Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - PLx Pharma Inc. | a2218793zex-23_1.htm |

Use these links to rapidly review the document

Table of Contents

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on March 6, 2014

Registration Number 333-193780

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

DIPEXIUM PHARMACEUTICALS, LLC

(to be converted to Dipexium Pharmaceuticals, Inc.)

(Exact Name of Registrant as Specified in its Charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

27-1707962 (I.R.S. Employer Identification No.) |

74 Broad Street

New York, New York 10004

Phone: (212) 422-5717

Fax: (212) 269-6441

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

David P. Luci, Esq.

President and Chief Executive Officer

74 Broad Street

New York, New York 10004

Phone: (212) 422-5717

Fax: (212) 269-6441

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

| with copies to: | ||

Lawrence A. Rosenbloom, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas, 11th Floor New York, NY 10105 Phone: (212) 370-1300 Fax: (212) 370-7889 |

Ivan K. Blumenthal, Esq. Mintz Levin Cohn Ferris Glovsky and Popeo, P.C. Chrysler Center, 666 Third Avenue New York, NY 10017 Phone: (212) 935-3000 Fax: (212) 983-3115 |

|

Approximate date of commencement of proposed sale to public:

As soon as practicable after the effective date hereof.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

Dipexium Pharmaceuticals, LLC, the registrant whose name appears on the cover of this registration statement, is a Delaware limited liability company. Immediately prior to the effectiveness of this registration statement, Dipexium Pharmaceuticals, LLC intends to convert into a Delaware corporation pursuant to a statutory conversion and change its name to Dipexium Pharmaceuticals, Inc. As a result of the corporate conversion:

- •

- the Class A membership interests of Dipexium Pharmaceuticals, LLC will become shares of common stock of

Dipexium Pharmaceuticals, Inc. pursuant to a conversion ratio of seven shares of common stock of Dipexium Pharmaceuticals, Inc. for each Class A membership interest of Dipexium

Pharmaceuticals, LLC previously held. Accordingly, 767,911 outstanding Class A membership interests of Dipexium Pharmaceuticals, LLC issued and outstanding immediately prior to

the corporate conversion will be converted automatically into 5,375,377 shares of Dipexium Pharmaceuticals, Inc.; and

- •

- all of the outstanding warrants to purchase Class A membership interests of Dipexium Pharmaceuticals, LLC

will become warrants to purchase shares of common stock of Dipexium Pharmaceuticals, Inc. in a ratio of seven shares of common stock of Dipexium Pharmaceuticals, Inc. for each

Class A membership interest of Dipexium Pharmaceuticals, LLC underlying such warrants, with the effect that warrants to purchase 4,900 Class A membership interests of Dipexium

Pharmaceuticals, LLC outstanding immediately prior to the corporate conversion will automatically convert into warrants to purchase 34,300 shares of Dipexium Pharmaceuticals, Inc. upon

consummation of the corporate conversion; and

- •

- the exercise price of all of the outstanding warrants will be adjusted in the same ratio as the seven-for-one conversion ratio noted above such that all of our outstanding warrants to purchase Class A membership interests of Dipexium Pharmaceuticals, LLC which are currently exercisable at $60 per Class A membership interest will automatically be adjusted such that the new exercise price for the outstanding warrants upon consummating the corporate conversion will be $8.57 per share, subject to certain adjustments noted in each of the warrants.

The financial statements and summary historical financial data included in this registration statement are those of Dipexium Pharmaceuticals, LLC and do not give effect to the corporate conversion. All share and warrant amounts and related prices reflected in the accompanying prospectus give effect to the corporate conversion, however such amounts appearing in Part II of the accompanying registration statement do not give effect to the corporate conversion.

The information contained in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated March 6, 2014

2,307,693 Shares

Common Stock

$ per share

This is the initial public offering of common stock of Dipexium Pharmaceuticals, Inc. We are offering 2,307,693 shares of our common stock in this offering. Prior to this offering, there has been no public market for our common stock.

We currently expect the initial public offering price per share to be between $12.00 and $14.00.

We have applied to have our common stock listed on The NASDAQ Capital Market under the symbol "DPRX."

We are an "emerging growth company" under the federal securities laws and have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 10.

| |

Per Share | Total | |||||

|---|---|---|---|---|---|---|---|

Public offering price |

$ | $ | |||||

Discounts and commissions to underwriters(1) |

$ | $ | |||||

Proceeds to us, before expenses |

$ | $ | |||||

- (1)

- See "Underwriting" beginning on page 86 for additional information regarding underwriting compensation.

We have granted a 30-day option to the representative of the underwriters to purchase up to 346,154 additional shares of common stock solely to cover over-allotments, if any.

The underwriters expect to deliver the shares to purchasers on or about , 2014 through the book-entry facilities of The Depository Trust Company.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Oppenheimer & Co. | ||

| Feltl and Company |

The date of this prospectus is , 2014

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from or in addition to that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

Locilex™ is a trademark of Dipexium Pharmaceuticals, LLC. All other trademarks used herein are the property of their respective owners.

This summary highlights certain information appearing elsewhere in this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including "Risk Factors" beginning on page 9 and the financial statements and related notes included in this prospectus.

