Attached files

| file | filename |

|---|---|

| EX-14 - EX-14 - MYERS INDUSTRIES INC | d691118dex14.htm |

| 8-K - FORM 8-K - MYERS INDUSTRIES INC | d691118d8k.htm |

Myers

Industries, Inc. Investor Presentation

March 2014

Exhibit 99.1 |

Forward Looking

Statements 2

Statements in this presentation concerning the Company’s goals, strategies, and expectations for

business and financial results may be "forward-looking statements" within the

meaning of the Private Securities Litigation Reform Act of 1995 and are based on current

indicators and expectations. Whenever you read a statement that is not simply a statement of historical fact (such as when

we describe what we "believe," "expect," or "anticipate" will occur, and other

similar statements), you must remember that our expectations may not be correct, even though we

believe they are reasonable. We do not guarantee that the transactions and events

described will happen as described (or that they will happen at all). You should review this presentation with the

understanding that actual future results may be materially different from what we expect. Many

of the factors that will determine these results are beyond our ability to control or

predict. You are cautioned not to put undue reliance on any forward-looking

statement. We do not intend, and undertake no obligation, to update these forward-looking

statements. These statements involve a number of risks and uncertainties that could cause

actual results to differ materially from those expressed or implied in the applicable

statements. Such risks include:

(1) Fluctuations in product demand and market acceptance (2) Uncertainties

associated with the general economic conditions in domestic and international markets

(3) Increased competition in our markets (4) Changes in

seasonality (5) Difficulties in manufacturing operations, such as production outages or maintenance programs (6) Raw material

availability (7)

Fluctuations in raw material costs; fluctuations outside the “normal” range of industry cycles

(8) Changes in laws and regulations and approvals and decisions of courts, regulators, and

governmental bodies Myers Industries,

Inc. encourages investors to learn more about these risk factors. A detailed explanation

of these factors is available in the Company’s publicly filed quarterly and annual reports,

which can be found online at www.myersindustries.com and at the SEC.gov web site. |

Strategic

Goals Strategic & Financial Goals to Drive Shareholder Value

•

Focus

on

industries

that

have

strong,

sustainable growth and profit

potential

•

Position

our businesses to grow

through new products, geographic

expansion and acquisitions

•

Invest

within

our

five

business

growth platforms for value creation

•

Maintain

a strong and flexible

balance sheet, providing funds for

acquisitions and returns to

shareholders

•

Optimize

Lawn & Garden with Phase

1 and Phase 2 projects

3

•

Sales

Growth

>

1.5x

GDP

•

Gross

Margin

>

29%

•

EPS

Growth > 20%

CAGR •

Free

Cash

Flow

100%

of

Net

Income

•

ROIC

>

Cost

of

Capital

•

L&G

to

return

Cost

of

Capital

in

2015

Financial Goals |

Company at a

Glance 4

2013 Net Sales

2013

Adjusted

EBIT

Material Handling

Lawn & Garden

Engineered Products

Distribution

Two core businesses; four

reporting segments:

1.

Manufacturer of polymer

products

1.

Material Handling

2.

Engineered Products

3.

Lawn and Garden

2.

Wholesale distributor

4.

