Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Live Oak Bancshares, Inc. | d688561dex211.htm |

| EX-3.1 - EX-3.1 - Live Oak Bancshares, Inc. | d688561dex31.htm |

| EX-3.2 - EX-3.2 - Live Oak Bancshares, Inc. | d688561dex32.htm |

| EX-24.1 - EX-24.1 - Live Oak Bancshares, Inc. | d688561dex241.htm |

| EX-10.4 - EX-10.4 - Live Oak Bancshares, Inc. | d688561dex104.htm |

| EX-10.2 - EX-10.2 - Live Oak Bancshares, Inc. | d688561dex102.htm |

| EX-10.3 - EX-10.3 - Live Oak Bancshares, Inc. | d688561dex103.htm |

| EX-10.1 - EX-10.1 - Live Oak Bancshares, Inc. | d688561dex101.htm |

| EX-23.1 - EX-23.1 - Live Oak Bancshares, Inc. | d688561dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 14, 2014

Registration No. 333-[ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIVE OAK BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

| North Carolina | 6022 | 26-4596286 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1741 Tiburon Drive

Wilmington, North Carolina 28403

(910) 790-5867

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James S. Mahan, III

Chairman and Chief Executive Officer

Live Oak Bancshares, Inc.

1741 Tiburon Drive

Wilmington, North Carolina 28403

(910) 790-5867

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications to:

| Todd H. Eveson, Esq. Alexander M. Donaldson, Esq. Jonathan A. Greene, Esq. Wyrick Robbins Yates & Ponton LLP 4101 Lake Boone Trail, Suite 300 Raleigh, North Carolina 27607 (919) 781-4000 |

Frank M. Conner III, Esq. Michael Paul Reed, Esq. Covington & Burling LLP 1201 Pennsylvania Avenue, NW Washington, DC 20004-2401 (202) 662-6000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Maximum Aggregate Offering Price (1)(2) |

Amount of Registration Fee (3) | ||

| Common Stock, no par value per share |

$86,250,000 | $11,109 | ||

|

| ||||

|

| ||||

| (1) | Includes the aggregate offering price of additional shares that the underwriters have the right to purchase from the Registrant, if any. |

| (2) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Calculated in accordance with Rule 457(o) under the Securities Act of 1933, based on an estimate of the proposed maximum aggregate offering price. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

Table of Contents

SUBJECT TO COMPLETION, DATED APRIL 14, 2014

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Shares of Common Stock

$ Per Share

We are Live Oak Bancshares, Inc., the parent company and registered bank holding company of Live Oak Banking Company in Wilmington, North Carolina. We are offering shares of our common stock, no par value per share, and the selling shareholders identified in this prospectus are offering shares of our common stock in a fully underwritten initial public offering. We will not receive any proceeds from sales by the selling shareholders. The underwriters have an option to purchase additional shares of our common stock from us in this offering.

Prior to this offering, there has been no public market for our common stock. It is currently estimated that the initial public offering price per share will be between $ and $ . We intend to apply to list our common stock on the NASDAQ Global Market under the symbol “LOB.”

Investing in our common stock involves risks. See “Risk Factors” beginning on page 25 to read about factors you should consider before buying our common stock.

We are an “emerging growth company” under the federal securities laws and are eligible for reduced public company reporting requirements.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares of our common stock that you purchase in this offering will not be savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

||||||||

| Proceeds to us, before expenses |

||||||||

| Proceeds to selling shareholders, before expenses |

||||||||

| (1) | The underwriters will also be reimbursed for certain expenses incurred in this offering. See “Underwriting” for details of the compensation payable to the underwriters. |

The underwriters expect to deliver the common stock offered hereby in New York, New York on or about , 2014, subject to customary closing conditions.

We have granted the underwriters an option to purchase up to an additional shares of our common stock at the initial public offering price less the underwriting discount, within 30 days from the date of this prospectus.

SunTrust Robinson Humphrey

Prospectus dated [—], 2014.

Table of Contents

Table of Contents

| ii | ||||

| ii | ||||

| ii | ||||

| iii | ||||

| 1 | ||||

| 25 | ||||

| 41 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 48 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

49 | |||

| 77 | ||||

| 87 | ||||

| 93 | ||||

| 98 | ||||

| 99 | ||||

| 101 | ||||

| 107 | ||||

| 118 | ||||

| 122 | ||||

| 127 | ||||

| 127 | ||||

| 127 | ||||

| F-1 |

i

Table of Contents

You should rely only on the information contained in this prospectus. We, the selling shareholders, and the underwriters have not authorized any person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We, the selling shareholders, and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus outside of the United States.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus to “LOB,” “we,” “us,” “our,” the “Company,” or similar references, mean Live Oak Bancshares, Inc. and its subsidiaries on a consolidated basis. References to “Live Oak Bank” or the “Bank” mean our wholly-owned banking subsidiary, Live Oak Banking Company.

Industry and market data used in this prospectus has been obtained from independent industry sources and publications available to the public, sometimes with a subscription fee, as well as from research reports prepared for other purposes. We did not commission the preparation of any of the sources or publications referred to in this prospectus. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. We have not independently verified the data obtained from these sources. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this prospectus. Trademarks used in this prospectus are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

IMPLICATIONS OF BEING AN EMERGING GROWTH COMPANY

As a company with less than $1.0 billion in gross revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of reduced regulatory and reporting requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| • | we may present only two years of audited financial statements and only two years of related “Management’s Discussion and Analysis of Financial Condition and Results of Operations”; |

| • | we are exempt from the requirement to obtain an attestation and report from our auditors on the assessment of our internal control over financial reporting pursuant to the Sarbanes-Oxley Act; |

| • | we are permitted to provide less extensive disclosure about our executive compensation arrangements; |

| • | we are not required to hold non-binding advisory votes on executive compensation or golden parachute arrangements; and |

| • | we can delay the adoption of new or revised accounting standards affecting public companies until those standards would otherwise apply to private companies. |

ii

Table of Contents

We may take advantage of these provisions for up to five years unless we earlier cease to be an emerging growth company. We will cease to be an emerging growth company if we have more than $1.0 billion in annual gross revenues, have more than $700.0 million in market value of our common stock held by non-affiliates as of any June 30 before that time, or issue more than $1.0 billion of non-convertible debt in a three-year period. We may choose to take advantage of some but not all of these reduced regulatory and reporting requirements. We have elected in this prospectus to take advantage of scaled disclosure relating to executive compensation arrangements. However, we have elected to include the audited consolidated balance sheets, statements of income, comprehensive income, changes in shareholders’ equity and cash flows for the year ended December 31, 2011. We believe that the 2011 financial information provides relevant information regarding the Company’s growth and strategic trajectory.

Following this offering, we may continue to take advantage of some or all of the reduced regulatory, accounting and reporting requirements that will be available to us as long as we continue to qualify as an emerging growth company. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to avail ourselves of this extended transition period for complying with new or revised accounting standards and, therefore, we will not be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies. It is possible that some investors could find our common stock less attractive because we may take advantage of these exemptions. If some investors find our common stock less attractive, there may be a less active trading market for our common stock and our stock price may be more volatile.