Immediately prior to the effectiveness of the registration statement of which this prospectus forms a part, we will undertake a corporate conversion pursuant to which Dipexium Pharmaceuticals, Inc. will succeed to the business of Dipexium Pharmaceuticals, LLC and the holders of membership interests of Dipexium Pharmaceuticals, LLC will become stockholders of Dipexium Pharmaceuticals, Inc. In this prospectus, we refer to this transaction as the "corporate conversion." References in this prospectus to our capitalization and other matters pertaining to our common equity relate to the capitalization and common equity of Dipexium Pharmaceuticals, LLC after giving effect to the corporate conversion. However, the financial statements and summary historical financial data included in this prospectus are those of Dipexium Pharmaceuticals, LLC and do not give effect to the corporate conversion.

Unless the context indicates otherwise, as used in this prospectus, the terms "Dipexium," "we," "us," "our," "our company" and "our business" refer, prior to the corporate conversion discussed herein, to Dipexium Pharmaceuticals, LLC, and after the corporate conversion to Dipexium Pharmaceuticals, Inc.

Our Company

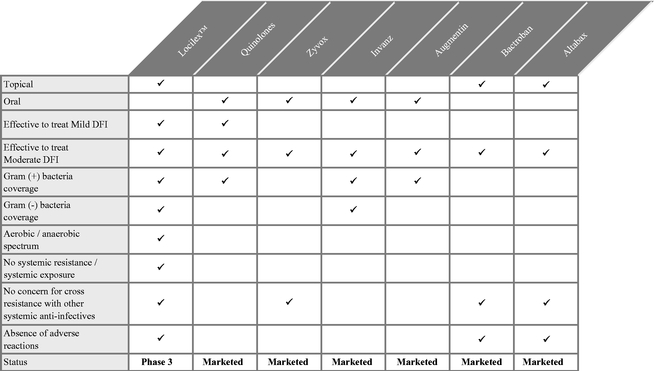

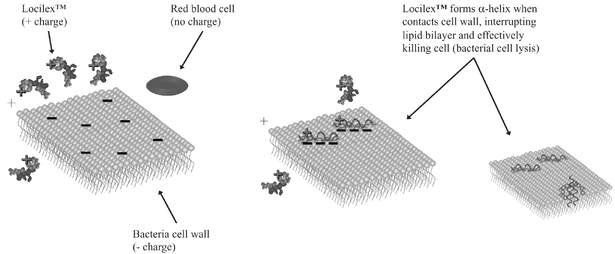

We are a late stage pharmaceutical company focused on the development and commercialization of Locilex™ (pexiganan acetate cream 1%), a novel, first-in-class, broad spectrum, topical antibiotic. Locilex™ is a chemically synthesized, 22-amino acid peptide isolated from the skin of the African Clawed Frog. Its novel mechanism of action kills microbial targets through disruption of bacterial cell membrane permeability. Locilex™ is initially being targeted for the treatment of mild infections of diabetic foot ulcers (or Mild DFI). In 2011, the market for diabetic foot infection therapeutics worldwide was $1.46 billion. We recently received a U.S. patent on the formulation of Locilex™ that expires in June 2032. Our primary objective is to establish Locilex™ as the standard of care for the treatment of patients with Mild DFI. Thereafter, our growth strategy includes potentially expanding the indications for Locilex™ to include moderate infections of diabetic foot ulcers (or Moderate DFI) and certain other mild or moderate skin and skin structure infections in superficial wounds.

We believe that we have a clear clinical and regulatory pathway with the potential for near term United States Food and Drug Administration (or FDA) approval of Locilex™. We believe that Locilex™ may be approved by the FDA within 24 months of commencing the Phase 3 enrollment. We have reached agreement with the FDA through a special protocol assessment (or SPA) for our Phase 3 program. We intend to conduct and complete two pivotal Phase 3, double blind, placebo-controlled, superiority studies. We expect to begin enrollment in these studies in the second quarter of 2014, with top line data from the Phase 3 studies anticipated in the first quarter of 2015. Concurrently, we also intend to conduct two separate Phase 1 skin irritation and skin sensitization studies, which are expected to commence in the first quarter of 2014. If the data from our Phase 3 studies are sufficient to meet the primary endpoints, we expect to submit our new drug application (or NDA) for Locilex™ in the second half of 2015. We expect to receive a response from the FDA within six months of our NDA submission.

1

According to the Infectious Disease Society of America (or IDSA), diabetic foot infections (or DFI) may be classified by their clinical severity as mild, moderate, or severe. Forty-seven percent of DFI patients present at the mild stage, 34% of DFI patients present at the moderate stage and 18% of DFI patients present at the severe stage. At the mild stage, patients can typically be treated on an outpatient basis and amputation risk is minimal (2 to 3% in Mild DFI). When not managed effectively, the potential for Mild DFI to progress to a limb- or life-threatening infection increases dramatically. Published research suggests amputation rates increase in Moderate DFI and severe infections of diabetic foot ulcers (or Severe DFI) to approximately 45% and 75%, respectively. Similarly, the hospitalization rate for Mild DFI patients is approximately 10%, increasing in Moderate and Severe DFI to approximately 55% and 85%, respectively. Thus, DFI are a major cause of patient morbidity, a substantial burden to the healthcare system, and a source of high financial costs.

