Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NAKED BRAND GROUP INC. | form8k.htm |

| EX-10.7 - EXHIBIT 10.7 - NAKED BRAND GROUP INC. | exhibit10-7.htm |

| EX-10.2 - EXHIBIT 10.2 - NAKED BRAND GROUP INC. | exhibit10-2.htm |

| EX-10.3 - EXHIBIT 10.3 - NAKED BRAND GROUP INC. | exhibit10-3.htm |

| EX-10.1 - EXHIBIT 10.1 - NAKED BRAND GROUP INC. | exhibit10-1.htm |

| EX-10.10 - EXHIBIT 10.10 - NAKED BRAND GROUP INC. | exhibit10-10.htm |

| EX-10.6 - EXHIBIT 10.6 - NAKED BRAND GROUP INC. | exhibit10-6.htm |

| EX-10.9 - EXHIBIT 10.9 - NAKED BRAND GROUP INC. | exhibit10-9.htm |

| EX-10.11 - EXHIBIT 10.11 - NAKED BRAND GROUP INC. | exhibit10-11.htm |

| EX-10.8 - EXHIBIT 10.8 - NAKED BRAND GROUP INC. | exhibit10-8.htm |

| EX-10.12 - EXHIBIT 10.12 - NAKED BRAND GROUP INC. | exhibit10-12.htm |

| EX-10.5 - EXHIBIT 10.5 - NAKED BRAND GROUP INC. | exhibit10-5.htm |

| CONFIDENTIAL | EXECUTION VERSION |

NOTE EXCHANGE AGREEMENT

This NOTE EXCHANGE AGREEMENT (this “Agreement”), dated as of April 4, 2014, among CSD HOLDINGS LLC, a Delaware limited liability company (the “Lender”), NAKED BRAND GROUP INC., a Nevada corporation (“NBGI”), and NAKED INC., a Nevada corporation (“Naked” and together with NBGI, the “Borrowers”).

WHEREAS:

| A. |

The Lender is the lawful owner and holder of that certain Promissory Note dated as of December 24, 2013 (as amended, restated or otherwise modified from time to time, the “Kalamalka Note”); and the total amount outstanding under the Kalamalka Note is Seventy Five Thousand and No/100 United States Dollars (USD$75,000.00), plus any accrued and unpaid interest thereon (collectively, the “Indebtedness”). |

| B. |

Pursuant to that certain Agency and Interlender Agreement, dated as of November 14, 2013 (as may be amended, amended and restated, supplemented or otherwise modified from time to time, the “Kalamalka Agent Agreement”), among Kalamalka Partners Ltd. (“Kalamalka”), the Lender and the other lenders set forth therein, Kalamalka is the designated agent for the Lender in respect of the Kalamalka Note. |

| C. |

The Kalamalka Note is secured by (i) that certain Security Agreement, dated as of November 14, 2013 (as may be amended, amended and restated, supplemented or otherwise modified from time to time), made by NBGI in favor of Kalamalka for, among others, the Lender and (ii) that certain Security Agreement, dated as of November 14, 2013 (as may be amended, amended and restated, supplemented or otherwise modified from time to time), made by Naked in favor of Kalamalka for, among others, the Lender. |

| D. |

Naked requires funds to expand its inventory and sales operations, and, in order to raise funds for that purpose, NBGI desires to issue certain secured convertible promissory notes (individually, the “Bridge Note” and collectively, the “Bridge Notes”) to a group of accredited investors (as defined in applicable U.S. federal securities legislation), including, without limitation, Carole Hochman, who is Lender’s designee, (collectively, the “ Bridge Lenders”) in connection with an agency and interlender agreement to be entered into as of the date hereof. The Bridge Notes shall be converted into and exchanged (in whole or in part) for the securities to be issued by NBGI in connection with a round of equity financing through a future private placement of certain secured convertible debentures. |

| E. |

The Lender, as the owner and holder of the Kalamalka Note, and the Borrowers, as the issuers of and borrowers under the Kalamalka Note, desire to have the Indebtedness evidenced by the Kalamalka Note severed and exchanged in its entirety for Indebtedness evidenced by a Bridge Note; and, in connection therewith, the Lender desires to have such Bridge Note issued to Carole Hochman, its designee. |

