Attached files

| file | filename |

|---|---|

| 8-K - Vertex Energy Inc. | vertex8k.htm |

| EX-2.1 - Vertex Energy Inc. | ex2-1.htm |

| EX-99.1 - Vertex Energy Inc. | ex99-1.htm |

EXHIBIT 99.2

Vertex Energy Acquisition Of Omega March 20, 2014 Ben Cowart, CEO – Vertex Energy Chris Carlson, CFO – Vertex Energy Ric Silverberg, CEO – Omega Holdings Dave Peel, COO – Omega Holdings VTNR NASDAQ LISTED

Disclaimer This document may contain forward-looking statements including words such as “may,” “can,” “could,” “should,” “predict,” “aim,” “potential,” “continue,” “opportunity,” “intend,” “goal,” “estimate,” “expect,” “expectations,” “project,” “projections,” “plans,” “anticipates,” “believe,” “think,” “confident,” “scheduled,” or similar expressions, as well as information about management’s view of Vertex Energy’s future expectations, plans and prospects, within the safe harbor provisions under Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors which may cause the results of Vertex Energy, its divisions and concepts to be materially different than those expressed or implied in such statements. These risk factors and others are included from time to time in documents Vertex Energy files with the Securities and Exchange Commission, including, but not limited to, its Form 10-Ks, Form 10-Qs and Form 8-Ks. Other unknown or unpredictable factors also could have material adverse effects on Vertex Energy’s future results. The forward-looking statements included in this presentation are made only as of the date hereof. Vertex Energy cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, Vertex Energy undertakes no obligation to update these statements after the date of this presentation, except as required by law, and also undertakes no obligation to update or correct information prepared by third parties that are not paid for by Vertex Energy. Recovering Tomorrow’s Energy

Transaction Overview Transaction Acquisition of re-refining assets from Omega Holdings Transaction structured in two closing Expected to close on Omega Refining assets (Marrero & Myrtle Grove) and Golden State Lube Works by April 15th Expected to close on Bango in Q3 when facility is fully restored Consideration $38.2M purchase price ($30.8M of cash and 2M shares of stock) (1) $9.7M of assumed capital leases and other liabilities Additional stock consideration issued upon achieving earn-out 949,000 shares of stock if Marrero generates $9M of EBITDA(2) Additional $9M of stock if Bango generates $5M of EBITDA in each of 2015 and 2016 (3) Financing Vertex intends to enter into a new term debt bank facility prior to the first closing and expand its existing line of credit Vertex will provide the seller with a $1.6M short-term line of credit between Initial Close and Second close (bearing 9.5% interest) Vertex will also hold a $5.8M promissory note, which is satisfied at 2nd close Note: 1. Excluding value of earn-out and assumed leases and liabilities; subject to adjustment based on inventory levels 2. During any 12 month period for the first 18 months after closing; subject to partial payment based upon achieving minimum $8M EBITDA 3. Based on 10-day VWAP (min. price of $3.15 and max of $10.00); subject to partial payment based upon achieving minimum $3.5M EBITDA Recovering Tomorrow’s Energy

Overview of the Companies Vertex is a leading recycler of used motor oil and refiner of off-specification petroleum and chemical co-products. Vertex’s Black Oil division collects and purchases used motor oil directly from third-party generators and aggregates used motor oil from an established network of local and regional collectors. The used motor oil is either sold to industrial burners or re-refineries, or it is processed in-house using the Company’s proprietary Thermal Chemical Extraction Process (“TCEP”) technology and sold to end customers as a higher-value product. Vertex’s Refining and Marketing division aggregates and manages the refining of petroleum distillates and other off-specification products and sells the refined products to end customers. LTM Revenue = $147M (1) LTM Adj. EBITDA = $6.7M Omega Holdings is one of the largest re-refiners of used motor oil in the US. It produces Vacuum Gas Oil (“VGO”) and base oil products. 2013 Revenue (Approx.) = $185M Marrero – 60M+ gallon re-refining facility located in Louisiana producing VGO Bango – 20M+ gallon re-refining facility located in Nevada producing base oils Myrtle Grove – High potential asset located 26 miles from Marrero which could be used as a future base oil or white oil production facility, receiving VGO from Marrero facility (45 acre facility) Golden State Lube Works (GSLW) - blending and storage facility in Bakersfield, CA Creating a deeply integrated player in the UMO recycling industry that can better manage costs, finished product prices, and growth Recovering Tomorrow’s Energy

