Attached files

| file | filename |

|---|---|

| 8-K - 8-K - First Liberty Power Corp | form8k.htm |

EXPLORATION AND MINING LEASE EARN-IN TO PURCHASE AGREEMENT

THIS EXPLORATION AND MINING LEASE EARN-IN TO PURCHASE AGREEMENT (the "Agreement") is made and entered into as of April 4, 2014 (the "Effective Date"), by and between RENAISSANCE EXPLORATION, INC. ("RenEx"), a Nevada corporation, whose address is 4750 Longley Lane, Suite 106, Reno, Nevada 89502, and FIRST LIBERTY POWER CORP., a Nevada corporation, ("Purchaser"), whose address is 7251 West Lake Mead Blvd Ste 300, Las Vegas, Nevada 89128.

RECITALS

A. RenEx is the owner of 21 unpatented and 7 patented mining claims and leaseholder of 8 patented claims covering all mineral rights, within the Area of Interest Exhibit A-l, - all of which are located in Pershing County, Nevada. These lands, controlled by RenEx, form the Arabia ("PROJECT") as more particularly described on Exhibit A-2. Any underlying agreements that exist at the time of execution are provided in Exhibit A-3 the "Underlying Agreements".

B. RenEx desires to grant to Purchaser and Purchaser desires to acquire the exclusive right to explore, evaluate, and develop the PROJECT, and to earn a 100% undivided interest in the PROJECT, and all easements, rights-of-way, water rights, and other appurtenances associated therewith (collectively, the "Property"), pursuant to the terms and conditions of this Agreement.

AGREEMENT

NOW, THEREFORE, for and in consideration of the Payment (as defined below in paragraph A.1(a)), and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confirmed, and the mutual promises, covenants, and conditions herein contained and recited, RenEx and Purchaser agree as follows:

A. GRANT OF EARN-IN RIGHTS

1. RenEx hereby grants to Purchaser the exclusive right and option to acquire a 100% undivided interest in the Property for the following consideration:

(a) agrees to pay to RenEx the amount of US $10,000 plus the reimbursement cost of all mining claim maintenance and lease fees paid in the past year and a commitment to pay the 2014 claim and lease fees prior to the Effective Date (the "Payment").

(b) In addition, in order to vest its 100% interest in the Property, Purchaser is required to pay RenEx $22,500.00 at the beginning of month 4, 7, 9, and 11 in the first agreement year as well as to pay all land maintenance and obligation costs 60 days prior to their due date on all federal unpatented claims and leasehold patented claims.

(c) A minimum of $50,000 in exploration and development will be conducted within each of the first two years through RenEx as per Exhibit C

1

B. TRANSFER OF INTEREST

1. Upon Purchaser's successful completion of Purchaser's first years obligations RenEx shall deliver to Purchaser a special warranty deed conveying to Purchaser a 100% undivided interest in the Property, subject to:

|

(a)

|

Purchaser's obligation to pay minimum payments to RenEx:

|

|

-

|

Year 2 pay $25,000 at beginning of months 2, 5, 8, and 11

|

|

-

|

Year 3 and subsequent years through the ten year term until a total of $1 million is paid at least $50,000 at the beginning of months 1 and 6.

|

(b) The mineral production royalty reserved by RenEx is 10% until the $1,000,000 is paid in-full and then it reduces to 7%. Half of the $1 million payment ($500,000) is direct payment and the other half ($500,000) is advanced minimum royalty.

(c) If production occurs prior to the $1,000,000 being paid to RenEx then all of the 10% royalty goes to paying the $500,000 advanced royalty. This will continue for as long as the $500,000 payments and the $500,000 advanced royalty remainincomplete. For example, if the advanced royalty ($500,000) is paid, but the payments due ($500,000) are incomplete the royalty remains at 10% until the entire one million is paid.

(d) Purchaser has the right to buy down the NSR (indexed by the average 30 day gold price using the London historical am and pm gold price ending 5 days prior to the purchase date) before the following anniversary dates:

|

-

|

4th anniversary 1% for one million dollars

|

|

-

|

5th anniversary an additional 1% for two million dollars

|

|

-

|

6th anniversary an additional 1% for four million dollars

|

2. Upon completion of the first years payments and obligations all permitting and bonding will be under the name of, and the responsibility of Purchaser. RenEx will be copied on all communications related to bonding and permitting.

3. Until Purchaser pays RenEx minimum payments in the total of $1,000,000 all land payments pursuant to the underlying agreement will go through RenEx and must be paid 60 days in advance. Penalties and remediation are described in D.3.

C. REPRESENTATIONS, WARRANTIES AND COVENANTS

1. RenEx represents and warrants to Purchaser that:

(a) The PROJECT is accurately described in Exhibit A-1, A-2, and A-3 attached hereto, RenEx is the owner or optionee thereof and is subject to the paramount title of the United States in respect of the mining claims, is in exclusive possession thereof, and the Property is free and clear of all liens, claims, and encumbrances, except as defined in the underlying agreements.

(b) As to each of the Unpatented Claims, subject to the paramount title of the United States of America: (i) the Unpatented Claims were properly located and monumented, free and clear of any conflicting claims of which RenEx is aware; (ii) location notices and certificates and required maps were properly posted, recorded and filed for each of the Unpatented Claims; (iii) all filings and recordings required to maintain the Unpatented Claims in good standing through the Effective Date of this Agreement, including evidence of timely payment of required claim maintenance fees, have been timely and properly made in the appropriate governmental offices; and, (iv) all required annual claim maintenance fees, BLM fees and other payments necessary to maintain the Unpatented Claims through the assessment year ending September 1, 2014, have been timely and properly made.

2

(c) All patented claims or other private ground are in good standing relative to any underlying lease payments or taxes due.

(d) All operations and activities conducted by or on behalf of RenEx on the Unpatented, Patented Claims or other lands obtained for the project have been conducted in compliance with applicable federal, state and local laws, rules and regulations, including without limitation Environmental Laws.

(e) RenEx is duly incorporated, validly existing and in good standing under the laws of the State of Nevada, and is qualified to do business and in good standing under the laws of the State of Nevada. RenEx has the requisite corporate power and capacity to carry on business as presently conducted, to enter into this Agreement, and to perform all of its obligations hereunder.

(f) There are no outstanding agreements, leases or options (whether oral or written) which contemplate the acquisition of the Claims or any interest therein by any other person or entity, except the Underlying Agreements.

(g) RenEx owns or controls a 100% interest in the PROJECT, except as may be defined by Underlying Agreements in Exhibit A-3.

(h) The entering into of this Agreement and the performance by RenEx of its obligations hereunder will not violate or conflict with any applicable law or any order, decree or notice of any court or other governmental agency, nor conflict with, or result in a breach of, or accelerate the performance required by any contract or other commitment to which RenEx is a party or by which it is bound.

