Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACURA PHARMACEUTICALS, INC | v370808_8k.htm |

Roth Capital – March, 2014 Non - Confidential Copyright © 2013 Acura Pharmaceuticals. All rights reserved.

Caution Regarding Forward Looking Statements Certain statements in this presentation constitute "forward - looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements expressed or implied by such forward - looking statements . Forward - looking statements may include, but are not limited to, our and our licensee’s ability to successfully launch and commercialize our products and technologies including Oxecta ® Tablets and Nexafed ® Tablets, the price discounting that may be offered by Pfizer for Oxecta ®, the ability of us or our licensee’s to obtain necessary regulatory approvals and commercialize products utilizing our technologies and the market acceptance of and competitive environment for any of our products, expectations regarding potential market share for our products and the timing of first sales, our ability to enter into additional license agreements for our other product candidates, the ability to avoid infringement of patents, trademarks and other proprietary rights of third parties, and the ability of our patents to protect our products from generic competition, and the ability to fulfill the U . S . Food and Drug Administration’s, or FDA, requirements for approving our product candidates for commercial manufacturing and distribution in the United States, including, without limitation, the adequacy of the results of the laboratory and clinical studies completed to date, the results of laboratory and clinical studies we may complete in the future to support FDA approval of our product candidates and the sufficiency of our development to meet over - the - counter, or OTC, Monograph standards as applicable, the adequacy of the development program for our product candidates, including whether additional clinical studies will be required to support FDA approval of our product candidates, changes in regulatory requirements, adverse safety findings relating to our product candidates, whether the FDA will agree with our analysis of our clinical and laboratory studies and how it may evaluate the results of these studies or whether further studies of our product candidates will be required to support FDA approval, whether or when we are able to obtain FDA approval of labeling for our product candidates for the proposed indications and will be able to promote the features of our abuse discouraging technologies, whether our product candidates will ultimately deter abuse in commercial settings and whether our Impede™ technology will disrupt the processing of pseudoephedrine into methamphetamine . In some cases, you can identify forward - looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” and similar expressions intended to identify forward - looking statements . These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties . Given these uncertainties, you should not place undue reliance on these forward - looking statements . We discuss many of these risks in greater detail in our filings with the Securities and Exchange Commission . 2

Abuse Deterrent Specialty Pharmaceutical Company • FDA approved technology • 1 st Aversion® opioid product launched by Pfizer Feb. 2012 • Follow - on products in development • Aversion® (Tamper Resistant) Technology • Impede® (Meth Resistant) Technology • Nexafed ® commercially available December 2012 • Follow - on products in development • Opioids are the largest U.S. prescription drug category • Sizeable non - prescription cough/cold/allergy market • $26 million of cash and investments (12/31/13) • Sufficient cash to execute current business plan through at least the next two years 3

Product Portfolio Summary • Broad pipeline of product candidates • Two proprietary technologies: Aversion® and Impede® Product Area Technology Licensee Status Oxycodone HCL, USP CII Opioid Aversion Pfizer Marketed in the U.S. Hydrocodone/APAP Opioid Aversion IND Active (Jan. 2013) 6 Additional Opioids Opioid Aversion Proof of Concept Complete Nexafed ® Cold/Allergy Impede Marketed in the U.S. Nexafed ® Combo #1 Cold/Allergy Impede In Commercial Scale - up Nexafed ® Combo #2 Cold/Allergy Impede In Development 4 Proof of concept = stability and bioavailability (some formulations include niacin)

Aversion ® Technology Proprietary mixture of inactive ingredients Aversive ingredients intended to deter snorting Physical/chemical properties intended to deter injection 5

Physician Perception of Opioid Abuse Source: Company Research, 400 Primary Care, Surgeon, Pain Specialists & Emergency Room Physicians, December 2011 • Snorting and Injecting are the methods with the highest concern for serious adverse health consequences with immediate release opioids 6

