Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jason Industries, Inc. | d693977d8k.htm |

| EX-2.1 - EX-2.1 - Jason Industries, Inc. | d693977dex21.htm |

| EX-2.2 - EX-2.2 - Jason Industries, Inc. | d693977dex22.htm |

Quinpario Acquisition Corp.

Investor Presentation

Acquisition of Jason Incorporated

March 18, 2014

Exhibit 99.1 |

Disclaimer

2

Forward Looking Statements

This presentation includes “forward looking statements” within

the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements

may be identified by the use of words such as “anticipate,”

“believe,” “expect,” “estimate,” “plan,” “outlook,” and “project” and other similar expressions that predict or indicate future events or trends or that

are not statements of historical matters. Such forward looking statements

include projected financial information. Such forward looking statements with respect to revenues, earnings, performance, strategies,

prospects and other aspects of the businesses of Quinpario Acquisition

Corp. (“QPAC”), Jason Partners Holdings Inc. (“Jason”) and the combined company after completion of the proposed business

combination are based on current expectations that are subject to risks and

uncertainties. A number of factors could cause actual results or outcomes to differ materially from those indicated by such forward

looking statements. These factors include, but are not limited to: (1) the

occurrence of any event, change or other circumstances that could give rise to the termination of the Stock Purchase Agreement for the

business combination (the “Purchase Agreement”); (2) the outcome

of any legal proceedings that may be instituted against Jason or QPAC following announcement of the proposed business combination and

transactions contemplated thereby; (3) the inability to complete the

transactions contemplated by the proposed business combination due to the failure to obtain approval of the stockholders of QPAC, or other

conditions to closing in the Purchase Agreement; (4) the ability to obtain

or maintain the listing of the post-combination company’s common stock on NASDAQ following the business combination; (5) the risk

that the proposed business combination disrupts current plans and

operations as a result of the announcement and consummation of the transactions described herein; (6) the ability to recognize the anticipated

benefits of the business combination, which may be affected by, among other

things, competition, the ability to integrate the Jason and QPAC businesses, and the ability of the combined business to grow and

manage growth profitably; (7) costs related to the business combination;

(8) changes in applicable laws or regulations; (9) the possibility that Jason or QPAC may be adversely affected by other economic,

business, and/or competitive factors; and (10) other risks and

uncertainties indicated from time to time in the proxy statement, including those under “Risk Factors” therein, and other filings with the Securities

and Exchange Commission (“SEC”) by QPAC. You are cautioned not to

place undue reliance upon any forward-looking statements, which speak only as of the date made. QPAC and Jason undertake no

obligation to update or revise the forward-looking statements, whether

as a result of new information, future events or otherwise. Financial Presentations

This presentation includes non-GAAP financial measures, including EBIT,

EBITDA, Proforma EBITDA, EBIT Margin and EBITDA Margin. EBITDA is calculated as earnings before interest and taxes (“EBIT”)

plus depreciation and amortization (“EBITDA”). In addition,

Proforma EBITDA is calculated as EBITDA adjusted to give pro forma effect to (i) the proposed business combination with QPAC, (ii) the business

combination’s related changes to the post-combination

company’s capitalization structure and (iii) the estimated increase expenses of operating as a public company. EBIT Margin is defined as EBIT divided by

total revenues. EBITDA Margin is defined as EBITDA divided by total

revenues. Non-GAAP and Other Company Information

Jason believes that these non-GAAP measures of financial results

provide useful information to management and investors regarding certain financial and business trends relating to Jason’s financial condition

and results of operations. Jason’s management uses these non-GAAP

measures to compare Jason’s performance to that of prior periods for trend analyses, for purposes of determining management incentive

compensation, and for budgeting and planning purposes. These measures are

used in monthly financial reports prepared for management and Jason’s board of directors. Jason believes that the use of these

non-GAAP financial measures provides an additional tool for investors

to use in evaluating ongoing operating results and trends and in comparing Jason’s financial measures with other companies in the

finishing, seating, acoustics or components business, many of which present

similar non-GAAP financial measures to investors. Management of Jason does not consider these non-GAAP measures in isolation

or as an alternative to financial measures determined in accordance with

GAAP. We have not reconciled the non-GAAP forward looking information to their corresponding GAAP measures because we do not

provide guidance for the various reconciling items such as stock-based

compensation, provision for income taxes, depreciation and amortization, costs related to acquisitions, and foreign currency

remeasurements and transactions gains and losses, as certain items that

impact these measures are out of our control or cannot be reasonably predicted. You should review Jason’s audited financial statements,

which will be presented in QPAC’s proxy statement to be filed with the

SEC and delivered to QPAC’s stockholders, and not rely on any single financial measure to evaluate Jason’s business.

Other companies may calculate EBITDA, Adjusted EBITDA and other

non-GAAP measures differently, and therefore our EBITDA, Adjusted EBITDA and other non-GAAP measures and that of Jason may not

be directly comparable to similarly titled measures of other companies.

Additional Information

Participants in the Solicitation

QPAC and its directors and executive officers and other persons may be

deemed to be participants in the solicitations of proxies from QPAC’s stockholders in respect of the proposed business combination.

Information regarding QPAC’s directors and executive officers is

available in its Annual Report on Form 10-K for the year ending December 31, 2013 filed with the SEC on March 7, 2014. Additional

information regarding the participants in the proxy solicitation and a

description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement when it

becomes available.

The proposed business combination will be submitted to stockholders of QPAC

for their consideration. Stockholders are urged to read the proxy statement regarding the proposed business combination

when it becomes available because it will contain important information.

Stockholders will be able to obtain a free copy of the proxy statement, as well as other filings containing

information

about

QPAC,

without

charge,

at

the

SEC’s

Internet

site

(www.sec.gov).

You

will

also

be

able

to

obtain

these

documents,

free

of

charge,

by

accessing

Quinpario’s

website

(http://www.quinpario.com).

Copies

of

the

proxy

statement

and

the

filings

with

the

SEC

that

will

be

incorporated

by

reference

in

the

proxy

statement

can

also

be

obtained,

without

charge,

by directing a

request to Paul J. Berra III, Vice President, General Counsel and

Secretary, 12935 N. Forty Drive, St. Louis, Missouri 63141. |

Agenda

•

Summary

•

Jason Overview

•

Growth Opportunities

•

Financial Overview |

Quinpario Acquisition Corp. to Acquire Jason Incorporated

•

On March 16, 2014, Quinpario Acquisition Corp. (“QPAC”) entered

into a definitive agreement to acquire Jason Incorporated

(“Jason”) 4

Entity to be listed on NASDAQ post business combination

JPHI Holdings Inc.

