Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EDISON INTERNATIONAL | eix-sceform8xkresanonofres.htm |

| EX-99.2 - CERTAIN DOCUMENTS DISTRIBUTED AT MARCH 27, 2014 SETTLEMENT CONFERENCE - EDISON INTERNATIONAL | exhibit99-2.htm |

| EX-10.1 - SETTLEMENT AGREEMENT BETWEEN SCE, SDG&E, ORA AND TURN, DATED MARCH 27, 2014 - EDISON INTERNATIONAL | exhibit10-1.htm |

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 0 Proposed SONGS Settlement

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 1 Statements contained in this presentation about future performance that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. Forward-Looking Statements

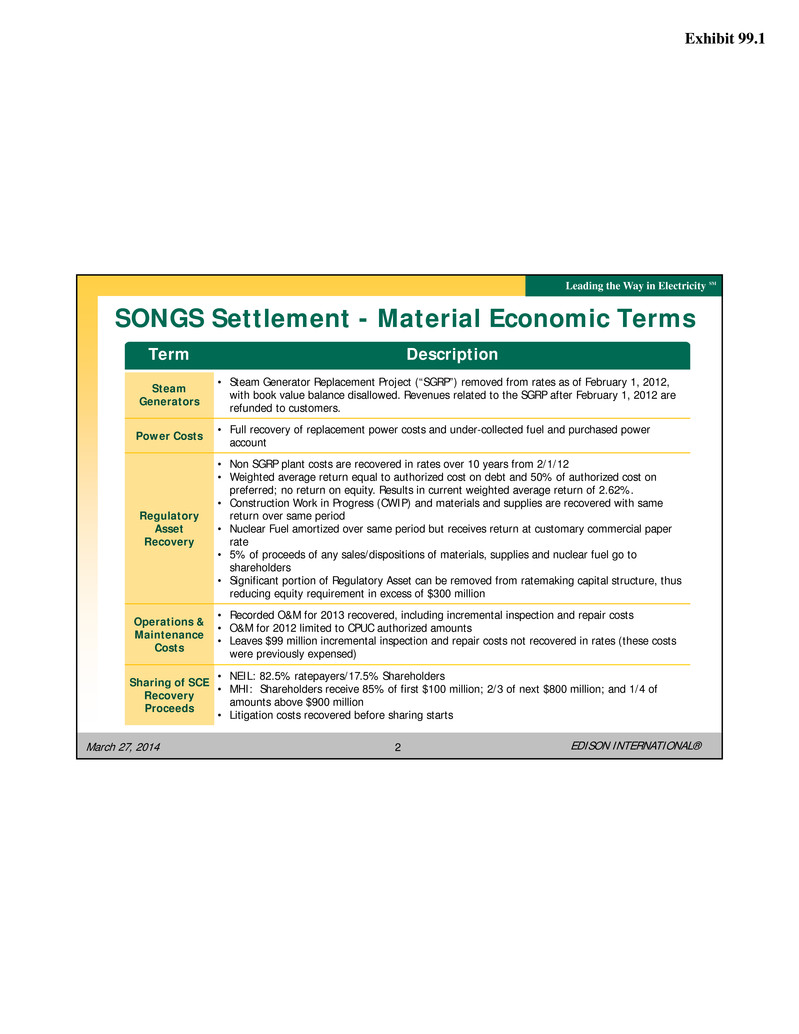

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 2 SONGS Settlement - Material Economic Terms Term Description Steam Generators • Steam Generator Replacement Project (“SGRP”) removed from rates as of February 1, 2012, with book value balance disallowed. Revenues related to the SGRP after February 1, 2012 are refunded to customers. Power Costs • Full recovery of replacement power costs and under-collected fuel and purchased power account Regulatory Asset Recovery • Non SGRP plant costs are recovered in rates over 10 years from 2/1/12 • Weighted average return equal to authorized cost on debt and 50% of authorized cost on preferred; no return on equity. Results in current weighted average return of 2.62%. • Construction Work in Progress (CWIP) and materials and supplies are recovered with same return over same period • Nuclear Fuel amortized over same period but receives return at customary commercial paper rate • 5% of proceeds of any sales/dispositions of materials, supplies and nuclear fuel go to shareholders • Significant portion of Regulatory Asset can be removed from ratemaking capital structure, thus reducing equity requirement in excess of $300 million Operations & Maintenance Costs • Recorded O&M for 2013 recovered, including incremental inspection and repair costs • O&M for 2012 limited to CPUC authorized amounts • Leaves $99 million incremental inspection and repair costs not recovered in rates (these costs were previously expensed) Sharing of SCE Recovery Proceeds • NEIL: 82.5% ratepayers/17.5% Shareholders • MHI: Shareholders receive 85% of first $100 million; 2/3 of next $800 million; and 1/4 of amounts above $900 million • Litigation costs recovered before sharing starts

