Attached files

| file | filename |

|---|---|

| 8-K - SOUTHWEST IOWA RENEWABLE ENERGY, LLC 8-K 3-21-2014 - SOUTHWEST IOWA RENEWABLE ENERGY, LLC | form8k.htm |

Exhibit 99.1

2014 Annual Meeting Fiscal year 2013 in review

This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are made in good faith by Southwest Iowa Renewable Energy, LLC (“SIRE,” “us” or “we”) and are identified by including terms such as “may,” “will,” “should,” “expects,” “anticipates,” “estimates,” “plans,” or similar language. In connection with these safe-harbor provisions, SIRE has identified in its registration statement on Form 10-K, and in its other filings with the SEC, important factors that could cause actual results to differ materially from those contained in any forward-looking statement made by or on behalf of SIRE, including, without limitation, the risk and nature of our business and the effects of general economic conditions on us. We may experience significant fluctuations in future operating results due to a number of economic conditions, including, but not limited to, competition in the ethanol industry, commodity market risks, financial market risks, counter-party risks, and risks associated with changes to federal policy or regulation. The cautionary statements in this presentation expressly qualify all of SIRE’s forward-looking statements. The forward-looking statements contained in this presentation are included in the safe harbor protection provided by Section 27A of the Securities Act of 1933. SIRE further cautions that such factors are not exhaustive or exclusive. SIRE does not undertake to update any forward-looking statement which may be made from time to time by or on behalf of SIRE unless an update is required by applicable securities laws. FORWARD-LOOKING STATEMENTS AND DISCLAIMER

Operate Profitably Operate Safely Manage Risk Low Cost Producer Yield Energy Chemicals Manage Expenses Operate Plant at High Volume when margins allow Continue to pay down debt and lower debt per gallon of capacity Fiscal Year 2013 Objectives

SIRE bought 39.3MM bushels corn Total - $279.7MM ($7.12 / bu) SIRE sold 111.8MM gallon`s ethanol SIRE sold 384,700 tons of DG SIRE saw the worst margins in history and the best margins in history Fiscal Year End 2013

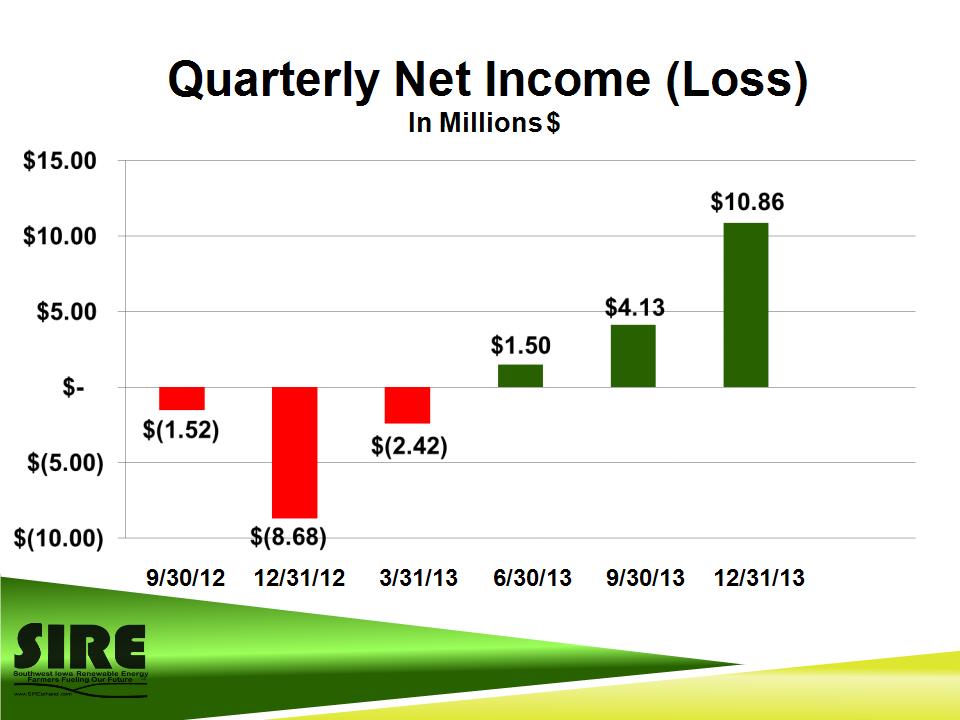

Quarterly Net Income (Loss) In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Total Days Without a Lost Time Day Accident

