Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - American Homes 4 Rent | v371694_8k.htm |

| EX-99.3 - EXHIBIT 99.3 - American Homes 4 Rent | v371694_ex99-3.htm |

| EX-99.1 - EXHIBIT 99.1 - American Homes 4 Rent | v371694_ex99-1.htm |

Fourth Quarter 2013

Supplemental Information Package

|

|

|

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Table of Contents

| Summary | |

| Financial and Operating Highlights | 3 |

| Fact Sheet | 4 |

| Notes to Fact Sheet | 5 |

| Earnings | |

| 2013 Quarterly Consolidated Statements of Operations | 6 |

| Funds from Operations and Adjusted Funds from Operations | 7 |

| Property Information | |

| Top 20 Markets Summary | 9 |

| Top 20 Markets Home Price Appreciation Trends | 10 |

| Leasing Experience | 11 |

| Operational Information | |

| Acquisition, Renovation and Leasing Rates | 12 |

| Portfolio Footprint Map | 13 |

| Non-GAAP Financial Measures | |

| Reconciliation of Net Operating Income to Net Loss | 14 |

| 2 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Financial and Operating Highlights

Fourth Quarter 2013 Highlights

| · | 31.2% sequential quarterly growth in revenues to $64.9 million |

| · | Funds from operations (“FFO”) was $20.9 million or $0.09 per FFO share, compared to $19.6 million or $0.09 per FFO share for the third quarter |

| · | Adjusted funds from operations (“AFFO”) (as defined) was $25.6 million or $0.11 per FFO share, compared to $20.7 million or $0.10 per FFO share for the third quarter |

| · | Net operating income from leased properties (“NOI”) was $40.0 million, a 26.6% increase from the $31.6 million reported for the prior quarter |

| · | 9.4% increase in portfolio to 23,268 single-family properties from 21,267 as of September 30, 2013, and from January 1, 2014 through February 28, 2014, acquired an additional 1,533 homes, increasing the portfolio to 24,801 |

| · | 3,473 properties leased during quarter ended December 31, 2013, for a total of 17,328 leased properties as of December 31, 2013 |

| · | Continued growth in total portfolio occupancy to 74.5% as of December 31, 2013, which has improved to 79.5% since yearend |

| · | Solid tenant renewal rate of 73.4% |

Year 2013 Highlights

| · | Revenues of $139.0 million and NOI of $86.5 million |

| · | During 2013 acquired approximately 20,000 single-family properties in desirable sub-markets of 22 states |

| · | Leased approximately 15,460 homes during 2013, raising the Company’s total portfolio occupancy from 31.9% to 74.5% |

| · | Successfully raised $886.8 million in initial public offering in July 2013 |

| · | 2013 tenant renewal rate of 71.1% |

| 3 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Fact Sheet

(Amounts in thousands, except share, per share and property information)

(Unaudited)

| Mar 31, 2013 | Jun 30, 2013 | Sep 30, 2013 | Dec 31, 2013 | |||||||||||||

| Operating Data - for the three months ended | ||||||||||||||||

| Revenues from single-family properties (1) | $ | 6,559 | $ | 17,757 | $ | 49,163 | $ | 64,470 | ||||||||

| Total revenues | $ | 6,559 | $ | 18,120 | $ | 49,463 | $ | 64,890 | ||||||||

| Leased property operating expenses | $ | 2,503 | $ | 6,859 | $ | 17,579 | $ | 24,470 | ||||||||

| Net operating income (2) | $ | 4,056 | $ | 10,898 | $ | 31,584 | $ | 40,000 | ||||||||

| Net operating income margin | 62 | % | 61 | % | 64 | % | 62 | % | ||||||||

| General and administrative expense and | ||||||||||||||||

| advisory fees as a percentage of total revenues | 67 | % | 24 | % | 6 | % | 6 | % | ||||||||

| Annualized general and administrative expense and | ||||||||||||||||

| advisory fees as a percentage of total assets | 1.04 | % | 0.51 | % | 0.28 | % | 0.35 | % | ||||||||

| Selected Balance Sheet Information - at end of period | ||||||||||||||||

| Single-family properties, net | $ | 1,120,843 | $ | 3,039,504 | $ | 3,530,122 | $ | 3,861,422 | ||||||||

