Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d694394d8k.htm |

Myers

Industries, Inc. Investor Presentation

March 2014

Exhibit 99.1 |

Forward Looking

Statements 2

Statements

in

this

presentation

concerning

the

Company’s

goals,

strategies,

and

expectations

for

business

and

financial

results

may

be

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

and

are

based

on

current

indicators

and

expectations.

Whenever

you

read

a

statement

that

is

not

simply

a

statement

of

historical

fact

(such

as

when

we

describe

what

we

“believe,”

“expect,”

or

“anticipate”

will

occur,

and

other

similar

statements),

you

must

remember

that

our

expectations

may

not

be

correct,

even

though

we

believe

they

are

reasonable.

We

do

not

guarantee

that

the

transactions

and

events

described

will

happen

as

described

(or

that

they

will

happen

at

all).

You

should

review

this

presentation

with

the

understanding

that

actual

future

results

may

be

materially

different

from

what

we

expect.

Many

of

the

factors

that

will

determine

these

results

are

beyond

our

ability

to

control

or

predict.

You

are

cautioned

not

to

put

undue

reliance

on

any

forward-looking

statement.

We

do

not

intend,

and

undertake

no

obligation,

to

update

these

forward-looking

statements.

These

statements

involve

a

number

of

risks

and

uncertainties

that

could

cause

actual

results

to

differ

materially

from

those

expressed

or

implied

in

the

applicable

statements.

Such

risks

include:

(1) Fluctuations in product demand and market acceptance

(2) Uncertainties associated with the general economic conditions in domestic and

international markets (3) Increased competition in our markets

(4) Changes in seasonality

(5)

Difficulties

in

manufacturing

operations,

such

as

production

outages

or

maintenance

programs

(6) Raw material availability

(7)

Fluctuations

in

raw

material

costs;

fluctuations

outside

the

“normal”

range

of

industry

cycles

(8) Changes in laws and regulations and approvals and decisions of courts,

regulators, and governmental bodies

Myers Industries, Inc. encourages investors to learn more about these risk factors.

A detailed explanation of these factors is available in the Company’s

publicly filed quarterly and annual reports, which can be found online at

www.myersindustries.com and at the SEC.gov web site. |

Strategic

Goals Strategic & Financial Goals to Drive Shareholder Value

•

Focus

on

industries

that

have

strong,

sustainable growth and profit

potential

•

Position

our

businesses

to

grow

through new products, geographic

expansion and acquisitions

•

Invest

within

our

five

business

growth platforms for value creation

•

Maintain

a

strong

and

flexible

balance sheet, providing funds for

acquisitions and returns to

shareholders

•

Optimize

Lawn

&

Garden

with

Phase

1 and Phase 2 projects

3

•

Sales

Growth

>

1.5x

GDP

•

Gross

Margin

>

29%

•

EPS

Growth

>

20%

CAGR

•

Free

Cash

Flow

>

100%

of

Net

Income

•

ROIC

>

Cost

of

Capital

•

L&G

to

return

Cost

of

Capital

in

2015

Financial Goals |

Company at a

Glance 4

2013 Net Sales

2013 Adjusted EBIT

Material Handling

Lawn & Garden

Engineered Products

Distribution

Two core businesses; four

reporting segments:

1.

Manufacturer of polymer

products

1.

Material Handling

2.

Engineered Products

3.

Lawn and Garden

2.

Wholesale distributor

4.

Distribution

Restructuring in Process |

Business

Segments 5 |

Growth

Platforms 6

Platform

Segment

Growth

Recent

Acquisitions

Returnable

Packaging

Material

Handling

Drive conversions to reusable products through

further penetration of food, liquid, bulk solids and

agricultural markets.

Novel

Storage &

Safety

Products

Material

Handling

Further grow platform with acquisitions. Strengthen

competitive advantage through distribution channels.

Jamco Products

Inc.

Tire Repair

& Retread

Products

Engineered

Products

Leverage product and customer expertise to grow

niche market.

Specialty

Molding

Engineered

Products

Expand our capabilities to further grow our positions

in Marine and RV.

Tire Supply

Distribution

Distribution

Grow through market reach, innovative products and

expanded global sourcing.

