Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - Vocus, Inc. | d718179dex311.htm |

| EX-31.2 - EX-31.2 - Vocus, Inc. | d718179dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-51644

VOCUS, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 58-1806705 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) |

12051 Indian Creek Court

Beltsville, Maryland 20705

(301) 459-2590

(Address including zip code, and telephone number, including area code, of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, par value $.01 per share | NASDAQ Global Select Market | |

| (Title of Class) | (Names of Each Exchange on which Registered) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the common stock held by nonaffiliates of the registrant (19,699,395 shares) based on the $10.52 closing price of the registrant’s common stock as reported on the NASDAQ Global Market on June 30, 2013, was approximately $207,237,635. For purposes of this computation, all officers, directors and 10% beneficial owners of the registrant are deemed to be affiliates. Such determination should not be deemed to be an admission that such officers, directors or 10% beneficial owners are, in fact, affiliates of the registrant.

As of February 28, 2014, there were 21,621,817 outstanding shares of the registrant’s common stock.

Documents Incorporated by Reference

None.

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Form 10-K/A”) amends the Annual Report on Form 10-K for the year ended December 31, 2013 (the “Original Form 10-K”) of Vocus, Inc. filed with the Securities and Exchange Commission (the “SEC”) on March 7, 2014. This Form 10-K/A is being filed to include certain information that was to be incorporated by reference from our definitive proxy statement (pursuant to Regulation 14A under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) for our 2014 Annual Meeting of Stockholders (the “2014 Proxy Statement”). This Form 10-K/A hereby amends and restates in their entirety Items 10 through 14 of Part III of the Original Form 10-K as well as the cover page to remove the statement that information is being incorporated by reference from the 2014 Proxy Statement.

Except as otherwise expressly noted herein and the filing of related certifications, this Form 10-K/A does not amend any other information set forth in the Original Form 10-K, and we have not updated disclosures contained therein to reflect any events that occurred at a date subsequent to the date of the Original Form 10-K. Accordingly, this Form 10-K/A should be read in conjunction with the Original Form 10-K and our other filings with the SEC.

Unless the context requires otherwise, all references to “Vocus,” “we,” “our” and “us” mean Vocus, Inc., a Delaware corporation.

Table of Contents

| Page | ||||||

| PART III | ||||||

| Item 10. |

1 | |||||

| Item 11. |

3 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

20 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

21 | ||||

| Item 14. |

22 | |||||

| PART IV | ||||||

| Item 15. |

23 | |||||

| 24 | ||||||

Table of Contents

| Item 10. | Directors, Executive Officers and Corporate Governance |

DIRECTOR INFORMATION AND QUALIFICATIONS

Our certificate of incorporation and bylaws provide that the number of our directors shall be fixed from time to time by resolution of our board of directors (“Board of Directors” or “Board”). Presently, the number of directors is fixed at seven, and that number of directors is divided into three classes, with one class standing for election each year for a three-year term. At each annual meeting of stockholders, directors of a particular class will be elected for three-year terms to succeed the directors of that class whose terms are expiring. Six of our directors are elected by the holders of our common stock, and one of our directors is elected by the holder or holders of our convertible preferred stock.

Listed below are the biographies of each director. The biographies include information regarding each individual’s service as a director of the Company, business experience and principal occupations for at least the past five years, director positions at public companies held currently or at any time during the past five years, and the experiences, qualifications, attributes or skills that led the Corporate Governance & Nominating Committee (the “Governance Committee”) to recommend, and the Board to determine, that the person should serve as a director for the Company.

Kevin Burns, 64, has been a member of our Board of Directors since October 2000 and was named our lead director in January 2008. Mr. Burns was a managing principal of Lazard Technology Partners, a private equity firm, from March 1998 until February 2013. Since February 2013, Mr. Burns has served as a technology investor and board advisor to various companies. Mr. Burns founded Intersolv, Inc. (formerly Sage Software), a software company, in 1982 and served as its President and Chief Executive Officer until 1997. Mr. Burns also serves on the board of directors of BoxTone Inc., a privately held technology company. Mr. Burns holds a B.S. degree in finance from The Ohio State University and an M.B.A. in finance from the University of Colorado at Boulder.

The Board believes that Mr. Burns’ formal education, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership with technology companies over the course of his successful career provide Mr. Burns with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Gary Golding, 57, has been a member of our Board of Directors since January 2000. Mr. Golding has been a general partner with Edison Venture Fund, a venture capital fund, since November 1997. Mr. Golding also serves on the board of directors of Tangoe, Inc., a public company, and on the board of directors of JTH Holding Inc., a public company. Mr. Golding holds a B.A. degree in management from Boston College and a Masters degree in Urban and Regional Planning from the University of Pittsburgh.

The Board believes that Mr. Golding’s formal education, his service on the boards of several other companies, and his in-depth knowledge of the Company’s businesses and industry provide Mr. Golding with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Gary Greenfield, 59, has been a member of our Board of Directors since October 2008. Mr. Greenfield has served as a Partner at Court Square Capital Partners since February 2013. From 2007 to February 2013, Mr. Greenfield served as Chairman, Chief Executive Officer and President of Avid Technology, Inc., a provider of digital media content-creation solutions. From 2003 to 2007, Mr. Greenfield was Chief Executive Officer of GXS, Inc., a privately held technology company. Mr. Greenfield has also served as Chief Executive Officer of Peregrine Systems, Inc., and President and Chief Executive Officer of Merant, and Chief Executive Officer of Intersolv, Inc., which merged with MicroFocus to form Merant. Mr. Greenfield serves on the board of directors of Ancile and Encompass Digital Media, both privatey held companies. Mr. Greenfield holds a B.S. degree from the U.S. Naval Academy, an M.S.A. degree from George Washington University, and an M.B.A. degree from Harvard Business School.

The Board believes that Mr. Greenfield’s formal education, his positions as CEO of both private and public companies, his service as a director on the boards of both private and public companies, and his demonstrated leadership over the course of his successful career provide Mr. Greenfield with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Ronald Kaiser, 60, has been a member of our Board of Directors since January 2005. Mr. Kaiser has served as the interim Chief Executive Officer of The Neat Company, a privately held digital filing company, since October 2013 (and has served on its board since November 2012). From January 2008 through October 2009 and from March 2011 until October 2013, Mr. Kaiser served as an independent consultant and board member for companies in the technology and life sciences fields. From November 2009 to March 2011, Mr. Kaiser served as Chief Executive Officer and Chairman of the Board of MobileAccess Networks, Inc., a privately held provider of in-building wireless communications equipment. From January 2007 to January 2008, Mr. Kaiser served as the Chief Financial Officer for Sucampo Pharmaceuticals, Inc., a pharmaceutical research and development company. From March 2005 through December 2006, Mr. Kaiser served as Chief Financial officer of PharmAthene, Inc., a bio-defense company. From April 2003 to January 2005, Mr. Kaiser served as Chief Financial Officer of Air Cargo, Inc., a freight logistics and bill processing provider. In December 2004, Air Cargo filed a voluntary petition for bankruptcy under Chapter 11 of the United States Bankruptcy Code. Mr. Kaiser served as a member of the board of directors of OPNET Technologies, Inc., a public company, from October 2003 through its sale in December 2012, as a member of the board of directors of Tangoe, Inc., a public company, since January 2009 and on the board of directors of a number of privately held companies and non-for-profit organizations. Mr. Kaiser holds B.A. degrees in accounting and in multidisciplinary-prelaw from Michigan State University.

1

Table of Contents

The Board believes that Mr. Kaiser’s formal education, his experience as Chief Financial Officer of several public and private companies, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership over the course of his successful career provide Mr. Kaiser with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Robert Lentz, 53, co-founded Vocus and served as our Chief Technology Officer from 1992 until February 2008. Mr. Lentz has been a member of our Board of Directors since 1992. Prior to joining Vocus, Mr. Lentz served as President of Dataway Corporation, a software development company. From 2006 until 2010, Mr. Lentz also served on the board of directors of Savo, a privately held technology company.

