Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SMITH & WESSON BRANDS, INC. | d685938d8k.htm |

Exhibit 99.1

| March 2014 Smith & Wesson Investor Presentation |

| 2 Safe Harbor Certain statements contained in this presentation may be deemed to be forward-looking statements under federal securities laws, and the Company intends that such forward- looking statements be subject to the safe-harbor created thereby. Such forward-looking statements include but are not limited to statements regarding the Company's markets and strategies; the Company's vision and mission; anticipated sales, GAAP diluted EPS, fully diluted weighted average share count, non-recurring ERP related costs, and capital expenditures for the Company; the opportunities for growth of the Company; the Company's new products and product development; the demand for the Company's products and services; the Company's focus and objectives; and the Company's strategic direction and drivers for future periods. The Company cautions that these statements are qualified by important factors that could cause actual results to differ materially from those reflected by such forward-looking statements. Such factors include the demand for the Company's products, the Company's growth opportunities, the ability of the Company to obtain operational enhancements, the success of new products, the potential for increased regulation of firearms and firearm-related products, and other risks detailed from time to time in the Company's reports filed with the SEC. |

| 3 Business Highlights U.S. market leader in firearms with 162 years of rich history Iconic brand with 92% aided awareness*Smith & Wesson(r) Brand = revolver Innovative product portfolio serving broad user groupsRevolvers, polymer pistols, metal pistols, concealed carry pistols and revolvers, bolt action rifles, single shot rifles, rimfire and centerfire modern sporting rifles Diverse sales sources: Consumer: sporting goods, hunting, personal protection, concealed carryProfessional: international, law enforcement, government, military Healthy balance sheet with minimal leverage Solid, experienced management team Strong strategic direction 1,500 jobs in America - products made in America* Survey respondents who own a firearm and do not intend to purchase in the next 12 months andrespondents who intend to purchase a firearm within 12 months, whether or not they are current owners. |

| 4 Vision / Mission Our Vision: The leading firearms manufacturer Our Mission: To allow our employees to design, produce, and market high-quality, innovative firearms that meet the needs and desires of our consumer and professional customers |

| 5 Focus, Simplify, Execute Strategy for growth - underpinned by a focus on firearmsConsumer and professional marketsFamily of brands:Smith & Wesson(r)M&P(r)Thompson/Center Arms(tm)Performance Center(r)M&P as a brand and product platform: Polymer pistolsOperations: Ready to adapt to changing environmentExpand capacity and continue strong focus on flexibilityProducts: Deliver new products that meet needs, wants, and desires of professionals and consumersSales: Continue to increase market share in handguns |

| 6 Experienced Leadership Team James Debney, President & CEO 20+ years: multinational consumer and business-to- business environments including President of Presto Products Co., a $500 million business unit of Alcoa Consumer ProductsJeffrey Buchanan, EVP & CFO 25+ years: private and public company experience in financial management and law; CFO for publicly traded, global manufacturing company; law firm partner; public company board member |