Systemic antibiotics currently prescribed off-label to treat Mild DFI generate resistant pathogens which create infections that are more difficult to treat. Such antibiotics are also associated with toxic side effects in patients who typically have some degree of compromised liver and kidney function. We believe that a topical preparation like Locilex™, which is locally administered on the open wound and skin, offers significant advantages over systemic treatments. Currently, there are no products specifically approved by the FDA for the treatment of Mild DFI, nor are there any topical antibiotics currently approved for any severity of DFI. As such, we believe that Locilex™ has the potential to be the first topical antibiotic approved for the treatment of DFI, as well as the first product of any kind to be labeled specifically for the treatment of Mild DFI.

We believe the key attributes of Locilex™ are:

- •

- it has not generated resistant bacteria systemically;

- •

- it has not generated cross resistance with other antibiotics;

- •

- it has demonstrated activity against a broad spectrum of pathogens, including difficult to treat gram negative, and

anaerobic bacteria;

- •

- it has not been systemically absorbed; and

- •

- it has not caused any significant safety issues in over 500 patients treated.

These attributes lead us to believe that Locilex™ has the potential to be positioned as the standard of care to treat patients with Mild DFI. In addition, Locilex™ data generated to date support the potential use of Locilex™ to treat a broad array of mild or moderate skin and skin structure infections in superficial wounds.

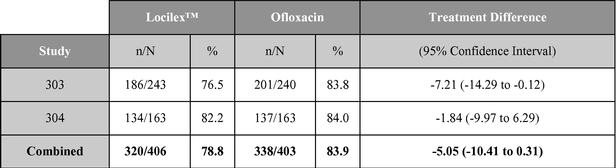

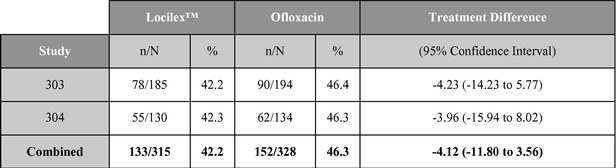

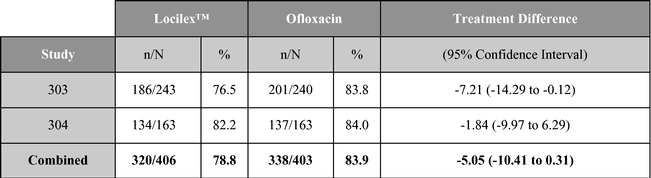

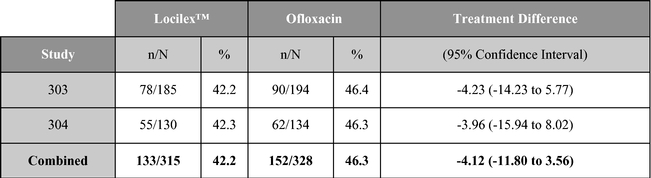

As reported in published research, Locilex™ previously has been evaluated in two large-scale clinical studies in patients with Mild or Moderate DFI. Each of these trials was a randomized, active-controlled, double blind, multi-center trial designed to establish equivalence of Locilex™ to ofloxacin, a systemic antibiotic. Across both trials, 835 patients received twice-daily Locilex™ cream plus placebo pill or twice-daily oral ofloxacin plus placebo cream for 14 to 28 days. The primary outcome was the clinical improvement of infection in response to antimicrobial treatment. Secondary outcomes included eradication of the wound pathogens, healing of the ulcer, development of antibiotic resistance to a study drug, and safety.

Although one study (Study 303) did not demonstrate equivalence, the second study (Study 304) and the combined data for the two trials did demonstrate equivalent results for topical Locilex™ and oral ofloxacin in clinical improvement rates and overall microbiological eradication rates. Guidelines for establishing equivalence for these results were a 95% confidence interval with a lower bound delta of -15%, for clinical effectiveness, and a lower bound delta of -20%, for overall microbiological effectiveness. In each case, the confidence interval must cross zero. Additionally, there were no statistically significant differences in wound assessment scores between patients treated with Locilex™ and ofloxacin. Wound assessment scores decreased at the end of treatment visit in both studies for both treatment arms, and they decreased further at the follow-up visit. No serious adverse events were

2

determined to have been related to either Locilex™ or ofloxacin. Moreover, the overall incidence of serious adverse events unrelated to the study medication (12% Locilex™ to 9% ofloxacin), including worsening cellulitis (2% to 4%) and amputation (2% to 3%), did not differ significantly between treatment arms. Bacterial resistance to ofloxacin emerged in some patients in the control arm, but no significant resistance to Locilex™ emerged among patients in the treatment arm.

A summary table of the primary clinical outcome and secondary microbiological outcome are shown below:

Clinical outcome (% cure or improved)

Microbiological outcome (% responders)

Source: Lipsky, et al. Clinical Infectious Disease. 2008; 47(12): 1537-45.

We have conducted microbiology studies that highlight the sensitivity of resistant bacteria, including methicillin-resistant staphylococcus aureus (or MRSA), vancomycin-resistant enterococcus (or VRE), extended-spectrum b-lactamase (or ESBL) and multi-drug resistant (or MDR) bacteria, to pexiganan, the active pharmaceutical ingredient (or API) in Locilex™. Due to the increased global prevalence of resistant bacteria, Locilex™ may provide an important therapeutic advance.

