Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TOTAL SYSTEM SERVICES INC | d715518d8k.htm |

| EX-99.1 - EX-99.1 - TOTAL SYSTEM SERVICES INC | d715518dex991.htm |

2014

First Quarter Results April 22, 2014

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Exhibit 99.2 |

Forward-Looking Statements

2

This presentation and comments made by management contain forward-

looking

statements

including,

among

others,

statements

regarding

the

expected

future

operating

results

of

TSYS.

These

statements

are

based

on

management’s current expectations and assumptions and are subject to

risks, uncertainties and changes in circumstances. Forward-looking

statements include all statements that are not historical facts and can be

identified by the use of forward-looking terminology such as the words

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“potential”, “estimate”

or

similar expressions. Actual results may differ materially from those set

forth in the forward-looking statements due to a variety of

factors. More information about these risks, uncertainties and factors

may be found in TSYS’

filings with the Securities and Exchange Commission, including its

2013 Annual Report on Form 10-K. TSYS does not assume any obligation

to update any forward-looking statements as a result of new information,

future developments or otherwise.

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Use of

Non-GAAP Financial Measures 3

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

This slide presentation contains certain non-GAAP financial measures

determined by methods other than in accordance with generally accepted

accounting principles. Such non-GAAP financial measures include the

following: revenues before reimbursable items; operating margin excluding

reimbursable items; revenues measured on a constant currency basis; free

cash flow; EBITDA, adjusted EBITDA , adjusted cash earnings per share,

adjusted

segment

operating

income

and

adjusted

segment

operating

margin.

The most comparable GAAP measures to these measures are revenues;

operating margin; revenues; cash flows from operating activities; net income;

net income; earnings per share, operating income and operating margin,

respectively. Management uses these non-GAAP financial measures to

assess the performance of TSYS’

core business. TSYS believes that these non-GAAP

financial measures provide meaningful additional information about TSYS to

assist investors in evaluating TSYS’

operating results. These non-GAAP

financial measures should not be considered as a substitute for operating

results determined in accordance with GAAP and may not be comparable to

other similarly titled measures of other companies. The computations of the

non-GAAP financial measures used in this slide presentation are set forth in

the Appendix to this slide presentation. |

Phil

Tomlinson Chairman and Chief Executive Officer

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Troy

Woods President & Chief Operating Officer

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

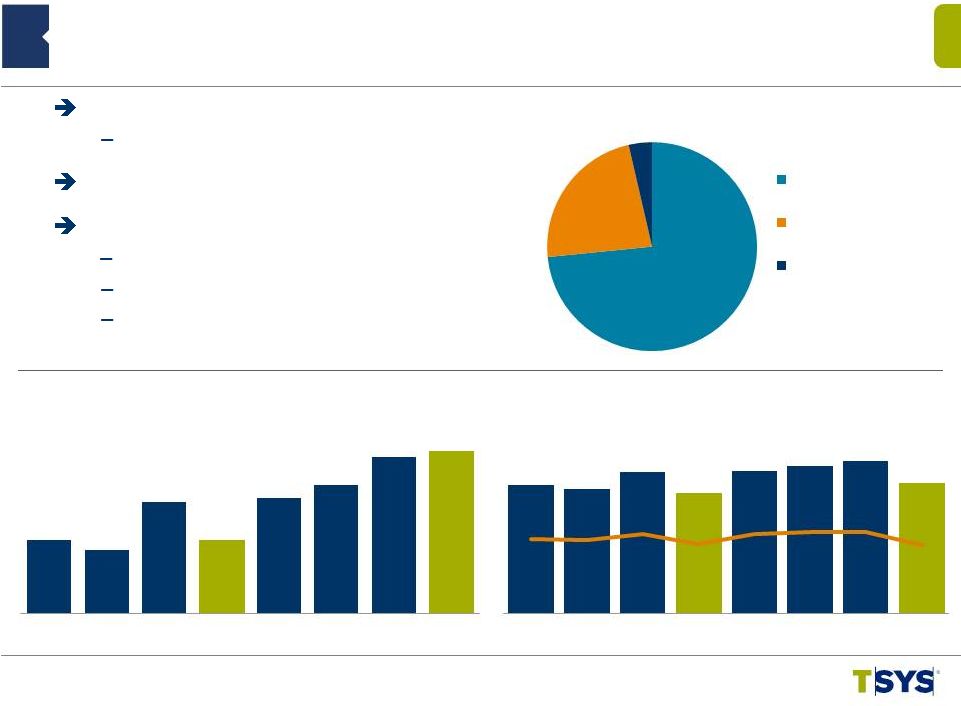

1Q

2014 North America Segment Highlights 6

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

($ in millions)

