Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - First Liberty Power Corp | ex311.htm |

| EX-31.2 - CERTIFICATION - First Liberty Power Corp | ex312.htm |

| EX-32.1 - CERTIFICATION - First Liberty Power Corp | ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

(Mark One)

|

|

|

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended July 31, 2012

|

|

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from __________ to __________

|

|

|

000-52928

|

|

|

Commission File Number

|

|

|

FIRST LIBERTY POWER CORP.

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

Nevada

|

90-0748351

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

7251 W. Lake Mead Blvd, Suite 300, Las Vegas, NV

|

89128

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

(702) 675-1196

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

Title of each class

|

Name of each exchange on which registered

|

|

n/a

|

n/a

|

|

Securities registered pursuant to Section 12(g) of the Exchange Act:

|

|

Common Stock

|

|

Title of class

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

Yes

|

[X]

|

No

|

[ ]

|

1

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

Yes

|

[ ]

|

No

|

[ ]

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

|

Yes

|

[ ]

|

No

|

[X]

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

[ ]

|

Accelerated filer

|

[ ]

|

|

Non-accelerated filer

|

[ ]

|

Smaller reporting company

|

[X]

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

Yes

|

[ ]

|

No

|

[X]

|

|

The aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant was approximately $1,502,073 (based on 37,551,834 shares held by non-affiliates and an April 30, 2012 closing market price of $0.04 per share) as of April 30, 2012, the last business day of the registrant’s most recently completed third quarter, assuming solely for the purpose of this calculation that all directors, officers and greater than 10% stockholders of the registrant are affiliates. The determination of affiliate status for this purpose is not necessarily conclusive for any other purpose.

|

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST 5 YEARS:

Indicate by check mark whether the issuer has filed all documents and reports required to be filed by Section 12, 13, or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

|

Yes

|

[ ]

|

No

|

[ ]

|

APPLICABLE ONLY TO CORPORATE REGISTRANTS

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

166,808,870 shares of common stock issued and outstanding as of November 13, 2012

|

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g. Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes.

|

None

|

TABLE OF CONTENTS

|

Page

|

||

|

PART I

|

||

|

Item 1

|

Business

|

4 |

|

Item 1A

|

Risk Factors

|

7 |

|

Item 1B

|

Unresolved Staff Comments

|

7 |

|

Item 2

|

Properties

|

7 |

|

Item 3

|

Legal Proceedings

|

16 |

|

Item 4

|

Mine Safety Disclosures

|

16 |

|

PART II

|

||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17 |

|

Item 6

|

Selected Financial Data

|

19 |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19 |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

21 |

|

Item 8

|

Financial Statements and Supplementary Data

|

22 |

|

F-1 to F-20

|

||

|

Item 9

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

23 |

|

Item 9A(T)

|

Controls and Procedures

|

23 |

|

Item 9B

|

Other Information

|

24 |

|

PART III

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

25 |

|

Item 11

|

Executive Compensation

|

27 |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29 |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

30 |

|

Item 14

|

Principal Accounting Fees and Services

|

30 |

|

PART IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

31 |

|

SIGNATURES

|

32 |

3

ITEM 1. BUSINESS

Forward Looking Statements

This Annual Report on Form 10-K (“Annual Report”) contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors" and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

These risks include, by way of example and not in limitation:

|

|

·

|

the uncertainty that we will not be able to successfully identify commercially viable resources on our exploration properties;

|

|

|

·

|

risks related to the large number of established and well-financed entities that are actively competing for limited resources within the mineral property exploration field;

|

|

|

·

|

risks related to the failure to successfully manage or achieve growth of our business if we are successful in identifying a viable mineral resource, and;

|

|

|

·

|

other risks and uncertainties related to our business strategy.

|

This list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and we undertake no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

The safe harbors of forward-looking statements provided by Section 21E of the Exchange Act are unavailable to issuers of penny stock. As we issued securities at a price below $5.00 per share, our shares are considered penny stock and such safe harbors set forth under the Private Securities Litigation Reform Act of 1995 are unavailable to us.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the common shares in our capital stock.

As used in this Annual Report, the terms "we," "us," “Company,” "our" and "First Liberty" mean First Liberty Power Corp., unless otherwise indicated.

Corporate Information

The address of our principal executive office is 7251 W. Lake Mead Blvd, Suite 300, Las Vegas, Nevada, 89128. Our telephone number is 702-675-8198.

Our common stock is quoted on the OTC QB under the symbol "FLPC".

4

We were incorporated in the State of Nevada under the name “Quuibus Technology, Inc.” on March 28, 2007, to engage in the business of developing and offering a server-based software product for the creation of wireless communities. Due to an inability to commence viable operations in the software production industry, new management of the Company began to evaluate various business alternatives available to us.

In accordance with approval by the Board of Directors, effective December 22, 2009, the Nevada Secretary of State effected a forward stock split of our authorized and issued and outstanding shares of common stock on a one (1) old for 27 new basis, such that our authorized capital increased from 20,000,000 shares of common stock with par value of $0.001 to 540,000,000 shares of common stock with a par value of $0.001 and, correspondingly, our issued and outstanding shares of common stock increased from 2,525,000 shares of common stock to 68,175,000 shares of common stock. Also, effective December 22, 2009, we changed our name from “Quuibus Technology, Inc.” to “First Liberty Power Corp.” by way of a merger with our wholly owned subsidiary First Liberty Power Corp. which was formed solely for the purpose of the change of name. The change of name and forward stock split became effective with the Over-the-Counter Bulletin Board at the opening for trading on February 4, 2010, under the new stock symbol “FLPC”. The change of name was effected to better reflect the new business direction of our company.

We do not have any subsidiaries.

Other than as set out herein, we have not been involved in any bankruptcy, receivership or similar proceedings, nor have we been a party to any material reclassification, merger, consolidation or purchase or sale of a significant amount of assets not in the ordinary course of our business.

Our Current Business

We are an exploration stage company engaged in the exploration of mineral properties.

On December 24, 2009, we entered into two purchase agreements with GeoXplor Corp. (“GeoXplor”). Under the agreements, we have been granted an exclusive exploration license in regards to the mineral properties described in the agreements. One agreement is in regards to claims located in Esmeralda County, Nevada, for Lithium and Lithium Carbonate exploration (the "Lithium Agreement"), and one agreement is in regards to claims located in San Juan County, Utah, for Vanadium and Uranium exploration (the "Van-Ur Agreement").

On February 3, 2011, we entered into and closed a property acquisition and exploration rights agreements with New America Energy Corp. (“NECA”) for the claims identified within the Van-Ur Agreement, under which we retained certain residual and recovery rights to the claims. Certain payments due to the Company on June 3, 2011 were not paid, and on August 1, 2011, with an effective date of May 31, 2011, the parties executed an extension to the agreement, extending due dates through to October 3, 2011. The outstanding payments were not delivered by NECA, and we did not then exercise our rights to recovery under the agreements, therefore the claims fully reverted back to GeoXplor Corp.