Distribution

Restructuring in Process

50%

14%

17%

19%

39%

25%

21%

15% |

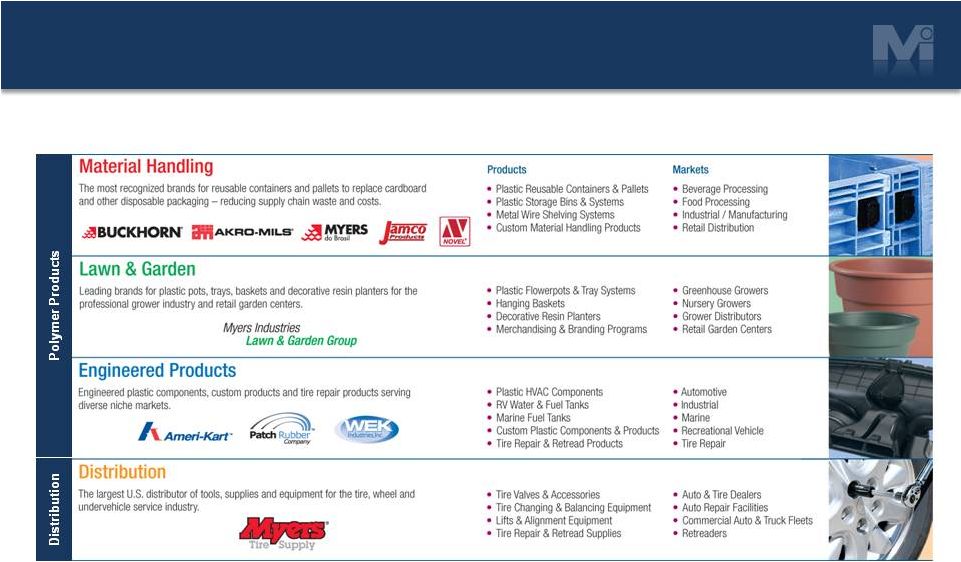

Business

Segments 5 |

Growth

Platforms 6

Platform

Segment

Growth

Recent

Acquisitions

Returnable

Packaging

Material

Handling

Drive conversions to reusable products through

further penetration of food, liquid, bulk solids and

agricultural markets.

Novel

Storage &

Safety

Products

Material

Handling

Further grow platform with acquisitions. Strengthen

competitive advantage through distribution channels.

Jamco Products

Inc.

Tire Repair

& Retread

Products

Engineered

Products

Leverage product and customer expertise to grow

niche market.

Specialty

Molding

Engineered

Products

Expand our capabilities to further grow our positions

in Marine and RV.

Tire Supply

Distribution

Distribution

Grow through market reach, innovative products and

expanded global sourcing.

Myers Tyre Supply

India Limited

We will continuously upgrade Myers’

performance through:

Disciplined Portfolio Management

and

Investment in Profitable Growth |

Tiltview

Product Line

Innovative New Products in 2013

7

Polymer Products

Distribution

Lawn and Garden

Material Handling

Engineered Products

Grower

Decorative

Containers

Decorative Products

for Retail

32x30 Bulk Box

(Gen II)

640-lb

CheeseBox

Novel

Beverage

Crate

Divider

Label Tab

Angle Vu Label Holder

Redesigned

AkroBin Lids

AirFlexx

Bendable

Air Valve

Myers Pneumatics Line

TPMS Program Tool

Akro-

Shelf

Myers Tire Supply |

Full Year 2013

Highlights •

Achieved 6.4% increase in adjusted EPS

•

$1.00 compared to $0.94 in 2012

•

Generated 95% increase in free cash flow

•

$66.1 million compared to $33.8 million

•

6% of total sales in 2013 came from products, services or markets

developed in the last three years.

•

Realized $16 million in Operations Excellence savings

•

3% of Cost of Goods sold

•

2012

Novel

&

Jamco

acquisitions

performed

as

anticipated

in

2013

and

continue to be a good strategic fit

•

Increased dividend 12.5% to $0.09 per quarter or $0.36 per year

•

Invested $8.1 million to repurchase common stock

8

•

As part of Innovation initiative more than 40 new products and services

were introduced |

Full Year 2013

Financial Summary 9

•

Sales increased 4.3%

•

Novel and Jamco acquisitions

were the primary contributor to

the increase

•

Adjusted gross margin

expanded to 27.7% from 27.4%

•

Operations Excellence

initiatives

drove productivity improvements

and cost savings

•

Adjusted net income increased

6.1%

•

Adjusted EPS increased 6.4%

Note: All figures except ratios and percents are $Millions

FY

FY

Highlights

2013

2012

B/(W)

Net sales

$825.2

$791.2

4.3%

Gross profit

margin -

adjusted¹

27.7%

27.4%

1.1%

SG&A

$173.7

$163.4

(6.3%)