(i) All requisite corporate action on the part of RenEx, and on the part of its officers, directors, and shareholders, necessary for the execution, delivery, and performance by it of this Agreement and all other agreements contemplated hereby, have been taken. This Agreement and all agreements and instruments contemplated hereby are, and when executed and delivered by it (assuming valid execution and delivery by the other party), will be, legal, valid, and binding obligations of it enforceable against it in accordance with their respective terms. Notwithstanding the foregoing, no representation is made as to the availability of equitable remedies for the enforcement of this Agreement or any other agreement contemplated hereby. Additionally, this representation is limited by applicable bankruptcy, insolvency, moratorium, and other similar laws affecting generally the rights and remedies of creditors and secured parties.

(j) To the best of its knowledge, information and belief, there are no adverse environmental conditions at the Property that could result in a violation of or liability under any federal, state or local laws, rules or regulations concerning protection of the environment or human health and safety ("Environmental Laws"). In conducting activities on the Property, RenEx has complied with all applicable Environmental Laws as they relate to the Property and there have been no breaches of or liabilities caused or permitted to arise by RenEx under any Environmental Laws. RenEx has not received notification from any person, including without limitation, any governmental authority, of any potential breach or alleged breach of any applicable Environmental Laws relating to the Property or of any inspection or possible inspection or investigation by any governmental authority under any applicable Environmental Laws relating to the Property. RenEx has not received any notification of and has no knowledge of the presence of any contaminants (including hazardous substances or materials, dangerous goods, chemicals or toxic wastes) in the soil or water in, on or under the Property and RenEx has not been the subject of any claims or incurred any expenses in respect of the presence of any contaminants in the soil or water in, on or under the Property.

3

(k) To the best of knowledge of RenEx, there is no circumstance that would prevent any and all governmental licenses and permits required to carry out exploration, development, mining, processing and reclamation operations on the Property from being obtained, as and when necessary.

(l) RenEx has obtained all consents required under any agreements to which it is a party and all required consents and approvals from governmental agencies and any stock exchange, as necessary for it to execute, deliver and perform its obligations under this Agreement.

(m) There are no actions, suits or proceedings pending or, to the knowledge of RenEx, threatened against or affecting the Property, including any actions, suits, or proceedings being prosecuted by any federal, state or local department, commission, board, bureau, agency, or instrumentality. To the knowledge of RenEx, it is not subject to any order, writ, injunction, judgment or decree of any court or any federal, state or local department, commission, board, bureau, agency, or instrumentality which relates to the Property.

(n) RenEx will assist Purchaser in making applications for required exploration permits or other required approvals from regulatory authorities required in order to conduct exploration on the Property.

2. Purchaser represents and warrants to RenEx that:

(a) Purchaser is duly incorporated under the laws of Nevada and is in good standing. Purchaser has the requisite corporate power and capacity to carry on business as presently conducted, to enter into this Agreement, and to perform all of its obligations hereunder.

(b) The entering into of this Agreement and the performance by Purchaser of its obligations hereunder will not violate or conflict with any applicable law or any order, decree or notice of any court or other governmental agency, nor conflict with, or result in a breach of, or accelerate the performance required by any contract or other commitment to which Purchaser is a party or by which it is bound.

(c) All requisite corporate action on the part of Purchaser, and on the part of its officers, directors and shareholders, necessary for the execution, delivery and performance by it of this Agreement and all other agreements contemplated hereby, have been taken. This Agreement and all agreements and instruments contemplated hereby are, and when executed and delivered by it (assuming valid execution and delivery by the other party), will be legal, valid and binding obligations enforceable in accordance with their respective terms. Notwithstanding the foregoing, no representation is made as to the availability of equitable remedies for the enforcement of this Agreement. Additionally, this representation is limited by applicable bankruptcy, insolvency, moratorium, and other similar laws affecting generally the rights and remedies of creditors and secured parties.

(d) Purchaser has obtained all consents required under any agreement to which it is a party and all required consents and approvals from governmental agencies and any stock exchange, as necessary for it to execute, deliver and perform its obligations under this Agreement.

(e) In the event that Purchaser requests that RenEx assist in specified exploration and development activities to be conducted on or for the benefit of the Property, the provisions contained in Exhibit C shall apply.

4

D. TERMINATION OF AGREEMENT

1. Purchaser may in its sole discretion terminate this Agreement at any time by giving not less than 60 days prior written notice to that effect to RenEx. Upon expiry of the 60 day notice period, or if the Agreement is terminated pursuant to any other provision of this Agreement, the Agreement will be of no further force and effect, subject to Purchaser's obligations which accrue to the termination date. Upon such termination, Purchaser shall have no further obligation to incur Exploration and Development Expenses on or for the benefit of the Property and shall have no further obligations or liabilities to RenEx under this Agreement or with respect to the Property (including without limitation liability for lost profits or consequential damages as a result of an election by Purchaser to terminate this Agreement), other than (a) Purchaser's obligations which accrue to the termination date and as set forth in the remainder of this paragraph, and (b) to reclaim (in accordance with applicable law) any disturbances of the Property made by Purchaser. RenEx hereby agrees to grant Purchaser such access to the Property as is reasonably necessary to complete any required reclamation. At any time Purchaser may, at its option, terminate its interest in some but less than all of the Claims, Patents or Lease Agreements by written notice to RenEx, provided that if such notice (or notice of termination of this Agreement in its entirety) is received by RenEx after June 30th of any year, or within 60 days of any filing date, Purchaser shall remain obligated to pay the claim maintenance fees (and make all filings and recordings required in connection therewith) for those Claims to which such termination applies for the upcoming assessment year. In addition, Purchaser is responsible for all continuing reclamation obligations. To the extent Purchaser terminates its interest in some but less than all of the Claims, this Agreement shall remain in full force and effect with respect to the remaining Claims.

2. In the event Purchaser is in default in the observance or performance of any of Purchaser's covenants, agreements or obligations under this Agreement (other than fiscal which are covered in D. 3.), RenEx may give written notice of such alleged default specifying the details of same. Purchaser shall have 30 days following receipt of said notice (or, in the event Purchaser in good faith disputes the existence of such a default, 30 days after a final, non-appealable order of a court of competent jurisdiction finding that such a default exists) within which to remedy any such default described therein, or to diligently commence action in good faith to remedy such default. If Purchaser does not cure or diligently commence to cure such default by the end of the applicable 30-day period, then RenEx shall have the right to terminate this Agreement by providing 30 days advance written notice to Purchaser. In the event of such termination, the provisions of Section D.1 shall apply with respect to the parties' ongoing obligations and liabilities.

3. In the event Purchaser is in financial default by 30 days prior to Purchaser's minimum payment in the total of $ 1 million then the Project shall revert to RenEx. Land payments pursuant to the Underlying Agreements must be paid in full 60 days prior to the due date. If payments are not paid more than 30 days before due then the Project reverts to RenEx. If minimum payments to RenEx are not paid on time (60 days prior) then there is an automatic 0.5% per day late penalty which will expire after 30 days and the entire project reverts to RenEx. For example, if Purchaser were 20 days late in their payment, the payment is 120% of what is owed. If Purchaser is 30 days late in their payment then the Project reverts to RenEx.