On May 31, 2012, we entered into a purchase agreement with GeoXplor Corp. (“Lithium Agreement”). Under this Lithium Agreement, we have been granted an exclusive four year exploration license in regards to the two mineral properties described in the Lithium Agreement. One property encompasses 58 placer claims (9280 acres) located in Lida Valley, Esmeralda County, Nevada for Lithium and Lithium Carbonate exploration (the "Lida Valley Property"), and the other encompasses 70 placer claims (11,200 acres) located in Smokey Valley, Esmeralda County, Nevada for Lithium and Lithium Carbonate exploration (the "Smokey Valley Property"). The Lida Valley Property encompasses claims previously included in agreements between the Company and GeoXplor, specifically the Purchase agreement between the Company and GeoXplor dated December 24, 2009. This Agreement supersedes and replaces all prior agreements in respect to those claims.

The claims identified in the Lithium Agreement are situated on undeveloped raw land. We have undertaken exploration on these claims, and intend to undertake further exploration in the expectation of finding commercially viable deposits of Lithium / Lithium Carbonate. This will continue to be our principal activity, until and if our minerals of interest are discovered in commercially viable quantities, which would then become our principal products.

5

Our exploration program will be exploratory in nature and there is no assurance that a commercially viable mineral deposit, a reserve, exists until further exploration, particularly drilling, is undertaken and a comprehensive evaluation concludes economic and legal feasibility. We have not yet generated or realized any revenues from our business operations.

Should we be successful in raising sufficient funds in order to conduct our additional exploration programs, the full extent and cost of which is not presently known beyond that required by our proposed drilling program and mandatory work programs as noted below, and such exploration programs results in an indication that production of our minerals of interest is economically feasible, then at that point in time we would make a determination as to the best and most viable approach for mineral extraction.

As all of our minerals of interest are commodity products, they are expected to be readily saleable on an open market at then current prices, therefore we foresee no direct competition per se for the selling of our products, should we ever reach the production stage. However, we would be competing with numerous other companies in the region, in the state of Nevada, in the country, and globally, for the equipment, manpower, geological expertise, and capital, required to fund, explore, develop, extract, and distribute such minerals.

Our mineral exploration programs are subject to State and Federal regulations, which sets forth rules for: locating claims, posting claims, working claims and reporting work performed. We are also subject to rules on how and where we can explore for minerals. We must comply with these laws to operate our business. Compliance with these rules and regulations will not adversely affect our operations. We are also subject to the numerous laws for the environmental protection of forests, lakes and rivers, fisheries, wild life etc. These codes deal with environmental matters relating to the exploration and development of mining properties. We are responsible to provide a safe working environment, not disrupt archaeological sites, and conduct our activities to prevent unnecessary damage to the property.

We will secure all necessary permits for exploration and, if development is warranted on the properties, will file final plans of operation before we start any mining operations. We anticipate no discharge of water into active stream, creek, river, lake or any other body of water regulated by environmental law or regulation. No endangered species will be disturbed. Restoration of the disturbed land will be completed according to law. All holes, pits and shafts will be sealed upon abandonment of the property. It is difficult to estimate the cost of compliance with the environmental law since the full nature and extent of our proposed activities cannot be determined until we start our operations and know what that will involve from an environmental standpoint. We are in compliance with all regulations at present and will continue to comply in the future. We believe that compliance with these regulations will not adversely affect our business operations in the future.

We intend to subcontract exploration work out to third parties, which are identified below in our more detailed discussions. We intend to use the services of subcontractors for manual labor exploration work.

Employees

We have not entered into employment agreements with the officers or directors of the Company.

However, in order to undertake the administrative and management operations of the Company, the Company has entered into consulting agreements to provide required services to the Company, with the particulars as follows.

|

|

·

|

On March 1, 2010, the Company entered into a consulting agreement with Mr. John Rud, wherein Mr. Rud has agreed to provide, among other things, consulting services to the Company for a period of 12 months. By mutual consent, this agreement was extended for an additional year under the same terms and conditions. Mr. Rud resigned as a director in November 2011, and his agreement has ended.

|

|

|

·

|

On May 3, 2010, we entered into a consulting agreement with Mr. John Hoak, wherein Mr. Hoak has agreed to provide, among other things, consulting services to the Company. The agreement was effective March 24, 2010 and continued to March 24, 2012. Mr. Hoak resigned as a director in March 2012, and his agreement has ended

|

|

|

·

|

On December 4, 2009, Mr. Glynn Garner was appointed President, Secretary, Treasurer, and a member of the board of directors of the Company. Mr. Garner did not enter into any formal employment or consulting agreement at the time. Mr. Garner resigned all of his officer and director positions on December 28, 2010, effective January 1, 2011.

|

|

|

·

|

On November 29, 2010, Mr. Don Nicholson was appointed as a member of the board of directors of the Company, and on December 28, 2010, effective January 1, 2011; Mr. Nicholson was appointed Chief Executive Officer, President, and Secretary-Treasurer. The services of Mr. Nicholson are provided to the Company through an agreement with LTV International Holdings Ltd., for which company Mr. Nicholson provides consulting service, as entered into on July 2, 2011, effective November 15, 2010.

|

6

|

|

·

|

Effective April 1, 2012, we entered into a consulting agreement with Robert B. Reynolds Jr., wherein Mr. Reynolds has agreed to provide, among other things, consulting services to the Company for a period of 12 months.

|

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K. and all amendments to those reports that we file with the Securities and Exchange Commission, or SEC, are available at the SEC's public reference room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the public reference room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements and other information regarding reporting companies.

ITEM 1A. RISK FACTORS

As a “smaller reporting company”, we are not required to provide the information required by this Item.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Executive Offices

The address of our principal executive office is 7251 W. Lake Mead Blvd, Suite 300, Las Vegas, Nevada, 89128. Our telephone number is 702-675-8198.

Mineral Properties

Lida Valley Property

A) Lithium Agreement:

Claims

On May 31, 2012, we entered into a purchase agreement with GeoXplor Corp. (“Lithium Agreement”). Under this Lithium Agreement, we have been granted an exclusive four year exploration license in regards to the two mineral properties described in the Lithium Agreement. One property encompasses 58 placer claims (9280 acres) located in Lida Valley, Esmeralda County, Nevada for Lithium and Lithium Carbonate exploration (the "Lida Valley Property"), and the other encompasses 70 placer claims (11,200 acres) located in Smokey Valley, Esmeralda County, Nevada for Lithium and Lithium Carbonate exploration (the "Smokey Valley Property"). These requirements apply to both the Lida Valley Property and the Smokey Valley Property, and the Work Program requirements may be allocated to the respective properties at the discretion of the Company. The Lida Valley Property encompasses claims previously included in agreements between the Company and GeoXplor, specifically the Purchase agreement between the Company and GeoXplor dated December 24, 2009. This Agreement supersedes and replaces all prior agreements in respect to those claims.