Myers Tyre Supply

India Limited

We will continuously upgrade Myers’

performance through:

Disciplined Portfolio Management

and

Investment in Profitable Growth |

Innovative

Products in 2013 7

Polymer Products

Distribution

Lawn and Garden

Material Handling

Engineered Products

Grower

Decorative

Containers

Decorative Products

for Retail

32x30 Bulk

Box (Gen II)

640-lb

CheeseBox

Novel

Beverage

Crate

AirFlexx

Bendable

Air Valve

Myers Pneumatics Line

TPMS Program Tool

Distribution

Tiltview

Product Line

Redesigned

AkroBin Lids

Rotationally-Molded

Polyethylene Marine Fuel

Tanks

Waste Water Holding

Tanks for Recreational

Vehicles |

Full Year 2013

Highlights •

Achieved 6.4% increase in adjusted EPS

•

$1.00 compared to $0.94 in 2012

•

Generated 95% increase in free cash flow

•

$66.1 million compared to $33.8 million

•

6% of total sales in 2013 came from products, services or markets

developed in the last three years.

•

Realized $16 million in Operations Excellence savings

•

3% of Cost of Goods sold

•

2012 Novel & Jamco acquisitions performed as anticipated in 2013

and

continue to be a good strategic fit

•

Increased dividend 12.5% to $0.09 per quarter or $0.36 per year

•

Invested $8.1 million to repurchase common stock

8

•

As part of Innovation initiative more than 40 new products and services

were introduced |

Full Year 2013

Financial Summary 9

•

Sales increased 4.3%

•

Novel and Jamco acquisitions

were the primary contributor to

the increase

•

Adjusted gross margin

expanded to 27.7% from 27.4%

•

Operations

Excellence

initiatives

drove

productivity

improvements

and

cost

savings

•

Adjusted net income increased

6.1%

•

Adjusted EPS increased 6.4%

Note: All figures except ratios and percents are $Millions

FY

FY

Highlights

2013

2012

B/(W)

Net sales

$825.2

$791.2

4.3%

Gross profit

margin -

adjusted¹

27.7%

27.4%

1.1%

SG&A

$173.7

$163.4

(6.3%)

Net income -

adjusted²

$34.1

$32.1

6.1%

Effective tax

rate

34.0%

36.7%

EPS -

adjusted²

$1.00

$0.94

6.4%

¹

See Reconciliation of Non-GAAP Measures slide 16

²

See Reconciliation of Non-GAAP Measures on slide 17 |

Progress

Towards Financial Goals 10

See Reconciliations of Non-GAAP Measures on slides 16 & 17 for details regarding

adjusted calculations in the above chart Metric

Goal

2013

2012

Sales Growth

(1)

> 1.5x GDP

4.3%

4.7%

Adjusted Gross Margin

> 29%

27.7%

27.4%

Adjusted EPS Growth

>20% CAGR

39.3%

21.8%

Free Cash Flow

>

100% of Net Income

254%

113%

ROIC

(2)

> 10%

10%

10%

Innovation / NPD

(3)

>10% of Sales

6%

6%

Operations Excellence Savings

5% of COGS (gross)

3%

3%

(1) Using real GDP forecasted and actual growth rates, 1.5x GDP growth = 2.9% and

3.3% for 2013 and 2012 respectively. (2) ROIC = Net Operating Profit After

Tax/(Debt + Equity). (3) NPD = New Product Development calculation based on

products/services introduced within the last three years. Key Accomplishment

Metrics |

Strong &

Flexible Balance Sheet 11

Note:

1) Net Debt-to-Capital ratio calculated as net debt/(net debt +

equity). Net Debt-to-Capital

Maintaining strong balance sheet for investments and

returning capital to shareholders |

Solid Cash

Flow Generation 12

Notes:

1)

Free cash flow calculated as cash flow from continuing operations less capital

expenditures. $(Millions)

Free Cash Flow

Generating Free Cash Flow, Investing for the Future and

Returning Cash to Shareholders

$31

$18

$29

$55

$77

$20

$57

$25

$42

$34

$66

$0

$20

$40

$60

$80

$100

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013 |

Balanced

Approach to Capital Allocation 13

•

New product development

•

Acquisitions

•

Dividends

•

Share repurchases

•

Debt reduction

Grow Shareholder Value

Return Capital to Shareholders

Re-invest in the Business

•

Organic growth capital expenditures

•

Process improvements |

Returning Cash

to Shareholders 14

•

Increasing Dividends

•

Increased Q1 2014 quarterly dividend by 44% to $0.13 per share

Quarterly Dividends Paid

Notes:

1) Above adjusted for stock dividends and splits in 2000, 2001, 2002 and 2004.

