaluate the safety and efficacy of daily injections of Abaloparatide-SC in women with osteoporosis. Postmenopausal women between the ages of 55 and 85 (inclusive) who had a BMD t-score < -2.5 at the lumbar spine or hip (femoral neck) by DXA or a BMD t-score < -2 and a prior low trauma fracture or an additional risk factor were candidates for this study. The study evaluated the effects of Abaloparatide-SC at multiple doses (placebo, 20 µg, 40 µg and 80 µg) on recovery of BMD, a marker of fracture risk, and on biomarkers of anabolic and resorptive activity in bone. The study also included a Forteo treatment arm for reference. After the initial 24 weeks of treatment, eligible patients were offered a second 24 weeks of their assigned treatment. Safety was assessed throughout the study and reported on at both 24 weeks and 48 weeks. Abaloparatide-SC and placebo were self-administered using a prefilled cartridge in a pen-injector device. Forteo was self-administered as the marketed product at the approved dose of 20 µg per day by subcutaneous injection. Four weeks prior to start of treatment, patients began taking calcium and vitamin D supplements that continued throughout the study.

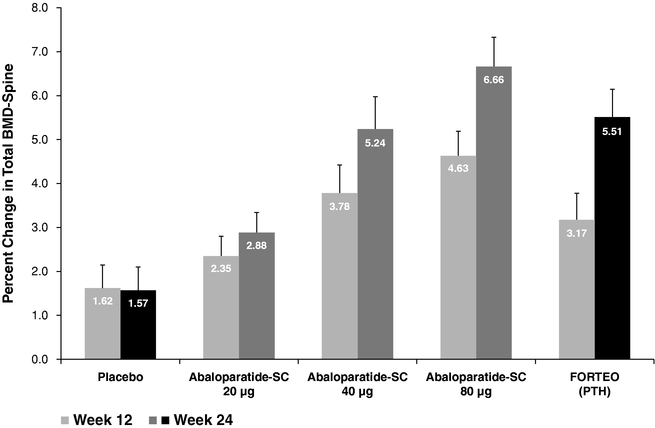

Initial 24 weeks of treatment — The following tables depict the percent change in total BMD-spine and BMD-hip at 12 and 24 weeks for each of arm of the trial.

In the ITT population, the mean percent change from baseline at week 12 in lumbar spine BMD (active treatment — placebo) for Abaloparatide-SC 40 µg and 80 µg groups were statistically significant (p = 0.0013 and p < 0.001, respectively). The difference was not statistically significant in the Abaloparatide-SC 20 µg group, in the placebo group or in the Forteo group (p = 0.055). At week 24, the mean percent change from baseline continued to increase and was statistically significantly proportional to dose (p < 0.001) as shown in Figure A below. Again, the mean gain in total spine BMD was statistically significant for Abaloparatide-SC 40 µg (p <

0.001) and 80 µg (p < 0.001) groups. The mean BMD gain at week 24 was also statistically significant for the Forteo group (p < 0.001). The difference was not statistically significant in the Abaloparatide-SC 20 µg group or in the placebo group. The response of lumbar spine BMD to Abaloparatide-SC was dose dependent, and the 80 µg Abaloparatide-SC dose produced a larger percentage increase in BMD at the lumbar spine than the approved 20 µg Forteo dose.

Figure A — Mean Standard Error of the Mean (SEM) Percent Change from Baseline at weeks 12 and 24 in Total Spine BMD (ITT Population,N =221)

An even greater proportional response in BMD was elicited in the hip region. By week 24, mean percent changes in total hip BMD were 0.4%, 1.4%, 2.0% and 2.6% for the placebo, abaloparatide at a dose of 20 µg, abaloparatide at a dose of 40 µg, and abaloparatide at a dose of 80 µg groups, respectively. Mean percent change in the Forteo (0.5%) group was similar to placebo as shown in Figure B below. The change in total hip BMD showed a dose response to Abaloparatide-SC and a more than five-fold benefit of abaloparatide at a dose of 80 µg over Forteo. A similar relative benefit of abaloparatide at a dose of 80 µg over Forteo was seen in all regions of the hip.