(*) Revenues Before Reimbursable Items

($ in millions)

3.4%

(1.3%)

1.9%

0.8%

4.4%

4.5%

6.8%

Adjusted Segment Operating Income

Operating Margin*

73%

23%

4%

(1)

Includes Credit, Debit,

Retail, Prepaid & Loyalty

(2)

Includes Healthcare

9.1%

Improving Revenue Growth

6th Straight Positive Growth Quarter

Adjusted Segment Operating Income Up 8.5%

Adjusted Operating Margin: 33.2%

Chase License Payments Expired

Increased Incentive Pay

Market Salary Adjustments

$205.6

$203.5

$213.6

$205.6

$214.5

$217.3

$223.3

$224.4

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Segment

Revenue*

YOY Growth %

$73.4

$71.5

$81.2

$68.7

$81.3

$84.4

$87.1

$74.6

35.7%

35.2%

38.0%

33.4%

37.9%

38.9%

39.0%

33.2%

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Consumer (1)

Commercial (2)

Other

Segment Revenue by Line of Business* |

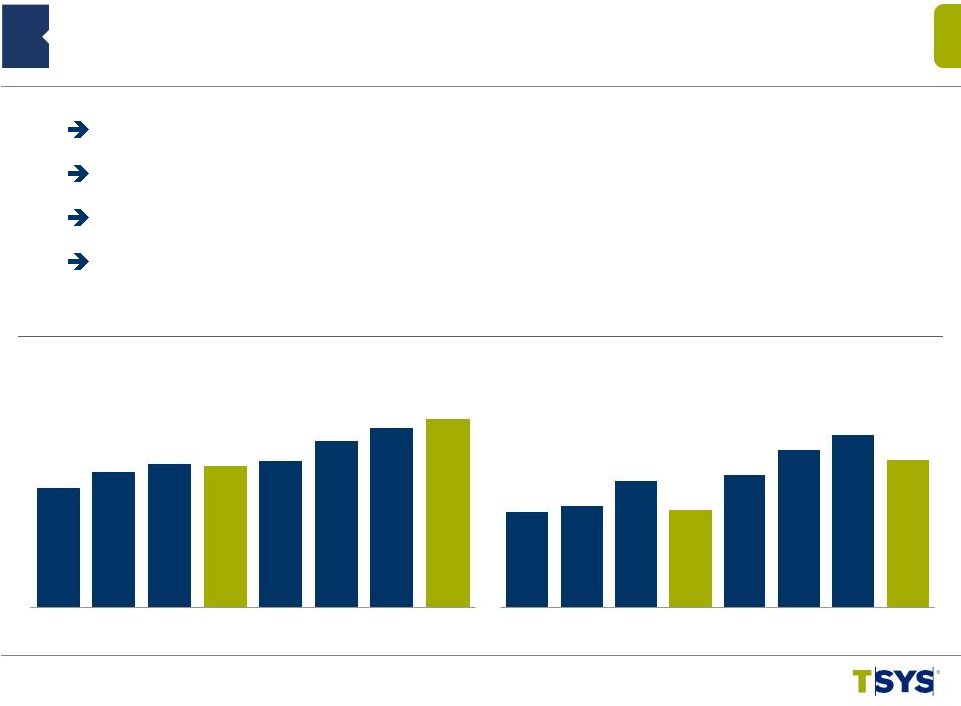

1Q

2014 North America Segment Highlights 7

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

*

(in millions)

(in millions)

