Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DOVER Corp | d694364d8k.htm |

BAML Global Industrials & EU Autos Conference

Robert Livingston

President & CEO

March 20, 2014

Exhibit 99.1 |

| 2

Forward looking statements

We want to remind everyone that our comments may contain forward-looking

statements that are inherently subject to uncertainties. We caution everyone to

be guided in their analysis of Dover Corporation by referring to

our Form 10-K

for a list of factors that could cause our results to differ from those anticipated

in any such forward-looking statements.

We would also direct your attention to our website,

dovercorporation.com, where considerably more

information can be found. 2 |

3

Since our last Dover Day investor meeting…

Building our industrial businesses

–

Continued to expand in our growth areas

Energy, Fluids, Refrigeration, Printing & ID all grew organically

and through acquisition

–

Anthony, Finder, KPS, Fibrelite and MS all expand product

breadth and geographic reach

–

Our business profile is more consistent and focused

with sustainable higher margins

New segment structure to capture growth opportunities

–

Energy, Fluids, Refrigeration & Food Equipment,

and Engineered Systems

The next generation of Dover leadership to drive performance

–

Andy Fincher, Bill Johnson and Soma Somasundaram to lead

Engineered Systems, Refrigeration & Food Equipment,

and Energy, respectively

3 |

4

…but our strengths remain unchanged

Customer intimacy

–

Innovate for the customer

We win when we help our customers win

Recurring theme of delivering efficiency (energy, cost & speed)

and sustainability

–

Superior customer service

On-time delivery, quality, support

Leverage our scale

Generate cash

–

Free cash flow remains consistently strong

Market share leadership

–

Strong focus on technology leadership and innovation

drive share gains and customer loyalty

4 |

5

Dover has several levers for value creation

5

GROWTH

3% -

5% organically,

complemented by

acquisition growth

MARGIN

Expand segment

margin to 19%

CASH FLOW

Generate free cash flow in

excess of 10% of revenue

Substantial growth

opportunities

Accelerated

productivity initiatives

Significant balance

sheet optionality

Mid-term targets*

*Mid-term: 2014 -2016 |

6

Energy: At a glance

Dover

Energy

is

a

leading

provider

of

customer driven solutions and services for

safe and efficient production and

processing of fuels worldwide, and has a

strong presence in the bearings and

compression components market. |

7

Growth opportunities: A look forward

Energy

–

Significant investments in sales, field engineering and

facilities are paying dividends….will continue in 2014

24% and 45% international growth* in 2012 and in 2013

–

Increase participation in global tenders

Middle East, South America & Australia

–

Seek additional industry partnership opportunities

–

Progressive cavity pumps……..others

–

Remote monitoring/automation for oil and gas production

–

Leverage plunger and gas lift technologies into international markets

–

Strengthen our position in faster growing basins

–

Increase OEM share in bearings and compression

7

*Note: Outside North America and Europe, on a pro forma basis

Continue to expand geographical presence

Fill in product gaps internally and through acquisition

Grow core business |

8

Engineered Systems: At a glance

Dover

Engineered

Systems

is

focused

on

the design, manufacture and service of

critical equipment and components serving

the printing & identification, vehicle service,

waste handling, and select niche industrial

end-markets. |

9

Growth opportunities: A look forward

Engineered Systems

–

Recent MS acquisition adds exposure to fast growing textile markets

Capitalize on “analog to digital”

trend

Leverage ink expertise to drive additional opportunity

Extend technology to other textiles including flooring and wall coverings

–

Grow North American and China presence in core markets

–

Concentrate on after-market customer productivity solutions

Curotto Can a great example of creating value in “mature”

markets

More opportunities in vehicle service markets

–

Expand in high growth recycling and waste-to energy markets

–

Achieve YOY 10%+ growth outside the US

–

Growing middle class consumption and higher operating costs

driving automation solutions in emerging markets

9

Expand markets served in Printing & Identification

Make focused industrial investments

Extend geographic reach |

10

Fluids: At a glance

Dover

Fluids

is

focused

on

the

safe

handling of critical fluids across the oil &

gas, retail fueling, chemical, hygienic and

industrial end-markets. |

11

Growth opportunities: A look forward

Fluids

–

Targeting

25%

growth

in

markets

outside

North

America

and

Europe

in

2014

Grow presence in Middle East and China through Maag and Finder channels

Double revenue in Australia through Ebsray’s LPG and chemical pump

technologies

–

Complete “station in a box”