The Board believes that Mr. Lentz’ former position as Chief Technology Officer of the Company and his in-depth knowledge of the Company’s businesses and industry provide Mr. Lentz with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Richard Rudman, 53, co-founded Vocus and has served as our Chief Executive Officer, President and Chairman since 1992. From 1986 through 1992, Mr. Rudman served as a senior executive at Dataway Corporation, a software development company. From 1984 through 1986, Mr. Rudman served as an accountant and systems analyst at Barlow Corporation, a privately held real estate development and management company. From 1979 through 1983, Mr. Rudman served in the United States Air Force. Mr. Rudman holds a B.S. degree in accounting from the University of Maryland and is a Certified Public Accountant.

The Board believes that Mr. Rudman’s formal education, his position as CEO of the Company, his in-depth knowledge of the Company’s businesses and industry, and his demonstrated leadership over the course of his successful career provide Mr. Rudman with the appropriate attributes to serve on the Board and enable him to make valuable contributions to the Board and to the Company.

Jit Sinha, 39, has been a member of our Board of Directors since February 2012 when the Board of Directors appointed him to serve as the initial director designated by the holder of our convertible preferred stock. Mr. Sinha was then elected by the holder of our convertible preferred stock. Mr. Sinha is a General Partner of JMI Equity, a growth equity firm. Mr. Sinha has served on the board of directors of several privately held companies. Previously, Mr. Sinha worked as a Principal at Bain Capital Ventures, and in operating roles at several software companies. Mr. Sinha holds a B.S. degree in finance and a B.A. degree in sociology from the University of Pennsylvania.

EXECUTIVE OFFICERS

A listing of our executive officers, key employees and their biographies are included under the caption “Executive Officers and Key Employees” under Item 1 of the Original Form 10-K.

CORPORATE GOVERNANCE

Investor Designated Director

On February 24, 2012, in connection with our acquisition of iContact Corporation, we issued 1,000,000 shares of Series A convertible preferred stock to JMI Equity Fund VI, L.P. (“JMI”), which had been a stockholder of iContact. Each share of Series A convertible preferred stock is initially convertible into 3.0256 shares of our common stock. Pursuant to the certificate of designation of the Series A convertible preferred stock, for so long as the outstanding shares of preferred stock continue to represent at least 5% of the total outstanding shares of our common stock, calculated assuming the conversion of all outstanding shares of preferred stock into shares of common stock, the holders of the preferred stock, voting as a separate class, will have the exclusive right to elect one director to our Board (the “Series A Director”). In addition, pursuant to an Investor Rights Agreement we entered into with JMI, the holders of the preferred stock have the right to nominate a director to our board of directors for as long as they hold 5% or more of our issued and outstanding capital stock (which nominee shall be the Series A Director for so long as the holders of preferred stock have the right to elect the Series A Director pursuant to the certificate of designation). Jit Sinha currently serves as the Series A Director.

Committees of the Board of Directors

The Audit Committee

The Audit Committee currently consists of Messrs. Kaiser, Burns and Golding. Mr. Kaiser serves as the Chairman of the Audit Committee. The Board of Directors has determined that each of the members of the Audit Committee is independent under the NASDAQ Marketplace Rules and under rules adopted by the SEC pursuant to the Sarbanes-Oxley Act of 2002. The Board of Directors has also determined that all members of the Audit Committee meet the requirements for financial literacy and that Mr. Kaiser qualifies as an “audit committee financial expert” in accordance with applicable rules and regulations of the SEC.

Code of Conduct

We have adopted a Code of Conduct for all of our employees, including all of our executive officers. This Code of Conduct is available on our website, at www.vocus.com. We intend to disclose any amendments to or waivers of a provision of our Code of Conduct made with respect to our directors or executive officers on our website. One may also obtain, without charge, a copy of this Code of Conduct by contacting our Investor Relations Department at (301) 459-2590. These documents are also available in print to any stockholder requesting a copy in writing from our corporate secretary at our executive offices set forth herein.

2

Table of Contents

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2013, the Compensation Committee of the Board of Directors consisted of Messrs. Burns, Golding and Kaiser. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers who serve on our Board of Directors or Compensation Committee.

During 2013, none of our executive officers served as: (i) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Compensation Committee; (ii) a director of another entity, one of whose executive officers served on our Compensation Committee; or (iii) a member of the compensation committee (or other committee of the board of directors performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as one of our directors.

| ITEM 11. | Executive Compensation |

COMPENSATION DISCUSSION AND ANALYSIS

In this section, we provide an explanation and analysis of the material elements of the compensation provided to our named executive officers. Throughout this section, the individuals who served as chief executive officer and chief financial officer for 2013, as well as the other executive officers named in the “Summary Compensation Table” below, are referred to as our “named executive officers” or “NEOs.”

Named Executive Officers for 2013:

| Richard Rudman | Chief Executive Officer, President and Chairman | |||||

| Mark Heys | Chief Technology Officer | |||||

| Stephen Vintz | Executive Vice President, Chief Financial Officer, Treasurer and Secretary | |||||

| Norman Weissberg(1) | Senior Vice President, North American Sales | |||||

| (1) | Mr. Weissberg ceased to be an executive officer in February 2014. |

Executive Summary

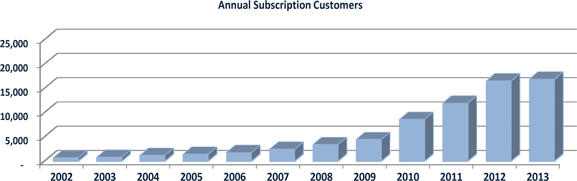

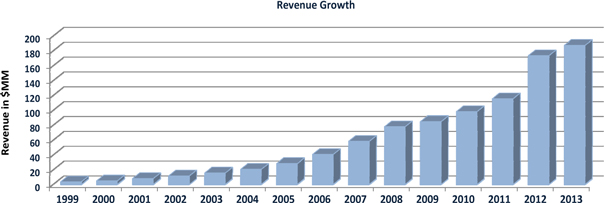

We are a leading provider of cloud-based marketing and public relations software that enables companies to acquire and retain customers. We offer products and services to help customers attract and engage prospects, capture and keep customers and measure and improve marketing effectiveness. Our cloud solutions address key areas of digital marketing and public relations, including social media marketing, search marketing and news distribution, email marketing and publicity. Our software is designed for marketers to attract customers through search engines, increase and engage their followers on social networks, communicate with prospects and customers via email and generate and track visibility in traditional and online media.

In order to support our strategy and to continue to deliver strong execution, we strive to provide an executive compensation program that serves to attract, retain, motivate and reward highly qualified executive officers in a highly competitive software industry. To reinforce our performance oriented, results-based culture that rewards individual, team and corporate success, we use a mix of compensation elements including base salary, cash bonus compensation that is solely based on financial performance, equity incentives, change of control benefits and employee benefits.

Company Performance

Below are some of our business achievements in 2013:

| • | GAAP revenue for 2013 was $186.9 million, a 9% increase over 2012. |

| • | Increased revenue for our marketing suite product by over 280% to $17.2 million in 2013. |

| • | Cash flow from operations was $6.8 million. |

| • | Released the next generation of the Vocus Marketing Suite, which includes new features such as landing pages, campaigns, social customer relationship management and improved tracking. |

| • | Launched a completely redesigned Vocus Public Relations Suite with several new enhancements, including advanced media and outlet filtering and the ability to edit scheduled distributions. |

| • | Announced the closing of our small business sales operations in Manila, the closing of North Social, a business that provides standalone Facebook applications primarily to small organizations and the discontinuance of our Small Business Edition product. |

| • | In February 2014, announced the appointment of Steve Pogorzelski, a technology and sales veteran formerly with ClickFuel and Monster, to the position of Chief Revenue Officer at Vocus. |

3

Table of Contents

These achievements are part of our broader value creation strategy to move away from non-core point products to concentrate our efforts on selling integrated suites to marketing and PR professionals.