Net income -

adjusted²

$34.1

$32.1

6.1%

Effective tax

rate

34.0%

36.7%

EPS -

adjusted²

$1.00

$0.94

6.4%

¹

See Reconciliation of Non-GAAP Measures slide 16

²

See Reconciliation of Non-GAAP Measures on slide 17 |

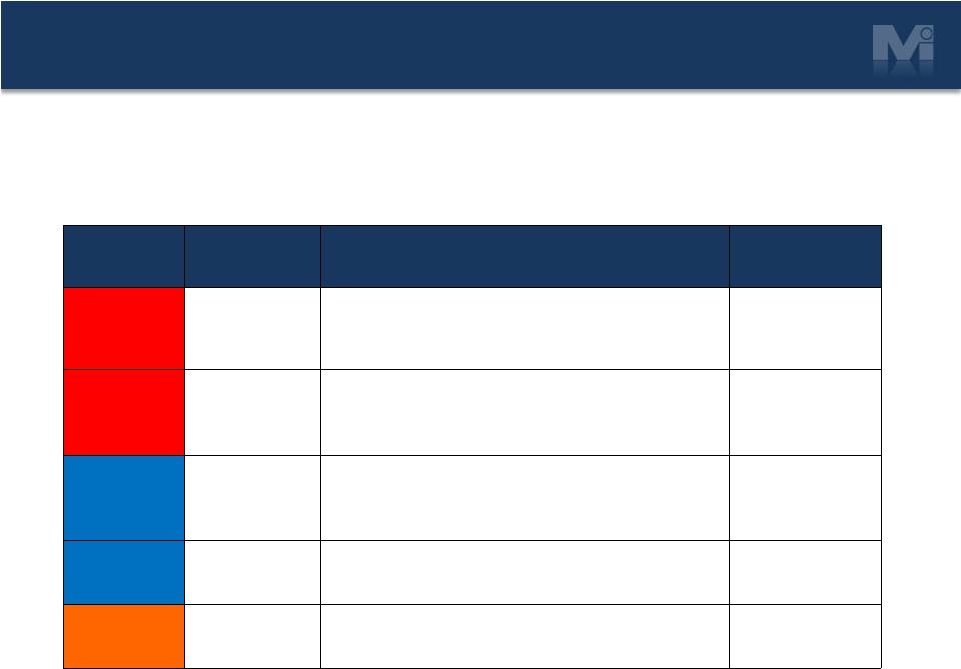

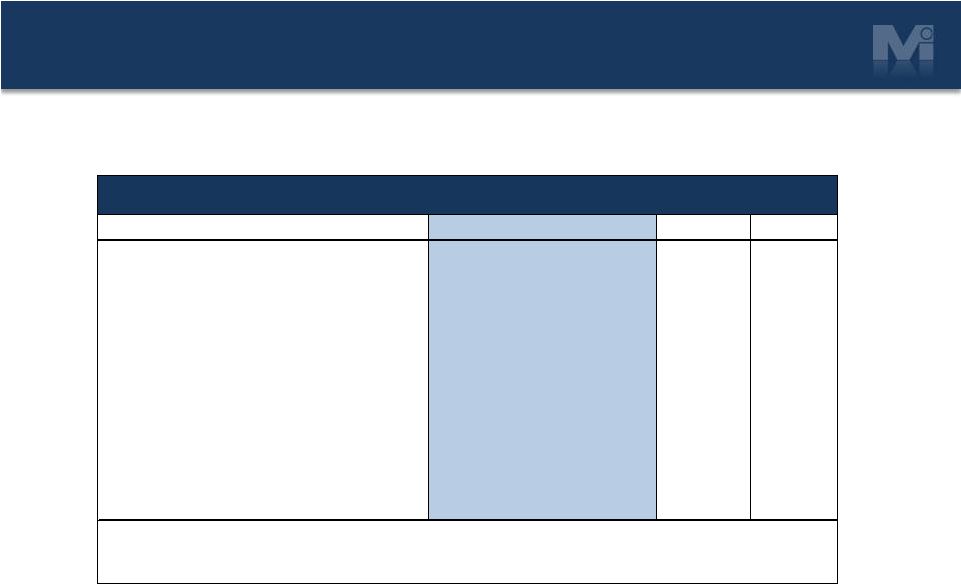

Progress

Towards Financial Goals 10

Metric

Goal

2013

2012

Sales Growth

(1)