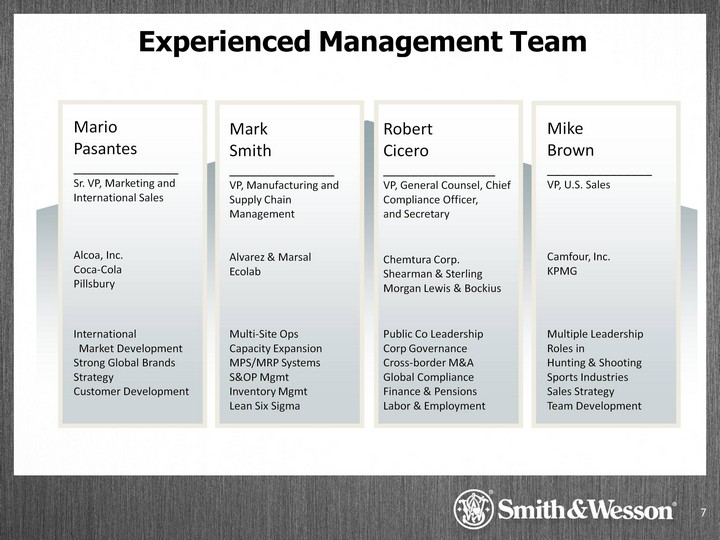

| 7 Experienced Management Team MarioPasantes_______________Sr. VP, Marketing and International SalesAlcoa, Inc.Coca-ColaPillsbury Mark Smith_______________VP, Manufacturing and Supply Chain ManagementAlvarez & MarsalEcolab Robert Cicero________________VP, General Counsel, Chief Compliance Officer,and SecretaryChemtura Corp.Shearman & SterlingMorgan Lewis & Bockius Mike Brown_______________VP, U.S. SalesCamfour, Inc.KPMG International Market DevelopmentStrong Global BrandsStrategyCustomer Development Multi-Site OpsCapacity ExpansionMPS/MRP SystemsS&OP MgmtInventory MgmtLean Six Sigma Public Co LeadershipCorp GovernanceCross-border M&AGlobal ComplianceFinance & Pensions Labor & Employment Multiple Leadership Roles inHunting & ShootingSports IndustriesSales StrategyTeam Development |

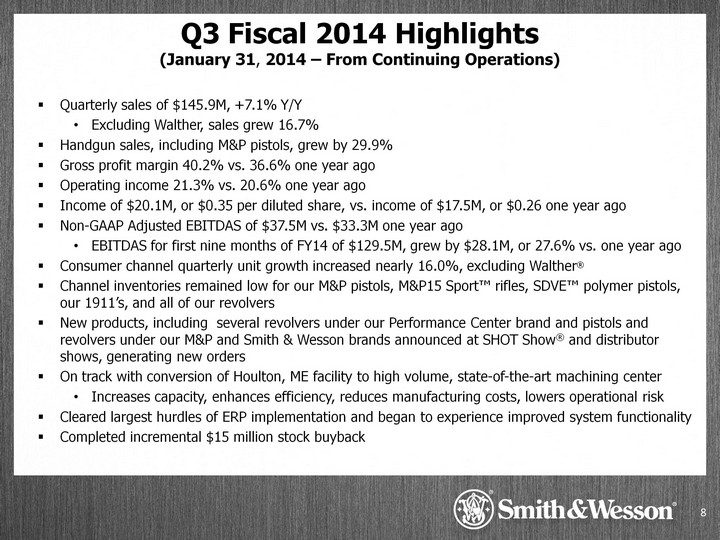

| 8 Q3 Fiscal 2014 Highlights (January 31, 2014 - From Continuing Operations) Quarterly sales of $145.9M, +7.1% Y/Y Excluding Walther, sales grew 16.7%Handgun sales, including M&P pistols, grew by 29.9%Gross profit margin 40.2% versus 36.6% one year agoOperating income 21.3% versus 20.6% one year agoIncome of $20.1M, or $0.35 per diluted share, versus income of $17.5M, or $0.26 one year agoNon-GAAP Adjusted EBITDAS of $37.5M versus $33.3M one year agoEBITDAS for first nine months of FY14 of $129.5M, grew by $27.5M, or 27% versus one year agoConsumer channel quarterly unit growth increased nearly 16.0%, excluding WaltherChannel inventories remained low for our M&P(r) pistols, M&P15 Sport rifles, SDVE(tm) polymer pistols, our 1911's, and all of our revolversNew products, including several revolvers under our Performance Center brand and pistols and revolvers under our M&P and Smith & Wesson brands announced at SHOT and distributor shows, generating new ordersOn track with conversion of Houlton, ME facility to high volume, state-of-the-art machining centerIncreases capacity, enhances efficiency, reduces manufacturing costs, lowers operational riskCleared largest hurdles of ERP implementation and began to experience improved system functionalityCompleted incremental $15 million stock buyback |