2013 Compensation Decisions

The Committee believes financial and operating performance are important in terms of managing sustained performance for the creation of long-term shareholder value. Company performance is based not only on total shareholder return (TSR) but on financial metrics including revenue, adjusted operating income and cash flow from operations. Our key executive compensation decisions for 2013 included the following:

| • | Held base salaries steady for Messrs. Rudman, Vintz, Heys and Weissberg aligning with the 35th, 30th, 30th and 45th percentiles of the peer group, respectively, following a review of individual performance and peer compensation data. |

| • | Set total cash compensation targets (base salary plus target annual incentive) at 100% achievement of financial goals that are generally consistent with the competitive 55th percentile, although the CEO and CFO total cash compensation align to the 45th percentile of the peer group. |

| • | Set CEO and CFO total direct compensation targets that are generally consistent with the 60th and 65th percentile of the peer group respectively, although variable pay components make up a significant part of total direct compensation which may result in realizable pay that aligns with a lower percentile of the peer group . |

| • | Cash incentive awards granted to our Named Executive Officers individually ranged from 56% to 100% of their respective target levels. |

| • | Updated the peer group of companies which we utilize to make competitive executive compensation comparisons; improving the match to, and focusing on companies in our sector with similar size, and eliminating companies that have been acquired. |

4

Table of Contents

Pay for Performance

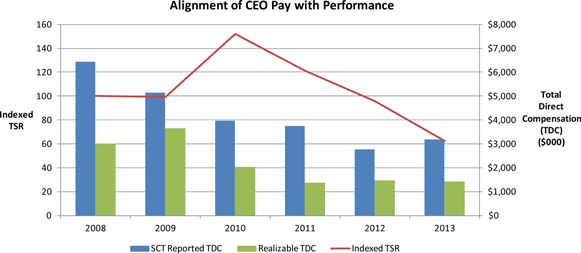

Aligning compensation paid to our NEOs with company performance is at the core of our compensation philosophy. Compensation paid to our CEO is one example of how we adhere to this philosophy. In 2013, our overall financial performance was below several of our internal targets, and these factors negatively impacted the compensation of our CEO, as intended by the design of our compensation program. Additionally, Mr. Rudman’s compensation relates appropriately to our TSR over time. The table below shows the comparison of Mr. Rudman’s total compensation1 from the “Summary Compensation Table” to our indexed TSR2 over the past five fiscal years, as well as Mr. Rudman’s realizable total compensation3 which is actual paid cash compensation plus in-the-money or period-ending value of awards granted during the year:

| 1 | Reported in thousands. |

| 2 | Indexed TSR was calculated based on an assumed $100 investment in Vocus common stock on December 31, 2008 and then adjusted for each year based on the return that would have been made on that investment as of December 31 of each year. |

| 3 | Reported in thousands. |

The “Compensation Discussion and Analysis” and the tables and narratives disclose CEO compensation in compliance with required SEC reporting rules. However, such compensation disclosures may obscure the degree to which pay and performance were linked in any given year. In assessing our compensation programs and making compensation determinations, it is important to note that the Compensation Committee evaluates the pay for performance link by assessing the relationship of compensation that would be earned—especially equity award values actually generated—to our business performance for the corresponding year or period. The Compensation Committee believes that this view of realizable pay more precisely demonstrates the link between pay and performance than relying on pay numbers generated, for example, by accounting values established at the grant date for equity awards. For example, many stock option awards may have little to no value because of our current stock price and the exercise price of the award. So our NEOs realizable total compensation may be much less than the target peer group thus keeping compensation aligned with TSR.

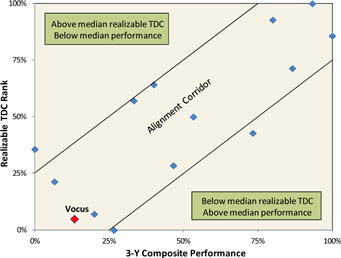

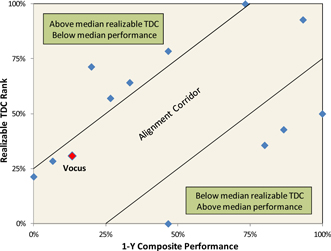

The following charts demonstrate the alignment between Mr. Rudman’s realizable pay and our performance over the last one and three year periods compared to the Vocus peer group described in more detail under “Benchmarking”. While TSR is an important financial metric, the Committee believes financial and operating performance are also important in terms of managing sustained performance for the creation of long-term shareholder value. As such, Company performance or “Composite Performance” is based not only on TSR but on the financial metrics used in our annual cash incentive plan, including revenue, adjusted operating income and cash flow from operations. The resulting comparison shows that Mr. Rudman’s realizable pay is reasonably aligned with our Composite Performance.

5

Table of Contents

Over the one- and three-year periods of 2011 through 2013, our Composite Performance approximated the 13th percentile of the peer group, for both the one- and three year periods, while Mr. Rudman’s aggregate realizable compensation over the same period approximated the 31st and 5th percentiles of the Vocus Peer Group’s CEOs, respectively.

Corporate Governance

Our pay practices emphasize good governance and market practice, and are designed to incentivize long-term shareholder value creation while providing total compensation opportunities that will allow us to attract, retain and motivate highly talented executives. To this end:

| • | Total direct compensation is competitively targeted at the median of our peer group, but the CEO and CFO actual total direct compensation resulted in compensation approximating the 35th percentile of the peer group, with an emphasis on long-term equity incentives. |

| • | Base salaries approximate the 40th percentile of the peer group, although the CEO and CFO base salaries align with the 25th and 35th percentiles of the peer group respectively. |

| • | Annual bonus payouts are performance based, and in 2013 the Company did not make any additional discretionary or guaranteed bonus payments (other than the annual bonus payments). |

| • | Total cash compensation at 100% achievement of target approximates the 55th percentile of the peer group. |

| • | We have very limited perquisites which are not integral to our compensation program. For example, we do not have perquisites such as club memberships or financial planning services, and we do not have any separate executive retirement plan that is not generally available to all employees. |

| • | The Compensation Committee has authority to select, retain and/or replace any compensation or other outside consultant for assistance in the evaluation of director, CEO or other executive officers’ compensation, including the sole authority to approve the consultant’s fees and other retention terms. The Compensation Committee has used an independent compensation consultant to aid in the evaluation of our executive compensation program. Such consultant does not provide any services to our management and had no prior relationship with our management prior to its engagement by the Compensation Committee. |

| • | We maintain a strong risk management program, which includes our Compensation Committee’s significant oversight of the ongoing evaluation of the relationship between our compensation programs and risk. The details of this risk assessment can be found below in the section entitled “Compensation Risk Assessment.” |

| • | Our 2005 Stock Award Plan prohibits restricted stock awards from being sold, transferred, pledged, hypothecated, margined or otherwise encumbered by the award holders. Additionally, all of our directors, officers and restricted employees are subject to our Insider Trading Policy. Our Insider Trading Policy prohibits, among other things, insiders from engaging in short-term or recurring speculative transactions in our securities, including (i) short sales, (ii) short-term trading, (iii) any short-term or speculative transaction whereby the insider could profit from a decline in our stock price, and (iv) transactions involving publicly traded options or other derivatives, such as trade in puts or calls in our stock. |

| • | In February 2014, our Board adopted stock ownership guidelines for our CEO and other executive officers. |

| • | In February 2014, the Board adopted a clawback policy applicable to our executive officers, providing our Board with the ability to require the reimbursement or forfeiture of cash incentive-based compensation in the event of fraud or intentional misconduct that results in the required restatement of our financial statements. |

Stockholder Advisory Vote on Executive Compensation

At our 2013 Annual Meeting of the Stockholders (the “2013 Annual Meeting”), we provided our stockholders with the opportunity to vote, on an advisory basis, to approve the compensation of our NEOs as described in our proxy statement for the 2013 Annual Meeting. Our stockholders did not approve the compensation of our NEOs with 45% of the votes cast in favor of such compensation (the “2013 Say-on-Pay Vote”).

