Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CHIQUITA BRANDS INTERNATIONAL INC | v371029_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - CHIQUITA BRANDS INTERNATIONAL INC | v371029_ex99-1.htm |

Creating a Leading Global Produce Company Investor Presentation March 10, 2014

2 This presentation contains certain statements that are “forward - looking statements” within the meaning of the U.S. Private Secur ities Litigation Reform Act of 1995. These statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of Chi qui ta and Fyffes, including: the customary risks experienced by global food companies, such as prices for commodity and other inputs, currency exchange fluctu ati ons, industry and competitive conditions (all of which may be more unpredictable in light of continuing uncertainty in the global economic environment), go ver nment regulations, food safety issues and product recalls affecting Chiquita and/or Fyffes or the industry, labor relations, taxes, political instability an d t errorism; unusual weather events, conditions or crop risks; access to and cost of financing; and the outcome of pending litigation and governmental investigations involvi ng Chiquita and/or Fyffes, as well as the legal fees and other costs incurred in connection with these items. Readers are cautioned that any forward - looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward - looking statement. Forward - looki ng statements relating to the transaction involving Fyffes and Chiquita include, but are not limited to: statements about the benefits of the transaction, inc luding future financial and operating results; Fyffes and Chiquita’s plans, objectives, expectations and intentions; the expected timing of completion of the transaction; and othe r s tatements relating to the transaction that are not historical facts. Forward - looking statements involve estimates, expectations and projections and, as a result, are subject to risks and uncertainties. There can be no assurance that actual results will not materially differ from expectations. Important factors co uld cause actual results to differ materially from those indicated by such forward - looking statements. With respect to the transaction, these factors include, but are not limited to: risks and uncertainties relating to the abili ty to obtain the requisite Fyffes and Chiquita shareholder approvals; the risk that Fyffes or Chiquita may be unable to obtain governmental and regulatory approvals require d f or the transaction, or required governmental and regulatory approvals may delay the transaction or result in the imposition of conditions that could reduce t he anticipated benefits from the transaction or cause the parties to abandon the transaction; the risk that a condition to closing of the Combination may not be satisfied; the length of time necessary to consummate the transaction; the risk that the businesses will not be integrated successfully; the risk that the cost savin gs and any other synergies from the transaction may not be fully realized or may take longer to realize than expected; disruption arising as consequence of the t ran saction making it more difficult to maintain existing relationships or establish new relationships with customers, employees or suppliers; the diversion of manag eme nt time on transaction - related issues; the ability of the combined company to retain and hire key personnel; the effect of future regulatory or legislative act ions on the companies; and the risk that the credit ratings of the combined company or its subsidiaries may be different from what the companies expect. These risks, as well as other risks associated with the transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the Registration Statement on Form S - 4 that will be filed with the SEC in connection with the transaction. Additional risks and unc ertainties are identified and discussed in Chiquita’s reports filed with the SEC and available at the SEC’s website at www.sec.gov and in Fyffes reports filed with the Registrar of Companies in Ireland and available at Fyffes website at www.fyffes.com . Forward - looking statements included in this document speak only as of the date of this document. Neither Chiquita nor Fyffes undertakes any obligation to update its forward - looking statements to reflect events or circumstances after the date of this document . Safe Harbor Statement

Tom Murphy Finance Director, Fyffes Rick P. Frier Executive Vice President and Chief Financial Officer, Chiquita Edward F. Lonergan President and Chief Executive Officer, Chiquita David McCann Executive Chairman, Fyffes Speakers on Today’s Call 3