5

E. RIGHTS AND OBLIGATIONS DURING EARN-IN PERIOD

1. During the Earn-In Period, Purchaser and its employees, agents and independent contractors shall have the exclusive right to enter upon the Property and to conduct such prospecting, exploration, development or other mining work thereon and thereunder as they desire and as is permitted by federal and Nevada laws. Purchaser's activities on the Property may include any activities for which the costs would qualify as Exploration and Development Expenses, as well as the removal of mineral samples for the purpose of, and in amounts appropriate for, testing such mineral samples, including bulk sampling, and in addition Purchaser shall have the right to bring upon and erect upon the Property such buildings, plants, machinery and equipment as Purchaser may deem necessary or desirable to carry out such activities.

2. Purchaser in its sole discretion will decide any matter concerning the conduct of its prospecting, exploration, development or other mining activities on the Property.

3. In the conduct of its exploration, development and other activities on the Property, Purchaser shall be responsible for compliance with applicable laws and regulations, including laws and regulations related to exploration, development, mining and reclamation.

4. Purchaser, so long as it has not terminated this Agreement in whole or in part, shall be responsible for timely payment to RenEx of required claim maintenance fees, property taxes, and any other payment required to maintain the Property 60 days prior to their due date (D 3.). RenEx shall be responsible for timely filing and recording of all documents required to evidence the payment of required claim maintenance fees.

5. Subject to RenEx's prior written approval (which shall not be unreasonably withheld), Purchaser shall have the full, exclusive right, but not the obligation, to abandon (including abandonment and relocation as millsites), relocate, amend, defend contests or adverse actions or suits and negotiate settlement thereof with respect to any and all of the Claims, and RenEx shall cooperate with Purchaser and shall execute any and all documents necessary or desirable in the opinion of Purchaser to further such amendments, relocations, contests, adverse actions or suits, or settlement of such contests or adverse actions or suits. Purchaser shall not be liable to RenEx for the loss of any of the Claims as a result of such abandonments, amendments, relocations, contests or adverse actions or suits, so long as the same are undertaken in good faith.

6. All exploration and related data generated by either party must be provided to both parties in as close to near real time as reasonable. This obligation includes having RenEx on the email list for copies of preliminary and final assay results, draft and final reports and other time sensitive material. In addition, RenEx may request copies of any other data or information pertaining to the PROJECT at any time and this must be provided by Purchaser within a reasonable time frame.

7. As a publicly traded company RenEx is bound by stock exchange rules for timely disclosure. Data for any imminent press release must be received in full, one week prior to any anticipated release. Purchaser will have the right to review any press release or public disclosure put out by RenEx within 3 business days. If Purchaser is a publicly traded company and also must be bound by timely public disclosure rules then both parties must agree to review each other’s press releases within 3 business days. Press releases must be coincident. This means that once both parties agree on each other’s final draft it will be decided to simultaneously submit the information either after market or before market opens. In the case of markets in different time zones both parties must agree to and adhere to a policy for such releases.

6

F. FORCE MAJEURE

If Purchaser should be delayed in or prevented from performing any of the terms, covenants or conditions of this Agreement by reason of a cause beyond the control of Purchaser, whether or not foreseeable, including fires, floods, earthquakes, subsidence, ground collapse or landslides, interruptions or delays in transportation or power supplies, strikes, lockouts, wars, acts of God, native title claims, inability to obtain required governmental permits or approvals in a timely manner provided that Purchaser timely and diligently applies for such permits, government regulation or interference (but excluding a lack of funds), then any such failure on the part of Purchaser to so perform shall not be deemed to be a breach of this Agreement and the time within which Purchaser is obliged to comply with any terms, covenants or conditions of this Agreement shall be extended by the period of all such delays. Purchaser shall give notice in writing to RenEx forthwith and for each new cause of delay or prevention shall set out in such notice particulars of the cause, and the date on which the same arose, and shall take all reasonable steps to remove the cause of such delay or prevention, and shall also give notice immediately following the date that such cause ceases to exist.

G. AREA OF INTEREST

1. Any interest or rights to acquire (a) any interest in mining claims or in other real property interests within the area described in Exhibit A-1 (the “Area of Interest") or (b) contiguous unpatented, patented claims or other mineral and property rights which are contiguous and extend beyond the Area of Interest, acquired during the Earn-In Period by or on behalf of either party or any affiliate or subsidiary of either party shall become subject to the terms and provisions of this Agreement in accordance with the provisions of Section G.2. After the full payment of one million dollars then the AOI will pertain to only the contiguous claims that have been staked (if any) and the rectangular AOI as defined in Exhibit A1.

2. Within 30 days after the acquisition of such additional property, all or any portion of which lies within the Area of Interest (or constitutes contiguous property that may extend beyond the Area of Interest), the acquiring party shall notify the other party of such acquisition. Such notice shall describe in detail the acquisition, the lands, the nature of the interest therein, the mining claims or other real property interest covered thereby, and the acquisition cost. In addition to such notice, the acquiring party shall make any and all information concerning the additional property available to the other party. The other party shall then have 30 days after receipt of such notice and information to elect in its sole discretion to include such additional interest in the Property.

3. If a party elects not to include such an additional interest as part of the Property, then with respect to that additional interest, either party shall be free to take actions with respect to and dispose of such interest without any obligation to the other party.

4. All real property interest and any new claims accepted to the Property must be acquired in the name of RenEx until such time as Purchaser has vested its 100% interest in the PROJECT.

H. ASSIGNMENT

1. This Agreement shall be binding upon and inure to the benefit of the parties and their permitted successors and assigns. Purchaser may, upon the prior written approval of RenEx, which approval shall not be unreasonably withheld, assign this Agreement to other parties that are not affiliated with Purchaser at any time, provided that the assignee agrees in writing to assume all Purchaser's obligations under this Agreement. Upon such assignment, or an assignment to an affiliate (as described below), Purchaser shall have no further obligations or liabilities under this Agreement. At any time, and without the consent of RenEx, Purchaser may assign this Agreement (a) to one or more of its affiliates upon the affiliate assuming all of Purchaser's obligations under this Agreement (affiliate meaning any entity which directly or indirectly controls or is controlled by, or under common control with, Purchaser); (b) in connection with a pledge by Purchaser for financing purposes, (c) in connection with a corporate merger or reorganization involving Purchaser, or (d) in connection with a sale of all or substantially all of Purchaser's assets, unless the project represents 50% or more of the assets. Upon Purchaser's prior written approval, which approval shall not be unreasonably withheld, RenEx may assign its interest in the Property and this Agreement to a third party, provided that any such third party must agree in writing to be bound by all of the terms and conditions of this Agreement.