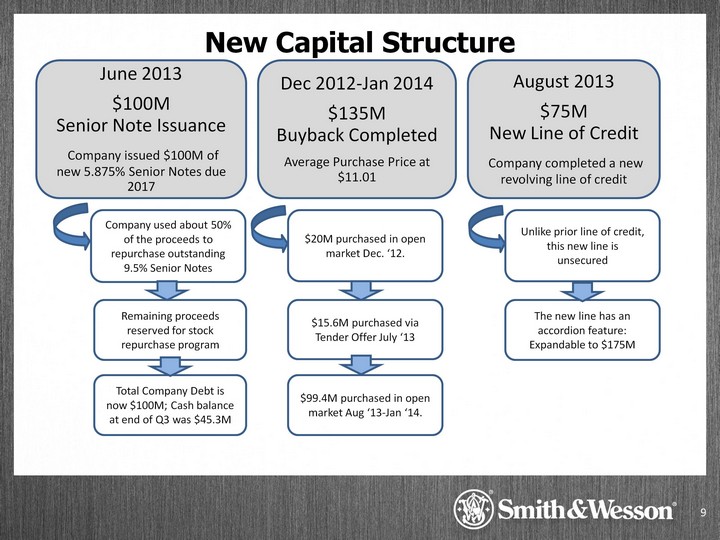

| 9 June 2013$100M Bond Issuance Company issued $100M of new 5.875% Senior Notes due 2017 Dec 2012-Jan 2014$135M Buyback CompletedAverage Purchase Price at $11.01 August 2013$75MNew Line of Credit Company completed a new revolving line of credit New Capital Structure Company used about 50% of the proceeds to repurchase outstanding 9.5% Senior Notes Total Company Debt is now $100M; Cash balance at end of Q2 was $52.9M Remaining proceeds reserved for stock repurchase program $20M purchased in open market Dec. '12. $99.4M purchased in open market Aug '13-Jan '14. Unlike prior line of credit, this new line isunsecured The new line has an accordion feature:Expandable to $175M $15.6M purchased via Tender Offer July '13 |

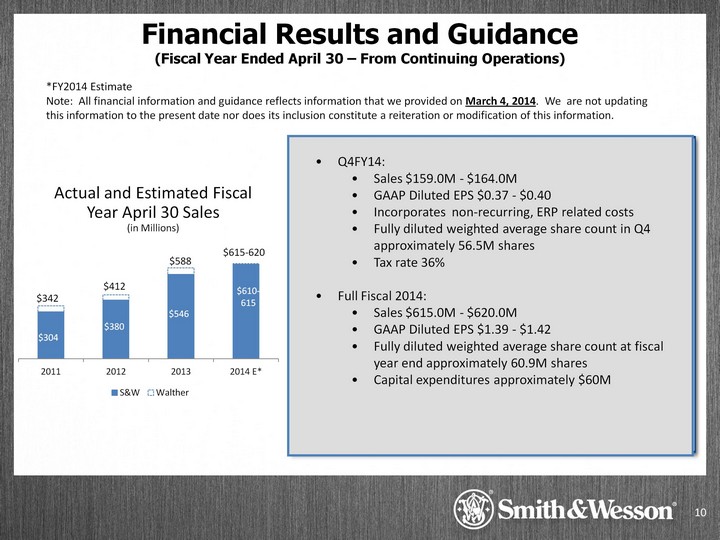

| 10 Financial Results and Guidance (Fiscal Year Ended April 30 - From Continuing Operations) Actual and Estimated Fiscal Year April 30 Sales (in Millions) Q4FY14:Sales $159.0M - $164.0M GAAP Diluted EPS $0.38 - $0.40Incorporates non-recurring, ERP related costsFully diluted weighted average share count in Q4 approximately 56.5M sharesFull Fiscal 2014:Sales $615.0M - $620.0M GAAP Diluted EPS $1.36 - $1.38Fully diluted weighted average share count at fiscal year end approximately 60.9M sharesTax rate 36%Capital expenditures approximately $60M *FY2014 EstimateNote: All financial information and guidance reflects information that we provided on March 4, 2014. We are not updatingthis information to the present date nor does its inclusion constitute a reiteration or modification of this information. |