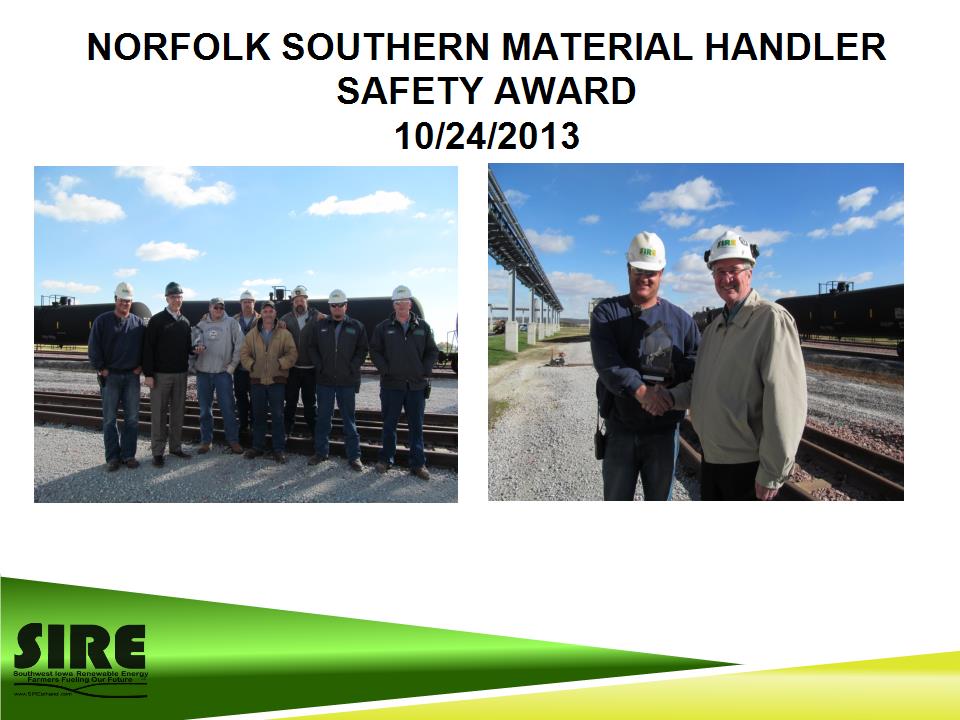

NORFOLK SOUTHERN MATERIAL HANDLER SAFETY AWARD 10/24/2013 Norfolk Southern Material Handler Safety Award 10/24/2013 Matt O’Grady, Production Mgr. Brian Cahill, General Mgr.

GOVERNOR SUPPORTS “DON’T MESS WITH THE RFS” CAMPAIGN IN SUPPORT OF ETHANOL

CO2 PLANT CONSTRUCTION APRIL 2014

Remember, the SIRE newsletter has gone paperless. Please sign up to receive it by email. It will also be posted on our website, www.sireethanol.com

Name: Address: Home Phone: Cell Phone: Work Phone: Email: Winter Address: (If Applicable)

