Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EDISON INTERNATIONAL | eix-sceform8xkresanonofres.htm |

| EX-99.1 - PROPOSED SONGS SETTLEMENT PRESENTATION - EDISON INTERNATIONAL | exhibit99-1.htm |

| EX-10.1 - SETTLEMENT AGREEMENT BETWEEN SCE, SDG&E, ORA AND TURN, DATED MARCH 27, 2014 - EDISON INTERNATIONAL | exhibit10-1.htm |

Exhibit 99.2 CERTAIN DOCUMENTS DISTRIBUTED AT THE SAN ONOFRE SETTLEMENT CONFERENCE MARCH 27, 2014

SUMMARY OF KEY TERMS OF SETTLEMENT AGREEMENT Confidential – Subject to Rule 12.6 Do Not Distribute The following summary of the Settlement Agreement is qualified in its entirety by reference to the complete text of the Settlement Agreement 23125433.2 1 Disallowances, Refunds, and Rate Recoveries Steam Generators The utilities will not recover in rates the net investment associated with the steam generators as of February 1, 2012 (§ 4.2(d)), which is the first day following the tube leak in Unit 3. (§ 4.2(d).) These amounts ($597 million for SCE and $160.4 million for SDG&E) will not be recoverable in rates. The utilities will refund any capital-related revenue requirement associated with the steam generators collected after February 1, 2012. (§ 4.2(b).) The utilities keep all capital-related revenues for the steam generators collected prior to February 1, 2012. (§ 4.2(c).) Base Plant The utilities will remove Base Plant from rate base as of February 1, 2012. (§ 4.3(a).) Base Plant will be recovered at a reduced rate of return over 10 years. The rate of return is calculated as each utility’s authorized cost of debt plus 50% of each utility’s authorized cost of preferred stock, weighted by the amount of debt and preferred stock in each utility’s authorized ratemaking capital structure; return on equity is not considered. (§ 4.3(c).) Using this approach, the weighted average return for SCE base plant is 2.95% in 2012 and 2.62% in 2013 and 2014. For SDG&E, the return on base plant is 2.75% in 2012 and 2.35% in 2013 and 2014. The utilities are entitled to retain all capital-related revenues collected for Base Plant prior to February 1, 2012. (§ 4.3(a).) For periods after February 1, 2012, the utilities will refund to ratepayers all revenues for Base Plant that exceed the revenue the utilities are entitled to collect under the reduced rate of return and amortization period set forth in the settlement agreement. (§ 4.3(b)(ii).) Base Plant includes the net investment of all SONGS-related capital investments (including marine mitigation projects, nuclear design basis documentation, and deferred debits), but excludes the SGRP, nuclear fuel, and the materials and supplies inventory, which are addressed separately. (§ 2.6.) Each utility has the option to exclude the unamortized portion of its investment from its capital structure for purposes of determining regulatory capital requirements. (§ 4.4.)

SUMMARY OF KEY TERMS OF SETTLEMENT AGREEMENT Confidential – Subject to Rule 12.6 Do Not Distribute The following summary of the Settlement Agreement is qualified in its entirety by reference to the complete text of the Settlement Agreement 23125433.2 2 Materials and Supplies The settlement agreement allows the utilities rate recovery of their net investments in Materials and Supplies (“M&S”) over 10 years at the reduced rate of return provided for base plant. (§ 4.5(a).) To provide an incentive to sell M&S, the utilities will retain 5% of all sales of the M&S inventory. (§ 4.5(b).) The remaining 95% will be credited to ratepayers. (§ 4.5(b).) Nuclear Fuel The settlement agreement also allows the utilities rate recovery of entire net investment in nuclear fuel (§ 4.6(a)), including those costs that the utilities incur in connection with efforts to cancel their outstanding obligations to purchase nuclear fuel. (§ 2.30.) Nuclear fuel costs are recovered over 10 years at a rate of return equal to commercial paper. (§ 4.6(b).) To provide an incentive to sell nuclear fuel, the utilities will retain 5% of net sale proceeds, while the ratepayers will be credited the remaining 95%. (§ 4.7(a).) Also, the utilities will retain 5% of the difference between outstanding contractual obligations to purchase nuclear fuel and the costs incurred to cancel these contracts. (§ 4.7(c)(i).) Construction Work in Progress The settlement agreement allows the utilities to collect the balance of Construction Work in Progress (“CWIP”), except the portion of CWIP associated with the replacement steam generators. (§§ 4.8(a) & 3.37.) Prior to February 1, 2012, the CWIP balance accumulates the authorized Allowance for Funds Used During Construction (“AFUDC”) rate. After February 1, 2012, CWIP associated with projects that the utilities cancelled will stop earning AFUDC. (§ 4.8(a)(i)(A).) For projects the utilities did not cancel, the associated CWIP will earn AFUDC post February 1, 2012, at the same rate as the return on Base Plant. (§ 4.8(a)(ii)(A) & (a)(ii)(A)(2).) CWIP will be amortized over 10 years with the same return as Base Plant, except that the amortization period for CWIP associated with projects that the utilities have not cancelled will begin on the day the project enters service or the last day of the month of the Commission’s approval of the settlement, whichever is earlier. (§ 4.8(a)(i)(C)- (D) & (ii)(C)-(D).)