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 3 Asset Impairment (February Business Update) Exposure to refunds for amounts collected from customers Exposure to recovery of net investment from future rates Revenue Subject to Refund Since 1/1/12 Since 11/1/12 Authorized revenues (as of 12/31/13) $1,248 $706 Replacement power (as of 6/6/13) $680 $339 SONGS Regulatory Asset Net investment1 (as of 5/31/13) $2,096 Less: $575 million impairment (575) Add: other costs 70 Regulatory Asset2 (as of 12/31/13) $1,591 ($ millions) 1 Includes approximately $404 million of PP&E, including CWIP, that is expected to support ongoing activities at the site and also includes excess nuclear fuel and material and supplies that, if sold, would reduce the amount of the regulatory asset by such proceeds 2 SCE has also recorded $266 million as a reduction to its regulatory asset for revenue collected in excess of amounts recognized resulting in a Net Regulatory Asset of $1,325 million Recognition of a regulatory asset is based on an assessment that such amount is probable of recovery2

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 4 Settlement Accounting • In Q2 2013, SCE recorded a $575 million (pre-tax) impairment based on management’s judgment of the recoverability of its SONGS investment Developed based on a range of possible outcomes Each quarter management must assess recoverability • In Q1 2014, SCE expects to increase its pre-tax impairment to ~$730 million (~$465 million after-tax) based on terms of Settlement. Primary drivers: Disallowance of SGRP investment ($542 million as of May 31, 2013) Refund of revenues related to SGRP previously recognized from February 1, 2012 through May 31, 2013 of $153 million Implementation of other terms of the Settlement Agreement, including refund of authorized return in excess of the return allowed for non-SGRP investments • If approved, the settlement would result in a core earnings benefit of approximately $0.03 per share in 2014 and $0.04 per share annualized, declining over 10 years • SCE will not record a receivable for potential recoveries from either MHI or NEIL SCE expects to record an additional pre-tax impairment of ~$155 million (~$100 million after tax or $0.31 per share) in Q1 2014