| Total assets | $ | 1,678,261 | $ | 3,482,695 | $ | 3,885,261 | $ | 4,224,144 | ||||||||

| Outstanding borrowings under credit facility (3) | $ | - | $ | 670,000 | $ | 238,000 | $ | 375,000 | ||||||||

| Total liabilities | $ | 49,798 | $ | 831,359 | $ | 395,968 | $ | 573,485 | ||||||||

| Total market capitalization (4) | n/a | n/a | $ | 3,861,700 | $ | 3,873,866 | ||||||||||

| NYSE AMH Class A common share closing price | n/a | n/a | $ | 16.15 | $ | 16.20 | ||||||||||

| Portfolio Data - at end of period | ||||||||||||||||

| Leased single-family properties | 2,338 | 10,245 | 14,384 | 17,328 | ||||||||||||

| Single-family properties being renovated | 3,880 | 6,074 | 4,147 | 2,744 | ||||||||||||

| Vacant single-family properties available for lease | 1,356 | 2,007 | 2,736 | 3,152 | ||||||||||||

| Single-family properties held for sale | - | - | - | 44 | ||||||||||||

| Total single-family properties | 7,574 | 18,326 | 21,267 | 23,268 | ||||||||||||

| Total portfolio occupancy | 30.9 | % | 55.9 | % | 67.6 | % | 74.5 | % | ||||||||

| Available for rent 30+ days occupancy (5) | n/a | 89.7 | % | 89.6 | % | 90.1 | % | |||||||||

| Available for rent 90+ days occupancy (6) | n/a | 96.7 | % | 96.2 | % | 94.5 | % | |||||||||

| Quarterly lease renewal rate | 62.3 | % | 68.3 | % | 73.0 | % | 73.4 | % | ||||||||

| Other Data | ||||||||||||||||

| Distributions declared per common share | $ | - | $ | - | $ | - | $ | 0.05 | ||||||||

| Distributions declared per Series A preferred share (7) | $ | - | $ | - | $ | - | $ | 0.23 | ||||||||

| 4 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Notes to Fact Sheet

| (1) | Consists of rents from single-family properties and other revenues from single-family properties. |

| (2) | Net operating income (“NOI”) is a supplemental non-GAAP financial measure that we define as rents from single-family properties and other revenues from single-family properties, less property operating expenses for leased single-family properties. A reconciliation between net loss (as determined in accordance with GAAP) and NOI is included in a schedule accompanying this supplemental information package. |

| (3) | Our credit facility provides for borrowing capacity of up to $800 million and bears interest at 30 day LIBOR plus 2.75% (3.125% beginning in March 2017). Borrowings are available until March 2015, which may be extended for an additional year subject to the satisfaction of certain financial covenant tests. Upon expiration of the credit facility period, any outstanding borrowings will convert to a term loan through September 30, 2018. |

| (4) | Total market capitalization includes common shares outstanding at the end of respective period and 13,787,292 Class A units, 31,085,974 Series C units, 4,375,000 Series D units and 4,375,000 Series E units. |

| (5) | Available for rent 30+ days occupancy is calculated as the number of leased properties divided by the number of leased properties after we have completed initial renovations or are available for rent for a period of greater than 30 days. |

| (6) | Available for rent 90+ days occupancy is calculated as the number of leased properties divided by the number of leased properties after we have completed initial renovations or are available for rent for a period of greater than 90 days. |

| (7) | Represents initial pro-rated quarterly dividend on the Company’s 5% Series A participating preferred shares. |

| 5 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

2013 Quarterly Consolidated Statements of Operations

(Amounts in thousands, except share and per share information)