A Under the Lithium Agreement, the Company is required to:

Make Cash Payments - First Liberty shall pay GeoXplor in consideration of the grant of the exploration license and other rights granted under this Agreement a total of $725,000, according to the following schedule:

|

|

(1)

|

Twenty-Five Thousand Dollars ($25,000.00) within 5 days of the execution of this agreement;

|

|

|

(2)

|

One-hundred Thousand Dollars ($100,000.00) to GeoXplor on or before December 31, 2012;

|

7

|

|

(3)

|

Two-hundred Thousand Dollars ($200,000.00) to GeoXplor on or before December 31, 2013;

|

|

|

(4)

|

Two-hundred Thousand Dollars ($200,000.00) to GeoXplor on or before December 31, 2014;

|

|

|

(5)

|

Two-hundred Thousand Dollars ($200,000.00) to GeoXplor on or before December 31, 2015;

|

Stock Issuance – As additional consideration, the Purchase Price shall include the issuance of 2,000,000 Shares, subject to such conditions as may be imposed by the rules and regulations of the United States Securities and Exchange Commission, as follows:

|

|

(1)

|

Five-hundred Thousand (500,000) Shares to GeoXplor on or before December 31, 2012;

|

|

|

(2)

|

Five-hundred Thousand (500,000) Shares to GeoXplor on or before December 31, 2013;

|

|

|

(3)

|

Five-hundred Thousand (500,000) Shares to GeoXplor on or before December 31, 2014;

|

|

|

(4)

|

Five-hundred Thousand (500,000) Shares to GeoXplor on or before December 31, 2015;

|

Work Commitment – First Liberty shall expend not less than One Million Five-Hundred Thousand Dollars ($1,500,000) in Mineral Exploration and Development Testing ("Work"). The Work shall be scheduled according to the following schedule:

|

|

(1)

|

One Hundred Thousand Dollars ($100,000.00) on or before November 15, 2012;

|

|

|

(2)

|

Four-hundred Thousand Dollars ($400,000.00) on or before December 31, 2012;

|

|

|

(3)

|

Five-hundred Thousand Dollars ($500,000.00) on or before December 31, 2013;

|

|

|

(4)

|

Five-hundred Thousand Dollars ($500,000.00) on or before December 31, 2014;

|

|

Conditions for Transfer of Title and Subsequent Limitations –

|

|

|

(1)

|

At such time as the First Liberty has completed the required payments, work program and stock transfers, the Properties shall be transferred to First Liberty by Quitclaim Deed.

|

|

|

(2)

|

Concurrently with the transfer of title to First Liberty, First Liberty shall convey to GeoXplor a “Net Value Royalty” on production of lithium carbonate and other lithium minerals from the Properties measured by five percent (5%) of the gross proceeds received by the First Liberty from the sale or other disposition of lithium carbonate or other lithium compounds less (i) transportation of the product from the place of treatment to the purchaser, (ii) all handling and insurance charges associated with the transportation, and (iii) any taxes associated with the sale or disposition of the product (excluding any income taxes of First Liberty). First Liberty shall have the further right to purchase up to four percent (4%) of the Net Value Royalty, in whole percentage points, for One Million Dollars ($1,000,000) for each one percent (1%).

|

|

|

(3)

|

If First Liberty, its assignee or a joint venture including First Liberty, (i) delivers to its Board of Directors or applicable other management a feasibility study recommending mining of lithium carbonate or other lithium compound from the Properties and such Board of management authorizes implementation of a mining plan, or (ii) sells, options, assigns, disposes or otherwise alienates all or a portion of its interest in the Properties, First Liberty shall pay GeoXplor an additional bonus of Five Hundred Thousand Dollars ($500,000) in cash or Shares of First Liberty. The election to obtain cash or shares of First Liberty shall be at the sole election of GeoXplor.

|

8

Lida Valley Claims, Esmeralda County, NV

Location and Access

The Lida Valley Property is located in South Western Nevada, approximately 150 miles north of Las Vegas and within 15 miles of the Montezuma peak. The project area has excellent infrastructure including a network of roads, railroads and cellular telephone coverage.

Regional & Property Geology

Lida Valley is one of a group of inter-mountain basins in west-central Nevada and is surrounded by Cuprite Hills to the Northwest, Stonewall Mountains to the East and Slate Ridge to the Southwest. It has a playa floor of about 12 square miles that receives surface drainage from an area of about 60 square miles. The playa floor contains erosion remnants of Lithium-rich rhyolite tuff and is surrounded by alluvial fan slopes of the mountain ranges. Altitudes range from 4,630 feet on the playa floor to 7,000 feet on the Stonewall Ridge.

The tertiary volcanic rocks are considered to be involved in the origin of the Lithium deposits in south-central Nevada. The volcanism that created the volcanic rocks also provided the heat energy and hydrothermal activity required to mobilize the Lithium from volcanic glass and other relatively unstable minerals. The Tertiary rhyolites from the Montezuma Range and surrounding mountain ranges are considered to be the most lithium rich rhyolites in the world, (MacDonald et. Al; 1992) Transport of the Lithium would require a hydrothermal fluid, surface water or meteoric groundwater. Evaporation concentrated the Lithium in the brine to economic grades which are considered to be in the 100 to 300 ppm range. The Lithium rich water would also alter the playa sediments to form Lithium-rich clays and Lithium rich inclusions in halite.

Exploration

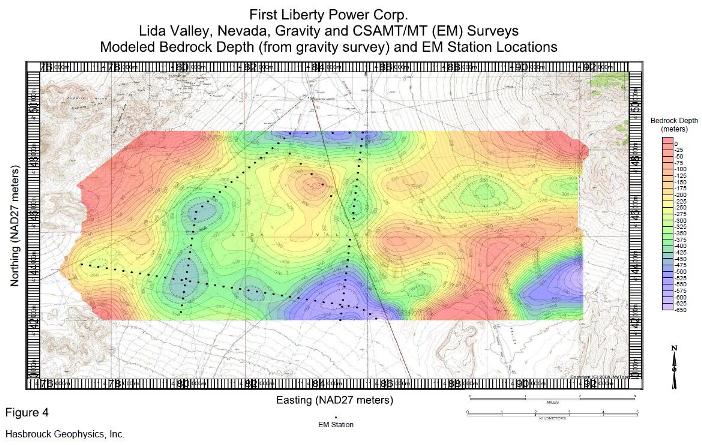

In March of 2010, the Company commissioned a gravity survey on the Lida Valley Property, total cost of $85,287, undertaken by Hasbrouck Geophysics, Inc. of Prescott, Arizona, which report was completed in June 2010. The gravity survey was conducted for lithium brine exploration over claims Lida Valley Property. The purpose of the survey was to map depth to bedrock or thickness of sediments, map any geologic structures that may be significant to the occurrence of lithium brine, and provide information for the selection and design of additional geophysical surveys.

Interpretation of the modeled gravity data indicates several areas with increased bedrock depths or lower bedrock elevations. These areas may be conducive for concentration of lithium-bearing brines, but the presence, dip and continuity of aquifer beds plus the detailed mapping of any structures both within the sedimentary section and bedrock should be determined through high resolution geophysical means prior to drilling.

In order to further detail on the above gravity survey, a 2nd gravity survey was commissioned for a cost of $22,000, which was completed in August 2010.