7

2. Except as otherwise provided in Section 1, if either party (the "Selling Party") desires to transfer all or any part of its rights hereunder, the other party (the "Remaining Party") shall have a right of first offer to acquire such interests as provided in this Section 2:

(a) if the Selling Party intends to transfer all or any of its rights hereunder, it shall promptly notify the Remaining Party of its intentions. The Remaining Party shall have 30 days from the date such notice is delivered to notify the Selling Party whether it elects to acquire the offered interest and the terms and conditions thereof and the price (the "Offered Price") therefore. The consideration payable for the offered interest shall be stated in cash unless agreed;

(b) if the Remaining Party does so elect, and the Selling Party is not agreeable to the terms and conditions by the Remaining Party, the Selling Party shall have 45 days following receipt of the offer from the Remaining Party to sell the interest to an arm's length third party upon terms and conditions no less favorable than those offered by the Remaining Party, including that the offer price shall not be less than an amount that is 10% greater than the Offered Price;

(c) if the Remaining Party does not so elect within the period provided for in Section 2(a), the Selling Party shall have 45 days following the expiration of such period to consummate the transfer to an arm's length third party upon such terms and conditions as are satisfactory to the Selling Party; and

(d) if the Selling Party fails to consummate the transfer to a third party within the period set forth in Sections 2(b) and (c), the right of first offer of the Remaining Party in such offered interest shall be deemed to be revived. Any subsequent proposal to transfer such interest shall be conducted in accordance with all of the procedures set forth in this Section 2.

I. INDEMNIFICATION

1. Purchaser agrees to indemnify, defend and hold harmless RenEx (and its officers, directors, successors and assigns) from and against any and all debts, liens, claims, causes of action, administrative orders and notices, costs (including, without limitation, response and/or remedial costs), personal injuries, losses, damages, liabilities, demands, interest, fines, penalties and expenses, including reasonable attorney's fees and expenses, consultant's fees and expenses, court costs and all other out-of-pocket expenses, suffered or incurred by Purchaser and its successors as a result of: (a) preexisting conditions on the property, or (b) any breach by RenEx of any of its representations, warranties and covenants set forth in this Agreement, or (c) any operations or activities engaged in by RenEx on the Property, including without limitation any matter, condition or state of fact involving Environmental Laws or hazardous materials which may arise after the Effective Date of this Agreement and that is caused by RenEx.

2. RenEx agrees to indemnify, defend and hold harmless Purchaser (and its officers, directors, successors and assigns) from and against any and all debts, liens, claims, causes of action, administrative orders and notices, costs (including, without limitation, response and/or remedial costs), personal injuries, losses, damages, liabilities, demands, interest, fines, penalties and expenses, including reasonable attorney's fees and expenses, consultant's fees and expenses, court costs and all other out-of-pocket expenses, suffered or incurred by Purchaser and its successors as a result of, (a) any breach by Purchaser of any of its representations, warranties and covenants set forth in this Agreement, or (b) any operations or activities engaged in by Purchaser on the Property, including without limitation any matter, condition or state of fact involving Environmental Laws or hazardous materials which may exist prior to the Effective Date of this Agreement or which may arise after the Effective Date of this Agreement and that is caused by Purchaser.

8

3. The parties hereto, within 5 days after the service of process upon either of them in a lawsuit, including any notices of any court action or administrative action (or any other type of action or proceeding), or promptly after either of them, to its respective knowledge, shall become subject to, or possess actual knowledge of, any damage, liability, loss, cost, expense, or claim to which the indemnification provisions of this Section I relate, shall give written notice to the other party setting forth the fact relating to the claim, damage, or loss, if available, and the estimated amount of the same. "Promptly" for purposes of this paragraph shall mean giving notice within 5 days. Failure to receive prompt notification shall not relieve either party of its indemnification obligations hereunder unless such party is materially prejudiced thereby. Upon receipt of such notice relating to a lawsuit, the indemnifying party shall be entitled to: (i) participate at its own expense in the defense or investigation of any claim or lawsuit, or (ii) assume the defense thereof, in which event the indemnifying party shall not be liable to the indemnified party for legal or attorney fees thereafter incurred by such indemnified party in defense of such action or claim; provided, that if the indemnified party may have any unindemnified liability out of such claim, such party shall have the right to approve the counsel selected by the indemnifying party, which approval shall not be withheld unreasonably. If the indemnifying party assumes the defense of any claim or lawsuit, all costs of defense of such claim or lawsuit shall thereafter be borne by such party and such party shall have the authority to compromise and settle such claim or lawsuit, or to appeal any adverse judgment or ruling with the cost of such appeal to be paid by such party; provided, however, if the indemnified party may have any unindemnified liability arising out of such claim or lawsuit the indemnifying party shall have the authority to compromise and settle each such claim or lawsuit only with the written consent of the indemnified party, which shall not be withheld unreasonably. The indemnified party may continue to participate in any litigation at its expense after the indemnifying party assumes the defense of such action. In the event the indemnifying party does not elect to assume the defense of a claim or lawsuit, the indemnified party shall have authority to compromise and settle such claim or lawsuit only with the written consent of the indemnifying party, which consent shall not be unreasonably withheld, or to appeal any adverse judgment or ruling, with all costs, fees, and expenses indemnifiable under this Section J hereof to be paid by the indemnifying party. Upon the indemnified party's furnishing to the indemnifying party an estimate of any loss, damage, liability, or expense to which the indemnification provisions of this Section J relate, the indemnifying party shall pay to the indemnified party the amount of such estimate within 10 days after receipt of such estimate.

4. Purchaser agrees to carry such insurance, covering all persons working at or on the Property for Purchaser, as will fully comply with the requirements of the laws of the State of Nevada pertaining to worker’s compensation and occupational disease and disabilities as are now in force or as may be hereafter amended or enacted. In addition, during the Earn-In Period, so long as it is carrying out exploration, development or activities as the exploration operator, Purchaser agrees to carry liability insurance with respect to such operations in reasonable amounts not less than the greater of the minimum levels required by law or as set forth below:

(a) Commercial General Liability Insurance with limits of not less than $1,000,000 per occurrence.

(b) Automobile Liability Insurance, with:

(i) Limits of not less than $1,000,000 Combined Single Limit per accident.

(ii) Coverage applying to any auto.

All of the above-described policies (with the exception of worker’s compensation) shall name RenEx as an additional insured and shall contain provisions that the insurance companies will have no right of recovery or subrogation against RenEx, its affiliates, or subsidiary companies, it being the intention of the parties that Purchaser’s carrier shall be liable for any and all losses covered by the above-described insurance. All policies providing coverage hereunder shall contain provisions that no cancellation or material changes in the policies shall become effective except on thirty (30) days’ advance written notice thereof to RenEx.

9

J. CONFIDENTIALITY

1. All data and information coming into possession of RenEx or Purchaser by virtue of this Agreement with respect to the business or operations of the other party, or the Property generally, shall be kept confidential and shall not be disclosed to any person not a party hereto without the prior written consent of the other party, except:

(a) as required by law, rule, regulation or policy of any stock exchange or securities commission having jurisdiction over a party;

(b) as may be required by a party in the prosecution or defense of a lawsuit or other legal or administrative proceedings;

(c) as required by a financial institution in connection with a request for financing relating to development or mining activities; or

(d) as may be required in connection with a proposed conveyance to a third party of an interest in the Property or this Agreement, provided such third party agrees in writing in a manner enforceable by the other party to abide by all of the provisions of this Section K with respect to such data and information.