(Unaudited)

| For the Three Months Ended | ||||||||||||||||||||

| Mar 31, 2013 | Jun 30, 2013 | Sep 30, 2013 | Dec 31, 2013 | Year Ended Dec 31, 2013 | ||||||||||||||||

| Revenues: | ||||||||||||||||||||

| Rents from single-family properties | $ | 6,495 | $ | 17,020 | $ | 47,364 | $ | 61,843 | $ | 132,722 | ||||||||||

| Other revenues from single-family properties | 64 | 737 | 1,799 | 2,627 | 5,227 | |||||||||||||||

| Other | - | 363 | 300 | 420 | 1,083 | |||||||||||||||

| Total revenues | 6,559 | 18,120 | 49,463 | 64,890 | 139,032 | |||||||||||||||

| Expenses: | ||||||||||||||||||||

| Property operating expenses | ||||||||||||||||||||

| Leased single-family properties | 2,503 | 6,859 | 17,579 | 24,470 | 51,411 | |||||||||||||||

| Vacant single-family properties and other | 1,729 | 4,391 | 7,873 | 8,348 | 22,341 | |||||||||||||||

| General and administrative expense | 1,625 | 811 | 2,742 | 3,667 | 8,845 | |||||||||||||||

| Advisory fees | 2,742 | 3,610 | - | - | 6,352 | |||||||||||||||

| Interest expense | 370 | - | - | - | 370 | |||||||||||||||

| Noncash share-based compensation expense | 174 | 279 | 153 | 473 | 1,079 | |||||||||||||||

| Acquisition fees and costs expensed | 1,390 | 2,099 | 496 | 814 | 4,799 | |||||||||||||||

| Depreciation and amortization | 2,905 | 10,879 | 24,043 | 33,160 | 70,987 | |||||||||||||||

| Total expenses | 13,438 | 28,928 | 52,886 | 70,932 | 166,184 | |||||||||||||||

| Gain on remeasurement of equity method investment | - | 10,945 | - | - | 10,945 | |||||||||||||||

| Remeasurement of Series E units | - | - | (438 | ) | (1,619 | ) | (2,057 | ) | ||||||||||||

| Remeasurement of Preferred shares | - | - | - | (1,810 | ) | (1,810 | ) | |||||||||||||

| Income / (loss) from continuing operations | (6,879 | ) | 137 | (3,861 | ) | (9,471 | ) | (20,074 | ) | |||||||||||

| Discontinued operations | ||||||||||||||||||||

| Gain on disposition of single-family properties | - | 904 | - | - | 904 | |||||||||||||||

| Income from discontinued operations | 22 | 82 | - | - | 104 | |||||||||||||||

| Total income from discontinued operations | 22 | 986 | - | - | 1,008 | |||||||||||||||

| Net income / (loss) | (6,857 | ) | 1,123 | (3,861 | ) | (9,471 | ) | (19,066 | ) | |||||||||||

| Noncontrolling interest | 895 | 4,664 | 3,798 | 3,888 | 13,245 | |||||||||||||||

| Dividends on preferred shares | - | - | - | 1,160 | 1,160 | |||||||||||||||

| Conversion of preferred units | - | 10,456 | - | - | 10,456 | |||||||||||||||

| Net loss attributable to common shareholders | $ | (7,752 | ) | $ | (13,997 | ) | $ | (7,659 | ) | $ | (14,519 | ) | $ | (43,927 | ) | |||||

| Weighted average shares outstanding - basic and diluted | 48,233,982 | 95,971,706 | 162,725,150 | 185,499,066 | 123,592,086 | |||||||||||||||

| Net loss per share - basic and diluted: | ||||||||||||||||||||

| Loss from continuing operations | $ | (0.16 | ) | $ | (0.16 | ) | $ | (0.05 | ) | $ | (0.08 | ) | $ | (0.37 | ) | |||||

| Discontinued operations | - | 0.01 | - | - | 0.01 | |||||||||||||||

| Net loss attributable to common shareholders | ||||||||||||||||||||

| per share - basic and diluted | $ | (0.16 | ) | $ | (0.15 | ) | $ | (0.05 | ) | $ | (0.08 | ) | $ | (0.36 | ) | |||||

| 6 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Funds from Operations and Adjusted Funds from Operations

