Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - COMMUNITY FINANCIAL CORP /MD/ | v372121_8k.htm |

1 1 Parent of: Investor Presentation March 2014

2 Certain statements contained in this presentation are “forward - looking statements” within the meaning of the protections of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 or the Exchange Act . These forward - looking statements are covered by the safe harbor provisions for forward - looking statements contained in the Private Securities Litigation Reform Act of 1995 , and we are including this statement for purposes of invoking these safe harbor provisions . Forward - looking statements are made based on our management’s expectations and beliefs concerning future events impacting our company and are subject to uncertainties and factors relating to our operations and economic environment, all of which are difficult to predict and many of which are beyond our control . You can identify these statements from our use of the words “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target,” “may” and similar expressions . These forward - looking statements may include, among other things : ▪ statements relating to projected growth, anticipated improvements in earnings, earnings per share, and other financial performance measures, and management’s long - term performance goals ; ▪ statements relating to the anticipated effects on results of operations or our financial condition from expected developments or events ; ▪ statements relating to our business and growth strategies ; and ▪ any other statements which are not historical facts . Forward - looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements to differ materially from our expectations of future results, performance or achievements, or industry results, expressed or implied by these forward - looking statements . These forward - looking statements may not be realized due to a variety of factors, including without limitation : ▪ the effects of future economic, business and market conditions ; ▪ changes in interest rates ; ▪ governmental monetary and fiscal policies ; ▪ changes in prices and values of real estate ; ▪ legislative and regulatory changes, including changes in banking, securities and tax laws and regulations and their application by our regulators, including changes in the cost and scope of FDIC insurance ; ▪ the failure of assumptions regarding the levels of non - performing assets and the adequacy of the allowance for loan losses ; ▪ weaker than anticipated market conditions in our primary market areas ; ▪ the effects of competition in our market areas ; ▪ liquidity risks through an inability to raise funds through deposits, borrowings or other sources, or to maintain sufficient liquidity at the Company separate from the Bank’s liquidity ; ▪ volatility in the capital and credit markets ; and ▪ the other risk factors discussed from time to time in the periodic reports that we file with the SEC, including our Annual Report on Form 10 - K for the year ended December 31 , 2013 . You should not place undue reliance on any forward - looking statement . Forward - looking statements speak only as of the date made . We undertake no obligation to update any forward - looking statement to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events . NOTE REGARDING NON - GAAP FINANCIAL MEASURES This presentation contains financial information determined by methods other than those prescribed by accounting principles generally accepted in the United States of America ("GAAP") . These non - GAAP financial measures include the following : efficiency ratio, tangible common equity, tangible book value per common share, tangible common equity to tangible assets and tangible equity to tangible assets . Management uses these non - GAAP financial measures because it believes that they are useful for evaluating our operations and performance over periods of time, as well as in managing and evaluating our business and in discussions about our operations and performance . Management believes these non - GAAP financial measures provide users of our financial information with meaningful measures for assessing our financial results, as well as comparison to financial results for prior periods . These non - GAAP financial measures should not be considered as a substitute for financial measures determined in accordance with GAAP and may not be comparable to other similarly titled financial measures used by other companies . For a reconciliation of the differences between our non - GAAP financial measures and the most comparable GAAP measures, please refer to the Appendix of this presentation . Forward Looking Information

3 Corporate Overview

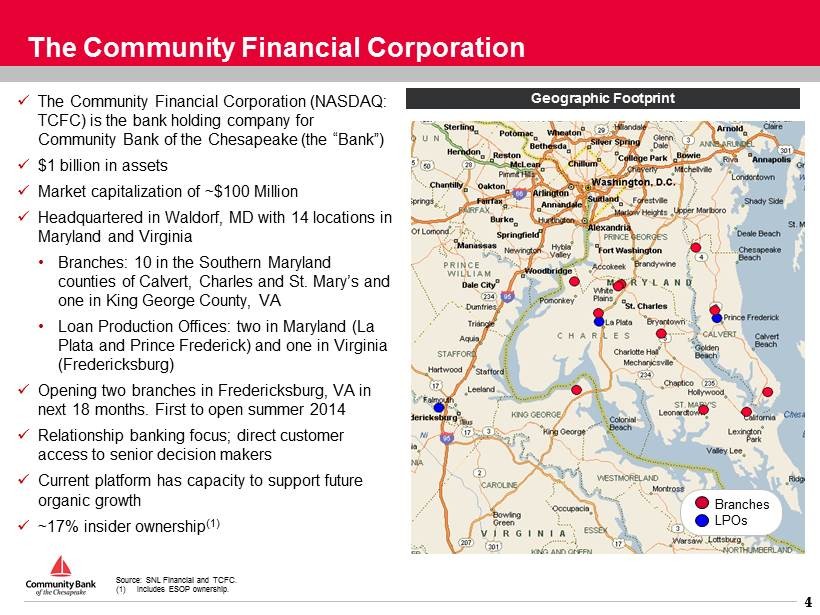

4 4 The Community Financial Corporation x The Community Financial Corporation (NASDAQ: TCFC) is the bank holding company for Community Bank of the Chesapeake (the “Bank”) x $1 billion in assets x Market capitalization of ~$100 Million x Headquartered in Waldorf, MD with 14 locations in Maryland and Virginia • Branches: 10 in the Southern Maryland counties of Calvert, Charles and St. Mary’s and one in King George County, VA • Loan Production Offices: two in Maryland (La Plata and Prince Frederick) and one in Virginia (Fredericksburg) x Opening two branches in Fredericksburg, VA in next 18 months. First to open summer 2014 x Relationship banking focus; direct customer access to senior decision makers x Current platform has capacity to support future organic growth x ~17% insider ownership (1) Branches LPOs Geographic Footprint Source: SNL Financial and TCFC. (1) Includes ESOP ownership.

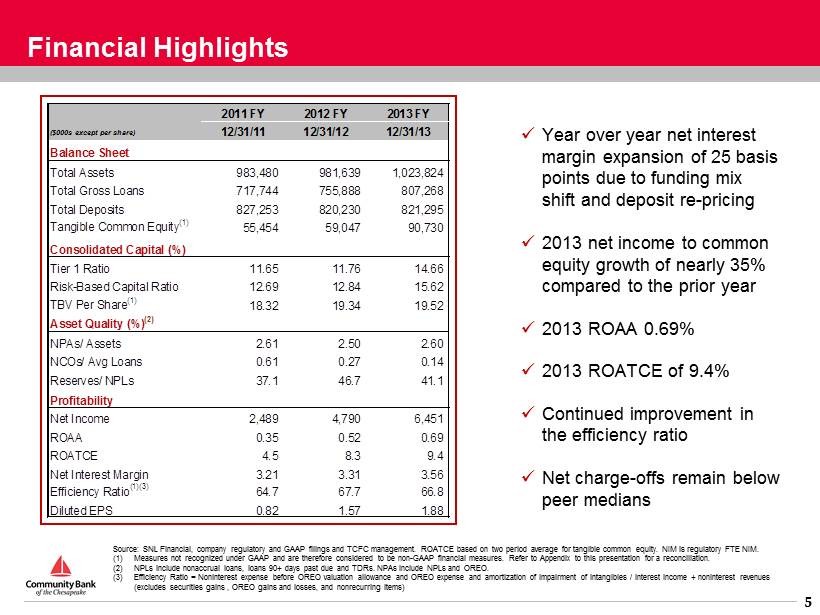

5 5 Financial Highlights Source: SNL Financial, company regulatory and GAAP filings and TCFC management. ROATCE based on two period average for tangib le common equity. NIM is regulatory FTE NIM. (1) Measures not recognized under GAAP and are therefore considered to be non - GAAP financial measures. Refer to Appendix to this pre sentation for a reconciliation. (2) NPLs include nonaccrual loans, loans 90+ days past due and TDRs. NPAs include NPLs and OREO. (3) Efficiency Ratio = Noninterest expense before OREO valuation allowance and OREO expense and amortization of impairment of intangibles / interest income + noninterest revenues (excludes securities gains , OREO gains and losses, and nonrecurring items) x Year over year net interest margin expansion of 25 basis points due to funding mix shift and deposit re - pricing x 2013 net income to common equity growth of nearly 35% compared to the prior year x 2013 ROAA 0.69% x 2013 ROATCE of 9.4% x Continued improvement in the efficiency ratio x Net charge - offs remain below peer medians 2011 FY 2012 FY 2013 FY ($000s except per share) 12/31/11 12/31/12 12/31/13 Balance Sheet Total Assets 983,480 981,639 1,023,824 Total Gross Loans 717,744 755,888 807,268 Total Deposits 827,253 820,230 821,295 Tangible Common Equity (1) 55,454 59,047 90,730 Consolidated Capital (%) Tier 1 Ratio 11.65 11.76 14.66 Risk-Based Capital Ratio 12.69 12.84 15.62 TBV Per Share (1) 18.32 19.34 19.52 Asset Quality (%) (2) NPAs/ Assets 2.61 2.50 2.60 NCOs/ Avg Loans 0.61 0.27 0.14 Reserves/ NPLs 37.1 46.7 41.1 7655 8247 8138 Profitability Net Income 2,489 4,790 6,451 ROAA 0.35 0.52 0.69 ROATCE 4.5 8.3 9.4 Net Interest Margin 3.21 3.31 3.56 Efficiency Ratio (1)(3) 64.7 67.7 66.8 Diluted EPS 0.82 1.57 1.88