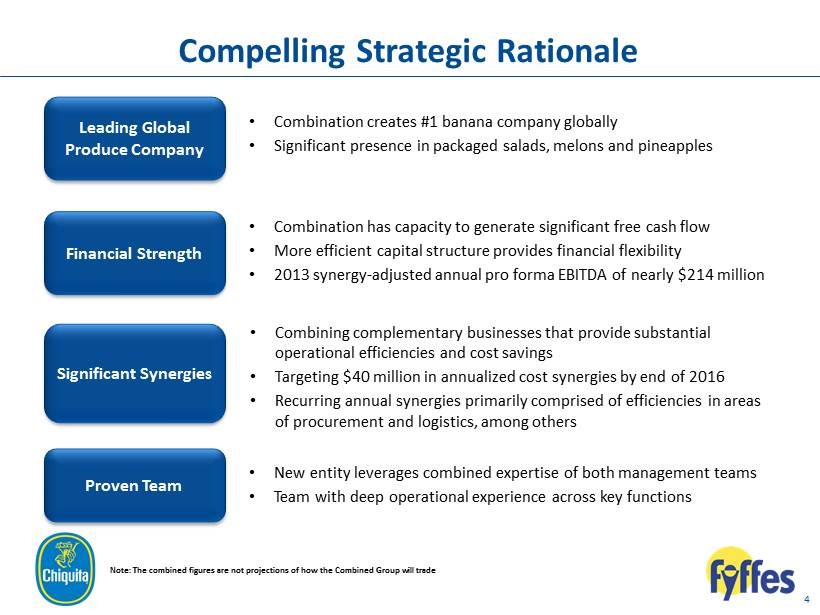

4 Leading Global Produce Company Significant Synergies Financial Strength Proven Team • Combination creates #1 banana company globally • Significant presence in packaged salads, melons and pineapples • New entity leverages combined expertise of both management teams • Team with deep operational experience across key functions • Combination has capacity to generate significant free cash flow • More efficient capital structure provides financial flexibility • 2013 synergy - adjusted annual pro forma EBITDA of nearly $214 million • Combining complementary businesses that provide substantial operational efficiencies and cost savings • Targeting $40 million in annualized cost synergies by end of 2016 • Recurring annual synergies primarily comprised of efficiencies in areas of procurement and logistics, among others Compelling Strategic Rationale Note: The combined figures are not projections of how the Combined Group will trade

5 Ownership Corporate Structure Corporate Presence Management Structure • All stock merger; 0.1567x shares of Chiquita for each Fyffes share • Fully diluted ownership of ~50.7 % Chiquita and ~49.3 % Fyffes shareholders • Key executives located in Charlotte , North Carolina and Dublin, Ireland • Company will be listed on New York Stock Exchange and domiciled in Ireland • CEO – David McCann 1 • CFO – Tom Murphy 1 • COO Fresh Fruit – Coen Bos • COO Salads – Brian Kocher • CAO – Kevin Holland • CLO – James E Thompson • CRO – Manuel Rodriguez Best of Both Board Composition • Chairman – Ed Lonergan • Equal number of directors plus 1 mutually agreed Combined Equity Value of Approximately $1.07 Billion Expected to Close Before End of 2014 1 Will become member of ChiquitaFyffes plc Board

6 • #1 European operator • #2 US operator • US market leader in packaged salads • # 1 US melon importer • #3 pineapple distributor in US and Europe Largest in global banana category Strong positions in other key categories Global Presence With Widely Recognized Brands