2) In 2007 there was an additional special dividend (not shown above) of $0.28 or $9.9M

accrued but not paid until 2008, resulting from a merger termination payment.

•

Buying Back Shares

•

Investing $40M to buy back shares in 2014

•

Invested $33M to buy back 2.8M shares from 2011 to 2013 |

15

Appendix |

16

Reconciliation of Non-GAAP Measures

Note

on

Reconciliation

of

Income

and

Earnings

Data:

Gross

profit

excluding

the

items

mentioned

above

in

the

text

of

this

release

and

in

this

reconciliation

chart

is

a

non-GAAP

financial

measure

that

Myers

Industries,

Inc.

calculates

according

to

the

schedule

above,

using

GAAP

amounts

from

the

unaudited

Consolidated

Financial

Statements.

The

Company

believes

that

the

excluded

items

are

not

primarily

related

to

core

operational

activities.

The

Company

believes

that

gross

profit

excluding

items

that

are

not

primarily

related

to

core

operating

activities

is

generally

viewed

as

providing

useful

information

regarding

a

company's

operating

profitability.

Management

uses

gross

profit

excluding

these

items

as

well

as

other

financial

measures

in

connection

with

its

decision-making

activities.

Gross

profit

excluding

these

items

should

not

be

considered

in

isolation

or

as

a

substitute

for

gross

profit

prepared

in

accordance

with

GAAP.

The

Company's

method

for

calculating

gross

profit

excluding

these

items

may

not

be

comparable

to

methods

used

by

other

companies.

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

CONDENSED CONSOLIDATED GROSS PROFIT (UNAUDITED)

(Dollars in thousands)

Twelve Months Ended

December 31

2013

2012

Gross Profit as reported

$ 217,628

$ 215,281

Restructuring and other adjustments in cost of sales

Material Handling Segment

178

—

Lawn & Garden Segment

10,957

—

Engineered Products Segment

56

1,121

Gross Profit as adjusted

$ 228,819

$ 216,402

|

Reconciliation

of Non-GAAP Measures 17

Note: Numbers in the Corporate and interest expense section above may

be rounded for presentation purposes. Note

on

Reconciliation

of

Income

and

Earnings

Data:

Income

(loss)

excluding

the

items

mentioned

above

in

the

text

of

this

release

and

in

this

reconciliation

chart

is

a

non-GAAP

financial

measure

that

Myers

Industries,

Inc.

calculates

according

to

the

schedule

above,

using

GAAP

amounts

from

the

unaudited

Consolidated

Financial

Statements.

The

Company

believes

that

the

excluded

items

are

not

primarily

related

to

core

operational

activities.

The

Company

believes

that

income

(loss)

excluding

items

that

are

not

primarily

related

to

core

operating

activities

is

generally

viewed

as

providing

useful

information

regarding

a

company's

operating

profitability.

Management

uses

income

(loss)

excluding

these

items

as

well

as

other

financial

measures

in

connection

with

its

decision-making

activities.

Income

(loss)

excluding

these

items

should

not

be

considered

in

isolation

or

as

a

substitute

for

net

income

(loss),

income

(loss)

before

taxes

or

other

consolidated

income

data

prepared

in

accordance

with

GAAP.

The

Company's

method

for

calculating

income

(loss)

excluding

these

items

may

not

be

comparable

to

methods

used

by

other

companies.