> 1.5x GDP

4.3%

4.7%

Adjusted Gross Margin

> 29%

27.7%

27.4%

Adjusted EPS Growth

>20% CAGR

39.3%

21.8%

Free Cash Flow

= 100% of Net Income

254%

113%

ROIC

(2)

> 10%

10%

10%

Innovation / NPD

(3)

>10% of Sales

6%

6%

Operations Excellence Savings

5% of COGS (gross)

3%

3%

(1) Using real GDP forecasted and actual growth rates, 1.5x GDP growth = 2.9% and 3.3% for 2013 and

2012 respectively. (2) ROIC = Net Operating Profit After Tax/(Debt + Equity).

(3) NPD = New Product Development calculation based on products/services introduced within the last

three years. Key Accomplishment Metrics

See Reconciliations of Non-GAAP Measures on slides 16 & 17 for details regarding

adjusted calculations in the above chart |

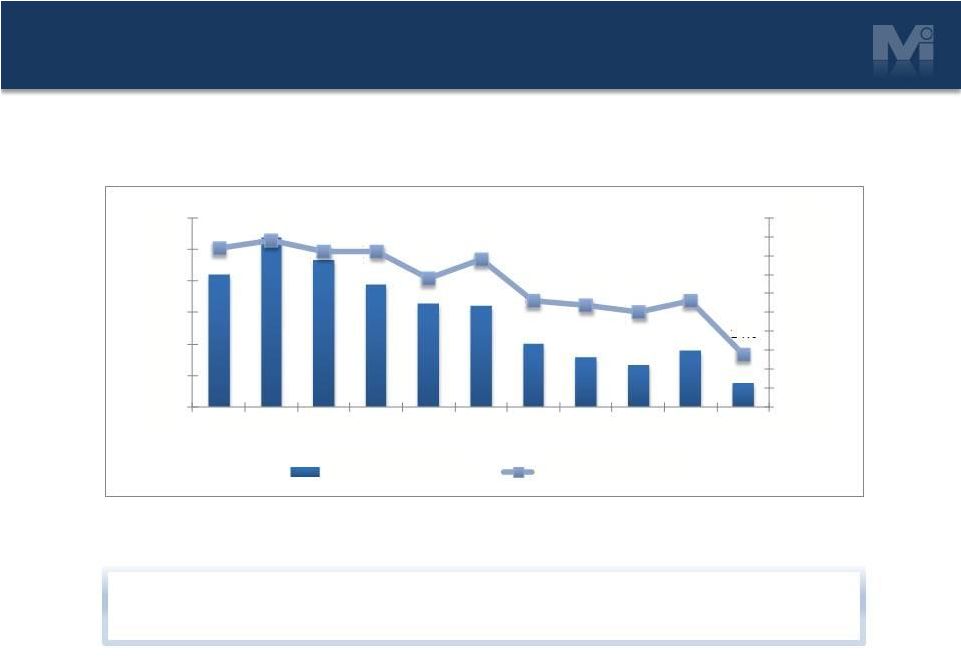

Strong &

Flexible Balance Sheet 11

Note:

1) Net Debt-to-Capital ratio calculated as net debt/(net debt +

equity). Net Debt-to-Capital

Maintaining strong balance sheet for investments and

returning capital to shareholders

42%

44%

41%

41%

34%

39%

28%

27%

25%

28%

14%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

$0

$50

$100

$150

$200

$250

$300

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Net Debt ($ Millions)

