Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MACERICH CO | a2219700z8-k.htm |

QuickLinks -- Click here to rapidly navigate through this document

Dear Fellow Stockholders:

The year 2013 was a transformational one for our Company in many ways. We recently celebrated our 20th anniversary as a public company and it is remarkable how our Company has developed over those years. On March 9, 1994, Macerich went public with a total market capitalization of about $714 million and as of December 31, 2013, our total market capitalization was approximately $15 billion. I am pleased to report that today we are in the top 10% of all REITs as measured by total enterprise value.

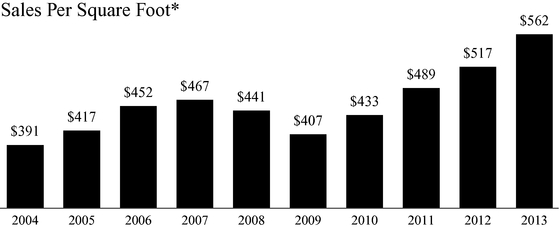

As I look back over those 20 years, I am proud of our progress and accomplishments across all aspects of our business. We have grown from a base of 12 malls to over 50 malls and now own some of the most productive and iconic retail venues in the country. Our mall productivity over this 20-year span has more than doubled with our current sales per square foot at $562. One of the key highlights in our history occurred in 2013 when our Company was added to the S&P 500 Index. When we went public, Macerich was not even one of the top 25 mall owners in the country. Today we are clearly recognized as one of the top mall companies in the U.S.

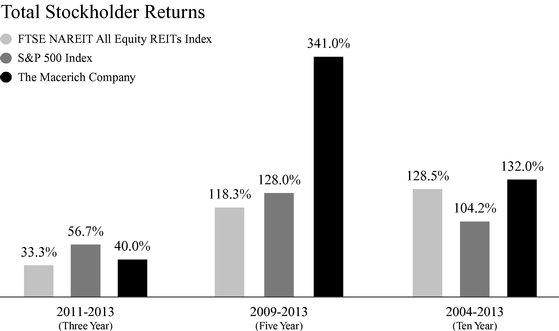

We also are especially proud that Macerich ranks in the top 25% of all publicly traded equity REITs in terms of our total stockholder return over our 20-year history and, in the most recent five years, our total stockholder return ranks in the top 10% of this REIT group.

Overall, 2013 was a particularly outstanding year and we achieved many of the primary goals that we established for our Company as we emerged from the global financial crisis of 2008 and 2009.

You may recall that in spring 2009, our Company elected not to sell "survival equity" as we believed it would unfairly dilute our stockholders on a permanent basis. Instead, we pursued a multi-faceted strategy to initially generate capital through non-core asset dispositions and property-specific joint ventures. We later issued equity but at much higher prices than were available in spring 2009. This financial crisis taught us many lessons and we transformed our Company into one with a strong balance sheet in terms of our assets as well as our liabilities and equity. We learned our fortress centers—the "must have" assets for retailers and shoppers—performed significantly better during that severe recession than our lesser quality assets. The lessons we learned from 2009 will never be forgotten. As a result, we have substantially upgraded the quality of our asset base through the acquisition of properties, including Kings Plaza and Green Acres, the consolidation of partnership interests in Arrowhead Towne Center and FlatIron Crossing, and the development of world-class assets such as Fashion Outlets of Chicago.

Although we had already substantially improved our portfolio, we decided in 2013 to pursue a strategy of further upgrading our asset base by disposing of additional non-core assets—those assets with lower sales productivity and slower growing net operating income (NOI). We successfully disposed of eight malls and one office complex during 2013 and generated gross sales proceeds of $856 million. Effectively, the entire amount of these proceeds was used to deleverage our balance sheet. As a result of our accomplishments, our Company has the strongest balance sheet in our history.