7 • 37 million people in the United States have used Rx opioids non - medically in their lifetime • Immediate Release (IR) opioids are more frequently abused than Extended Release (ER) opioids Abuse of Opioids is Prevalent Source: SAMHSA, Office of Applied Studies, 2012 National Survey on Drug Use and Health 0 5 10 15 20 25 Tramadol Demerol® Methadone Morphine OxyContin® Codeine Hydrocodone Percocet®, Percodan® & Tylox® Darvocet®, Darvon®, Tylenol®… Vicodin®, Lortab®, & Lorcet® Numbers (in millions) Immediate Release Only Extended & Immediate Release Only Lifetime Abuse of Selected Pain Relievers Age 12 or Older

Aversion® IR Product Markets Hydrocodone/ Acetaminophen Source: IMS NPA, MAT Dec. 2013 • 238 million dispensed prescriptions in 2013 • $2.6 billion in sales (mostly generic prices) 8 Oxycodone Oxycodone/ Acetaminophen

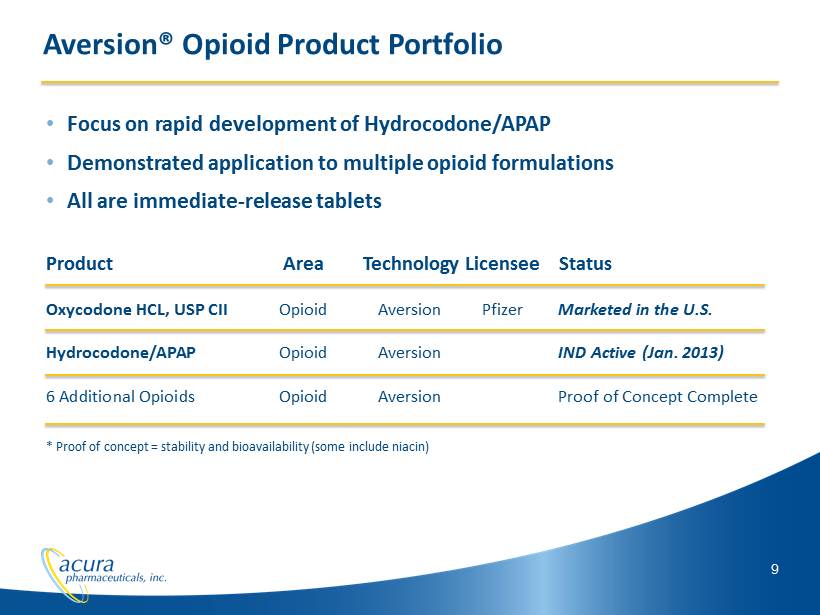

9 Aversion® Opioid Product Portfolio • Focus on rapid development of Hydrocodone/APAP • Demonstrated application to multiple opioid formulations • All are immediate - release tablets Product Area Technology Licensee Status Oxycodone HCL, USP CII Opioid Aversion Pfizer Marketed in the U.S. Hydrocodone/APAP Opioid Aversion IND Active (Jan. 2013) 6 Additional Opioids Opioid Aversion Proof of Concept Complete * Proof of concept = stability and bioavailability (some include niacin)

• Marketed By: Pfizer Inc. • Brand Name: Oxecta ® • FDA Approval: June 17, 2011 (February 2, 2012 1 st commercial sale) • Direct Market Size: 16.7 million annual IR oxycodone Rx’s +3.2% growth versus 2012 ~100 Tabs per Rx • Royalties: 5% to 25% based on level of sales achieved Aversion® Oxycodone HCl Tablets CII Source: IMS NPA, MAT Dec. 2012 Oxecta is a registered trademark of Pfizer Inc. 10 • Pfizer initiated promotion in late Q4 - 2013 to national cross section of healthcare providers who treat pain • Pfizer’s promotion does not include sales reps • Acura and Pfizer to strategically review the results on - going