6 6 Investment Highlights x Strong Fundamental Operating Trends • 28 consecutive years of profitability • Return on tangible common equity of 9.4% • Net interest margin improvement driven by stable loan yields and improving funding costs x Robust Lending Pipeline x Strong Market Share and Brand Recognition in Core Footprint • Third largest deposit market share in Southern Maryland x Excellent Regional Demographics Driven by Proximity to Department of Defense (“DoD”) Headquarters, Homeland Security and Other Federal Agencies • Approximately $12B in annual procurement contracts to companies in Maryland from the DoD • 45% of Maryland’s DoD work force is made up of skilled civilian contractors conducting research, development, testing and evaluation projects • Distribution center for Dominion Power – Cove Point L iquefied Natural Gas Terminal x Shrinking Locally Based, Community Focused Commercial Bank Competitors x Experienced Senior Management Team with Strong Track Record • Average of 29 years in banking and 16 years with the Company • Proven ability to grow organically through recent economic cycle

7 7 Senior Management Team William J. Pasenelli Michael L. Middleton x Chairman and Chief Executive Officer x Joined in 1973 x President and Chief Executive Officer since 1979 x EVP and Chief Risk Officer x Joined in 2005 x Former EVP and Senior Loan Officer at Mercantile Southern Maryland Bank x President and Chief Financial Officer (TCFC) x Joined in 2000 x Former CFO of Acacia Federal Savings Bank (1987 - 2000) Gregory Cockerham x EVP and Chief Lending Officer x Joined in 1988 x Former Executive with Maryland National Bank James M. Burke Todd L. Capitani James F. Di Misa x EVP and Chief Operating Officer x Joined in 2005 x Former EVP at Mercantile Southern Maryland Bank x EVP and Chief Financial Officer (Bank) x Joined in 2009 x Former Senior Finance Manager with Deloitte Consulting and CFO of Ruesch International, Inc.

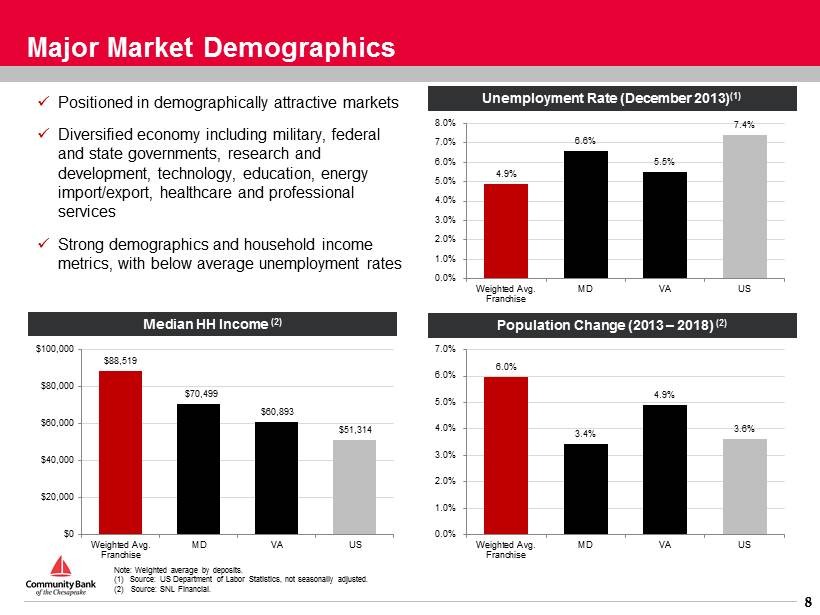

8 8 $88,519 $70,499 $60,893 $51,314 $0 $20,000 $40,000 $60,000 $80,000 $100,000 Weighted Avg. Franchise MD VA US 6.0% 3.4% 4.9% 3.6% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% Weighted Avg. Franchise MD VA US Major Market Demographics x Positioned in demographically attractive markets x Diversified economy including military, federal and state governments, research and development , technology, education , energy import/export, healthcare and professional services x Strong demographics and household income metrics, with below average unemployment rates Unemployment Rate (December 2013) (1) Note: Weighted average by deposits. (1) Source: US Department of Labor Statistics, not seasonally adjusted. ( 2 ) Source: SNL Financial. Population Change (2013 – 2018) (2) Median HH Income (2) 4.9% 6.6% 5.5% 7.4% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% Weighted Avg. Franchise MD VA US

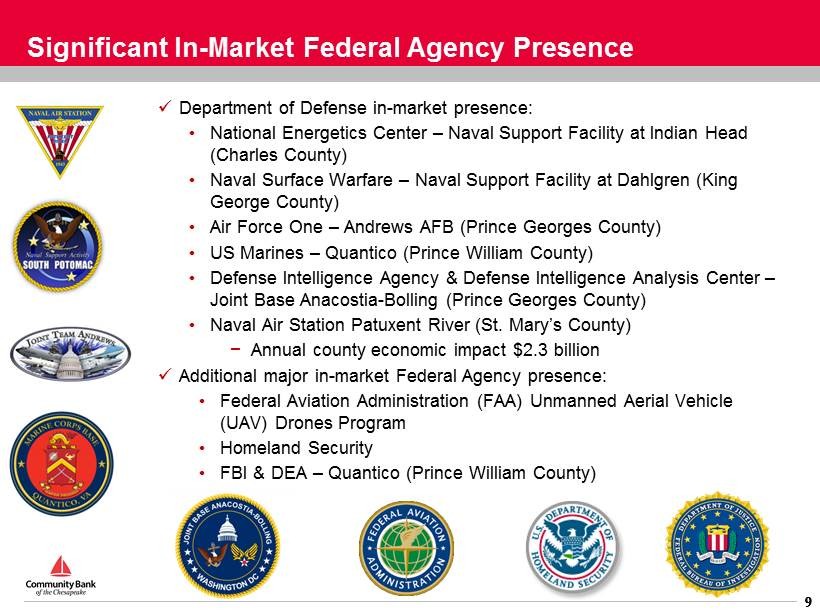

9 9 Significant In - Market Federal Agency Presence x Department of Defense in - market presence: • National Energetics Center – Naval Support Facility at Indian Head (Charles County) • Naval Surface Warfare – Naval Support Facility at Dahlgren (King George County) • Air Force One – Andrews AFB (Prince Georges County) • US Marines – Quantico (Prince William County) • Defense Intelligence Agency & Defense Intelligence Analysis Center – Joint Base Anacostia - Bolling (Prince Georges County) • Naval Air Station Patuxent River (St. Mary’s County) − Annual county economic impact $2.3 billion x Additional major in - market Federal Agency presence: • Federal Aviation Administration (FAA) Unmanned Aerial Vehicle (UAV) Drones Program • Homeland Security • FBI & DEA – Quantico (Prince William County)

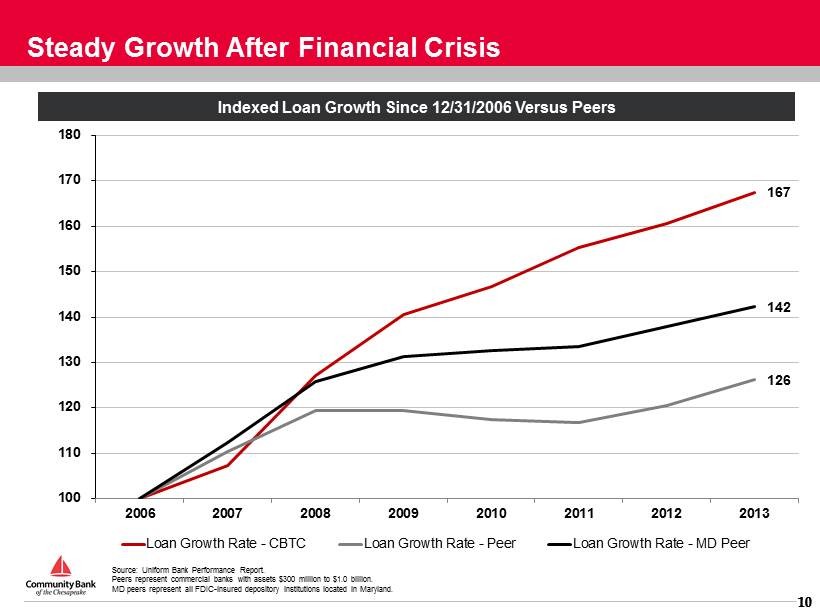

10 10 Steady Growth After Financial Crisis Source: Uniform Bank Performance Report. Peers represent commercial banks with assets $300 million to $1.0 billion. MD peers represent all FDIC - insured depository institutions located in Maryland. Indexed Loan Growth Since 12/31/2006 Versus Peers 167 126 142 100 110 120 130 140 150 160 170 180 2006 2007 2008 2009 2010 2011 2012 2013 Loan Growth Rate - CBTC Loan Growth Rate - Peer Loan Growth Rate - MD Peer

