Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EDGEWELL PERSONAL CARE Co | a8-k33114.htm |

| EX-99.1 - PRESS RELEASE, RESULTS OF OPERATIONS AND FINANCIAL CONDITION - EDGEWELL PERSONAL CARE Co | enrpr33114.htm |

| EX-99.2 - ENERGIZER ANNOUNCES INTENT TO SEPARATE INTO TWO PUBLICLY TRADED COMPANIES - EDGEWELL PERSONAL CARE Co | exhibit99233114.htm |

Creating Two Leading Consumer Companies April 30, 2014

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra This presentation contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, statements regarding the planned separation of the Household Products and Personal Care businesses, the timing of any such separation, the future earnings and performance of Energizer Holdings or any of its businesses, including the Household Products and Personal Care businesses on a standalone basis if the separation is completed. These statements generally can be identified by the use of forward-looking words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "will," "should," "forecast," "outlook," or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this presentation are only made as of the date of this presentation and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward- looking statements, including, without limitation whether the separation of the Household Products and Personal Care businesses is completed, as expected or at all, and the timing of any such separation; whether the conditions to the separation can be satisfied; whether the operational, marketing and strategic benefits of the separation can be achieved; whether the costs and expenses of the separation can be controlled within expectations; general market and economic conditions; market trends in the categories in which we operate; the success of new products and the ability to continually develop and market new products; our ability to attract, retain and improve distribution with key customers; our ability to continue planned advertising and other promotional spending; our ability to timely execute strategic initiatives, including restructurings, in a manner that will positively impact our financial condition and results of operations and does not disrupt our business operations; the impact of strategic initiatives, including restructurings, on our relationships with employees, customers and vendors; our ability to maintain and improve market share in the categories in which we operate despite heightened competitive pressure; our ability to improve operations and realize cost savings; the impact of raw material and other commodity costs; the impact of foreign currency exchange rates and currency controls as well as offsetting hedges; our ability to acquire and integrate businesses, and to realize the projected results of acquisitions; the impact of advertising and product liability claims and other litigation; compliance with debt covenants as well as the impact of interest and principal repayment of our existing and any future debt; or the impact of legislative or regulatory determinations or changes by federal, state and local, and foreign authorities, including taxing authorities. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in Energizer's publicly filed documents, including its annual report on Form 10-K for the year ended September 30, 2013. Cautionary Statement 1

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Trademarks and Brands We use “Energizer” and the Energizer logo as our trademarks. Product names and company programs appearing in this presentation are trademarks of Energizer Holdings, Inc. or its subsidiaries. This presentation also may refer to brand names, trademarks, service marks and trade names of other companies and organizations, and these brand names, trademarks, service marks and trade names are the property of their respective owners. Market and Industry Data Unless we indicate otherwise, we base the information concerning our industry contained in this presentation on our general knowledge of and expectations concerning the industry. Our market position and market share is based on our estimates using data from various industry sources and assumptions that we believe to be reasonable based on our knowledge of the industry. We have not independently verified data from industry sources and cannot guarantee its accuracy or completeness. In addition, we believe that data regarding the industry and our market position and market share within such industry provides general guidance but is inherently imprecise. Regulation G – Non-GAAP Financial Measures For full reconciliation of non-GAAP financial measures, visit www.energizerholdings.com, About Energizer, Investor Relations, Presentations Additional Disclosures 2

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Energizer Holdings to separate into two companies through a tax-free spin-off Reflects our continued focus on creating long term shareholder value Creates two strong independent public companies — Distinct brands, categories and corporate strategies Multi-year restructuring program will continue to be implemented as planned Expected to close in second half of FY2015 Summary 3

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Geographies Global Predominantly Developed Markets Channel Focus Across All Retail Formats (Modern and Traditional) Primarily Modern (FDM) Retail Presence/ Relationships Relatively complex Varied in-store locations Multiple buyers per account Relatively simple Center of store locations Single buyer per category Advertising & Promotion Focused on distribution, merchandising and visibility Focused on consumer pull and advertising Near-Term Operational Focus Optimize cost structure Invest in innovation CPG Companies with Distinct Operating Models 4 Household Products Personal Care

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Household Products Personal Care Strong Brand Portfolios 5

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Business Mix New Household Products: Overview 6 Leading consumer products company with globally recognized brands and icons Strong market positions around the globe Products sold throughout the world Strong cycle plan for marketing and innovation Robust profitability and cash flow Revenue: $1.9 billion 63% 37% Alkaline Batteries Other Batteries and Lighting 50% 23% 18% 9% US & Canada EMEA Asia Latin America