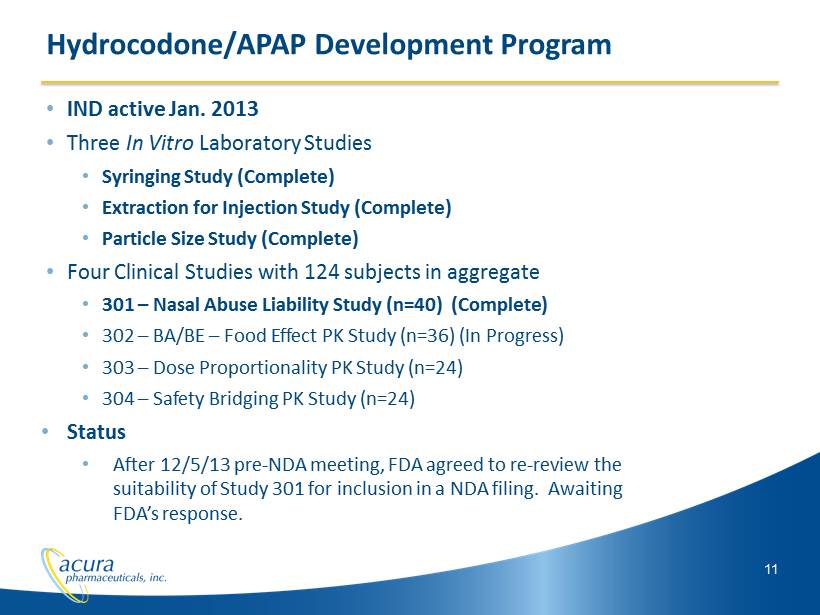

11 Hydrocodone/APAP Development Program • IND active Jan. 2013 • Three In Vitro Laboratory Studies • Syringing Study (Complete) • Extraction for Injection Study (Complete) • Particle Size Study (Complete) • Four Clinical Studies with 124 subjects in aggregate • 301 – Nasal Abuse Liability Study (n=40) (Complete) • 302 – BA/BE – Food Effect PK Study (n=36) (In Progress) • 303 – Dose Proportionality PK Study (n=24) • 304 – Safety Bridging PK Study (n=24) • Status • After 12/5/13 pre - NDA meeting, FDA agreed to re - review the suitability of Study 301 for inclusion in a NDA filing. Awaiting FDA’s response.

12 Hydrocodone Acetaminophen Aversion® Hydrocodone/APAP Bioequivalent to Norco® (hydrocodone bitartrate /APAP) Single, fasted 10/325mg dose (n=47)

Study AP - ADF - 301 (Nasal Snorting) • 40 completers of recreational drug abusers • Randomized, cross - over design • Blinded as to volume, particle size, and visible differences • 5 - arm study: placebo, 2 positive - controls, 2 test articles • Phases: • Drug discrimination/Dose titration • Volumetric Testing • Treatment • Primary Endpoint • Bi - Polar 100 - point Visual Analog Drug Like/Dislike score • Mean of the Maximum score (Emax): Active Comparator vs. Aversion hydrocodone/APAP 13

14 Study AP - ADF - 301 (Nasal Snorting) Results Endpoint Aversion Active Control Placebo Drug Liking ( Emax ) 72.1 75.6 p=.22 54.5 p<.00001 Drug Dislike ( Emin ) 40.2 50.4 p=.0042 48.8 p=.00003 Time to Emax ( hrs ) 1.6 0.9 1.1 Take Drug Again 45.1 71.0 p<.00001 42.2 p=.36 • Results consistent with Oxecta ® nasal snorting study results • Small reduction in Emax (maximum drug liking) • Statistically significant reduction in Take Drug Again • Statistically significant reduction Emin (maximum drug disliking) • Subject were able to snort almost all doses Mean scores presented; p - values compared to Aversion® Carryover effect observed in Emax scores

15 …The Revolution Takes Shape “Scott Co. sees drop in meth labs with new strategy” - WBIR Knoxville, TN NBC Affiliate