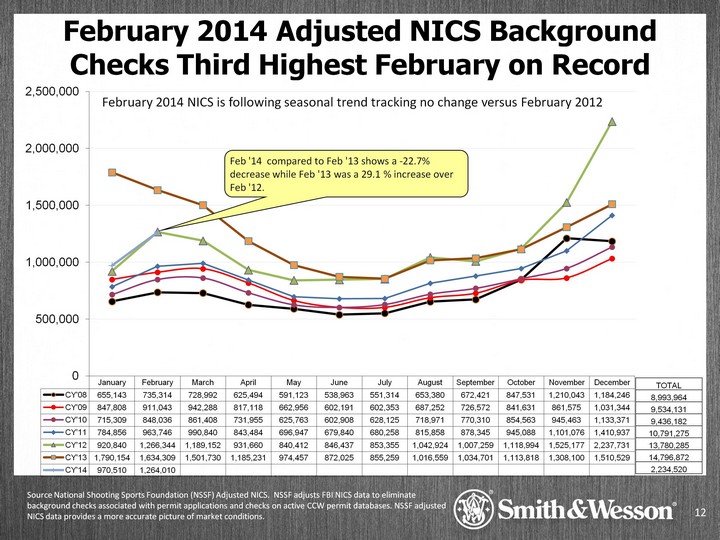

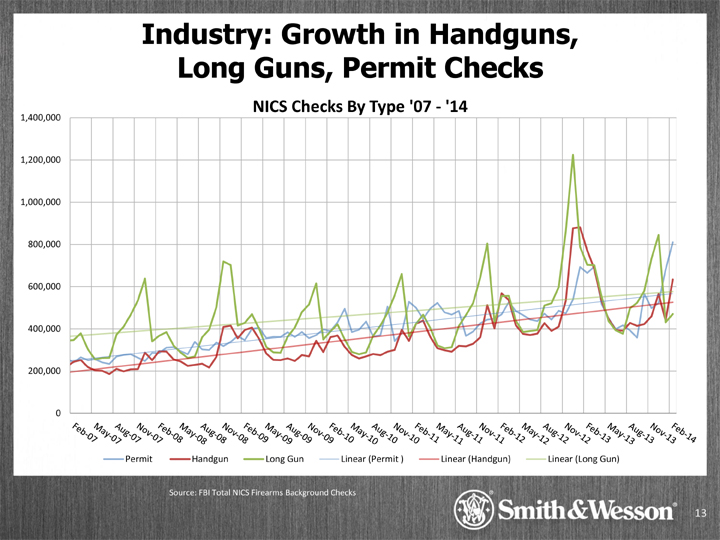

| 11 Industry Indicators NICSNICS background checks are conducted at the point of sale, tracked by the FBI, and reported monthly. NSSF adjusts the total to eliminate permit-related checks and other "noise"Adjusted NICS serves as a proxy for consumer sales since Smith & Wesson sells only to federally licensed firearm dealers who must, by law, conduct a background check on every firearm they sellApplies to retail stores, gun shows, anywhere an FFL sells a firearmFET DataFederal Excise Tax collection on manufacturing sales valuesNSSF translates into manufacturer's salesLagging data |

| 12 Source National Shooting Sports Foundation (NSSF) Adjusted NICS. NSSF adjusts FBI NICS data to eliminate background checks associated with permit applications and checks on active CCW permit databases. NSSF adjusted NICS data provides a more accurate picture of market conditions. (CHART) January 2014 Adjusted NICS Background Checks Second Highest January on Record TOTAL 8,993,964 9,534,131 9,436,182 10,791,275 13,780,285 14,796,872 970,510 January 2014 NICS is following seasonal trend tracking +5.4% versus January 2012 |

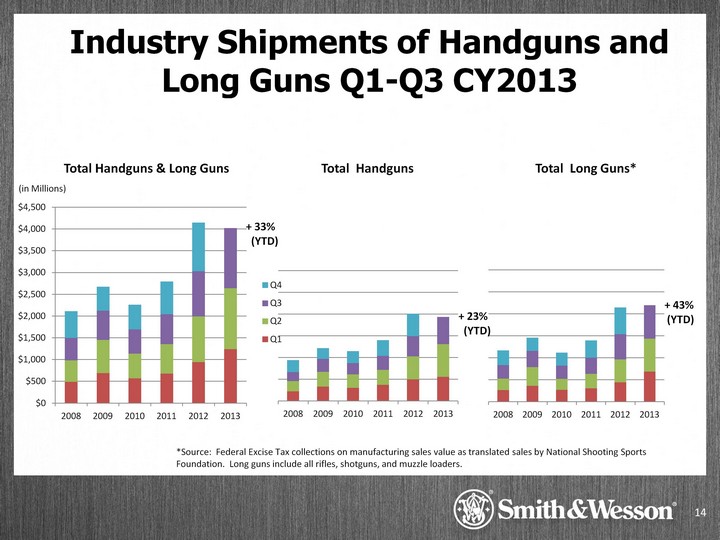

| Industry Shipments of Handguns and Long Guns Q1-Q3 CY2013 (in Millions) Total Handguns & Long Guns Total Handguns Total Long Guns* 14 (CHART) (CHART) (CHART) + 23% (YTD) + 43% (YTD) + 33% (YTD) *Source: Federal Excise Tax collections on manufacturing sales value as translated sales by National Shooting Sports Foundation. Long guns include all rifles, shotguns, and muzzle loaders. |