JPHI Holdings Inc. |

Transaction Overview

5

Transaction

•

QPAC, through its newly formed acquisition sub, JPHI Holdings Inc., will

acquire 100% of Jason

•

Transaction expected to close 2nd Quarter, 2014

Consideration

•

Transaction value of $538.65 million

–

6.75x 2013 Actual Proforma EBITDA of $79.8 million

–

Includes cash for working capital, payment of transaction expenses, and

assumes 50% of warrants repurchased at $0.75 per warrant

Board &

Management

•

Jeffry N. Quinn, founder of Quinpario, to serve as the chairman of the

board of directors

•

David Westgate, Chief Executive Officer of Jason, to remain CEO and serve

on the board of directors

•

Board to be constituted of members from incumbent QPAC board members,

incumbent Jason board members and other qualified

individuals •

Existing Jason management to continue to run the business

•

Total estimated Transaction capital requirement of approximately $655

million

•

Acquisition funding sources assumes approximately $420 million of newly

issued debt, $14 million of foreign rollover debt, $177

million of cash in trust at QPAC, $35 million of rollover

equity from management and existing shareholders, and $8.5

million of cash to be left in Jason |

(1)

Debt at foreign subsidiaries

(2)

Assumes $177.075 million of cash in trust does

not redeem

(3)

Estimated amount relating to sale of JV

(4)

Assumes 50% of the warrants are repurchased at

$0.75 per share and cancelled

(5)

Ownership as of transaction close

(6)

Remainder of Quinpario promote to vest upon

certain share price hurdles

Capitalization and Ownership

6

Sr.

Secured

1

st

Lien

Term

Loan

$300

Sr.

Secured

2

nd

Lien

Term

Loan

120

Rollover

Debt

1

14

Revolver ($40M Facility)

-

QPAC

Equity

2

177

Rollover Equity

35

Cash

Left

in

the

Business

3

9

Total Sources

$655

Purchase Price

$539

Warrant

Adjustment

4

7

Fees and Cash for Working Capital

109

Total Uses

$655

Pro Forma Capitalization at Closing

Cash

$80

1

st

Lien

Term

Loan

$300

2

nd

Lien

Term

Loan

120

Rollover Debt

14

Total Debt

$434

Equity Capitalization

$212

Total Capitalization

$646

2013A Proforma EBITDA

$79.8

Net Cap / 2013A Proforma EBITDA

7.10x

Net Debt / 2013A Proforma EBITDA

4.44x

Sources

Uses

Post Transaction Share Cap:

Shares

% of Total

QPAC Public Shareholders

17,250,000

74.8%

Rollover Equity

3,441,720

14.9%

Quinpario Private Placement Shares

1,150,000

5.0%

Quinpario Sponsor Promote

6

1,226,667

5.3%

TOTAL

23,068,386

100.0%

Pro

Forma

Ownership

5

($ in millions) |

Investment Highlights

7

Market leader in niche highly engineered components

Macro trends that support growth across all segments

Diversified blue chip customer base

Earnings growth opportunities from pricing, operational improvements and

margin expansion

Strong free cash flow generation

Robust new product pipeline with a track record of innovation

Proven acquisition platform to support future M&A activity

Experienced management team with a track record of success

|

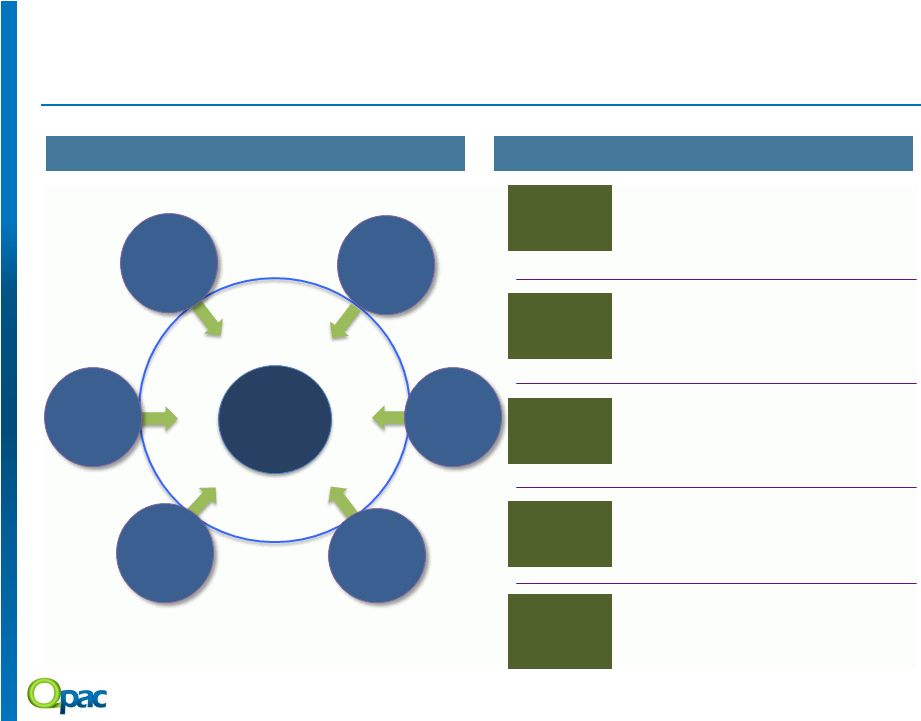

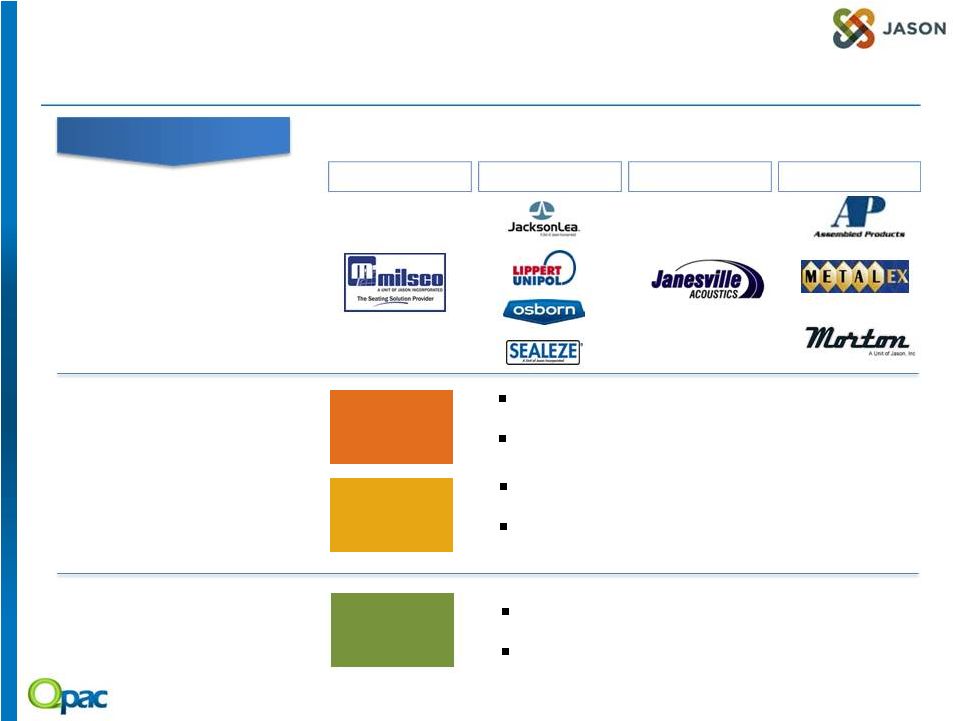

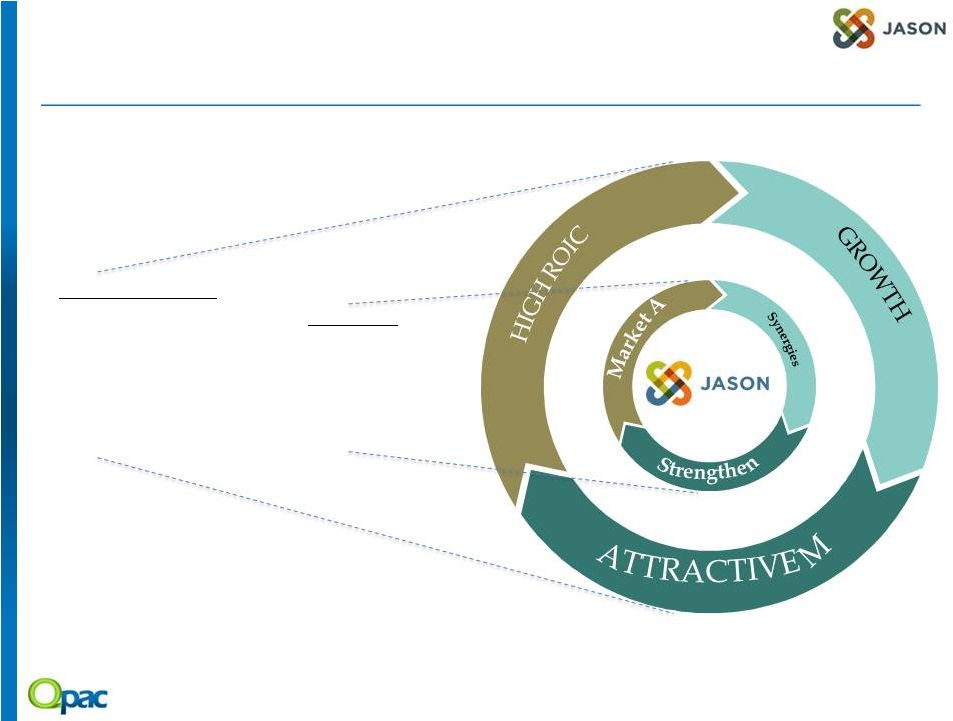

Quinpario’s Capabilities will Strengthen Jason

8

•

Engage in synergistic bolt-on acquisitions to

strengthen core business, with initial focus on

Jason’s Finishing and Seating segments

•

Seek new platform acquisition opportunities that

will generate excess returns for shareholders

•

Grow Jason’s business segments globally with a

focus on new market access & increased market

penetration, especially in Asia and Latin America

•

Further differentiate Jason’s key brands through

insight-driven channel/product development

•

Capture operational synergies across businesses

•

Improve operating efficiency by instilling

demand-driven lean processes

•

Leverage global sourcing spend to scale up

performance and margins

•

Develop robust strategic planning process

•

Strengthen market & customer driven approach

•

Develop shareholder driven mentality based on

long term success of the business

Quinpario

Partners

Legal and

Governance

M&A

Strategic

Planning

Shareholder

Mindset

Deep

Analytics

Business

Operations

Quinpario’s Capabilities

•

World-class public company board to assist

growth and development of Jason

•

Align management incentives with shareholder

value creation

Quinpario’s Support to Jason

Strategy

Process

Excellence

Global

Growth

M&A

Corporate

Governance |

•

Summary

•

Jason Overview

•

Growth Opportunities

•

Financial Overview |

Employees:

~4,000

Headquarters:

Milwaukee, WI

2013 Revenue:

$680.8M

2013

EBITDA:

$79.8M

Founded:

1985

Manufacturing:

32 Sites in 11 Countries

Square Feet of Manufacturing

Space:

~2.5 Million

Management:

David Westgate, Chairman, President and CEO

Steve Cripe, Chief Financial Officer

Jason Business Overview

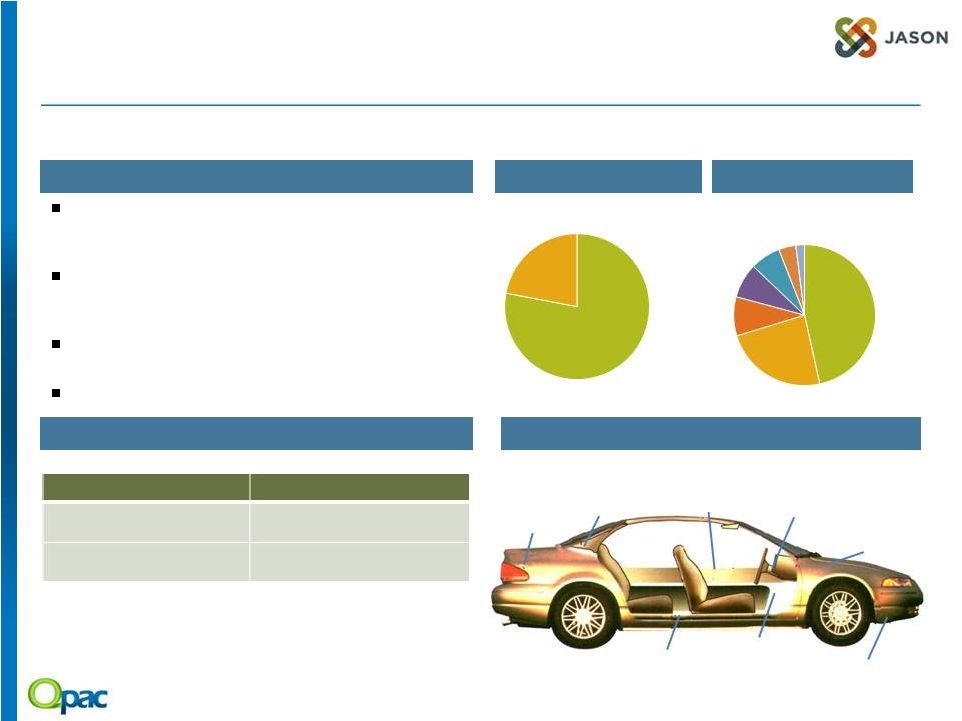

10

Financial Profile

Business Mix

(1)