Based on the positive indicators found from the two gravity survey reports, two geophysical approaches were recommended in areas selected from the gravity surveys: 1) controlled-source audiomagnetotellurics / magnetotellurics (CSAMT/MT) surveys, and 2) reflection seismic surveys. It was recommended that the CSAMT/MT surveys be conducted because they will determine if conductive zones, possibly indicative of lithium-bearing brines, are present and continuous. Additionally these surveys may help define aquifer dip.

Based on the above recommendation, the Company engaged GeoXplor, in association with Hasbrouck Geophysics, Inc., to undertake the CSAMT/MT surveys. The work was completed and a report provided to the Company in February 2011, for a total cost of $112,500. As with the previous two geophysical surveys conducted, the results were positive, and include having identified areas of potential lithium brine deposits. The mapping indicated a geologic stratigraphy and structure relative to the occurrence of lithium brine, and identified conductors that are thought to be representative of lithium-bearing brine, thus providing information for the selection and design of additional geophysical surveys or the identification of drilling locations.

9

Collectively, the three reports show several clear targets for further exploratory investigations. Drilling targets in both the southern end of the Property and in the northern area of the playa have been located based on the identification of several areas showing areas of low resistivity. The complete reports from Hasbrouck Geophysics from all exploration stages on the Property are currently available at the Company’s website, www.firstlibertystrategic.com.

Based on these results, in May 2011, the Company determined that the best and most efficient approach is to bypass seismic surveys, and proceed directly to a 3 – 5 hole drilling program, and therefore requested a work program estimate from GeoXplor, which has now been presented to the Company in October 2011. The drill program, estimated at 3000m total, will target areas of significant Lithium brine potential identified by the Company's exploration program (i.e., areas marked by gravity lows and low resistivity) through certain initial holes followed by the remaining holes depending on first results. By penetrating the formations comprising the basin fill in the Lida Valley Property, the drill results will allow the Company to identify the concentration, if any, of Lithium and other constituents in the groundwater in these target zones. GeoXplor Corp., who will perform the drilling, estimates that each hole will require one week's time, with a budgeted cost of $343,000.

The Company is required to undertake a combined total of approximately $1,500,000 worth of work on the Lida Valley Property and Smokey Valley Property prior to December 2014. The next steps for exploration, over the next year, are expected to be the drill program as indicated above. If the results are positive for the drill program, we will base our next phase exploration program on those results, though we would expect additional drilling to be involved.

As of July 31, 2012 and to date, the exploration work undertaken has provided continued positive indications that additional exploration is warranted, but there are as of yet no known or proven reserves, and substantial additional exploration work must be undertaken on the Lida Valley Property in order to determine if a commercially viable reserve does exist.

At present, the Company does not have sufficient funds for the planned drill program, and would need to raise additional capital either through obtaining additional loans, or through the sale of its common stock. While initial arrangements have been made to accomplish the raising of additional funds, and the Company expects to be able to raise the required funds for the next phases of the exploration program, our success in doing so cannot be assured.

10

Smokey Valley Claims, Esmeralda County, NV

Location and Access

The Smokey Valley Property is also located in South Western Nevada, approximately 170 miles north of Las Vegas and within 15 miles of the Montezuma peak, positioned North-West as opposed to South, as is the Lida Valley Property. The project area, off highway 265 approximately 5 miles from Silver Creek road, the location of the lithium producing Chemetall Foote project, has excellent infrastructure including a network of paved roads, railroads and cellular telephone coverage.

Regional & Property Geology

The Smokey Valley Property, adjacent to Clayton Valley, is also located in one of a group of inter-mountain basins in west-central Nevada and is surrounded by Cuprite Hills to the Northwest, Stonewall Mountains to the East and Slate Ridge to the Southwest. It has a playa floor of an estimated 15 square miles that receives surface drainage from an area of about 140 square miles. The playa floor contains erosion remnants of Lithium-rich rhyolite tuff and is surrounded by alluvial fan slopes of the mountain ranges.

The tertiary volcanic rocks are considered to be involved in the origin of the Lithium deposits in south-central Nevada. The volcanism that created the volcanic rocks also provided the heat energy and hydrothermal activity required to mobilize the Lithium from volcanic glass and other relatively unstable minerals. The Tertiary rhyolites from the Montezuma Range and surrounding mountain ranges are considered to be the most lithium rich rhyolites in the world, (MacDonald et. Al; 1992) Transport of the Lithium would require a hydrothermal fluid, surface water or meteoric groundwater. Evaporation concentrated the Lithium in the brine to economic grades which are considered to be in the 100 to 300 ppm range. The Lithium rich water would also alter the playa sediments to form Lithium-rich clays and Lithium rich inclusions in halite.

Exploration

In the 1970’s USGS conducted a gravity survey covering Clayton Valley and the valley connecting Clayton Valley to Big Smoky where the Smokey Valley Property claims are located. The resulting maps show a relationship between the brine field in Clayton Valley and the deepest parts of the valley. The map also suggests that there is a height of bedrock between the Smoky Valley claims and Clayton Valley which may act as a barrier for water moving from Big Smoky Valley to Clayton Valley. The USGS performed two exploratory drill holes in Big Smoky Valley, (not on Smoky Valley Property) as part of a program to evaluate the lithium resource potential of the basins adjacent to Clayton Valley. Hole BS13 was terminated to 675 feet, Lithium in sediments ranged from 48-365ppm averaging 160ppm, lithium in water ranged from 100-1,700ppb. Hole BS14 was terminated at 215 feet. Lithium in sediments ranged from 40-287ppm, averaging 150ppm, lithium in water ranged from 820-1300ppb. These results were of indicative of the validity of additional work being performed on the Smoky Valley Property.

In February 2011, Hasbrouck Geophysics conducted a preliminary controlled source audio magnetotellurics / magnetotellurics (CSMAT/MT), the purpose of the survey was to determine if conductors that might be representative of lithium-bearing brine were present near a previously identified low value gravity anomaly. This geophysical survey indicated the presence of predominant zones of lower resistivities, which are interpreted as salty, water-saturated sediments or highly fractured bedrock, of sufficient extent and depth to further warrant additional exploration activity.

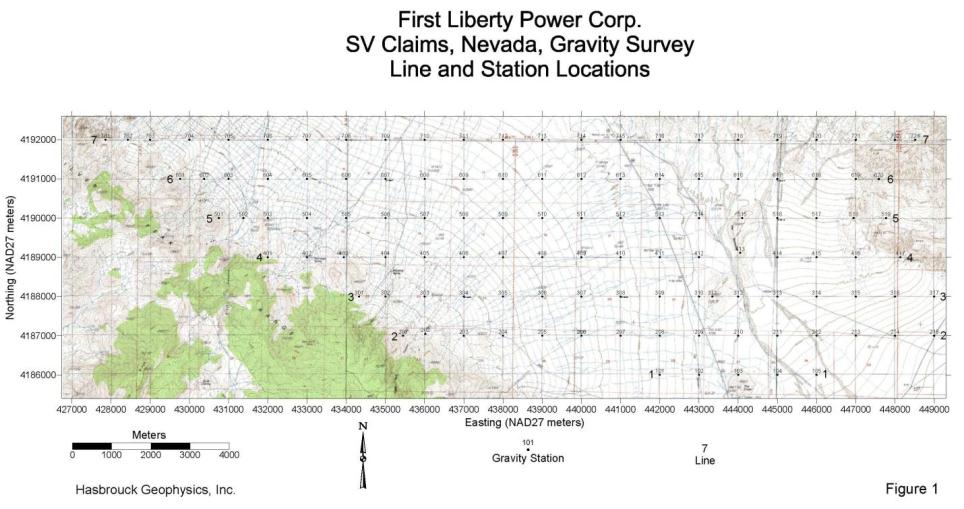

In May 2012, First Liberty commissioned a Gravity Survey report at a cost of $74,000, which survey was completed by July 2012.

