Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | form8-kxitpsclosing.htm |

| EX-99.2 - SUPPLEMENTARY FINANCIAL INFORMATION - AVAYA INC | a8kschedulesq214recast99.htm |

| EX-99.1 - AVAYA INC. UNAUDITED PRO FORMA FINANCIAL INFORMATION - AVAYA INC | form8-k_notestotheunaudite.htm |

| EX-99.1 - AVAYA INC. UNAUDITED PRO FORMA FINANCIAL INFORMATION - AVAYA INC | unauditedproformafinancial.htm |

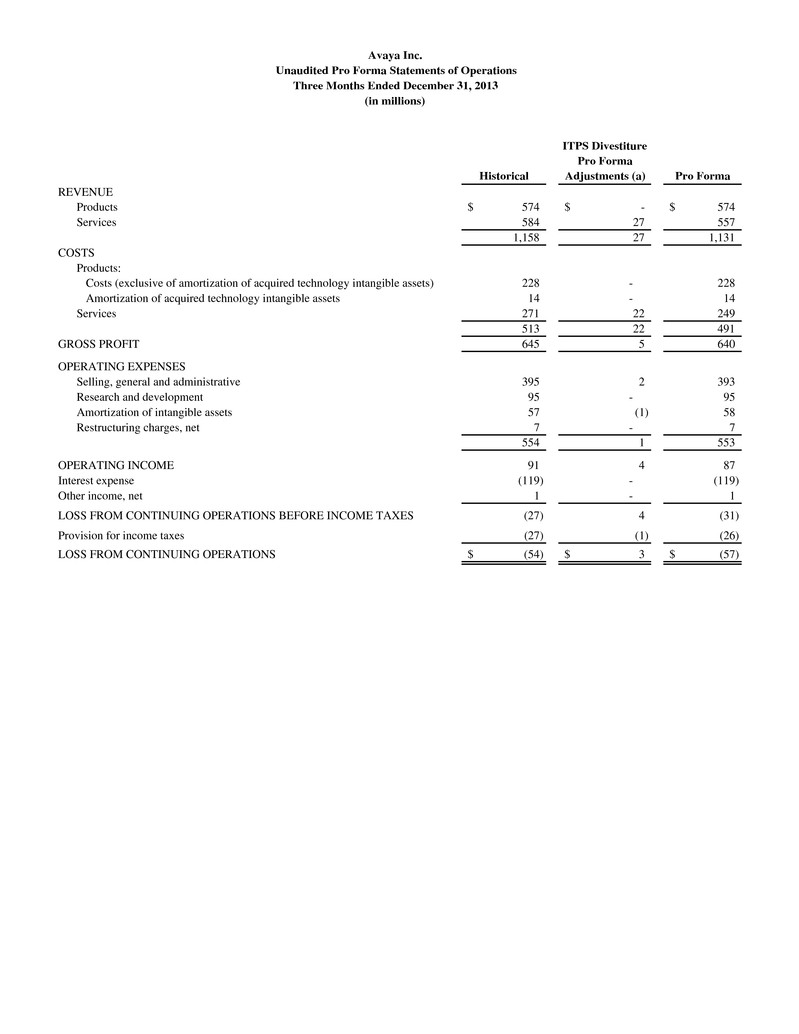

Historical ITPS Divestiture Pro Forma Adjustments (a) Pro Forma REVENUE Products 574$ -$ 574$ Services 584 27 557 1,158 27 1,131 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 228 - 228 Amortization of acquired technology intangible assets 14 - 14 Services 271 22 249 513 22 491 GROSS PROFIT 645 5 640 OPERATING EXPENSES Selling, general and administrative 395 2 393 Research and development 95 - 95 Amortization of intangible assets 57 (1) 58 Restructuring charges, net 7 - 7 554 1 553 OPERATING INCOME 91 4 87 Interest expense (119) - (119) Other income, net 1 - 1 LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (27) 4 (31) Provision for income taxes (27) (1) (26) LOSS FROM CONTINUING OPERATIONS (54)$ 3$ (57)$ Avaya Inc. Unaudited Pro Forma Statements of Operations (in millions) Three Months Ended December 31, 2013

Historical ITPS Divestiture Pro Forma Adjustments (a) Pro Forma REVENUE Products 631$ -$ 631$ Services 609 33 576 1,240 33 1,207 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 261 - 261 Amortization of acquired technology intangible assets 22 - 22 Services 291 26 265 574 26 548 GROSS PROFIT 666 7 659 OPERATING EXPENSES Selling, general and administrative 384 3 381 Research and development 118 - 118 Amortization of intangible assets 57 (1) 58 Restructuring charges, net 84 - 84 643 2 641 OPERATING INCOME 23 5 18 Interest expense (108) - (108) Loss on extinguishment of debt (3) - (3) Other expense, net (6) - (6) LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (94) 5 (99) Benefit from income taxes 9 (1) 10 LOSS FROM CONTINUING OPERATIONS (85)$ 4$ (89)$ Avaya Inc. Unaudited Pro Forma Statements of Operations Three Months Ended December 31, 2012 (in millions)