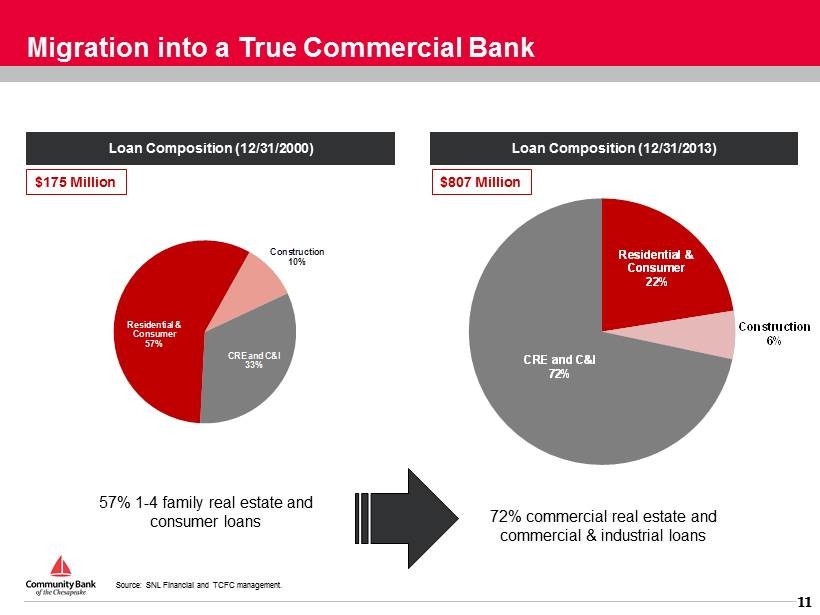

11 11 Residential & Consumer 22% Construction 6% CRE and C&I 72% Migration into a True Commercial Bank Loan Composition (12/31/2000) $175 M illion Loan Composition (12/31/2013) Source: SNL Financial and TCFC management. $807 M illion 57% 1 - 4 family real estate and consumer loans 72% commercial real estate and commercial & industrial loans CRE and C&I 33% Residential & Consumer 57% Construction 10%

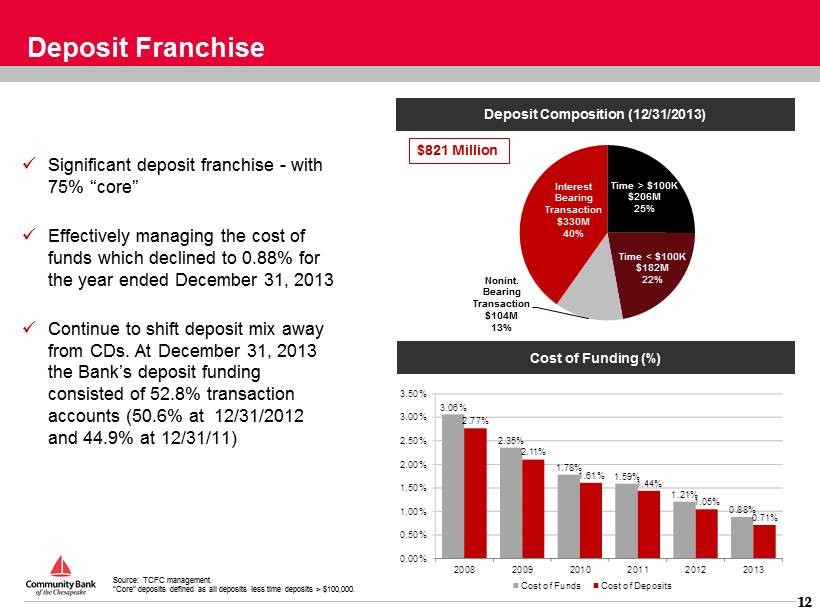

12 12 Deposit Franchise Deposit Composition (12/31/2013) x Significant deposit franchise - with 75% “core” x Effectively managing the cost of funds which declined to 0.88% for the year ended December 31, 2013 x Continue to shift deposit mix away from CDs. At December 31, 2013 the Bank’s deposit funding consisted of 52.8% transaction accounts (50.6% at 12/31/2012 and 44.9% at 12/31/11) Cost of Funding (%) $821 Million Source: TCFC management. “Core” deposits defined as all deposits less time deposits > $100,000. 3.06% 2.35% 1.78% 1.59% 1.21% 0.88% 2.77% 2.11% 1.61% 1.44% 1.05% 0.71% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 2008 2009 2010 2011 2012 2013 Cost of Funds Cost of Deposits Time > $100K $ 206M 25% Time < $100K $182M 22% Nonint. Bearing Transaction $104M 13% Interest Bearing Transaction $330M 40%

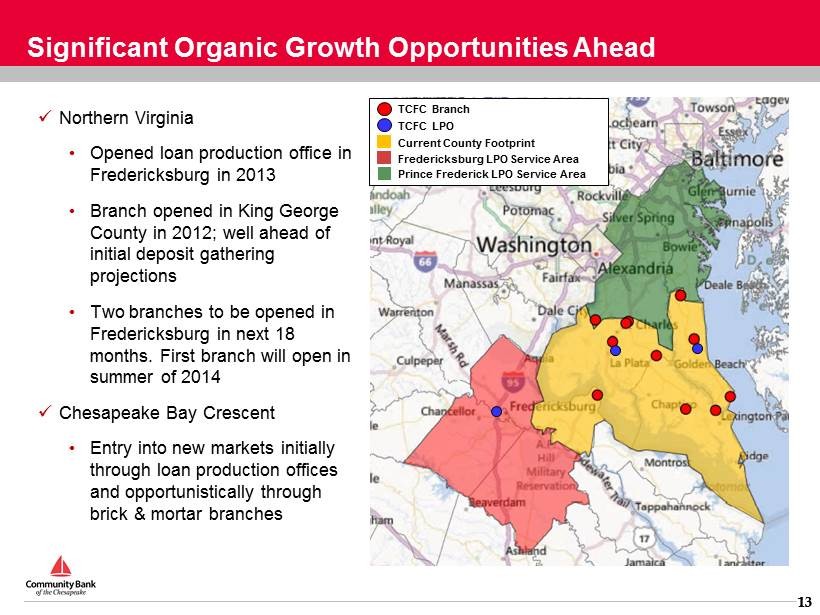

13 13 Significant Organic Growth Opportunities Ahead x Northern Virginia • Opened loan production office in Fredericksburg in 2013 • Branch opened in King George County in 2012; well ahead of initial deposit gathering projections • Two branches to be opened in Fredericksburg in next 18 months. First branch will open in summer of 2014 x Chesapeake Bay Crescent • Entry into new markets initially through loan production offices and opportunistically through brick & mortar branches TCFC Branch TCFC LPO Current County Footprint Fredericksburg LPO Service Area Prince Frederick LPO Service Area

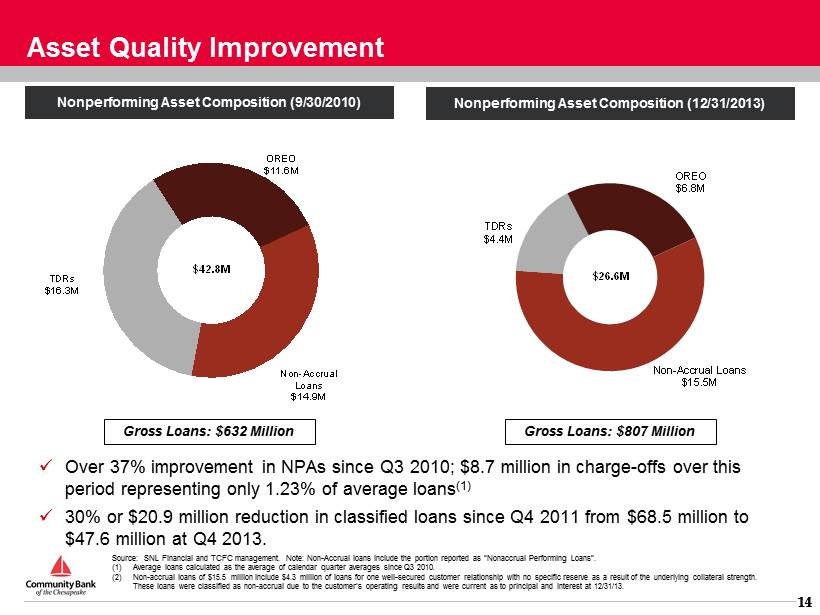

14 14 Asset Quality Improvement Source: SNL Financial and TCFC management. Note: Non - Accrual loans include the portion reported as “Nonaccrual Performing Loans”. (1) Average loans calculated as the average of calendar quarter averages since Q3 2010. (2) Non - accrual loans of $15.5 million include $4.3 million of loans for one well - secured customer relationship with no specific res erve as a result of the underlying collateral strength. These loans were classified as non - accrual due to the customer’s operating results and were current as to principal and interest at 12/31/13. Nonperforming Asset Composition (9/30/2010) Nonperforming Asset Composition (12/31/2013) x Over 37% improvement in NPAs since Q3 2010; $8.7 million in charge - offs over this period representing only 1.23% of average loans (1) x 30% or $20.9 million reduction in classified loans since Q4 2011 from $68.5 million to $47.6 million at Q4 2013. Gross Loans: $632 Million Gross Loans: $807 Million Non - Accrual Loans $14.9M TDRs $16.3M OREO $11.6M $42.8M Non - Accrual Loans $15.5M TDRs $4.4M OREO $6.8M $26.6M

15 15 Concluding Remarks x Profitable Franchise x Organic Growth Capacity x Positioned in Demographically Attractive Markets x Appealing Competitive Dynamics x Strong, Experienced Management Team

16 Appendix

17 17 Re - Branding Campaign x On October 18, 2013, the Bank re - branded “Community Bank of the Chesapeake” from “Community Bank of Tri - County” x New branding more accurately reflects our positioning as the community bank of choice throughout the western Chesapeake Bay region x Holding company was re - branded as “The Community Financial Corporation” from “Tri - County Financial Corporation” x The Company continues to trade under the symbol “TCFC”