offering worldwide with KPS and Fibrelite

–

Penetrate North American plastics and oil & gas markets though European

acquisitions

–

Build comprehensive offering of highly engineered pump technologies

–

Innovate around automation, energy efficiency and evolving regulatory

standards –

Expand hygienic pump presence

11

Leverage our global footprint to accelerate growth

Develop and acquire products that provide complete solutions

Access new markets through recent acquisitions |

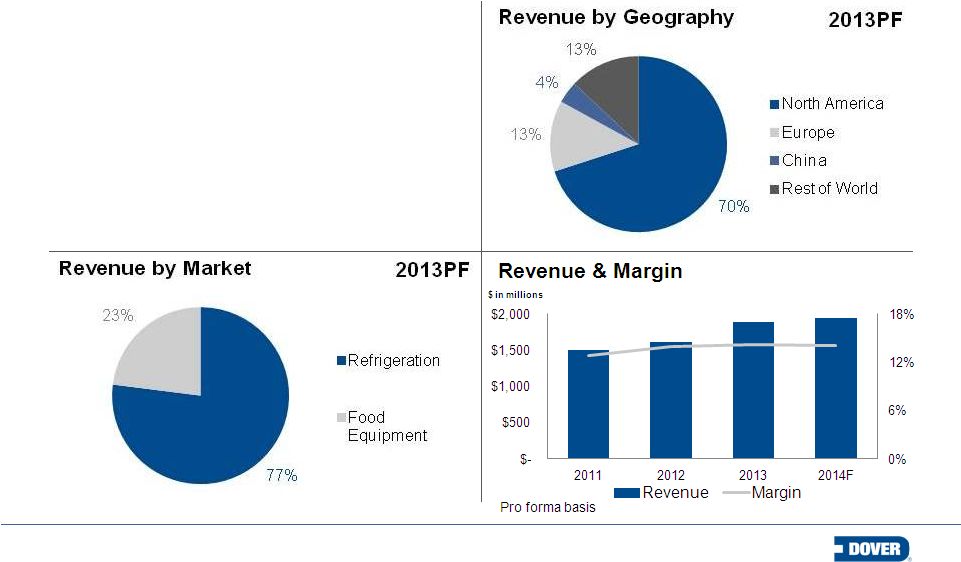

12

Refrigeration & Food Equipment: At a glance

Dover Refrigeration & Food Equipment

is the leading provider of energy efficient

equipment and systems serving the

commercial refrigeration and food service

industries. |

13

Growth opportunities: A look forward

Refrigeration & Food Equipment

–

Build share with targeted accounts

–

Leverage strong customer relationships as supermarket chains expand globally

–

Rising energy costs and increasing government regulation are driving strong demand

for energy efficient solutions

Close-the-case sales grew +15% in 2013 with strong growth expected to

continue –

Large retailers shifting to smaller store formats

–

C-store and “Dollar”

stores expected to continue above market growth rates

–

Convergence of refrigeration and food equipment in supermarket

–

Extend Anthony after-market business

–

Build turn-key refrigeration capabilities in Brazil and Europe; Add-ons in

food equipment 13

Develop broader customer base

Capitalize on secular trends

Penetrate higher growth adjacent markets

Leverage new sales channel organization and synergies

Acquire assets that expand technology and geography |

14

Margin enhancement through productivity

Global supply chain

–

Program now in its 5

th

year

–

Continuing to leverage the scale of Dover

Many spend categories are being reviewed again

$90

-$120

million

in

savings

or

cost

avoidance

expected

over

the

next

3

years

Shared manufacturing

–

Several consolidation projects are near completion

Hill

Phoenix

will

consolidate

4

sites

in

Atlanta

area

~$3M

of

annualized

savings

*

Energy

will

combine

5

sites

in

Houston

~$1M

of

annualized

savings

*

More projects are on the way

Investing in Lean and Post-Merger Integration (“PMI”)

–

Adding lean resources across segments

–

PMI leaders driven to integrate faster with focus on near term accretion

14

* Annualized savings over 3 years (2014 –

2016) |

15

Capital allocation: Recent history

Consistently returning cash

to shareholders

Acquisition spending will

remain disciplined

15

* Includes Knowles capex and acquisitions |

16

Capital allocation 2014

Strong balance sheet

–

$800 million cash as of December 31, 2013 (primarily overseas)

–

$400 million from Knowles

–

$170 million in proceeds from DEK sale (expected mid-year)