2. To the extent either party intends to disclose data or information via press release or other similar format as described in Section J.1(a), the disclosing party shall provide the other party with not less than three business days notice of the text of the proposed disclosure, and the other party shall have the right to comment on the same.

K. ENTIRE AGREEMENT

This Agreement contains the entire agreement between the parties relating to the Property.

L. DISPUTE RESOLUTION

The parties hereby agree that any dispute arising under this Agreement shall be subject to the informal dispute resolution procedure set forth in this Section M. For purposes of this Section M, the party asserting the existence of a dispute as to the interpretation of any provision of this Agreement or the performance by the other party of any of its obligations hereunder shall notify the other party of the nature of the asserted dispute. Within seven business days after receipt of such notice, the President of Purchaser and the President of RenEx shall arrange for a personal or telephone conference in which they use good faith efforts to resolve such dispute. If those individuals are unable to resolve the dispute, they shall each prepare and, within seven business days after their conference, circulate to the President of Purchaser and the President of RenEx a memorandum outlining in reasonable detail the nature of the dispute. Within five business days after receipt of the memoranda, the individuals to whom the memoranda were addressed shall arrange for a personal or telephone conference in which they attempt to resolve such dispute. If those individuals are unable to resolve the dispute, either party may proceed with any legal remedy available to it, provided, however, that the parties agree that any statement made as to the subject matter of the dispute in any of the conferences referred to in this Section L shall not be used in any legal proceeding against the party that made such statement. Notwithstanding the foregoing, if Purchaser has earned its undivided 100% interest in the Property in accordance with the provisions of Section B. 1, and RenEx refuses to execute and deliver the deed referred to therein, the parties agree that Purchaser may seek an order from a court requiring specific performance of that obligation, as an appropriate and necessary remedy under such circumstances, in addition to any other legal or equitable remedies that may be available.

10

M. GENERAL

1. Notice to Purchaser or to RenEx shall be sufficiently given if delivered personally, or if sent by prepaid mail or reputable overnight courier, or if transmitted by facsimile to and recorded by such party:

(a) in the case of a notice to Purchaser at:

First Liberty Power Corp

7251 West Lake Mead Blvd, Ste 300

Las Vegas, NV 89128

Attn: Exploration Manager

FAX (702) 675-8198

And

(b) in the case of a notice to RenEx at:

Renaissance Exploration Inc..

4750 Longley Lane, Suite 106

Reno, NV 89502

Attention: Richard Bedell / Eric Struhsacker

FAX: 775-337-1542

or at such other address or addresses as the party to whom such notice or other writing is to be given shall have last notified the party giving the same in the manner provided in this section. Any notice or other writing delivered to the party to whom it is addressed as set forth above shall

be deemed to have been given and received on the day it is so delivered at such address, provided that if such day is not a business day in the city where the notice is delivered, then such notice or other writing shall be deemed to have been given and received on the next following business day. Any notice or other writing submitted by facsimile or other form of recorded communication shall be deemed to have been given and received on the first business day after its transmission.

2. Each of Purchaser and RenEx shall, with reasonable diligence, do all such things and provide all such reasonable assurances and assistance as may be required to consummate the transactions contemplated by this Agreement and each party shall provide such further documents or instruments required by the other party as may reasonably be necessary or desirable in order to give effect to the terms and conditions of this Agreement and carry out its provisions at, before or after the Effective Date.

11

3. This Agreement may be executed by each of Purchaser and RenEx in counterparts and by facsimile, each of which when so executed and delivered shall be an original, but both such counterparts, whether executed and delivered in the original or by facsimile, shall together constitute one and the same agreement. The parties agree to execute and deliver a short form of this Agreement to be prepared by Purchaser, which the parties agree Purchaser may record in the official records of Pershing County, Nevada.

4. All dollar references in this Agreement are to the United States dollars.

5. This Agreement, including all documents annexed hereto and other agreements, documents and other instruments delivered in connection herewith shall be governed by and construed in accordance with the laws of the State of Nevada (other than its rules as to conflicts of law) and the laws of the United States as applicable.

6. The parties agree that this Agreement shall be construed to benefit the parties hereto and their respective permitted successors and assigns only, and shall not be construed to create any third party beneficiary rights in any other party or in any governmental organization or agency, except as specifically set forth in Section 10.

7. In the event that any one or more of the provisions contained in this Agreement or in any other instrument or agreement contemplated hereby shall, for any reason, be held to be invalid, illegal, or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision of this Agreement or any such other instrument or agreement contemplated hereby.

8. No implied term, covenant, condition or provision of any kind whatsoever except for good faith and fair dealing shall affect any of the parties' respective rights and obligations hereunder, including, without limitation, rights and obligations with respect to exploration, development, mining, processing and marketing of minerals, and the only terms, covenants, conditions, or provisions which shall in any way affect any of their respective rights and obligations shall be those expressly set forth in this Agreement.

9. This Agreement may not be amended or modified, nor may any obligation hereunder be waived, except by writing duly executed on behalf of all Parties, and unless otherwise specifically provided in such writing, any amendment, modification, or waiver shall be effective only in the specific instance and for the purpose it is given.

10. This Agreement is, and the rights and obligations of the parties are, strictly limited to the matters set forth herein. Subject to the provisions of Section H, each of the parties shall have the free and unrestricted right to independently engage in and receive the full benefits of any and all business ventures of any sort whatever, whether or not competitive with the matters contemplated hereby, without consulting the other or inviting or allowing the other to participate therein. The doctrines of "corporate opportunity" or "business opportunity" shall not be applied to any other activity, venture, or operation of either party, whether adjacent to, nearby, or removed from the Property, and neither party shall have any obligation to the other with respect to any opportunity to acquire any interest in any property outside the Property at any time, or within the Property after termination of this Agreement, regardless of whether the incentive or opportunity of a party to acquire any such property interest may be based, in whole or in part, upon information learned during the course of operations or activities hereunder.

12

<Remainder of page intentionally left blank, signature page to follow>

13

IN WITNESS WHEREOF, the parties have executed this Earn-In Agreement effective as of the date first set forth above.

Renaissance Exploration, Inc.

a Nevada corporation

By:

Name:

Title:

First Liberty Power Corp.

A Nevada corporation

By:

Name:

Title:

14

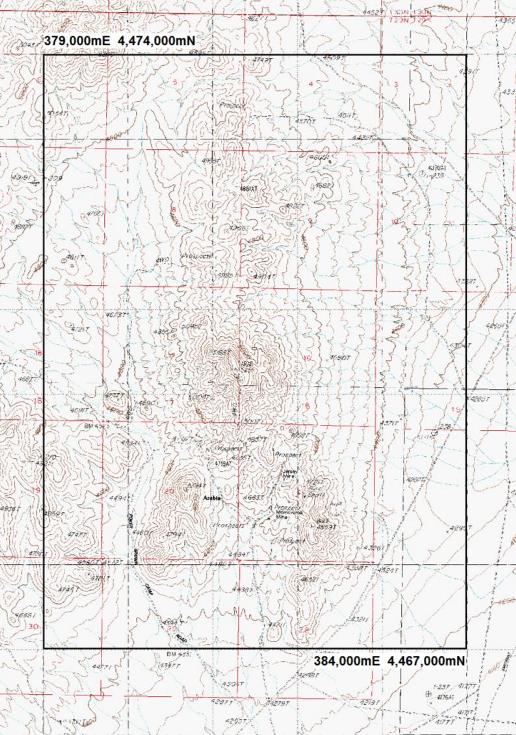

EXHIBIT A-1

AREA OF INTEREST

The Area of Interest as described herein and contiguous claims or contiguous third Party rights subsequently obtained which are contiguous to the exterior boundaries of the Area of Interest.