DEVELOPMENTS AFFECTING OUR BUSINESS AFTER THE OFFERING

In connection with the completion of this offering, we intend to take the following significant corporate actions which will affect our financial condition and results of operations after the offering:

| • | nCino Spin-Off: spin-off the ownership interests in our investment in nCino, Inc. to our shareholders as of a record date prior to completion of this offering, which we refer to in this prospectus as the “nCino Spin-Off”; |

| • | Cash Dividend: pay a cash distribution to our existing shareholders prior to our conversion from a “Subchapter S” corporation to a “C corporation” to offset the estimated tax liability of our shareholders created by the nCino Spin-Off and for any undistributed 2014 tax amounts related to shareholders’ allocable share of 2014 S corporation taxable income, which we refer to in this prospectus as the “Cash Dividend”; and |

| • | C Corporation Conversion: voluntarily terminate our status as a “Subchapter S” corporation and convert to a C corporation for federal income tax purposes, which we refer to in this prospectus as the “C Corporation Conversion.” |

For an explanation of each of these developments and their impact on our operations, see “Prospectus Summary – Developments Affecting Our Business After the Offering” and “Unaudited Pro Forma Consolidated Financial Data.”

iii

Table of Contents

This summary highlights selected information contained in greater detail elsewhere in this prospectus and does not contain all the information that you need to consider in making your investment decision. You should carefully read this entire prospectus before deciding whether to invest in our common stock. You should pay special attention to, among other things, our consolidated financial statements and the related notes thereto and the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of this prospectus to determine whether an investment in our common stock is appropriate for you.

Although we intend to effect the nCino Spin-Off, the Cash Dividend, and the C Corporation Conversion immediately prior to the completion of this offering, except where we indicate otherwise, our discussion of our financial condition and results of operations does not reflect these transactions.

Our Company

We are a nationwide lender to small businesses in niche industries. We leverage industry expertise and a unique technology platform to optimize the credit extension, administration process and borrowing experience for our customers. We have developed a business model we believe mitigates credit risk and capitalizes on technology that facilitates efficient and prudent loan generation and portfolio management. Our guiding principles, in order of priority, are soundness, profitability, and growth.

We originate loans partially guaranteed by the U.S. Small Business Administration, or the SBA, to small businesses and professionals in a select group of industries with low risk characteristics. We refer to these carefully selected industries as “verticals.” Within each vertical we have developed in-depth expertise by retaining officers who possess extensive industry lending experience in these sectors and who continue to deepen trade knowledge by participating in a variety of sector-focused educational and marketing events.

Our tactical immersion into industry verticals is coupled with our focus on developing detailed knowledge of our customers’ businesses through regular visits to their operations wherever they are located to provide us and our customers with an in-depth and personalized experience throughout the loan relationships. We believe our industry and customer-focused approach provides us greater insight into our customers’ credit characteristics and needs and furthers our knowledge base of the vertical in which the customer operates. In turn, we are able to provide our borrowers valuable insight into trends and developments in their industry verticals and within their operations. We are able to service our customers efficiently throughout the loan process and monitor their performance by means of our integrated proprietary technology platform. As a result, we have no need to maintain any traditional branch locations or ATMs and we do not employ any tellers, thus eliminating a significant component of the overhead expense associated with the traditional banking franchise.

We typically sell the SBA-guaranteed portion (generally 75% of the principal balance) of the loans we originate at a premium in the secondary market. We also generally sell participation interests in the remaining portion of our loans while retaining a 10% unguaranteed interest and the servicing rights to the entire loan. As a result of our business model, our net income is driven primarily by non-interest income rather than net interest income.

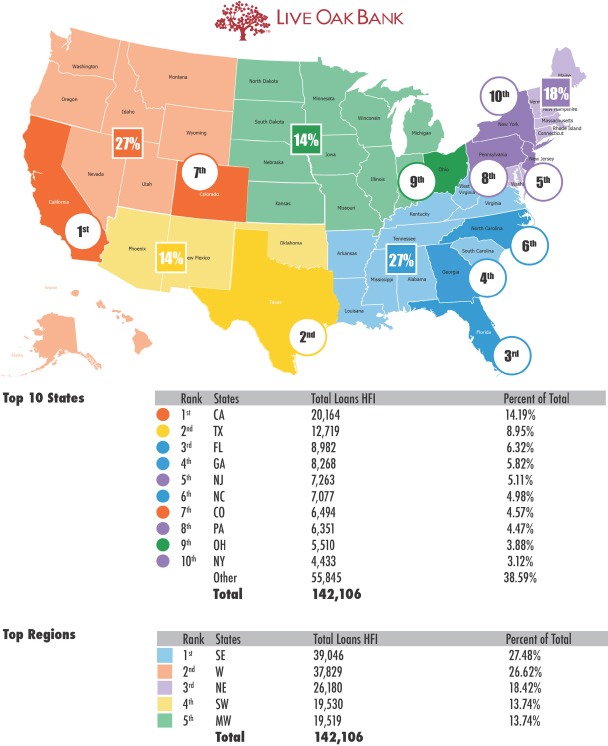

Our focus on originating SBA guaranteed loans in select verticals nationwide has allowed us to organically develop loan portfolio credit characteristics that we believe are attractive. Our portfolio is geographically dispersed throughout all U.S. regions (Southeast, Northeast, Midwest, Southwest, and West) with each region representing between 14% and 27% of our total loan portfolio during 2013. Only one state (California at 14%) represented more than 10% of our aggregate held-for-investment loan portfolio at year-end 2013. Additionally, during 2013 our average unguaranteed exposure per loan was approximately $125 thousand compared to an average outstanding principal loan balance of approximately $800 thousand.

1

Table of Contents

Our ability to develop and execute on our business model has yielded a compounded growth rate in loan production of 25% since 2008. For the U.S. government’s 2013 fiscal year (the four quarters ended September 30, 2013), we were the third most active SBA 7(a) lender in the United States by gross approval amount, behind only Wells Fargo Bank and U.S. Bank.

Vertical Immersion Strategy

We have focused our lending to small businesses and professionals in specific industry segments, or verticals, in which we build deep industry expertise. Our seven existing industry verticals consist of the following:

| • | Veterinary Practices |

| • | Healthcare Services (medical/dental/optometry) |

| • | Independent Pharmacies |

| • | Death Care Management (funeral/crematory) |

| • | Investment Advisors |

| • | Family Entertainment Centers |

| • | Poultry Agriculture |

We are engaged and active in each of the industries we serve by attending conventions and trade shows, and by speaking at universities and industry events. Each vertical is staffed by personnel with industry-specific knowledge, experience and contacts. For example, our senior lender in the Independent Pharmacies vertical is a third-generation pharmacist who brings broad experience and expertise to his position as a loan officer responsible for examining, evaluating and closing extensions of credit to independent pharmacies. Our Death Care Management vertical expertise includes the former president and chief operating officer of Service Corporation International (a company that operates a network of more than 2,000 funeral homes and cemeteries), and another individual who began his career in the funeral services industry over 32 years ago. Our Veterinary Practices vertical benefits from the experience of a licensed veterinarian and attorney who provides an informed perspective to our Veterinary Practices vertical team and customers.

This industry-specific expertise and participation increases our visibility within our verticals. It is also helpful in identifying and selecting credit-worthy borrowers and attractive financing projects prior to the formal underwriting process. Our familiarity with and participation in our verticals allows us to provide ongoing customer service that is relevant for each business owner’s specific industry segment.