The composition of our "A quality" assets dramatically improved as a result of these dispositions. At December 31, 2013, after giving effect to our dispositions, acquisitions and new development, our portfolio consisted of interests in 54 regional malls averaging sales per square foot of $562 compared to 61 regional malls averaging sales per square foot of $517 at December 31, 2012. Our top 40 malls at December 31, 2012, generated 77.9% of our pro rata NOI. By December 31, 2013, our top 40 malls generated 89% of our pro rata NOI.

The short-term balance sheet impact of our dispositions was to pay off our line of credit and other debt. Long term, we successfully rebalanced our portfolio and will recycle that capital by expanding and redeveloping our highly productive, core assets. As I later outline, our development and redevelopment projects are focused on our best and most productive properties.

Several other companies, particularly in the mall sector, pursued the separation of their core and non-core assets through either spin-offs or corporate reorganizations. We elected not to follow this strategy because we wanted to retain the proceeds from our non-core dispositions to benefit our stockholders by investing those proceeds into our proven centers and new centers, such as Fashion Outlets of Chicago. Our plan is to focus on fewer but more dominant assets in densely populated urban markets. As several analysts have noted, our Company has greater population density per mall than any other mall company in the U.S. This is important to note as ease of shopping and proximity to retail stores become even more critical in the years ahead with retailers, through their omni-channel strategies, implementing same-day delivery and "click-and-collect" initiatives which allow customers to buy goods online for pick-up at their local stores.

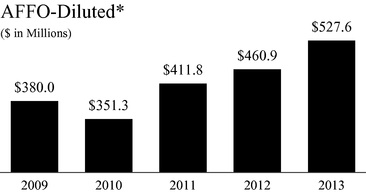

- *

- AFFO-diluted represents adjusted funds from operations on a fully-diluted basis. For the definition of AFFO-diluted and a reconciliation of AFFO-diluted to net income attributable to common stockholders-diluted, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Funds from Operations and Adjusted Funds from Operations" in the Form 10-K included herein.

Developments and Redevelopments

During 2013, Macerich made substantial progress on our major development and redevelopment projects that we believe will fuel our Company's growth over the years to come. As we move into 2014 and beyond, we will reinvest our capital into exciting new development, redevelopment and expansion projects.

Fashion Outlets of Chicago. The most notable development of 2013 within our portfolio was Fashion Outlets of Chicago. This breakthrough outlet project opened in August over 90% leased, with fashion-leading anchors Last Call by Neiman Marcus, Bloomingdale's The Outlet Store, Saks Fifth Avenue Off 5th and Forever 21. In addition, the tenant roster included luxury outlet retailers Longchamp, Brunello Cucinelli, Prada, DVF, Moncler, Gucci, Giorgio Armani, Michael Kors, Coach, Coach Men's and Tory Burch. We fully anticipate that this center will be one of the top centers of our portfolio as measured by sales per square foot.

Tysons Corner Center. We made significant progress toward the 2014-2015 opening of the office, residential and hotel towers at Tysons Corner. We successfully signed leases for a substantial portion of the office tower and it is currently more than 70% committed, with Intelsat, the world's leading provider of satellite services, as our marquee anchor. We strongly believe that our office tower will open in the third quarter of 2014 more than 80% leased and with rents above our original projections. Tysons' 300-room Hyatt Regency hotel along with our 430-unit residential tower are scheduled to open in spring 2015, coupled with a new 1.5-acre plaza that will provide Tysons Corner with direct access to the expanded Metro Silver Line opening in summer 2014. We are already reaping the benefits of our Tysons development and see the positive impact on retail rents for the shopping center. The retail community is recognizing the dramatic impact the densification of Tysons Corner will have on overall sales productivity and traffic. We remain confident that upon completion, this development will be one of the premier projects of its kind in the U.S.

The Shops at North Bridge. Another major addition to our portfolio in 2013 was the December opening of the nation's second Eataly at The Shops at North Bridge. This 63,000 square-foot, dynamic artisanal Italian food and wine emporium is already changing the retail traffic flow on Michigan Avenue and generating additional retail interest for North Bridge and our surrounding properties. In addition, Eddie V's restaurant and a new mall entrance were added to this center during 2013.