The following is a reconciliation of net loss attributable to common shareholders, determined in accordance with GAAP, to FFO and AFFO for the three months ended September 30, 2013 and December 31, 2013 (amounts in thousands, except share and per share information):

| For the Three Months Ended | ||||||||

| Sep 30, 2013 | Dec 31, 2013 | |||||||

| Net loss attributable to common shareholders | $ | (7,659 | ) | $ | (14,519 | ) | ||

| Adjustments: | ||||||||

| Noncontrolling interests in the Operating Partnership | 4,028 | 3,718 | ||||||

| Depreciation and amortization of real estate assets | 23,211 | 31,702 | ||||||

| Funds from operations | $ | 19,580 | $ | 20,901 | ||||

| Adjustments: | ||||||||

| Acquisition fees and costs expensed | 496 | 814 | ||||||

| Noncash share-based compensation expense | 153 | 473 | ||||||

| Remeasurement of Series E units | 438 | 1,619 | ||||||

| Remeasurement of Preferred shares | - | 1,810 | ||||||

| Adjusted funds from operations | $ | 20,667 | $ | 25,617 | ||||

| Weighted average number of FFO shares (1) | 216,348,416 | 239,122,332 | ||||||

| FFO per weighted average FFO share | $ | 0.09 | $ | 0.09 | ||||

| AFFO per weighted average FFO share | $ | 0.10 | $ | 0.11 | ||||

| (1) | Includes 162,725,150 and 185,499,066 weighted average Class A common shares and Class B common shares outstanding for the three months ended September 30, 2013 and December 31, 2013, respectively, and assumes full conversion of all Operating Partnership units outstanding, including 13,787,292 Class A units, 31,085,974 Series C units, 4,375,000 Series D units and 4,375,000 Series E units. |

FFO is a non-GAAP measure that we calculate in accordance with the White Paper on FFO approved by the Board of Governors of the National Association of Real Estate Investment Trusts (“NAREIT”), which defines FFO as net income or loss calculated in accordance with Generally Accepted Accounting Principles (“GAAP”), excluding extraordinary items, as defined by GAAP, gains and losses from sales of depreciable real estate and impairment write-downs associated with depreciable real estate, plus real estate-related depreciation and amortization (excluding amortization of deferred financing costs and depreciation of non-real estate assets), and after adjustment for unconsolidated partnerships and joint ventures.

AFFO is a non-GAAP financial measure that we use as a supplemental measure of our performance. We compute AFFO by adjusting FFO for (1) acquisition fees and costs expensed incurred with recent business combinations and the acquisition of properties with existing leases, (2) noncash share-based compensation expense and (3) noncash fair value adjustments associated with remeasuring our Series E units liability and Preferred shares derivative liability to fair value.

| 7 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Funds from Operations and Adjusted Funds from Operations (continued)

We present FFO and FFO per FFO share because we consider FFO to be an important measure of the performance of real estate companies, as do many analysts in evaluating our Company. We believe that FFO is a helpful measure of a REIT’s performance since FFO excludes depreciation, which is included in computing net income and assumes the value of real estate diminishes predictably over time. We believe that real estate values fluctuate due to market conditions and in response to inflation. We also believe that AFFO and AFFO per FFO share are helpful to investors as supplemental measures of the operating performance of our Company as they allow investors to compare our operating performance to prior reporting periods without the effect of certain items that, by nature, are not comparable from period to period.

FFO and AFFO are not a substitute for net cash flow provided by operating activities or net loss per share, as determined in accordance with GAAP, as a measure of our liquidity or operating performance or our ability to pay dividends. FFO and AFFO also are not necessarily indicative of cash available to fund future cash needs. Because other REITs may not compute FFO and AFFO in the same manner, FFO and AFFO may not be comparable among REITs.

| 8 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Top 20 Markets Summary

The table below summarizes certain information with respect to our top 20 markets as of December 31, 2013:

| Market | Number

of Properties | Percentage

of Total Properties | Net

Book Value ($ millions) | Percentage

of Net Book Value | Net

Book Value per Property | Average Sq. Ft. | Avg.

