Attached files

| file | filename |

|---|---|

| 8-K - HOOPER HOLMES, INC. 8-K - HOOPER HOLMES INC | a50831897.htm |

| EX-99.1 - EXHIBIT 99.1 - HOOPER HOLMES INC | a50831897ex99_1.htm |

Exhibit 99.2

1 Hooper Holmes, Inc.

March 26, 2014 Earnings Presentation Speakers: Henry Dubois, Chief

Executive Officer Tom Collins, Chief Financial Officer

2 Safe Harbor Statement 2 The presentation contains forward-looking statements concerning plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact. The forward-looking statements contained in this release reflect our current beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward-looking statements. You are referred to the documents filed by us with the SEC, specifically reports on Form 10-K and Form 10-Q including risk factors that could cause actual results to differ from forward-looking statements. These reports are available at www.sec.gov. This presentation should be used in conjunction with the earnings call dated March 26, 2014. This presentation contains information from third-party sources, including data from studies conducted by others and market data and industry forecasts obtained from industry publication. Although Hooper Holmes Inc. believes that such information is reliable, Hooper Holmes Inc. has not independently verified any of this information and Hooper Holmes Inc. does not guarantee the accuracy or completeness of this information.

3 Welcome & Introduction: The New Hooper Leveraging our capabilities in a Rapidly Growing Market Our Opportunity Our Existing Capabilities Market Dynamics & Growth Existing Customer Base Enhancements Underway

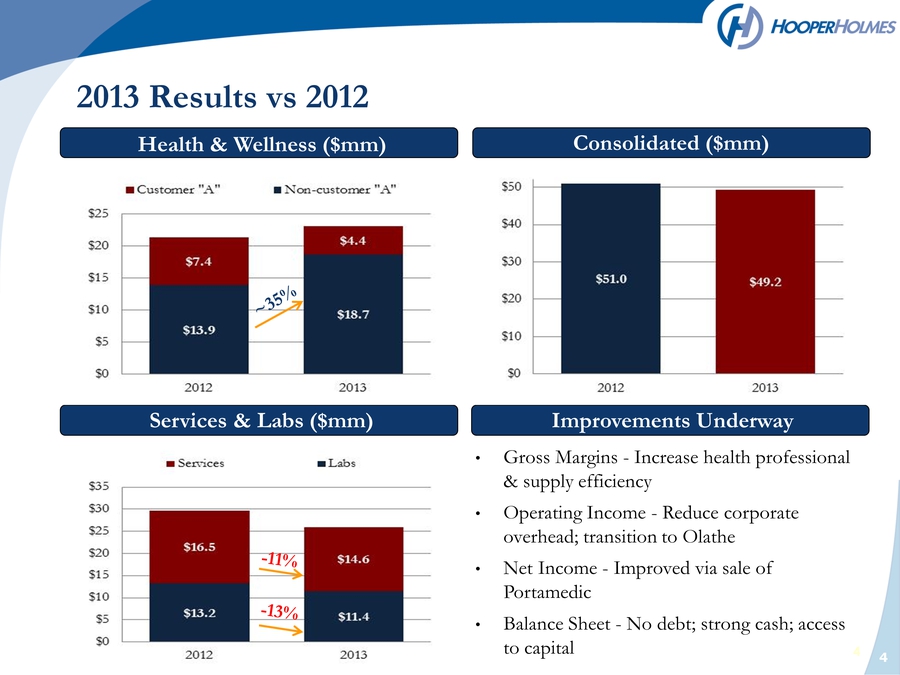

4 2013 Results vs 2012 4 Health & Wellness ($mm) Services & Labs ($mm) Consolidated ($mm) •Gross Margins - Increase health professional & supply efficiency •Operating Income - Reduce corporate overhead; transition to Olathe •Net Income - Improved via sale of Portamedic •Balance Sheet - No debt; strong cash; access to capital Improvements Underway