While this vote was, and will continue to be, advisory and non-binding, to the extent there is a significant vote against the compensation of our NEOs, we will consider stockholder concerns and the Compensation Committee and Board will evaluate whether any actions are necessary to address those concerns. We have carefully considered the 2013 Say-on-Pay Vote and its implications for our executive compensation philosophy, program and practices, and for our executive compensation disclosure practices. In 2013, as in previous years, the Compensation Committee engaged an independent compensation consulting firm to conduct an overall review of our executive compensation practices. The Compensation Committee also undertook an in-depth analysis of our executive compensation.

In connection with the 2013 Say-on-Pay Vote, a member of the Compensation Committee and our Chief Financial Officer reached out to major stockholders to understand their thinking about our executive compensation programs and policies and reported back to the Compensation Committee. Our outreach included discussions with institutional stockholders (including representatives of mutual fund families, investment managers, non-U.S. investment funds, and pension funds), review of written correspondence submitted by stockholders to the Board or management, internal discussions with employees, analysis of market practices at peer companies, advice from the Compensation Committee’s independent compensation consultant, and discussions with proxy advisory services and corporate governance research firms, regarding our executive compensation programs and Board decisions.

6

Table of Contents

As a result of these discussions and in light of the outcome of our 2013 Say-on-Pay Vote, we modified our executive compensation programs and policies in significant ways, including:

| • | Engaged an independent national executive compensation consulting firm to help us improve our executive compensation practices (as we have done in previous years); |

| • | Did not increase the chief executive officer’s salary or bonus for 2014; |

| • | Aligned target total direct compensation of our chief executive officer roughly with the median compensation level of peer company chief executive officers; |

| • | Eliminated gross-up provisions by revising the chief financial officer’s employment agreement in March 2014; |

| • | Implemented double-trigger vesting on equity awards in 2014 and thereafter by revising employment agreements for executive officers to eliminate single-trigger vesting; |

| • | Adopted stock ownership guidelines for our CEO and other executive officers; and |

| • | Adopted a clawback policy applicable to our executive officers, providing our Board with the ability to require the reimbursement or forfeiture of cash incentive-based compensation in the event of fraud or intentional misconduct that results in the required restatement of our financial statements. |

We believe that we have responded appropriately to the concerns expressed by our stockholders and that our executive compensation arrangements closely align the interests of our NEOs with the interests of our stockholders. We value the feedback from stockholders on this matter and will continue to conduct outreach to obtain such feedback.

Compensation Philosophy and Objectives

We believe strongly in pay-for-performance and measurement of quantifiable results. While compensation for the CEO and other executive officers should reflect the marketplace for similar positions, a significant portion of their compensation is earned based on our financial performance and the financial performance of each executive’s area of responsibility. Quantifiable financial performance objectives related to topline growth, profit margins and cash flow are established in advance and recommended by the Compensation Committee for approval by the full Board, early in the year. Our emphasis on measurable performance objectives emanates from our belief that sustained strong financial performance is an effective means of enhancing long-term stockholder return. Although qualitative objectives are important to the effective management of the Company, we do not tie incentive compensation to such qualitative objectives.

Our executive compensation program is intended to:

| • | Attract, retain, motivate and reward highly qualified executive officers who create value for our stockholders; |

| • | Reinforce our performance oriented, results-based culture that rewards individual, team and corporate success; |

| • | Reflect the financial resources available to us based on our Board-approved annual business plan and our strategic objective to increase stockholder value; |

| • | Encourage company performance without encouraging excessive risk by using a mix of compensation elements; and |

| • | Consider corporate tax deductions and accounting rules when appropriate. |

Key elements of our executive compensation program include:

| • | Annual base salaries that are competitive relative to other public technology companies in our peer group; |

| • | Cash bonuses that are solely based on financial performance; |

| • | Long-term incentive compensation that is delivered through a combination of stock option and restricted stock awards, and in 2014, performance-based restricted stock unit awards; and |

| • | A balanced portfolio emphasizing variable and long-term compensation. |

We believe that our executive compensation program makes a significant contribution to our success, mirrors our culture, promotes employee commitment to our Company, and adheres to high standards of corporate governance. We have created a compensation program that has a mix of short-term and long-term components, cash and equity elements and fixed and contingent payments in proportions that we believe will provide appropriate incentives to retain and incentivize our NEOs and other senior executives and attract newly hired NEOs and executives.

7

Table of Contents

Compensation Committee Oversight of Executive Compensation

The Compensation Committee has overall responsibility for recommending the compensation of our Chief Executive Officer, or CEO, and other executive officers to the Board of Directors for approval. Each member of the Committee is appointed by the Board and has been determined by the Board to be an independent director under applicable NASDAQ Marketplace Rules.

At the beginning of each year, the Compensation Committee reviews the preceding year’s performance of the Company and of each individual executive officer, as well as each executive officer’s compensation, tenure, past employment experience and compensation history, and potential to contribute to our future growth. At that time, the Committee determines each executive officer’s compensation for the new year. As part of the Committee’s review, the CEO delivers a report on the performance of the Company and of each executive officer, including a self-assessment of his own performance. The CEO also proposes compensation packages for the executive officers (except for the CEO) based on the competitive benchmarking analysis provided by an independent compensation consultant, which the Committee considers in making its decisions. The Committee makes regular reports to the full Board of Directors on the Committee’s activities, and the Committee prepares an annual report on executive compensation.

Compensation Consultant

The Compensation Committee has the sole authority to select, retain and/or replace any compensation or other outside consultant for assistance in the evaluation of director, CEO or other executive officers’ compensation, including the sole authority to approve the consultant’s fees and other retention terms. In 2013, the Compensation Committee selected Pearl Meyer & Partners, or PM&P, as its compensation consultant. The Committee considers PM&P to be independent and selected PM&P because of its experience in compensation consulting, and its knowledge of compensation practices in the technology industry. PM&P does not serve as the Company’s independent registered public accounting firm. Services provided by the consultant have included evaluating our existing executive officer and director compensation based on market comparables, analyzing compensation design alternatives and advising us on proxy statement disclosure rules. The consultant did not provide specific recommendations on compensation decisions regarding the CEO or other executive officers.

The Compensation Committee regularly reviews the services provided by its outside consultants and believes that PM&P is independent in providing executive compensation consulting services. In 2013, the Compensation Committee conducted a specific review of its relationship with PM&P and determined that PM&P’s consulting work for the Compensation Committee did not raise any conflicts of interest, consistent with the guidance provided under the Dodd-Frank Wall Street Reform and Consumer Protection Act, or the Dodd-Frank Act, and by the SEC and the NASDAQ. The Compensation Committee continues to periodically monitor the independence of its compensation consultant.

In October 2013, the Compensation Committee again selected PM&P as its compensation consultant for 2014.