7.2%

3.4%

5.5%

5.2%

6.3%

16.2%

16.5%

18.0%

20.9%

20.9%

16.9%

11.2%

11.6%

13.4%

12.1%

9.5%

12.7%

7.8%

11.5%

17.6%

13.4%

15.6%

17.2%

17.1%

Thirteenth Straight Quarter of Account On File YOY Growth

Large Account Conversion Pipeline

Sixteenth Straight Quarter of Transaction YOY Growth

Same Client Transactions Up 12.9%: Eighteenth Straight Quarter of YOY Growth

387.3

413.4

424.8

422.8

430.7

461.4

481.9

495.5

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Accounts on File

YOY Growth%

2,003.8

2,036.6

2,194.7

2,013.4

2,235.0

2,395.8

2,488.2

2,327.6

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Transaction Volume

YOY Growth%

(*) Growth

Excluding

Prepaid,

Government

Services

and

Single

Use

Accounts |

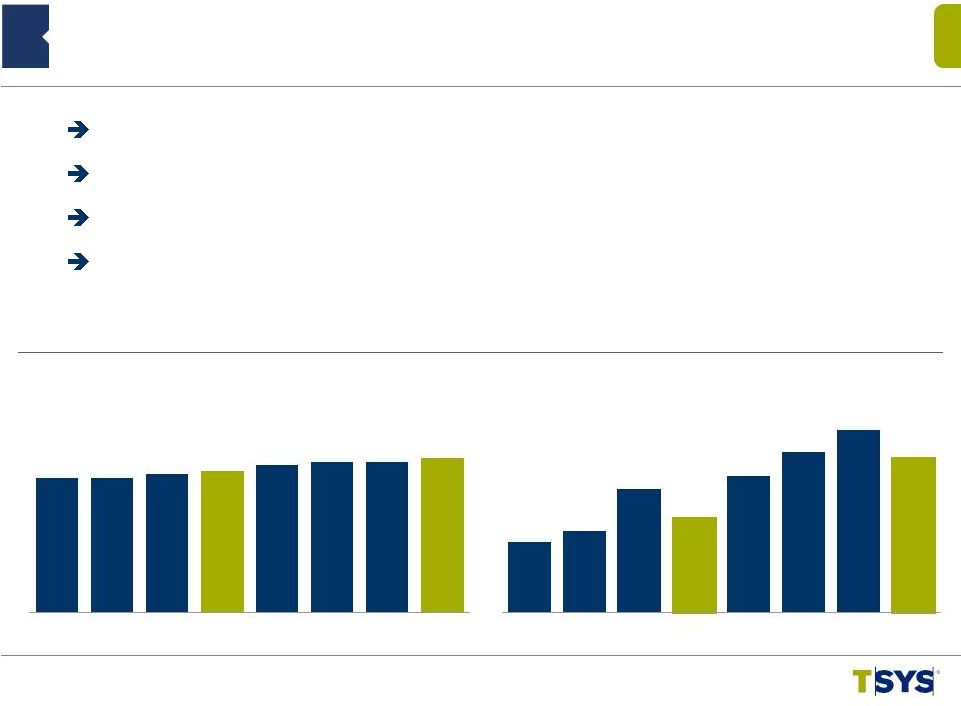

5%

6%

1Q 2014 International Segment Highlights

8

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

($ in millions)

Reported

Constant

Currency

(*) Revenues Before Reimbursable Items

($ in millions)

Adjusted Segment Operating Income

Operating Margin*

5.6%

1.4%

1.1%

(2.6%)

(4.0%)

0.7%

9.6%

4.4%

0.1%

(0.9%)

3.1%

9.0%

8.6%

89%

0.5%

(4.6%)

Revenue $76.8M* –

Up 0.5%

Down 4.6% on Constant Currency

Currency Tailwinds

Continued Margin Improvement Focus

Reemphasis on Accelerating Growth

Japan Market Divestitures

(NOTE: International numbers restated for Japan discontinued operations

(1.0%)

$79.8

$77.3

$83.1

$76.4

$76.6

$77.9

$90.6

$76.8

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Segment

Revenue*

YOY Growth %

$9.2

$6.8

$7.0

$6.9

$7.7

$9.5

$18.0

$4.6

11.5%

8.9%

8.4%

9.0%

10.0%

12.2%

19.9%

5.9%

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Segment Revenue by Region

QTD |

1Q

2014 International Segment Highlights 9

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

(in millions)