–

Strong free cash flow

We

expect

to

raise

the

dividend

for

59

th

consecutive

year

Capex expected to be roughly $200 million

Acquisitions

–

Pipeline is active

–

Could close $500 million to $1 billion in deals this year

Will complete $1 billion program in Q1

–

Capacity to do more; largely dependent on how pipeline develops

16 |

17

Summary

2014

Organic

growth rate

Mid-term

(a)

Organic

Growth rate

Energy

4% -

5%

4% -

6%

Engineered Systems

3% -

4%

3% -

5%

Fluids

4% -

5%

4% -

6%

Refrigeration & Food

Equipment

2% -

3%

2% -

4%

Total organic

3% -

4%

3% -

5%

Acquisitions

3%

(b)

5%

Total growth

6% -

7%

8% -

10%

Mid-term growth complemented by:

–

Mid-term margin expansion to 19%

driven by continuing focus on lean and

productivity initiatives

–

Strong free cash flow generation in

excess of 10% of revenue

–

Consistent return of cash to

shareholders

17

(a): 2014 –

2016

(b): Growth from completed acquisitions

2014 is on track

–

Early bookings trends show solid

broad-based growth

–

Q1 revenue growth as expected,

sequentially in-line with Q4 2013

–

EPS seasonality generally consistent

with last year

Q1

2013

Q2

2013

Q3

2013

Q4

2013

FY

2013

Adjusted EPS*

$0.93

$1.13

$1.25

$1.02

$4.33

% of FY

21%

26%

29%

24%

100%

*

See appendix slide for reconciliation |

*

*

*

*

*

*

*

*

*

***************************** |

19

Appendix –

2013 Quarterly adjusted EPS from continuing operations

(unaudited) (in thousands, except per share data)

Q1

Q2

Q3

Q4

FY 2013

REVENUE:

Energy

462,679

$

465,906

$

467,688

$

457,580

$

1,853,853

$

Engineered Systems

605,325

639,426

642,205

651,606

2,538,562

Fluids

273,638

310,137

309,241

343,822

1,236,838

Refrigeration & Food Equipment

422,468

517,574

521,322

426,476

1,887,840

Intra-segment eliminations

(133)

(632)

(245)

(430)

(1,440)

Total consolidated revenue

1,763,977

$

1,932,411

$

1,940,211

$

1,879,054

$

7,515,653

$

EARNINGS FROM CONTINUING OPERATIONS:

Segment earnings:

Energy

118,708

$

109,662

$

119,086

$

112,193

$

459,649

$

Engineered Systems

83,283

102,804

111,850

101,511

399,448

Fluids

47,601

58,768

63,056

55,098

224,523

Refrigeration & Food Equipment

52,110

82,177

86,446

46,574

267,307

Total segments

301,702

353,411

380,438

315,376

1,350,927

Corporate expense / other

33,632

34,860

32,532

28,752

129,776

Net interest expense

30,284

30,232

30,236

29,920

120,672

Earnings from continuing operations before provision for

income taxes

237,786

288,319

317,670

256,704

1,100,479

Provision for income taxes

70,573

30,261

91,435

74,138

266,407

Earnings from continuing operations

167,213

$

258,058

$

226,235

$

182,566

$

834,072

$

BASIC EARNINGS PER COMMON SHARE:

Earnings from continuing operations

0.96

$

1.51

$

1.33

$

1.07

$

4.87

$

Weighted average shares outstanding

173,448

171,111

170,544

170,027

171,271

DILUTED EARNINGS PER COMMON SHARE:

Earnings from continuing operations

0.95

$

1.49

$

1.31

$

1.06

$

4.81

$

Weighted average shares outstanding

175,567

173,097

172,734

172,265

173,547

ADJUSTED EARNINGS FROM CONTINUING OPERATIONS:

Earnings from continuing operations

167,213

$

258,058

$

226,235

$

182,566

$

834,072

$

Gains from discrete and other tax items

4,343

61,477

7,751

6,084

79,655

Other one-time gains, net of tax

-

-

2,866

-

2,866

Adjusted earnings from continuing operations

162,870

$

196,581

$

211,782

$

180,318

$

751,551

$

ADJUSTED DILUTED EARNINGS PER COMMON SHARE:

Earnings from continuing operations

0.95

$

1.49

$

1.31

$

1.06

$

4.81

$

Gains from discrete and other tax items

0.02

0.36

0.04

0.04

0.46

Other one-time gains, net of tax

-

-

0.02

-

0.02

Adjusted earnings from continuing operations

0.93

$

1.13

$

1.25

$

1.02

$

4.33

$

2013 |