Financial Summary March 2014

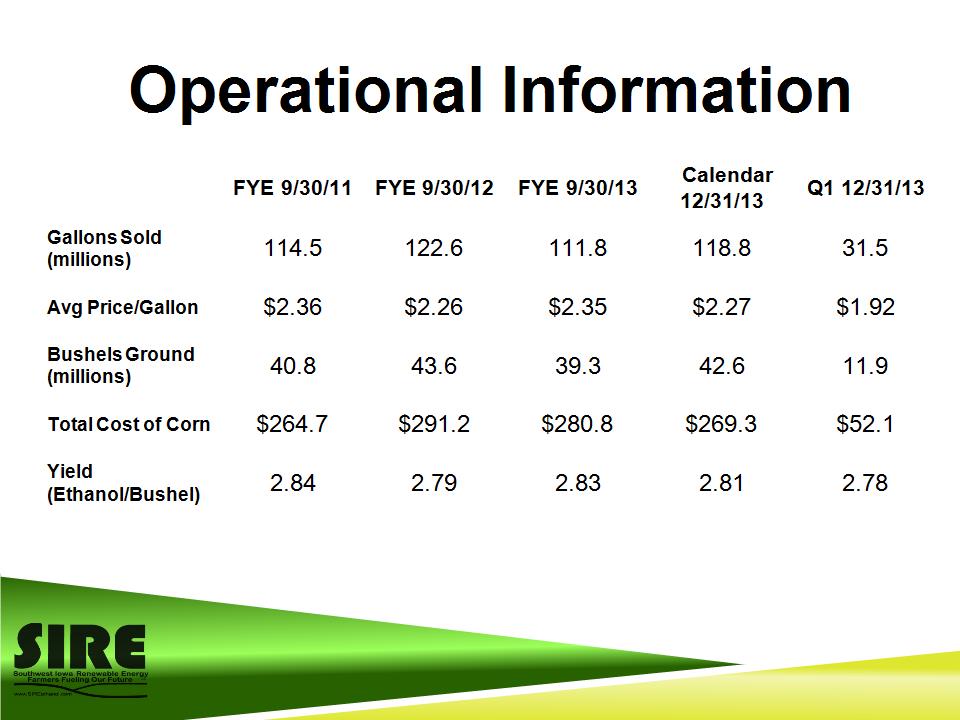

Operational Information FYE 9/30/11 FYE 9/30/12 FYE 9/30/13 Calendar 12/31/13 Q1 12/31/13 Gallons Sold (millions) 114.5 122.6 111.8 118.8 31.5 Avg Price/Gallon $2.36 $2.26 $2.35 $2.27 $1.92 Bushels Ground (millions) 40.8 43.6 39.3 42.6 11.9 Total Cost of Corn $264.7 $291.2 $280.8 $269.3 $52.1 Yield (Ethanol/Bushel) 2.84 2.79 2.83 2.81 2.78

Financial Highlights ($000s) FYE 9/30/11 FYE 9/30/12 FYE 9/30/13 Calendar 12/31/13 Q1 12/31/13 Revenue $333.1 $362.9 $350.2 $356.1 $80.2 Cost of Corn $264.7 $291.2 $280.8 $269.3 $52.1 Crush Margin / Gallon $0.65 $0.64 $0.59 $0.73 $0.89 EBITDA $20.7 $20.9 $15.3 $34.4 $15.8 Net Income (Loss) $(2.7) $(0.7) $(5.5) $14.0 $10.9