A total of 116 separate gravity stations were acquired along seven profiles, as shown in Figure 1, at nominal line and station spacings of one kilometer. The station locations were first located on a topographic map, uploaded to a hand-held Global Positioning System (GPS), and then staked in the field. Elevations of individual stations were acquired in the field with a Trimble GeoXH GPS unit and confirmed with elevations taken from USGS topographic maps. Because the survey was considered reconnaissance in nature, the generally better than one-half meter elevation accuracies of the stations were considered adequate.

11

From results of previous modeling conducted in the general area by the report author and other investigators, a density contrast between valley fill sediments and Paleozoic bedrock of 0.5 g/cm3 was chosen to best represent a two-layer case. All lines, except number 1, extended to outcrop at the beginning and/or ending stations and thus the depth to bedrock at those stations was considered as zero for modeling purposes. The middle of survey line number 1 was located near the base of the prominent cinder cone in the area with the idea that bedrock might be near the surface. The most accurate depth modeling results would require bedrock depths from drilling along the line(s) as constraints in the modeling. Since the survey was considered essentially reconnaissance, lines with identified bedrock outcrop at either or both ends were considered sufficiently accurate for the purposes of the survey.

There are two main factors that must be considered regarding target areas for lithium mineralization and concentration: 1) where is the source of the lithium, and 2) does a basin environment exist for the concentration of the lithium transported by meteoric water from the source In the Clayton Valley region it is thought that the source of the lithium is the dark gray lithium enriched rhyolite tuffs that outcrop near Montezuma Peak. Once lithium has been liberated into the water system it remains highly mobile and movement of the lithium with surface water and groundwater will follow basic hydrological principles. Hydrologic basins in Nevada consist of basin fill underlain by either low-permeability or permeable rock with water movement through the basin fill, permeable rock and along faults. Nothing more complex than a topographic low or closed basin is required to concentrate lithium-bearing water. For topographic lows with larger catchment areas there is a greater opportunity to accumulate lithium from wider sources. The water trapped in these lows may move through dipping aquifers until it reaches an impermeable barrier such as a fault scarp.

The complete Bouguer gravity map shown in Figure 2 is contoured from the total 116 stations, using Golden Software’s Surfer computer program (version 10.7.972), with a Bouguer slab density of 2.67 g/cm3. The bedrock depth map can be thought of as a thickness of sediments map, but because the surface elevation within the gravity survey area varies then the bedrock elevation map can often be more useful for identification of low bedrock areas.

If one reasonably assumes that lithium source material and transport mechanisms for this gravity survey area are present and similar to those that have supplied Clayton Valley lithium-bearing brines then areas with lower bedrock elevations (i.e., bedrock topographic lows) may be conducive to increased lithium-bearing brines concentration. Increased bedrock depth, or increased sedimentary thickness, and lower bedrock elevations that form a basin are present in the approximate middle of the survey area. This bedrock topographic low appears to be closed off to the south, but remains open to the north. The deepest portion of the bedrock low is modeled as about 1,850 meters below ground surface (bgs), or approximately -300 meters elevation, along line 7. Because no drilling results are available to those depths, the gravity modeling depths should be considered approximate. However, it is important that the gravity modeling results indicate the presence of a deep basin that

12

extends over a large area particularly if an arbitrary depth of 600 meters is chosen to represent the boundaries of the basin. With such a large catchment area there is a greater opportunity to accumulate lithium from wider sources. On both the bedrock depth and elevation maps it appears that an additional small, closed basin at a depth of about 900 meters is present near the eastern one-third of line 3 (essentially centered between stations 313 and 314). Somewhat similarly, an anomalous area is present at about the western one-third of line 4 (near station 405) and also approximately three to four kilometers from the western beginning of line 7 (between about stations 705 and 706). These additional anomalous areas may or may not be related to the main bedrock topographic low. From these profiles (either A-A’ or BA’) it is apparent that significantly shallower bedrock is located at the southern end of the geophysically surveyed area, while the bedrock continues to deepen to the northern extent of the survey area.

Based on the interpretation of the modeled gravity data indicates a large topographic low, or basin, that appears to be closed off to the south but remains open to the north. This extensive basin area may be favorable for the accumulation of lithium-bearing brines, but additional investigations need to be conducted. Additional geophysical surveys will further determine the structure of the basin identified in this survey, and map the presence, dip and continuity of conductive zones within the basin.

Recommended additional geophysical surveys prior to drilling are: 1) extend the gravity survey along line 1 to the west and east and add one additional line one kilometer south of line 1 to better define the indicated southern basin closure, 2) acquire additional gravity data along at least two lines to the north, separated by one kilometer each, to determine if the basin closes in that direction, and 3) conduct controlled-source audio-magnetotellurics / magnetotellurics (CSAMT / MT) surveys in selected areas from the gravity survey(s) to determine if conductive zones, possibly indicative of lithium-bearing brines, are present and if so then to map the dip and continuity of those aquifer beds. It is estimated that to satisfy items number 1 and 2 above that approximately 60 additional gravity stations will be required. It is anticipated that nominally 100 CSAMT / MT stations will be sufficient to satisfy item number 3 above. After additional gravity data and new CSAMT / MT data are acquired, processed and interpreted then either reflection seismic surveys or drilling can be conducted. The reflection seismic surveys will detail any possible lithium-bearing brines beds (e.g., similar to the Main Ash and Lower Gravel Aquifers, amongst others, in Clayton Valley) and will map structure in greater detail than the other geophysical techniques.

At present, the Company does not have sufficient funds for the planned additional exploration program, and would need to raise additional capital either through obtaining additional loans, or through the sale of its common stock. While initial arrangements have been made to accomplish the raising of additional funds, and the Company expects to be able to raise the required funds for the next phases of the exploration program, our success in doing so cannot be assured.