We hold U.S. rights to a patent covering our proprietary formulation of Locilex™ and the method of using it for the treatment of skin and wound infections. This patent was granted in September 2013 and expires in the U.S. in June 2032. In addition, we have filed a Patent Cooperation Treaty (or PCT) application that will allow us to seek corresponding protection outside of the U.S., including in Europe, Japan, China, Australia, and Korea, as well as in other PCT jurisdictions. We also hold an exclusive sublicense to the composition-of-matter patent covering the pexiganan technology, which expires in June 2016, not including any patent term extension that we expect to seek under The Drug Price Competition and Patent Term Restoration Act of 1984 (or the Hatch-Waxman Act).

We have contracted with third party vendors with respect to all key elements of our clinical and regulatory program, including vendors to: (i) conduct the Phase 3 and Phase 1 clinical trials for Locilex™; (ii) manufacture the API; (iii) formulate the finished product; and (iv) label and package the product. We believe these key relationships will help drive our clinical and regulatory program for Locilex™ in a timely and efficient manner.

3

Locilex™ was originally sponsored by Magainin Pharmaceuticals, Inc. (or Magainin), which engaged in the FDA review process for a prior formulation of Locilex™. In its 1999 non-approvable letter, the FDA identified two cGMP manufacturing issues. The first issue concerned the stability of the product. Examination of the product over time showed evidence of water separation from the cream matrix. The second issue related to the purity level of the API in the product. The prior source of the API yielded a purity level as low as 95%. We acquired the worldwide rights to pexiganan, the API in Locilex™, from a third party in April 2010. These rights included the prior formulation and all of the clinical and preclinical data generated by Magainin in its FDA review process. This includes data from over 1,000 evaluable patients, including 835 in large-scale, randomized, active-controlled, double blind multi-center clinical studies as compared to a systemic quinolone standard of care. After acquiring the rights to Locilex™, we developed a detailed product development plan to arrive at an optimized formulation to address these issues to the satisfaction of the FDA. In October 2013, we submitted our manufacturing data, including data from the cGMP batch as well as 18-month stability data on our non-cGMP batch, to the FDA, and in December 2013 the FDA indicated in written communications with us that Locilex™'s stability and purity levels are acceptable for use in our upcoming Phase 3 studies. We believe we have corrected the manufacturing problems encountered by the prior sponsor.

Our Strategy

Our primary objective is to establish Locilex™ as the standard of care to treat patients with Mild DFI. The key elements of our strategy are as follows:

- •

- Complete the Phase 3 program for

Locilex™;

- •

- Obtain FDA approval of Locilex™ for Mild

DFI;

- •

- Commercially launch Locilex™ in the U.S.;

- •

- Expand Locilex™'s FDA-approved uses;

and

- •

- Commence clinical and regulatory activities in Europe.

We will rely on our strong management team, board of directors and scientific advisory board to execute our strategy. The individuals on our management team, board of directors and scientific advisory board will contribute their significant development and regulatory experience to the development and commercialization of Locilex™.

Corporate Conversion

We currently operate as a limited liability company, organized in the State of Delaware under the name Dipexium Pharmaceuticals, LLC. Immediately prior to the effectiveness of the registration statement of which this prospectus forms a part, Dipexium Pharmaceuticals, LLC will convert from a Delaware limited liability company to a Delaware corporation and will be renamed Dipexium Pharmaceuticals, Inc. As a result of the corporate conversion:

- •

- the Class A membership interests of Dipexium Pharmaceuticals, LLC will become shares of common stock of

Dipexium Pharmaceuticals, Inc. pursuant to a conversion ratio of seven shares of common stock of Dipexium Pharmaceuticals, Inc. for each Class A membership interest of Dipexium

Pharmaceuticals, LLC previously held. Accordingly, 767,911 Class A membership interests of Dipexium Pharmaceuticals, LLC issued and outstanding immediately prior to the corporate

conversion will be converted automatically into 5,375,377 shares of Dipexium Pharmaceuticals, Inc.;

- •

- all of the outstanding warrants to purchase Class A membership interests of Dipexium Pharmaceuticals, LLC will become warrants to purchase shares of common stock of Dipexium Pharmaceuticals, Inc. in a ratio of seven shares of common stock of Dipexium Pharmaceuticals, Inc. for each Class A membership interest of Dipexium Pharmaceuticals, LLC underlying such

4

- •

- the exercise price of all of the outstanding warrants will be adjusted in the same ratio as the seven-for-one conversion ratio noted above such that all of our outstanding warrants to purchase Class A membership interests of Dipexium Pharmaceuticals, LLC which are currently exercisable at $60 per Class A membership interest will automatically be adjusted such that the new exercise price for the outstanding warrants upon consummating the corporate conversion will be $8.57 per share, subject to certain adjustments noted in each of the warrants.

warrants, with the effect that warrants to purchase 4,900 Class A membership interests of Dipexium Pharmaceuticals, LLC outstanding immediately prior to the corporate conversion will automatically convert into warrants to purchase 34,300 shares of Dipexium Pharmaceuticals, Inc. upon consummation of the corporate conversion; and

The purpose of the corporate conversion is to reorganize our corporate structure so that our company will continue as a corporation rather than a limited liability company following this offering, and so that our existing investors will own our common stock rather than equity interests in a limited liability company. For further information regarding the corporate conversion, see "Corporate Conversion."