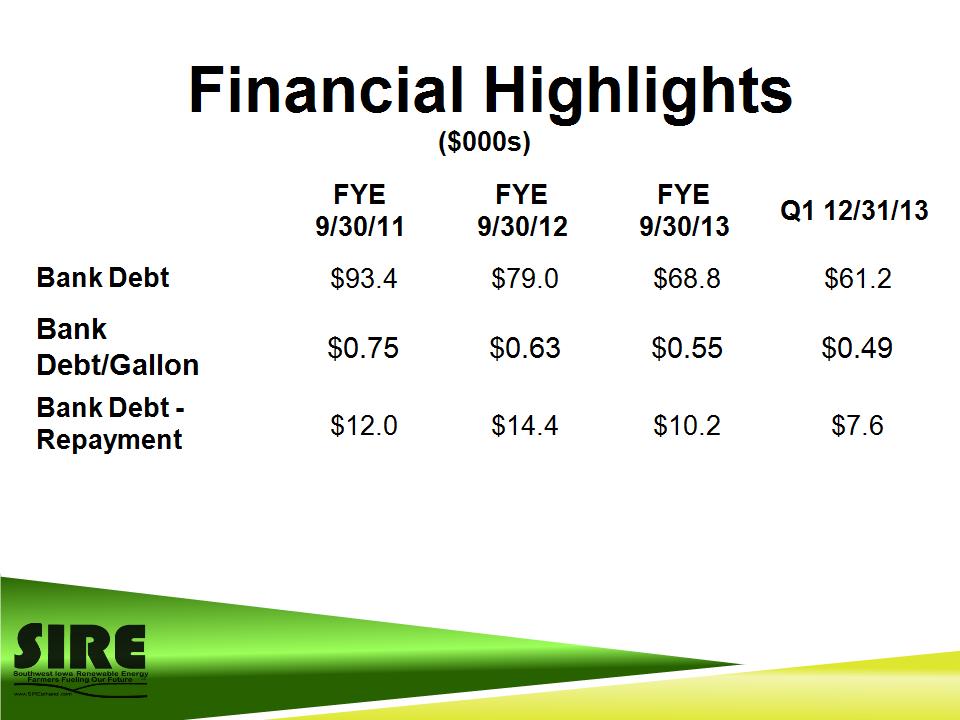

Financial Highlights ($000s) FYE 9/30/11 FYE 9/30/12 FYE 9/30/13 Q1 12/31/13 Bank Debt $93.4 $79.0 $68.8 $61.2 Bank Debt/Gallon $0.75 $0.63 $0.55 $0.49 Bank Debt - Repayment $12.0 $14.4 $10.2 $7.6

Quarterly Crush Margin In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Quarterly EBITDA In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Quarterly Net Income (Loss) In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Liquidity In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Bank Debt In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Sub Debt In Millions $ 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Book Value per Unit 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Quarterly Ethanol Production In Millions of Gallons 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Quarterly Ethanol Yield In gallons/bu 9/30/12 12/31/12 3/31/13 6/30/13 9/30/13 12/31/13

Kristan Barta Dustin Ploeger Channing Batz Meet the Merchandising Team

Corn Grind – 100,000 – 130,000 bu/day Storage space – 1 million bushes At full grind we have about 7.5 days of storage We offer many different marketing programs for your corn Basis HTA – Hedge to Arrive Deferred pricing Alliance Advantage Picked up off the farm