Figure B — Mean (SEM) Percent Change from Baseline at weeks 12 and 24 in Total Hip BMD (ITT Population, N=221)

Abaloparatide-SC also induced a dose-dependent rise in major markers of bone anabolic activity, including P1NP, bone specific alkaline phosphatase, or BSAP, and osteocalcin. The response to Forteo was somewhat greater for anabolic markers and bone resorption markers (C-telopeptides of type I collagen crosslinks, or CTX, and N-telopeptides of type I collagen crosslinks, or NTX), consistent with published data, suggesting a close of the anabolic window and attenuation in the anabolic benefit of continued Forteo administration. While elevated over baseline, the Abaloparatide-SC patient group maintained lower levels of resorption markers (CTX) throughout the study period as compared to Forteo. We believe abaloparatide may demonstrate a lengthening of the anabolic window as compared to Forteo.

Abaloparatide-SC was well tolerated at all doses and safety events were consistent with usual medical events in a study population of this age and gender. The safety profile was also similar to that of Forteo and there were no treatment-related serious adverse events, or SAE’s. Adverse events were reported by 74% of patients in the first six months of treatment, with a similar incidence across all treatment groups. The majority of on-treatment events were mild-to-moderate in severity and there were no deaths reported. Treatment-related treatment emergent adverse events were reported in approximately 30% of patients, with similar incidence across all

treatment groups. Seven subjects discontinued due to adverse events: one in the abaloparatide 20 µg group, one in the abaloparatide 40 µg group, three in the abaloparatide 80 µg group and two in the Forteo group. Eight patients (four percent) experienced at least one SAE and the incidence of such events was similar across treatment groups. Five SAEs, unrelated to treatment, were reported in three patients. Local tolerance at the injection site was similar across treatment groups and fewer than 20% of subjects reported any symptoms, such as redness at the injection site across the many months of injections.

The level of calcium in the blood, known as serum calcium levels, were monitored throughout the study and clinically significant elevated levels (greater than or equal to 10.5 milligrams per deciliter, or mg/dL) were observed in 40% of the Forteo group while also observed in four percent, 12%, 19% and 18% of the placebo, Abaloparatide-SC at doses of 20 µg, 40 µg and 80 µg groups, respectively. Most elevations were noted at the four-hour post-injection time point.

Blood pressure was assessed throughout the study for postural change. Postural changes in blood pressure (predetermined level of change in systolic or diastolic from lying to standing) were reported in seven patients, including 0%, 5%, 2%, 2% and 7% of patients in the placebo, Abaloparatide-SC 20 µg, 40 µg, 80 µg and Forteo groups, respectively. Pre-dose postural changes in blood pressure were similar across treatment groups. There were no clinically meaningful differences in ECG parameters between the placebo and active treatment groups.

Sixteen patients had low titer antibodies against abaloparatide after 24 weeks of treatment. Of these, five were in the abaloparatide 20 µg group, six were in the abaloparatide 40 µg group and five were in the abaloparatide 80 µg group. There were no associated safety events or attenuation of treatment efficacy. One antibody- positive patient in the Abaloparatide-SC 40 µg group was found to have possible evidence of neutralizing activity using an in vitro assay at 24 weeks without evidence of attenuation of drug efficacy; the patient achieved a 9.3% gain in total spine BMD at the week 24 assessment.

Extended 24 weeks of treatment — Patients who completed the initial 24 weeks of treatment and continued to meet eligibility criteria were offered participation in the 24-week extension study in which they would continue their assigned treatment. On completion of the regulatory process to approve the study extension, 69 patients remained eligible and 55 participated, including 13, 10, 7, 11 and 14 patients in Abaloparatide-SC 20 µg, 40 µg, 80 µg, placebo and Forteo groups, respectively. Forty-eight patients completed the extended treatment period.