Benchmarking

The Compensation Committee considers competitive benchmarking data in the establishment of base salaries, incentive targets, equity awards and total compensation levels. For purposes of comparing our executive compensation program with market practices, the Compensation Committee, with the assistance of our compensation consultant, reviews executive compensation from a group of peer companies, which we refer to as the “Vocus Peer Group.” In November 2012, the Compensation Committee, after considering the recommendation of PM&P, approved the Vocus Peer Group based on the pre-defined selection criteria set forth below:

| • | industry and product/services similarity; |

| • | annual revenues between $88 million and $481 million, which is approximately one-half to three-and-a-half times our revenue at the time the peer group was approved by the Compensation Committee; and |

| • | market capitalization between $214 million and $3.3 billion, which is approximately three-fourths to ten times our market capitalization at the time the peer group was approved by the Compensation Committee. |

The Vocus Peer Group for purposes of setting 2013 annual executive compensation included the 15 companies listed below. These companies are technology companies that provide business applications software, frequently through an on-line, on-demand, or software-as-a-service model. While not necessarily direct competitors of Vocus, these companies have similar business models or size, are routinely used as comparable companies by analysts and investors and compete with us for executive talent.

| Actuate Corp. |

DemandTec, Inc. | RightNow Technologies, Inc. | ||

| Ariba, Inc. |

Kenexa Corporation | SuccessFactors | ||

| Blackboard, Inc. |

Keynote Systems, Inc. | Taleo Corp. | ||

| Concur Technologies, Inc. |

LogMeIn, Inc. | Ultimate Software Group Inc. | ||

| Constant Contact, Inc. |

NetSuite, Inc. | Websense Inc. |

The Compensation Committee used information about the Vocus Peer Group to provide context for its compensation decision-making for 2013. Data from the 2013 Vocus Peer Group companies was compiled during November and December 2012. After the peer group companies are selected, PM&P prepares and presents a report to the Compensation Committee summarizing the competitive data and comparisons of our NEOs to the comparable company market data, based on executive officers at the peer group companies who have similar jobs as our NEOs, utilizing publicly available data from the comparable companies and broad survey data (reflecting companies of similar size in the high-technology and software industries). We use the broad survey data in conjunction with peer group data in evaluating our compensation practices for NEOs other

8

Table of Contents

than the CEO and CFO since all peer companies have these roles. Data from survey sources and the peer companies are combined to develop a market composite which is based on an average of survey data and peer company data. The Compensation Committee does not rely upon data from any individual company participating in any of the surveys in making compensation decisions. Each element of our compensation is reviewed as part of this analysis and evaluation.

The Committee concluded the following based on the results of PM&P’s benchmarking study:

| • | Total direct compensation targets (base salary plus target annual incentive plus fair value of equity incentive awards) at 100% achievement of financial goals generally approach the competitive 60th percentile, although both the CEO and CFO total direct compensation aligns with the 35th percentile of the peer group; |

| • | Base salaries are generally consistent with the competitive 40th percentile, although the CEO and CFO base salaries align with the 25th and 35th percentiles of the peer group respectively; and |

| • | Total cash compensation targets (base salary plus target annual incentive) at 100% achievement of financial goals are generally consistent with the competitive 55th percentile, although the CEO and CFO total cash compensation aligns with the 40th and 50th percentiles of the peer group respectively. |

In December 2013, PM&P again provided benchmarking information to the Compensation Committee. The Vocus Peer Group was reviewed and revised for purposes of setting 2014 annual executive compensation and includes the 15 companies listed below. The Vocus Peer Group was revised for 2014 to eliminate those peers that had been acquired and to include new on-line, on-demand and software-as-a-service companies similar to the company in size and/or business model.

| Actuate Corp. |

Keynote Systems, Inc. | Responsys, Inc. | ||

| Blackbaud, Inc. |

LivePerson, Inc. | Synchronoss Technologies, Inc. | ||

| Callidus Software Inc. |

LogMeIn, Inc. | Tangoe, Inc. | ||

| Concur Technologies, Inc. |

NetSuite, Inc. | Ultimate Software Group Inc. | ||

| Constant Contact, Inc. |

RealPage, Inc. | Websense, Inc. |

Elements of Vocus’ Executive Compensation Program

Our executive compensation program consists of five basic elements—base salary; quarterly variable incentive bonuses; long-term incentive compensation that is currently delivered through a combination of stock options and restricted stock, and performance-based restricted stock units in 2014; employee benefits; and retention features such as employment agreements and change-in-control provisions. The remainder of this section provides details on each of these elements of our executive compensation program.

Base Salary

The base salary for each of our executive officers is initially established through negotiation at the time of hire, based on such factors as the officer’s qualifications, experience, prior salary and competitive salary information. Any increases thereafter are determined by an assessment of the officer’s sustained performance as well as competitive salary information.

The Compensation Committee established 2013 base salaries for Vocus’ executive officers in February 2013, based on PM&P’s benchmarking study and the Committee’s assessment of each officer’s sustained performance. In determining base salaries for executive officers other than the CEO, the Committee requested and received information from the CEO on the executive officer’s performance and contributions. The Compensation Committee considered economic, market, individual and company factors in its deliberations about executive compensation for 2013. In February 2013, the Committee and the Board approved the 2013 base salaries set forth in the table below for Messrs. Rudman, Vintz, Heys and Weissberg, respectively. The 2013 base salary changes for our executive officers reflect the annual review based on performance, compensation of market comparables and promotional increases.

| Name |

Position |

2012 Base Salary |

2013 Base Salary |

% Change | ||||||||||

| Richard Rudman |

CEO, President and Chairman | $ | 450,000 | $ | 450,000 | 0 | % | |||||||

| Stephen Vintz |

EVP, CFO, Treasurer and Secretary | $ | 325,000 | $ | 325,000 | 0 | % | |||||||

| Mark Heys |

Chief Technology Officer | $ | 240,000 | $ | 240,000 | 0 | % | |||||||

| Norman Weissberg |

Senior Vice President, North American Sales | $ | 275,000 | $ | 275,000 | 0 | % | |||||||

In February 2014, the Committee did not approve a raise of base salary for Messrs. Rudman or Weissberg. The Committee approved base salary raises of 8% and 15% for Messrs. Vintz and Heys, respectively. The Board established the 2014 base salaries for Messrs. Rudman, Vintz and Heys at $450,000, $350,000 and $275,000, respectively. Mr. Weissberg ceased to be an executive officer in February 2014 and his salary remained $275,000.

9

Table of Contents

Cash Bonus Compensation

Our bonus compensation is paid in cash quarterly and is intended to reward executive officers for short-term performance. Early in 2013, the CEO proposed specific financial objectives and targets for each executive officer, which were then approved by the Compensation Committee and the Board. The objectives and targets were derived directly from our business plan for 2013, as approved by the Board of Directors, and were considered by the Board to be achievable but challenging. The objectives were based on the following:

| • | Topline, which consists of total company sales plus revenue. Total company sales include amounts invoiced to customers under our subscription and related agreements as well as transaction-based sales from our e-commerce offerings; |

| • | Pro forma operating income, which consists of income from operations excluding stock-based compensation, amortization of acquired intangible assets, acquisition related expenses, the effect of adjustments to deferred revenue related to purchase accounting and adjustments to the fair value of contingent consideration for acquisition earn-outs; and |

| • | Free cash flow, which consists of cash provided by operating activities less cash paid for purchases of property and equipment, net of proceeds from disposals and capitalized software development costs plus excess tax benefits from stock-based compensation. |

The Committee also approved additional sales objectives for executives with primary sales responsibilities.