Net Debt-to-Capital |

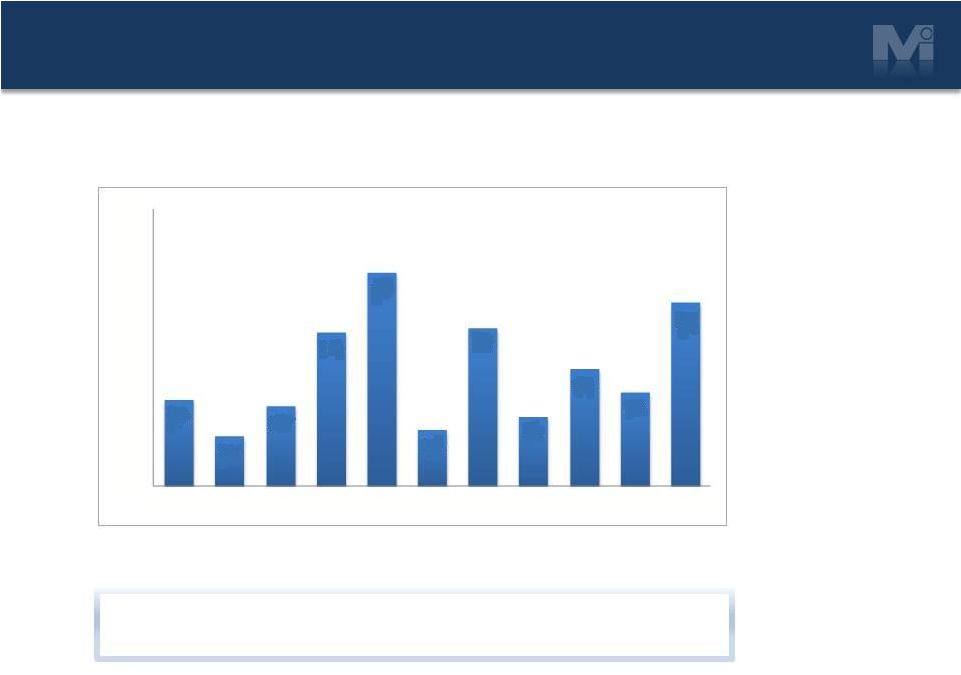

Solid Cash

Flow Generation 12

$(Millions)

Free Cash Flow

Generating Free Cash Flow, Investing for the Future and

Returning Cash to Shareholders

$31

$18

$29

$55

$77

$20

$57

$25

$42

$34

$66

$0

$20

$40

$60

$80

$100

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Notes:

1)

Free cash flow calculated as cash flow from continuing operations less capital expenditures. |

Balanced

Approach to Capital Allocation 13

•

New product development

•

Acquisitions

•

Dividends

•

Share repurchases

•

Debt reduction

Grow Shareholder Value

Return Capital to Shareholders

Re-invest in the Business

•

Organic growth capital expenditures

•

Process improvements |

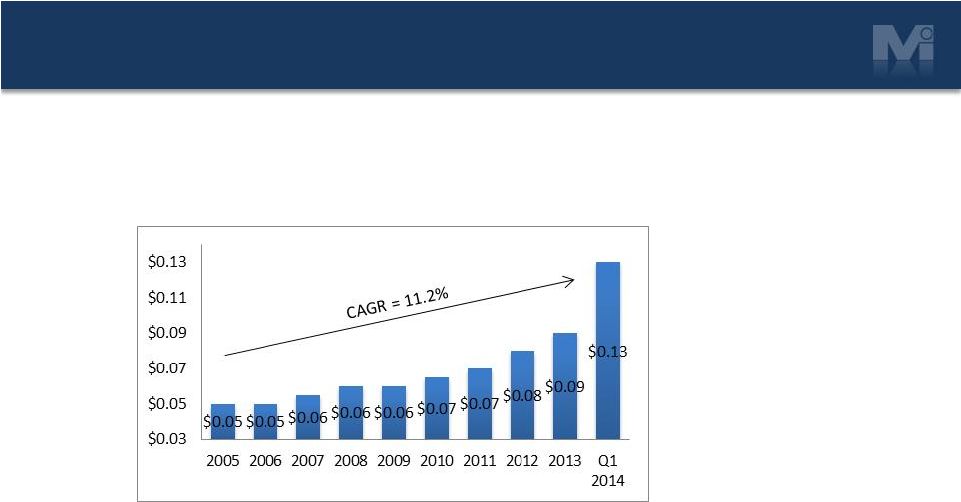

Returning Cash

to Shareholders 14

•

Increasing Dividends

•

Increased Q1 2014 quarterly dividend by 44% to $0.13 per share

Quarterly Dividends Paid

Notes:

1) Above adjusted for stock dividends and splits in 2000, 2001, 2002 and 2004.