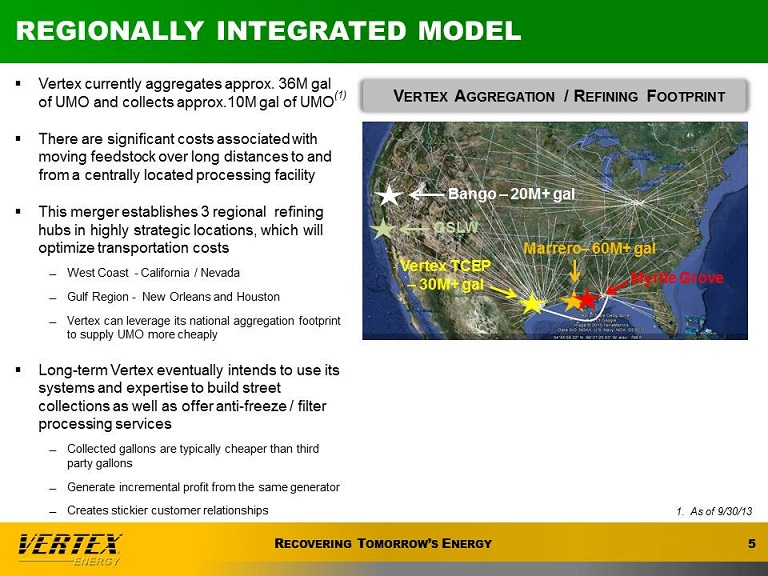

Regionally integrated model Vertex currently aggregates approx. 36M gal of UMO and collects approx.10M gal of UMO(1) There are significant costs associated with moving feedstock over long distances to and from a centrally located processing facility This merger establishes 3 regional refining hubs in highly strategic locations, which will optimize transportation costs West Coast - California / Nevada Gulf Region - New Orleans and Houston Vertex can leverage its national aggregation footprint to supply UMO more cheaply Long-term Vertex eventually intends to use its systems and expertise to build street collections as well as offer anti-freeze / filter processing services Collected gallons are typically cheaper than third party gallons Generate incremental profit from the same generator Creates stickier customer relationships Vertex Aggregation / Refining Footprint (1) As of 9/30/13 Bango – 20M+ gal GSLW Vertex TCEP – 30M+ gal Marrero– 60M+ gal Myrtle Grove Recovering Tomorrow’s Energy

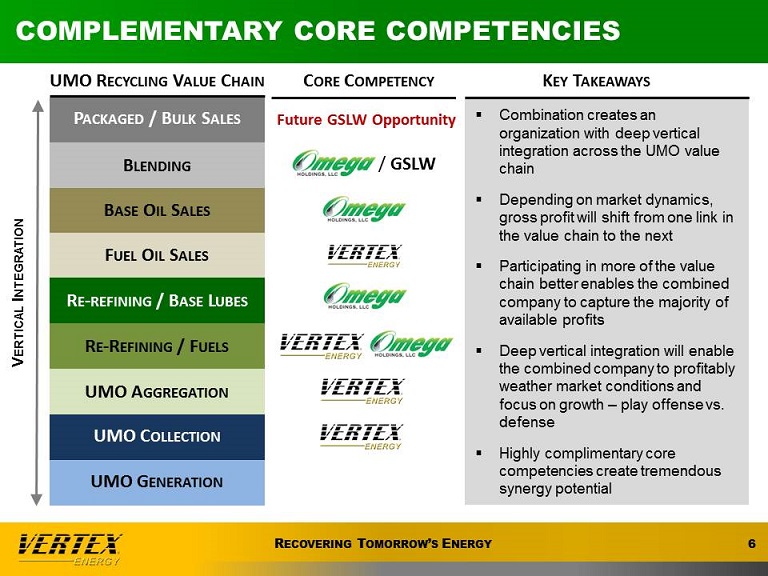

Complementary Core competencies UMO Recycling Value Chain Packaged / Bulk Sales Blending Base Oil Sales Fuel Oil Sales Re-refining / Base Lubes Re-Refining / Fuels UMO Aggregation UMO Collection UMO Generation Core Competency Future GSLW Opportunity Omega Holdings LLC Vertex Energy / GSLW Key Takeaways Combination creates an organization with deep vertical integration across the UMO value chain Depending on market dynamics, gross profit will shift from one link in the value chain to the next Participating in more of the value chain better enables the combined company to capture the majority of available profits Deep vertical integration will enable the combined company to profitably weather market conditions and focus on growth – play offense vs. defense Highly complimentary core competencies create tremendous synergy potential Vertical Integration Recovering Tomorrow’s Energy