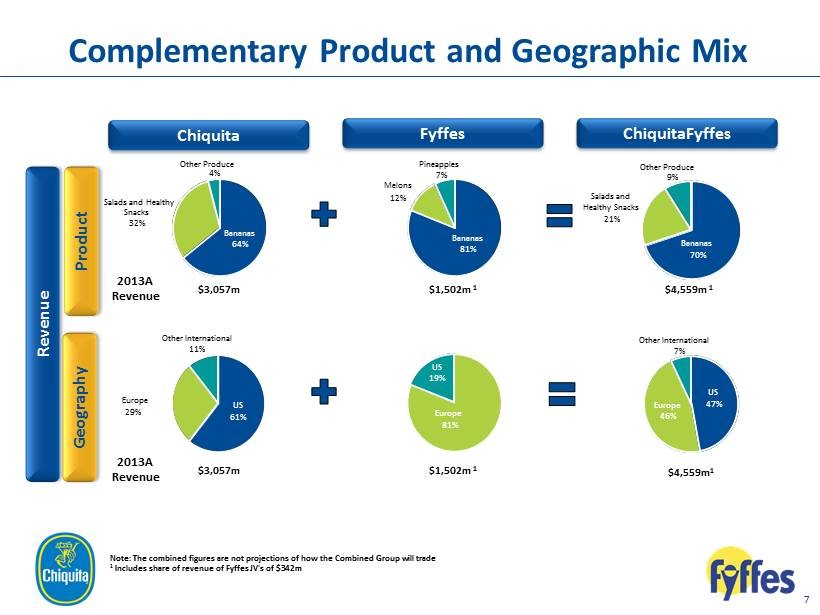

7 Chiquita Product Geography Fyffes ChiquitaFyffes 2013A Revenue $3,057m 2013A Revenue $ 1,502m 1 $ 4,559m 1 $3,057m $ 1,502m 1 $4,559m 1 Revenue Complementary Product and Geographic Mix Note: The combined figures are not projections of how the Combined Group will trade 1 Includes share of revenue of Fyffes JV's of $ 342m US 19% Bananas 81% Melons 12% Pineapples 7% Europe 81% US 61% Europe 29% Other International 11% Bananas 64% Salads and Healthy Snacks 32% Other Produce 4% Bananas 70% Salads and Healthy Snacks 21% Other Produce 9% US 47% Europe 46% Other International 7%

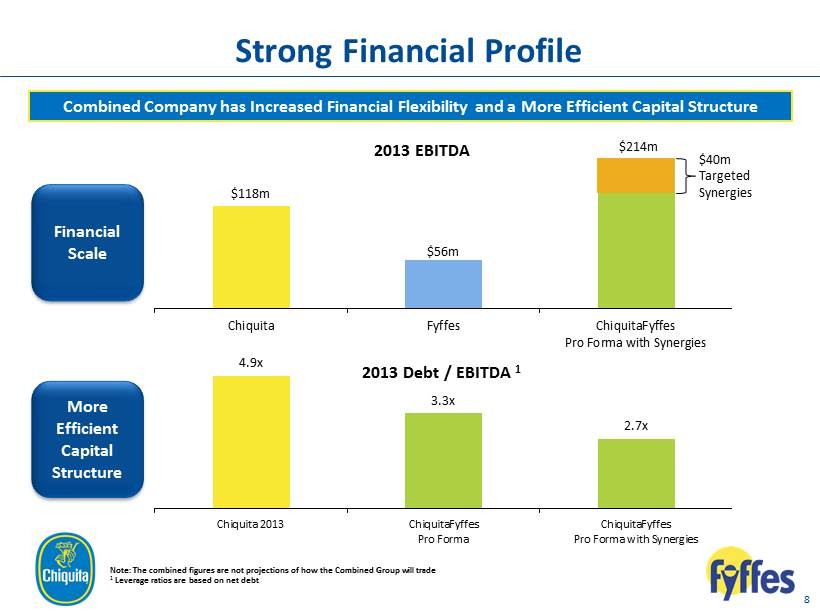

$ 118m $ 56m $214m Chiquita Fyffes ChiquitaFyffes Pro Forma with Synergies 2013 EBITDA 8 Financial Scale More Efficient Capital Structure 4.9x 3.3x 2.7x Chiquita 2013 ChiquitaFyffes Pro Forma ChiquitaFyffes Pro Forma with Synergies 2013 Debt / EBITDA 1 Strong Financial Profile Combined Company has Increased Financial Flexibility and a More Efficient Capital Structure $40m Targeted Synergies Note: The combined figures are not projections of how the Combined Group will trade 1 Leverage ratios are based on net debt

9 • Owned production in each category • Relationships with leading third party producers Production and Procurement • Modern distribution centers in key markets • Proven operational and logistics strengths Infrastructure and Operating Capabilities • Potential for greater combined efficiencies • Product diversity via Chiquita’s salads and healthy products and Fyffes melon business Depth and Breadth Operational Strength and Opportunities