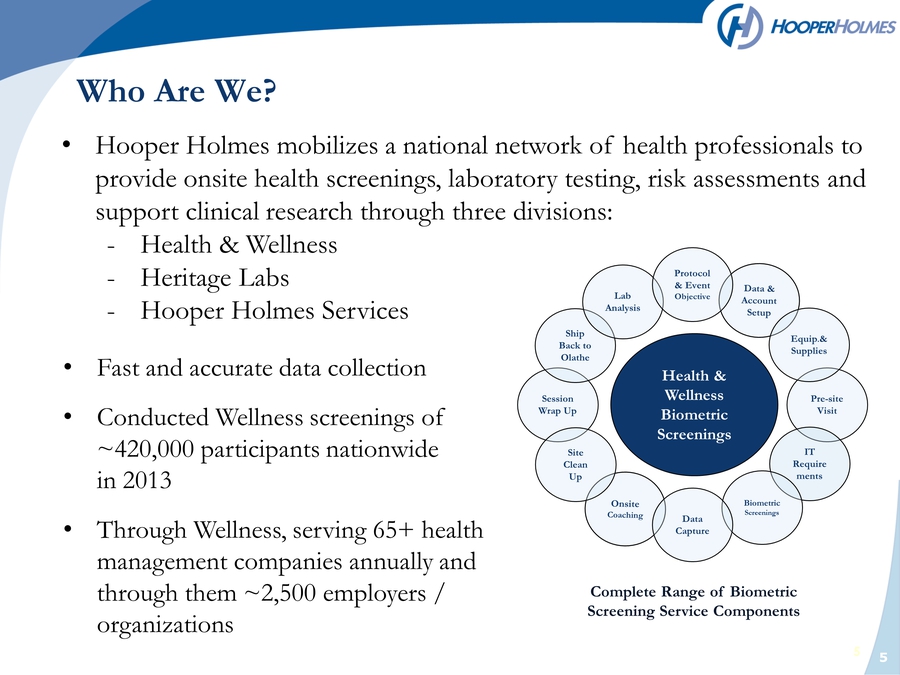

5 Who Are We? •Hooper Holmes mobilizes a national network of health professionals to provide onsite health screenings, laboratory testing, risk assessments and support clinical research through three divisions: -Health & Wellness -Heritage Labs -Hooper Holmes Services •Fast and accurate data collection •Conducted Wellness screenings of ~420,000 participants nationwide in 2013 •Through Wellness, serving 65+ health management companies annually and through them ~2,500 employers / organizations 5 Session Wrap Up Pre-site Visit Ship Back to Olathe IT Requirements Lab Analysis Biometric Screenings Protocol & Event Objective Data Capture Site Clean Up Equip.& Supplies Health & Wellness Biometric Screenings Complete Range of Biometric Screening Service Components

Health Professional Network with National Scale Infrastructure Delivers Coverage, Compliance and Consistency Nationwide •National network of over 9,000 health professionals •Over 1.5 million lab tests run annually •150,000 participants coached COVERAGE •Credentialing of all Health Professionals •Training and oversight for professional execution •Maintain appropriate clinical protocols COMPLIANCE •Event and Site Management •Centralized Scheduling, Staffing and Fulfillment •Equipment Standardization •99% Participant Satisfaction CONSISTENCY 699 6 2013 Screenings - National Presence 6

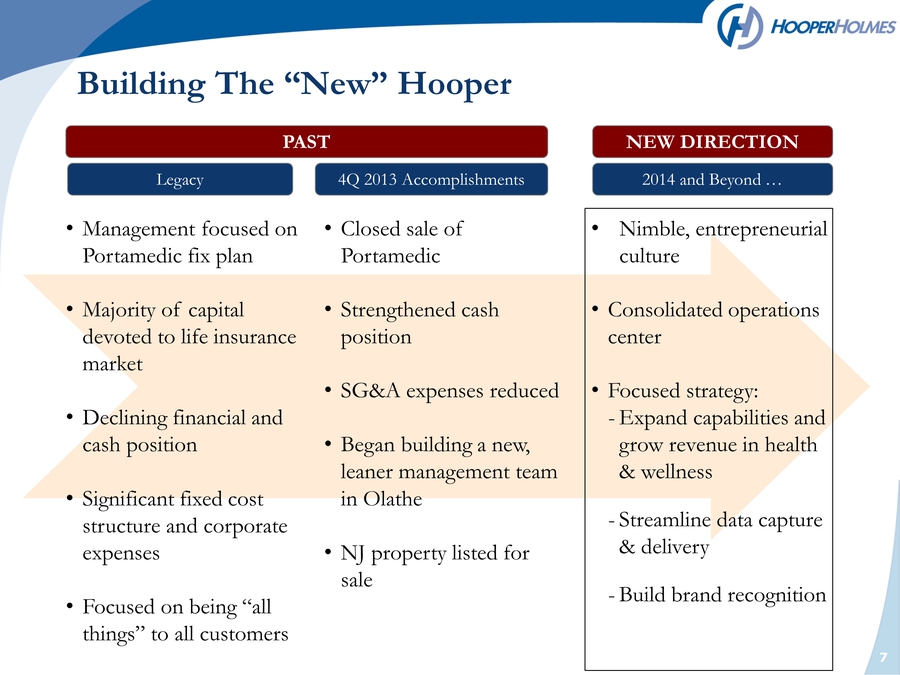

7 Building The “New” Hooper •Management focused on Portamedic fix plan •Majority of capital devoted to life insurance market •Declining financial and cash position •Significant fixed cost structure and corporate expenses •Focused on being “all things” to all customers •Closed sale of Portamedic •Strengthened cash position •SG&A expenses reduced •Began building a new, leaner management team in Olathe •NJ property listed for sale •Nimble, entrepreneurial culture •Consolidated operations center •Focused strategy: -Expand capabilities and grow revenue in health & wellness -Streamline data capture & delivery -Build brand recognition 4Q 2013 Accomplishments 2014 and Beyond … PAST NEW DIRECTION Legacy