2) In 2007 there was an additional special dividend (not shown above) of $0.28 or $9.9M

accrued but not paid until 2008, resulting from a merger termination payment.

•

Buying Back Shares

•

Investing $40M to buy back shares in 2014

•

Invested $33M to buy back 2.8M shares from 2011 to 2013 |

Appendix

15 |

16

Reconciliation of Non-GAAP Measures

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

CONDENSED CONSOLIDATED GROSS PROFIT (UNAUDITED)

(Dollars in thousands)

Twelve Months Ended

December 31

2013

2012

Gross Profit as reported

217,628

215,281

Restructuring and other adjustments in cost of sales

Material Handling Segment

Lawn & Garden Segment

Engineered Products Segment

56

1,121

Gross Profit as adjusted

228,819

216,402

10,957

178

$

$

$

$

Note on

Reconciliation

of

Income

and

Earnings

Data:

Gross

profit

excluding

the

items

mentioned

above

in

the

text

of

this

release

and

in

this

reconciliation chart is a non-GAAP financial measure that Myers Industries,

Inc. calculates according to the schedule above, using GAAP amounts from

the unaudited Consolidated Financial Statements. The Company believes that the excluded items are not primarily related to core operational

activities. The Company believes that gross profit excluding items that are not

primarily related to core operating activities is generally viewed as

providing useful information regarding a company's operating profitability.

Management uses gross profit excluding these items as well as other

financial

measures

in

connection

with

its

decision-making

activities.

Gross

profit

excluding

these

items

should

not

be

considered

in

isolation

or

as

a

substitute

for

gross

profit prepared

in accordance

with

GAAP.

The

Company's

method

for

calculating

gross

profit

excluding

these

items

may

not

be

comparable

to

methods

used

by

other

companies.

—

— |

Reconciliation

of Non-GAAP Measures 17

MYERS INDUSTRIES, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

INCOME (LOSS) BEFORE TAXES BY SEGMENT (UNAUDITED)

(Dollars in millions, except per share data)

Twelve Months Ended

December 31

2013

2012

Material Handling

Income before taxes as reported

$

41.1

$

47.5

Restructuring expenses

0.2

0.2

Income before taxes as adjusted

41.3

47.7

Lawn and Garden

Income (loss) before taxes as reported

(1.5)

2.9

Restructuring expenses and other adjustments

11.4

0.6

Loss on disposal of assets

0.6

0.0

Depreciation recapture

1.3

0.0

Income before taxes as adjusted

11.8

3.5

Distribution

Income before taxes as reported

14.4

14.8

Restructuring expenses

0.2

0.7

Gain on building sale

0.0

(0.8)

Income before taxes as adjusted

14.6

14.7

Engineered Products

Income before taxes as reported

15.3

14.5

Restructuring expenses

0.2

1.2

Income before taxes as adjusted

15.5

15.7

Corporate and interest expense

Income (loss) before taxes as reported

(29.9)

(32.4)

Severance and other

0.0

1.8

Loss before taxes as adjusted

(29.9)

(30.6)

Consolidated

Income before taxes as reported

39.4

47.3

Restructuring expenses and other adjustments

13.9

3.7

Income before taxes as adjusted

53.3

51.0

Income taxes

19.2

18.9

Net Income as adjusted

$

34.1

$

32.1

Adjusted earnings per diluted share

$

1.00

$

0.94

Note: Numbers in the Corporate and interest expense section above may

be rounded for presentation purposes. Note on

Reconciliation

of

Income

and

Earnings

Data:

Income (loss)

excluding

the

items

mentioned

above in

the

text

of

this

release

and

in

this reconciliation chart is a non-GAAP financial measure that Myers

Industries, Inc. calculates according to the schedule above, using GAAP

amounts from the unaudited Consolidated Financial Statements. The Company believes that the excluded items are

not

primarily related to core operational activities. The Company believes that income

(loss) excluding items that are not primarily related to

core operating activities is generally viewed as providing useful information

regarding a company's operating profitability. Management uses income (loss)

excluding these items as well as other financial measures in connection

with

its

decision-making

activities.

