Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VERIZON COMMUNICATIONS INC | d715494d8k.htm |

| EX-99.1 - EX-99.1 - VERIZON COMMUNICATIONS INC | d715494dex991.htm |

VlpHU09DSUQyMDEzUTQ=

VlpHU09DSUQyMDE0UTE

1

st

QUARTER 2014

EARNINGS RESULTS

Fran Shammo

Chief Financial Officer

April 24, 2014

Exhibit 99.2 |

2

NOTE: In this presentation we have made forward-looking statements. These

statements are based on our estimates and assumptions and are subject to

risks and uncertainties. Forward-looking statements include the

information

concerning

our

possible

or

assumed

future

results

of

operations.

Forward-looking

statements

also

include

those

preceded

or

followed

by

the

words

“anticipates,”

“believes,”

“estimates,”

“hopes”

or

similar

expressions.

For

those

statements,

we

claim

the

protection

of

the

safe

harbor

for

forward-looking

statements

contained in the Private Securities Litigation Reform Act of 1995. The following

important factors, along with those discussed in our filings with the

Securities and Exchange Commission (the “SEC”), could affect future results and

could cause those results to differ materially from those expressed in the

forward-looking statements: the ability to realize the expected benefits

of our transaction with Vodafone in the timeframe expected or at all; an adverse

change

in

the

ratings

afforded

our

debt

securities

by

nationally

accredited

ratings

organizations

or

adverse

conditions in the credit markets affecting the cost, including interest rates,

and/or availability of further financing; significantly increased levels of

indebtedness as a result of the Vodafone transaction; changes in tax laws or

treaties, or in their interpretation; adverse conditions in the U.S. and

international economies; material adverse changes in labor matters,

including labor negotiations, and any resulting financial and/or operational impact;

material

changes

in

technology

or

technology

substitution;

disruption

of

our

key

suppliers’

provisioning

of

products

or services; changes in the regulatory environment in which we operate, including

any increase in restrictions on our ability to operate our networks;

breaches of network or information technology security, natural disasters, terrorist

attacks or acts of war or significant litigation and any resulting financial impact

not covered by insurance; the effects of competition in the markets in which

we operate; changes in accounting assumptions that regulatory agencies,

including the SEC, may require or that result from changes in the accounting rules

or their application, which could result in an impact on earnings;

significant increases in benefit plan costs or lower investment returns on plan

assets; and the inability to implement our business strategies.

“Safe Harbor”

Statement

As required by SEC rules, we have provided a reconciliation of the non-GAAP

financial measures included in this presentation to the most directly

comparable GAAP measures in materials on our website at www.verizon.com/investor. |

3

1Q ’14

EPS

Reported

$1.15

Less:

Omnitel Gain on Sale

$0.55

Add:

Debt redemption

Purchase transaction costs

$0.17

$0.08

Adjusted

$0.84

Note: Results above are adjusted for non-operational items. Amounts may not add due to

rounding. Strong earnings per share

CONSOLIDATED

Earnings Summary |

4

1Q ’14 *

Net Income ($B)

EPS

Adjusted Earnings

$2.9

$0.84

Add:

45% VZW Income (1/1/14 –

2/21/14)

Tax effect

$1.9

($0.8)

$1.2

Less:

Transaction related costs (1/1/14 –

2/21/14)

Tax effect

($0.4)

$0.2

($0.3)

Adjusted to show full 1Q ’14 VZW ownership

$3.8

$0.91**

*

Results above are adjusted for non-operational items. Amounts may not add due to rounding.

**

Assumes 4.149 billion diluted shares outstanding from 1/1/14 to 3/31/14.

Full ownership illustrative impact in 1Q ’14 of $0.07 per share

ILLUSTRATIVE NON-GAAP CONSOLIDATED EARNINGS

Full Ownership of VZW –

1Q ’14

Note: Verizon acquired full ownership of Verizon Wireless on 2/21/14. The illustration

above assumes 100% ownership of Verizon Wireless from 1/1/14

to 3/31/14. |

5

CONSOLIDATED

1Q ’14 Overview

•

Double-digit growth in operating income and earnings per

share for past five quarters

•

Strongest consolidated revenue growth in past five quarters

•

Industry-leading wireless service revenue growth and

profitability

•

Growth in consumer revenue driven by FiOS

•

Solid cash flow with a focus on disciplined investment

Delivered strong results |

6

•

Consolidated revenue of

$30.8B, up 4.8% Y/Y

–

Revenue growth across all

strategic areas

•

1Q ’14 EBITDA margin of

36.7%, up 160 bps Y/Y

•

1Q ’14 adjusted EPS of $0.84,

up 23.5% Y/Y; reported EPS

of $1.15

4.8%

Y/Y Growth

$29.4

$31.1

Wireline

Wireless

Total Revenue ($B)

$30.8

Adjusted EPS

$0.68

$0.66

$0.84

23.5%

Y/Y Growth

Revenue growth and margin expansion drive earnings

CONSOLIDATED

1Q ’14 Financial Summary

Note: Results above for EPS are adjusted for non-operational items.

1Q '13

4Q '13

1Q '14

1Q '13

4Q '13

1Q '14 |

•

1Q ’14 cash flow of $7.1B

•

1Q ’14 Capex/Revenue of

13.5%

•

1Q ’14 free cash flow of $3.0B

1Q ’13

1Q ’14

Cash flow from operations

$7.5

$7.1

Capital expenditures

$3.6

$4.2

Free cash flow

$3.9

$3.0

Total Debt

$52.9

$109.8

Net Debt to Adjusted EBITDA

1.2x

2.5x

Cash Flow Summary ($B)

Solid cash flow and capital profile

CONSOLIDATED

Cash Flow

Note: Amounts may not add due to rounding.