Key Company Facts

Geographic Footprint

Acoustics

Components

Finishing

Seating

Components

20%

Acoustics

30%

Finishing

26%

Seating

24%

US

73%

EU

19%

Mexico

5%

ROW

3%

_____________________

(1)

Estimated 2013 mix |

Segment Overview

11

Segment

Leading commercial and industrial

seat manufacturer

Designs and manufactures a broad

spectrum of seating systems for

multiple vehicle platforms

Differentiated patents and IP filings

Key Highlights

Brands

Products

% of 2013A Revenue

% of 2013A EBITDA

World’s largest producer of

customized industrial brushes, buffs

and buffing compounds

65% consumable, high recurring

revenue

Over 10,000 SKUs of industrial

consumable products

Used for surface finishing,

preparation, metal removal, sealing,

shielding and polishing

Leading Provider of fiber-based

acoustical products to the

automotive industry

Have product on 75% of the light

vehicle platforms in North America

Innovative solution provider with

brand recognition

Broad range of stamped, formed,

expanded and perforated metal

components and sub assemblies

Products used in filter products,

smart utility meters, railcars,

generators and other industrial

equipment

Seating

Finishing

Acoustics

Components |

Seating Overview

12

Milsco brand maintains the #1 position in the global

static seating market

Primary product segments include Heavyweight

Motorcycles, Turf Care, Heavy Industry and

Powersports

Next generation seating product development

focus on turf care and industrial equipment seating

products

Seating’s high quality products and superior design capabilities have

positioned it as the #1 provider of seats across a majority of its

target end markets United

States

82%

Motorcycle

Aftermarket

13%

United

States

82%

_____________________

(1)

Management estimates.

Representative Products and Applications

Overview

Addressable Market

(1)

Revenue by Geography

Revenue by End Product

_____________________

Note: Based on 2012 revenue.

Mexico

11%

Europe

7%

Turf

Equipment

47%

Motorcycle

OEM

20%

Lifts

9%

Constr. &

Ag.

5%

Marine

4%

Utility

Vehicles

2%

Market Size

North America

$450 M

Global

$2.5B |

Finishing Overview

13

Manufacturing, distribution and sales facilities in 17

countries

65% of revenue from consumables

#1 manufacturer of industrial and maintenance

brushes, buffs and compounds in the world

More than 30,000 customers worldwide; only

business supplying global marketplace

Europe

55%

Finishing’s well-recognized brands maintain exceptional

world-wide reputations for quality _____________________

(1)

Management estimates.

Representative Products and Applications

Overview

Addressable Market

(1)

Revenue by Geography

Revenue by End Product

_____________________

Note: Based on 2012 revenue.

Industrial

Compounds

23%

Industrial

Brushes

62%

Europe

55%

India

2%

Mexico

3%

South

America

6%

North

America

34%

Other

15%

Industrial Brushes

Buffs and Compounds

Total Global Addressable Market

Market Size

$1,035 M

$195 M

$7 B |

Acoustics Overview

14

Products are used in approximately 75% of light

vehicles in North America today, including the

majority of top platforms

Acoustic products also sold to a wide range of other

vehicles, including sport utility vehicles and light

trucks

Jason’s Acoustics Segment product content per

vehicle increased by 34% between 2009-2012

Growth opportunity in Asia and Latin America

Acoustics has developed extensive design and manufacturing expertise that

allows it to provide custom acoustical solutions for each vehicle

platform it serves Luggage

Compartment

Door Panels

Dash Insulators

Interior -

Exterior

Under Bonnet /

Hoodliners

Floor –

Carpet

Underlayment

Hush Panels

Wheelhouse /

Cowl

Package Tray

Substrate

_____________________

(1)

Management estimates.

Representative Products and Applications

Overview

Addressable Market

(1)

Revenue by Geography

Revenue by End Product

_____________________

Note: Based on 2012 revenue.

Market Size

North America

$2

B

Global

$10

B

Die Cut

Insulation

47%

Molded

Insulation

24%

Trunk

Systems

9%

Carpet

Systems

8%

IP Panels

7%

Wheel

Liners

4%

Engine

2%

North

America

78%

Europe

22% |

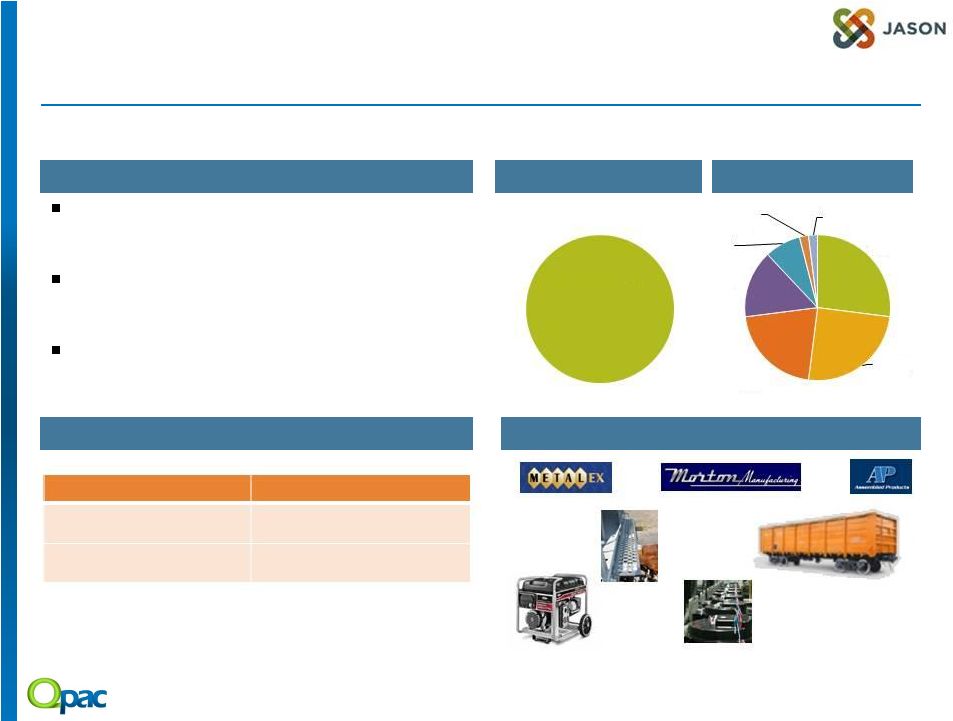

Components Overview

15

Leading manufacturer of individual engineered

solutions and expanded / perforated metal

components

#1 independent manufacturer of electric meter bases,

rail safety products (anti-slip surface) and expanded

metal products in North America

Product categories are united by a common culture

of maintaining industry leading engineering

capabilities

Jason Components has great long term customer partnerships due to its

innovative design and manufacturing capabilities

North America

100%

_____________________

(1)

Management estimates.