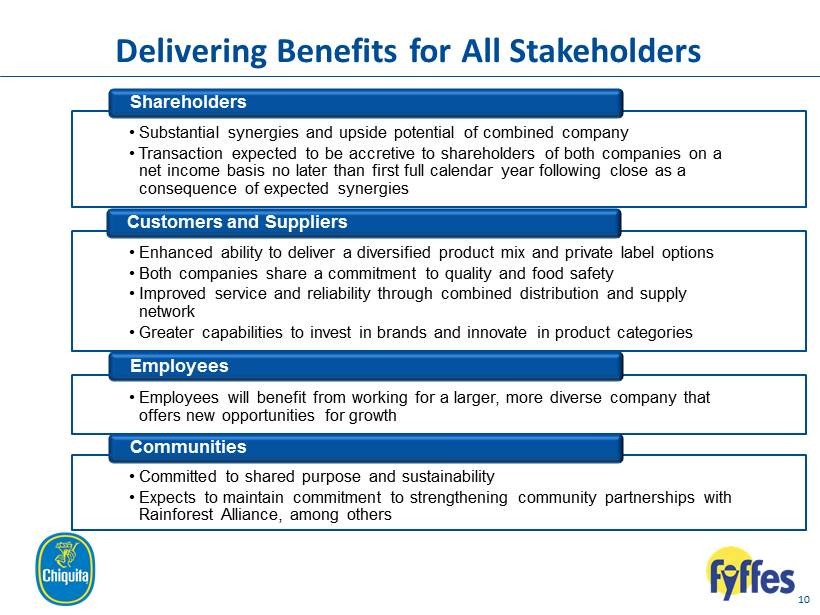

10 • Substantial synergies and upside potential of combined company • Transaction expected to be accretive to shareholders of both companies on a net income basis no later than first full calendar year following close as a consequence of expected synergies Shareholders • Enhanced ability to deliver a diversified product mix and private label options • Both companies share a commitment to quality and food safety • Improved service and reliability through combined distribution and supply network • Greater capabilities to invest in brands and innovate in product categories Customers and Suppliers • Employees will benefit from working for a larger, more diverse company that offers new opportunities for growth Employees • Committed to shared purpose and sustainability • Expects to maintain commitment to strengthening community partnerships with Rainforest Alliance, among others Communities Delivering Benefits for All Stakeholders

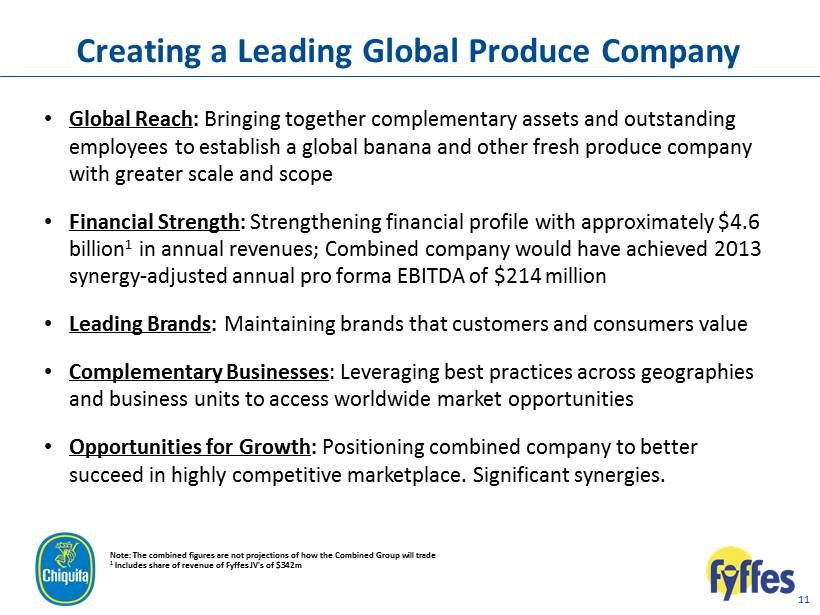

11 Creating a Leading Global Produce Company • Global Reach : Bringing together complementary assets and outstanding employees to establish a global banana and other fresh produce company with greater scale and scope • Financial Strength : Strengthening financial profile with approximately $4.6 billion 1 in annual revenues; Combined company would have achieved 2013 synergy - adjusted annual pro forma EBITDA of $214 million • Leading Brands : Maintaining brands that customers and consumers value • Complementary Businesses : Leveraging best practices across geographies and business units to access worldwide market opportunities • Opportunities for Growth : Positioning combined company to better succeed in highly competitive marketplace. Significant synergies. Note: The combined figures are not projections of how the Combined Group will trade 1 Includes share of revenue of Fyffes JV's of $ 342m