(in millions)

11.6%

5.7%

4.1%

3.7%

9.9%

12.1%

8.5%

18.1%

15.9%

19.5%

14.2%

23.3%

26.7%

17.3%

8.9%

19.3%

Strong AOF Growth, Despite Some Client Purging

Irish Debit AOF Grew By 71.2%

Double-digit Transaction Growth of 19.3%

Same Client Transaction Growth of 17.3%

52.8

52.9

54.5

55.7

58.0

59.2

59.1

60.7

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Accounts on File

YOY Growth%

399.2

414.6

473.6

434.0

492.4

525.5

555.6

517.9

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Transaction Volume

YOY Growth% |

Anniversary of Acquisitions

Completed Clearing and Settlement

Conversion

Direct Revenue Mix Holds at 57%

Expanded CPAY Ownership to 75%

1Q 2014 Merchant Segment Highlights

10

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

(*) Revenues Before Reimbursable Items

($ in millions)

5.0%

15.6%

5.5%

11.1%

15.6%

5.4%

4.3%

Adjusted Segment Operating Income

Operating Margin*

($ in millions)

(4.3%)

Segment Revenue*

YOY Growth %

$39.6%

38.2%

35.6%

34.4%

36.6%

35.9%

32.6%

28.8%

Segment Revenue by Mix*

QTD

57%

43%

$97.7

$107.8

$105.9

$109.3

$113.0

$113.6

$110.4

$104.6

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

$38.7

$41.1

$37.7

$37.6

$41.3

$40.8

$36.0

$30.2

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Direct

Indirect |

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

11

1Q 2014 Merchant Segment Highlights

(*) Excludes Managed Accounts

Segment Revenue by LOB

($ in billions)

12.3%

23.0%

32.2%

35.3%

40.6%

22.0%

11.1%

(12%)

45%

55%

26%

22%

(11%)

(12%)

(12%)

($ in millions)

4%

(14%)

9.3%

Direct Revenues Up 4.2%

Indirect Revenues Down 13.5%

POS Transactions Increased 2.7%, Excluding Deconverted Accounts

High Single-digit Direct Small Business Sales Volume Growth

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

$3.8

$4.4

$4.7

$4.8

$5.3

$5.3

$5.2

$5.3

SBS Sales Volume*

YOY Growth %

YOY Growth %

Indirect

Direct

$58

$58

$55

$52

$51

$51

$48

$45

$40

$50

$51

$57

$62

$63

$62

$59

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14 |

Segment Revenue

YOY Growth %

1Q 2014 NetSpend Segment Highlights

12

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

($ in millions)

Revenue $132.6M –

up 13.1%

Added 2k Retail Locations

Added 70+ New PayCard Clients

Announced PayChex and Western Union

Partnerships

($ in millions)

(*NOTE: Periods prior to the acquisition by TSYS have been restated )

$25.7

$24.9

$23.9

$28.0

$29.3

$34.6

$31.7

$28.7

30.1%

29.4%

26.7%

23.9%

27.9%

33.4%

30.5%

21.7%

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

$85.3

$84.9

$89.7

$117.3

$104.9

$103.7

$104.1

$132.6

14.7%

14.2%

16.9%

28.3%

22.9%

22.2%

16.1%

13.1%

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

Partner

Retail

Direct

Paycard

Segment Revenue by Channel

QTD

8%

52%

28%

12%

Adjusted Segment Operating Income*

Operating Margin* |

1Q

2014 NetSpend Segment Highlights 13

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Gross Dollar Volume

YOY Growth %

Direct Deposit Active Cards

YOY Growth %

Direct Deposit Active Cards up 21.2%

Exceeded 2M for the first time in history

Gross Dollar Volume (GDV) up 22.1%

Record Tax Season

(in thousands)

($ in millions)