16 The next generation pseudoephedrine hydrochloride » maximum strength » non - drowsy » non - prescription » effective nasal and sinus congestion relief » with methamphetamine resistant Impede® technology Nexafed® is:

17 The only meth - resistant pseudoephedrine product that meets FDA standards demonstrating therapeutic equivalence to the products consumers currently use, such as Sudafed® Sudafed is a registered trademark and product of Johnson & Johnson Nexafed® - A Unique Selling Proposition

18 » Establish Nexafed as the new standard of care at the local pharmacy level ▪ Drive consumer purchases via pharmacy recommendations. » Generate public awareness through media outreach ▪ Draw attention to the meth problem ▪ Establish Nexafed as part of the solution » Attract chain retail attention ▪ Protect access to non - Rx PSE for legitimate patients ▪ Offer high quality pharmaceutical products that deliver expected efficacy and convenience ▪ Discourage illicit meth activity/traffic in stores and communities ▪ Provide win - win for retailers who want to avoid being targeted by media as being part of the problem Nexafed® - Strategy

19 » 8,300 pharmacies stock and sell Nexafed ® ▪ 12% of the estimated 65,000 retail outlets Nexafed® - Retail Track Record Stocking Reordering Kerr Kroger Fruth Publix Bartells Rite Aid Kroger

Fruth , Rite Aid and many Independent Pharmacies are leading the charge in addressing meth » Many have replaced all single ingredient pseudoephedrine products with Nexafed ®, exclusively. » Rite Aid replaced all single ingredient pseudoephedrine products in West Virginia with Nexafed ®, rolling out Rite Aid branded educational materials on Nexafed ® to their nationwide network » Scott County, TN independent pharmacies all moved to Nexafed ® Only » 69% drop in meth lab incidents in the first month » No meth lab incidents for three straights months 20 Nexafed® - A New Standard of Care

21 Nexafed® – Success is Contagious » Legislative ▪ West Virginia legislation considering requiring all pseudoephedrine products to require a prescription; with exemption for meth - resistant products ▪ Many approaches being discussed in many states » Media ▪ Investigative reports on the impact of meth - resistant products ▪ Op Ed’s focusing on the proper role for pharmacies and manufacturers in the meth - resistant era » Law Enforcement/Others ▪ Supported by the TN State Troopers Association ▪ Recognized by District Attorney Lori Phillips - Jones ▪ Supported by the TN Chapter of the NAACP ▪ Partnership with The Meth Project

22 Nexafed® – Market Opportunities 30mg Market Estimate* 372M Tablets 15.5M Boxes of 24 ~20 Boxes per outlet per month Nexafed ® Avg. Boxes per Store Per Month** Oct - Dec 2013 * 2009 AC Nielsen ** Based on store wholesale purchases 2009 Branded Product Retail Sales in Millions* Claritin - D*** Mucinex - D*** Zyrtec - D*** Advil Sudafed 12 & 24 Hr*** Sudafed *** Sustained Release formulation