Risks Associated with our Business

Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in the section entitled "Risk Factors" in this prospectus:

- •

- We are heavily dependent on attaining regulatory approval for and, if approved, successfully commercializing

Locilex™. Locilex™ is our only product candidate. As such, all of our resources and efforts have been and are expected for the foreseeable future to be

dedicated to the development and commercialization of Locilex™. As such, we are subject to the risk of dependency on this sole product, and if our efforts fail to gain FDA or other

regulatory approvals for Locilex™ (for example, for use in treating mild or moderate skin and skin structure infections in superficial wounds), our viability would be materially impacted

unless we were able to develop or acquire other product candidates.

- •

- The regulatory approval process for Locilex™ may be lengthy and is inherently

unpredictable. Although we anticipate certain time frames for our regulatory pathway for Locilex™, the approval process of the FDA and comparable foreign regulatory

authorities may be lengthy and time consuming. The process also is inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for Locilex™, our business will

be substantially harmed.

- •

- Manufacturing issues may prevent Locilex™ from receiving regulatory

approval. Although we believe that we have successfully worked with our third-party vendors to resolve the manufacturing issues

encountered by Locilex™'s prior sponsor and previously identified by the FDA, to the extent that such issues are not resolved, regulatory approval for Locilex™ may be delayed

or withheld, and we may not be able to meet the developmental milestones necessary to continue our business.

- •

- Even if Locilex™ is approved, the market may not accept it as a viable treatment

option. Even if Locilex™ is approved, there is a risk that it may not be accepted in the marketplace for a variety of reasons. If we are unable to generate revenue

from sales of Locilex™, our business will be substantially harmed.

- •

- We have a very limited operating history, have not generated revenues to date, and have incurred significant losses since our inception. We were formed in 2010, and we have not yet generated any revenues from product sales or otherwise. As such, you have limited data on which to evaluate our past performance and ability to progress our business plan forward. Moreover, we do not expect to generate revenues, and we expect to incur losses, for the foreseeable future and may never achieve or maintain profitability.

5

- •

- We rely on single source third-party contract manufacturing and contract research organizations to manufacture and supply

Locilex™ for us and conduct our clinical trials. We are a small organization with limited full time employees, and thus we rely and will continue to rely on key

third party vendors to, among other functions, manufacture, formulate and package Locilex™ and conduct our upcoming clinical trials. If one of our suppliers, manufacturers or vendors fails

to perform adequately or fulfill our needs, or if our agreements with these parties are terminated, we may be required to incur significant costs and devote significant efforts to find new suppliers

or manufacturers. We may also face delays in the development and commercialization of Locilex™ or other product candidates that we may develop or acquire in the future.

- •

- We may have a need for funding beyond this offering to reach profitability. Even following this

offering, if we are unable to raise capital if and when needed, we could be forced to delay, reduce or eliminate one or more aspects of our development or commercial activities.

- •

- We are subject to risks associated with clinical trials and regulatory oversight. The conduct of

clinical trials is inherently subject to numerous risks and uncertainties, some of which will be beyond our control. If clinical trials of Locilex™, or any other product candidate that we

may develop in the future, fail to demonstrate safety and efficacy to the satisfaction of the FDA or similar regulatory authorities outside the U.S. or do not otherwise produce positive results, we

may incur additional costs or experience delays in completing, or ultimately be unable to complete, the development and commercialization of Locilex™ or any other product candidate we may

develop in the future. In addition, the pharmaceutical industry is intensely regulated. Compliance with such regulations is costly and time consuming, and our failure to comply with such regulations

would have a material adverse effect on our ability to implement our business plans.

- •

- Our future viability depends on the strength of our intellectual property. Due to the exclusivity

that intellectual property protection can afford, our commercial success depends to a material extent on our ability to maintain adequate protection for our intellectual property for

Locilex™ (and any other product candidates we may develop in the future) in the U.S. and other countries. We consider our U.S. Patent No. 8,530,409, relating to our new proprietary

formulation and methods of use for Locilex™, to be particularly important to our company. If we are unable to protect U.S. Patent No. 8,530,409 or other intellectual property rights

for Locilex™, or our intellectual property for any future product candidates, it may materially and adversely affect our ability to market and generate sales of the product.

- •

- Our current and future viability depends on our existing management and our ability to attract and retain other key employees. Given their history with our company, we are materially reliant on our current management, including David P. Luci and Robert J. DeLuccia. The loss of their services would have a materially adverse impact on our ability to progress our business plan. Moreover, as we grow, we will be required to attract and retain other key employees. Our inability to do so could also have a material adverse impact on our company.

Corporate Information

We were organized originally as a limited liability company under the laws of the State of Delaware in January 2010 and will convert to a corporation immediately prior to the effectiveness of the registration statement of which this prospectus forms a part. Our principal executive office is located at 74 Broad Street, New York, New York 10004, and our phone number is (212) 422-5717.