24.2%

24.8%

25.1%

66.7%

42.3%

23.8%

22.1%

17.1%

17.9%

18.2%

42.8%

30.1%

22.4%

21.2%

21.5%

22.1%

957.0

1,018.5

1,081.6

1,707.9

1,361.4

1,261.1

1,321.1

2,070.3

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14

$3,034.7

$3,089.8

$3,265.4

$5,378.7

$3,947.9

$3,780.9

$3,967.6

$6,567.2

2Q12

3Q12

4Q12

1Q13

2Q13

3Q13

4Q13

1Q14 |

Jim

Lipham Chief Financial Officer

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Consolidated Selected Financial Highlights

15

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Total Revenues

$592,848

$448,791

32.1%

Revenues Before Reimbursable Items

532,750

388,032

37.3

Adjusted EBITDA*

149,596

123,446

21.2

Adjusted Cash EPS* from Continuing

Operations

$0.38

$0.38

(1.1)

1

st

Qtr

2014

1

st

Qtr

2013

Percent

Change

(in thousands, except per share data)

(*) Adjusted Cash EPS and Adjusted EBITDA definitions are contained in

Appendix |

Revenues before

Reimbursable

Items

Adjusted

Operating Margin

Adjusted

Segment

Operating Income

North America

$74,578

$224,368

33.24%

International

4,555

76,773

5.93%

Merchant

30,168

104,625

28.83%

NetSpend

28,717

132,640

21.65%

Eliminations

--

(5,656)

Corporate administration excluding stock comp

(24,144)

--

Adjusted operating margin

$113,874

$532,750

21.37%

Amortization of acquisition intangibles

(24,313)

NetSpend M&A expenses

(1,253)

Stock-based compensation

(7,611)

Operating income (US GAAP)

$80,697

Segment Operating Margin and Consolidated

Adjusted Operating Margin

(in thousands)

16

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Three Months Ended March 31, 2014 |

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

Rollforward of Quarterly Cash Balance

$200

$500

$100

$0

$300

Beginning

Balance

$248

Operating

Activities

$149

Cap Ex

($47)

Debt Pmts

($22)

Dividends

($19)

Acquisition

($38)

Other

$3

Ending Balance

$274

(in millions)

12/31/2013

3/31/2014

17

$400 |

Cash

Flow Strength: 2014 TTM Consolidated Financial Highlights

18

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide.

TTM = Trailing Twelve Months

(in millions)

$650

$549

$363

$249

$274

$0

$75

$150

$225

$300

$375

$450

$525

$600

$675

$750

Adjusted EBITDA

Cash flow from operations

Free cash flow

Net income

Ending cash |

2014

Revised Guidance* Range

Range

Percent Change

Total Revenues

$2,422

to

$2,471

17%

to

20%

Revenues Before Reimbursable Items

$2,182

to

$2,226

20%

to

22%

Adjusted EBITDA

$732

to

$746

17%

to

20%

Adjusted Cash EPS from continuing

operations

$1.90

to

$1.93

10%

to

12%

Average Basic Weighted Shares

188.4

(in millions, except per share data)

19

(*) See Appendix for guidance assumptions

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Q&A

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix

©2014

Total

System

Services,

Inc.®

Proprietary.

All

rights

reserved

worldwide. |

Appendix: Non-GAAP Items –

Adjusted EBITDA

and Adjusted Cash EPS

•

Adjusted EBITDA is net income excluding equity in income of equity investments,

nonoperating income/(expense), taxes, depreciation, amortization and

stock-based compensation expenses and other non-recurring items.

•

Adjusted cash EPS is adjusted cash earnings divided by weighted average shares

outstanding used for basic EPS calculations. Adjusted cash earnings is net

income excluding the after-tax impact of stock-based compensation expenses, amortization of acquisition intangibles,

and other non-recurring items.

•

Adjusted segment operating income is operating income at the segment level adjusted

for acquisition intangible amortization. •

Adjusted segment operating margin is adjusted segment operating income divided by

segment revenues before reimbursable items. •

The Company believes that these non-GAAP financial measures it presents are

useful to investors in evaluating the Company’s operating performance

for the following reasons: –

adjusted EBITDA and adjusted cash EPS are widely used by investors to measure a

company’s operating performance without regard to items, such as

interest expense, income tax expense, depreciation and amortization, merger and acquisition expenses and employee stock-based

compensation

expense

that

can

vary

substantially

from

company

to

company

depending

upon

their

respective

financing

structures

and

accounting policies, the book values of their assets, their capital structures and

the methods by which their assets were acquired; and –

securities

analysts

use

adjusted

EBITDA

and

adjusted

cash

EPS

as

supplemental

measures

to

evaluate

the

overall

operating

performance

of

companies.