Representative Products and Applications

Overview

Addressable Market

(1)

Revenue by Geography

Revenue by End Product

_____________________

Note: Based on 2012 revenue.

Filtration

27%

Electric

Meters

25%

Rail

21%

Industrial

15%

Small

Engines

8%

Power

Equip.

2%

OEM

2%

Market Size

North America

$790 M

Global

$2B |

Long-Term Relationships with Blue Chip Customers

16

Customer Since 1934

80 Years

Customer Since 1928

86 Years

Customer Since 1968

46 Years

Customer Since 1967

47 Years

Customer Since 1990

24 years

Customer Since 1988

26 Years

Customer Since 1991

23 Years

Customer Since 1990

24 years

Customer Since 2011

2 Years

Customer Since 2011

2 Years

Customer Since 1993

21 Years

Customer Since 2002

11 Years

Customer Since 2008

5 Years

Customer Since 2009

4 Years

Customer Since 1984

30 Years

Customer Since 1987

27 Years

Customer Since 1986

28 Years

Customer Since 1978

35 Years

Customer Since 1975

39 Years

Customer Since 1972

42 Years

Customer Since 1975

39 Years

Customer Since 1978

35 Years |

A Leading Supplier of Highly Engineered Components

17

Established Industry

Leader

Scalable Business

Model

Diverse, Global

Footprint

Effective Management

Philosophy

Growing Presence in

Emerging Markets

Successful,

Long-Tenured

Management Team

Strong Free Cash

Flow Generation

Proven Acquisition

Platform

Superior Design and

Manufacturing

Solutions |

•

Summary

•

Jason Overview

•

Growth Opportunities

•

Financial Overview |

Strong Platform to Support Organic Growth

Enhanced commercial approach to improve pricing and

margin

Share expertise and best practices across businesses by

applying Jason Business System (JBS)

Continued

global

expansion

-

Finishing

in

South

Asia,

Seating in Eastern Europe, Brazil

Leverage the Company’s scalable platform to optimize its

international presence

Further

Geographic

Expansion

Collaborative design and manufacture of customized

products for Seating and Finishing

Fast growing rail and heavy industries markets expected to

account for >25% of new product revenues

New Product

Development

19

Strong industrial production

and capacity utilization rates

Jason’s market-leading

brands to provide sustainable

profitability

Seating

Finishing

Acoustics

Components

Innovation and Global

Expansion

Operational and Commercial

Improvements

Growth Drivers

Margin

Expansion |

New Products to Contribute $40M-$60M

(1)

Annually in Growth

20

Oil & gas pipeline brushes

High Temp Furnace Rolls

Snow Protec –

snow protection

for heated railroad switches

Agricultural and Construction

Seating

Commercial Turfcare Seating

Heavy-Duty Motorcycle Seating

Underbody panels

Storage Bins (Glove Box, Map

Pocket, Coin Tray)

Landis + Gyr S4X Meter

Generator Panel for Portable

Generators

Safety Platforms

Jason has a robust new product pipeline; macro trends support several new

product launches Finishing

Seating

Acoustics

Components

Segment

Select New Product Pipeline

New pipelines driven by

Clean coal, deep water and

hydraulic fracturing

Growing global agriculture

and construction equipment

demand will spur need for

next generating seating

Shift towards lower weight,

fuel efficient Hybrid and

electric vehicles

Continued demand for

hopper cars

Increased oil production

driving tank car production

Trends

Attractive End Markets

_____________________

(1)

Management estimates. |

•

$250M-$500M revenue

•

Target businesses that

will leverage Jason’s

core competencies

•

A focus on generating

above market returns

•

$25M-$250M

of additional

revenue

•

Strengthen core

businesses

Future M&A Activity to Drive Significant Shareholder Returns

21

BOLT-ON

NEW PLATFORM

BOLT-ON

NEW PLATFORM |

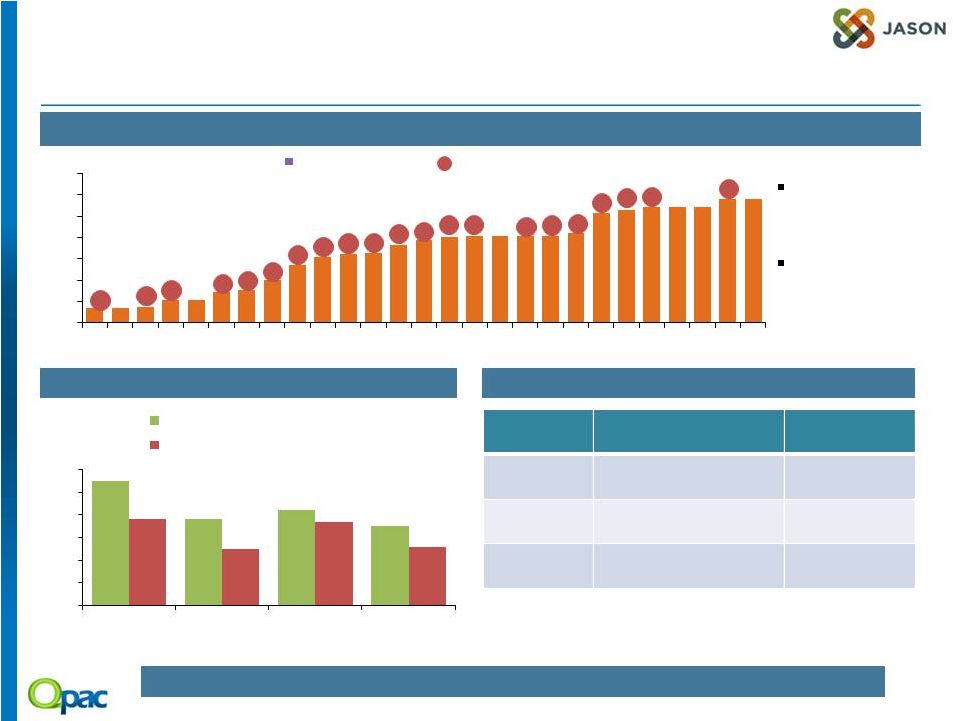

Demonstrated Track Record of Acquiring Businesses

Since formation,

Jason has acquired

and integrated 40

businesses

Successfully

integrating

acquisitions has

been key to Jason’s

Strategy

Significant

Growth Potential from M&A

45 Targets identified with over $1 Billion+ Revenue

Cumulative Revenue

(1)

#

Number of Acquisitions

3

1

2

2

3

2

1

1

2

2

2

3

4

2

1

1

2

2

2

1

1

($ in millions)

22

Average Multiple Reduction of ~1.0x

Current

Pipeline

Segment

Rationale

Estimated

Revenue ($m)

Seating

Market Expansion,

Product Line Expansion

$50-$250

Finishing

Product Line Expansion,

Synergistic

$85-$200

Components

Market Expansion

$35-$100

Jason

would

strongly

consider

adding

a

new

platform

in

the

right

adjacent

market

_____________________

Note: 1. Excludes organic growth of acquired businesses.