Fashion Outlets of Niagara Falls USA. We began construction on the 175,000 square-foot expansion of this outlet center in 2013 and had lease commitments for approximately 71% at year-end. During 2014, we anticipate substantially completing the expansion of this already highly successful outlet center.

Broadway Plaza. We recently began a $260 million expansion of this extremely productive retail center in Walnut Creek, California, that currently has sales over $700 per square foot. We will be expanding this open-air center by adding approximately 235,000 square feet of net new shop space to the existing 776,000 square feet currently anchored by Nordstrom, Neiman Marcus and Macy's. We are recreating this new retail complex by demolishing about 80,000 square feet of existing retail space as well as two older, inefficient parking structures which will be replaced with a modern, five-level parking deck. This project will open in phases beginning in late 2015.

Santa Monica Place. We are very excited to have recently received approval to add a 48,000 square-foot state-of-the-art, 12-screen ArcLight Cinemas to the third-level entertainment and dining deck of Santa Monica Place. We are also honored that Santa Monica Place received the most prestigious design and development award from the International Council of Shopping Centers in 2013, winning the Best-of-the-Best VIVA Global Design and Development Award which recognized Santa Monica Place as the best retail center built in the world. While we are pleased with our initial results, we are confident that Santa Monica Place has an even brighter future with our planned theatre addition, which we believe will drive significant incremental traffic and sales productivity to this iconic center.

Los Cerritos Center. We will begin the redevelopment of Los Cerritos Center in 2014 with the addition of a new state-of-the-art theatre and a major sporting goods junior anchor. Los Cerritos is a very successful center with sales per square foot of $674 and we are confident that these additional anchors will continue to expand its drawing power.

Scottsdale Fashion Square. We will begin a 130,000 square-foot expansion this year at Scottsdale Fashion Square, involving the addition of a new major sporting goods junior anchor and a new state-of-the-art cinema.

Kings Plaza Shopping Center. Even though we only recently acquired Kings Plaza, we began remerchandising this well-positioned property in Brooklyn as well as redeveloping the mall's interior and parking structure.

Green Acres Mall. Shortly after our acquisition of Green Acres Mall, we acquired 20 acres of land contiguous to this center and we plan to build more than 300,000 square feet of retail space, which we anticipate opening in fall 2016.

- *

- Tenants 10,000 square feet and under.

Excellence in Operations

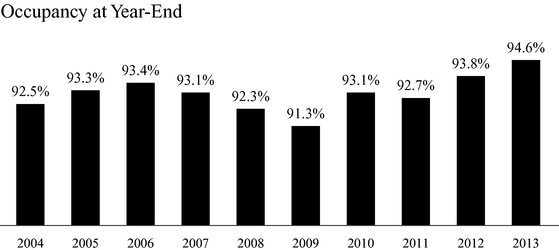

Our operational fundamentals are very strong, and our core metrics reflect this robust performance. We increased our AFFO per share-diluted by approximately 11% during 2013 even after factoring in the dilution from our dispositions. Annual sales per square foot ended the year at $562 compared to $517 for the prior year. Our releasing spreads for 2013 were extremely positive at 17.2% and we ended the year with mall occupancy at 94.6%. As a result, we achieved 2013 same center NOI growth in our portfolio of 4.1%. In addition to overall occupancy gains and strong releasing spreads, we achieved this increase in our same center NOI growth by converting temporary leases to permanent leases, and disposing of our slower growing and less productive centers. The average sales per square foot of the assets that we sold in 2013 was $340, substantially below our portfolio average. By disposing of assets that historically have not grown at the same rate as our more productive assets and redeploying the proceeds via redevelopment into our top 20 centers, we believe we will substantially enhance our net asset value as well as benefit our same center NOI growth.

Balance Sheet and Liquidity

In addition to selling approximately $856 million of non-core assets during the year, we also deleveraged by selling common equity of $171 million at approximately $70 per share concurrent with our inclusion in the S&P 500 Index. As previously noted, our balance sheet today is the strongest it has been in the history of our Company. We further extended our average debt maturity schedule to approximately six years and reduced our debt-to-EBITDA ratio to 7.2x. We ended the year with significant liquidity, with only $30 million outstanding on our $2 billion line of credit and $102 million of cash on the balance sheet.