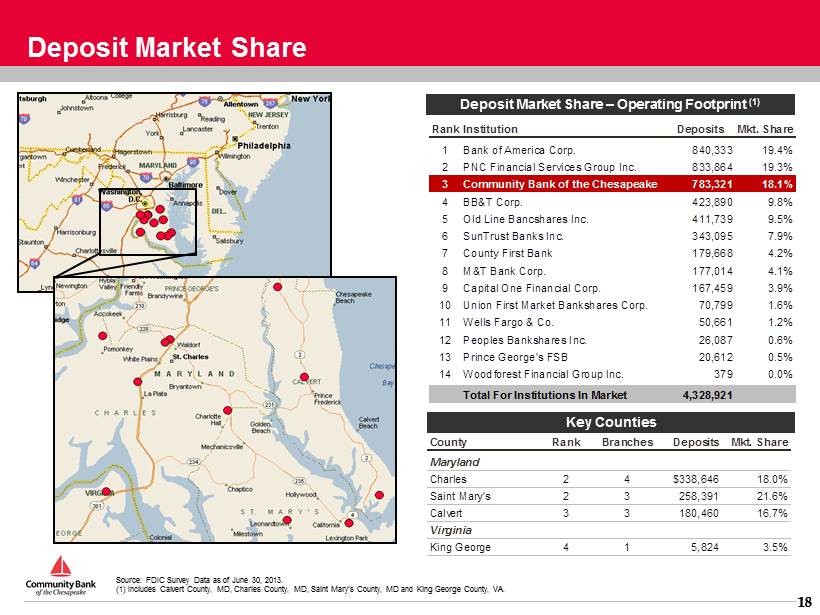

18 18 Deposit Market Share Deposit Market Share – Operating Footprint (1) Key Counties Source: FDIC Survey Data as of June 30, 2013. (1) Includes Calvert County, MD, Charles County, MD, Saint Mary’s County, MD and King George County, VA. County Rank Branches Deposits Mkt. Share Maryland Charles 2 4 $338,646 18.0% Saint Mary's 2 3 258,391 21.6% Calvert 3 3 180,460 16.7% Virginia King George 4 1 5,824 3.5% RankInstitution Deposits Mkt. Share 1 Bank of America Corp. 840,333 19.4% 2 PNC Financial Services Group Inc. 833,864 19.3% 3 Community Bank of the Chesapeake 783,321 18.1% 4 BB&T Corp. 423,890 9.8% 5 Old Line Bancshares Inc. 411,739 9.5% 6 SunTrust Banks Inc. 343,095 7.9% 7 County First Bank 179,668 4.2% 8 M&T Bank Corp. 177,014 4.1% 9 Capital One Financial Corp. 167,459 3.9% 10 Union First Market Bankshares Corp. 70,799 1.6% 11 Wells Fargo & Co. 50,661 1.2% 12 Peoples Bankshares Inc. 26,087 0.6% 13 Prince George's FSB 20,612 0.5% 14 Woodforest Financial Group Inc. 379 0.0% Total For Institutions In Market 4,328,921

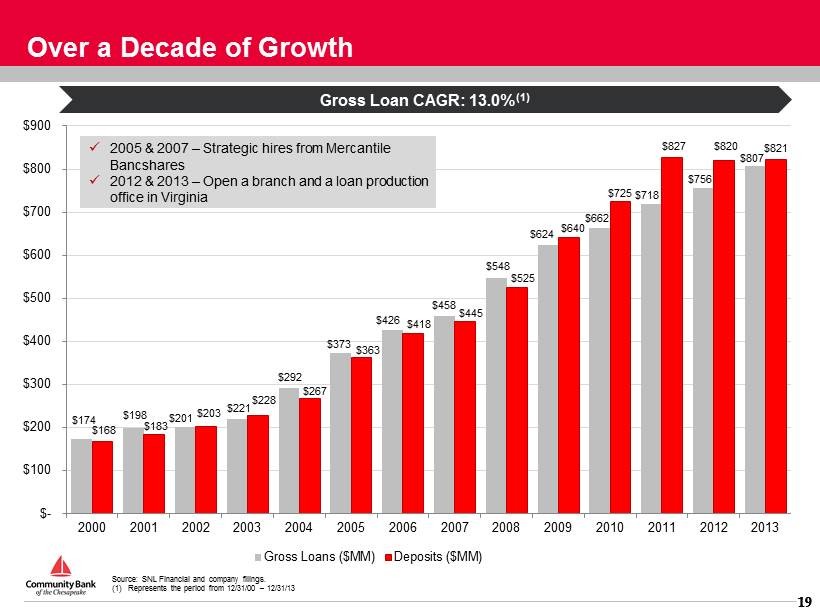

19 19 $174 $198 $201 $221 $292 $373 $426 $458 $548 $624 $662 $718 $756 $807 $168 $183 $203 $228 $267 $363 $418 $445 $525 $640 $725 $827 $820 $821 $- $100 $200 $300 $400 $500 $600 $700 $800 $900 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Gross Loans ($MM) Deposits ($MM) Gross Loan CAGR: 13.0% (1) Over a Decade of Growth Source: SNL Financial and company filings. (1) Represents the period from 12/31/00 – 12/31/13 x 2005 & 2007 – Strategic hires from Mercantile Bancshares x 2012 & 2013 – Open a branch and a loan production office in Virginia

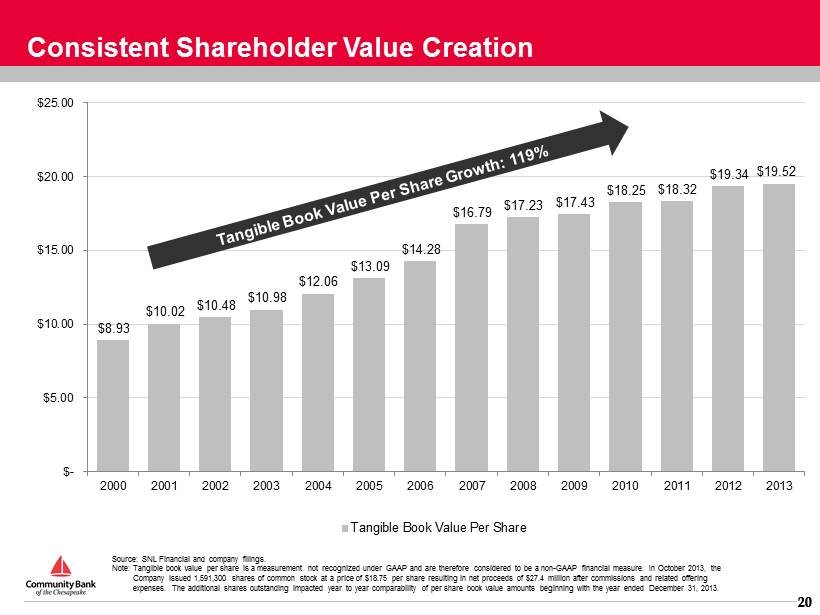

20 20 Consistent Shareholder Value Creation Source: SNL Financial and company filings. Note: Tangible book value per share is a measurement not recognized under GAAP and are therefore considered to be a non - GAAP financial measure. In October 2013, the Company issued 1,591,300 shares of common stock at a price of $18.75 per share resulting in net proceeds of $27.4 million aft er commissions and related offering expenses. The additional shares outstanding impacted year to year comparability of per share book value amounts beginning wit h t he year ended December 31, 2013. $8.93 $10.02 $10.48 $10.98 $12.06 $13.09 $14.28 $16.79 $17.23 $17.43 $18.25 $18.32 $19.34 $19.52 $- $5.00 $10.00 $15.00 $20.00 $25.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Tangible Book Value Per Share

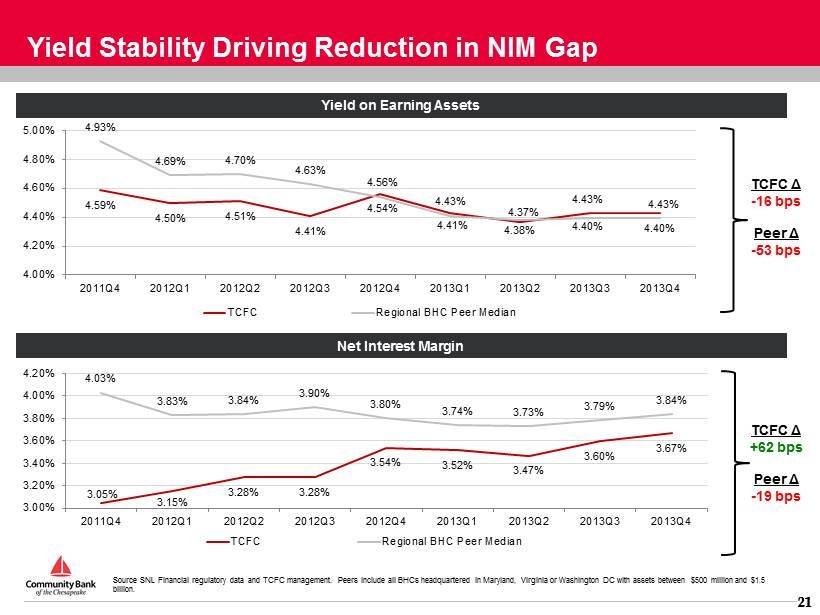

21 21 Yield Stability Driving Reduction in NIM Gap Net Interest Margin Source SNL Financial regulatory data and TCFC management. Peers include all BHCs headquartered in Maryland, Virginia or Washington DC wi th assets between $500 million and $1.5 billion. Yield on Earning Assets TCFC Δ - 16 bps Peer Δ - 53 bps TCFC Δ +62 bps Peer Δ - 19 bps 3.05% 3.15% 3.28% 3.28% 3.54% 3.52% 3.47% 3.60% 3.67% 4.03% 3.83% 3.84% 3.90% 3.80% 3.74% 3.73% 3.79% 3.84% 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 2013Q3 2013Q4 TCFC Regional BHC Peer Median 4.59% 4.50% 4.51% 4.41% 4.56% 4.43% 4.37% 4.43% 4.43% 4.93% 4.69% 4.70% 4.63% 4.54% 4.41% 4.38% 4.40% 4.40% 4.00% 4.20% 4.40% 4.60% 4.80% 5.00% 2011Q4 2012Q1 2012Q2 2012Q3 2012Q4 2013Q1 2013Q2 2013Q3 2013Q4 TCFC Regional BHC Peer Median