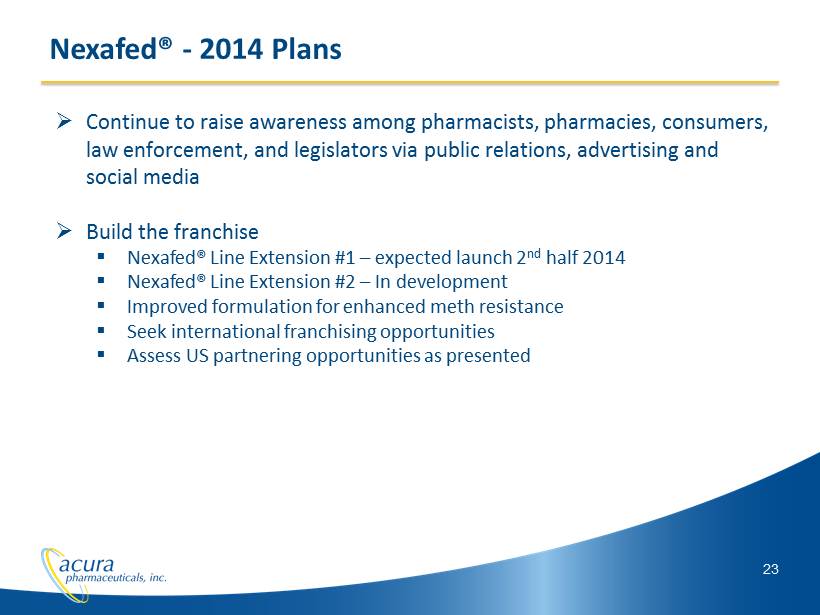

23 » Continue to raise awareness among pharmacists, pharmacies, consumers, law enforcement, and legislators via public relations, advertising and social media » Build the franchise ▪ Nexafed ® Line Extension #1 – expected launch 2 nd half 2014 ▪ Nexafed ® Line Extension #2 – In development ▪ Improved formulation for enhanced meth resistance ▪ Seek international franchising opportunities ▪ Assess US partnering opportunities as presented Nexafed® - 2014 Plans

Intellectual Property and Financial Information 24

• Aversion® Technology patents expire in 2023 to 2025 • 6 U.S. patents issued covering compositions of opioids and certain other abused drugs with functional inactive ingredients • 1 U.S. Patent issued covering an extended release opioid dosage form • Impede® Technology patents pending • Additional U.S. and foreign patents • Multiple patent applications pending in the United States and internationally Intellectual Property Position 25

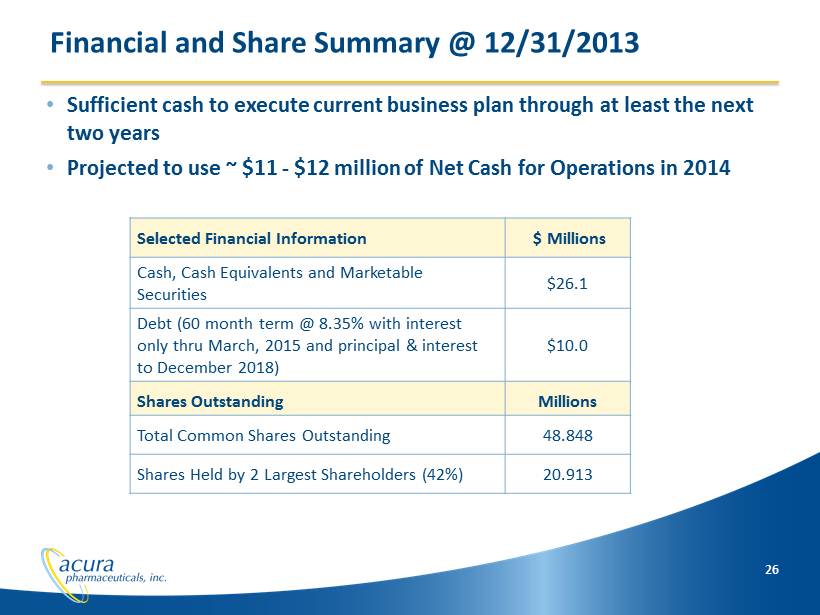

26 Selected Financial Information $ Millions Cash, Cash Equivalents and Marketable Securities $26.1 Debt (60 month term @ 8.35% with interest only thru March, 2015 and principal & interest to December 2018) $10.0 Shares Outstanding Millions Total Common Shares Outstanding 48.848 Shares Held by 2 Largest Shareholders (42%) 20.913 • Sufficient cash to execute current business plan through at least the next two years • Projected to use ~ $11 - $12 million of Net Cash for Operations in 2014 Financial and Share Summary @ 12/31/2013

Acura Pharmaceuticals, Inc. 616 N. North Court, Suite 120 Palatine, IL 60067 (847) 705 - 7709 NASDAQ: ACUR www.AcuraPharm.com Copyright © 2012 Acura Pharmaceuticals. All rights reserved.