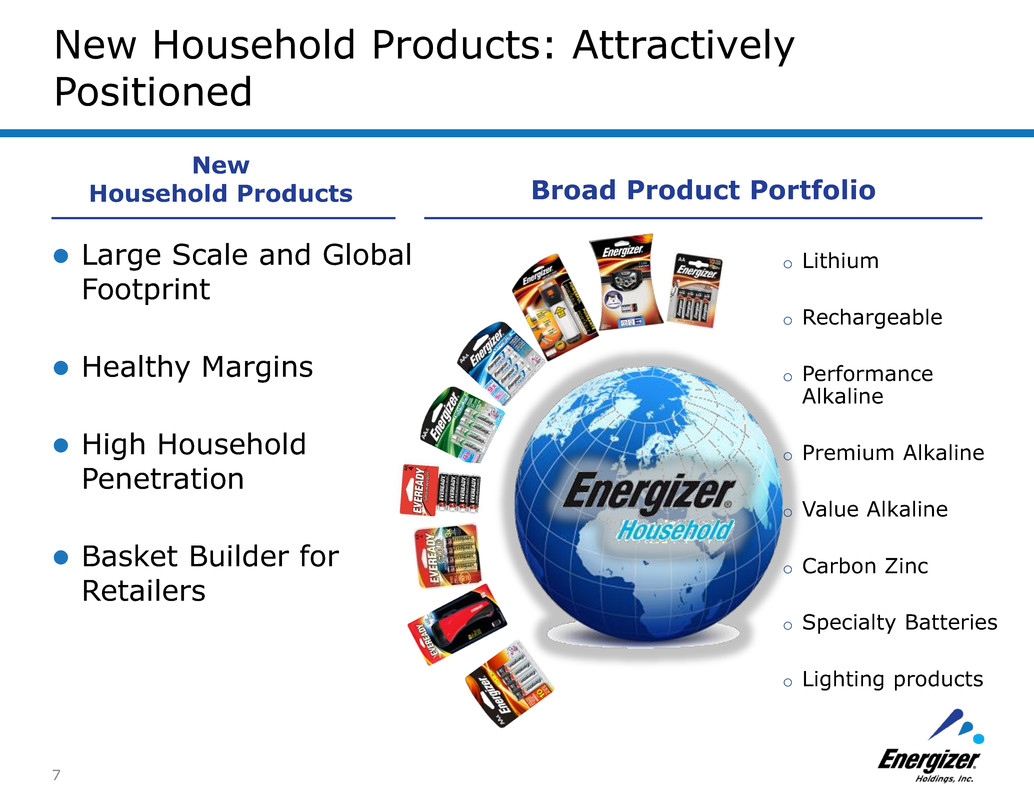

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra New Household Products: Attractively Positioned 7 New Household Products Broad Product Portfolio Large Scale and Global Footprint Healthy Margins High Household Penetration Basket Builder for Retailers o Lithium o Rechargeable o Performance Alkaline o Premium Alkaline o Value Alkaline o Carbon Zinc o Specialty Batteries o Lighting products

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Build market share through distribution and investment in effective category fundamentals Drive relevant, consumer-led marketing innovation Accelerate initiatives to optimize global cost structure Substantial free cash flow to enable return of capital to shareholders New Household Products: Strategy 8 Leverage leading brands and product portfolio to generate significant cash flows