Income

(loss)

excluding

these

items

should

not

be

considered

in

isolation

or

asa

substitute

for

net

income(loss),

income

(loss)

before

taxes

or

other

consolidated

income

data

prepared

in

accordance

with

GAAP.

The

Company's

method

for

calculating

income

(loss)

excluding

these

items

may not be comparable to methods used by other companies.

|

Strategic

Principles 18

Customer

Dedication

Innovation

Operations

Excellence

Organization

Development

Financial

Strength

•

Deliver next-generation products/services in high niche markets

•

•

Market based strategic planning

•

Maintain highest standards in safety and productivity

•

Ensure process for continuous quality, service and productivity

improvement

•

Ensure industry-best talent

•

Make Myers’

training and development a competitive advantage

Utilize “Voice of the Customer” tools Structure the organization

closer to the customer - decentralize

Build and maintain processes to maximize customer input Lead our industries in service,

quality and delivery

Generate strong financial results – EBITDA growth, Cash, ROIC Maintain a strong balance sheet Build industry leading

decision-making tools across the business

•

•

•

•

•

• |

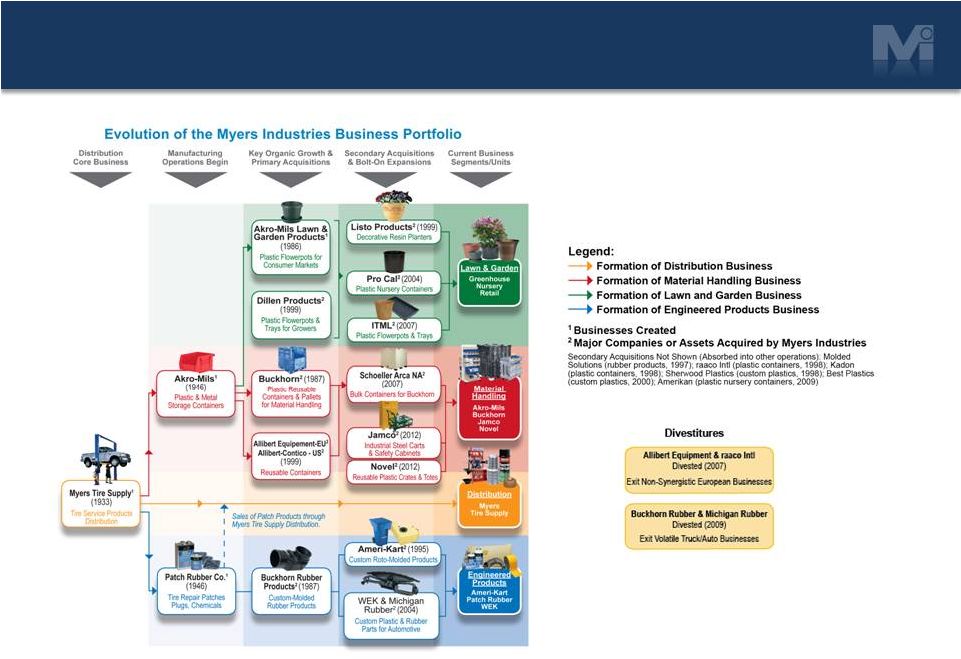

Portfolio

Evolution 19 |

Macro

Indicators 20

Material Handling

MHEM (Material Handling Equipment) Index

Source: Material Handling Industry Feb 2014 Forecast |

Macro

Indicators 21

Lawn & Garden

Housing Starts; Consumer Sentiment

Sources: National Association of Home Builders (NAHB), Jan 2014;