BMD continued to increase during the extended 24 weeks of treatment, with the largest percent increases in total spine BMD, femoral neck BMD and total hip BMD observed in the Abaloparatide-SC 80 µg group, as shown in Figure C below. By week 48, mean percent changes in spine BMD were 0.7%, 5.1%, 9.8% and 12.9% for the placebo, Abaloparatide-SC 20 µg, Abaloparatide-SC 40 µg and Abaloparatide-SC 80 µg, groups, respectively, while mean percent change from baseline in the Forteo group was 8.6%. At week 48, the mean femoral neck BMD in

the Abaloparatide-SC 80 µg group gained 4.1% compared to the mean of the Forteo group at 2.2%. The total gain in hip BMD was 0.7%, 2.0%, 2.1% and 2.7% for the placebo, Abaloparatide-SC 20 µg, Abaloparatide-SC 40 µg and Abaloparatide-SC 80 µg groups, respectively, compared to 1.3% for the Forteo group.

Figure C — Mean (SEM) Percent Change from Baseline at weeks 12, 24 and 48 in Total Spine BMD (Extension Population N=55)

No treatment-related SAEs or deaths were reported during this time period. Two patients discontinued treatment, one for bilateral femoral hernias (Abaloparatide-SC 80 µg) and one for moderate syncope (Abaloparatide-SC 40 µg). Study-related adverse events occurred in a similar proportion of patients in each treatment group across the 52-week study period and the majority of events were mild or moderate in severity. The profile of events was not different during the second 24 weeks of study treatment.

Non-Head-to-Head Comparison of Abaloparatide-SC and Amgen Anti-sclerostin Antibody Phase 2 Study Results

Our Abaloparatide-SC Phase 2 clinical study used substantially similar patient inclusion and exclusion criteria as a study completed by Amgen of the use of a human anti-sclerostin antibody, romosozumab or AMG 785, for the treatment of osteoporosis. A comparison of the 6-month and 12-month spine BMD results of the AMG 785 study at the 210 mg once-monthly subcutaneous dosing regimen, including both patients treated with AMG 785 and a control group of patients treated with Forteo, and our Abaloparatide-SC study at the 80 mcg single daily subcutaneous

dose are set forth in the following table. While we believe the comparison is useful in evaluating the results of our Phase 2 clinical study of Abaloparatide-SC, the Abaloparatide-SC and AMG 785 studies were separate trials conducted at different sites, and we have not conducted a head-to-head comparison of the drugs in a single clinical trial. Results of an actual head-to-head comparison study may differ significantly from those set forth in the following table. In addition, because the Abaloparatide-SC and AMG 785 studies were separate studies and because the Abaloparatide-SC Phase 2 clinical study involved a lesser number of patients, differences between the results of the two studies may not be statistically or clinically meaningful.

|

|

|

Abaloparatide-SC |

|

AMG 785 |

| ||||

|

Product |

|

Abaloparatide |

|

Forteo |

|

AMG 785 |

|

Forteo |

|

|

Dose |

|

80 mcg |

|

20 mcg |

|

210 mg |

|

20 mcg |

|

|

Dosing frequency |

|

Daily |

|

Daily |

|

Monthly |

|

Daily |

|

|

No. of Injections per dose |

|

1 |

|

1 |

|

3 |

|

1 |

|

|

Type of Injection |

|

Self |

|

Self |

|

Physician |

|

Self |

|

|

Spine Mean Percent BMD Change from Baseline — 24 weeks/6 months |

|

+6.7 |

% |

+5.5 |

% |

+8.2 |

% |

+4.8 |

% |

|

Spine Mean Percent BMD Change from Baseline — 48 weeks/12 months |

|

+12.9 |

% |

+8.6 |

% |

+11.3 |

% |

+7.1 |

% |

|

Femoral Neck Mean Percent BMD Change from Baseline — 48 weeks/12 months |

|

+4.1 |

% |

+2.2 |

% |

+3.7 |

% |

+1.1 |

% |

(1) Abaloparatide-SC Study n=221 (24 weeks) and n=55 (48 weeks), 5 arms

(2) AMG 785 Study n=419 (12 months), 9 arms

Abaloparatide-SC Phase 1 Clinical Trials

We have completed three Phase 1 clinical trials of Abaloparatide-SC. Together with our Phase 2 clinical trials and ongoing Phase 3 clinical trial, over 1,300 patients have received the drug. The

results of our Phase 1 clinical trials suggest that Abaloparatide-SC is safe and well tolerated at doses of up to 100 µg administered once daily. These studies also demonstrated that abaloparatide was 100% bioavailable, meaning it was absorbed completely, when administered subcutaneously, and that it was rapidly cleared from the circulation.