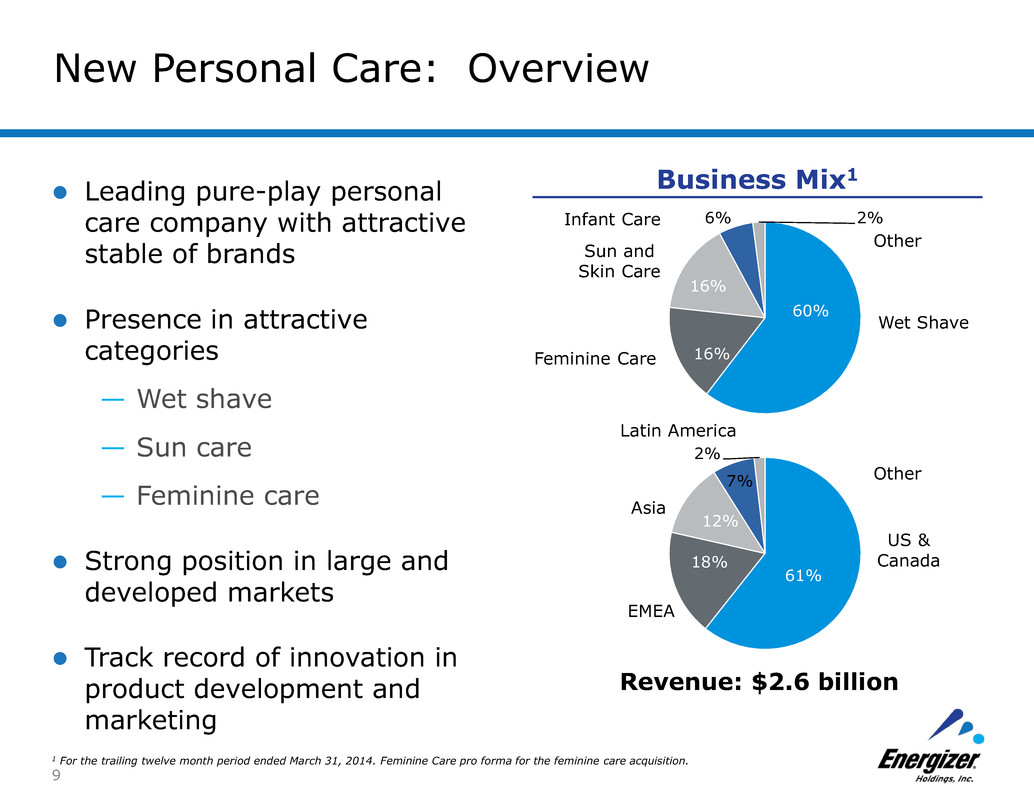

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Business Mix1 New Personal Care: Overview 9 1 For the trailing twelve month period ended March 31, 2014. Feminine Care pro forma for the feminine care acquisition. Leading pure-play personal care company with attractive stable of brands Presence in attractive categories — Wet shave — Sun care — Feminine care Strong position in large and developed markets Track record of innovation in product development and marketing Revenue: $2.6 billion 60% 16% 16% 6% 2% Wet Shave Sun and Skin Care 61% 18% 12% 7% 2% US & Canada EMEA Asia Latin America Feminine Care Infant Care Other Other

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra New Personal Care: Attractive Categories Category Brands Key Geographies Rank Wet Shave US, Japan, Western Europe #2 Sun and Skin Care US, Mexico, Australia #1 Feminine Care US #2 Infant Care US #1 10

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Accelerate growth across all categories — Meaningful investments in building brand equity — Maintain strong innovation pipeline Focused global go-to-market strategy Substantial free cash flow to enable investments and capital return Disciplined approach to personal care acquisitions New Personal Care: Strategy Brand investments and innovation to drive topline growth and market share 11

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Intensify focus on distinct commercial priorities of Household Products and Personal Care Allocate the resources of each business to meet its needs Allow each business to pursue distinct capital structures and capital allocation strategies Provide clear investment thesis and visibility to attract long- term investor base suited to each business Rationale for Separation Maximize strategic flexibility and value to shareholders 12

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Executive Chairman J. Patrick Mulcahy Ward Klein Chief Executive Officer Alan Hoskins David Hatfield Executive Management 13 Household Products Personal Care

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Tax-free distribution of new SpinCo stock to Energizer Holdings shareholders SpinCo entity / Stock distribution ratio are to be determined Transaction is expected to close in the second half of FY2015 Timeline designed so that ongoing initiatives are not disrupted Subject to market, regulatory and certain other conditions Expect to incur one-time charges related to the transaction during the periods preceding the separation Both companies are expected to be well capitalized with independent approaches to capital allocation Final approval by Energizer Board of Directors Favorable opinion confirming tax-free spin Effective Form 10 registration statement filed with the SEC Transaction Details 14 Potential Structure Potential Timing Financial Implications Closing Conditions

ZITHER2014\02 Presentations\03 Announcement Investor Presentation\DRAFT Project Hazel Announcement 15.pptx 99 107 112 177 181 183 185 188 191 Excel color scheme 47 99 164 Page heading title Non-bold Page heading subtitle Non-bold 0 147 221 147 153 199 Chart title bar 0 0 0 176 177 182 0 0 0 190 194 221 0 174 239 36 62 149 29 118 188 77 77 77 Extra Regulation G – Non GAAP Reconciliation 15 Non-GAAP Financial Measures. While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), these presentation slides include non-GAAP measures. These non-GAAP measures, such as pro forma Feminine Care Net Sales for the feminine care acquisition, which includes pro forma Net Sales for the feminine care acquisition, as outlined in the table below are not in accordance with, nor are they a substitute for, GAAP measures. The Company believes these non-GAAP measures provide a meaningful comparison to the corresponding historical or future period and assist investors in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. Personal Care - Sales Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 TTM Net Sales $ 649.5 $ 592.5 $ 550.2 $ 689.0 $ 2,481.2 Pro forma Net Sales 67.0 60.4 19.3 - 146.7 Total Pro forma Net Sales $ 716.5 $ 652.9 $ 569.5 $ 689.0 $ 2,627.9 Feminine Care - Sales Q3 FY13 Q4 FY13 Q1 FY14 Q2 FY14 TTM Feminine Care Net Sales $ 46.4 $ 47.9 $ 80.9 $ 107.0 $ 282.2 Feminine Care Pro forma Net Sales 67.0 60.4 19.3 - 146.7 Feminine Care Total Pro forma Net Sales $ 113.4 $ 108.3 $ 100.2 $ 107.0 $ 428.9 Feminine Care Net Sales % 11% Feminine Care Total Pro forma Net Sales % 16%