Macro Concerns

After meeting with a significant number of investors over the past three months, it is clear to me that there are macro concerns in the regional mall industry about the impact of e-commerce on brick-and-mortar sales as well as the future of JCPenney and Sears. In terms of the impact of e-commerce on brick-and-mortar sales, it is evident to us that the dot.com business of each of our retailers is synergistic with its other distribution channels, whether these retailers are full price, off price or outlet. If, for example, you think of a retailer's e-commerce distribution channel as a single store, and that retailer has 500 stores, most likely the e-commerce store will always be the highest-volume and fastest-growing store. The fact that the e-commerce distribution channel may be the highest-volume store, however, does not mean that any particular retail chain would ever consider closing its brick-and-mortar stores to rely solely on its e-commerce channel. Our most successful retailers fully believe that each of their channels of distribution is synergistic with one another. We believe fortress centers are a key component of not only a retailer's brick-and-mortar strategy but also its e-commerce strategy. I do believe that malls and retail stores located in the center of dense populations, such as our current portfolio, will have an advantage as retailers utilize such options as same-day delivery, "click-and-collect" and other logistical conveniences for their customers.

With respect to JCPenney and Sears, we are always hopeful that each of our anchor department stores will be successful. Macerich substantially reduced the number, and relative risk, of JCPenney and Sears stores in our portfolio through our recent disposition program. We experienced numerous anchor evolutions over the years, and, in almost every case, when one anchor goes out of business or is purchased by another anchor, the Darwinian nature of the retail business results in greater productivity from the replacement anchor. We are constantly evaluating how to upgrade the uses of various spaces at our properties. As we continue to enhance our portfolio and focus on major urban markets, we believe that a recapture of our anchors will result in replacement anchors and/or uses that upgrade the quality of these centers over time. For example, in 2005, Santa Monica Place was anchored by Robinsons May and Macy's. These two anchors together generated less business than either Bloomingdale's or Nordstrom generate in that center today. We believe owning dominant, "A quality" fortress malls in dense trade areas provides us with the ability to remerchandise both small store space as well as anchor space in the event of any tenant closure.

Summary

As we emerged from the severe recession, we committed to you that Macerich would create a strong and much improved balance sheet both in terms of our assets and our liabilities and equity. We believe that we accomplished that goal. We significantly strengthened our capital and liquidity positions, bolstered the quality of our portfolio and expanded our business opportunities. However, we are never satisfied and will strive to further enhance the productivity of our centers as well as continue to improve our balance sheet. As a result of our accomplishments, 89% of our NOI is now generated from properties that average sales in excess of $600 per square foot and are located in some of the most densely populated and fastest-growing markets in the U.S. We have a very strong management team that is focusing their attention on recycling capital from our less productive assets into our proven winning assets. We are well-positioned to refinance our loan maturities due over the next several years. Based on current underwriting standards, we believe we could generate excess financing proceeds to completely fund our development/redevelopment pipeline. Furthermore, given the high average existing interest rates on debt maturing in the next three years, interest rates would need to increase dramatically for us not to realize a lower interest rate on our refinancings.

I want to thank our stockholders and our board of directors for their guidance and support during the year. In particular, I would like to thank our directors that have been with us since we went public 20 years ago, including our lead director, Fred Hubbell, as well as Stan Moore, Dr. William Sexton and, of course, our founding directors, Dana Anderson and Edward Coppola. We also would like to welcome Steven Soboroff who was appointed to the board earlier this year. Mr. Soboroff has been a strong community leader and real estate developer in Los Angeles for over 35 years and is currently

the President of the Los Angeles Police Commission. We are confident that he will be a valuable addition to our already strong board.

I look forward to reporting to you during the balance of this year.

Very truly yours,

Arthur M. Coppola Chairman and Chief Executive Officer |