Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAKED BRAND GROUP INC. | form8k.htm |

| EX-10.7 - EXHIBIT 10.7 - NAKED BRAND GROUP INC. | exhibit10-7.htm |

| EX-10.2 - EXHIBIT 10.2 - NAKED BRAND GROUP INC. | exhibit10-2.htm |

| EX-10.3 - EXHIBIT 10.3 - NAKED BRAND GROUP INC. | exhibit10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - NAKED BRAND GROUP INC. | exhibit10-1.htm |

| EX-10.10 - EXHIBIT 10.10 - NAKED BRAND GROUP INC. | exhibit10-10.htm |

| EX-10.4 - EXHIBIT 10.4 - NAKED BRAND GROUP INC. | exhibit10-4.htm |

| EX-10.6 - EXHIBIT 10.6 - NAKED BRAND GROUP INC. | exhibit10-6.htm |

| EX-10.9 - EXHIBIT 10.9 - NAKED BRAND GROUP INC. | exhibit10-9.htm |

| EX-10.11 - EXHIBIT 10.11 - NAKED BRAND GROUP INC. | exhibit10-11.htm |

| EX-10.8 - EXHIBIT 10.8 - NAKED BRAND GROUP INC. | exhibit10-8.htm |

| EX-10.12 - EXHIBIT 10.12 - NAKED BRAND GROUP INC. | exhibit10-12.htm |

| CONFIDENTIAL | EXECUTION VERSION |

CONVERSION AGREEMENT

This Conversion Agreement (as may be amended, amended and restated, supplemented or otherwise modified from time to time, this “Agreement”) is made as of April 4, 2014, by and among BRYCE STEPHENS (the “Lender”), NAKED BRAND GROUP INC., a Nevada corporation (“NBGI”), and NAKED INC., a Nevada corporation (“Naked” and together with NBGI, the “Borrowers”). The Lender and the Borrowers are each referred to herein as a “Party”, and collectively as the “Parties”.

WHEREAS:

| A. |

Naked is a wholly-owned subsidiary of NBGI operating a product manufacturing and distribution business for men’s clothing products. |

| B. |

The Borrowers have issued certain secured convertible promissory notes (the “Promissory Notes”; capitalized terms used but not otherwise defined herein shall have the meanings ascribed to them in the Promissory Notes) in the aggregate principal sum of $100,000 to the Lender in connection with that certain Agency and Interlender Agreement, dated as of August 10, 2012, as amended, among the Borrowers, Kalamalka Partners Ltd., as agent (the “Agent”), the Lender and each of the persons listed on the signature pages thereof; and NBGI has issued to the Agent and the Lender certain warrants to purchase shares of common stock of NBGI (“Common Stock”); |

| C. |

Naked requires additional funds to expand its inventory and sales operations, and, in order to raise funds for that purpose, NBGI desires to issue certain secured convertible promissory notes (the “Bridge Notes”) to a group of accredited investors (as defined in applicable U.S. federal securities legislation) in connection with an agency and interlender agreement to be dated as of even date herewith (the “Bridge Financing Transaction”). |

| D. |

Following the issuance of the Bridge Notes, NBGI intends to complete a round of equity financing through a private placement (the “Offering”) of certain secured convertible debentures. |

| E. |

In connection with the Bridge Financing Transaction, the Lender desires to exercise its option pursuant to Section 10 of the Promissory Notes (the “Conversion Election”) to convert the total balance outstanding under all of the Loans (including Principal and Interest) into Common Stock; and, as an inducement of the Lender’s willingness to exercise the Conversion Election, NBGI desires to amend the Conversion Price to be equal to one share of Common Stock for each ten cents (USD$0.10) of the Loan so converted. |

NOW THEREFORE THE PARTIES HERETO AGREE as follows:

| 1. |

The Parties hereby agree to amend the Conversion Price to be equal to one share of Common Stock for each ten cents (USD$0.10) of the Loan so converted (the “New Conversion Price”). |

| 2. |

The Parties hereby agree to convert the total balance outstanding under all of the Loans (including Principal and Interest) into Common Stock at the New Conversion Price (the “Converted Shares”), and the Lender shall cooperate with NBGI to execute and deliver to NBGI any documents or agreements that are necessary to allow NBGI to promptly convert and cancel the Promissory Notes. |

| 3. |

The Lender hereby agrees that it shall not, from the date hereof and until the twelve (12) month period following the final closing date of the Offering, directly or indirectly, assign, transfer, gift, pledge, hypothecate, encumber, distribute or other disposition, whether voluntarily or by operation of law, any of the Converted Shares without the prior written consent of NBGI (which consent may be withheld or denied in its sole discretion). |

| 4. |

The Secretary of NBGI may stamp on the certificates representing the Converted Shares in a prominent manner the following legend: |

|

“THE SALE OR OTHER DISPOSITION OF ANY SHARES REPRESENTED BY THIS CERTIFICATE IS PROHIBITED BY A CONVERSION AGREEMENT, DATED AS OF APRIL 4, 2014, AS AMENDED FROM TIME TO TIME, BY AND AMONG NAKED BRAND GROUP INC., NAKED INC. AND THE SHAREHOLDER.” |

| 5. |

Governing Law. This Agreement and all matters arising hereunder will be governed by the laws of British Columbia. |

| 6. |

Counterparts. This Agreement may be executed and delivered (including by facsimile and other electronic transmission) in one or more counterparts, and by different parties hereto in separate counterparts, each of which shall be deemed to be an original, but all of which taken together shall constitute one and the same agreement. |

| 7. |

Entire Agreement. This Agreement, together with each of the Promissory Notes, constitutes the entire understanding of the parties hereto with respect to its subject matter and may not be modified or amended, except in writing by such parties. |