SUMMARY OF KEY TERMS OF SETTLEMENT AGREEMENT Confidential – Subject to Rule 12.6 Do Not Distribute The following summary of the Settlement Agreement is qualified in its entirety by reference to the complete text of the Settlement Agreement 23125433.2 3 Operations and Maintenance Costs For 2012, SCE will retain Operations and Maintenance (“O&M”) expenses provisionally authorized in SCE’s 2012 General Rate Case (the “GRC”). (§ 4.9(a).) The utilities may not recover the incremental steam generator inspection and repair (“SGIR”) costs that exceed the provisionally authorized revenue requirement for O&M in 2012. (§ 4.9(a)(ii).) These incremental costs are $99 million for SCE. (§ 3.44.) For 2012, SDG&E will recover its recorded O&M expenses, resulting in a refund of approximately $5.1 million. (§ 4.9(a)(iii).) For 2012 non-O&M expenses, the utilities will be permitted to retain the provisionally authorized revenue requirement, except that the utilities shall refund revenues that exceed recorded non-O&M expenses by more than $10 million. (§ 4.9(b).) For 2013, the utilities will recover their recorded O&M, SONGS-related severance expenses, incremental steam generator inspection and repair costs, and non-O&M expenses, up to authorized. (§ 4.9(e) & (g).) The utilities will refund amounts that exceed these recorded costs. (§ 4.9(f).) 2014 costs are subject to future CPUC review (§ 4.9(h)), and the utilities will refund amounts collected in 2014 pursuant to provisionally authorized rates that exceed the utilities’ recorded costs in 2014. (§ 4.9(i).) To the extent the utilities recover costs from the Nuclear Decommissioning Trusts, the utilities will refund any rates collected that duplicate recoveries from the trusts. (See, e.g., § 4.9(g) & (i).) Replacement Power Costs The settlement agreement allows the utilities to recover all purchased power costs associated with replacing the output of SONGS from January 1, 2012, until the last day of the month of the Commission’s decision approving the settlement agreement. (§ 4.10(a).) The utilities are permitted to amortize these costs in rates by December 31, 2015. (§ 4.10(b).) Provision of Refunds Associated with Previous Overcollections Refunds of revenues previously collected in rates will be effectuated via a reduction to each utility’s respective under-collected ERRA balance. (§ 4.12.)

SUMMARY OF KEY TERMS OF SETTLEMENT AGREEMENT Confidential – Subject to Rule 12.6 Do Not Distribute The following summary of the Settlement Agreement is qualified in its entirety by reference to the complete text of the Settlement Agreement 23125433.2 4 Third-Party Recoveries The utilities are seeking recovery from Mitsubishi Heavy Industries, Inc., and related entities (“MHI”) and from Nuclear Energy Insurance Limited (“NEIL”). (§§ 3.31-3.33.) The utilities will apply recoveries from MHI and NEIL first to recover the costs of pursuing recovery of those claims. (§ 4.11(a) & (b).) The remaining net proceeds are shared between ratepayers and the utilities. Net recoveries from NEIL are provided 82.5% to ratepayers and 17.5% retained by the utilities. (§ 4.11(c)(i).) Net recoveries from MHI are shared as follows. SCE shall retain 85% of the first $100 million, 66.67% of the next $800 million, and 25% of any further recoveries, and shall distribute the remainder to ratepayers. (§ 4.11(c)(ii)(A).) SDG&E shall retain 85% of the first $25 million, 66.67% of the next $200 million, and 25% of any further recoveries, and shall distribute the remainder to ratepayers (§ 4.11(c)(ii)(B).) Ratepayer share of litigation recoveries will be applies as follows: NEIL recoveries applied to reduce ERRA; first two tranches of MHI recoveries applied as a credit to BRRBA/NGBA; last tranche of MHI recoveries applied to reduce regulatory assets and then as a credit to BRRBA/NGBA. (§ 4.11(d).) The utilities have discretion to resolve the NEIL and MHI disputes without CPUC approval or review (§ 4.11(f)), but the utilities will use their best efforts to inform the Commission of any settlement or other resolution of these disputes to the extent this is possible without compromising any aspect of the resolution. (§ 4.11(g).) Procedure The terms and conditions are not binding unless and until the Commission issues a decision approving the agreement. (§ 5.13.) Settling parties will use best efforts to obtain CPUC approval without modification. (§ 5.1(a)(i).) If CPUC does not approve settlement within six months, settling parties may terminate. (Introduction). After the Commission approves the settlement agreement, the utilities are required to file revised tariff sheets and Tier 2 Advice Letters to implement the rate changes provided under the settlement agreement. (§§ 6.1 & 6.2.)