We attempt to identify verticals with a statistical history of performance and a low risk profile. It is our intent to add a new industry to our portfolio every 12 months. Potential industries are identified and researched by our “Emerging Markets” division. We have chosen verticals that display some or all of the following characteristics:

| • | Stable cash flows |

| • | Barriers to entry |

| • | Granular customer bases |

| • | Collateral shortfall |

| • | Limited to no foreign competition |

| • | Growing demand |

| • | Rapid cash cycles |

| • | Recession resistant |

2

Table of Contents

| • | Limited malpractice risk |

| • | Underserved by other/traditional banking models |

Through our industry expertise, speed-to-market, and differentiated level of borrower experience and customer service, we have increased annual production in each year since inception. The growth in production has been due to the maturity of certain industry verticals, the establishment of new industry verticals and our origination of loans that are generally larger than the average SBA loan. The following table summarizes our annual production by industry vertical:

| Years Ended December 31, | ||||||||||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | Total | |||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||

| Veterinary Practices |

$ | 40,226 | $ | 161,230 | $ | 145,920 | $ | 150,788 | $ | 149,485 | $ | 174,768 | $ | 147,661 | $ | 970,078 | ||||||||||||||||

| Healthcare Services |

— | 150 | 13,385 | 56,580 | 69,860 | 81,363 | 109,317 | 330,655 | ||||||||||||||||||||||||

| Independent Pharmacies |

— | — | — | 48,919 | 86,757 | 103,358 | 106,391 | 345,425 | ||||||||||||||||||||||||

| Death Care Management |

— | — | — | — | — | 54,075 | 101,736 | 155,811 | ||||||||||||||||||||||||

| Investment Advisors |

— | — | — | — | — | — | 33,647 | 33,647 | ||||||||||||||||||||||||

| Other |

775 | 1,209 | 1,275 | 30 | 535 | 199 | — | 4,023 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total |

$ | 41,001 | $ | 162,589 | $ | 160,580 | $ | 256,317 | $ | 306,637 | $ | 413,763 | $ | 498,752 | $ | 1,839,639 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

In January 2014, we hired a team of five commercial lenders who have decades of experience in the poultry agriculture industry. The addition of these professionals provides us with an experienced team of poultry industry lenders who have a close understanding of agricultural businesses. We expect loans extended in this vertical to primarily fund the following agricultural-related activities: the construction of new poultry farms, the purchase or refinancing of existing operations, and the purchase of new equipment or supplies.

Our vertical immersion strategy and our commitment to sound credit underwriting and credit administration are reflected in the credit quality of our loan portfolio. Our borrowers have historically had an average Fair Isaac Corporation, or FICO, score in excess of 700 using the lowest of scores provided by three credit bureaus at the time of underwriting and an average debt service coverage ratio of approximately 200% using the most current borrower financial statements available as of February 2014. To date, we have never had a denial or repair of any SBA guarantee submitted for payment.

We do not pay our lenders commissions. Our management believes that incentivizing our lenders to produce more loans through the payment of commissions creates an inherent conflict with sound credit administration. By choosing not to implement a commission-based payment structure, we believe we generate loans of greater credit quality, enhancing overall portfolio performance and aligning lenders’ interests with those of the entire company. We believe this alignment of interests is a strategic differentiator at Live Oak.

Technology

We have created a technology-based platform to facilitate lending to the small business community on a national basis and we have leveraged this technology to optimize our loan origination process, customer experience, reporting metrics, and servicing activity. In 2012, we formed nCino, Inc., or nCino, to develop this technology, known as nCino’s Bank Operating System. The nCino Bank Operating System is a fully integrated operating system built on Salesforce.com, Inc.’s Force.com cloud computing infrastructure platform. It provides a real-time view of our loan pipeline, as well as additional process, borrower and credit data. The integration of this system into our day-to-day operations has improved work flow efficiency, minimized loan file and documentation exceptions, and provided clarity into our loan portfolio. For example, we are able to segregate production data by vertical, geography, lender, participating bank, or referral source. We can examine loans by their status in our pipeline and determine what outstanding documents are required prior to submission to the SBA.

3

Table of Contents

The technology we utilize also streamlines the paperwork that typically accompanies SBA loans. A typical SBA loan under the 7(a) program may require up to 150 separate loan documents to be submitted. Through our partnership with nCino, we collect, track, and organize these documents in a manner that maximizes efficiency and minimizes unnecessary customer contact, and we have staffed the Bank with software developers to further enhance and optimize the software. This technology has ultimately transformed the traditional means of loan servicing into one of our strongest competitive advantages by accelerating our ability to issue proposals, complete due diligence and finalize commitments. Our customers are also able to benefit from our technology, as it allows borrowers the ability to track a loan’s progress towards approval and funding through a secure online portal.

While the nCino Spin-Off will occur prior to completion of this offering, it is anticipated that the Company and nCino will remain closely aligned for the foreseeable future. Immediately after the nCino Spin-Off, directors, officers and employees of the Company and the Bank will own approximately 52% of nCino’s outstanding common stock. In addition, our executive officers, Messrs. James “Chip” S. Mahan III, Neil L. Underwood and David G. Lucht, will continue as members of the board of directors of nCino. Transactions between the Company or the Bank and nCino, including an existing software license agreement and the lease agreement for commercial office space, are anticipated to remain in effect without modification. Our transactions with nCino are at arm’s length and comply with the quantitative and qualitative requirements of Sections 23A and 23B of the Federal Reserve Act, as amended, and Regulation W of the Board of Governors of the Federal Reserve System.

Our History and Performance

Live Oak Lending Company, our predecessor company, began originating loans to small businesses in May 2007. During this time, we began the application process to become a state-chartered financial institution insured by the Federal Deposit Insurance Corporation, or FDIC. We currently operate through Live Oak Bancshares, Inc., a North Carolina business corporation and registered bank holding company subject to regulation by the Board of Governors of the Federal Reserve System, or the Federal Reserve, and the North Carolina Commissioner of Banks. Our principal subsidiary is Live Oak Banking Company, a North Carolina chartered commercial bank that commenced operations on May 12, 2008, and is subject to regulation by the FDIC and the North Carolina Commissioner of Banks.

We have experienced significant growth in assets, loans, deposits and earnings during the last five years, all of which has been achieved organically, as we have not acquired any banks, thrifts, branches, or loans. At December 31, 2013, we had total assets of $430.4 million, loans of $300.8 million, deposits of $356.6 million, and shareholders’ equity of $48.4 million. Since December 31, 2009, our assets have grown at a compounded annual growth rate of 35.1%, and our net interest income, noninterest income, noninterest expense and net income have grown at a compounded annual growth rate of 71.5%, 54.6%, 51.8% and 102.3%, respectively. For the year ended December 31, 2013, our net interest income, noninterest income, noninterest expense and net income were $10.8 million, $56.5 million, $40.2 million and $28.1 million, respectively, and grew by 33.1%, 32.9%, 19.3% and 74.4%, respectively, from the year ended December 31, 2012. Our net income available to our common shareholders and diluted earnings per share grew by 66.8% and 71.8%, respectively, from 2012.

Credit quality and on-going credit administration are cornerstones of our franchise. Non-performing loans represented 2.02% of total assets at December 31, 2013. Adjusting for the portion of nonperforming loans that carry a U.S. Government guarantee, the ratio becomes 0.40%. Our ratio of net charge-offs to average total loans on book was 0.66% for the year ended December 31, 2013. Our ratio of allowance for loan losses to loans was 1.93% at December 31, 2013 and our ratio of allowance for loan losses to nonperforming loans not guaranteed by the U.S. government was 158.8% at December 31, 2013. In evaluating our credit quality we focus on the unguaranteed portion of our loan portfolio. As of December 31, 2013, approximately $86.5 million of our assets or approximately 20% were guaranteed by the SBA.

4

Table of Contents

Our principal executive office is located at 1741 Tiburon Drive, Wilmington, North Carolina 28403 and our telephone number is (910) 790-5867. Our Internet address is www.liveoakbank.com. Information on or accessible through our website is not incorporated by reference into and is not part of this prospectus.

Our Executive Management Team and Board of Directors

Our executive management team has a combined 154 years of banking and financial experience, as well as extensive experience in developing technologies to support online and Internet operations and within our industry verticals.

James “Chip” S. Mahan III, Chief Executive Officer and Chairman of the Board, has more than 40 years of banking experience and has founded multiple banks, including Cardinal Bancshares, which he took public in 2002, and Security First Network Bank, the nation’s first Internet-only bank and predecessor of S1 Corporation.