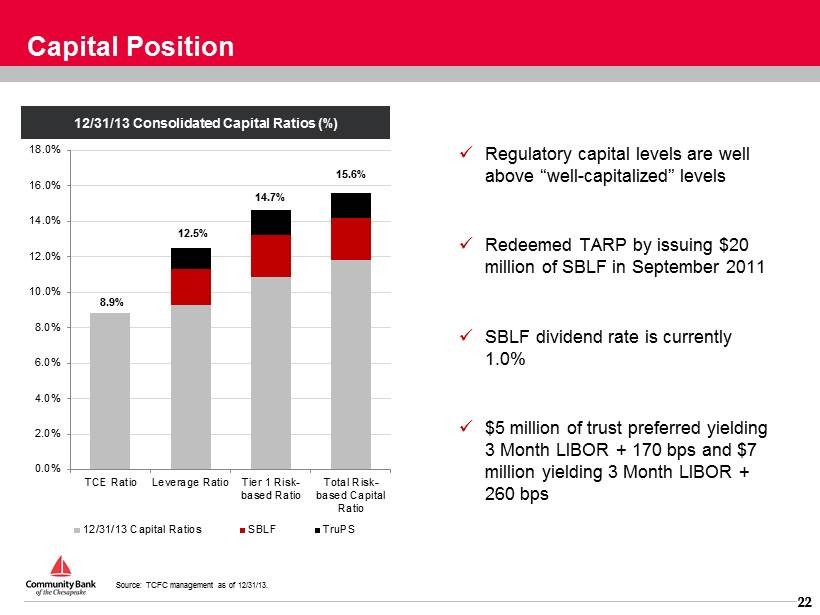

22 22 Capital Position 12/31/13 Consolidated Capital Ratios (%) x Regulatory capital levels are well above “well - capitalized” levels x Redeemed TARP by issuing $20 million of SBLF in September 2011 x SBLF dividend rate is currently 1.0% x $5 million of trust preferred yielding 3 Month LIBOR + 170 bps and $7 million yielding 3 Month LIBOR + 260 bps Source: TCFC management as of 12/31/13. 8.9% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% TCE Ratio Leverage Ratio Tier 1 Risk- based Ratio Total Risk- based Capital Ratio 12/31/13 Capital Ratios SBLF TruPS 12.5% 14.7% 15.6%

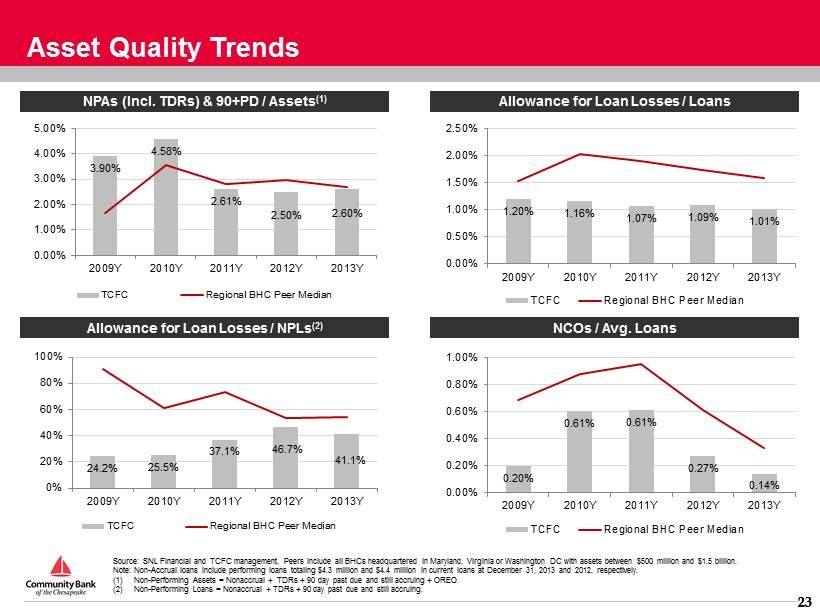

23 23 1.20% 1.16% 1.07% 1.09% 1.01% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 2009Y 2010Y 2011Y 2012Y 2013Y TCFC Regional BHC Peer Median 0.20% 0.61% 0.61% 0.27% 0.14% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 2009Y 2010Y 2011Y 2012Y 2013Y TCFC Regional BHC Peer Median Asset Quality Trends NPAs (Incl. TDRs) & 90+PD / Assets (1) Allowance for Loan Losses / Loans Allowance for Loan Losses / NPLs (2) NCOs / Avg. Loans Source: SNL Financial and TCFC management, Peers include all BHCs headquartered in Maryland, Virginia or Washington DC with assets between $500 million and $1.5 billion. Note: Non - Accrual loans include performing loans totaling $4.3 million and $4.4 million in current loans at December 31, 2013 and 2012, respectively. (1) Non - Performing Assets = Nonaccrual + TDRs + 90 day past due and still accruing + OREO. (2) Non - Performing Loans = Nonaccrual + TDRs + 90 day past due and still accruing. 3.90% 4.58% 2.61% 2.50% 2.60% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 2009Y 2010Y 2011Y 2012Y 2013Y TCFC Regional BHC Peer Median 24.2% 25.5% 37.1% 46.7% 41.1% 0% 20% 40% 60% 80% 100% 2009Y 2010Y 2011Y 2012Y 2013Y TCFC Regional BHC Peer Median

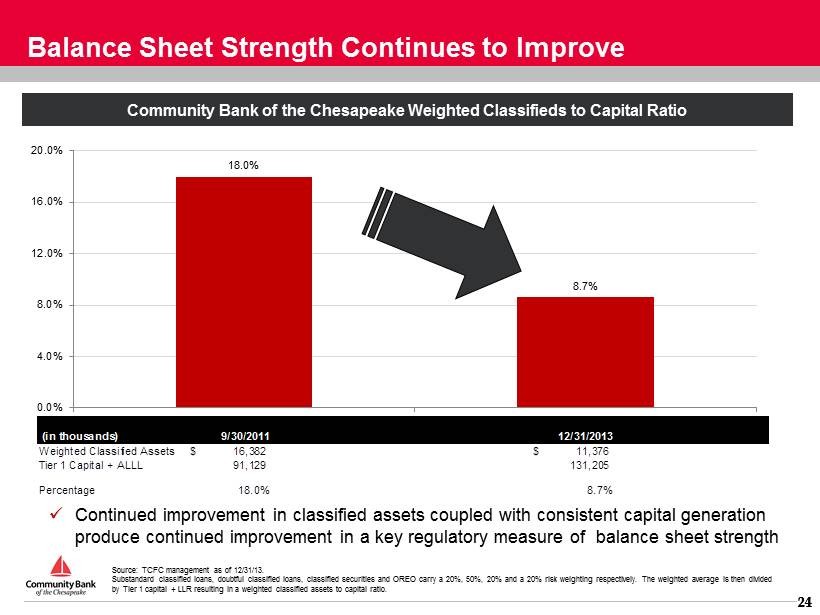

24 24 18.0% 8.7% 0.0% 4.0% 8.0% 12.0% 16.0% 20.0% 9/30/2011 12/31/2013 Community Bank of the Chesapeake Weighted Classifieds to Capital Ratio Source: TCFC management as of 12/31/13. Substandard classified loans, doubtful classified loans, classified securities and OREO carry a 20%, 50%, 20% and a 20% risk wei ghting respectively. The weighted average is then divided by Tier 1 capital + LLR resulting in a weighted classified assets to capital ratio. Balance Sheet Strength Continues to Improve x Continued improvement in classified assets coupled with consistent capital generation produce continued improvement in a key regulatory measure of balance sheet strength (in thousands) 9/30/2011 12/31/2013 Weighted Classified Assets 16,382$ 11,376$ Tier 1 Capital + ALLL 91,129 131,205 Percentage 18.0% 8.7%