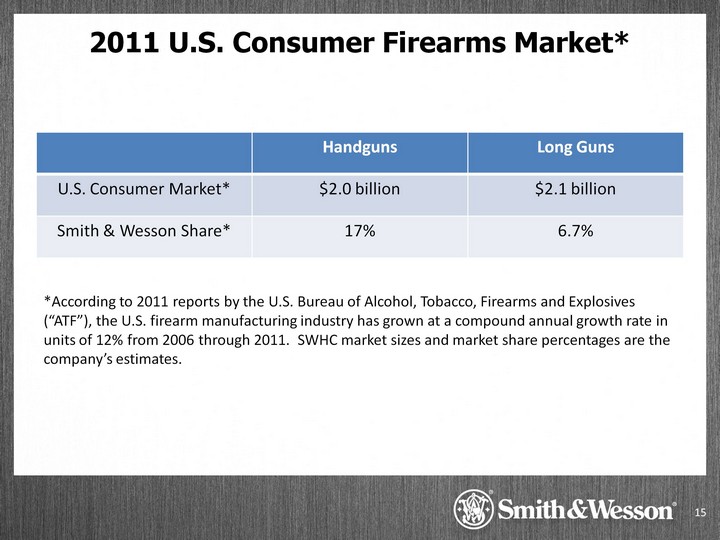

| 2011 U.S. Consumer Firearms Market* 2011 U.S. Consumer Firearms Market* 15 *According to 2011 reports by the U.S. Bureau of Alcohol, Tobacco, Firearms and Explosives ("ATF"), the U.S. firearm manufacturing industry has grown at a compound annual growth rate in units of 12% from 2006 through 2011. SWHC market sizes and market share percentages are the company's estimates. |

| 16 Consumer Market - U.S.NSSF Survey, 2011 (10,000 Respondents)90% of survey respondents who own a handgun own multiple firearms; the average number of firearms owned by those respondents was 8.1NSSF Survey, April 2013 (8,300 Respondents)Of those who have been sport shooting in 2012, 20% were new to shooting within past 5 yearsThat included 11% who just began shooting in 2012Females make up a disproportionate amount of new shooters. While only 22% of established shooters are female, 37% of new shooters are femaleFirst purchase drivers: home defense (87.3%), self-defense (76.5%), shooting with family/friends (73.2%) NSSF : Industry Research |

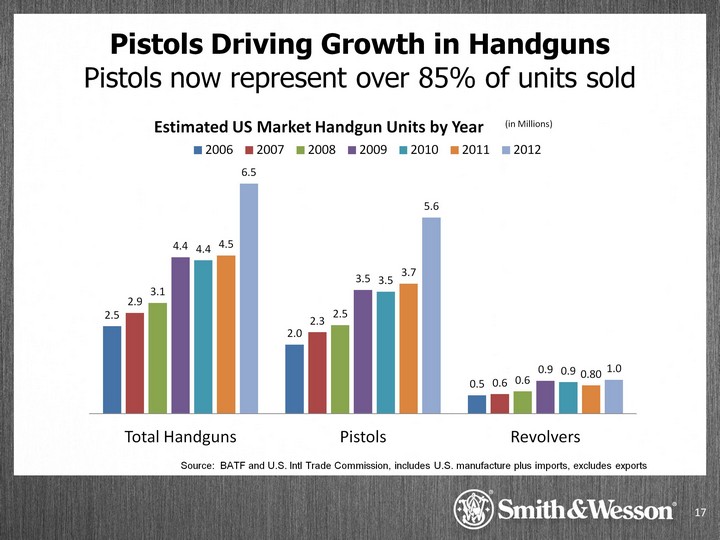

| 17 Pistols Driving Growth in Handguns Pistols now represent over 85% of units sold Pistols now represent over 85% of units sold Pistols now represent over 85% of units sold Source: BATF and U.S. Intl Trade Commission, includes U.S. manufacture plus imports, excludes exports |