William “Lee” L. Williams III is the Vice Chairman of the Company and one of the original founders of the Bank. Prior to starting Live Oak Bank, Williams spent 19 years in corporate banking at Wachovia and worked for 14 years at Vine Street Financial engaged in SBA lending.

Neil L. Underwood, President, has significant banking and technology experience, and was instrumental in the development of both nCino and S1 Corporation.

David G. Lucht, Chief Risk Officer, joined the Live Oak team in May 2007 as a founding member. Prior to joining Live Oak, Mr. Lucht was the Chief Credit Officer, Executive Vice President and Director for First Merit Bank in Akron, Ohio, where he was responsible for leading the turnaround in credit culture and performance of the $10.5 billion bank.

S. Brett Caines, Chief Financial Officer, joined the Live Oak team in June 2007. Prior to the Bank, Mr. Caines worked as a Production Engineer for INVISTA and as a Process Engineer for Shell Chemical Company.

Our board of directors consists of experienced individuals, many of whom have direct connections with our chosen industry verticals, allowing them to understand and provide meaningful contributions to both our operations and strategy.

Developments Affecting Our Business After the Offering

We intend to take the following significant corporate actions which will affect our financial condition and results of operations after the offering:

nCino Spin-Off

Immediately prior to the completion of this offering, we intend to spin off the shares of common stock we own in nCino to our shareholders as of a record date prior to completion of this offering. nCino commenced operations in early 2012 and was a consolidated subsidiary of the Company until January 2013, when our ownership interest declined to a level that no longer allowed for consolidation. Since January 28, 2013, our interest in nCino has been accounted for as an equity method investment. The distribution of nCino’s shares will be taxable as if nCino shares had been sold for their fair market value, and any gain will flow through to our existing shareholders for income tax purposes, not creating a tax liability to the Company. In addition, for income tax purposes, the nCino Spin-Off will be treated as a distribution of property to our existing shareholders. The nCino Spin-Off will be accounted for at book value for financial reporting purposes. Accordingly, no gain or loss will be recorded in the statement of income related to the nCino Spin-Off. In addition, we do not expect to record any impairment related to the nCino Spin-Off based on our last valuation of the entity on the effective date of the

5

Table of Contents

aforementioned deconsolidation, performed in the first quarter of 2013. Because of the timing of the last valuation, no subsequent impairment analysis has been performed. Because the nCino Spin-Off will be taxable to our current shareholders, a valuation of nCino will be performed immediately prior to the nCino Spin-Off. Any impairment resulting from the book value of the net assets exceeding their fair value at the time of the nCino Spin-Off, although not anticipated, will be recorded on our books to the extent of our ownership at that time.

As shown in the Unaudited Pro Forma Consolidated Financial Data beginning on page 10, nCino will no longer be our affiliate as a result of the nCino Spin-Off, and we will no longer report our respective share of nCino’s earnings (loss). For the years ended December 31, 2013, 2012, and 2011, nCino generated net losses of $6.7 million, $3.6 million, and $0, respectively. After the nCino Spin-Off, we will no longer recognize our allocated portion of these net losses, however, we will continue to receive income from nCino for rental income on shared office space as well as certain administrative services we provide. For the years ended December 31, 2013, 2012, and 2011, the allocated net losses we reported from nCino were $0.2 million $2.3 million, and $0, respectively.

In addition to the effect on our net earnings, the nCino Spin-Off will reduce our assets by approximately $11.3 million, based upon the December 31, 2013 carrying amount of this equity method investment.

Cash Dividend

We intend to pay a cash distribution of approximately $6.0 million to our existing shareholders prior to our conversion from a “Subchapter S” corporation to a C corporation to offset the estimated tax liability of our shareholders created by the nCino Spin-Off and for any undistributed 2014 tax amounts related to shareholders’ allocable share of 2014 S corporation taxable income. Our final determination of the amount of the cash distribution will be largely dependent upon the fair value of our investment in nCino at the time of the nCino Spin-Off.

C Corporation Conversion

We intend to voluntarily terminate our status as a “Subchapter S” corporation and convert to a C corporation for income tax purposes. As a “Subchapter S” corporation, our earnings were not subject to income tax at the corporate level but were passed through to our shareholders, who incurred income tax liability for a portion of our earnings proportionate to their percentage of common stock ownership. Accordingly, we have not paid any income tax on our earnings since inception. As a C corporation, we will be subject to income tax at the corporate level at an estimated effective rate of 38.5%.

6

Table of Contents

THE OFFERING

| Common stock offered |

||

| By us |

shares of our common stock. | |

| By the selling shareholders |

shares of our common stock. | |

| Total |

shares of our common stock. | |

| Option to purchase additional shares |

The underwriters will have an option to purchase up to additional shares of our common stock in this offering, exercisable within 30 days from the date of this prospectus. | |

| Common stock to be outstanding immediately after this offering |

shares ( if the underwriters exercise their option in full). | |

| Dividends |

We will pay dividends on our common stock, when, as, and if declared by our board of directors or a duly authorized committee thereof. Our ability to declare and pay dividends is limited by state law and by applicable federal and state regulatory restrictions, including the regulations and guidelines of the Federal Reserve applicable to bank holding companies. | |

| In addition, because we are a bank holding company, our ability to pay dividends on our common stock will be highly dependent upon the receipt of dividends, fees and other amounts from the Bank, which, in turn, will be highly dependent upon the Bank’s historical and projected results of operations, liquidity, cash flows and financial condition, as well as various legal and regulatory prohibitions and other restrictions on the ability of the Bank to pay dividends, extend credit or otherwise transfer funds to us. For additional information, see “Dividend Policy.” | ||

| Listing |

We intend to apply to list our common stock on the NASDAQ Global Market under the symbol “LOB.” | |

| Risk factors |

Investing in our common stock involves risks. See “Risk Factors” for a discussion of factors you should consider carefully before making a decision to invest in our common stock. | |

| Tax consequences |

The material U.S. federal income tax consequences of purchasing, owning and disposing of our common stock are described in “Material U.S. Federal Income Tax Considerations.” You should consult your tax advisor with respect to the U.S. federal income tax consequences of owning our common stock in light of your own particular situation and with respect to any tax consequences arising under the laws of any state, local, foreign or other taxing jurisdiction. | |

7

Table of Contents

| Since inception, we have been taxable for federal income tax purposes as an “S corporation” under the Internal Revenue Code of 1986, as amended. As a result, our net income has not been subject to, and we have not paid, U.S. federal income taxes, and no provision or liability for federal or state income tax has been included in our consolidated financial statements. Shortly before the consummation of this offering, our status as an S corporation will terminate, and our net income will thereafter be subject to U.S. federal income taxes and state income taxes. | ||

| Use of proceeds |

Assuming an initial public offering price of $ per share, which is the midpoint of the estimated price range set forth on the cover page of this prospectus, we expect to receive net proceeds from this offering of approximately $ million (or $ million if the underwriters exercise their option in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. | |

| We intend to use the net proceeds of this offering to pay off outstanding debt of the Company estimated to be $8.0 million at the time of the offering, to support the growth and expansion of our franchise and for general corporate purposes such as investments in the development of new technology platforms. We may also use net proceeds for possible acquisitions of, or investments in, bank or permissible non-bank entities, including opportunities to enhance and optimize our internal operations. In addition, proceeds from this offering may be used for investments in additional subsidiaries to take advantage of potential start-up opportunities that we believe we have created or identified through the use of technology to enhance and optimize our internal operations and observations of the banking industry in general. However, no agreements or understandings presently exist with respect to any acquisitions or investments. Before we apply any of the proceeds for any of these uses, the proceeds likely will be temporarily invested in short-term investment securities. See “Use of Proceeds.” | ||

| Transfer agent and registrar |

Broadridge Corporate Issuer Solutions, Inc., Brentwood, New York. | |

8

Table of Contents

Unless expressly indicated or the context otherwise requires, all information in this prospectus:

| • | assumes no exercise by the underwriters of their option to purchase up to an additional shares of our common stock in this offering; |

| • | does not include as outstanding 22,500 shares of our common stock issuable upon the exercise of outstanding stock options as of December 31, 2013 at a weighted average exercise price of $16.77 per share; |

| • | does not include as outstanding 141,000 shares of our common stock and 59,999 shares of restricted stock reserved for issuance in connection with stock awards that remain available for issuance under our stock incentive plans. |