$0

$100

$200

$300

$400

$500

$600

$700

'86

'87

'88

'89

'90

'91

'92

'93

'94

'95

'96

'97

'98

'99

'00

'01

'02

'03

'04

'05

'06

'07

'08

'09

'10

'11

'12

5.5x

3.8x

4.2x

3.5x

3.8x

2.5x

3.7x

2.6x

0.0x

1.0x

2.0x

3.0x

4.0x

5.0x

6.0x

Morton

Michigan Seat

Lippert-Unipol

Arcor

EBITDA Multiple at Acquisition

EBITDA Multiple Post Integration |

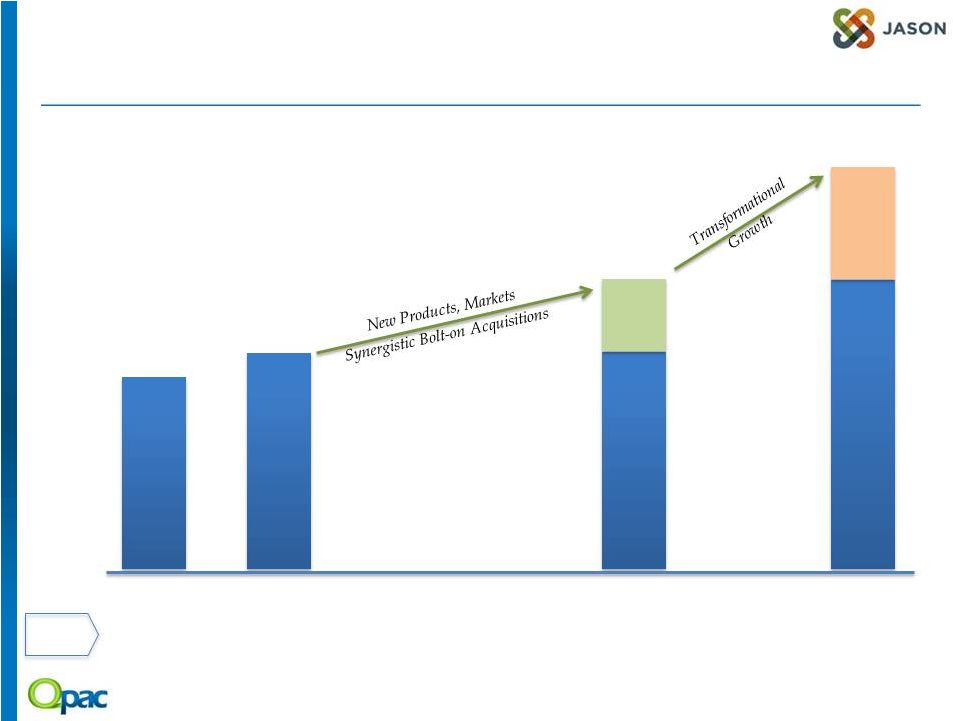

Quinpario’s Vision: Jason -

a Significant Growth Platform

23

EBITDA

$79.8M

11.7%

$91.6M

12.4%

$150M

15%

~$200M

~15%

Jason a $1 billion platform by 2017

2013

2015

2017

$681M

$741M

~$1.0B

~1.25-1.50B

2017

1.

Robust Businesses

2.

Strong Pipeline of Products

3.

Opportunities for Geographic Expansion

4.

Significant Margin Expansion Potential

5.

Demonstrated Integration Track Record

|

•

Summary

•

Jason Overview

•

Growth Opportunities

•

Financial Overview |

($ in millions)

2011A

2012A

2013A

2014P

2015P

Total Revenues

600.6

655.0

680.8

697.7

741.4

% Growth

7.6%

9.1%

3.9%

2.5%

6.3%

Gross Profit

130.6

139.9

153.5

165.7

176.2

% Gross Margin

21.7%

21.4%

22.5%

23.7%

23.8%

SG&A

96.3

99.1

110.0

114.2

116.8

% of Total Revenues

16.0%

15.1%

16.2%

16.4%

15.8%

Adjusted EBITDA

58.0

70.4

79.8

82.8

91.6

% EBITDA Margin

9.7%

10.7%

11.7%

11.9%

12.4%

Depreciation & Amortization

20.2

24.2

27.0

25.0

27.3

% of Total Revenues

3.4%

3.7%

4.0%

3.6%

3.7%

Adjusted EBIT

37.8

46.2

52.8

57.8

64.3

% EBIT Margin

6.3%

7.1%

7.8%

8.3%

8.7%

Capital Expenditures

16.3

17.8

19.1

23.2

24.3

% of Total Revenues

2.7%

2.7%

2.8%

3.3%

3.3%

Jason Historical and Projected Financial Performance

25

_____________________

Source

of

historical

financials:

Audited

financial

statements

of

Jason

Partners

Holdings

Inc.

A reconciliation from non-GAAP measures to GAAP measures is included

in the appendix hereto 2014P and 2015P EBITDA include $3M of

estimated annual public company costs (half year for 2014) and exclude earnings from JV sold in Q1 2014

Historical

Projections |

A Focus on Margin Expansion to Drive Profitability

26

EBITDA (2010-2013)

EBITDA Margins (2010-2013)

($ in millions)

80

Increased pricing and improved

customer perception has lead to

significant impact on gross

margins within Acoustics

Moving towards being the price

leader in Finishing where Jason’s

revenue is three times its largest

competitor

Further margin expansion

expected as a result of higher-

margin new product launches

Productivity initiatives, Lean and

Six Sigma projects will improve

COGS by 5% over prior year

9.9%

9.7%

10.7%

11.7%

2010

2011

2012

2013

55

58

70

2010

2011

2012

2013 |

Appendix |

Jason Adjusted EBITDA Reconciliation

28

2011

2012

2013

($ in millions)

Net income

$9.3

$14.7

$24.1

Tax provision

4.1

4.8

18.2

Interest expense

17.0

18.6

20.7

Depreciation and amortization

20.2

24.2

27.0

Loss

on

disposals

of

fixed

assets

-

net

0.1

0.5

-

EBITDA

50.7

62.8

90.0

Adjustments:

Impairment of long-lived assets

1.3

0.5

-

Restructuring

0.7

1.6

4.0

Advisory, legal, professional fees and special bonuses

0.9

1.0

6.1

Newcomerstown net fire costs (income) and related items

3.0

(1.4)

(18.8)

Adjustment for non-discrete fire costs

-

1.4

(1.4)