NOW THEREFORE THE PARTIES HERETO AGREE as follows:

| 1. |

On and after the date hereof, the Indebtedness evidenced by the Kalamalka Note, of which the entire amount is outstanding, shall be, and hereby is, severed and exchanged in its entirety for the Indebtedness evidenced by the Bridge Note. |

| 2. |

Simultaneously herewith, the Bridge Note shall be executed and delivered by NBGI to Carole Hochman, who is hereby designated by the Lender as having the right to receive such Bridge Note, in complete severance and substitution for the Kalamalka Note, which shall be tendered by the Lender to NBGI in exchange therefor. |

| 3. |

The Indebtedness evidenced by the Bridge Note is, in the aggregate, equal to the Indebtedness evidenced by the Kalamalka Note, and shall be secured by that certain Security Agreement, dated as of the date hereof, among NBGI and the Bridge Lenders, in which NBGI granted to the Bridge Lenders a security interest in certain collateral to secure the Bridge Notes (the “Bridge Security Agreement”). For the avoidance of doubt, nothing contained in this Agreement or the Bridge Notes shall be deemed to alter the Indebtedness evidenced by the Kalamalka Note which, pursuant to this Agreement, is replaced in its entirety with the Bridge Note and shall be secured by the Bridge Security Agreement. |

| 4. |

Severability. If any provision of this Agreement is declared by a court of competent jurisdiction to be in any way invalid, illegal or unenforceable, the balance of this Agreement shall remain in effect, and if any provision is inapplicable to any person or circumstance, it shall nevertheless remain applicable to all other persons and circumstances. If it shall be found that any interest or other amount deemed interest due hereunder shall violate applicable laws governing usury, the applicable rate of interest due hereunder shall automatically be lowered to equal the maximum permitted rate of interest. |

| 5. |

Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each of the parties hereto hereby agree that all legal proceedings concerning the interpretations, enforcement and defense of this Note shall be commenced in the state and federal courts sitting in The City of New York, County of New York (the “New York Courts” ). Each of the parties hereto hereby irrevocably submit to the exclusive jurisdiction of the New York Courts for the adjudication of any dispute hereunder (including with respect to the enforcement of this Agreement), and hereby irrevocably waive, and agree not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such suit, action or proceeding is improper. Each of the parties hereto hereby irrevocably waive personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to the other at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Each of the parties hereto hereby irrevocably waive, to the fullest extent permitted by applicable law, any and all right to trial by jury in any legal proceeding arising out of or relating to this Agreement or the transactions contemplated hereby. |

| 6. |

Counterparts. This Amendment may be executed and delivered (including by facsimile and other electronic transmission) in one or more counterparts, and by different parties hereto in separate counterparts, each of which shall be deemed to be an original, but all of which taken together shall constitute one and the same agreement. |