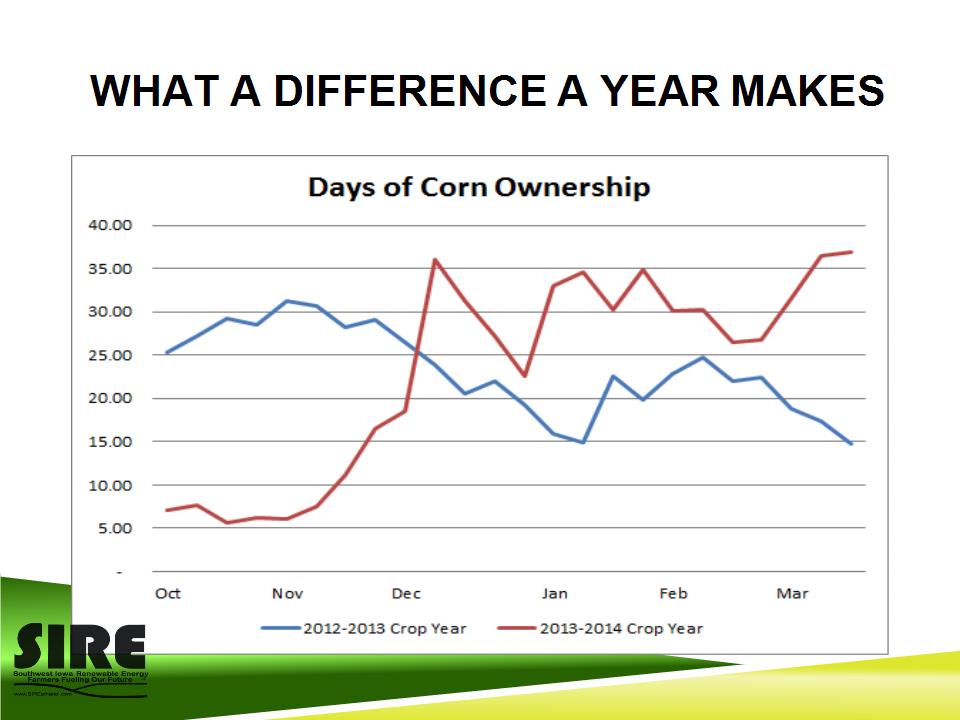

WHAT A DIFFERENCE A YEAR MAKES

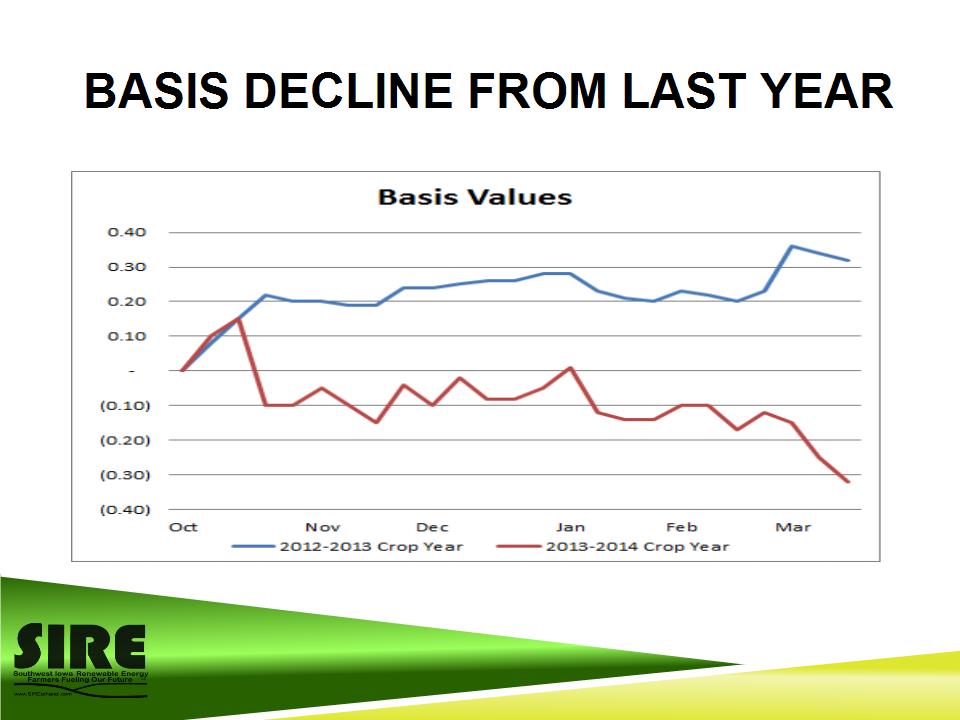

BASIS DECLINE FROM LAST YEAR

CASH PRICE DECLINE’S WITH LARGER ENDING STOCKS 1.968 MBU PREDICTED NEXT YEAR

Co-Products We make approximately 1,000 tons per day of distiller co-products. DDG feeds cattle, hogs, poultry, goats, fish, etc. We ship DDG from SIRE nearly all over the US and export to China and Mexico via railcars, trucks or containers.

WDG – Wet Distillers Grain Our customer base has continued to grow as more feeders try wet distillers grains and like its: Consistency Digestibility Value as a feed source

All Products Can Be Bought Direct!! Common Misconception: You can only buy thru a broker – this is not true!! We have many different options to make it easy for you to use co products from SIRE. We Offer: fob or delivered contracts no minimum volumes load syrup and wet feed 24/7 you can contract with us on spot or forward contracts We prefer to sell direct to the end user like you!!

Focus for 2014 Debt Refinance Operate Safely Operate Profitably Manage Risk Operate Plant at High Volume When Margins Allow Increase Grain Storage Capacity Evaluate New Technology; Continue Diversification Continue Retiring Debt Quickly Pay members distributions Plan for 2015 thru 2019 Questions?