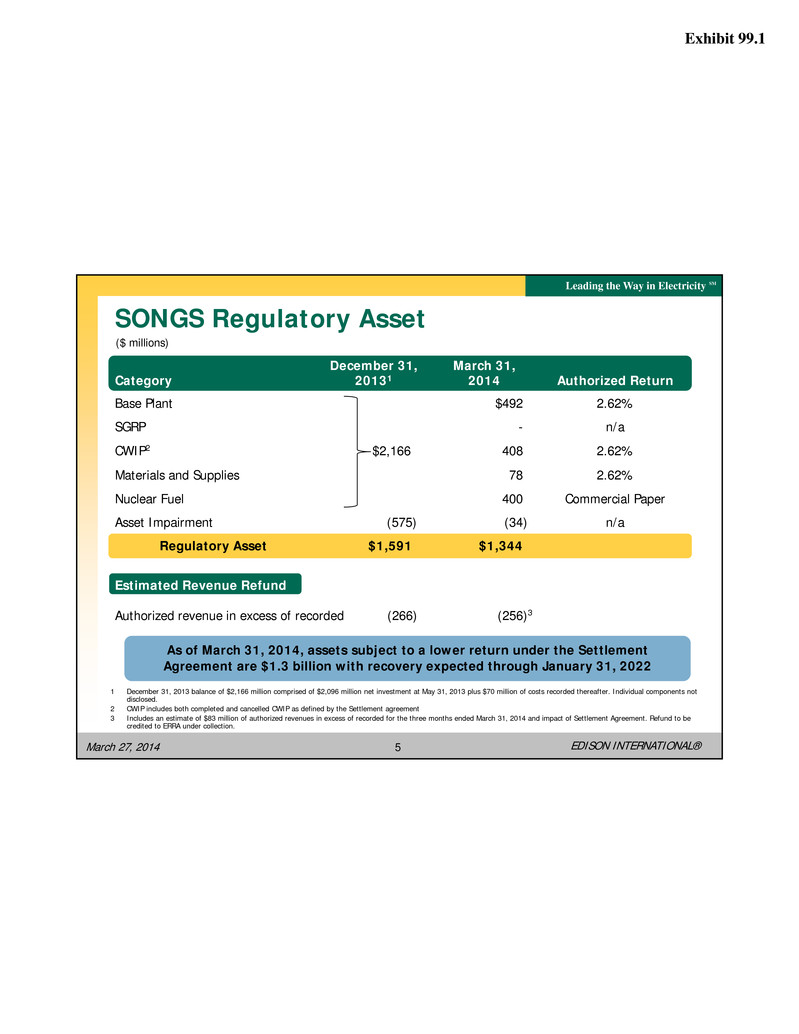

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 5 SONGS Regulatory Asset Category December 31, 20131 March 31, 2014 Authorized Return Base Plant $492 2.62% SGRP - n/a CWIP2 $2,166 408 2.62% Materials and Supplies 78 2.62% Nuclear Fuel 400 Commercial Paper Asset Impairment (575) (34) n/a Regulatory Asset $1,591 $1,344 Estimated Revenue Refund Authorized revenue in excess of recorded (266) (256)3 1 December 31, 2013 balance of $2,166 million comprised of $2,096 million net investment at May 31, 2013 plus $70 million of costs recorded thereafter. Individual components not disclosed. 2 CWIP includes both completed and cancelled CWIP as defined by the Settlement agreement 3 Includes an estimate of $83 million of authorized revenues in excess of recorded for the three months ended March 31, 2014 and impact of Settlement Agreement. Refund to be credited to ERRA under collection. As of March 31, 2014, assets subject to a lower return under the Settlement Agreement are $1.3 billion with recovery expected through January 31, 2022 ($ millions)

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 6 Cash Flow Impact of Settlement • With SONGS shutdown, SCE has purchased significant amounts of replacement power Energy Resource Recovery Account (ERRA) balance $1 billion under collected as of December 31, 2013 Expected to grow by $100 million each month SONGS related amount in ERRA balance $467 million • Settlement would allow recovery of SONGS replacement power costs in ERRA proceeding Refunds owed to customers, and return of over collected SONGS accounts, to be credited against ERRA under collection Decision in 2014 ERRA proceeding still required • Subject to CPUC approval, SONGS decommissioning trusts may also provide additional funds to reduce ERRA balance • On March 24, SCE received proposed decision in 2014 ERRA proceeding SCE will file comments supporting adoption of the proposed decision The settlement and other related actions may allow SCE to substantially offset its under collected fuel and purchased power account

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 7 1,005 264 195 1,464 (186) (267) (517) (61) (213) 220 ERRA 2013 End of Year Jan - April 2014 May 2014 due to ERRA delay May 31, 2014 ERRA Decom. Trust (June '13 - May '14) SONGS Settlement - May 31, 2014 Refund June - Dec 2014 ERRA Decom. Trust (June '14 - Dec '14) Settlement - June - Dec '14 Refund ERRA 2014 End of Year SAR2 15.7 16.6 16.5 Jan 2015 $ Millions Key Items 2014 ERRA: Assumes Commission approves March 25 proposed decision Decommissioning Trust: recorded O&M recovered from Trust beginning June 2013 SONGS Settlement: Capital and O&M revenue from Feb 1, 2012 – December 31, 2014 refunded as part of settlement 1 Assumes June 1, 2014 Effective Date 2 SAR = System Average Rate Note: Settlement refunds include nuclear fuel amortization Forecasted ERRA Recovery1

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 8 2014 Core and Basic Earnings Guidance Note: See Use of Non-GAAP Financial Measures in Appendix Key Assumptions: • Midpoint rate base of $22.1 billion • Approved capital structure – 48% equity, 10.45% CPUC & FERC ROE • 325.8 million common shares outstanding (no change) • No significant transmission project delays Other Assumptions: • EME results not consolidated • No changes in tax policy • O&M cost savings flow through to ratepayers in 2015 GRC • Updates to be provided on SONGS and EME bankruptcy as they develop 2014 Earnings Guidance as of 2/25/14 Low $3.60 Mid $3.70 High $3.80 • Cost savings / other - $0.35 • Income taxes - $0.14 • Energy efficiency earnings - $0.03 • SONGS LT Debt & Pf dividends $3.40 $(0.07) $0.52 $(0.15) $3.70 SCE 2014 EPS from Rate Base Forecast SONGS Shutdown SCE 2014 Positive Variances EIX Parent & Other 2014 Midpoint Guidance

Exhibit 99.1 EDISON INTERNATIONAL® Leading the Way in Electricity SM March 27, 2014 9 Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included on the slide where the information appears. Use of Non-GAAP Financial Measures EIX Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Felicia Williams, Senior Manager (626) 302-5493 felicia.williams@edisonintl.com