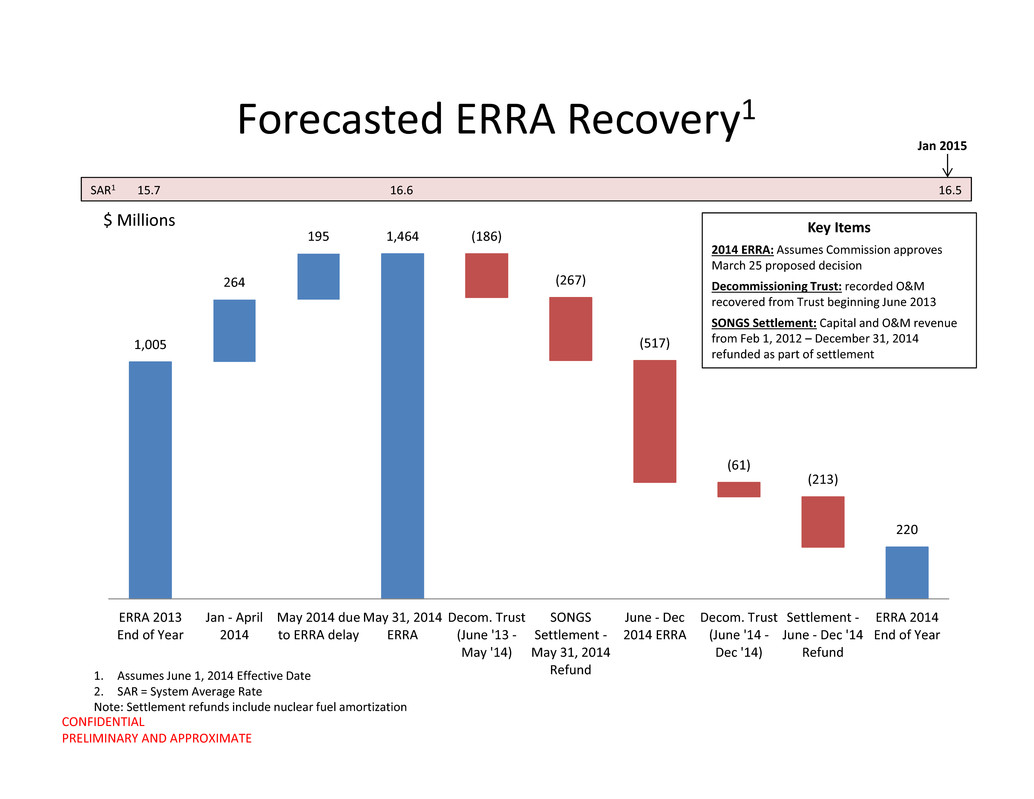

CONFIDENTIAL PRELIMINARY AND APPROXIMATE Forecasted ERRA Recovery1 1,005 264 195 1,464 (186) (267) (517) (61) (213) 220 ERRA 2013 End of Year Jan ‐ April 2014 May 2014 due to ERRA delay May 31, 2014 ERRA Decom. Trust (June '13 ‐ May '14) SONGS Settlement ‐ May 31, 2014 Refund June ‐ Dec 2014 ERRA Decom. Trust (June '14 ‐ Dec '14) Settlement ‐ June ‐ Dec '14 Refund ERRA 2014 End of Year 1. Assumes June 1, 2014 Effective Date 2. SAR = System Average Rate Note: Settlement refunds include nuclear fuel amortization SAR1 15.7 16.6 16.5 Jan 2015 $ Millions Key Items 2014 ERRA: Assumes Commission approves March 25 proposed decision Decommissioning Trust: recorded O&M recovered from Trust beginning June 2013 SONGS Settlement: Capital and O&M revenue from Feb 1, 2012 – December 31, 2014 refunded as part of settlement

CONFIDENTIAL PRELIMINARY AND APPROXIMATE $ Millions SCE TURN Litigation ORA Litigation Settlement SCE Litigation PVRR @ 10.00% 2,061$ 1,923$ 2,571$ 3,693$ Components: RSG ‐ 86 ‐ 696 Base Plant 900 708 1,115 1,416 O&M 659 627 673 773 Nuclear Fuel 419 419 394 419 Replacement Power1 83 83 389 389 Return (% 2013) RSG 0.00% 0.00% 0.00% 5.54% Debt 0.00% 0.00% 0.00% 5.49% Preferred 0.00% 0.00% 0.00% 5.79% Equity 0.00% 0.00% 0.00% 5.54% Base Plant ‐ Required 2,3,4 0.00% 0.00% 2.62% 7.90% Debt 0.00% 0.00% 5.49% 5.49% Preferred 0.00% 0.00% 2.90% 5.79% Equity 0.00% 0.00% 0.00% 10.45% Base Plant ‐ Not Required 4 0.00% 0.00% n/a 5.54% Debt 0.00% 0.00% n/a 5.49% Preferred 0.00% 0.00% n/a 5.79% Equity 0.00% 0.00% n/a 5.54% 1. Does not include forgone sales 2. In Settlement Agreement, Non‐RSG plant is not distinguished as "required" or "not‐required" as defined in the SCE litigation position. As such, Base Plant, CWIP, and M&S earns the rate of return shown in the table 3. In SCE litigation position, higher return on required plant only applicable through 2017. Thereafter, rate of return on "not‐required" plant applies. 4. Base Plant includes CWIP and M&S