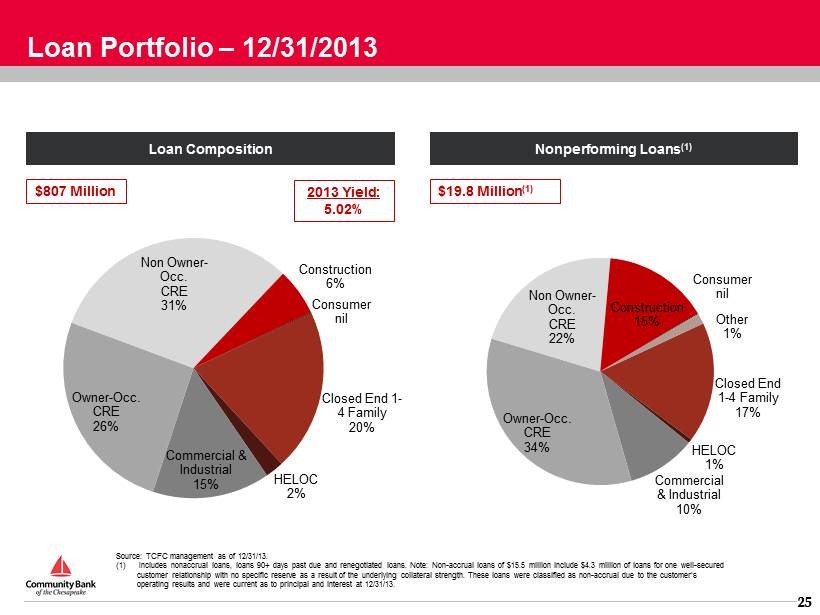

25 25 Loan Portfolio – 12/31/2013 Loan Composition $807 M illion Nonperforming Loans (1 ) Source: TCFC management as of 12/31/13. (1) Includes nonaccrual loans, loans 90+ days past due and renegotiated loans. Note: Non - accrual loans of $15.5 million include $4. 3 million of loans for one well - secured customer relationship with no specific reserve as a result of the underlying collateral strength. These loans were classified as non - accrual due to the customer’s operating results and were current as to principal and interest at 12/31/13. $19.8 Million (1) 2013 Yield: 5.02% Closed End 1 - 4 Family 20% HELOC 2% Commercial & Industrial 15% Owner - Occ. CRE 26% Non Owner - Occ. CRE 31% Construction 6% Consumer nil Closed End 1 - 4 Family 17% HELOC 1% Commercial & Industrial 10% Owner - Occ. CRE 34% Non Owner - Occ. CRE 22% Construction 15% Consumer nil Other 1%

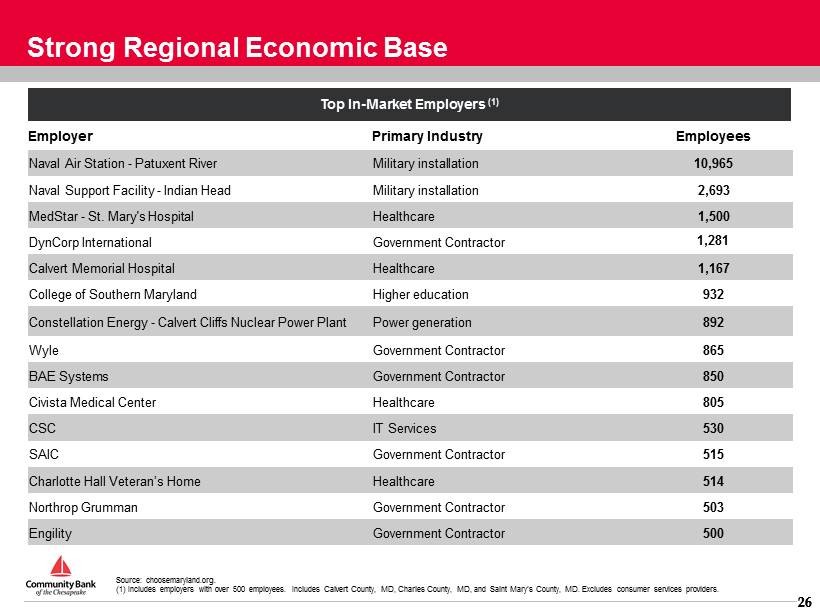

26 26 Strong Regional Economic Base Top In - Market Employers (1) Employer Primary Industry Employees Naval Air Station - Patuxent River Military installation 10,965 Naval Support Facility - Indian Head Military installation 2,693 MedStar - St . Mary's Hospital Healthcare 1,500 DynCorp International Government Contractor 1,281 Calvert Memorial Hospital Healthcare 1,167 College of Southern Maryland Higher education 932 Constellation Energy - Calvert Cliffs Nuclear Power Plant Power generation 892 Wyle Government Contractor 865 BAE Systems Government Contractor 850 Civista Medical Center Healthcare 805 CSC IT Services 530 SAIC Government Contractor 515 Charlotte Hall Veteran’s Home Healthcare 514 Northrop Grumman Government Contractor 503 Engility Government Contractor 500 Source: choosemaryland.org. (1) Includes employers with over 500 employees. Includes Calvert County, MD, Charles County, MD, and Saint Mary’s County, MD. Ex cludes consumer services providers.

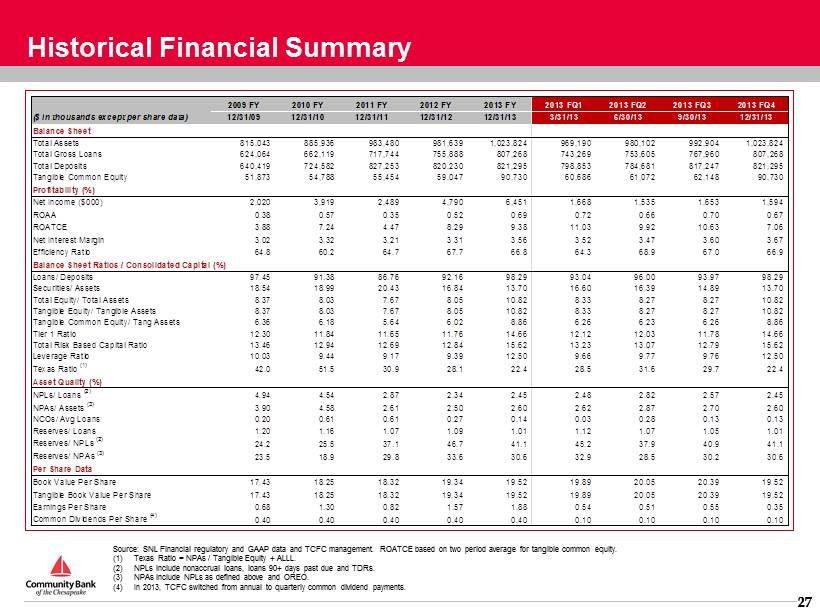

27 27 Historical Financial Summary Source: SNL Financial regulatory and GAAP data and TCFC management. ROATCE based on two period average for tangible common eq uit y. (1) Texas Ratio = NPAs / Tangible Equity + ALLL. (2) NPLs include nonaccrual loans, loans 90+ days past due and TDRs. (3) NPAs include NPLs as defined above and OREO. (4) In 2013, TCFC switched from annual to quarterly common dividend payments. 2009 FY 2010 FY 2011 FY 2012 FY 2013 FY 2013 FQ1 2013 FQ2 2013 FQ3 2013 FQ4 ($ in thousands except per share data) 12/31/09 12/31/10 12/31/11 12/31/12 12/31/13 3/31/13 6/30/13 9/30/13 12/31/13 Balance Sheet Total Assets 815,043 885,936 983,480 981,639 1,023,824 969,190 980,102 992,904 1,023,824 Total Gross Loans 624,064 662,119 717,744 755,888 807,268 743,269 753,605 767,960 807,268 Total Deposits 640,419 724,582 827,253 820,230 821,295 798,853 784,681 817,247 821,295 Tangible Common Equity 51,873 54,788 55,454 59,047 90,730 60,686 61,072 62,148 90,730 Profitability (%) Net Income ($000) 2,020 3,919 2,489 4,790 6,451 1,668 1,535 1,653 1,594 ROAA 0.38 0.57 0.35 0.52 0.69 0.72 0.66 0.70 0.67 ROATCE 3.88 7.24 4.47 8.29 9.38 11.03 9.92 10.63 7.06 Net Interest Margin 3.02 3.32 3.21 3.31 3.56 3.52 3.47 3.60 3.67 Efficiency Ratio 64.8 60.2 64.7 67.7 66.8 64.3 68.9 67.0 66.9 Balance Sheet Ratios / Consolidated Capital (%) Loans/ Deposits 97.45 91.38 86.76 92.16 98.29 93.04 96.00 93.97 98.29 Securities/ Assets 18.54 18.99 20.43 16.84 13.70 16.60 16.39 14.89 13.70 Total Equity/ Total Assets 8.37 8.03 7.67 8.05 10.82 8.33 8.27 8.27 10.82 Tangible Equity/ Tangible Assets 8.37 8.03 7.67 8.05 10.82 8.33 8.27 8.27 10.82 Tangible Common Equity/ Tang Assets 6.36 6.18 5.64 6.02 8.86 6.26 6.23 6.26 8.86 Tier 1 Ratio 12.30 11.84 11.65 11.76 14.66 12.12 12.03 11.78 14.66 Total Risk Based Capital Ratio 13.46 12.94 12.69 12.84 15.62 13.23 13.07 12.79 15.62 Leverage Ratio 10.03 9.44 9.17 9.39 12.50 9.66 9.77 9.76 12.50 Texas Ratio (1) 42.0 51.5 30.9 28.1 22.4 28.5 31.6 29.7 22.4 Asset Quality (%) NPLs/ Loans (2) 4.94 4.54 2.87 2.34 2.45 2.48 2.82 2.57 2.45 NPAs/ Assets (3) 3.90 4.58 2.61 2.50 2.60 2.62 2.87 2.70 2.60 NCOs/ Avg Loans 0.20 0.61 0.61 0.27 0.14 0.03 0.28 0.13 0.13 Reserves/ Loans 1.20 1.16 1.07 1.09 1.01 1.12 1.07 1.05 1.01 Reserves/ NPLs (2) 24.2 25.5 37.1 46.7 41.1 45.2 37.9 40.9 41.1 Reserves/ NPAs (3) 23.5 18.9 29.8 33.6 30.6 32.9 28.5 30.2 30.6 7471 7669 7655 8247 8138 8350 8034 8079 8138 Per Share Data Book Value Per Share 17.43 18.25 18.32 19.34 19.52 19.89 20.05 20.39 19.52 Tangible Book Value Per Share 17.43 18.25 18.32 19.34 19.52 19.89 20.05 20.39 19.52 Earnings Per Share 0.68 1.30 0.82 1.57 1.88 0.54 0.51 0.55 0.35 Common Dividends Per Share (4) 0.40 0.40 0.40 0.40 0.40 0.10 0.10 0.10 0.10