Age (years) | Leased Properties | Occupancy Percentage | |||||||||||||||||||||||||||

| Dallas-Fort Worth, TX | 2,085 | 9.0 | % | $ | 324.3 | 8.4 | % | $ | 155,542 | 2,188 | 10.2 | 1,573 | 75.4 | % | ||||||||||||||||||||||

| Indianapolis, IN | 2,021 | 8.7 | % | 292.5 | 7.6 | % | 144,743 | 1,893 | 11.5 | 1,509 | 74.7 | % | ||||||||||||||||||||||||

| Greater Chicago area, IL and IN | 1,519 | 6.5 | % | 230.4 | 6.0 | % | 151,702 | 1,861 | 12.4 | 857 | 56.4 | % | ||||||||||||||||||||||||

| Atlanta, GA | 1,461 | 6.3 | % | 237.0 | 6.1 | % | 162,204 | 2,157 | 13.0 | 1,112 | 76.1 | % | ||||||||||||||||||||||||

| Cincinnati, OH | 1,244 | 5.3 | % | 207.4 | 5.4 | % | 166,756 | 1,849 | 13.5 | 842 | 67.7 | % | ||||||||||||||||||||||||

| Houston, TX | 1,223 | 5.3 | % | 210.4 | 5.4 | % | 172,010 | 2,293 | 9.6 | 860 | 70.3 | % | ||||||||||||||||||||||||

| Charlotte, NC | 1,058 | 4.5 | % | 177.8 | 4.6 | % | 168,027 | 1,964 | 10.7 | 906 | 85.6 | % | ||||||||||||||||||||||||

| Nashville, TN | 994 | 4.3 | % | 199.2 | 5.2 | % | 200,444 | 2,202 | 9.5 | 884 | 88.9 | % | ||||||||||||||||||||||||

| Jacksonville, FL | 974 | 4.2 | % | 140.6 | 3.6 | % | 144,333 | 1,923 | 9.6 | 801 | 82.2 | % | ||||||||||||||||||||||||

| Phoenix, AZ | 962 | 4.1 | % | 143.2 | 3.7 | % | 148,828 | 1,811 | 11.3 | 868 | 90.2 | % | ||||||||||||||||||||||||

| Tampa, FL | 818 | 3.5 | % | 156.9 | 4.1 | % | 191,850 | 2,081 | 10.3 | 661 | 80.8 | % | ||||||||||||||||||||||||

| Raleigh, NC | 815 | 3.5 | % | 144.7 | 3.7 | % | 177,519 | 1,918 | 9.5 | 638 | 78.3 | % | ||||||||||||||||||||||||

| Salt Lake City, UT | 727 | 3.1 | % | 156.5 | 4.1 | % | 215,337 | 2,199 | 12.0 | 627 | 86.2 | % | ||||||||||||||||||||||||

| Columbus, OH | 725 | 3.1 | % | 104.0 | 2.7 | % | 143,515 | 1,823 | 12.7 | 433 | 59.7 | % | ||||||||||||||||||||||||

| Las Vegas, NV | 713 | 3.1 | % | 119.8 | 3.1 | % | 168,051 | 1,846 | 12.1 | 676 | 94.8 | % | ||||||||||||||||||||||||

| Orlando, FL | 613 | 2.6 | % | 99.8 | 2.6 | % | 162,743 | 1,966 | 12.5 | 468 | 76.3 | % | ||||||||||||||||||||||||

| Austin, TX | 408 | 1.8 | % | 57.0 | 1.5 | % | 139,795 | 1,892 | 9.7 | 277 | 67.9 | % | ||||||||||||||||||||||||

| Greenville, SC | 380 | 1.6 | % | 63.0 | 1.6 | % | 165,886 | 1,919 | 10.4 | 252 | 66.3 | % | ||||||||||||||||||||||||

| Tucson, AZ | 376 | 1.6 | % | 48.9 | 1.3 | % | 129,994 | 1,654 | 9.6 | 350 | 93.1 | % | ||||||||||||||||||||||||

| Greensboro, NC | 356 | 1.5 | % | 59.7 | 1.5 | % | 167,819 | 1,909 | 10.0 | 256 | 71.9 | % | ||||||||||||||||||||||||

| All Other (2) | 3,796 | 16.3 | % | 688.3 | 17.8 | % | 181,231 | 1,850 | 11.4 | 2,478 | 65.3 | % | ||||||||||||||||||||||||

| Total / Average | 23,268 | 100.0 | % | $ | 3,861.4 | 100.0 | % | $ | 165,948 | 1,972 | 11.2 | 17,328 | 74.5% (1) | |||||||||||||||||||||||

| (1) | As of the date of this supplemental information package, March 13, 2014, our total portfolio occupancy has increased to approximately 79.5%. |