9

Table of Contents

Summary Selected Historical Consolidated Financial Data and

Unaudited Pro Forma Consolidated Financial Data

The table below sets forth selected historical consolidated financial data and other information for the periods presented. We have derived the selected financial data as of and for the years ended December 31, 2013, 2012 and 2011 from our audited consolidated financial statements included elsewhere in this prospectus. We have derived the selected financial data as of and for the year ended December 31, 2010 from our audited consolidated financial statements not included in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

The selected consolidated historical financial information should be read in conjunction with:

| • | our audited consolidated financial statements as of and for the years ended December 31, 2013, 2012 and 2011 and related notes included in this prospectus, as well as the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus; and |

| • | the section entitled “Risk Factors” in this prospectus. |

The unaudited pro forma consolidated financial data as of and for the years ended December 31, 2013 and 2012 are presented to show the impact on our historical financial position and results of operations from the nCino Spin-Off, the Cash Dividend and the C Corporation Conversion.

The unaudited pro forma consolidated balance sheet data reflects our historical position as of December 31, 2013 and 2012 with pro forma adjustments based on the assumption that the nCino Spin-Off, the Cash Dividend and the C Corporation Conversion were effective as of January 1, 2013 and 2012, respectively. The unaudited pro forma consolidated statements of operations data assume that each such transaction was consummated on January 1 of the earliest indicated period. The adjustments are based on information available and certain assumptions that we believe are reasonable.

The following information should be read in conjunction with and is qualified in its entirety by our consolidated financial statements and accompanying notes included in this prospectus.

The unaudited pro forma consolidated financial data are intended for informational purposes and are not necessarily indicative of our future financial position or future operating results or of our financial position or operating results that would have actually occurred had the nCino Spin-Off, the Cash Dividend and the C Corporation Conversion been in effect as of the date or for the period presented. The unaudited pro forma consolidated financial data will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

10

Table of Contents

Summary Selected Historical Consolidated Financial Data

| As of and for the years ended December 31, | ||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | |||||||||||||

| (dollars in thousands except per share) | ||||||||||||||||

| Selected Period End Balance Sheet Data |

||||||||||||||||

| Total assets |

$ | 430,355 | $ | 342,468 | $ | 266,157 | $ | 245,336 | ||||||||

| Cash and due from banks |

37,244 | 44,173 | 27,536 | 25,977 | ||||||||||||

| Investment securities available for sale, at fair value |

19,446 | 15,416 | 16,842 | 6,134 | ||||||||||||

| Loans held for sale |

159,438 | 145,183 | 111,877 | 81,884 | ||||||||||||

| Loans held for investment |

141,349 | 92,669 | 85,721 | 60,730 | ||||||||||||

| Total loans held for sale and investment |

300,787 | 237,852 | 197,598 | 142,614 | ||||||||||||

| Allowance for loan losses |

(2,723 | ) | (5,108 | ) | (4,617 | ) | (3,438 | ) | ||||||||

| Servicing assets |

29,053 | 24,220 | 18,731 | 15,250 | ||||||||||||

| Deposits |

356,620 | 286,674 | 222,163 | 167,964 | ||||||||||||

| Long-term borrowings |

12,325 | 12,205 | 8,659 | 4,200 | ||||||||||||

| Total shareholders’ equity |

48,390 | 33,057 | 27,583 | 17,162 | ||||||||||||

| Tangible shareholders’ equity(1) |

47,963 | 33,057 | 27,583 | 17,162 | ||||||||||||

| Selected Income Statement Data |

||||||||||||||||

| Interest income |

$ | 15,302 | $ | 11,725 | $ | 8,744 | $ | 6,636 | ||||||||

| Interest expense |

4,521 | 3,628 | 2,737 | 3,339 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income |

10,781 | 8,097 | 6,007 | 3,297 | ||||||||||||

| Provision for loan losses |

(858 | ) | 2,110 | 2,855 | 2,619 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income after provision for loan losses |

11,639 | 5,987 | 3,152 | 678 | ||||||||||||

| Noninterest income |

56,467 | 42,480 | 32,127 | 20,932 | ||||||||||||

| Noninterest expense |

40,164 | 33,669 | 20,967 | 13,365 | ||||||||||||

| Net income attributable to noncontrolling interest |

120 | 1,297 | — | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Live Oak Bancshares, Inc. |

$ | 28,062 | $ | 16,095 | $ | 14,312 | $ | 8,245 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (net of tax effect)(2) |

$ | 17,258 | $ | 9,899 | $ | 8,802 | $ | 5,070 | ||||||||

| Per Share Data (Common Stock) Attributable to the Company |

||||||||||||||||

| Earnings: |

||||||||||||||||

| Basic |

$ | 13.79 | $ | 8.27 | $ | 8.15 | $ | 5.66 | ||||||||

| Diluted(3) |

13.73 | 7.99 | 6.97 | 4.88 | ||||||||||||

| Earnings (net of tax effect)(2): |

||||||||||||||||

| Basic |

8.48 | 5.08 | 5.01 | 3.48 | ||||||||||||

| Diluted(3) |

8.44 | 4.92 | 4.29 | 3.00 | ||||||||||||

| Dividends(4) |

4.81 | 5.91 | 5.48 | 2.70 | ||||||||||||

| Book value(5) |

23.82 | 16.30 | 14.64 | 11.01 | ||||||||||||

| Tangible book value(1) |

23.61 | 16.30 | 14.64 | 11.01 | ||||||||||||

| Selected Performance Metrics |

||||||||||||||||

| Return on average assets |

6.53 | % | 5.01 | % | 5.75 | % | 4.13 | % | ||||||||

| Return on average equity |

62.82 | 50.62 | 61.64 | 59.63 | ||||||||||||

| Return on average assets (net of tax effect) (2)(6) |

4.02 | 3.08 | 3.54 | 2.54 | ||||||||||||

| Return on average equity (net of tax effect) (2)(6) |

38.63 | 31.13 | 37.91 | 36.67 | ||||||||||||

| Average yield on loans(7) |

5.04 | 4.91 | 4.82 | 4.92 | ||||||||||||

| Average cost of deposits(7) |

1.13 | 1.10 | 1.22 | 2.03 | ||||||||||||

| Net interest margin(7) |

2.95 | 2.83 | 2.81 | 2.16 | ||||||||||||

| Efficiency ratio(8) |

59.73 | 66.57 | 54.98 | 55.16 | ||||||||||||

| Noninterest income to total revenue(9) |

83.97 | 83.99 | 84.25 | 86.39 | ||||||||||||

| Average equity to average assets |

10.40 | 9.89 | 9.33 | 6.93 | ||||||||||||

| Dividend payout ratio(10) |

10.65 | 33.56 | 20.70 | — | ||||||||||||

| Dividend payout ratio (net of tax effect)(2)(10) |

17.32 | 54.57 | 33.66 | — | ||||||||||||

| Employees at year end(11) |

141 | 94 | 62 | 44 | ||||||||||||

11

Table of Contents

Summary Selected Historical Consolidated Financial Data (continued)

| As of and for the years ended December 31, | ||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | |||||||||||||

| (dollars in thousands except per share) | ||||||||||||||||

| Selected Loan Metrics |

||||||||||||||||

| Annual number of loans originated(12) |

524 | 447 | 322 | 277 | ||||||||||||

| Annual amount of loans originated(12) |

$ | 498,752 | $ | 413,764 | $ | 306,637 | $ | 256,317 | ||||||||

| Outstanding borrowers’ principal balance |

1,446,772 | 1,104,160 | 802,653 | 551,203 | ||||||||||||

| Percent of total loans held for sale and investment guaranteed by the U.S. government(13) |