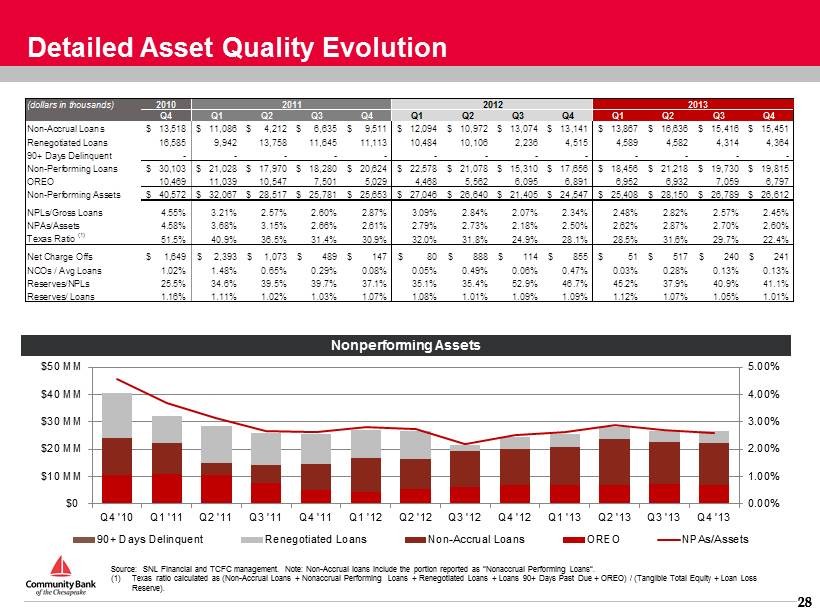

28 28 Detailed Asset Quality Evolution Source: SNL Financial and TCFC management. Note: Non - Accrual loans include the portion reported as “Nonaccrual Performing Loans”. (1) Texas ratio calculated as (Non - Accrual Loans + Nonaccrual Performing Loans + Renegotiated Loans + Loans 90+ Days Past Due + ORE O) / (Tangible Total Equity + Loan Loss Reserve). Nonperforming Assets 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% $0 $10 MM $20 MM $30 MM $40 MM $50 MM Q4 '10 Q1 '11 Q2 '11 Q3 '11 Q4 '11 Q1 '12 Q2 '12 Q3 '12 Q4 '12 Q1 '13 Q2 '13 Q3 '13 Q4 '13 90+ Days Delinquent Renegotiated Loans Non-Accrual Loans OREO NPAs/Assets (dollars in thousands) 2010 2011 2012 2013 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Non-Accrual Loans 13,518$ 11,086$ 4,212$ 6,635$ 9,511$ 12,094$ 10,972$ 13,074$ 13,141$ 13,867$ 16,636$ 15,416$ 15,451$ Renegotiated Loans 16,585 9,942 13,758 11,645 11,113 10,484 10,106 2,236 4,515 4,589 4,582 4,314 4,364 90+ Days Delinquent - - - - - - - - - - - - - Non-Performing Loans 30,103$ 21,028$ 17,970$ 18,280$ 20,624$ 22,578$ 21,078$ 15,310$ 17,656$ 18,456$ 21,218$ 19,730$ 19,815$ OREO 10,469 11,039 10,547 7,501 5,029 4,468 5,562 6,095 6,891 6,952 6,932 7,059 6,797 Non-Performing Assets 40,572$ 32,067$ 28,517$ 25,781$ 25,653$ 27,046$ 26,640$ 21,405$ 24,547$ 25,408$ 28,150$ 26,789$ 26,612$ NPLs/Gross Loans 4.55% 3.21% 2.57% 2.60% 2.87% 3.09% 2.84% 2.07% 2.34% 2.48% 2.82% 2.57% 2.45% NPAs/Assets 4.58% 3.68% 3.15% 2.66% 2.61% 2.79% 2.73% 2.18% 2.50% 2.62% 2.87% 2.70% 2.60% Texas Ratio (1) 51.5% 40.9% 36.5% 31.4% 30.9% 32.0% 31.8% 24.9% 28.1% 28.5% 31.6% 29.7% 22.4% Net Charge Offs 1,649$ 2,393$ 1,073$ 489$ 147$ 80$ 888$ 114$ 855$ 51$ 517$ 240$ 241$ NCOs / Avg Loans 1.02% 1.48% 0.65% 0.29% 0.08% 0.05% 0.49% 0.06% 0.47% 0.03% 0.28% 0.13% 0.13% Reserves/NPLs 25.5% 34.6% 39.5% 39.7% 37.1% 35.1% 35.4% 52.9% 46.7% 45.2% 37.9% 40.9% 41.1% Reserves/ Loans 1.16% 1.11% 1.02% 1.03% 1.07% 1.08% 1.01% 1.09% 1.09% 1.12% 1.07% 1.05% 1.01%

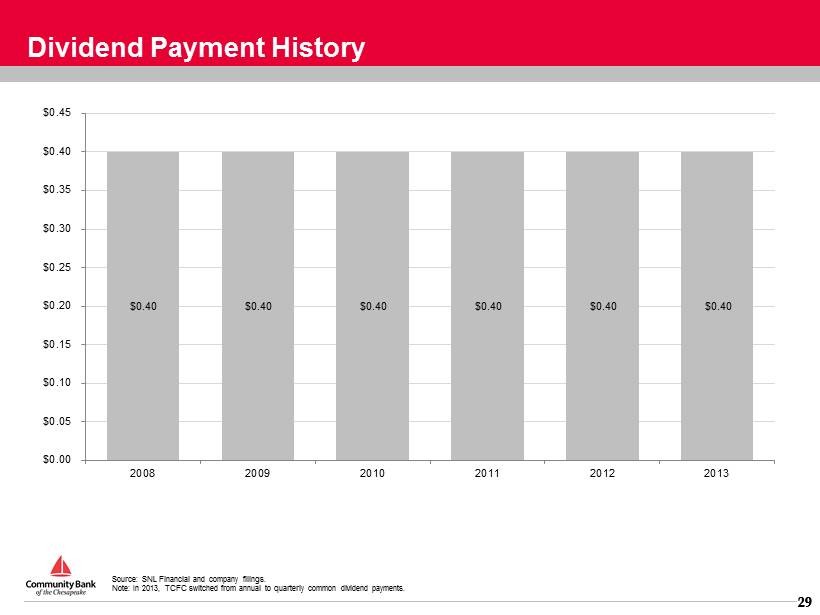

29 29 Dividend Payment History Source: SNL Financial and company filings. Note: In 2013, TCFC switched from annual to quarterly common dividend payments. $0.40 $0.40 $0.40 $0.40 $0.40 $0.40 $0.00 $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 $0.35 $0.40 $0.45 2008 2009 2010 2011 2012 2013

30 Seasoned Leadership Team Michael L . Middleton is the Chairman and Chief Executive Officer of TCFC and its banking subsidiary, Community Bank of the Chesapeake, Waldorf, Maryland . Mr . Middleton joined the Bank in 1973 and was promoted to President and Chief Executive Officer in 1979 . Under his leadership, the Bank has grown to become the largest deposit market share holder of Maryland domiciled banks in Southern Maryland . Prior to joining the Bank, Mr . Middleton was employed by KMPG - Peat Marwick, Baltimore, Maryland . Education : Bellarmine University, Bachelor of Arts in Accounting ; University of Maryland Robert Smith School, MBA, Finance Concentration ; Harvard Business School Program on Negotiation Professional Memberships : Mr . Middleton is a Director and Past Chairman of the Board of Directors of the Maryland Bankers Association . Mr . Middleton is the former Chairman of the Board of Directors of the Federal Home Loan Bank of Atlanta and was a Director of the Council of the Federal Home Loan Banks . He is a former director of the Federal Reserve Bank of Richmond, Baltimore Branch and presently serves as a member of the Federal Reserve Board's Community Depository Institutions Advisory Committee . He presently serves as Chairman of the Board of Directors of the College of Southern Maryland . Michael L. Middleton Chairman & CEO William J . Pasenelli is President and Chief Financial Officer of TCFC and President of the Bank . In his role as President, Mr . Pasenelli has responsibility for the overall operations of the Bank and the holding company . Prior to joining the Bank in 2000 , Mr . Pasenelli had been the Chief Financial Officer of Acacia Federal Savings Bank, Annandale, Virginia since 1987 . Education : Magna Cum Laude, Duke University, Bachelor of Arts in Management Science ; National School of Banking ; Harvard Business School Program on Negotiation . Mr . Pasenelli is a member of the American Institute of Certified Public Accountants and the DC Institute of Certified Public Accountants . William J. Pasenelli President & CFO (TCFC) James M . Burke is Executive Vice President, Chief Risk Officer of TCFC and its banking subsidiary, Community Bank of the Chesapeake . Mr . Burke joined the company in December 2005 . Prior to joining the company, Mr . Burke served as the Executive Vice President and Senior Loan Officer at Mercantile Southern Maryland Bank in Leonardtown, MD . Education : High Point College, Bachelor of Arts in Political Science ; Maryland Bankers School ; East Carolina Advanced School of Commercial Lending ; Harvard Business School Program on Negotiation James M. Burke Chief Risk Officer Biography