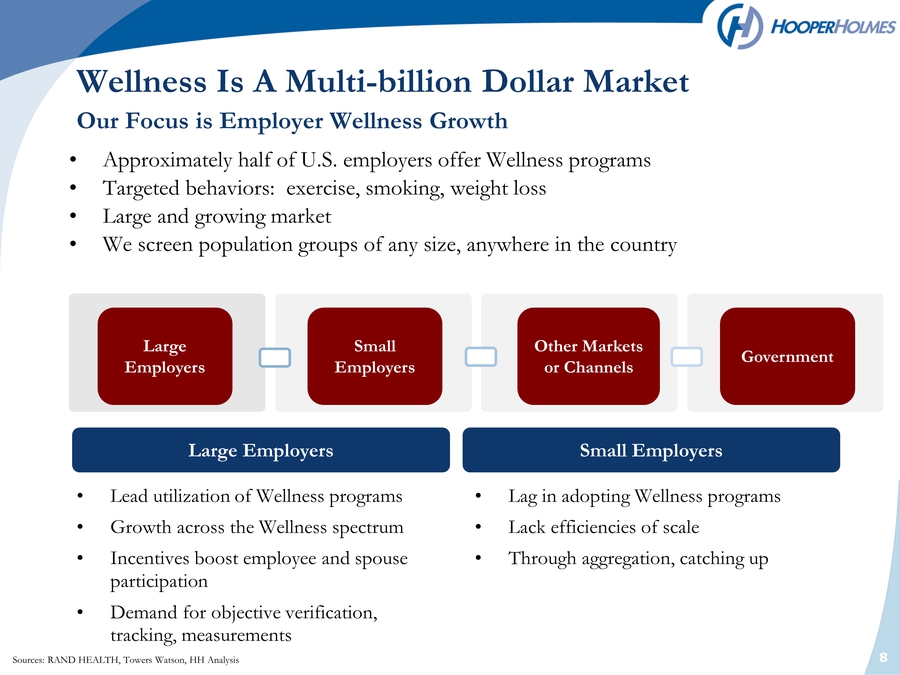

Wellness Is A Multi-billion Dollar Market Our Focus is Employer Wellness Growth 8 Large Employers Small Employers Other Markets or Channels Government •Lead utilization of Wellness programs •Growth across the Wellness spectrum •Incentives boost employee and spouse participation •Demand for objective verification, tracking, measurements •Lag in adopting Wellness programs •Lack efficiencies of scale •Through aggregation, catching up •Approximately half of U.S. employers offer Wellness programs •Targeted behaviors: exercise, smoking, weight loss •Large and growing market •We screen population groups of any size, anywhere in the country Large Employers Small Employers Sources: RAND HEALTH, Towers Watson, HH Analysis 8