28.72 | % | 33.96 | % | 32.86 | % | 35.56 | % | ||||||||

| U.S. government guaranteed loans sold at a premium(14) |

$ | 339,342 | $ | 276,676 | $ | 238,442 | $ | 169,251 | ||||||||

| U.S. government guaranteed loans sold at par for excess servicing(14) |

— | — | — | — | ||||||||||||

| Loans sold not guaranteed by U.S. government(14) |

42,932 | 52,574 | 12,680 | 9,907 | ||||||||||||

| Total loans sold and serviced for others(14) |

382,274 | 329,250 | 251,122 | 179,158 | ||||||||||||

| Outstanding balance of guaranteed loans sold(15) |

1,005,764 | 767,721 | 550,622 | 350,649 | ||||||||||||

| Number of loans serviced(16) |

1,780 | 1,323 | 929 | 623 | ||||||||||||

| Average net gain on sale of loans(17) |

$ | 99.99 | $ | 101.85 | $ | 90.05 | $ | 80.56 | ||||||||

| Average servicing fee on sale of loans(18) |

0.89 | % | 0.84 | % | 0.95 | % | 0.94 | % | ||||||||

| Average servicing fee on sale of loans guaranteed by the U.S. government(18) |

1.00 | 1.00 | 1.00 | 1.00 | ||||||||||||

| Weighted average servicing fee of sold loans guaranteed by the U.S. government(19) |

1.16 | 1.24 | 1.39 | 1.67 | ||||||||||||

| Average outstanding loan size(20) |

$ | 812.8 | $ | 834.6 | $ | 864.0 | $ | 884.8 | ||||||||

| Average balance of loans on balance sheet(21) |

173.9 | 185.1 | 214.2 | 232.4 | ||||||||||||

| Average balance of loans on balance sheet not guaranteed by U.S. government(22) |

124.0 | 122.2 | 143.8 | 149.8 | ||||||||||||

| Asset Quality Ratios |

||||||||||||||||

| Nonperforming loans and foreclosed assets guaranteed by the U.S. government(23) |

$ | 6,983 | $ | 5,062 | $ | 6,791 | $ | — | ||||||||

| Nonperforming loans to total assets(23) |

2.02 | % | 2.51 | % | 3.71 | % | 1.85 | % | ||||||||

| Nonperforming loans not guaranteed by the U.S. government to total assets(23) |

0.40 | 1.03 | 1.16 | 1.85 | ||||||||||||

| Nonperforming loans to loans held for investment(23) |

6.15 | 9.27 | 11.52 | 7.46 | ||||||||||||

| Nonperforming loans not guaranteed by the |

||||||||||||||||

| U.S. government to loans held for investment(23) |

1.21 | 3.81 | 3.59 | 7.46 | ||||||||||||

| Allowance for loan losses to nonperforming loans not guaranteed by the U.S. government(23) |

158.83 | 144.66 | 149.90 | 75.93 | ||||||||||||

| Allowance for loan losses to loans held for investment |

1.93 | 5.51 | 5.39 | 5.66 | ||||||||||||

| Net charge-offs |

$ | 1,887 | $ | 1,860 | $ | 1,461 | $ | 1,062 | ||||||||

| Net charge-offs to average loans on book outstanding(24) |

0.66 | % | 0.82 | % | 0.85 | % | 0.83 | % | ||||||||

| Capital Ratios |

||||||||||||||||

| Tier 1 leverage ratio (Bank) |

10.39 | % | 10.63 | % | 11.84 | % | 8.84 | % | ||||||||

| Tier 1 risk-based capital ratio (Bank)(25) |

15.09 | 16.65 | 17.13 | 14.72 | ||||||||||||

| Total risk-based capital ratio (Bank)(25) |

15.95 | 17.91 | 18.40 | 15.99 | ||||||||||||

| Total equity to total assets |

11.24 | 9.65 | 10.36 | 7.00 | ||||||||||||

| Tangible common equity to tangible assets(26) |

11.16 | 9.65 | 10.36 | 7.00 | ||||||||||||

12

Table of Contents

Unaudited Pro Forma Consolidated Financial Data

| As of and for the years ended December 31, | ||||||||||||||||

| 2013 | 2012 | |||||||||||||||

| Pro Forma | Actual | Pro Forma | Actual | |||||||||||||

| (dollars in thousands except per share) | ||||||||||||||||

| Selected Period End Balance Sheet Data |

||||||||||||||||

| Total assets |

$ | 413,030 | $ | 430,355 | $ | 340,460 | $ | 342,468 | ||||||||

| Cash and due from banks |

31,244 | 37,244 | 37,795 | 44,173 | ||||||||||||

| Investment securities available for sale, at fair value |

19,446 | 19,446 | 15,416 | 15,416 | ||||||||||||

| Loans held for sale |

159,438 | 159,438 | 145,183 | 145,183 | ||||||||||||

| Loans held for investment |

141,349 | 141,349 | 92,669 | 92,669 | ||||||||||||

| Total loans held for sale and investment |

300,787 | 300,787 | 237,852 | 237,852 | ||||||||||||

| Allowance for loan losses |

(2,723 | ) | (2,723 | ) | (5,108 | ) | (5,108 | ) | ||||||||

| Servicing assets |

29,053 | 29,053 | 24,220 | 24,220 | ||||||||||||

| Deposits |

356,620 | 356,620 | 287,198 | 286,674 | ||||||||||||

| Long-term borrowings |

12,325 | 12,325 | 12,205 | 12,205 | ||||||||||||

| Total shareholders’ equity(27) |

29,880 | 48,390 | 30,234 | 33,057 | ||||||||||||

| Selected Income Statement Data |

||||||||||||||||

| Interest income |

$ | 15,332 | $ | 15,302 | $ | 12,087 | $ | 11,725 | ||||||||

| Interest expense |

4,521 | 4,521 | 3,628 | 3,628 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income |

10,811 | 10,781 | 8,459 | 8,097 | ||||||||||||

| Provision for (recovery of) loan losses |

(858 | ) | (858 | ) | 2,110 | 2,110 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income after provision for loan losses |

11,669 | 11,639 | 6,349 | 5,987 | ||||||||||||

| Noninterest income |

46,738 | 56,467 | 41,938 | 42,480 | ||||||||||||

| Noninterest expense |

39,692 | 40,164 | 29,850 | 33,669 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income before income tax & noncontrolling interest |

$ | 18,715 | $ | 27,942 | $ | 18,437 | $ | 14,798 | ||||||||

| Provision for income tax expense |

(8,390 | ) | — | (6,263 | ) | — | ||||||||||

| Net income attributable to noncontrolling interest |

— | 120 | — | 1,297 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Live Oak Bancshares, Inc. |

$ | 10,325 | $ | 28,062 | $ | 12,174 | $ | 16,095 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (net of tax effect)(2) |