| 18 Industry: Pistols vs. Revolvers Pistols and revolvers have different attributes, but pistols are preferred by both professionals and consumers Pistol advantages versus revolvers:Ergonomics/comfortHigh tech/cutting edgeModern shapeTrigger pullCapacitySafety featuresRevolver advantages versus pistols:Simpler to useEasy maintenance Reliability Source: 12/10 Strategic Platform and Extendibility Study |

| 19 Major Focus: M&P Pistol Growth Current Situation:Pistols are more than 85% of handguns soldCompact/slim and full-size polymer pistols are increasing in popularityM&P polymer pistols are highly sought after by professionals and consumers - especially M&P ShieldOur Focus:Grow M&P pistol market share:Understand consumer better than competition and market to facilitate share gainFocus on consumer trends: Concealed Carry, Personal Protection, RecreationIntelligently increase capacity and maintain robust new product pipelineMake it easier for dealers to support the M&P platform:Strong merchandising and store programsArmorer's Training and On-The-Hip ProgramNew CONNECT(tm) retail associate incentive programCommunicate directly with consumers to drive brand/product awarenessLeverage higher performance standards from professional markets |

| Key element in our go-to-market strategyRetail associate incentive rewards programIntuitive graphic interface, easy to use & register salesPoints never expire, and are transportableExtensive catalog of products & experiences, including select S&W, M&P, and T/C(r) firearmsTwo-way dialogue opportunity with retail associatesAbility to quickly assess market conditions through surveys, and communicate key product initiatives 20 |

| M&P Advertising: Communicating Directly with the Consumer 21 Welcome To The Closest Bond YetBetween Hand and Gun Numerous Features.Not One You'll Have To Think About |

| 22 M&P - Proven Performance M&P - Proven Performance Strong & Marketable Differences |

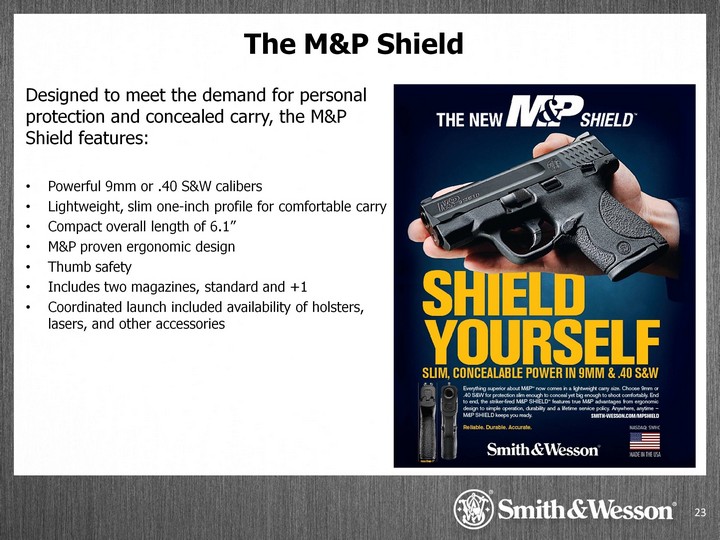

| 23 The M&P Shield Designed to meet the demand for personal protection and concealed carry, the M&P Shield features:Powerful 9mm or .40 S&W calibersLightweight, slim one-inch profile for comfortable carryCompact overall length of 6.1"M&P proven ergonomic designThumb safetyIncludes two magazines, standard and +1Coordinated launch included availability of holsters, lasers, and other accessories |