Thomson Reuters/University of Michigan, Feb 2014 |

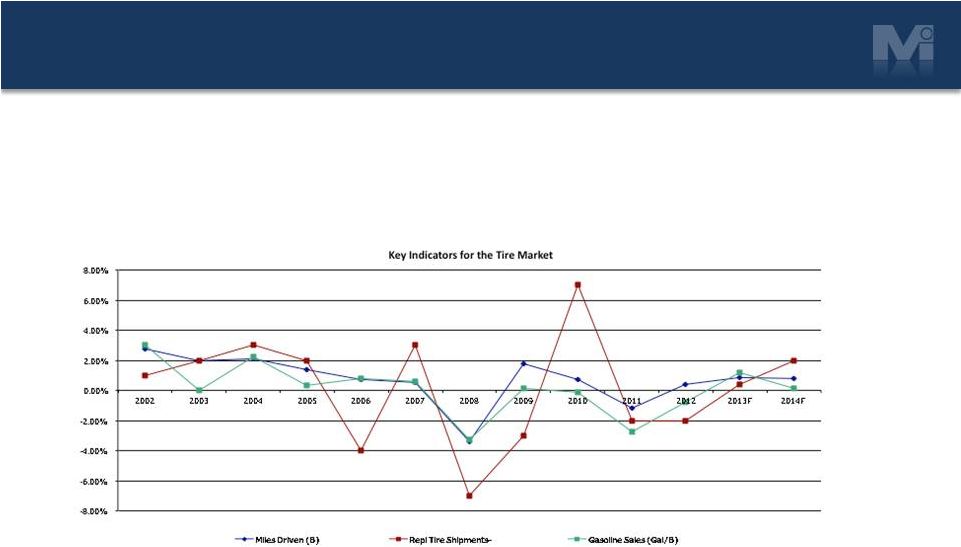

Macro

Indicators 22

Distribution

Replacement Tire Shipments; Miles Driven; Fuel Prices

Source: JP Morgan, RMA, Energy Information Administration, Feb 2014

|

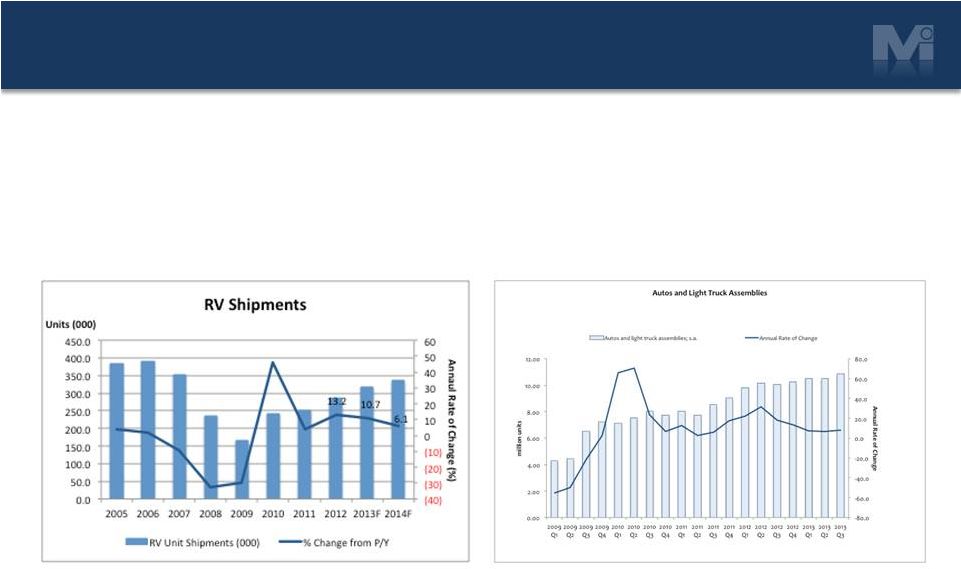

Macro

Indicators 23

Engineered Products

RVIA; Motor Vehicle and Parts Production

Sources: RVIA Forecasts, Dec 2013;

FRB G17 Release, Feb 2014 |

|