$ | 10,325 | $ | 17,258 | $ | 12,174 | $ | 9,899 | ||||||||

| Per Share Data (Common Stock) Attributable to the Company |

||||||||||||||||

| Earnings: |

||||||||||||||||

| Basic |

$ | 5.07 | $ | 13.79 | $ | 6.25 | $ | 8.27 | ||||||||

| Diluted(3) |

5.05 | 13.73 | 6.05 | 7.99 | ||||||||||||

| Earnings (net of tax effect)(2): |

||||||||||||||||

| Basic |

5.07 | 8.48 | 6.25 | 5.08 | ||||||||||||

| Diluted(3) |

5.05 | 8.44 | 6.05 | 4.92 | ||||||||||||

| Dividends(4) |

13.32 | 4.81 | 7.79 | 5.91 | ||||||||||||

| Book value(5) |

14.71 | 23.82 | 14.91 | 16.30 | ||||||||||||

| Selected Performance Metrics |

||||||||||||||||

| Efficiency ratio(8) |

68.98 | % | 59.73 | % | 59.23 | % | 66.57 | % | ||||||||

| Noninterest income to total revenue(9) |

81.21 | 83.97 | 83.22 | 83.99 | ||||||||||||

| Asset Quality Ratios |

||||||||||||||||

| Nonperforming loans and foreclosed assets guaranteed by the U.S. government(23) |

$ | 6,983 | $ | 6,983 | $ | 5,062 | $ | 5,062 | ||||||||

| Nonperforming loans to total assets(23) |

2.11 | % | 2.02 | % | 2.52 | % | 2.51 | % | ||||||||

| Nonperforming loans not guaranteed by the U.S. government to total assets(23) |

0.42 | 0.40 | 1.04 | 1.03 | ||||||||||||

| Nonperforming loans to loans held for investment(23) |

6.15 | 6.15 | 9.27 | 9.27 | ||||||||||||

| Nonperforming loans not guaranteed by the U.S. government to loans held for investment(23) |

1.21 | 1.21 | 3.81 | 3.81 | ||||||||||||

| Allowance for loan losses to nonperforming |

||||||||||||||||

| Loans not guaranteed by the U.S. government(23) |

158.83 | 158.83 | 144.66 | 144.66 | ||||||||||||

| Allowance for loan losses to loans held for investment |

1.93 | 1.93 | 5.51 | 5.51 | ||||||||||||

| Net charge-offs |

$ | 1,887 | $ | 1,887 | $ | 1,860 | $ | 1,860 | ||||||||

13

Table of Contents

Unaudited Pro Forma Consolidated Statement of Income

For the Year Ended December 31, 2013

| Live Oak Historical |

nCino Spin-Off(28) |

Cash Dividend and C Corporation Conversion |

Live Oak Pro Forma |

|||||||||||||

| ( in thousands except per share ) | ||||||||||||||||

| Interest income |

||||||||||||||||

| Loans and fees on loans |

$ | 14,481 | $ | — | $ | — | $ | 14,481 | ||||||||

| Investment securities |

391 | — | — | 391 | ||||||||||||

| Other interest earning assets |

430 | 30 | — | 460 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total interest income |

15,302 | 30 | — | 15,332 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest expense |

||||||||||||||||

| Deposits |

3,947 | — | — | 3,947 | ||||||||||||

| Borrowings |

574 | — | — | 574 | ||||||||||||

| Total interest expense |

4,521 | — | — | 4,521 | ||||||||||||

| Net interest income |

10,781 | 30 | — | 10,811 | ||||||||||||

| Provision for (recovery of) loan losses |

(858 | ) | — | — | (858 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income after provision for loan losses |

11,639 | 30 | — | 11,669 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Noninterest income |

||||||||||||||||

| Loan servicing revenue & revaluation |

7,926 | — | — | 7,926 | ||||||||||||

| Net gains on sales of loans |

38,225 | — | — | 38,225 | ||||||||||||

| Gain on deconsolidation of subsidiary |

12,212 | (12,212 | ) | — | — | |||||||||||

| Income from equity method investments |

(2,756 | ) | 2,648 | — | (108 | ) | ||||||||||

| Gain on sale of securities available for sale |

11 | — | — | 11 | ||||||||||||

| Other noninterest income |

849 | (165 | ) | — | 684 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total noninterest income |

56,467 | (9,729 | ) | — | 46,738 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Noninterest expense |

||||||||||||||||

| Salaries and employee benefits |

20,766 | (349 | ) | — | 20,417 | |||||||||||

| Travel expense |

4,458 | (16 | ) | — | 4,442 | |||||||||||

| Professional services expense |

2,237 | (56 | ) | — | 2,181 | |||||||||||

| Advertising and Marketing expense |

2,316 | (11 | ) | — | 2,305 | |||||||||||

| Occupancy expense |

1,678 | (2 | ) | — | 1,676 | |||||||||||

| Data processing expense |

1,749 | (1 | ) | — | 1,748 | |||||||||||

| Equipment expense |

1,042 | — | — | 1,042 | ||||||||||||

| Other expense |

5,918 | (37 | ) | — | 5,881 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total noninterest expense |

40,164 | (472 | ) | — | 39,692 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income before income tax & noncontrolling interest |

$ | 27,942 | $ | (9,227 | ) | $ | — | $ | 18,715 | |||||||

| Provision for income tax expense |

— | — | (8,390 | ) | (8,390 | ) | ||||||||||

| Net Income |

27,942 | (9,227 | ) | (8,390 | ) | 10,325 | ||||||||||

| Net loss attributable to noncontrolling interest |

120 | (120 | ) | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Live Oak Bancshares, Inc. |

$ | 28,062 | $ | (9,347 | ) | $ | (8,390 | ) | $ | 10,325 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per common share: |

||||||||||||||||

| Basic |

$ | 13.79 | $ | 5.07 | ||||||||||||

| Diluted |

13.73 | 5.05 | ||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

2,035 | 2,035 | ||||||||||||||

| Diluted |

2,044 | 2,044 | ||||||||||||||

14

Table of Contents

Unaudited Pro Forma Consolidated Balance Sheet

As of December 31, 2013

| Live Oak Historical |

nCino Spin-Off(28) |

Cash Dividend and C Corporation Conversion |

Live Oak Pro Forma |

|||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| Cash and due from banks |

$ | 37,244 | $ | — | $ | (6,000 | ) | $ | 31,244 | |||||||

| Investment securities available for sale, at fair value |

19,446 | — | — | 19,446 | ||||||||||||

| Loans held for sale |

159,438 | — | — | 159,438 | ||||||||||||

| Loans held for investment |

141,349 | — | — | 141,349 | ||||||||||||

| Allowance for loan losses |

(2,723 | ) | — | — | (2,723 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Loans |

138,626 | — | — | 138,626 | ||||||||||||

| Accrued interest receivable |

1,842 | — | — | 1,842 | ||||||||||||

| Premises and equipment, net |

25,036 | — | — | 25,036 | ||||||||||||

| Foreclosed real estate |

341 | — | — | 341 | ||||||||||||

| Servicing assets |

29,053 | — | — | 29,053 | ||||||||||||

| Investments in non-consolidated affiliates |

11,467 | (11,325 | ) | — | 142 | |||||||||||

| Other assets |

7,862 | — | — | 7,862 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

$ | 430,355 | $ | (11,325 | ) | $ | (6,000 | ) | $ | 413,030 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities and Shareholders’ Equity |

||||||||||||||||

| Deposits |

||||||||||||||||

| Noninterest-bearing |

$ | 13,022 | $ | — | $ | — | $ | 13,022 | ||||||||

| Interest-bearing |

343,598 | — | — | 343,598 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Deposits |

356,620 | — | — | 356,620 | ||||||||||||

| Long-term borrowings |

12,325 | — | — | 12,325 | ||||||||||||

| Other liabilities |

9,415 | — | 1,185 | 10,600 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

378,360 | — | 1,185 | 379,545 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Redeemable equity securities |