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

INCOME (LOSS) BEFORE TAXES BY SEGMENT (UNAUDITED)

(Dollars in millions, except per share data)

Twelve Months Ended

December 31

2013

2012

Material Handling

Income before taxes as reported

$ 41.1

$ 47.5

Restructuring expenses

0.2

0.2

Income before taxes as adjusted

41.3

47.7

Lawn and Garden

Income (loss) before taxes as reported

(1.5)

2.9

Restructuring expenses and other adjustments

11.4

0.6

Loss on disposal of assets

0.6

0.0

Depreciation recapture

1.3

0.0

Income before taxes as adjusted

11.8

3.5

Distribution

Income before taxes as reported

14.4

14.8

Restructuring expenses

0.2

0.7

Gain on building sale

0.0

(0.8)

Income before taxes as adjusted

14.6

14.7

Engineered Products

Income before taxes as reported

15.3

14.5

Restructuring expenses

0.2

1.2

Income before taxes as adjusted

15.5

15.7

Corporate and interest expense

Income (loss) before taxes as reported

(29.9)

(32.4)

Severance and other

0.0

1.8

Loss before taxes as adjusted

(29.9)

(30.6)

Consolidated

Income before taxes as reported

39.4

47.3

Restructuring expenses and other adjustments

13.9

3.7

Income before taxes as adjusted

53.3

51.0

Income taxes

19.2

18.9

Net Income as adjusted

$ 34.1

$ 32.1

Adjusted earnings per diluted share

$ 1.00

$ 0.94

|

Strategic

Principles 18

Customer

Dedication

Innovation

Operations

Excellence

Organization

Development

Financial

Strength

•

Structure the organization closer to the customer -

decentralize

•

Build and maintain processes to maximize customer input

•

Lead our industries in service, quality and delivery

•

Deliver next-generation products/services in high niche markets

•

Utilize “Voice of the Customer”

tools

•

Market based strategic planning

•

Maintain highest standards in safety and productivity

•

Ensure process for continuous quality, service and productivity

improvement

•

Ensure industry-best talent

•

Make Myers’

training and development a competitive advantage

•

Generate strong financial results –

EBITDA growth, Cash, ROIC

•

Maintain a strong balance sheet

•

Build industry leading decision-making tools across the business

|

Portfolio

Evolution 19 |

Macro

Indicators 20

Material Handling

MHEM (Material Handling Equipment) Index

Source: Material Handling Industry Feb 2014 Forecast |

Macro

Indicators 21

Lawn & Garden

Housing Starts; Consumer Sentiment

Sources: National Association of Home Builders (NAHB), Jan 2014;

Thomson Reuters/University of Michigan, Feb 2014 |

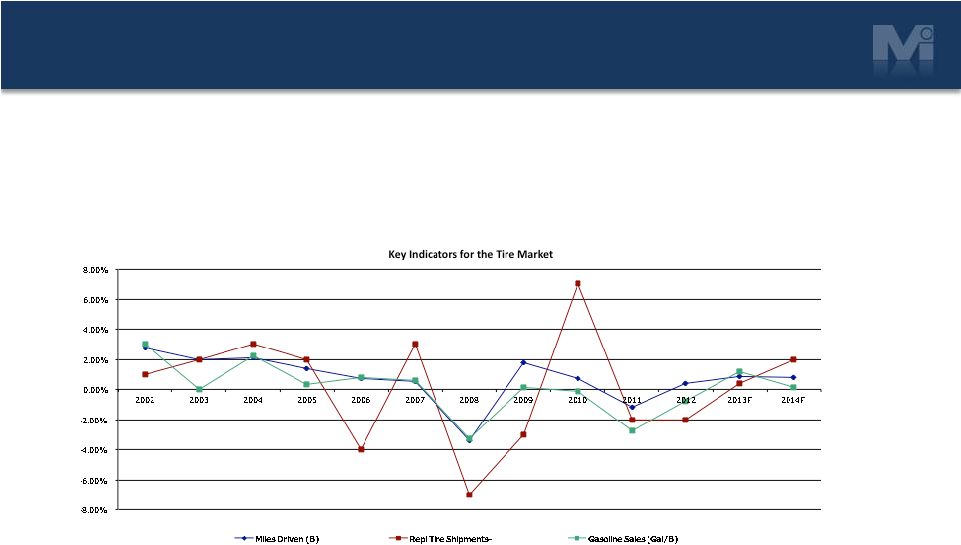

Macro

Indicators 22

Distribution

Replacement Tire Shipments; Miles Driven; Fuel Prices

Source: JP Morgan, RMA, Energy Information Administration, Feb 2014

|

Macro

Indicators 23

Engineered Products

RVIA; Motor Vehicle and Parts Production

Sources: RVIA Forecasts, Dec 2013;

FRB G17 Release, Feb 2014 |

|