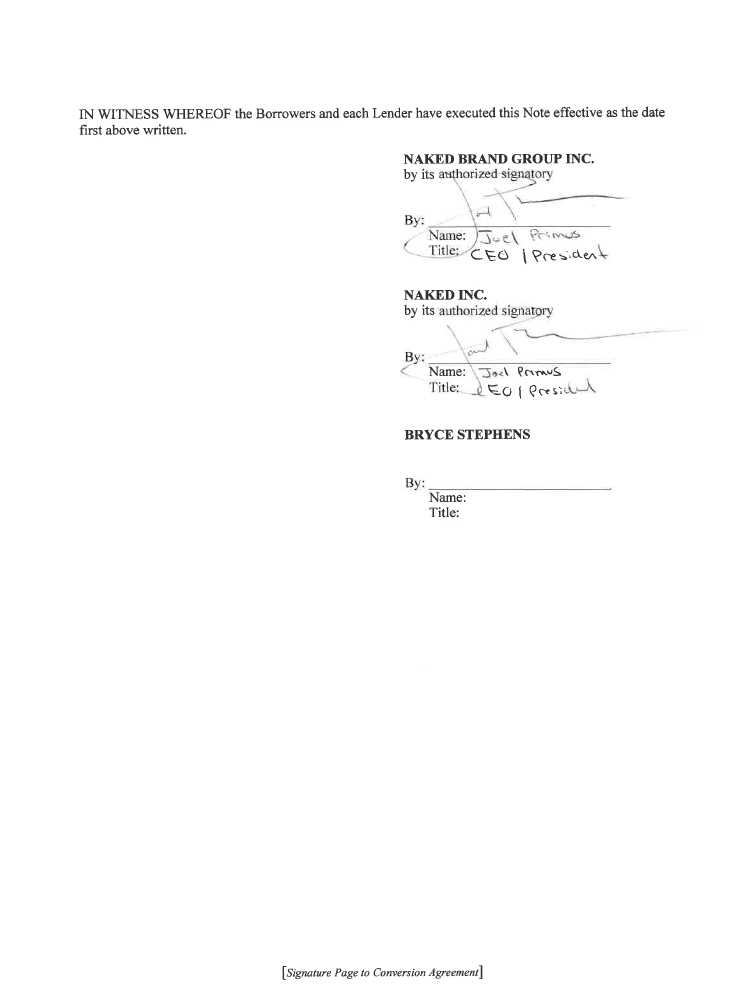

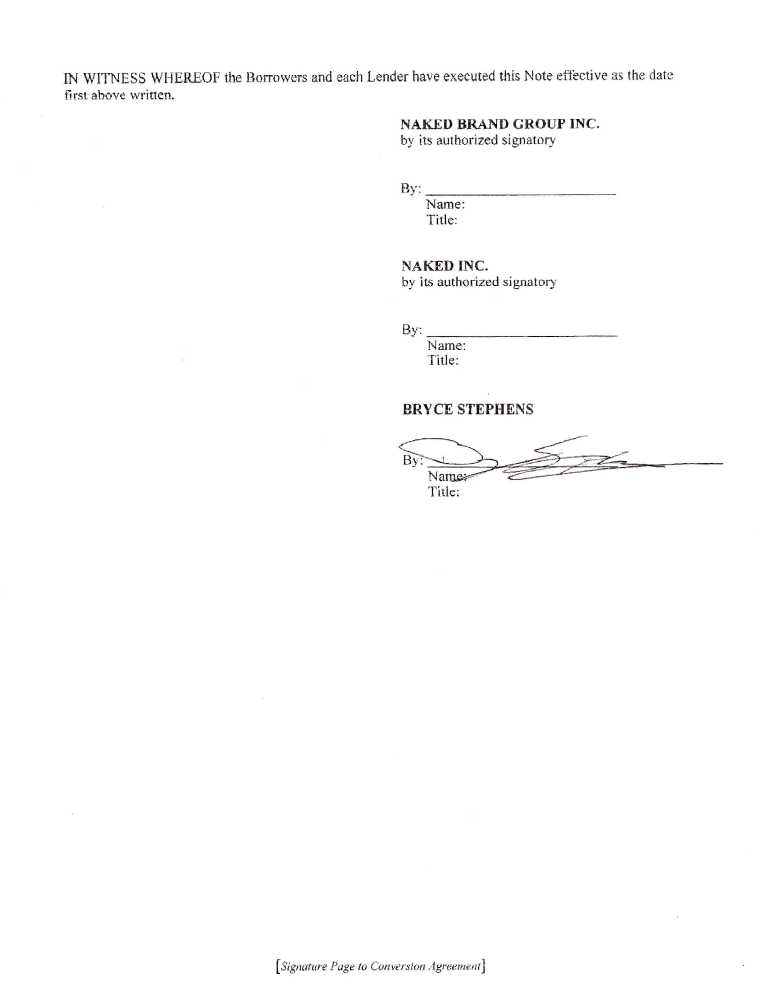

[Signature Pages Follow]

2