Implications of Being an Emerging Growth Company

We qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012 (or the JOBS Act). As a result, we are permitted to, and intend to, rely on exemptions from

6

certain disclosure requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

- •

- being permitted to present only two years of audited financial statements and only two years of related "Management's

Discussion and Analysis of Financial Condition and Results of Operations" in this prospectus;

- •

- not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of

2002, as amended (or the Sarbanes-Oxley Act);

- •

- reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration

statements; and

- •

- exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

In addition, the JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. This provision allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies. We have elected to avail ourselves of this extended transition period.

We will remain an emerging growth company until the earliest to occur of: (i) our reporting $1 billion or more in annual gross revenues; (ii) the end of fiscal year 2018; (iii) our issuance, in a three year period, of more than $1 billion in non-convertible debt; and (iv) the end of the fiscal year in which the market value of our common stock held by non-affiliates exceeded $700 million on the last business day of our second fiscal quarter.

7

| Common stock offered by us | 2,307,693 shares | |

Common stock to be outstanding after this offering |

7,683,070 shares (or 8,029,224 shares if the underwriters exercise their over-allotment option in full). |

|

Over-allotment option |

We have granted the underwriters a 30-day option to purchase up to an additional 346,154 shares of our common stock at the initial public offering price to cover over-allotments, if any. |

|

Use of proceeds |

We expect to use the proceeds received from the offering to further develop Locilex™ including, without limitation, conducting our pivotal Phase 3 clinical studies, commencing preliminary commercialization activities, expanding uses of Locilex™, as well as for working capital and general corporate purposes. See the "Use of Proceeds" section in this prospectus for a more complete description of the intended use of proceeds from this offering. |

|

Concentration of ownership |

Upon completion of this offering, our executive officers and directors will beneficially own, in the aggregate, approximately 52.1% of the outstanding shares of our common stock. |

|

Proposed NASDAQ Capital Market symbol |

"DPRX" |

|

Risk Factors |

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 9 and the other information in this prospectus for a discussion of the factors you should consider carefully before you decide to invest in our common stock. |

All information in this prospectus assumes the underwriters do not exercise their over-allotment option. The total number of shares of our common stock outstanding assuming our corporate conversion took place on March 6, 2014 is 5,375,377 and excludes the following (numbers presented on a post-conversion basis):

- •

- 70,000 shares of common stock issuable to members of our board of directors which are currently unvested and, in each

case, vest over a period of time for service on the board of directors;

- •

- 34,300 shares of common stock issuable upon conversion of warrants issued to investors in prior financings, in each case,

with a conversion price equal to $8.57 per share;

- •

- 1,536,614 shares of our common stock (which is equal to 20% of our issued and outstanding common stock immediately after the consummation this offering) reserved for future issuance under our 2013 Equity Incentive Plan, which will become effective as of the closing of this offering.

Summary Financial Information

The following summary financial data as of and for the years ended December 31, 2013 and 2012, have been derived from our audited financial statements included in this prospectus. The financial data set forth below should be read in conjunction with "Management's Discussion and Analysis of

8

Financial Condition and Results of Operations" and the financial statements and notes thereto included elsewhere in this prospectus.

| |

Year Ended December 31, 2013 |

Year Ended December 31, 2012 |

||||||

|---|---|---|---|---|---|---|---|---|

| |

(in thousands) |

|||||||

Statement of Operations Data: |

||||||||

OPERATING EXPENSES: |

||||||||

Research and Development |

$ | 1,730 | $ | 845 | ||||

General and Administrative |

2,284 | 999 | ||||||

TOTAL OPERATING EXPENSES |

4,014 | 1,844 | ||||||

LOSS FROM OPERATIONS |

4,014 | 1,844 | ||||||

NET LOSS |

4,014 | $ | 1,844 | |||||

| |

As of December 31, 2013 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Actual | Pro Forma, Warrant Exchange(1) |

Pro Forma, Corporate Conversion(2) |

Pro Forma, As Adjusted(3) |

||||||||||

| |

(in thousands) |

|||||||||||||

Balance Sheet Data: |

||||||||||||||

Current Assets |

$ |

3,907 |

3,907 |

3,907 |

31,105 |

|||||||||

Total Assets |

4,030 | 4,030 | 4,030 | 31,105 | ||||||||||

Total Liabilities |

824 | 824 | 824 | 701 | ||||||||||

Total Members' Equity |

3,206 | 3,206 | — | — | ||||||||||

Shareholders' Equity(4) |

— | 3,206 | 30,404 | |||||||||||

Total Liabilities and Members' Equity/Shareholders' Equity |

4,030 | 4,030 | 4,030 | 31,105 | ||||||||||

- (1)

- The

December 31, 2013 pro forma (warrant exchange) balance sheet data reflects the February 2014 issuance of an aggregate of 23,719 Class A

membership interests to investors in our prior financings in exchange for the redemption of outstanding warrants to purchase an aggregate of 89,900 Class A membership interests in our company.

As the warrants and membership interests are both classified as equity instruments, the exchange resulted in no impact to Total Members' Equity.

- (2)

- The

December 31, 2013 pro forma (corporate conversion) balance sheet data reflects our conversion from a limited liability company to a corporation,

and, in connection therewith, the conversion of 767,911 Class A membership interests in our company issued and outstanding immediately prior to the conversion into an aggregate of

5,375,377 shares of common stock.