| (2) | Represents 22 markets in 15 states. |

| 9 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Top 20 Markets Home Price Appreciation Trends

| HPA Index (1) | ||||||||||||||||||||||||||||

| Market | Relative Weighting of Top 20 Markets (2) | Dec 31, 2012 (3) | Mar 31, 2013 | Jun 30, 2013 | Sep 30, 2013 | Dec 31, 2013 | 2013 HPA Index Appreciation | |||||||||||||||||||||

| Dallas-Fort Worth, TX (4) | 9.507 | % | 100.0 | 100.9 | 105.5 | 107.1 | 108.4 | 8.4 | % | |||||||||||||||||||

| Indianapolis, IN | 8.880 | % | 100.0 | 104.0 | 107.4 | 110.4 | 108.0 | 8.0 | % | |||||||||||||||||||

| Greater Chicago area, IL and IN | 7.679 | % | 100.0 | 101.2 | 109.7 | 110.8 | 111.7 | 11.7 | % | |||||||||||||||||||

| Atlanta, GA | 7.545 | % | 100.0 | 104.1 | 111.5 | 114.6 | 115.0 | 15.0 | % | |||||||||||||||||||

| Nashville, TN | 6.390 | % | 100.0 | 102.1 | 106.7 | 107.9 | 109.9 | 9.9 | % | |||||||||||||||||||

| Houston, TX | 6.312 | % | 100.0 | 102.1 | 106.7 | 108.2 | 111.0 | 11.0 | % | |||||||||||||||||||

| Cincinnati, OH | 6.119 | % | 100.0 | 99.6 | 105.4 | 107.9 | 105.3 | 5.3 | % | |||||||||||||||||||

| Salt Lake City, UT | 5.495 | % | 100.0 | 104.7 | 109.7 | 110.3 | 109.6 | 9.6 | % | |||||||||||||||||||

| Tampa, FL | 5.361 | % | 100.0 | 100.2 | 107.8 | 111.1 | 112.3 | 12.3 | % | |||||||||||||||||||

| Charlotte, NC | 5.354 | % | 100.0 | 105.3 | 109.5 | 112.8 | 113.4 | 13.4 | % | |||||||||||||||||||

| Phoenix, AZ | 5.270 | % | 100.0 | 102.4 | 109.8 | 115.0 | 117.0 | 17.0 | % | |||||||||||||||||||

| Jacksonville, FL | 4.776 | % | 100.0 | 108.0 | 111.0 | 112.1 | 113.2 | 13.2 | % | |||||||||||||||||||

| Las Vegas, NV | 4.371 | % | 100.0 | 102.7 | 112.0 | 122.0 | 125.3 | 25.3 | % | |||||||||||||||||||

| Raleigh, NC | 4.040 | % | 100.0 | 103.5 | 106.1 | 107.8 | 107.0 | 7.0 | % | |||||||||||||||||||

| Columbus, OH | 3.167 | % | 100.0 | 101.5 | 106.9 | 111.0 | 107.8 | 7.8 | % | |||||||||||||||||||

| Orlando, FL | 3.036 | % | 100.0 | 99.4 | 106.9 | 110.0 | 107.5 | 7.5 | % | |||||||||||||||||||

| Tucson, AZ | 1.867 | % | 100.0 | 98.5 | 102.6 | 106.4 | 107.7 | 7.7 | % | |||||||||||||||||||

| Greensboro, NC | 1.789 | % | 100.0 | 102.8 | 104.8 | 105.4 | 102.3 | 2.3 | % | |||||||||||||||||||

| Austin, TX | 1.550 | % | 100.0 | 101.6 | 108.7 | 110.7 | 109.2 | 9.2 | % | |||||||||||||||||||

| San Antonio, TX | 1.490 | % | 100.0 | 99.0 | 100.3 | 101.1 | 100.8 | 0.8 | % | |||||||||||||||||||

| Total / weighted average | 100.0 | % | 10.8 | % | ||||||||||||||||||||||||

| (1) | HPA Index reflects the House Price Index of the Federal Housing Finance Agency (“FHFA”), known as the Quarterly Purchase-Only Index, specifically the non-seasonally adjusted “Purchase-Only Index” for the “100 Largest Metropolitan Statistical Areas.” |