Abaloparatide-TD Phase 2 Clinical Trials

We conducted a randomized, double-blind, placebo-controlled, Phase 2 clinical trial of abaloparatide administered via a coated transdermal microarray delivery system in healthy postmenopausal women with osteoporosis. This study was conducted in nine centers in the United States, Denmark, Poland and Estonia. The primary objective of this study was to determine the clinical safety and efficacy of Abaloparatide-TD as assessed by changes in BMD when compared to a transdermal placebo and Abaloparatide-SC. Postmenopausal women between the ages of 55 and 85 (inclusive) who had a BMD t-score < -2.5 at the lumbar spine or hip (femoral neck) by DXA or a BMD t-score < -2 and a prior low trauma fracture or an additional risk factor were candidates for this study. Abaloparatide-TD was administered via a spring-loaded applicator and Abaloparatide-SC was administered by a multi-use pen injector into which a multi-dose glass cartridge was inserted. Four weeks prior to the start of treatment, subjects began taking calcium and vitamin D supplements which were continued throughout the study. The study drug was to be administered once daily for a total of six months.

A total of 372 subjects were screened and 250 were randomized to treatment in one of five treatment regimens: transdermal placebo, Abaloparatide-TD at doses of 50 µg, 100 µg, and 150 µg or Abaloparatide-SC at a dose of 80 µg. Two hundred and forty-nine subjects were included in the safety population and 231 subjects were included in the modified intent-to-treat, or mITT, population.

In the mITT population, the mean percent change from baseline in total spine BMD after six months of treatment increased with Abaloparatide-TD dose (0.04%, 1.87%, 2.33% and 2.95% in the placebo, Abaloparatide 50 µg, 100 µg and 150 µg groups, respectively). The test for a dose response was statistically significant (<0.0001). The mean differences (active treatment — placebo) of the percent change from baseline in total spine BMD at six months were 1.83%, 2.29% and 2.91% in the Abaloparatide-TD 50 µg, 100 µg, and 150 µg groups, respectively. The results for all Abaloparatide-TD dose groups were statistically significantly better than placebo (p=0.0066, 0.0005, and <0.0001, respectively).

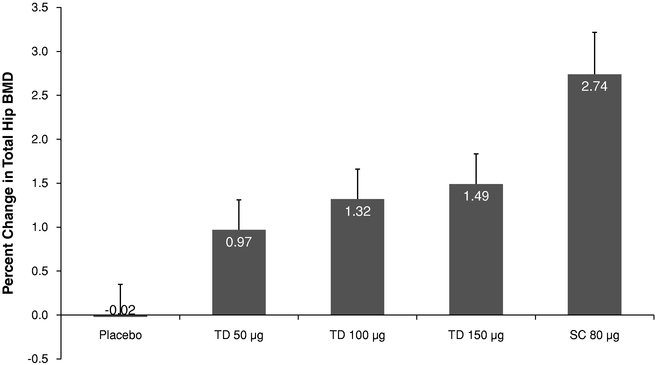

Figure D — Mean (SEM) Percent Change from Baseline at Six Months in Total Spine BMD

Similar to the findings in the spine, the mean percent change from baseline in total hip BMD after six months of treatment also increased with Abaloparatide-TD dose (-0.02% and 0.97%, 1.32% and 1.49% in the placebo, abaloparatide 50 µg, 100 µg and 150 µg groups. The mean differences (active treatment — placebo) of the percent change from baseline in total hip BMD at six months were 0.99%, 1.33% and 1.51% in the abaloparatide 50 µg, 100 µg, and 150 µg groups, respectively; the results for the 100 µg and 150 µg Abaloparatide-TD dose groups were statistically significantly better than placebo (p=0.0056 and 0.0018, respectively).