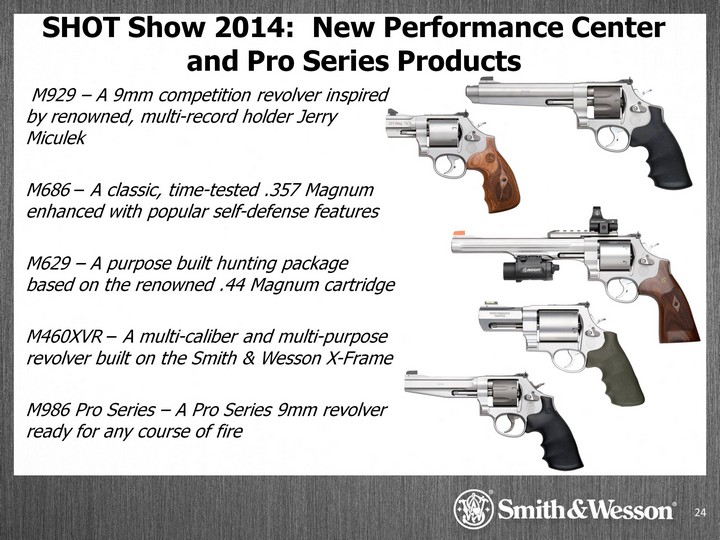

| 24 SHOT Show(r) 2014: New Performance Center(r) and ProSeries Products M929 - A 9mm competition revolver inspired by renowned, multi-record holder Jerry Miculek M686 - A classic, time-tested .357 Magnum enhanced with popular self-defense features M629 - A purpose built hunting package based on the renowned .44 Magnum cartridge M460XVR - A multi-caliber and multi-purpose revolver built on the Smith & Wesson X-Frame M986 Pro Series - A Pro Series 9mm revolver ready for any course of fire |

| 25 SHOT Show(r) 2014: New M&P Products M&P BODYGUARD(r) 380 - A sub-compact .380 ACP pistol enhanced with M&P style features M&P15-22 (Multi-color) - Popular M&P15-22 rifle now in four new camouflage finishes M&P10 - Multi-purpose M&P10 rifle now available with 20 round magazine capacity M&P15 300 Whisper(r) - All black finish M&P15 rifle in new .300 Whisper/.300 AAC Blackout caliber |

| 26 SHOT Show(r) 2014: New Smith & Wesson Models Model 69 Combat Magnum - Smith & Wesson's first L-Frame revolver in historic .44 Magnum Model 66 Combat Magnum - Collectible Combat Magnum revolver returns to the product lineup Governor(r) - Multi-caliber revolver now offered in popular matte silver finish SDVE9 and 40 - Popular SDVE pistols now available in California compliant models |

| Confidential, not for redistribution 27 SWHC: Firearms Growth Drivers Impact of California Microstamping Regulations In California, all new handguns must be approved and placed on a Roster, and all existing handguns must be recertified annuallyRecently, California began requiring all new pistols placed on the Roster to comply with microstamping. Additionally, any change to an existing pistol (no matter how small -- other than cosmetic) will cause the pistol to become subject to microstamping upon recertification to the RosterMicrostamping is ineffective and cost-prohibitive - we will not microstamp our firearms. Since we continually make enhancements to our firearms, various SKUs of our full and compact pistols (excluding California-compliant M&P Shield(tm) and SDVE models) will begin to fall off the Roster as recertification of each SKU occursStarting in February, we will begin to sell our California-compliant M&P Shield and SDVE(tm) pistols in California because those existing models were approved prior to the effective date of the microstamping requirement and thus will be grandfathered as long as we make no changes to those models Sales of these two models are expected to more than offset lost sales from M&Ps that will no longer be sold in CaliforniaRifles and revolvers are not impacted by the microstamping requirement |

| 28 Professional MarketLaw Enforcement / Federal Government International - large orders, e.g., Belgium, Australia, Canada, Puerto RicoUnited States Army Modular Handgun System (M-9 pistol) replacement:Attended 1st industry day Dec. 2013 - Second industry day originally planned Feb. 2014, has since been postponed Smith & Wesson will submit the M&P pistol: increased performance, reduced life cycle cost vs. current side armContract, if awarded, estimated at 450K M&P pistols over 5-10 years with deliveries beginning in two to three yearsValue to SWHC: honor to support military, reputation, halo effect SWHC: Firearms Growth Drivers |

| 29 Our Strategic Direction Grow sales and increase profitabilityOptimize manufacturing capacityAdd flexible capacity, internally and externallyFocus on M&P pistols and conceal carry products Financial modelQuarterly gross margins in the range of 37% - 41%Quarterly operating margins in the range of 20% - 25%Margins vary among quarters due to absorption impacts of seasonality, factory shutdowns, and holidaysMaintain robust new product pipelineLaunch new products strategicallyLeverage existing product portfolioLeverage balance sheet:Invest in firearm businessBuy back stock: Further buybacks restricted by bond covenants until May 2014 |

| March 2014 Smith & Wesson Investor Presentation |