15

(Description of the "Project")

Unpatented Mining Claims – 21 claims

Claim Name and Number BLM Serial Number

|

NMC1001831

|

|

|

AUR-2

|

NMC1001832

|

|

AUR-3

|

NMC1001833

|

|

AUR-5

|

NMC1001834

|

|

AUR-7

|

NMC1001835

|

|

AUR-9

|

NMC1001836

|

|

AUR-21

|

NMC1001837

|

|

AUR-27

|

NMC1001838

|

|

AUR-28

|

NMC1001839

|

|

AUR-29

|

NMC1001840

|

|

AUR-30

|

NMC1001841

|

|

AUR-31

|

NMC1001842

|

|

AUR-33

|

NMC1001844

|

|

AUR-35

|

NMC1001846

|

|

AUR-37

|

NMC1001848

|

|

AUR-59

|

NMC1001862

|

|

AUR-4

|

NMC1047433

|

|

AUR-6

|

NMC1047434

|

|

AUR-39

|

NMC1047449

|

|

AUR-60

|

NMC1047469

|

|

AUR-61

|

NMC1047470

|

16

Patented Mining Claims

Leased by Renaissance Exploration

Silver Saddle Resources, LLC - 2 leased patented claims

T29N, R32E, Section 20, MDB&M, Pershing County, Nevada

C. W. Claim & Co., Survey #1906, Patent #34632, APN #003-071-44 (formerly#088-010-080), containing 20.66 acres, more or less; and

G. D. B. Claim & Co., Survey #1908, Patent #34636, APN #003-071-45 (formerly #088-010-080), containing 20.66 acres, more or less.

Jack Saylor and Dan Damico - 1 leased patented claim

T29N, R32E, Sections 20 and 21, MDB&M, Pershing County, Nevada

Boston Claim & Co, Survey #1912, Patent #35526, APN #003-071-46, (formerly #088-010-078), containing 20.64 acres, more or less.

Victory Exploration Inc., formerly named F. W. Lewis Inc. - 3 leased patented claims

T29N, R32E, Section 21, MDB&M, Pershing County, Nevada

Total of 52.13 acres, more or less

Clipper, Survey #1794, Patent #29265, APN #003-071-50, (formerly #088-010-030), containing 15.50 acres, more or less; and

Hoodlum, Survey #1794, Patent #29265, APN #003-071-50, (formerly #088-010-030), containing 19.97 acres, more or less.

Victor, Survey 1794, Patent #29265, APN #003-071-50, (formerly #088-010-030). Containing 16.66 acres, more or less.

Chris Cook (“Owner” and successor in interest to Oliver Cook, original owner)- 2 leased patented claims T29N, R32E, Section 21, MDB&M, Pershing County, Nevada

Jersey Claim, Survey #44 (re-numbered as Survey #1437), Patent #7666, APN #003-071-48, (formerly #088-010-010), containing 2.75 acres, more or less.

Montezuma Claim, Survey #45 (re-numbered as Survey #1438), Patent #17511, APN #003-071-49, (formerly #088-010-010), containing 5.67 acres, more or less.

17

Patented Mining Claims

Owned by Renaissance Exploration

Renaissance Exploration, Inc. – 7 owned patented claims

T29N, R32E, Section 20 & 21, MDB&M, Pershing County, Nevada

Containing 121.53 acres, more or less

Claim list with original Pershing County APN number

|

Claim Name

|

Survey#

|

Acres

|

Patent#

|

Pat Date

|

County APN

|

|

Ajax Lode

|

4742

|

11.00

|

1111733

|

7/26/1941

|

088-010-026

|

|

Aztex Lode

|

4742

|

15.00

|

1111733

|

7/26/1941

|

088-010-026

|

|

Capital Claim & Co.

|

1913

|

20.66

|

34634

|

11/2/1901

|

088-010-027

|

|

Electric Claim & Co.

|

1879

|

17.90

|

34631

|

11/2/1901

|

088-010-027

|

|

G.W. Claim & Co.

|

1909

|

20.66

|

34637

|

11/2/1901

|

088-010-027

|

|

Last Chance Claim & Co.

|

1911

|

15.47

|

34638

|

11/2/1901

|

088-010-027

|

|

Lester Claim & Co.

|

1907

|

20.66

|

34633

|

11/2/1901

|

088-010-027

|

Claim list with current Pershing County APN number

|

Claim Name

|

Survey#

|

Acres

|

Patent#

|

Pat Date

|

County APN

|

|

Ajax Lode

|

4742

|

11.00

|

1111733

|

7/26/1941

|

003-071-47

|

|

Aztex Lode

|

4742

|

15.00

|

1111733

|

7/26/1941

|

003-071-47

|

|

Capital Claim & Co.

|

1913

|

20.66

|

34634

|

11/2/1901

|

003-071-43

|

|

Electric Claim & Co.

|

1879

|

17.90 |

34631

|

11/2/1901

|

003-071-43

|

|

G.W. Claim & Co.

|

1909

|

20.66

|

34637

|

11/2/1901

|

003-071-42

|

|

Last Chance Claim & Co.

|

1911

|

15.47

|

34638

|

11/2/1901

|

003-071-43

|

|

Lester Claim & Co.

|

1907

|

20.66

|

34633

|

11/2/1901

|

003-071-43

|

18

EXHIBIT A-3

UNDERLYING AGREEMENTS

Not Included for filing

19

EXHIBIT B

1. Calculation.

(a) As used herein, “Payor” means the Party obligated to pay the Production Royalty (and its successors and assigns), and “Payee” means the Party entitled to receive the Production Royalty (and its successors and assigns).

(b) As used herein, “Net Smelter Returns” means the Gross Returns from any and all ores, metals, minerals and materials of every kind and character found in, on or under the Claims (“Valuable Minerals”), extracted, produced and sold or deemed to have been sold from the Claims, less all Allowable Deductions.