| (2) | Relative weighting of top 20 markets based on properties as of September 30, 2013, consistent with relative weighting used for purposes of computing the “HPA Factor” for our 5% Series A participating preferred shares and 5% Series B participating preferred shares as described in the prospectuses for those securities. |

| (3) | For the illustrative purposes of this table, the HPA Index has been indexed as of December 31, 2012 and, as such, a baseline index value of 100.0 has been assigned to each market as of such date. The HPA Index values with respect to the other periods presented are relative measures calculated in relation to the baseline index value. |

| (4) | Our Dallas-Fort Worth, TX market is comprised of the Dallas-Plano-Irving and Fort Worth-Arlington Metropolitan Divisions, with each division being given equal weighting for purposes of determining the HPA Index. |

| 10 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Leasing Experience

The table below summarizes our leasing experience through December 31, 2013:

| Market | Leased (1) | Available for Rent 30+ Days(2) | Available for Rent 90+ Days(3) | 30+ Days Occupancy % (4) | 90+ Days Occupancy % (5) | Average Annual Scheduled Rent Per Property | ||||||||||||||||||

| Dallas-Fort Worth, TX | 1,554 | 1,667 | 1,583 | 93.2 | % | 98.2 | % | $ | 17,523 | |||||||||||||||

| Indianapolis, IN | 1,479 | 1,656 | 1,601 | 89.3 | % | 92.4 | % | 14,717 | ||||||||||||||||

| Greater Chicago area, IL and IN | 774 | 974 | 849 | 79.5 | % | 91.2 | % | 19,258 | ||||||||||||||||

| Atlanta, GA | 1,093 | 1,144 | 1,119 | 95.5 | % | 97.7 | % | 15,902 | ||||||||||||||||

| Houston, TX | 773 | 800 | 791 | 96.6 | % | 97.7 | % | 18,144 | ||||||||||||||||

| Phoenix, AZ | 827 | 875 | 866 | 94.5 | % | 95.5 | % | 13,247 | ||||||||||||||||

| Cincinnati, OH | 816 | 950 | 878 | 85.9 | % | 92.9 | % | 16,795 | ||||||||||||||||

| Jacksonville, FL | 690 | 713 | 698 | 96.8 | % | 98.9 | % | 15,388 | ||||||||||||||||

| Nashville, TN | 856 | 865 | 864 | 99.0 | % | 99.1 | % | 17,741 | ||||||||||||||||

| Charlotte, NC | 883 | 915 | 901 | 96.5 | % | 98.0 | % | 15,728 | ||||||||||||||||

| All Other (6) | 6,813 | 7,815 | 7,368 | 87.2 | % | 92.5 | % | 16,529 | ||||||||||||||||

| Total / Average | 16,558 | 18,374 | 17,518 | 90.1 | % | 94.5 | % | $ | 16,444 | |||||||||||||||

| (1) | Includes leases on properties for which we have completed renovations and excludes leases with tenants existing at the date of acquisition (“Stabilized Properties”) |

| (2) | Available for Rent 30+ Days represents the number of properties that have been leased after we have completed renovations or are available for rent (i.e., “rent-ready”) for a period of greater than 30 days. |

| (3) | Available for Rent 90+ Days represents the number of properties that have been leased after we have completed renovations or are available for rent (i.e., “rent-ready”) for a period of greater than 90 days. |

| (4) | Occupancy percentage is computed by dividing the number of leased properties by the number of properties available for rent 30+ days. |

| (5) | Occupancy percentage is computed by dividing the number of leased properties by the number of properties available for rent 90+ days. |

| (6) | Represents 32 markets in 19 states. |

| 11 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Acquisition, Renovation and Leasing Rates

“Rent Ready” includes properties for which initial construction has been completed during each quarter