Figure E — Mean (SEM) Percent Change from Baseline at Six Months in Total Analyzable Hip BMD

Analysis of adverse events was performed on treatment-emergent adverse events, or TEAEs. There were no apparent differences between the TEAE profiles across the five treatment groups. Overall, nasopharyngitis, headache, and influenza were the most frequently reported TEAEs. There were 9 serious TEAEs reported, one in the placebo group, two in the 100 µg group, two in the 150 µg group and four in the Abaloparatide-SC group. No subjects died during the course of this study. All of the events were consistent with medical events in women with postmenopausal osteoporosis, and none of the events were considered to be related to treatment with study medication.

Assessment of local tolerance consisted of daily self-evaluation by the subject of any dermal reaction for two months during the course of the study using scales that ranged from 0 to 3 or 6, with 0 indicating no effect. In general, the types of symptoms reported were similar across the treatment groups, with dermal response and swelling being the effects most frequently reported. In an initial analysis, detectable antibodies against abaloparatide were noted in a subset of patients. However, these antibodies were of low titer, and there was no evidence of an effect on safety or attenuation of treatment efficacy.

Abaloparatide-TD Phase 1 Clinical Trials

We have completed three Phase 1 clinical trials that collectively evaluated the safety, PK, time course of delivery and dose ranging. Abaloparatide-TD was characterized by a rapid release of abaloparatide with a faster time to reach peak concentration as well as more rapid elimination in plasma compared to Abaloparatide-SC. Peak transdermal drug levels were consistent with Abaloparatide-SC. An optimal wear time of five minutes or less was identified as well as effective sites of application. Abaloparatide-TD showed an increase in the bone-formation marker P1NP in serum after seven days of exposure, consistent with bone-building activity, and was shown to be safe and well tolerated in all doses studied.

Preclinical Pharmacology of Abaloparatide

We have completed several preclinical studies of abaloparatide, and the following has been shown:

· Abaloparatide is a potent selective agonist of the human PTH type 1 receptor (PTHR1), with binding selectivity for the RG vs R0 receptor conformation compared to PTH(1-34) and greater selectivity than PTHrP(1-34);

· In models of calcium mobilization, abaloparatide has significantly less calcium mobilizing activity at higher doses than the native PTHrP(1-34), and less activity than PTH(1-34);

· Abaloparatide-SC stimulates the formation of normal, well-organized bone and restores BMD in ovariectomized (OVX), osteopenic rats and primates. Mechanical testing of bones from OVX rats after treatment with Abaloparatide-SC revealed a significant increase in femur and vertebral bone strength. Similar studies in rats with Abaloparatide-TD show comparable restoration of bone;

· Abaloparatide-SC was generally well tolerated over a wide range of doses in two species, rats and primates, for up to six months and nine months, respectively; and

· Safety pharmacology studies demonstrated no respiratory, gastroenterologic, hematologic, renal or central nervous system effects.

A two-year subcutaneous injection carcinogenicity study of abaloparatide in Fischer 344 albino rats was conducted to assess the carcinogenic potential of abaloparatide. The study was conducted according to the provisions set forth in Guidance ICH-S1A, ICH-S1B, and ICH-S1C(R2), and the design was accepted by the FDA on July 15, 2009. This study evaluated three abaloparatide dose levels. The doses were selected based upon findings and tolerance in completed long-term rat toxicology studies and the anticipated tolerance over a two-year dosing period. Furthermore, the doses represent an exposure multiple over maximum clinical doses. The study included a cohort of rats being dosed with a daily subcutaneous injection of PTH(1-34)as a positive control, as it was anticipated that osteosarcomas would be observed with this treatment, as previously published for both rhPTH(1-34) and rhPTH(1-84) in similar 2-year rat

carcinogenicity studies. The positive control served to provide confirmation of the sensitivity of the model. A preliminary unaudited analysis of histopathology data revealed osteosarcomas in our carcinogenicity study in both the abaloparatide and PTH(1-34) treated groups, with similar frequency between abaloparatide and PTH(1-34) when comparing comparable exposure multiples to the human therapeutic dose.