(c) As used herein, “Gross Returns” has the following meanings for the following categories of Valuable Minerals:

(i) If Payor causes refined gold that meets or exceeds the generally accepted commercial standards for refined gold to be produced by an independent third-party refinery from ores mined from the Claims, for purposes of determining the Production Royalty, the refined gold shall be deemed to have been sold in the calendar month in which it was produced at the refinery at the Monthly Average Gold Price for that month. The Gross Returns from such deemed sales shall be determined by multiplying Gold Production during the month by the Monthly Average Gold Price. As used herein, “Gold Production” means the quantity of refined gold that is outturned to Payor’s account by the refinery during the calendar month on either a provisional or final settlement basis. If outturn of refined gold is made by the refinery on a provisional basis, the Gross Returns shall be based upon the amount of such provisional settlement, but shall be adjusted in subsequent statements to account for the amount of refined metal established by final settlement by the refinery. As used herein, “Monthly Average Gold Price” means the average London Bullion Market Association P.M. Gold Fix, calculated by dividing the sum of all such prices reported for the month by the number of days for which such prices were reported. If the London Bullion Market Association P.M. Gold Fix ceases to be published, the Monthly Average Gold Price shall be determined by reference to prices for refined gold for immediate delivery in the most nearly comparable established market selected by Payor as such prices are published in “Metals Week” or a similar publication.

(ii) If Payor causes refined silver that meets or exceeds the generally accepted commercial standards for refined silver to be produced by an independent third-party refinery from ore mined from the Claims, for purposes of determining the Production Royalty, the refined silver shall be deemed to have been sold in the calendar month in which it was produced at the Monthly Average Silver Price for that month. The Gross Returns from such deemed sales shall be determined by multiplying Silver Production during the calendar month by the Monthly Average Silver Price. As used herein, “Silver Production” shall mean the quantity of refined silver that is outturned to Payor’s account by the refinery during the calendar month on either a provisional or final settlement basis. If outturn of refined silver is made by the refinery on a provisional basis, the Gross Returns shall be based upon the amount of such provisional settlement, but shall be adjusted in subsequent statements to account for the amount of refined metal established by final settlement by the refinery. As used herein, “Monthly Average Silver Price” shall mean the average New York Silver Price as published daily by Handy & Harman, calculated by dividing the sum of all such prices reported for the calendar month by the number of days for which such prices were reported. If the Handy & Harman quotation ceases to be published, the Monthly Average Silver Price shall be determined by reference to prices for refined silver for immediate delivery in the most nearly comparable established market selected by Payor as published in “Metals Week” or a similar publication.

20

(iii) If Payor sells refined metals (other than refined gold and refined silver), doré or concentrates produced from Valuable Minerals from the Claims, the Gross Returns for such refined metals shall be the proceeds actually received by Payor from their sale. If such sales are to an Affiliate, the refined metals, doré, or concentrates shall be deemed, solely for the purpose of computing Gross Returns, to have been sold at prices and on terms no less favorable to Payor than those which would have been received under similar circumstances from an unaffiliated third party. As used herein, “Affiliate” means any person, partnership, limited liability company, joint venture, corporation, or other form of enterprise which Controls, is Controlled by, or is under common Control with NewCo, and “Control” means the ability, directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of such entity through (A) the legal or beneficial ownership of voting securities or membership interests; (B) the right to appoint managers, directors or corporate management; (C) contract; (D) operating agreement; (E) voting trust; or (F) otherwise.

(d) As used herein, “Allowable Deductions” means the following costs, charges, and expenses incurred or accrued by Payor:

(i) If Payor sells or is deemed to have sold refined gold or refined silver:

(A) all costs, charges and expenses for smelting and refining doré or concentrates to produce the refined gold or refined silver (including handling, processing, and provisional settlement fees, sampling, assaying and representation costs, penalties, and other processor deductions);

(B) all costs, charges, and expenses for weighing, sampling, determining moisture content and packaging Valuable Minerals and for loading and transportation of ores, minerals, doré or concentrates from the Claims to the refinery or smelter and then to the place of sale (including freight, insurance, security, transaction taxes, handling, port, demurrage, delay, and forwarding expenses incurred by reason of or in the course of such transportation); and

(C) actual sales and brokerage costs incurred by Payor.

(ii) If Payor sells refined metals (other than refined gold or refined silver), doré, concentrate or ores:

(A) all costs, charges, and expenses for (I) beneficiation, processing or treatment of such materials at any plant or facility not owned by Payor and (II) smelting or refining to produce a refined metal (including handling, processing, and provisional settlement fees, sampling, assaying and representation costs, penalties, and other processor deductions);

(B) all costs, charges, and expenses for weighing, sampling, determining moisture content and packaging Valuable Minerals and for loading and transportation of ores, minerals, doré, concentrates or other products from the Claims (I) to the place of sale, or (II) if such ores or other materials are beneficiated, processed, treated, smelted or refined at any plant or facility more than five (5) miles from the exterior boundary of the Claims, to such plant of facility and then to the place of sale (including freight, insurance, security, transaction taxes, handling, port, demurrage, delay, and forwarding expenses incurred by reason of or in the course of such transportation); and

21

(C) actual sales and brokerage costs.

(iii) All royalties payable to any governmental agency and all sales, use, severance, Nevada net proceeds of mines and ad valorem taxes and any other tax or governmental levy or fee on or measured by mineral production from the Claims (other than taxes based on income).

(e) Payor shall have the right to market and sell or refrain from selling refined gold, refined silver and other mineral products from the Claims in any manner it may elect, including the right to engage in forward sales, future trading or commodity options trading, and other price hedging, price protection, and speculative arrangements (“Trading Activities”) which may involve the possible delivery of gold, silver or other mineral products from the Claims. With respect to Production Royalty payable on refined gold and refined silver and any other Valuable Minerals, Payee shall not be entitled to participate in the proceeds or be obligated to share in any losses generated by Payor’s actual marketing or sales practices or by its Trading Activities and no such profits or losses shall be included in Gross Returns.

2. Manner of Payment. Production Royalty payments shall be paid by Payor to Payee (or notice of a credit against Production Royalties as provided above shall be given to Payee) on or before thirty (30) days following the calendar quarter during which Payor shall have received payment for Valuable Minerals sold by Payor or during which Valuable Minerals are deemed sold as provided above. Production Royalties shall accrue to Payee’s account upon such final payment or upon being credited to the account of Payor by the smelter, refinery or other ore buyer to Payor for the Valuable Minerals sold and for which the Production Royalty is payable. All Production Royalty payments shall be made at Payor’s election by Payor’s check or by wire transfer. All Production Royalty payments shall be accompanied by a statement and settlement sheet showing the quantities and grades of Valuable Minerals mined and sold from the Claims, the proceeds of sales, cost, assays and analyses, and other pertinent information in reasonably sufficient detail to explain the calculation of the Production Royalty payment.

3. Payments; Where Made. All payments hereunder shall be sent by certified U.S. mail to Payee at its address as set forth above, or by wire transfer to an account designated by and in accordance with written instructions from Payee. The date of placing such payment in the United States mail by Payor, or the date the wire transfer process is initiated, shall be the date of such payment. Payments by Payor in accordance herewith shall fully discharge Payor’s obligation with respect to such payment, and Payor shall have no duty to otherwise apportion or allocate any payment due to Payee or its successors or assigns.