B) Uravan Claims, San Juan Country, Utah (“Van-Ur Property”)

A property purchase agreement for claims located in San Juan County, Utah, for Vanadium and Uranium exploration (the “Van-Ur Agreement”). In regards to the Van-Ur Agreement, the Company was required to:

|

1.

|

Make cash payments of $480,000 over a four-year period

|

|

a.

|

Initial cash payments of $80,000 were made in November and December of 2010; and

|

|

b.

|

A cash payment of $100,000 was required on December 24, 2010. On December 14, 2010, the parties agreed to defer this payment until up to February 7, 2011 (see below in regard to this payment required).

|

|

2.

|

Issue a total of 1,000,000 restricted shares of common stock over a three-year period

|

|

a.

|

250,000 shares of common stock were issuable upon execution of the agreement

|

|

b.

|

250,000 shares were issuable on the first anniversary, December 24 2010, of the Van-Ur Agreement

|

|

The initial 250,000 shares due and payable under the Van-Ur Agreement were issued in in June 2011. The remaining 250,000 shares were not issued, as a result of the assignment of the Van-Ur Agreement to New America Energy Corp. as described below, and no further share issuances are required.

|

|

3.

|

Comply with a work commitment of $1,000,000 within four years of the date of the Van-Ur Agreement.

|

|

a.

|

A total of $20,974 was expended on exploration and claim maintenance activities prior to the assignment of the Van-Ur Agreement to New America Energy Corp. as described below. No further payments are required.

|

13

On February 3, 2011, we entered into and closed agreements with New America Energy Corp. (“New America”) and GeoXplor Inc. (“NECA Agreement”), whereby the Company optioned its interest in the mining claims associated with the Van-Ur Agreement, granting an option, as well as exploration rights, in these claims to New America. Pursuant to the terms of the NECA Agreement, the consideration to the Company for entering into this agreement with New America was as follows:

|

1.

|

$10,000 on the execution of the NECA Agreement; $33,333 within 120 days of the execution of the NECA Agreement; $33,333 within 240 days of the execution of the NECA Agreement; and $33,334 within 360 days of the execution of the NECA Agreement;

|

|

a.

|

The amount of $10,000 was received by the Company on February 8, 2011

|

|

2.

|

500,000 shares of New America common stock

|

|

a.

|

These shares were issued to the Company on February 11, 2011. The fair value of the shares was recorded as an investment in the amount of $250,000 based on the trading price of the shares at the time of issuance, which was $0.50 per share. The value of these shares is to be periodically reviewed and adjusted as required.

|

|

3.

|

A 0.5% net smelter royalty on all net revenue derived from production.

|

Subject to New America fulfilling the terms of the NECA Agreement, the Company was not required to meet its obligations under the Van-Ur Agreement, including the December 24, 2010 payment of $100,000 (deferred until February 7, 2011) and all future payments, work program commitments, and stock issuances including the December 24, 2010 issuance for 250,000 shares.

Pursuant to the terms of the Van-Ur Agreement, New America made cash payments in the amount of $10,000, and issued 500,000 shares of common stock to the Company and made cash payments in the amount of $50,000 and issued 500,000 shares of common stock to GeoXplor.

The value of the mining property asset associated with this agreement has been divested from the Company’s financial statements, and as of July 31, 2012, the Company has recorded the gain on the transfer of the mineral property option in the amount of $75,000.

The payment of $33,333 due to the Company on June 3, 2011 and the payment of $50,000 due to GeoXplor on May 31, 2011 pursuant to the Van-Ur Agreement were not paid as due. The parties to the agreement verbally agreed to extend the payment due dates by 120 days and on August 1, 2011, with an effective date of May 31, 2011, the parties executed an extension agreement. Under the terms of the extension agreement, during the 120 day extension period commencing from May 31, 2011, GeoXplor had the right to solicit and accept offers by other parties on the property, in which case the Van-Ur Agreement would be terminated and neither New America nor the Company would have any further rights or interest in the Uravan property. At any time prior to the expiration of the 120 day term either NECA or the Company could pay the required payments to GeoXplor. If neither NECA nor the Company paid the required payments under the agreement then the property would revert to GeoXplor unless further extended.

The extension agreement lapsed on September 30, 2011, with neither New America nor the Company making any additional payments; therefore the claims fully reverted back to GeoXplor Corp. The Company has no further obligations in respect of the original Van-Ur Agreement or the assignment thereof.

Location and Access

The Uravan Property is located in the northeast corner of San Juan County approximately 40 miles southeast of Moab, Utah. The area is sparsely populated with a small village of La Sal, Utah, about 10 miles west of the claim block. Utah Highway 46, an all-weather paved road provides access to the southern region of the mineral claims. A network of forests roads, drill access roads and jeep trails make most of the claim block accessible year round.

The climate of San Juan County is semi-arid with minor precipitation. The average annual precipitation is 12.83 inches with an average snowfall of 44.5 inches. The snowfalls during November to May occasionally reach 15 inches or more. The Uravan Property is located in the high desert ecosystem with erosional landscape exposing the sandstone formations. Deep canyons with canyon walls composed of alternating erosion-resistant benches and highly erodible slopes, and broad flat benches are the predominant landscape features. Vegetation consists of greasewood, salt bush, rabbit bush with willows and cottonwood in the drainage area.

14

Regional & Property Geology

The Uravan Mineral claims are located within the Colorado Plateau near the Utah-Colorado border. The Colorado Plateau is a broad area of regional uplift consisting mainly of flat-lying Paleozoic, Mesozoic and Cenozoic sedimentary rocks. The strata is gently folded and faulted by uplift, intrusion and collapse of plastic evaporite formations on the east and by intrusion of laccolithic complexes now composing the La Sal Mountains on the west.

The uranium-vanadium deposits in the La Sal quadrangle occur in the uppermost sandstone of the Salt Wash Member of the Morrison Formation. The ore bearing sandstone range in thickness from a few feet to 100 feet. The sandstone is a medium to fine grained quartzose interbedded with siltstone and mudstone. Near the uranium-vanadium mineralization, the sandstone is white, light gray or light brown, and the siltstone and mudstone are usually light green or gray green.

The uranium-vanadium deposits mined in the nearby producing mines occur in the uppermost sandstone beds within the Salt Wash member of the Morrison Formation. This unit is commonly called the ore-bearing sandstone or third rim in reference to its position above the Entrada Sandstone.

The ore-bearing sandstone is composed of a single broad lens of cross-laminated sandstone ranging from 0 to 30 feet in thickness. In other areas it is composed of overlapping sandstone lenses which have a combined thickness of 30 to 100 feet. The cross-laminated sandstone appears to have been deposited in a flood-plain environment. Scour and fill bedding consisting of cross-bedded sandstone lenses truncated by and direct contact with other truncated lenses separated by thin discontinuous mudstone lenses or mudstone conglomerate. Fragments of fossil wood are abundant in the scour and fill beds and occur either along the bedding planes or in pot like masses called “trash pockets”.

Exploration

A radon survey was completed on the Uravan Mineral Claims during September, 2009. The theory of radon soil surveys is based on the element radon which is a radioactive daughter product of uranium decay. Radon is produced by the radioactive decay of radium, a product of uranium and thorium decay in rocks and soils. Theoretically, radon-222 concentrations in soil should be directly related to the uranium content of the minerals in the soil and rocks. Radon is a daughter product of uranium-238 and a non-reactive, highly mobile gas that migrates away from the site of its uranium parent by diffusion and advection along joints, faults, and intergranular permeable pathways.

The magnitude of a radon anomaly associated with a parent concentration of uranium will be due to the size and grade of the parent body. Dispersion and dilution along the pathways to the surface increase the size of the radon footprint but also reduce the magnitude. The location of the anomaly relative to the uranium body will be strongly influenced by the orientation of the pathways to the surface.