Multiemployer pension plan withdrawal expense (gain)

-

3.4

(0.7)

Purchase accounting impact of inventory write-up

0.4

-

-

Gain on claim settlement

-

-

(0.5)

Sponsor fees

1.0

1.1

1.1

Total adjustments

7.3

7.6

(10.2)

Adjusted EBITDA

$58.0

$70.4

$79.8 |

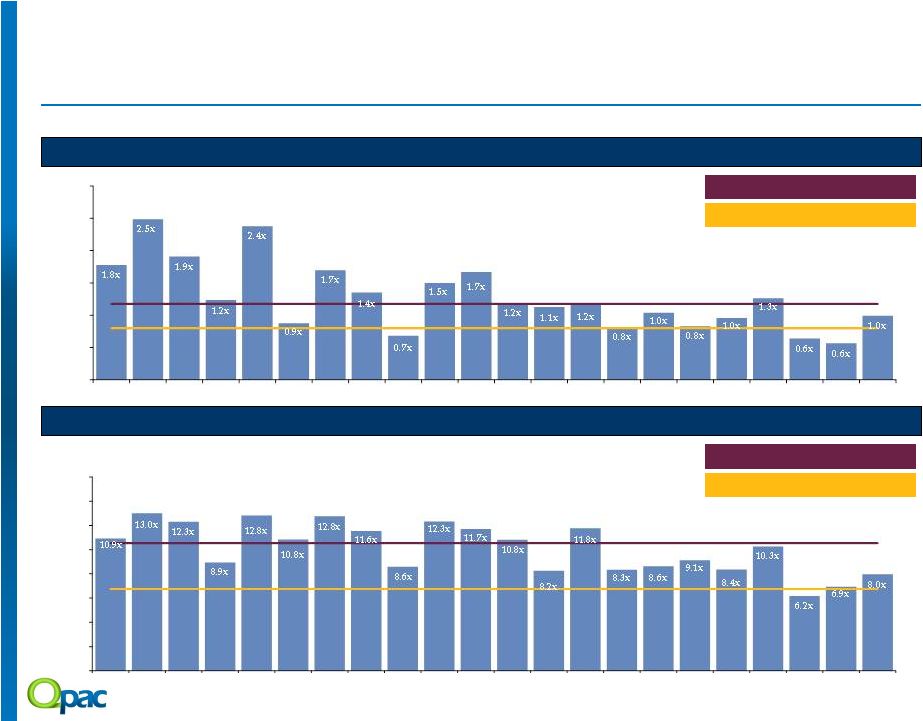

Valuation Summary

29

Selected Public Companies Trading Statistics

•EV/CY2013

Revenue EV/CY2013 EBITDA

EV/CY2013 Revenue Median: 1.2x

EV/CY2013 EBITDA Median: 10.5x

Target Purchase Multiple: 0.8x

Target Purchase Multiple: 6.8x

Source: S&P Capital IQ as of 3/7/2014, SEC filings, press releases,

investor presentations, Thomson Estimates, Factset Research Systems and Wall Street research.

0.0x

0.5x

1.0x

1.5x

2.0x

2.5x

3.0x

CSL

RXN

CR

RBC

B

AIT

NPO

TRS

GFF

CIR

AIMC

DW

BLT

FSS

PKOH

SXI

ROCK

CMCO

KAI

HNH

SHLO

NNBR

0.0x

2.0x

4.0x

6.0x

8.0x

10.0x

12.0x

14.0x

16.0x

CSL

RXN

CR

RBC

B

AIT

NPO

TRS

GFF

CIR

AIMC

DW

BLT

FSS

PKOH

SXI

ROCK

CMCO

KAI

HNH

SHLO

NNBR |

Valuation Summary

30

Selected Public Companies Trading Statistics (Detail)

Stock Price

Market Value

Valuation Multiples

Growth Data

% Off

Equity

Enterprise

EV / Rev

EV / EBITDA

P/E

Growth

PEG

3/7/14

LTM High

Value

Value

(1)

CY13

CY14

CY15

CY13

CY14

CY15

CY13

CY14

CY15

Rate

CY14

CY15

Carlisle Companies

$80.18

0%

$5,228

$5,225

1.8x

1.7x

1.6x

10.9x

9.8x

9.0x

20.0x

20.0x

17.1x

12%

1.7x

1.4x

Rexnord Corporation

30.82

0%

3,311

5,097

2.5x

2.3x

2.1x

13.0x

11.3x

10.5x

26.0x

19.0x

16.0x

23%

0.8x

0.7x

Crane Co.

73.08

0%

4,340

4,955

1.9x

1.6x

1.5x

12.3x

9.6x

8.8x

17.6x

15.5x

13.9x

10%

1.6x

1.5x

Regal Beloit Corporation

75.96

14%

3,456

3,825

1.2x

1.2x

1.1x

8.9x

8.5x

8.2x

17.9x

16.6x

14.3x

11%

1.5x

1.3x

Barnes Group

38.54

6%

2,118

2,595

2.4x

2.1x

2.1x

12.8x

9.8x

9.0x

21.4x

16.9x

15.2x

10%

1.7x

1.5x

Applied Industrial Technologies

51.66

4%

2,193

2,141

0.9x

0.8x

0.8x

10.8x

10.0x

8.5x

19.4x

17.5x

14.9x

12%

1.5x

1.2x

EnPro Industries

73.23

8%

1,558

1,940

1.7x

1.6x

1.6x

12.8x

11.7x

10.6x

N.M.

38.6x

32.0x

15%

2.6x

2.1x

TriMas Corporation

34.85

17%

1,577

1,885

1.4x

1.3x

1.2x

11.6x

8.5x

7.7x

16.5x

15.8x

13.5x

14%

1.1x

1.0x

Griffon Corporation

12.77

11%

656

1,294

0.7x

0.7x

N.A.

8.6x

8.0x

N.A.

42.6x

33.6x

N.A.

11%

3.1x

N.A.

CIRCOR International

75.53

9%

1,339

1,286

1.5x

1.4x

1.3x

12.3x

10.9x

9.6x

23.7x

20.2x

16.9x

21%

1.0x

0.8x

Altra Holdings

36.60

2%

990

1,206

1.7x

1.5x

1.4x

11.7x

9.6x

8.7x

22.4x

18.4x

15.7x

17%

1.1x

0.9x

Drew Industries Incorporated

52.17

5%

1,253

1,187

1.2x

1.1x

1.0x

10.8x

9.6x

8.2x

25.3x

19.3x

15.5x

17%

1.2x

0.9x

Blount International

12.62

14%

623

1,031

1.1x

1.1x

1.1x

8.2x

7.7x

7.2x

18.6x

15.2x

12.7x

13%

1.2x

1.0x

Federal Signal Corp

14.74

7%

938

1,007

1.2x

1.1x

1.1x

11.8x

11.0x

N.A.

