Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | form8-kxitpsclosing.htm |

| EX-99.1 - AVAYA INC. UNAUDITED PRO FORMA FINANCIAL INFORMATION - AVAYA INC | a8kschedulesq214proforma.htm |

| EX-99.1 - AVAYA INC. UNAUDITED PRO FORMA FINANCIAL INFORMATION - AVAYA INC | form8-k_notestotheunaudite.htm |

| EX-99.1 - AVAYA INC. UNAUDITED PRO FORMA FINANCIAL INFORMATION - AVAYA INC | unauditedproformafinancial.htm |

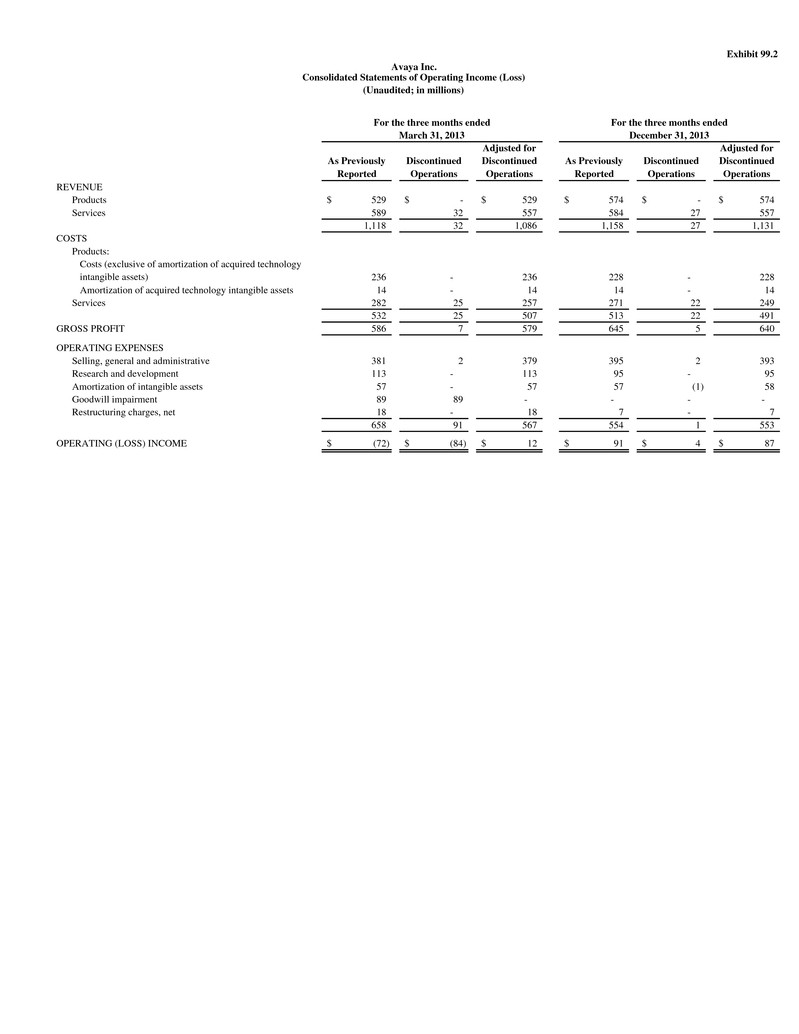

Exhibit 99.2 As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations REVENUE Products 529$ -$ 529$ 574$ -$ 574$ Services 589 32 557 584 27 557 1,118 32 1,086 1,158 27 1,131 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 236 - 236 228 - 228 Amortization of acquired technology intangible assets 14 - 14 14 - 14 Services 282 25 257 271 22 249 532 25 507 513 22 491 GROSS PROFIT 586 7 579 645 5 640 OPERATING EXPENSES Selling, general and administrative 381 2 379 395 2 393 Research and development 113 - 113 95 - 95 Amortization of intangible assets 57 - 57 57 (1) 58 Goodwill impairment 89 89 - - - - Restructuring charges, net 18 - 18 7 - 7 658 91 567 554 1 553 OPERATING (LOSS) INCOME (72)$ (84)$ 12$ 91$ 4$ 87$ For the three months ended March 31, 2013 Avaya Inc. Consolidated Statements of Operating Income (Loss) (Unaudited; in millions) For the three months ended December 31, 2013

March 31, December 31, 2013 2013 Adjusted EBITDA - Adjusted for discontinued operations 167$ 237$ Adjusted EBITDA - As previously reported 172 240 Adjusted EBITDA - Impact of discontinued operations 5$ 3$ Adjusted EBITDA - Adjusted for discontinued operations, as a % of revenue 15.4% 21.0% Revenue - Adjusted for discontinued operations 1,086$ 1,131$ Adjusted EBITDA - As previously reported, as a % of revenue 15.4% 20.7% Revenue - As previously reported 1,118$ 1,158$ Avaya Inc. Supplemental Schedule of Non-GAAP Adjusted EBITDA (Unaudited; in millions) For the Three Months Ended

As Previously Reported Discontinued Operations Adjusted for Discontinued Operations As Previously Reported Discontinued Operations Adjusted for Discontinued Operations GAAP Gross Profit 586$ 7$ 579$ 645$ 5$ 640$ GAAP Gross Margin 52.4% 21.9% 53.3% 55.7% 18.5% 56.6% Items excluded: Amortization of acquired technology intangible assets 14 - 14 14 - 14 Share-based compensation - - - 3 - 3 Non-GAAP Gross Profit 600 7 593 662 5 657 Non-GAAP Gross Margin 53.7% 21.9% 54.6% 57.2% 18.5% 58.1% Reconciliation of Non-GAAP Operating Income GAAP Operating (Loss) Income (72)$ (84)$ 12$ 91$ 4$ 87$ Percentage of Revenue -6% -263% 1% 8% 15% 8% Items excluded: Amortization of acquired assets 71 - 71 71 (1) 72 Restructuring and impairment charges, net 18 - 18 7 - 7 Acquisition/integration-related costs 6 - 6 3 - 3 Share-based compensation 1 - 1 6 - 6 Incremental accelerated depreciation associated with vacating facilities - - - 16 - 16 Other - - - 2 - 2 Goodwill impairment 89 89 - - - - Non-GAAP Operating Income 113$ 5$ 108$ 196$ 3$ 193$ Percentage of Revenue 10.1% 15.6% 9.9% 16.9% 11.1% 17.1% Reconciliation of Non-GAAP Gross Profit and Non-GAAP Gross Margin For the three months ended March 31, 2013 For the three months ended December 31, 2013 Avaya Inc. Supplemental Schedules of Non-GAAP Reconciliations (Unaudited; in millions)