- (3)

- The

December 31, 2013 pro forma as adjusted balance sheet data reflects the sale of shares of our common stock in this offering, assuming an initial

public offering price of $13.00 per share (the mid-point of the price range set forth on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and

estimated offering expenses payable by us.

- (4)

- Reflects the conversion of Members' Equity following our conversion from a limited liability company to a corporation.

9

Any investment in our securities involves a high degree of risk. You should carefully consider the risks described below, which we believe represent certain of the material risks to our business, together with the information contained elsewhere in this prospectus, before you make a decision to invest in our shares of common stock. If any of the following events occur, our business, financial condition and operating results may be materially adversely affected. In that event, the trading price of our securities could decline and you could lose all or part of your investment.

Risks Relating to Our Business and Industry

We have a very limited operating history and are expected to incur significant operating losses during the early stage of our corporate development.

We were organized on January 14, 2010 and we acquired the rights to our product candidate Locilex™ in April 2010. Accordingly, we have a limited operating history. We have not sold our product candidate because it is currently investigational in nature and requires completion of additional clinical and non-clinical trials and studies in order to obtain regulatory approval in the U.S. and abroad. Therefore, our historical financial information consists only of an audit of our financial results at and for the years ended December 31, 2012 and 2013. This is very limited historical financial information upon which to base an evaluation of our performance. We are an emerging company, and thus our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies in their early stages of operation, particularly in the pharmaceutical industry. We have generated cumulative losses of approximately $8.7 million since inception, and we expect to continue to incur losses until Locilex™ is approved by the FDA and foreign regulatory authorities. Even if regulatory approval is obtained, there is a risk that we will not be able to generate material sales of Locilex™, which would cause us to continue to incur losses. We thus expect to incur substantial operating expenses over the next several years as our product development and marketing activities increase. The amount of future losses and when, if ever, we will achieve profitability are uncertain.

We have never generated revenue, may never generate revenue, are not profitable and may never become profitable.

We expect to incur substantial losses and negative operating cash flow for the foreseeable future, and we may never achieve or maintain profitability. Even if we are able to launch Locilex™, we expect to incur substantial losses for the foreseeable future and may never become profitable.

As we have no operating revenue, we also expect to experience negative cash flow for the foreseeable future as we continue to fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability would negatively impact the value of your securities and potentially require us to shut down our business, which would result in the loss of your investment.

Given our lack of revenue and cash flow, we may need to raise additional capital, which may be unavailable to us or, even if consummated, may cause dilution or place significant restrictions on our ability to operate.

Since we will be unable to generate sufficient, if any, revenue or cash flow to fund our operations for the foreseeable future, we may need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations. We may also need additional funding to continue the

10

development of Locilex™, increase our sales and marketing capabilities, promote brand identity, or develop or acquire complementary companies, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Moreover, the regulatory compliance arising out of being a publicly registered company will dramatically increase our costs.

We do not currently have any arrangements or credit facilities in place as a source of funds, and there can be no assurance that we will be able to raise sufficient additional capital if needed on acceptable terms, or at all. If such financing is not available on satisfactory terms, or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities and our ability to achieve our business objectives, our competitiveness, and our operations and financial condition may be materially adversely affected. Our inability to fund our business could thus lead to the loss of your investment.

If we raise additional capital by issuing equity securities, the percentage ownership of our existing stockholders may be reduced, and accordingly these stockholders may experience substantial dilution. We may also issue equity securities that provide for rights, preferences and privileges senior to those of our common stock. Given our need for cash and that equity issuance is the most common type of fundraising for companies like ours, the risk of dilution is particularly significant for stockholders of our company.

Debt financing, if obtained, may involve agreements that include liens on our assets and covenants limiting or restricting our ability to take specific actions, such as incurring additional debt. Debt financing would also be required to be repaid regardless of our operating results.

If we raise additional funds through collaborations and licensing arrangements, we may be required to relinquish some rights to Locilex™, or to grant licenses on terms that are not favorable to us.

We have no experience as a company in obtaining regulatory approval for, or commercializing, any product candidate.

As a company, we have never obtained regulatory approval for, or commercialized, any product candidate. It is possible that the FDA may refuse to accept our planned NDA for Locilex™ for substantive review, or may conclude after review of our data that our application is insufficient to obtain regulatory approval of Locilex™ or any future product candidates. If the FDA does not accept or approve our planned NDA for Locilex™, it may require that we conduct additional clinical, preclinical or manufacturing validation studies, which may be costly, and submit that data before it will reconsider our applications. Depending on the extent of these or any other FDA required studies, approval of any NDA or application that we submit may be significantly delayed, possibly for several years, or may require us to expend more resources than we have available. Any delay in obtaining, or an inability to obtain, regulatory approvals would prevent us from commercializing Locilex™, generating revenues and achieving and sustaining profitability. It is also possible that additional studies, if performed and completed, may not be considered sufficient by the FDA to approve any NDA we submit. If any of these outcomes occur, we may be forced to abandon our planned NDA for Locilex™, which would materially adversely affect our business and could potentially cause us to cease operations. We face similar risks for any approval in a foreign jurisdiction.

Our current and future operations substantially depend on our management team and our ability to hire other key personnel, the loss of any of whom could disrupt our business operations.