The radon survey uses a system that measures the radon by utilizing an ion chamber with a electrically charged Teflon, called an electret, located inside an electrically conducting plastic chamber of known air volume. The electrets serve as a source of high voltage needed for the chamber to operate as an ion chamber. It also serves as a sensor for the measurement of ionization in air. The ions produced inside the sensitive volume of the chamber are collected by the electrets causing a depletion of charge. The measurement of the depleted charge during the exposure period is a measure of integrated ionization during the measurement period. The electrets charge is read before and after the exposure using a specially built non-contact electret voltage reader.

The Uravan mineral claims radon survey consisted of 101 readings with a minimum reading of 0.35 and a maximum reading of 27.75. The median reading was 6.75 with a midrange of 14.05. The grid results were then contoured and presented in the attached report. Proposed drill locations have also been located and presented on the following map.

The preliminary radon survey data indicates an anomalous east-west radiometric trend. The size of the anomalies appears to be similar to the size of the high grade vanadium-uranium beds mined from the Firefly, Gray Daun and Vanadium Queen Mine. A detailed radon survey would define drill targets and thereby, delineate tonnage and grade within the Uravan Claim Block.

15

Data compiled from mining activity and regional studies indicates ground considered favorable for Vanadium-Uranium mineralization has the following features:

|

|

•

|

Sandstone beds over 30 feet in thickness with a light brown to light gray color with a medium to fine grain size.

|

|

|

•

|

The sandstone contains carbonaceous material and a gray or grayish-green mudstone.

|

|

|

•

|

The beds contain mudstone as a film, pebbles or seams.

|

|

|

•

|

The sandstone is overlain by gray, greenish-gray or green mudstone

|

As of July 31, 2011, the exploration conducted to date has provided positive indications that additional exploration is warranted, but there are no known or proven reserves, and substantial additional exploration work must be undertaken on the Van-Ur Property.

As the Company is no longer in possession of this property as at July 31, 2012, the provided data is for historical reference only.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, active or pending legal proceedings against our Company, nor of any proceedings that a governmental authority is contemplating against us.

ITEM 4. MINE SAFETY DISCLOSURES

None.

16

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

Market Information

Our Common Stock is traded on the over-the-counter market and quoted on the OTCBB under the symbol “FLPC”

The table below sets forth the range of high and low bid information for our Common Shares as quoted on the OTCBB for each of the quarters during the two fiscal years ended July 31, 2012:

|

For the Quarter ended

|

High

|

Low

|

|

October 31, 2010

|

$0.65

|

$0.30

|

|

January 31, 2011

|

$0.49

|

$0.18

|

|

April 30, 2011

|

$0.44

|

$0.165

|

|

July 31, 2011

|

$0.33

|

$0.11

|

|

October 31, 2011

|

$0.10

|

$0.04

|

|

January 21, 2012

|

$0.08

|

$0.07

|

|

April 30, 2012

|

$0.05

|

$0.04

|

|

July 31, 2012

|

$0.05

|

$0.03

|

The quotations provided may reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Holders of our Common Stock

On July 31, 2012 the shareholders’ list of our common stock showed 15 registered shareholders and 82,001,834 shares outstanding.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our future dividend policy will be determined from time to time by our Board of Directors.

Securities Authorized for Issuance under Equity Compensation Plans

As of July 31, 2012, we had not adopted an equity compensation plan and had not granted any stock options.

Recent Sales of Unregistered Securities

On August 9, 2011, the Company signed a confidential term sheet in respect to the creation of a $3,000,000 Equity Line financing structure. Pursuant to the term sheet, the Company paid a document preparation fee of $7,500, and issued a total of 136,364 shares valued at $15,000. As of April 30, 2012, the Company has determined that it will not be proceeding with this transaction, and has expensed all costs accordingly.

On January 11, 2012, the Company entered into a 13 month agreement with an unrelated third party for the provision of non-exclusive financial advisor, investment bank and placement agent services to the Company. Pursuant to this agreement, the Company was required to issue 350,000 shares, which were issued in January 2012, and valued at $24,675 of which $12,390 has been expensed during the fiscal year ended July 31, 2012, and leaving a prepaid expense balance of $12,285.

17

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of these 136,364 and 350,000 shares, pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

According to the Company’s Lithium Agreement with GeoXplor, detailed in Note 3 – Mineral Properties above, 250,000 shares valued at $16,250, were issuable on the second anniversary of the Agreement, December 24 2011, which shares were issued in January 2012.

Further to the Company’s Lithium Agreement with GeoXplor, detailed in Note 3 – Mineral Properties above, a cash payment of $100,000 was required on December 15, 2011. On January 6, 2012, effective December 15, 2011, GeoXplor agreed to defer the payment until March 15, 2012, in exchange for the issuance of 500,000 compensation shares (issued January 2012 valued at $37,450), and the further issuance of 500,000 shares (issued in January 2012 valued at $28,500) to be held by GeoXplor as security against the Payment. Upon fulfilling the Payment obligations within the extension, these security shares are to be returned to the Company for cancellation. If the Company does not complete in full the Payment obligation before March 15, 2012, such shares may be sold by GeoXplor with the proceeds applied towards any remaining amounts owing. If there are proceeds in excess of the amounts owing, the excess shall be applied as a pre-payment towards exploration work obligations under the Lithium Agreement. According to an agreement between GeoXplor and the Company signed subsequent to the end of the period (May 31, 2012), effective as of March 15, 2012, all rights and obligations under the original agreement were replaced by those in the new agreement. The additional 500,000 shares, issued in January 2012 valued at $28,500, were agreed to be retained by GeoXplor as compensation and revalued at the effective date of the new agreement, March 15, 2012, for a value of $26,250.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of these 1,250,000 shares to GeoXplor, pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

On December 24, 2009, the Company borrowed $200,000 from an unrelated third party under a promissory note. The loan was unsecured, bore interest at 10 percent per annum, and was due and payable on or before December 23, 2010. On February 1, 2010, the Company borrowed an additional $50,000 from the same third party lender, which amount was also unsecured, bore interest at 10 percent per annum, and was due on or before February 1, 2011. On December 23, 2010, the Company and the lender agreed to consolidate the principal amounts, as of December 24, 2010, into a single consolidated loan. The new consolidated loan is in the amount of $250,000 and is unsecured, bears interest at 10 percent per annum, and is due on or before December 23, 2011. On December 23, 2011, the combined principal and interest of the note amounted to $301,973. On January 9, 2012, effective December 23, 2011, the Company and the Lender agreed to convert the entire $301,973 principal and interest, based on the average closing price of the Borrower’s shares for the 10 trading days prior and up to the effective date of the conversion agreement, into restricted common stock of the Company. The resultant quantity of shares amounted to 3,753,544 shares, which were issued in January 2012.