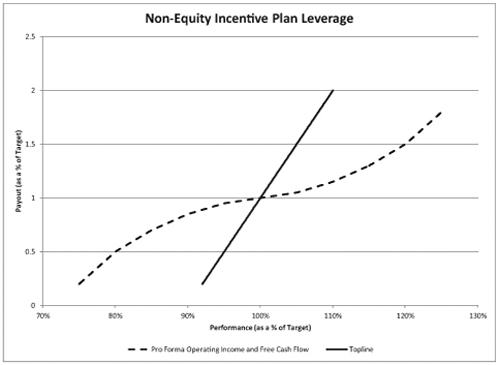

The Committee has set a minimum threshold for each specific financial objective. For topline incentive, at least 92% of the objective must be obtained in order to earn any payout under that objective. The payout for topline incentive is incrementally adjusted by 20% for performance that results in each incremental 2% variance to the target. For example, an executive officer would earn a 60% payout if 96% of the topline target were achieved, and would earn a 140% payout if 104% of the target were achieved.

| Threshold | Target | Maximum | ||||||||||

| Topline percentage of target |

92 | % | 100 | % | 110 | % | ||||||

| Payout as a percentage of target |

20 | % | 100 | % | 200 | % | ||||||

For operating income and free cash flow incentives, at least 75% of the objective must be obtained in order to earn any payout under that objective. The payout for such incentives is incrementally adjusted by 30%, 20%, 15%, 10%, 5%, 5%, 10%, 15%, 20% and 30% for performance that results in each incremental 5% variance to the target. For operating income and free cash flow incentives, an executive officer would earn an 85% payout if 90% of the performance target were achieved, and would earn a 115% payout if 110% of the target were achieved. If the target is achieved for an objective, the executive will receive 100% of the eligible payout for that specific objective.

| Threshold | Target | Maximum | ||||||||||

| Operating income/FCF percentage of target |

75 | % | 100 | % | 125 | % | ||||||

| Payout as a percentage of target |

20 | % | 100 | % | 180 | % | ||||||

For performance that exceeds 110% of the topline target the payout is 200%, and for performance that exceeds 125% of the operating income and free cash flow targets, the payout is 180%, although such levels were not achieved in 2013. Payouts for additional sales objectives are also determined using the scales set forth above.

The pay-for-performance relationship is graphically demonstrated below:

10

Table of Contents

Cash bonus compensation that was earned during 2013 was calculated and paid shortly after the end of each quarter. Total amounts earned during 2013 (including the fourth-quarter bonus compensation that was paid in early 2014) are disclosed in the “Non-Equity Incentive Plan Compensation” column of the “Summary Compensation Table.” Our financial performance during the year versus the pre-established targets resulted in 2013 non-equity incentive plan compensation as follows:

| Name |

Position |

Base Salary as % of Cash Comp Target |

Bonus as % of Cash Comp Target |

Total Cash Target (Base Salary + Bonus) |

Actual 2013 Incentive as % of Target |

2013 Bonus Paid |

2013 Total Cash |

|||||||||||||||||||

| Richard Rudman |

CEO, President and Chairman | 50 | % | 50 | % | $ | 900,000 | 34 | % | $ | 153,968 | $ | 603,968 | |||||||||||||

| Stephen Vintz |

EVP, CFO, Treasurer and Secretary | 59 | % | 41 | % | $ | 550,000 | 34 | % | $ | 76,984 | $ | 401,984 | |||||||||||||

| Mark Heys |

Chief Technology Officer | 64 | % | 36 | % | $ | 375,000 | 22 | % | $ | 30,024 | $ | 270,024 | |||||||||||||

| Norman Weissberg (1) |

Senior Vice President, North American Sales |

52 | % | 48 | % | $ | 525,000 | 17 | % | $ | 42,769 | $ | 317,769 | |||||||||||||

| (1) | Mr. Weissberg ceased to be an executive officer in February 2014. |

In February 2014, as part of the salary review process, the Compensation Committee established the annual cash bonus compensation targets for Messrs. Rudman, Vintz and Heys at $450,000, $225,000 and $150,000, respectively. Mr. Weissberg ceased to be an executive officer in February 2014. As a result, 2014 total cash compensation targets for our NEOs at 100% achievement of financial goals aligns to approximately the 50th percentile of the comparable peer companies.

Prior to February 2014, there was no provision for repaying quarterly cash bonuses upon a financial restatement, should one occur, however, in February 2014, the Board adopted a clawback policy applicable to our executive officers, providing our Board with the ability to require the reimbursement or forfeiture of cash incentive-based compensation in the event of fraud or intentional misconduct that results in the required restatement of our financial statements.

Long-Term Incentive Compensation

We typically grant stock options and/or restricted stock to executive officers and other employees at the time of hire to motivate employees to build long-term stockholder value and as a retention tool to incentivize employees to remain employed with us. Thereafter, additional awards may be made at varying times and in varying amounts to reward an executive officer for past performance, to provide a continuing incentive for future performance and to further align executive officer and stockholder interests. Such grants are determined by an assessment of the NEOs performance and responsibilities, company performance as well as competitive salary information. In 2013, our long-term incentive compensation consisted of both stock option and restricted stock awards.

Long-term incentive compensation is weighted more heavily toward performance-based measures with approximately 2/3 of the long-term incentive compensation being stock options for which realizable value is related to our stock price and 1/3 being time-based restricted stock awards. Stock option awards provide a continuing incentive for future individual and company performance and to align executive officer and stockholder interests because their realizable value is determined by our stock price. The restricted stock awards, which vest over time, provide incentive for an executive officer to remain employed with us. Our NEO’s realizable total compensation may be much less than the target peer group (thus keeping compensation aligned with TSR) because many stock option awards may have little to no value because of our current stock price and the exercise price of the award.

Details on restricted stock awards granted during 2013 to our CEO and other NEOs may be found in the table entitled “Grants of Plan-Based Awards.” Details on stock option awards exercised in 2013 by our CEO and other NEOs and restricted stock awards vested in 2013 may be found in the table entitled “Option Exercises and Stock Vested.” Details on all outstanding stock option awards and restricted stock award grants of our CEO and other NEOs as of the end of 2013 may be found in the table entitled “Outstanding Equity Awards at Fiscal Year End.”

All executive officers received both stock option and restricted stock awards in 2013. In 2013, Vocus’ long-term incentive compensation targets ranged from the 25th to 50th percentile of the peer group. Consistent with our governance standards, these awards were approved by the Compensation Committee and the Board of Directors and vest annually over four years. Grants of stock options and restricted stock in 2013 were awarded under our 2005 Stock Award Plan. On February 21, 2013, we made the following equity awards to our NEOs which are further disclosed in the “Grants of Plan Based Awards Table”:

| Name |

Option Award | Option Exercise Price |

Stock Awards | |||||||||

| Richard Rudman |

219,442 | $ | 13.94 | 64,186 | ||||||||

| Stephen Vintz |

114,597 | $ | 13.94 | 33,574 | ||||||||

| Mark Heys |

73,147 | $ | 13.94 | 21,395 | ||||||||

| Norman Weissberg |

60,956 | $ | 13.94 | 18,104 | ||||||||

In February 2014, the Board awarded restricted stock and performance-based restricted stock units to the CEO and other NEOs, except for Mr. Weissberg who ceased to be an executive officer in February 2014 and therefore did not receive an equity grant, for the 2014 fiscal year as set forth below. The vesting of the restricted stock units is tied to the achievement of a performance goal measured at the end of a one year performance period commencing on January 1, 2014. The actual number of shares of Vocus, Inc. common stock into which the restricted stock units will convert will be calculated by multiplying the target number of restricted stock units by a percentage ranging from 0% to 200% based on the actual level at which the performance goal is attained.

11

Table of Contents

In determining the number of restricted shares and restricted stock units to award, the Committee focused on the level of grants made by peer group companies, the absolute number of shares granted and the cost of those grants as required to be recognized as expense in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. These equity awards were approved by the Compensation Committee and the Board and vest annually over three years.

| Name |

Stock Award | Stock Units at 100% | ||||||

| Richard Rudman |

72,000 | 72,000 | ||||||

| Stephen Vintz |

53,000 | 53,000 | ||||||

| Mark Heys |

40,000 | 40,000 | ||||||

Employee Benefits and Executive Perquisites

The Compensation Committee periodically reviews the levels of perquisites and other personal benefits provided to our CEO and other executive officers. Except for a very limited number of items, as disclosed in the “All Other Compensation” column of the “Summary Compensation Table” and described below, or items that are immaterial in amount, we generally do not provide our CEO and other executive officers with special benefits and perquisites that are not otherwise available to all employees. We believe that such limited benefits and perquisites are not unusual in our industry.