We are also conducting one preclinical bone quality study in OVX rats with 12 months of daily Abaloparatide-SC dosing and a second preclinical bone quality study in adult OVX monkeys for 16 months. The primary objective of these studies is to determine the long-term treatment effects of Abaloparatide-SC on bone quality. Effects on bone mass, both cortical bone and cancellous bone, will be assessed by BMD and peripheral quantitative computed tomography, and bone strength will be determined by biomechanical testing. The mechanisms by which abaloparatide affects bone will be assessed by evaluation of biomarkers of bone turnover and histomorphometric indices of bone turnover. Preliminary data from the 12-month rat study has shown marked, dose dependent increases in BMD following abaloparatide treatment, increases in bone formation markers, but not bone resorption, and an increase in bone strength.

Preliminary results from the 16-month monkey OVX study have also shown significant BMD gains, together with increases in bone strength.

RAD1901

In June 2006, we exclusively licensed the worldwide rights (except for Japan) to RAD1901 from Eisai. We are developing RAD1901 as a SERD in Phase 1 clinical development for the treatment of BCBM. We are also developing RAD1901, which at lower doses acts as a SERM, in an oral formulation as a treatment for vasomotor symptoms, commonly known as hot flashes or hot flushes. We currently intend to advance the development of RAD1901 for the treatment of ER-positive BCBM with the initiation of a Phase 1b clinical trial in late 2014. We currently intend to seek potential collaborations with third parties in order to advance the development of RAD1901 for the treatment of vasomotor symptoms. We anticipate the next clinical study would be a Phase 2b study conducted in approximately 200 perimenopausal women experiencing a high frequency of hot flashes at baseline. The main study endpoints would be an assessment of the change in the frequency and severity of moderate and severe hot flashes.

Pharmacologic Characteristics

RAD1901 has been shown to bind with good selectivity to the ER alpha, or ERα, and to have both estrogen-like and estrogen antagonist effects in different tissues. RAD1901 has also been shown to have estrogen-like behavioral effects in an animal model of partner preference and to reduce vasomotor signs in an animal model of menopausal hot flashes. In bone, RAD1901 protects against gonadectomy-induced bone loss. RAD1901 does not stimulate the endometrium, as shown in short and long term animal models, where changes in uterine weight, uterine epithelial thickness and C3 gene expression are measured, all of which are sensitive indicators.

In studies in which an estrogen is used to stimulate the endometrium, RAD1901 antagonizes this estrogen-mediated stimulation of the endometrium. In cell culture, RAD1901 does not stimulate replication of breast cancer cells, and antagonizes the stimulating effects of estrogen on cell proliferation. Furthermore, in breast cancer cell lines a dose dependent down regulation of ERα is observed, a process we have shown to involve proteosomal mediated degradation pathway. In a model of breast cancer, in which human breast cancer cells are implanted in mice and allowed to establish tumors in response to estrogen treatment, we have shown that treatment with RAD1901 results in decreased tumor growth.

Pharmacokinetic studies with RAD1901 have established the PK profile including demonstration of good oral bioavailability and the ability of RAD1901 to cross the blood-brain barrier, with pharmacological levels detectable in the brain. We believe that RAD1901 is a promising agent for development in the treatment both vasomotor symptoms and a range of estrogen-driven cancers.

Clinical Development Program

Phase 2 Study — Vasomotor Symptoms

A Phase 2 proof of concept study was conducted in 100 healthy perimenopausal women using four doses of RAD1901 (10 mg, 25 mg, 50 mg and 100 mg) and placebo. The primary study outcome was reduction in the frequency and severity of moderate and severe hot flashes. While a classic dose-response effect was not demonstrated, efficacy was determined to occur at the 10 mg dose level which achieved a statistically significant reduction in the frequency of moderate and severe hot flashes both by linear trend test and by comparison to placebo and in overall (mild-moderate-severe) hot flashes at either the two-, three- or four-week time-points. A similar reduction in composite score (frequency × severity of hot flashes) was identified at all time-points, with a statistically significant difference from placebo achieved at the two-, three- or four-week time-points. Numerical reductions in mean severity and mean daily severity were observed, but did not reach statistical significance. We believe RAD1901 is an attractive candidate for advancement to Phase 3 development as a treatment for vasomotor symptoms.