16.9x

18.0x

15.8x

15%

1.2x

1.1x

Park-Ohio Holdings

52.43

5%

648

982

0.8x

0.7x

0.7x

8.3x

7.0x

N.A.

13.6x

11.2x

10.4x

13%

0.9x

0.8x

Standex International Corporation

57.28

12%

731

730

1.0x

1.0x

0.9x

8.6x

7.8x

N.A.

15.3x

13.5x

N.A.

15%

0.9x

N.A.

Gibraltar Industries

18.47

4%

570

687

0.8x

0.8x

0.8x

9.1x

8.1x

7.2x

28.0x

22.0x

15.8x

8%

2.7x

2.0x

Columbus McKinnon Corporation

26.05

8%

516

544

1.0x

0.9x

0.9x

8.4x

7.0x

6.2x

17.9x

14.6x

11.5x

16%

0.9x

0.7x

Kadant Inc.

40.07

4%

447

435

1.3x

1.1x

1.0x

10.3x

8.0x

7.9x

19.7x

15.1x

13.0x

20%

0.8x

0.7x

Handy & Harman

20.90

17%

271

418

0.6x

N.A.

N.A.

6.2x

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

N.A.

Shiloh Industries

17.48

31%

301

418

0.6x

0.5x

N.A.

6.9x

5.8x

N.A.

12.8x

10.7x

N.A.

19%

0.6x

N.A.

NN Inc.

19.27

10%

336

370

1.0x

0.9x

0.9x

8.0x

7.1x

6.5x

18.6x

14.7x

13.3x

16%

0.9x

0.8x

3rd Quartile

1.7x

1.5x

1.5x

11.9x

9.9x

9.0x

23.4x

19.6x

15.9x

17%

1.6x

1.4x

Mean

1.3x

1.2x

1.2x

10.1x

8.9x

8.4x

20.7x

18.4x

15.4x

15%

1.4x

1.1x

Median

1.2x

1.1x

1.1x

10.5x

8.5x

8.4x

19.0x

16.9x

15.1x

15%

1.2x

1.0x

1st Quartile

0.9x

0.9x

0.9x

8.4x

7.8x

7.4x

17.1x

14.9x

13.2x

12%

0.9x

0.8x

Source: S&P Capital IQ as of 3/7/2014, SEC filings, press releases,

investor presentations, Thomson Estimates, Factset Research Systems and Wall Street research.

1)

Enterprise value = market cap + net debt (including minority interest) +

redeemable convertible preferred. ($ in millions, except per

share data) |

Valuation Summary

31

Selected Public Companies Operating Statistics (Detail)

($ in millions, except per share data)

Revenue

Revenue Growth

Margin Analysis

Gross Margin

EBITDA

Net Income

CY13

CY14

CY15

CY13

CY14

CY15

CY13

CY14

CY15

CY13

CY14

CY15

CY13

CY14

CY15

Regal Beloit Corporation

$3,096

$3,251

$3,393

(2%)

5%

4%

26%

28%

26%

14%

14%

14%

4%

6%

7%

Carlisle Companies

2,943

3,148

3,370

3%

7%

7%

27%

28%

25%

16%

17%

17%

7%

8%

9%

Crane Co.

2,595

3,038

3,210

1%

17%

6%

40%

42%

34%

16%

17%

18%

8%

9%

9%

Applied Industrial Technologies

2,449

2,522

2,677

1%

3%

6%

28%

29%

N.A.

8%

9%

9%

5%

5%

5%

Rexnord Corporation

2,053

2,209

2,372

2%

8%

7%

40%

36%

37%

19%

20%

20%

1%

8%

8%

Griffon Corporation

1,901

1,949

N.A.

4%

3%

N.A.

24%

24%

23%

8%

8%

N.A.

0%

1%

N.A.

TriMas Corporation

1,395

1,485

1,576

10%

6%

6%

32%

31%

28%

12%

15%

15%

5%

7%

7%

Park-Ohio Holdings

1,218

1,366

1,445

7%

12%

6%

18%

N.A.

19%

10%

10%

N.A.

4%

4%

5%

EnPro Industries

1,144

1,184

1,242

(3%)

4%

5%

34%

37%

34%

13%

14%

15%

2%

5%

5%

Barnes Group

1,092

1,259

1,216

18%

15%

(3%)

46%

38%

34%

19%

21%

24%

25%

10%

11%

Drew Industries Incorporated

1,016

1,113

1,211

13%

10%

9%

26%

25%

21%

11%

11%

12%

5%

5%

6%

Blount International

901

935

971

(3%)

4%

4%

29%

31%

29%

14%

14%

15%

4%

5%

5%

CIRCOR International

858

889

956

1%

4%

7%

33%

35%

32%

12%

13%

14%

5%

8%

8%

Federal Signal Corp

851

905

947

6%

6%

5%

27%

27%

24%

10%

10%

N.A.

19%

5%

5%

Gibraltar Industries

828

865

910

5%

5%

5%

22%

22%

20%

9%

10%

11%

(1%)

3%

4%

Altra Holdings

722

826

868

(1%)

14%

5%

34%

37%

31%

14%

15%

16%

6%

6%

7%

Shiloh Industries

738

850

N.A.

23%

15%

N.A.

14%

11%

11%

8%

8%

N.A.

3%

3%

N.A.

Standex International Corporation

705

748

818

5%

6%

9%

37%

33%

33%

12%

13%

N.A.

6%

7%

N.A.

Handy & Harman

655

N.A.

N.A.

13%

N.A.

N.A.

N.A.

28%

N.A.

10%

N.A.

N.A.

6%

N.A.

N.A.

Columbus McKinnon Corporation

567

595

631

(7%)

5%

6%

31%

31%

32%

11%

13%

14%

13%

6%

7%

Kadant Inc.

344

412

423

4%

20%

3%

56%

56%

46%

12%

13%

13%

7%

7%

8%

NN Inc.

374

398

416

1%

6%

4%

21%

22%

19%

12%

13%

14%

5%

6%

N.A.

3rd Quartile

8%

13%

7%

36%

37%

34%

14%

15%

17%

7%

7%

8%

Mean

5%

8%

5%

31%

31%

31%

12%

13%

15%

6%

6%

7%

Median

3%

6%

6%

29%

29%

31%

12%

13%

14%

5%

6%

7%

1st Quartile

0%

4%

4%

25%

26%

22%

10%

10%

13%

4%

5%

5%

Jason Incorporated

$681

$698

$741

4%

2%

6%

22%

24%

24%

12%

12%

12%

1%

2%

3%

Source: S&P Capital IQ as of 3/7/2014, SEC filings, press releases,

investor presentations, Thomson Estimates, Factset Research Systems and Wall Street research. |