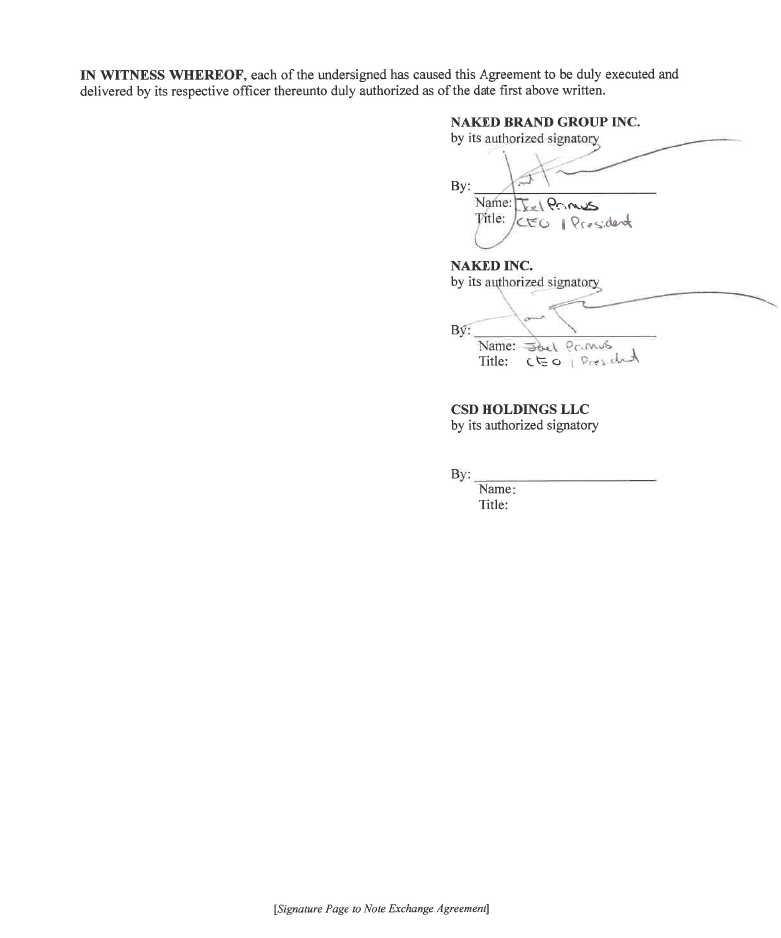

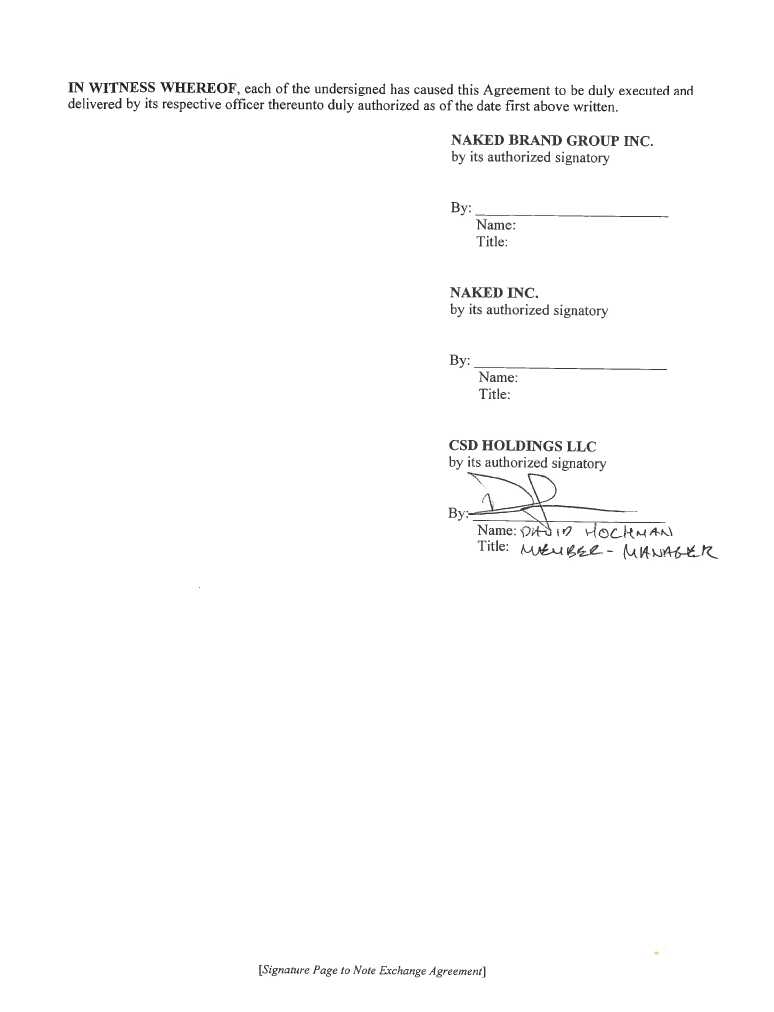

[Signature Page Follows]

2