The CEO and other executive officers participate in the same employee benefit plans as all other employees. The employee benefit programs, which are reviewed periodically by the Compensation Committee, include a 401(k) retirement program to which we make contributions and various health and welfare benefit programs. We believe that these programs are generally consistent with technology industry practice for companies of our size and financial position. We also reimburse certain costs related to travel, or associated with the officer’s or their spouse’s participation in certain events undertaken in connection with the Company.

Retention Programs

Consistent with peer-group practice (as determined in consultation with the compensation consultant’s research), we have entered into employment agreements with all of our executive officers. The purpose of these employment agreements is to enhance our executive recruiting and retention efforts by following industry practices, and to provide our executives with reasonable levels of security while being responsible in the potential use of shareholder assets. PM&P’s research indicated that the severance-related benefits provided to our executive officers are generally consistent with peer-group practices.

On March 31, 2014, the Company and each of Messrs. Vintz and Heys entered into an employment agreement. The employment agreements were entered into to update and replace the employment agreements previously entered into by the Company and Messrs. Vintz and Heys on December 6, 2005, as a result of the Company’s review of its prior forms of employment agreement with its executive officers, as noted in the Company’s proxy statement filed April 25, 2013 with respect to the 2013 annual meeting of stockholders. The Company and Mr. Rudman entered into a similar employment agreement in May 2013 (collectively with Messrs. Vintz and Heys’ agreements, the “Employment Agreements”).

The Employment Agreements include provisions for the payment of certain amounts and as well as the accelerated vesting of unvested equity awards upon the termination of the employee’s employment by the Company without cause or his resignation for good reason within 90 days prior to or 6 months after the effective date of a change in control (as defined in the Employment Agreements).

Thus, the Employment Agreements eliminate the “single-trigger” acceleration of vesting of equity awards granted hereafter; however, for Messrs. Vintz and Heys equity awards granted prior to 2014 will continue to be governed by the acceleration provisions set forth in the equity award agreement for each such award.

Messrs. Rudman and Vintz’ employment agreements also eliminate the tax gross-up provisions that were in their prior agreements.

Our employment agreement with Mr. Weissberg includes a 12-month window, beginning six months after a change in control, during which Mr. Weissberg would be able to resign for any reason and receive severance payments.

12

Table of Contents

Stock Ownership Guidelines

In February 2014, our Board adopted stock ownership guidelines for our CEO and other executive officers. The Committee recognizes that the CEO and other NEOs hold a significant number of shares and/or stock options and thus are strongly aligned with stockholder interests, but our discussions with shareholders and proxy advisory firms showed that such guidelines are important to investors. While our compensation consultant’s research did not indicate that stock ownership programs are prevalent among our peer group, the Committee determined that it was in the best interest of the Company and shareholders to have stock ownership and retention guidelines.

| Element |

Terms | |

| Salary Multiple |

CEO: 3X base salary Other NEOs: 1X base salary Directors: 3x annual retainer | |

| Shares Counted |

Actual shares held, unvested time-based restricted stock and exercisable, in-the-money value of stock options | |

| Disposition Guidelines |

Executives/directors that are noncompliant with the ownership guidelines are required to retain 50% of their net after-tax profit in shares obtained from stock option exercises or shares vesting until the ownership guideline level is met | |

| Compliance Assessment |

After 5 years | |

| Compliance Changing to Non-compliance | If NEO/director deemed in compliance and subsequently falls out of compliance, individual has 12 months to get back in compliance before disposition guideline is applied | |

Additionally, our CEO and lead director have each made open market purchases of our shares as set forth in the table below.

| Name |

Shares Purchased |

Date | ||||||

| Richard Rudman |

70,000 | 2/28/2013 | ||||||

| Kevin Burns |

25,000 | 5/20/2013 | ||||||

Policy Against Short Sales and Other Put-Equivalent Investment Transactions

Our 2005 Stock Award Plan prohibits restricted stock awards from being sold, transferred, pledged, hypothecated, margined or otherwise encumbered by the award holders.

Additionally, all of our directors, officers and restricted employees are subject to our Insider Trading Policy. Our Insider Trading Policy prohibits, among other things, insiders from engaging in short-term or recurring speculative transactions in our securities, including (i) short sales, (ii) short-term trading, (iii) any short-term or speculative transaction whereby the insider could profit from a decline in our stock price, and (iv) transactions involving publicly traded options or other derivatives, such as trade in puts or calls in our stock.

Impact of Regulatory Requirements

The Compensation Committee considers regulatory requirements and their impact when making executive compensation decisions concerning the CEO and other executive officers. Regulatory requirements that influence the Committee’s decisions include:

| • | Internal Revenue Code Section 162(m): Section 162(m) of the Internal Revenue Code disallows a tax deduction to public companies for compensation not deemed to be performance-based over $1,000,000 paid for any fiscal year to the CEO and other executive officers. We attempt to qualify executive compensation for deductibility under applicable tax laws to the fullest extent practicable. We believe that both our quarterly variable incentive bonuses and our stock option awards qualify for the performance-based exception. The Compensation Committee will not, however, necessarily seek to limit executive compensation to the amount deductible under Section 162(m). As an example, the restricted stock awards made in 2013 are unlikely to qualify for the performance-based exception. |

| • | Internal Revenue Code Section 409A: We believe that employees will not be subject to any tax penalties under 409A as a result of participating in any of our compensation programs or agreements. |

| • | Section 280G of the Code disallows a company’s tax deduction for “excess parachute payments,” which arise if payments that are contingent upon a change of control are paid to certain persons in an amount equal to or greater than three times the person’s base amount (the five-year average of Form W-2 compensation). The amount of an “excess parachute payment” is equal to the amount by which these payments exceed the person’s base amount. Additionally, Code Section 4999 imposes a 20% excise tax on the amount of the excess parachute payments (the “Excise Tax”) on any person who receives them. The Company’s employment agreements with its executive officers entitle the executives to payments in connection with a change in control that may result in excess parachute payments. |

13

Table of Contents

Compensation Risk Assessment

The Compensation Committee has reviewed and discussed the structure of our compensation programs to assess whether any aspect of the programs could potentially encourage or motivate employees to take inappropriate risks or introduce excessive business risks that could threaten our operating results, financial condition or affect long-term shareholder value. During 2013, at the direction of the Compensation Committee, our compensation practices and policies were reviewed by the Compensation Committee’s independent compensation consultant, PM&P, and the findings were presented to the Compensation Committee.

Based on its annual review, the Compensation Committee believes that our compensation programs represent an appropriate balance of short- and long-term compensation and do not encourage executive officers or other employees to take unnecessary or excessive risks that are reasonably likely to have a material adverse effect on the company. The Committee’s review also considered our internal controls, policies and risk-mitigating components in our incentive arrangements currently in place, as well as the Committee’s formal review and discussion.