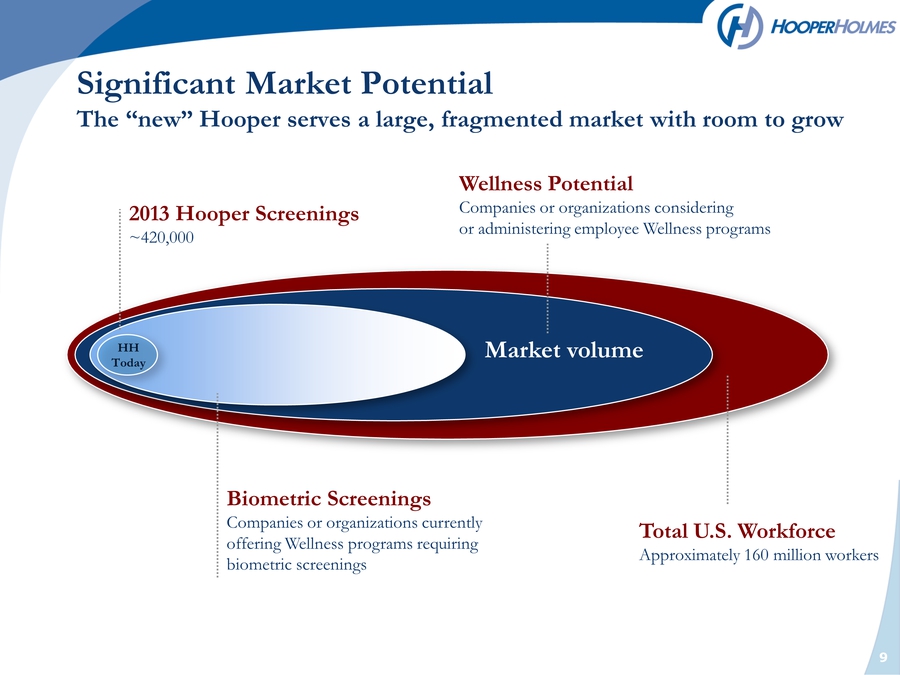

HH Today Market volume Wellness Potential Companies or organizations considering or administering employee Wellness programs Total U.S. Workforce Approximately 160 million workers Biometric Screenings Companies or organizations currently offering Wellness programs requiring biometric screenings 2013 Hooper Screenings ~420,000 Significant Market Potential The “new” Hooper serves a large, fragmented market with room to grow 9

Opportunities To Leverage Time With Participants Maximizing Participant Engagement 10 Coaching & Engagement Data Analysis & Reporting •Opportunities to leverage our Health Professionals’ time with Wellness program participants to provide new services •Currently offered on a limited basis •Largest sector of the market •New capabilities requested by customers •Higher margins •Large & growing national database 10

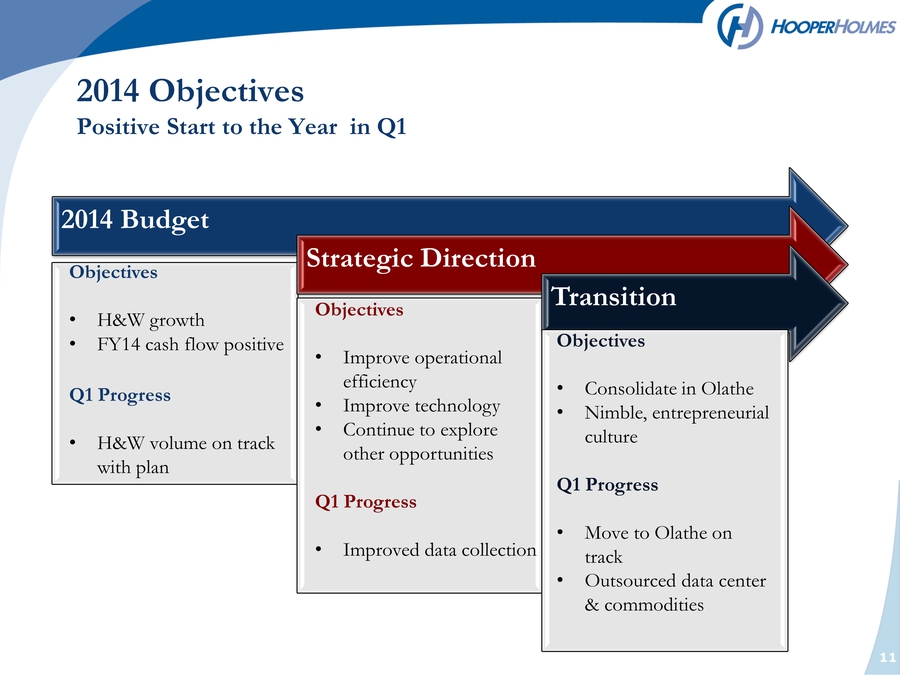

2014 Objectives Positive Start to the Year in Q1 11 2014 Budget Strategic Direction Transition Objectives •H&W growth •FY14 cash flow positive Q1 Progress •H&W volume on track with plan Objectives •Improve operational efficiency •Improve technology •Continue to explore other opportunities Q1 Progress •Improved data collection Objectives •Consolidate in Olathe •Nimble, entrepreneurial culture Q1 Progress •Move to Olathe on track •Outsourced data center & commodities 11

12 Summary 2014 Direction: Cash Flow Positive, Health & Wellness Growth •H&W is engine for growth •Well positioned through service quality, Health Professional network, data capabilities and customer partnerships •Clean balance sheet, no debt, access to capital •Drive to product line and business profitability •Multiple market and channel opportunities •Continued focus on long-term strategy

Where We’re Going and How We Will Get There Delivering the Finest Biometric Screenings in the Industry Quality Partnership Growth Leverage our capabilities and service quality: highest customer marks, in some cases 20% better than our competitors With our customer partners, attract new employers for services and continually refine offerings to broaden our revenue base Positioned to grow through •Focused operations •Lowered cost of doing business •Building a recognized brand 13