Historical ITPS Divestiture Pro Forma Adjustments (a) Pro Forma REVENUE Products 2,337$ -$ 2,337$ Services 2,371 130 2,241 4,708 130 4,578 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 963 - 963 Amortization of acquired technology intangible assets 63 - 63 Services 1,122 100 1,022 2,148 100 2,048 GROSS PROFIT 2,560 30 2,530 OPERATING EXPENSES Selling, general and administrative 1,520 9 1,511 Research and development 445 - 445 Amortization of intangible assets 227 (1) 228 Goodwill impairment 89 89 - Restructuring charges, net 200 - 200 Acquisition-related costs 1 - 1 2,482 97 2,385 OPERATING INCOME 78 (67) 145 Interest expense (467) - (467) Loss on extinguishment of debt (6) - (6) Other expense, net (14) - (14) LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (409) (67) (342) Benefit from income taxes 45 10 35 LOSS FROM CONTINUING OPERATIONS (364)$ (57)$ (307)$ Avaya Inc. Unaudited Pro Forma Statements of Operations (in millions) Year Ended September 30, 2013

Historical ITPS Divestiture Pro Forma Adjustments (a) Pro Forma REVENUE Products 2,672$ -$ 2,672$ Services 2,499 152 2,347 5,171 152 5,019 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 1,145 - 1,145 Amortization of acquired technology intangible assets 192 - 192 Services 1,248 114 1,134 2,585 114 2,471 GROSS PROFIT 2,586 38 2,548 OPERATING EXPENSES Selling, general and administrative 1,630 13 1,617 Research and development 464 - 464 Amortization of intangible assets 226 (1) 227 Restructuring and impairment charges, net 147 - 147 Acquisition-related costs 4 - 4 2,471 12 2,459 OPERATING INCOME 115 26 89 Interest expense (431) - (431) Other expense, net (20) - (20) LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (336) 26 (362) (Provision for) benefit from income taxes (8) (12) 4 LOSS FROM CONTINUING OPERATIONS (344)$ 14$ (358)$ Avaya Inc. Unaudited Pro Forma Statements of Operations (in millions) Year Ended September 30, 2012

Historical ITPS Divestiture Pro Forma Adjustments (a) Pro Forma REVENUE Products 2,976$ -$ 2,976$ Services 2,571 173 2,398 5,547 173 5,374 COSTS Products: Costs (exclusive of amortization of acquired technology intangible assets) 1,314 - 1,314 Amortization of acquired technology intangible assets 257 - 257 Services 1,344 130 1,214 2,915 130 2,785 GROSS PROFIT 2,632 43 2,589 OPERATING EXPENSES Selling, general and administrative 1,845 12 1,833 Research and development 461 - 461 Amortization of intangible assets 226 (1) 227 Restructuring charges, net 189 - 189 Acquisition-related costs 5 - 5 2,726 11 2,715 OPERATING LOSS (94) 32 (126) Interest expense (460) - (460) Loss on extinguishment of debt (246) - (246) Other income, net 5 - 5 LOSS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES (795) 32 (827) Provision for income taxes (68) (14) (54) LOSS FROM CONTINUING OPERATIONS (863)$ 18$ (881)$ Avaya Inc. Unaudited Pro Forma Statements of Operations (in millions) Year Ended September 30, 2011

Historical ITPS Divestiture Pro Forma Adjustments Pro Forma ASSETS Current assets: Cash and cash equivalents 300$ 98$ (b) 398$ Accounts receivable, net 686 (10) (c) 676 Inventory 226 - 226 Deferred income taxes, net 62 - 62 Other current assets 266 (9) (c) 257 TOTAL CURRENT ASSETS 1,540 79 1,619 Property, plant and equipment, net 326 - 326 Deferred income taxes, net 26 - 26 Intangible assets, net 1,426 10 (c) 1,436 Goodwill 4,103 (44) (c) 4,059 Other assets 168 - 168 TOTAL ASSETS 7,589$ 45$ 7,634$ LIABILITIES Current liabilities: Debt maturing within one year 35$ -$ 35$ Accounts payable 436 (6) (c) 430 Payroll and benefit obligations 221 (3) (c) 218 Deferred revenue 666 - 666 Business restructuring reserve, current portion 74 - 74 Other current liabilities 259 - 259 TOTAL CURRENT LIABILITIES 1,691 (9) 1,682 Long-term debt 6,042 - 6,042 Pension obligations 1,494 - 1,494 Other postretirement obligations 284 - 284 Deferred income taxes, net 251 - 251 Business restructuring reserve, non-current portion 74 - 74 Other liabilities 474 (6) (c) 468 TOTAL NON-CURRENT LIABILITIES 8,619 (6) 8,613 Commitments and contingencies STOCKHOLDER'S DEFICIENCY Common stock, par value $.01 per share; 100 shares authorized, issued and outstanding - - - Additional paid-in capital 2,943 - 2,943 Accumulated deficit (4,654) 60 (d) (4,594) Accumulated other comprehensive loss (1,010) - (1,010) TOTAL STOCKHOLDER'S DEFICIENCY (2,721) 60 (2,661) TOTAL LIABILITIES AND STOCKHOLDER'S DEFICIENCY 7,589$ 45$ 7,634$ (in millions) Avaya Inc. Unaudited Pro Forma Balance Sheet December 31, 2013