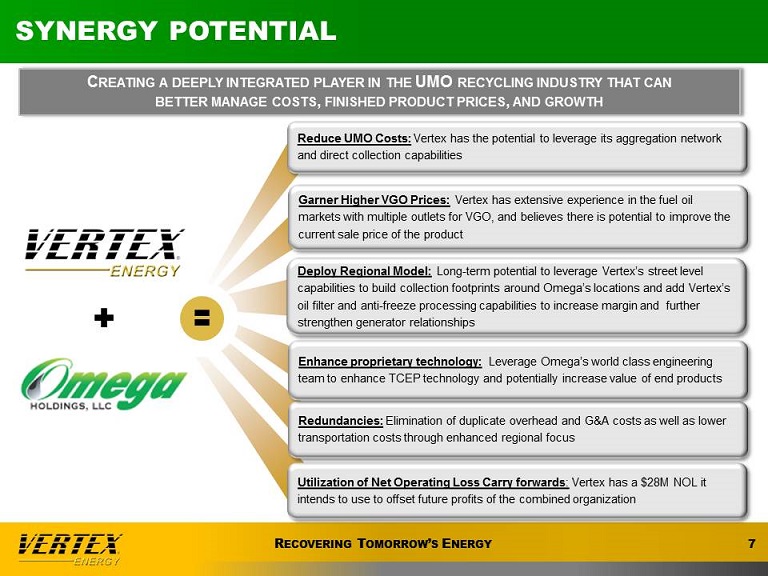

synergy potential Reduce UMO Costs: Vertex has the potential to leverage its aggregation network and direct collection capabilities Creating a deeply integrated player in the UMO recycling industry that can better manage costs, finished product prices, and growth Garner Higher VGO Prices: Vertex has extensive experience in the fuel oil markets with multiple outlets for VGO, and believes there is potential to improve the current sale price of the product Deploy Regional Model: Long-term potential to leverage Vertex’s street level capabilities to build collection footprints around Omega’s locations and add Vertex’s oil filter and anti-freeze processing capabilities to increase margin and further strengthen generator relationships Enhance proprietary technology: Leverage Omega’s world class engineering team to enhance TCEP technology and potentially increase value of end products Redundancies: Elimination of duplicate overhead and G&A costs as well as lower transportation costs through enhanced regional focus Utilization of Net Operating Loss Carry forwards: Vertex has a $28M NOL it intends to use to offset future profits of the combined organization Recovering Tomorrow’s Energy

Acquisition Thesis Summary Deep vertical integration to better manage input costs and sale prices Enhanced size, scale and diversification Highly complementary core competencies World-Class engineering expertise Potential to realize significant synergies Well positioned to capitalize on changing dynamics in the umo industry Accelerates regionally integrated model Optimize transportation costs Recovering Tomorrow’s Energy

OVERVIEW OF OMEGA

Marrero Originally constructed in 1992 by Chevron Texaco and located in Louisiana Through significant engineering and operations improvements, including the installation of an evaporator unit, Omega substantially increased the facility’s daily throughput Pre Omega: ~100,000 GPD Post Omega: 180,000+ GPD Based on continued improvements, Omega estimates annual throughput to be over 60+ million gallons of UMO, yielding 48+ million gallons of VGO Recovering Tomorrow’s Energy

Myrtle grove Omega is currently leasing and developing approximately 45 acres of land on the Gulf Coast in Myrtle Grove, LA Located 26 miles from Marrero and could be used as a future base oil or white oil production facility, receiving VGO from Marrero facility Site will have 9 million gallons of storage and is currently accessible by truck Other existing infrastructure includes office and maintenance buildings, lab, control room, and process area with existing piling & concrete, loading & unloading, and fire protection for process area Barge and rail access are subject to permit approval Landlord will operate waste water treatment Recovering Tomorrow’s Energy

Bango The Bango facility commenced operations in 2006 The facility originally lacked sufficient infrastructure and by 2011 was unable to sustain ongoing losses Omega began leasing the Bango plant in 2010 and implemented substantial improvements to increase throughput: Pre Omega: 17,500 GPD Omega forecasts the Bango facility to reach north of 65,000 GPD – 23+ million gallons annualized Bango is strategically located to serve the West Coast lubricants and base oil markets The facility has rail and truck access and is located approximately 75 miles from the CA border Recovering Tomorrow’s Energy

Golden State For purposes of operating a strategic blending facility on the West Coast, in 2012 Omega leased the blending facility at a former Tricor refinery in Bakersfield, CA Possesses a state-of-the-art quality control laboratory 56 storage tanks containing just under 5 million gallons of storage capacity Excellent rail and trucking access and unloading slots The primary blending and storage area is in excellent condition and is located on concrete slabs and diked to prevent potential environmental issues Recovering Tomorrow’s Energy