•

By comparing the Company’s adjusted EBITDA and adjusted cash EPS in different

historical periods, investors can evaluate the Company’s operating

results without the additional variations caused by employee stock-based compensation expense, which may not be

comparable from period to period due to changes in the fair market value of the

Company’s common stock (which is influenced by external factors like the

volatility of public markets and the financial performance of the Company’s peers) and is not a key measure of the

Company’s operations.

•

The Company’s management uses the non-GAAP financial measures:

–

as measures of operating performance, because they exclude the impact of items not

directly resulting from the Company’s core operations; –

for planning purposes, including the preparation of the Company’s annual

operating budget; –

to allocate resources to enhance the financial performance of the Company’s

business; –

to evaluate the effectiveness of the Company’s business strategies; and

–

in communications with the Company’s board of directors concerning the

Company’s financial performance. ©2014 Total System Services,

Inc.® Proprietary. All rights reserved worldwide.

22 |

Consumer Credit

234.8

203.7

15.3

234.8

228.9

2.6

Retail

27.5

25.2

9.3

27.5

27.8

(0.9

)

Total Consumer

262.3

228.9

14.6

262.3

256.7

2.2

Commercial

40.4

37.9

6.7

40.4

39.9

1.2

Other

19.7

13.4

46.5

19.7

18.9

4.4

Subtotal

322.4

280.2

15.1

322.4

315.5

2.2

Prepaid */

Stored Value

120.0

107.3

11.8

120.0

118.0

1.7

Government

Services

63.0

59.4

6.1

63.0

62.2

1.1

Commercial Card

Single Use

50.8

31.6

60.8

50.8

45.3

12.2

Total AOF

556.2

478.5

16.2

556.2

541.0

2.8

Appendix: Accounts on File Portfolio Summary

(in millions)

Mar

2014

Mar

2013

%

Change

Mar

2014

Dec

2013

%

Change

23

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

(* -

Prepaid does not include NetSpend accounts) |

Appendix: Non-GAAP Reconciliation –

Revenues Before Reimbursable Items

Three Months Ended

03/31/14

03/31/13 Total Revenues

$592,848

$448,791

Reimbursable Items

60,098

60,759

$532,750

$388,032

(in thousands)

24

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Revenues before Reimbursable Items |

Appendix: Non-GAAP Reconciliation –

Adjusted

Segment Operating Income and Operating Margin

Three Months Ended

Operating income

$80,697

$74,520

Add: Acquisition intangible amort

24,313

8,532

Add: Corporate admin and other

33,008

30,193

Total segment adjusted operating income

$138,018

$113,245

By segment: North America services (a)

$74,578

$68,748

International services (b)

$4,555

$6,861

Merchant services (c)

$30,168

$37,636

NetSpend (d)

$28,717

$--

Total revenues

$592,848

$448,791

Reimbursable items

(60,098)

(60,759)

Total segment revenues before reimbursable items

$532,750

$388,032

Intersegment revenues

5,656

3,252

By segment: North America services (e)

$224,368

$205,596

International services (f)

$76,773

$76,387

Merchant services (g)

$104,625

$109,301

NetSpend (h)

$132,640

$--

Adjusted segment operating margin:

North America services (a) / (e)

33.24%

33.44%

International services (b) / (f)

5.93%

8.98%

Merchant services (c) / (g)

28.83%

34.43%

NetSpend (d) / (h)

21.65%

na

(in thousands)

25

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

3/31/14

3/31/13 |

Three

Months Ended

3/31/14 3/31/13

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

Consolidated:

Constant Currency (1)

$588,485

$448,791

31.1%

Foreign Currency (2)

4,363

---

Total Revenues

$592,848

$448,791

32.1%

International Services:

Constant Currency (1)

$78,134

$80,891

(3.4%)

Foreign Currency (2)

4,244

---

Total Revenues

$82,378

$80,891

1.8%

26

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Three

Months Ended

3/31/14 3/31/13

Percentage

Change

Appendix: Non-GAAP Reconciliation –

Constant Currency

(1) Reflects current period results on a non-GAAP basis as if foreign currency

rates did not change from the comparable prior year period. (2) Reflects the

impact of calculated changes in foreign currency rates from the comparable period.