In regard to the compensation program relative to business risk, we offer a mixture of short-term and long-term incentives to our executive officers to balance their motivations. We also have in place numerous business controls, such as maximum payout levels in executive incentive plans, approvals and audit processes to mitigate and manage the risk that may arise as a result of focus on short-term, quarterly performance. While a portion of total compensation is tied to short-term performance, the Compensation Committee concluded that emphasis on long-term incentives appropriately balances risk and aligns the executive officers’ motivations for our long-term success, including stock price performance. Additionally, Our 2005 Stock Award Plan prohibits restricted stock awards from being sold, transferred, pledged, hypothecated, margined or otherwise encumbered by the award holders. Additionally, all of our directors, officers and restricted employees are subject to our Insider Trading Policy. Our Insider Trading Policy prohibits, among other things, insiders from engaging in short-term or recurring speculative transactions in our securities, including (i) short sales, (ii) short-term trading, (iii) any short-term or speculative transaction whereby the insider could profit from a decline in our stock price, and (iv) transactions involving publicly traded options or other derivatives, such as trade in puts or calls in our stock.

In February 2014, our compensation program also included performance-based equity awards within our executive compensation grants to ensure a portion of compensation will be tied closely to long-term stockholder interests. We also introduced stock ownership guidelines that require a level of stock ownership by our executive officers and our directors that we believe appropriately align their interests with those of our stockholders. Further, we implemented a “clawback” policy applicable to our executive officers, providing our Board with the ability to require the reimbursement or forfeiture of cash incentive-based compensation in the event of fraud or intentional misconduct that results in the required restatement of our financial statements.

Given the factors discussed above, we concluded that nothing inherent within the compensation program design increases the likelihood of a material risk being encouraged or introduced outside of the normal course of business practices

Conclusions

We believe that our executive compensation programs strongly support our philosophy of pay-for-performance. We further believe that compensation levels and programs for the CEO and other executive officers are consistent with competitive practices in our industry and thus advance our recruiting and retention objectives. We will continue to review our programs on a regular basis and expect to update them from time to time, based on changes in competitive practices, regulatory requirements and our needs.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management. Based on these reviews and discussions, the Compensation Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Form 10K/A.

| Respectfully submitted by the Compensation Committee, |

| Kevin Burns, Chair Gary Golding Ronald Kaiser |

14

Table of Contents

Executive Compensation

The following table sets forth 2013, 2012 and 2011 compensation information for: (i) the Chief Executive Officer; (ii) the Chief Financial Officer; and (iii) our two other executive officers during 2013. We refer to these individuals collectively as the “named executive officers.”

| Name and Principal Position |

Year | Salary | Bonus | Stock Awards(1) |

Option Awards(1) |

Non-Equity Incentive Plan Compensation(2) |

All Other Compensation |

Total | ||||||||||||||||||||||||

| Richard Rudman, |

2013 | $ | 450,000 | $ | — | $ | 894,753 | $ | 1,675,601 | $ | 153,968 | $ | 4,605 | (3) | $ | 3,178,927 | ||||||||||||||||

| Chief Executive Officer, |

2012 | $ | 450,000 | $ | — | $ | 644,334 | $ | 1,199,418 | $ | 473,625 | $ | 4,123 | (3) | $ | 2,771,500 | ||||||||||||||||

| President and Chairman |

2011 | $ | 425,000 | $ | — | $ | 988,806 | $ | 1,863,478 | $ | 464,738 | $ | 2,681 | (3) | $ | 3,744,703 | ||||||||||||||||

| Stephen Vintz, |

2013 | $ | 325,000 | $ | — | $ | 468,022 | $ | 875,032 | $ | 76,984 | $ | 3,279 | (4) | $ | 1,748,317 | ||||||||||||||||

| Executive Vice President, |

2012 | $ | 325,000 | $ | — | $ | 307,307 | $ | 573,053 | $ | 236,813 | $ | 3,254 | (4) | $ | 1,445,427 | ||||||||||||||||

| Chief Financial Officer, |

2011 | $ | 310,000 | $ | — | $ | 427,874 | $ | 806,374 | $ | 218,700 | $ | 4,061 | (4) | $ | 1,767,009 | ||||||||||||||||

| Treasurer and Secretary |

||||||||||||||||||||||||||||||||

| Mark Heys (7), |

2013 | $ | 240,000 | $ | — | $ | 298,246 | $ | 558,531 | $ | 30,024 | $ | 3,675 | (5) | $ | 1,130,476 | ||||||||||||||||

| Chief Technology Officer |

||||||||||||||||||||||||||||||||

| Norman Weissberg (8), |

2013 | $ | 275,000 | $ | — | $ | 252,370 | $ | 465,444 | $ | 42,769 | $ | 3,675 | (6) | $ | 1,039,258 | ||||||||||||||||

| Senior Vice President, |

2012 | $ | 275,000 | $ | — | $ | 214,783 | $ | 399,806 | $ | 170,500 | $ | 5,966 | (6) | $ | 1,066,055 | ||||||||||||||||

| North American Sales |

2011 | $ | 275,000 | $ | — | $ | 332,586 | $ | 626,803 | $ | 145,219 | $ | 4,523 | (6) | $ | 1,384,131 | ||||||||||||||||

| (1) | Amounts shown reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. Assumptions used in the calculation of the amounts are included in Footnote 2 to the Company’s audited financial statements for the fiscal year ended December 31, 2013 included in the Company’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 7, 2014. |

| (2) | Represents payment of cash bonus compensation discussed in the Compensation Disclosure and Analysis. |

| (3) | Amount reported includes $1,797, $1,815 and $1,833 for Vocus’ contributions to the individual’s accounts in Vocus’ 401(k) plan for the years 2013, 2012 and 2011 respectively; $2,808, $2,308 and $465 for personal travel paid for by Vocus, spousal attendance and other personal expenses paid by Vocus at company-related events for the years 2013, 2012 and 2011, respectively; and $1,088 and $383 as a gross-up or other reimbursement for tax payments, each for the years 2012 and 2011, respectively (no such amount was paid in 2013). |

| (4) | Amount reported includes $3,279, $3,254 and $3,213 for Vocus’ contributions to the individual’s accounts in Vocus’ 401(k) plan for the years 2013, 2012 and 2011, respectively; $465 for personal travel paid for by Vocus and other personal expenses paid by Vocus at company-related events in 2011 (no such amounts were paid in 2013 or 2012); and $383 as a gross-up or other reimbursement for tax payments for the year 2011 (no such amounts were paid in 2013 or 2012). |

| (5) | Amount reported includes $3,675 for Vocus’ contributions to the individual’s accounts in Vocus’ 401(k) plan for the year 2013. |

| (6) | Amount reported includes $3,675, $3,675 and $3,675 for Vocus’ contributions to the individual’s accounts in Vocus’ 401(k) plan for the years 2013, 2012 and 2011, respectively; $2,291 and $465 for personal travel paid for by Vocus, spousal attendance and other personal expenses paid by Vocus at company-related events for the years 2012 and 2011, respectively (no such amounts were paid in 2013); and $1,071 and $383 as a gross-up or other reimbursement for tax payments for the years 2012 and 2011, respectively (no such amount was paid in 2013). |

| (7) | Mr. Heys was appointed as an executive officer in February 2013. |

| (8) | Mr. Weissberg ceased to be an executive officer in February 2014. |

Grants of Plan-Based Awards

The following table sets forth, for the fiscal year ended December 31, 2013, certain information regarding incentive plan awards and stock options granted to the named executive officers.

| Name |

Grant Date |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) |

All Other Stock Awards: Number of Shares of Stock or Securities(2)(3) |

All Other Option Awards: Number of Options Underlying Securities(2)(3) |

Exercise or Base Price of Option Awards Underlying ($/share) |

Grant Date Fair Value of Stock and Option Awards(4) |

||||||||||||||||||||||||||

| Threshold | Target | Maximum | ||||||||||||||||||||||||||||||

| Richard Rudman |

N/A | $ | — | $ | 450,000 | $ | 864,000 | — | — | $ | — | $ | — | |||||||||||||||||||

| 2/21/2013 | $ | — | $ | — | $ | — | — | 219,442 | $ | 13.94 | $ | 1,676,537 | ||||||||||||||||||||