No SAEs were reported during the course of the study. Overall, 69% of patients had an adverse event, generally mild or moderate in severity, with some evidence of dose dependency, and events were most commonly gastrointestinal symptoms and headaches. Three severe adverse events occurred, one in a placebo patient, none of which were considered treatment related. Two patients discontinued treatment due to an adverse event, neither in relation to the 10 mg dose.

Phase 1 Study — Vasomotor Symptoms

We have conducted Phase 1 safety, PK and bioavailability studies of RAD1901 in 80 healthy postmenopausal women over a range of doses. Bioavailability was determined to be approximately 10%. Food effect was also investigated and the presence of food was determined

to increase absorption and delay clearance of RAD1901. RAD1901 was generally well tolerated at all dose levels tested. All study-related adverse events were of mild intensity, with some increase in frequency at the higher doses in the multiple dose group, most commonly gastrointestinal symptoms and headaches. There were no SAEs observed.

RAD140

RAD140 is a nonsteroidal selective androgen receptor modulator, or SARM, that resulted from an internal drug discovery program that began in 2005. RAD140 has demonstrated potent anabolic activity on muscle and bone in preclinical studies and has completed 28-day preclinical toxicology studies in both rats and monkeys. Because of its high anabolic efficacy, receptor selectivity, potent oral activity and long duration half-life, we believe that RAD140 has clinical potential in a number of indications where the increase in lean muscle mass and/or bone density is beneficial, such as treating the weight loss due to cancer cachexia, muscle frailty and osteoporosis, and also in the treatment of breast cancer.

We may choose to advance the RAD140 program internally or to collaborate with third parties for its further development and commercialization. Therefore, the date of any FDA approval of RAD140, if ever, cannot be predicted at this time. As a result of the uncertainties around the development strategy for RAD140, we are unable to determine the duration and costs to complete current or future clinical stages of our RAD140 product candidate.

Manufacturing

We do not own or operate manufacturing facilities for the production of any of our product candidates, nor do we have plans to develop our own manufacturing operations in the foreseeable future. The active pharmaceutical ingredient, or API, of abaloparatide is manufactured on a contract basis by Lonza Group Ltd., or Lonza, using a solid phase peptide synthesis assembly process, and purification by high pressure liquid chromatography. Abaloparatide-SC is supplied as a liquid in a multi-dose cartridge for use in a pen delivery device. The multi-dose cartridges are manufactured by Vetter. Abaloparatide-TD is manufactured by 3M based on their patented microneedle technology to administer drugs through the skin, as an alternative to subcutaneous injection. The API of RAD1901 is manufactured for us on a contract basis by Irix Pharmaceuticals, Inc.

Manufacturing is subject to extensive regulations that impose various procedural and documentation requirements, which govern record keeping, manufacturing processes and controls, personnel, quality control and quality assurance, among others. Our contract manufacturing organizations manufacture our product candidates under current Good Manufacturing Practice (cGMP) conditions. cGMP is a regulatory standard for the production of pharmaceuticals that will be used in humans.

Intellectual Property

As of December 31, 2013, we owned five issued United States patents, as well as ten pending U.S. patent applications and 45 pending foreign patent applications in Europe and 15 other jurisdictions, and 12 granted foreign patents. As of December 31, 2013, we had licenses to nine U.S. patents as well as numerous foreign counterparts to many of these patents and patent applications.

We strive to protect the proprietary technology that we believe is important to our business, including seeking and maintaining patents intended to cover our product candidates and compositions, their methods of use and processes for their manufacture and any other inventions that are commercially important to the development of our business. We also rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

Our success will significantly depend on our ability to obtain and maintain patent and other proprietary protection for commercially important technology and inventions and know-how related to our business, defend and enforce our patents, preserve the confidentiality of our trade secrets and operate without infringing the valid and enforceable patents and proprietary rights of third parties. We also rely on know-how and continuing technological innovation to develop and maintain our proprietary position.