“Leases Signed” includes the number of initial leases signed each quarter (includes Pre-Existing Leases)

| 12 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

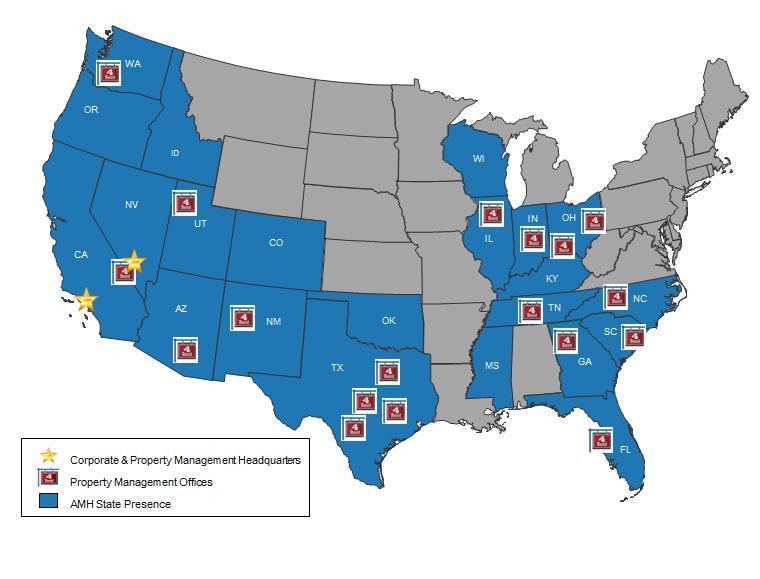

Portfolio Footprint Map

All properties in all markets are managed by AMH personnel.

| 13 |

American Homes 4 Rent

Supplemental Information Package

Fourth Quarter 2013

Reconciliation of Net Operating Income to Net Loss

NOI is a supplemental non-GAAP financial measure that AMH defines as rents from single-family properties and other revenues from single-family properties, less property operating expenses for leased single-family properties. NOI excludes income from discontinued operations, remeasurement of preferred shares, remeasurement of Series E units, gain on remeasurement of equity method investment, depreciation and amortization, acquisition fees and costs expensed, noncash share-based compensation expense, interest expense, advisory fees, general and administrative expense, property operating expenses for vacant single-family properties and other and other revenues.

AMH considers NOI to be a meaningful financial measure because we believe it is helpful to investors in understanding the operating performance of our leased single-family properties. It should be considered only as a supplement to net income / (loss) as a measure of our performance. NOI should not be used as a measure of AMH’s liquidity, nor is it indicative of funds available to fund AMH’s cash needs, including its ability to pay dividends or make distributions. NOI also should not be used as a substitute for net income / (loss) or net cash flows from operating activities (as computed in accordance with GAAP).

The following is a reconciliation of NOI to net loss as determined in accordance with GAAP (amounts in thousands):

| For the Three Months Ended | For the Years Ended December 31, | |||||||||||||||

| December 31, 2013 | September 30, 2013 | 2013 | 2012 | |||||||||||||

| Net loss | $ | (9,471 | ) | $ | (3,861 | ) | $ | (19,066 | ) | $ | (10,236 | ) | ||||

| Income from discontinued operations | - | - | (1,008 | ) | - | |||||||||||

| Remeasurement of Preferred shares | 1,810 | - | 1,810 | - | ||||||||||||

| Remeasurement of Series E units | 1,619 | 438 | 2,057 | - | ||||||||||||

| Gain on remeasurement of equity method investment | - | - | (10,945 | ) | - | |||||||||||

| Depreciation and amortization | 33,160 | 24,043 | 70,987 | 2,111 | ||||||||||||

| Acquisitions fees and costs expensed | 814 | 496 | 4,799 | 869 | ||||||||||||

| Noncash share-based compensation expense | 473 | 153 | 1,079 | 70 | ||||||||||||

| Interest expense | - | - | 370 | - | ||||||||||||

| Advisory fees | - | - | 6,352 | 937 | ||||||||||||

| General and administrative expense | 3,667 | 2,742 | 8,845 | 7,199 | ||||||||||||

| Property operating expenses for vacant | ||||||||||||||||

| single-family properties and other | 8,348 | 7,873 | 22,341 | 1,846 | ||||||||||||

| Other revenues | (420 | ) | (300 | ) | (1,083 | ) | - | |||||||||

| Net operating income | $ | 40,000 | $ | 31,584 | $ | 86,538 | $ | 2,796 | ||||||||

| 14 |