31 Seasoned Leadership Team Biography Gregory C . Cockerham is Executive Vice President, Chief Lending Officer of Community Bank of the Chesapeake . Prior to joining the Bank in 1988 , he worked for Maryland National Bank Education : College of Southern Maryland, Associate of Arts ; West Virginia University, Bachelor of Science in Business Management ; Maryland Bankers School ; Harvard Business School Program on Negotiation Gregory C. Cockerham Chief Lending Officer James F . Di Misa is Executive Vice President, Chief Operating Officer of Community Bank of the Chesapeake . Mr . Di Misa joined the Bank in 2005 as Senior Vice President in charge of operations . Prior to joining the Bank, Mr . Di Misa served as Executive Vice President for Mercantile Southern Maryland Bank in a similar capacity . Education : College of Southern Maryland, Associate of Arts ; George Mason University, Bachelor of Science in Business Management ; Mount St . Mary’s College, Master of Business Administration ; ABA Stonier Graduate School of Banking ; Harvard Business School Program on Negotiation James F. Di Misa Chief Operating Officer Todd L . Capitani is Executive Vice President, Chief Financial Officer of Community Bank of the Chesapeake . Mr . Capitani joined the Bank in 2009 . Prior to joining the Bank, Mr . Capitani served as Senior Finance Manager for Deloitte Consulting and Chief Financial Officer of Ruesch International, Inc . Education : University of California, Bachelor of Arts in Business Economics ; Yale School of Management Strategic Leadership Conference ; Harvard Business School Program on Negotiation . Mr . Capitani is a member of the American Institute of Certified Public Accountants . Todd L. Capitani Chief Financial Officer (Bank)

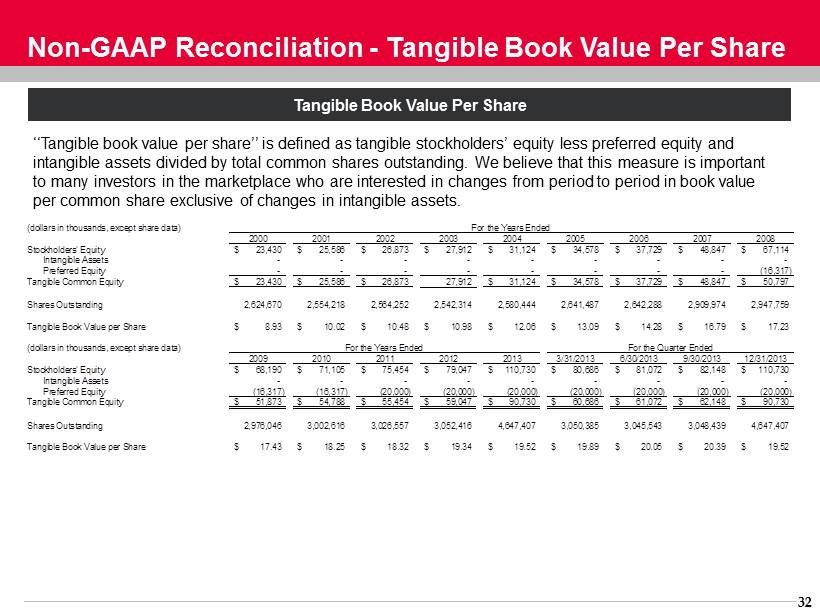

32 Non - GAAP Reconciliation - Tangible Book Value Per Share Tangible Book Value Per Share ‘‘Tangible book value per share’’ is defined as tangible stockholders’ equity less preferred equity and intangible assets divided by total common shares outstanding. We believe that this measure is important to many investors in the marketplace who are interested in changes from period to period in book value per common share exclusive of changes in intangible assets. (dollars in thousands, except share data) For the Years Ended 2000 2001 2002 2003 2004 2005 2006 2007 2008 Stockholders' Equity 23,430$ 25,586$ 26,873$ 27,912$ 31,124$ 34,578$ 37,729$ 48,847$ 67,114$ Intangible Assets - - - - - - - - - Preferred Equity - - - - - - - - (16,317) Tangible Common Equity 23,430$ 25,586$ 26,873$ 27,912 31,124$ 34,578$ 37,729$ 48,847$ 50,797$ Shares Outstanding 2,624,670 2,554,218 2,564,252 2,542,314 2,580,444 2,641,487 2,642,288 2,909,974 2,947,759 Tangible Book Value per Share 8.93$ 10.02$ 10.48$ 10.98$ 12.06$ 13.09$ 14.28$ 16.79$ 17.23$ (dollars in thousands, except share data) For the Years Ended For the Quarter Ended 2009 2010 2011 2012 2013 3/31/2013 6/30/2013 9/30/2013 12/31/2013 Stockholders' Equity 68,190$ 71,105$ 75,454$ 79,047$ 110,730$ 80,686$ 81,072$ 82,148$ 110,730$ Intangible Assets - - - - - - - - - Preferred Equity (16,317) (16,317) (20,000) (20,000) (20,000) (20,000) (20,000) (20,000) (20,000) Tangible Common Equity 51,873$ 54,788$ 55,454$ 59,047$ 90,730$ 60,686$ 61,072$ 62,148$ 90,730$ Shares Outstanding 2,976,046 3,002,616 3,026,557 3,052,416 4,647,407 3,050,385 3,045,543 3,048,439 4,647,407 Tangible Book Value per Share 17.43$ 18.25$ 18.32$ 19.34$ 19.52$ 19.89$ 20.05$ 20.39$ 19.52$

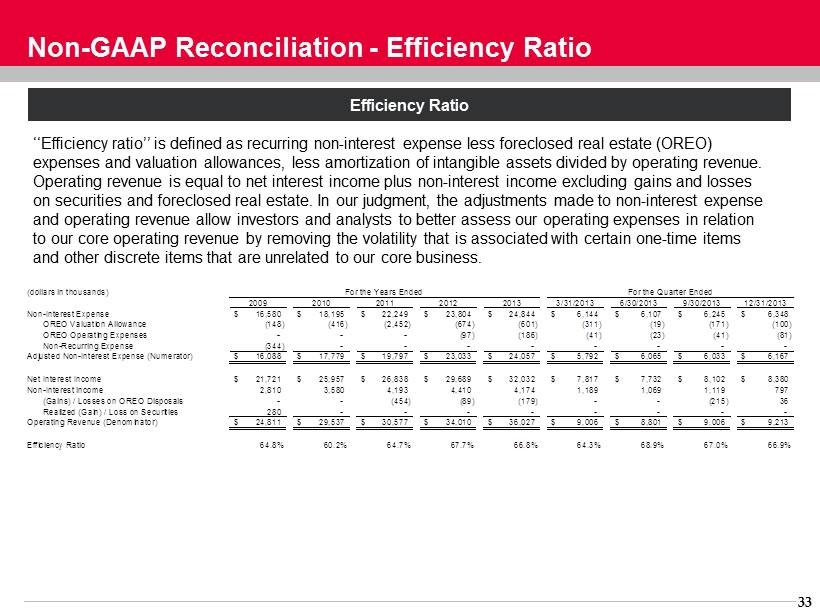

33 Non - GAAP Reconciliation - Efficiency Ratio Efficiency Ratio ‘‘Efficiency ratio’’ is defined as recurring non - interest expense less foreclosed real estate (OREO) expenses and valuation allowances, less amortization of intangible assets divided by operating revenue. Operating revenue is equal to net interest income plus non - interest income excluding gains and losses on securities and foreclosed real estate. In our judgment, the adjustments made to non - interest expense and operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one - time items and other discrete items that are unrelated to our core business. (dollars in thousands) For the Years Ended For the Quarter Ended 2009 2010 2011 2012 2013 3/31/2013 6/30/2013 9/30/2013 12/31/2013 Non-Interest Expense 16,580$ 18,195$ 22,249$ 23,804$ 24,844$ 6,144$ 6,107$ 6,245$ 6,348$ OREO Valuation Allowance (148) (416) (2,452) (674) (601) (311) (19) (171) (100) OREO Operating Expenses - - - (97) (186) (41) (23) (41) (81) Non-Recurring Expense (344) - - - - - - - - Adjusted Non-Interest Expense (Numerator) 16,088$ 17,779$ 19,797$ 23,033$ 24,057$ 5,792$ 6,065$ 6,033$ 6,167$ Net Interest Income 21,721$ 25,957$ 26,838$ 29,689$ 32,032$ 7,817$ 7,732$ 8,102$ 8,380$ Non-Interest income 2,810 3,580 4,193 4,410 4,174 1,189 1,069 1,119 797 (Gains) / Losses on OREO Disposals - - (454) (89) (179) - - (215) 36 Realized (Gain) / Loss on Securities 280 - - - - - - - - Operating Revenue (Denominator) 24,811$ 29,537$ 30,577$ 34,010$ 36,027$ 9,006$ 8,801$ 9,006$ 9,213$ Efficiency Ratio 64.8% 60.2% 64.7% 67.7% 66.8% 64.3% 68.9% 67.0% 66.9%