4. Audits; Objections to Payments. Payee, at its sole election and expense, shall have the right to perform, not more frequently than once annually following the close of each calendar year, an audit of Payor’s accounts relating to payment of the Production Royalty hereunder by any authorized representative of Payee. Any such inspection shall be for a reasonable length of time during regular business hours, at a mutually convenient time, upon at least five (5) business days prior written notice by Payee. All royalty payments made in any calendar year shall be considered final and in full accord and satisfaction of all obligations of Payor with respect thereto, unless Payee gives written notice describing and setting forth a specific objection to the calculation thereof within six (6) months following the close of the annual audit for that calendar year. Payor shall account for any agreed upon deficit or excess in Production Royalty payments made to Payee by adjusting the next quarterly statement and payment following completion of such audit to account for such excess.

22

5. Conduct of Operations. Payor shall have the sole and exclusive control of all operations on or for the benefit of the Claims, and of any and all equipment, supplies, machinery, and other assets purchased or otherwise acquired or under its control in connection with such operations. Payor may carry out such operations on the Claims as it may, in its sole discretion, determine to be warranted, so long as such operations are conducted in accordance with procedures acceptable in the mining and metallurgical industry. The timing, nature, manner and extent of any exploration, development, mining or processing operations carried out or in connection with the Claims shall be within the sole discretion of Payor, and there shall be no implied covenant whatsoever to begin or continue any such operations. If Payor at any time, and from time to time after commencing operations, desires to shut down, suspend or cease operations for any reason, it shall have the right to do so. Payor may use and employ such methods of mining as it may desire or find most profitable. Payor shall not be required to mine, preserve, or protect in its mining operations any ores, leachates, precipitates, concentrates or other products containing Valuable Minerals which cannot be mined or shipped at a reasonable profit to Payor. Any decision as to the time, manner and form, if any, in which ores or other products containing Valuable Minerals are to be sold shall be made by Payor in its sole discretion.

6. Ore Processing. All determinations with respect to: (a) whether ore from the Claims will be beneficiated, processed or milled by Payor or sold in a raw state; (b) the methods of beneficiating, processing or milling any such ore; (c) the constituents to be recovered therefrom, and (d) the purchasers to whom any ore, minerals or mineral substances derived from the Claims may be sold, shall be made by Payor in its sole and absolute discretion.

7. Ore Samples. The mineral content of all ore mined and removed from the Claims (but excluding ore leached in place) and the quantities of constituents recovered by Payor shall be determined by Payor, or with respect to such ore which is sold, by the mill or smelter to which the ore is sold, in accordance with standard sampling and analysis procedures, and shall be weighted average based on the total amount of ore from the Claims crushed and sampled, or the constituents recovered, during an entire calendar quarter. Upon reasonable advance written notice to Payor, Payee shall have the right to have representatives present at the time samples are taken for the purpose of confirming that the sampling and analysis procedure is standard and acceptable according to accepted industry practices.

8. Commingling of Ores. Payor shall have the right to mix or commingle, either underground, at the surface, or at processing plants or other treatment facilities, any material containing Valuable Minerals mined or extracted from the Claims with ores or material derived from other lands or properties owned, leased or controlled by Payor; provided, however, that before commingling, Payor shall calculate from representative samples the average grade of the ore from the Claims and shall either weigh or volumetrically calculate the number of tons of ore from the Claims to be commingled. As products are produced from the commingled ores, Payor shall calculate from representative samples the average percentage recovery of products produced from the commingled ores during each month. In obtaining representative samples, calculating the average grade of commingled ores and average percentage of recovery, Payor may use any procedures acceptable in the mining and metallurgical industry which Payor believes to be accurate and cost-effective for the type of mining and processing activity being conducted, and Payor’s choice of such procedures shall be final and binding upon Payee. In addition, comparable procedures may be used by Payor to apportion among the commingled ores any penalty charges imposed by the smelter or refiner on commingled ores or concentrates. The records relating to commingled ores shall be available for inspection by Payee, at Payee’s sole expense, at all reasonable times, and shall be retained by Payor for a period of two (2) years.

23

9. Waste Rock, Spoil and Tailings. Any ore, mine waters, leachates, pregnant liquors, pregnant slurries, and other products or compounds or metals or minerals mined from the Claims shall be the property of Payor, subject to the Production Royalty as provided for in Section 1. The Production Royalty shall be payable only on metals, ores, or minerals recovered prior to the time waste rock, spoil, tailings, or other mine waste and residue are first disposed of as such, and Payor shall be free to use or dispose of such waste and residue in whatever manner it sees fit in its sole discretion. Payor shall have the sole right to dump, deposit, sell, dispose of, or reprocess such waste rock, spoil, tailings, or other mine wastes and residues, and Payee shall have no claim or interest therein other than for the payment of the Production Royalty to the extent any Valuable Minerals are produced and sold therefrom.

10. No Covenants. The parties agree that in no event shall Payor have any duty or obligation, express or implied, to explore for, develop, mine or produce ores, minerals or mineral substances from the Claims, and the timing, manner, method and amounts of such exploration, development, mining or production, if any, shall be in the sole discretion of Payor. Payee acknowledges that the expenditures made by Payor to advance activities on the Claims and the right to the Production Royalty are sufficient consideration for the conversion of its Participating Interest. None of the provisions of this Section 10 or any other provision of this Exhibit D shall be deemed to limit or restrict Payor’s ability to sell or otherwise convey or transfer to any third party all or any portion of Payor’s interest in the Claims.

11. Nature of Payee’s Interest. Payee shall have only a royalty interest in the Claims and any real property interest within the Area of Interest acquired during the term of the joint venture agreement or LLC operating agreement (but no other properties adjacent to or in the vicinity of the Claims or within the Area of Interest) and rights and incidents of ownership of a non-executive royalty owner. Payee shall not have any possessory or working interest in the Claims nor any of the incidents of such interest. By way of example but not by way of limitation, Payee shall not have (a) the right to participate in the execution of applications for authorities, permits or licenses, mining leases, options, farm-outs or other conveyances, (b) the right to share in bonus payments or rental payments received as the consideration for the execution of such leases, options, farm-outs, or other conveyances, or (c) the right to enter upon the Claims and prospect for, mine, drill for, or remove ores, minerals or mineral products therefrom.

24

EXHIBIT C

RenEx as Operator or Contractor prior to Purchaser vesting

At Purchaser's discretion they may elect to have RenEx carry out all or parts of a work program.

1. Compensation and Payment

RenEx will charge at cost consistent with their current schedule of charges applied to all projects plus a 10% overhead.

Purchaser will be given a quarterly cash call and a monthly statement of expenditures.

Cash calls are due in 10 days and delinquent after 30 days. In the event of non-payment after 30 days then this agreement is automatically in default. The remedy will include a service charge of 12% annualized interest rate calculated from the day due.

2. Warranty.

RenEx Inc. warrants that it shall perform its services in accordance with the standards of care and diligence normally practiced by members of the profession performing exploration services of a similar nature under similar circumstances.

3. Liability Insurance.

RenEx will maintain a minimum of US$2 million in general liability and bodily injury insurance

4. Indemnity.

All indemnity provisions and rights provided in the main body of this agreement are in full force and effect.

5. Other.

Services performed under this general agreement are in full force and effect regardless of whether RenEx is operator, contractor, or not. Confidentiality, Force Majeure, Compliance, Arbitration and all other aspects of the overall agreement are in effect.

25