Abaloparatide

We acquired and maintain exclusive worldwide rights, excluding Japan, to certain patents, data and technical information related to abaloparatide through a license agreement with an affiliate of Ipsen. Composition of matter of abaloparatide is claimed in the United States (U.S. Patent No. 5,969,095), Europe, Australia, Canada, China, Hong Kong, South Korea, New Zealand, Poland, Russia, Singapore, Mexico, Hungary, and Taiwan. These cases have a normal patent expiration date of 2016 absent any U.S. patent term extension under the Hatch-Waxman Act. The Phase 3 clinical dosage of abaloparatide by the subcutaneous route for use in treating osteoporosis is covered by Patent No. 7,803,770 until 2028 (statutory term extended with 175 days of patent term adjustment due to delays in patent prosecution by the United States Patent and Trademark Office, or USPTO) in the United States (absent any patent term extension under the Hatch-Waxman Act). The intended therapeutic formulation for Abaloparatide-SC is covered by Patent No. 8,148,333 until 2027 (statutory term extended with 36 days of patent term adjustment due to delays in patent prosecution by the USPTO) in the United States (absent any patent term extension under the Hatch-Waxman Act). Related cases granted in China, Australia, Singapore, Japan, Mexico, New Zealand, and Ukraine, and currently pending in Europe, China, Australia, Canada, Brazil, Singapore, South Korea, India, Israel, Norway, Russia, and Hong Kong will have a normal un-extended patent expiration date of 2027. Patent applications which cover various aspects of abaloparatide for microneedle application are pending in the United

States, Australia, Brazil, Canada, China, Europe, Israel, India, Japan, Korea, Mexico, New Zealand, Russia, Singapore, and Ukraine. Any claims that might issue from these applications will have a normal expiration date no earlier than 2032.

RAD1901

We exclusively license the worldwide rights, except for Japan, to RAD1901 from Eisai. US Patent No. 7,612,114 (statutory term extended to 2026 with 967 days of patent term adjustment absent any Hatch-Waxman patent term extension) and US Patent No. 8,399,520 (statutory term expires 2023) cover RAD1901 as a composition of matter as well as the use of RAD1901 for treatment of estrogen-dependent breast cancer. Corresponding cases issued in Australia and Canada and pending in India and Europe will have a normal expiration date in 2023. Patent applications covering methods of using RAD1901 for the treatment of vasomotor symptoms are pending in the United States (published as US 2010/0105733A1) and Canada, and granted in Europe; any issued claims will have a normal expiration in 2027. Patent applications covering a dosage form have been filed in the United States, Europe, Canada and Mexico, and any claims that might issue from these applications will have a normal expiration date no earlier than 2031.

RAD140

The composition of matter of, and methods of using, RAD140 is covered by US Patent No. 8,067,448 (effective filing date February 19, 2009, and a statutory term extended to September 25, 2029, with 281 days of patent term adjustment due to delays by the USPTO) and U.S. Patent No. 8,268,872 (effective filing date February 19, 2009 with term understood to be extended with 232 days of patent term adjustments). Related patents have been granted in Australia, Japan and Mexico and additional patent applications are pending in the United States and numerous additional countries worldwide. Any patents issued from these filings will have a normal expiration in 2029 absent any extensions.

There can be no assurance that an issued patent will remain valid and enforceable in a court of law through the entire patent term. Should the validity of a patent be challenged, the legal process associated with defending the patent can be costly and time consuming. Issued patents can be subject to oppositions, interferences and other third party challenges that can result in the revocation of the patent or that can limit patent claims such that patent coverage lacks sufficient breadth to protect subject matter that is commercially relevant. Competitors may be able to circumvent our patents. Development and commercialization of pharmaceutical products can be subject to substantial delays and it is possible that at the time of commercialization any patent covering the product has expired or will be in force for only a short period of time following commercialization. We cannot predict with any certainty if any third party U.S. or foreign patent rights, or other proprietary rights, will be deemed infringed by the use of our technology. Nor can we predict with certainty which, if any, of these rights will or may be asserted against us by third parties. Should we need to defend ourselves and our partners against any such claims,