7 |

•

Sustained strong service

revenue growth in 1Q ’14

•

Total revenue growth of 6.9%

Y/Y

•

EBITDA growth of 11.3% Y/Y

•

EBITDA service margin

expands to 52.1%, up 170 bps

Y/Y

Service Revenue ($B)

EBITDA Service Margin %

Segment EBITDA ($B)

WIRELESS

Revenue & Profitability

Disciplined execution drives growth in revenue and profitability

8 |

•

Retail postpaid ARPA of

$159.67, up 6.3% Y/Y

–

50% of postpaid accounts on

More Everything Plans

–

Smartphone penetration of 72%,

up from 61% a year ago

•

35.1M retail postpaid accounts

–

2.77 connections per account

Retail Postpaid ARPA

More Everything Accounts

More Everything % of postpaid accounts

Connections and usage growth driving high-tier data plans

WIRELESS

ARPA

9 |

•

539K retail postpaid net

adds in 1Q ’14 including

866K 4G smartphones*

•

Retail postpaid tablet net

adds of 634K in 1Q ’14,

tablet base now at 4.3M

•

6.5% of retail postpaid base

upgraded in 1Q ’14

•

Retail postpaid churn of

1.07% in 1Q ’14

* Excludes acquisitions and adjustments

Retail Net Adds* (000)

Retail Connections (M)

4G smartphones and tablets drive retail postpaid net adds

WIRELESS

Connections / Net Adds / Churn

10

Retail Postpaid

Retail Prepaid |

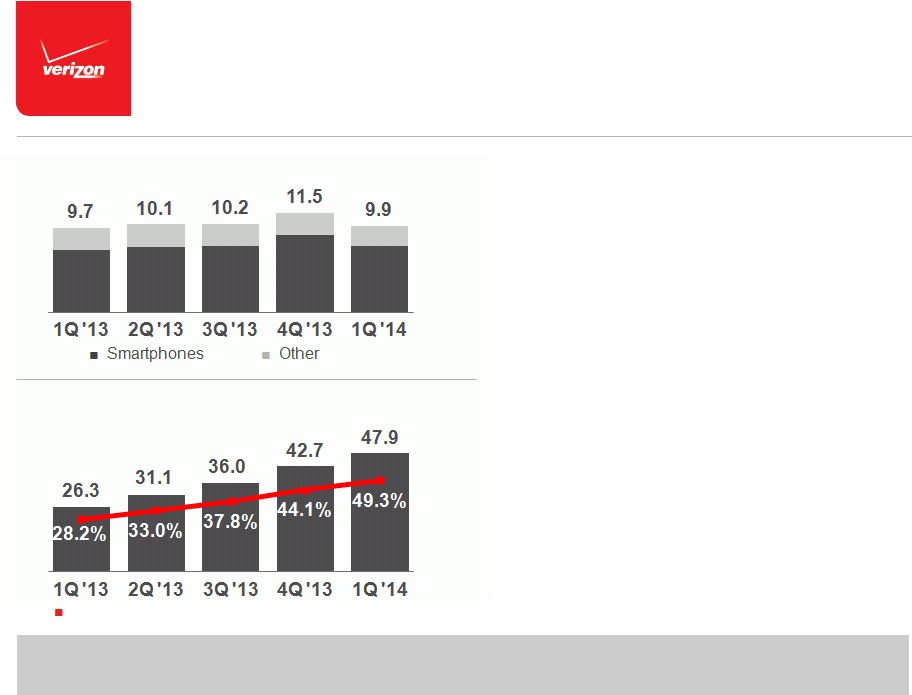

•

85% of device activations in

1Q ’14 were phones

–

7.6M smartphones activated in

1Q ’14

•

8.1M 4G LTE device activations

in 1Q ’14

•

Wireless 4G LTE network:

–

About 73% of total data traffic

currently on 4G LTE network

–

Industry leading in 4G LTE

connections

Retail Postpaid Device Activations (M)

4G LTE Devices (M)

% of Retail Postpaid Connections

Independent testing confirms 4G LTE leadership

WIRELESS

Devices / 4G LTE

11 |

•

6.2% consumer revenue growth

Y/Y;

7

th

consecutive

quarter

of

over 4% growth Y/Y

•

FiOS now 74% of consumer

revenue

–

8.7% Y/Y growth in triple play

customers

•

FiOS Internet subscribers

–

6.2M subscribers, 98K net adds

–

39.7% penetration

•

FiOS Video subscribers

–

5.3M subscribers, 57K net adds

–

35.0% penetration

Consumer Revenue ($B)

Copper Migrations (K)

FiOS driving consumer growth

WIRELINE

Mass Markets

12 |

•

FiOS revenue grew 15.5%

Y/Y

•

Global Enterprise revenue

down 4.4% Y/Y

–

Strategic services revenue

growth of 1.8% Y/Y

•

Total revenue of $9.8B in

1Q ’14, down 0.4% Y/Y

•

EBITDA margin of 22.3% in

1Q ’14

Total Revenue ($B)

EBITDA Margin %

Segment EBITDA ($B)

Focus on improving long-term profitability

WIRELINE

Revenue & Profitability

13 |

•

Continue to invest in network and platforms

•

Focus on margin expansion and profitable growth

•

Solid earnings momentum and cash flow generation

•

Disciplined capital program across entire business

•

Capitalize on strategic investments

CONSOLIDATED

Summary

Build on 1Q ’14 momentum

14 |

VlpHU09DSUQyMDEzUTQ=

1

st

QUARTER 2014

EARNINGS RESULTS

Fran Shammo

Chief Financial Officer

April 24, 2014 |