3,605 | — | — | 3,605 | ||||||||||||

| Shareholders’ Equity |

||||||||||||||||

| Common stock, no par value; 2,750,000 shares authorized; 2,031,833, shares issued and outstanding at December 31, 2013 |

18,319 | — | — | 18,319 | ||||||||||||

| Retained earnings (deficit) |

30,262 | (11,325 | ) | (7,185 | ) | 11,752 | ||||||||||

| Accumulated other comprehensive |

||||||||||||||||

| Income (loss) |

(191 | ) | — | — | (191 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Shareholders’ Equity |

48,390 | (11,325 | ) | (7,185 | ) | 29,880 | ||||||||||

| Noncontrolling interest |

— | — | — | — | ||||||||||||

| Total equity |

48,390 | (11,325 | ) | (7,185 | ) | 29,880 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities and Shareholders’ |

||||||||||||||||

| Equity |

$ | 430,355 | $ | (11,325 | ) | $ | (6,000 | ) | $ | 413,030 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

15

Table of Contents

Unaudited Pro Forma Consolidated Statement of Income

For the Year Ended December 31, 2012

| Live Oak Historical |

nCino Spin-Off(28) |

Cash Dividend and C Corporation Conversion |

Live Oak Pro Forma |

|||||||||||||

| ( in thousands except per share ) | ||||||||||||||||

| Interest income |

||||||||||||||||

| Loans and fees on loans |

$ | 11,178 | $ | — | $ | — | $ | 11,178 | ||||||||

| Investment securities |

467 | — | — | 467 | ||||||||||||

| Other interest earning assets |

80 | 362 | — | 442 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total interest income |

11,725 | 362 | — | 12,087 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest expense |

||||||||||||||||

| Deposits |

2,975 | — | — | 2,975 | ||||||||||||

| Borrowings |

653 | — | — | 653 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total interest expense |

3,628 | — | — | 3,628 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income |

8,097 | 362 | — | 8,459 | ||||||||||||

| Provision for (recovery of) loan losses |

2,110 | — | — | 2,110 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net interest income after provision for loan losses |

5,987 | 362 | — | 6,349 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Noninterest income |

||||||||||||||||

| Loan servicing revenue & revaluation |

8,346 | — | — | 8,346 | ||||||||||||

| Net gains on sales of loans |

33,535 | — | — | 33,535 | ||||||||||||

| Gain on sale of securities available for sale |

— | — | — | — | ||||||||||||

| Other noninterest income |

599 | (542 | ) | — | 57 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total noninterest income |

42,480 | (542 | ) | — | 41,938 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Noninterest expense |

||||||||||||||||

| Salaries and employee benefits |

17,968 | (2,211 | ) | — | 15,757 | |||||||||||

| Travel expense |

3,115 | (290 | ) | — | 2,825 | |||||||||||

| Professional services expense |

2,580 | (768 | ) | — | 1,812 | |||||||||||

| Advertising and Marketing expense |

2,181 | (206 | ) | — | 1,975 | |||||||||||

| Occupancy expense |

679 | (13 | ) | — | 666 | |||||||||||

| Data processing expense |

1,420 | 555 | — | 1,975 | ||||||||||||

| Equipment expense |

738 | (31 | ) | — | 707 | |||||||||||

| Other expense |

4,988 | (855 | ) | — | 4,133 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total noninterest expense |

33,669 | (3,819 | ) | — | 29,850 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income before income tax expense & noncontrolling interest |

$ | 14,798 | $ | 3,639 | $ | — | $ | 18,437 | ||||||||

| Provision for income tax expense |

— | — | (6,263 | ) | (6,263 | ) | ||||||||||

| Net income |

14,798 | 3,639 | (6,263 | ) | 12,174 | |||||||||||

| Net loss attributable to noncontrolling interest |

1,297 | (1,297 | ) | — | — | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to Live Oak Bancshares, Inc. |

$ | 16,095 | $ | 2,342 | $ | (6,263 | ) | $ | 12,174 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Earnings per common share: |

||||||||||||||||

| Basic |

$ | 8.27 | $ | 6.25 | ||||||||||||

| Diluted |

7.99 | 6.05 | ||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||

| Basic |

1,947 | 1,947 | ||||||||||||||

| Diluted |

2,014 | 2,014 | ||||||||||||||

16

Table of Contents

Unaudited Pro Forma Consolidated Balance Sheet

As of December 31, 2012

| Live Oak Historical |

nCino Spin-Off(28) |

Cash Dividend and C Corporation Conversion |

Live Oak Pro Forma |

|||||||||||||

| (dollars in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| Cash and due from banks |

$ | 44,173 | $ | (378 | ) | $ | (6,000 | ) | $ | 37,795 | ||||||

| Investment securities available for sale, at fair value |

15,416 | — | — | 15,416 | ||||||||||||

| Loans held for sale |

145,183 | — | — | 145,183 | ||||||||||||

| Loans held for investment |

92,669 | — | — | 92,669 | ||||||||||||

| Allowance for loan losses |

(5,108 | ) | — | — | (5,108 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Loans |

87,561 | — | — | 87,561 | ||||||||||||

| Accrued interest receivable |

1,457 | — | — | 1,457 | ||||||||||||

| Premises and equipment, net |

18,951 | — | — | 18,951 | ||||||||||||

| Foreclosed real estate |

232 | — | — | 232 | ||||||||||||

| Servicing assets |

24,220 | — | — | 24,220 | ||||||||||||

| Other assets |

5,275 | 3,535 | 835 | 9,645 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Assets |

$ | 342,468 | $ | 3,157 | $ | (5,165 | ) | $ | 340,460 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities and Shareholders’ Equity |

||||||||||||||||

| Deposits |

||||||||||||||||

| Noninterest-bearing |

$ | 2,479 | $ | 524 | $ | — | $ | 3,003 | ||||||||

| Interest-bearing |

284,195 | — | — | 284,195 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Deposits |

286,674 | 524 | — | 287,198 | ||||||||||||

| Long-term borrowings |

12,205 | — | — | 12,205 | ||||||||||||

| Other liabilities |

10,668 | (1,006 | ) | — | 9,662 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities |

309,547 | (482 | ) | — | 309,065 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Redeemable equity securities |

1,161 | — | — | 1,161 | ||||||||||||

| Shareholders’ Equity |

||||||||||||||||

| Common stock, no par value; 2,750,000 shares authorized; 2,027,495 shares issued and outstanding at December 31, 2012 |

20,535 | — | — | 20,535 | ||||||||||||

| Retained earnings (deficit) |

11,980 | 2,342 | (5,165 | ) | 9,157 | |||||||||||

| Accumulated other comprehensive income |

542 | — | — | 542 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Shareholders’ Equity |

33,057 | 2,342 | (5,165 | ) | 30,234 | |||||||||||

| Noncontrolling interest |

(1,297 | ) | 1,297 | — | — | |||||||||||

| Total equity |

31,760 | 3,639 | (5,165 | ) | 30,234 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Liabilities and Shareholders’ Equity |

$ | 342,468 | $ | 3,157 | $ | (5,165 | ) | $ | 340,460 | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

Table of Contents

NOTES TO SELECTED HISTORICAL CONSOLIDATED AND PRO FORMA FINANCIAL DATA

| (1) | We calculate tangible book value per share as total shareholders’ equity less goodwill and other intangible assets to determine “tangible shareholders equity” and then tangible shareholders’ equity is divided by the outstanding number of shares of our common stock at the end of the relevant year. Tangible book value is not a financial measure recognized by generally accepted accounting principles in the United States, or GAAP, and, as we calculate tangible book value, the most directly comparable GAAP financial measure is total shareholders’ equity. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “GAAP Reconciliation and Management Explanation of Non-GAAP Financial Measures” set forth below. |