The 3,753,544 shares issued were in compliance with the exemption from the registration requirements found in Regulation S promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933. The offer and sale to the purchaser was made in an offshore transaction as defined by Rule 902(h). No directed selling efforts were made in the U.S. as defined in Rule 902(c). The offer and sale to the purchaser was not made to a U.S. person or for the account or benefit of a U.S. person. The following conditions were present in the offer and sale: a) The purchaser of the securities certified that it is not a U.S. person and did not acquire the shares for the account or benefit of any U.S. person; b) The purchaser has agreed to resell the securities only in compliance with Regulation S pursuant to a registration under the Securities Act, or pursuant to an applicable exemption from registration; and has agreed not to engage in hedging transactions with regard to the securities unless in compliance with the Securities Act; c) The purchaser has acknowledged and agreed with the Company that the Company shall refuse registration of any transfer of the securities unless made in accordance with Regulation S, pursuant to a registration statement under the Securities Act, or pursuant to an applicable exemption from registration and; d) The purchaser has represented that it is acquiring the shares for its own account, for investment

18

purposes only and not with a view to any resale, distribution or other disposition of the shares in violation of the United States federal securities laws. Neither the Company nor any person acting on its behalf offered or sold these securities by any form of general solicitation or general advertising. The shares sold are restricted securities and the certificates representing these shares have been affixed with a standard restrictive legend, which states that the securities cannot be sold without registration under the Securities Act of 1933 or an exemption therefrom. No commissions or finder’s fees were paid by the Company in connection with the issuance of these shares.

On December 16, 2011, the Company received a total of $15,000 from the proceeds of the sale of 187,500 shares of its common stock under a private placement agreement, priced at $0.08 / share, which shares were issued in January 2012. The purchaser has received 187,500 warrants, each with the right to purchase a share at the price of $0.08/share, valid through to December 15, 2013.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of these 187,500 pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

On April 16, 2012, the Company issued 250,000 shares, according to the terms of a consulting agreement with Mr. Robert B. Reynolds Jr., valued at $0.046/share for a total valuation of $11,500.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of 250,000 shares to Mr. Reynolds, pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

The Company entered into an agreement on August 22, 2012 with Group8 Minerals, a Nevada Corporation ("Group8”), and Group8 Mining Innovations, a Nevada Corporation (“G8MI” or “Seller”), the sole Shareholder of Group8, whereby G8MI transferred 81% of the total issued and outstanding shares of Group8 in exchange for the issuance of 83,000,000 shares of First Liberty to G8MI. The Company is further obligated to make a cash payment to G8MI in the amount of $100,000 on or before September 30, 2012, which amount has been paid in full, and by the way of loans to Group8 for property payments and exploration costs, i) $500,000 on or before October 30, 2012; ii) $500,000 on or before December 31, 2012; iii) $500,000 on or before February 28, 2013, and; iv) $500,000 on or before April 30, 2013. Group8 holds a fifty percent (50%) interest in and to certain Nevada limited liability companies, which hold interests in certain mining properties and milling operations in Nevada, pertaining to the mineral ore Stibnite (Antimony). Approximately $149,000 has been provided as of the date of this filing towards the development obligations under the Agreement.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of the 83,000,000 shares to G8MI, pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

Tangiers Capital has exercised its right to convert portions of its Secured Convertible Promissory Note dated February 23, 2012, as follows;

|

|

i.

|

Under the Conversion Notice dated September 6, 2012, Tangiers converted a portion of the debt equal to $5,000 in exchange for shares at a rate of $0.01628 per share, for a total of 307,125 shares.

|

|

|

ii.

|

Under the Conversion Notice dated September 20, 2012, Tangiers converted a portion of the debt equal to $10,000 in exchange for shares at a rate of $0.01658 per share, for a total of 603,318 shares.

|

|

|

iii.

|

Under the Conversion Notice dated October 24, 2012, Tangiers converted a portion of the debt equal to $15,000 in exchange for shares at a rate of $0.01673 per share, for a total of 896,593 shares.

|

As of the date of this filing, a total of $30,000 has been converted for a total issuance of 1,807,036 shares.

The Company claims an exemption from the registration requirements of the Securities Act of 1933, as amended, for the issuance of the 1,807,036 shares to Tangiers, pursuant to Section 4(2) of the Act and/or Rule 506 of Regulation D promulgated thereunder since, among other things, the transaction does not involve a public offering, the purchasers are “accredited investors” and/or qualified institutional buyers, the purchasers have access to information about the Company and its purchase, the purchasers will take the securities for investment and not resale, and the Company is taking appropriate measures to restrict the transfer of the securities.

Purchases of Equity Securities by the Issuer and Affiliated Purchases

During each month within the fourth quarter of the fiscal year ended July 31, 2012, neither we nor any “affiliated purchaser,” as that term is defined in Rule 10b-18(a)(3) under the Exchange Act, repurchased any of our common stock or other securities.

ITEM 6. SELECTED FINANCIAL DATA.

As a “smaller reporting company”, we are not required to provide the information required by this Item.

This Annual Report on Form 10-K contains forward-looking statements relating to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may", "should", "intends", "expects", "plans", "anticipates", "believes", "estimates", "predicts", "potential", or "continue" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors which may cause our or our industry's actual results, levels of activity or performance to be materially different from any future results, levels of activity or performance expressed or implied by these forward-looking statements.

Such factors include, among others, the following: international, national and local general economic and market conditions: demographic changes; the ability of the Company to sustain, manage or forecast its growth; the ability of the Company to successfully make and integrate acquisitions; raw material costs and availability; new product development and introduction; existing government regulations and changes in, or the failure to comply with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and difficulty in

19

forecasting operating results; changes in business strategy or development plans; business disruptions; the ability to attract and retain qualified personnel; the ability to protect technology; and other factors referenced in this and previous filings.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or performance. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Given these uncertainties, readers of this Annual Report on Form 10-K and investors are cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to update any such factors or to publicly announce the result of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

All dollar amounts stated herein are in US dollars unless otherwise indicated.

The management’s discussion and analysis of our financial condition and results of operations are based upon our financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The following discussion of our financial condition and results of operations should be read in conjunction with our audited financial statements for the year ended July 31, 2011, together with notes thereto.

As used in this quarterly report, the terms "we", "us", "our", and the "Company" mean First Liberty Power Corp.

We are an exploration stage company engaged in the exploration of mineral properties.

Liquidity & Capital

As of July 31, 2012, our cash balance was $35,948 which is s decrease from our cash balance of $74,576 at July 31, 2011.

As of July 31, 2012, our total current assets are $307,832 ($799,893 - July 31, 2011). Our current liabilities are $794,097 ($439,009 – July 31, 2011).

At present, the Company’s cash position is insufficient to meet its obligations through to the end of the fiscal year, as we are not currently generating any revenues, and, over the next 12 months, we will require additional funds to meet our operating obligations and property payment / work program obligations, as well as the repayment of the convertible notes should they not be converted to equity prior to the maturity dates in February 22, 2013 and March 6, 2013. At present, we anticipate our funding requirements to be approximately $925,000. This estimate is comprised of $325,000 for required and additional exploration and maintenance expenditures on our Lithium properties, a further $600,000 to cover operating, debt and overhead costs. Additional amounts will be required if we identify additional acquisition targets, or determine that additional exploration on the Lithium properties are required to accelerate their development.