(in thousands)

27

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Consolidated:

Constant Currency (1)

$528,701

$388,032

36.3%

Foreign Currency (2)

4,049

---

Revenues before

reimbursable items

$532,750

$388,032

37.3%

International Services:

Constant Currency (1)

$72,843

$76,387

(4.6%)

Foreign Currency (2)

3,930

---

Revenues before

reimbursable items

$76,773

$76,387

0.5% |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

(in thousands)

28

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Three Months Ended

Mar

2014

Mar

2013

Net income :

As reported (GAAP) (a)

$51,625

$59,149

Adjusted for:

Deduct: Income from discontinued operations

(980)

(15)

Deduct: Equity in Income of Equity Investments

(4,096)

(3,817)

Add: Income Taxes

24,335

17,463

Add: Nonoperating expenses

9,813

1,740

Add: Depreciation and amortization

60,035

40,852

EBITDA

$140,732

$115,372

Adjust for:

Add: Share-based compensation

7,611

4,593

Add: NetSpend M&A expenses

1,253

3,481

Adjusted EBITDA

$149,596

$123,446 |

Appendix: Non-GAAP Reconciliation –

Adjusted Cash EPS

(in thousands)

29

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

Three Months Ended

Mar

2014

Mar

2013

Income from continuing operations available to

TSYS common shareholders:

As reported (GAAP) (a)

$49,321

$57,905

Adjusted for amounts attributable to TSYS

common shareholders (net of taxes):

Acquisition intangible amortization

15,813

5,492

Share-based compensation

5,017

3,148

Cash earnings

$70,151

$66,545

NetSpend M&A expenses (nonrecurring)

1,204

5,222

Adjusted cash earnings (b)

$71,355

$71,767

Average common shares outstanding and

participating securities (c)

187,752

186,807

Basic EPS from continuing operations available

to TSYS common shareholders (a) / (c)

$0.26

$0.31

Adjusted cash EPS Available to TSYS common

shareholders (b) / (c)

$0.38

$0.38 |

Appendix: Non-GAAP Reconciliation –

EBITDA and Adjusted EBITDA

Trailing

Twelve Months

Ended

3/31/2014

Net Income

$249,074

Adjusted for:

Deduct: Discontinued operations

(3,021)

Deduct: Equity in Income of Equity Investments

(13,327)

Add: Income Taxes

218,210

Add: Nonoperating expense

38,097

Add: Depreciation and Amortization

117,854

EBITDA

$606,886

Adjust for: Share-based compensation

31,950

NetSpend M&A Operating Expenses*

11,406

Adjusted EBITDA

$650,243

(in thousands)

30

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

* Excludes share-based compensation |

Appendix: Non-GAAP Reconciliation –

Free Cash Flow

Trailing

Twelve Months

Ended

3/31/2014

Cash Flows from Operating Activities

$548,668

Less:

Purchase of Property and Equipment

(47,757)

Additions to Licensed Computer Software from Vendors

(40,788)

Additions to Internally Developed Computer Software

(36,944)

Additions to Contract Acquisition Costs

(60,202)

Free Cash Flow

$362,977

(in thousands)

31

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide. |

Appendix: 2014 Guidance Assumptions

The guidance assumes:

32

©2014 Total System Services, Inc.®

Proprietary. All rights reserved worldwide.

•

There will be no significant movements in the London Interbank Offered

rate and TSYS will not make any significant draws on the remaining

balance of its credit facility;

•

There will be no significant movement in foreign currency exchange rates

related to TSYS’

business;

•

TSYS will not incur significant expenses associated with the conversion of

new large clients other than included in the 2014 estimate, additional

acquisitions,

or

any

significant

impairment

of

goodwill

or

other

intangibles;

•

There will be no deconversions of large clients during the year;

•

There will be minimal synergies from the NetSpend acquisition for 2014;

and

•

The economy will not worsen. |