Creating a Leading Global Produce Company Investor Presentation March 10, 2014

13 The directors of Chiquita accept responsibility for the information contained in this presentation other than that relating to Fyffes and the Fyffes Group and the directors of Fyffes and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Chiquita (who hav e t aken all reasonable care to ensure that such is the case), the information contained in this presentation for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect th e import of such information. The directors of Fyffes accept responsibility for the information contained in this presentation relating to Fyffes and the Fyffes Group and the directors of Fyffes and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the directors of Fyffes (who have taken all reasonable care to ensure such is the case), the information contained in this presentation for which the y accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such informat ion . NO OFFER OR SOLICITATION This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe f or or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the Combination or otherwise, nor shall there be any sale, issuance or transfer of s ecu rities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC ChiquitaFyffes plc (“ ChiquitaFyffes ”) will file with the SEC a registration statement on Form S - 4 that will include the Proxy Statement of Chiquita that also constitutes a Prospectus of ChiquitaFyffes . Chiquita and Fyffes plan to mail to their respective shareholders ( and to Fyffes Equity Award Holders for information only) the Proxy Statement/Prospectus/Scheme Circular (including the Scheme) in connection with the transactions described above. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS/SCHEME CIRCULAR (INCLUDING THE SCHEME) AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT CHIQUITA, FYFFES, CHIQUITAFYFFES, THE TRANSACTIONS AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus/Scheme Circular (including the Scheme) and other documents filed with the SEC by ChiquitaFyffes , Chiquita and Fyffes through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the Proxy Statement/Prospectus/Scheme Circular (including the Scheme) and other documents filed by Chiquita and ChiquitaFyffes with the SEC by contacting Chiquita Investor Relations at: Chiquita Brands International, Inc., c/o Corporate Secretary, 550 S Caldwell St, Charlotte, North Carolina, 28202 or by calling (908 ) 636 - 5000, and will be able to obtain free copies of the Proxy Statement/Prospectus/Scheme Circular (including the Scheme) and other documents filed by Fyffes by contacting Seamus Keenan, Company Secretary at c/o Fyffes , 29 North Anne Street, Dublin 7, Ireland or by calling +353 - 1 - 887 - 2700. PARTICIPANTS IN THE SOLICITATION Chiquita, ChiquitaFyffes , Fyffes and their respective directors and executive officers may be considered participants in the solicitation of proxies in connec ti on with the transaction. Information about the directors and executive officers of Fyffes is set forth in its Annual Report for the year ended December 31, 2012, which was published on March 6, 2013 . Information about the directors and executive officers of Chiquita is set forth in its Annual Report on Form 10 - K for the year ended December 31, 2013, which was filed with the SEC on March 4, 2014, its proxy statem ent for its 2013 annual meeting of stockholders, which was filed with the SEC on April 12, 2013, and its Current Report on Form 8 - K which was filed with the SEC on July 18, 2013. Other information regarding the partici pants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus described above and other relevant materi als to be filed with the SEC when they become available . NO PROFIT FORECAST / ASSET VALUATIONS / BASIS OF SYNERGIES This presentation should be read in conjunction with the full text of the joint announcement issued by Chiquita and Fyffes on 10 March 2014 announcing the proposed Combination (the “Rule 2.5 Announcement”). The Rule 2.5 Announcement has been published on a regulatory information service and will also be available on Chiquita’s website (w ww.chiquita.com) and Fyffes website (www.fyffes.com). The Rule 2.5 Announcement sets out the Conditions to the implementation of the Combination. The bases and assumptions for the statements of synergies are set out in Appendix I to the Rule 2.5 Announcement. The Rule 2. 5 A nnouncement sets out the report from PricewaterhouseCoopers in respect of certain merger benefit statements made in the Rule 2.5 Announcement in accordance with Rule 19.3(b) of the Irish Takeover Rules. Neither the synergy statements nor any statement that the Combination is earnings accretive nor any other statement in this p res entation should be construed as a profit forecast or interpreted to mean that the earnings of ChiquitaFyffes in 2015, or in any subsequent period, would necessarily match or be greater than or be less than those of C hiq uita and/or Fyffes for the relevant financial period or any other period. No statement in this presentation constitutes an asset valuation. Important Additional Information and Disclosures