Our business depends and will continue to depend in substantial part on the continued service of David P. Luci and Robert J. DeLuccia. Upon the consummation of this offering, Messrs. Luci and DeLuccia will be parties to employment agreements for an initial three year term of service, subject to automatic one year renewals absent termination with at least six months notice. Such agreements may also be terminated by us with or without Cause (as defined in the employment agreements) and by each of Messrs. Luci or DeLuccia voluntarily or with Good Reason (as defined in the employment

11

agreements). The loss of the services of either of these individuals would significantly impede implementation and execution of our business strategy and may result in the failure to reach our goals. We do not carry key person life insurance on any of our management, which would leave our company uncompensated for the loss of any of our management.

Our future viability and ability to achieve sales and profit will also depend on our ability to attract, retain and motivate highly qualified personnel in the diverse areas required for continuing our operations. There is a risk that we will be unable to attract, train or retain qualified personnel, both near term or in the future, and our failure to do so may severely damage our prospects.

Our independent registered public accounting firm, in their audit report related to our financial statements for the fiscal year ended December 31, 2013, expressed substantial doubt about our ability to continue as a going concern.

As a result of our continued losses, our independent registered public accounting firm has included an explanatory paragraph in its report on our financial statements for the fiscal year ended December 31, 2013, expressing substantial doubt as to our ability to continue as a going concern. The inclusion of a going concern explanatory paragraph in the report of our independent registered public accounting firm may make it more difficult for us to secure additional financing or enter into strategic relationships on terms acceptable to us, if at all, and may materially and adversely affect the terms of any financing that we might obtain.

There is a risk that Locilex™ will not receive regulatory approval, and without regulatory approval we will not be able to market Locilex™.

Our business currently depends entirely on the successful development and commercialization of Locilex™. Our ability to generate revenue related to product sales, if ever, will depend on the successful development and regulatory approval of Locilex™ for the treatment of Mild DFI.

We currently have no products approved for sale and we cannot guarantee that we will ever have marketable products. The development of a product candidate and issues relating to its approval and marketing are subject to extensive regulation by the FDA in the U.S., the European Medicines Agency (or EMA) in Europe and regulatory authorities in other countries, with regulations differing from country to country. We are not permitted to market our product candidates in the U.S. or Europe until we receive approval of a NDA from the FDA or a Marketing Authorisation Application (or MAA) from the EMA, respectively.

NDAs and MAAs must include extensive data and supporting information to establish the product candidate's safety and effectiveness for each desired indication. NDAs and MAAs must also include significant information regarding the chemistry, manufacturing and controls for the product. Obtaining approval of a NDA or a MAA is a lengthy, expensive and uncertain process, and we may not be successful in obtaining approval. The FDA and the EMA review processes can take years to complete and approval is never guaranteed. If we submit a NDA to the FDA, the FDA must decide whether to accept or reject the submission for filing. We cannot be certain that any submissions will be accepted for filing and review by the FDA. Regulators of other jurisdictions, such as the EMA, have their own procedures for approval of product candidates.

Even if a product is approved, the FDA or the EMA, as the case may be, may limit the indications for which the product may be marketed, require extensive warnings on the product labeling or require expensive and time-consuming clinical trials or reporting as conditions of approval. Regulatory authorities in countries outside of the U.S. and Europe also have requirements for approval of drug candidates with which we must comply prior to marketing in those countries. Obtaining regulatory approval for marketing of a product candidate in one country does not ensure that we will be able to obtain regulatory approval in any other country.

12

In addition, delays in approvals or rejections of marketing applications in the U.S., Europe or other countries may be based upon many factors, including regulatory requests for additional analyses, reports, data, preclinical studies and clinical trials, regulatory questions regarding different interpretations of data and results, changes in regulatory policy during the period of product development and the emergence of new information regarding Locilex™ or other product candidates we may develop or acquire in the future. Also, regulatory approval for Locilex™ or other product candidates we may develop or acquire in the future may be withdrawn.

Before we submit a NDA to the FDA or a MAA to the EMA for Locilex™ for Mild DFI, we must successfully complete two Phase 3 trials and two Phase 1 trials. We cannot predict whether our future trials and studies will be successful or whether regulators will agree with our conclusions regarding the preclinical studies and clinical trials we have conducted to date.

If we are unable to obtain approval from the FDA, the EMA or other regulatory agencies for Locilex™ and any other product candidates we may develop or acquire in the future, or if, subsequent to approval, we are unable to successfully commercialize Locilex™ or our other product candidates we may develop or acquire in the future, we will not be able to generate sufficient revenue to become profitable or to continue our operations.

Locilex™'s prior sponsor encountered certain difficulties in manufacturing Locilex™ on a commercial scale, and there is a risk that we will continue to experience manufacturing issues that may prevent Locilex™ from receiving regulatory approval.

In the late 1990s, a prior formulation of Locilex™ was tested by Magainin, Locilex™'s prior sponsor, with over 1,000 human subjects exposed to such prior formulation of Locilex™, including 835 evaluable patients in two Phase 3 clinical trials. The FDA Advisory Committee reviewing Locilex™ at the time unanimously approved the safety of the product, but did not approve its efficacy and recommended an additional Phase 3 placebo controlled trial. In its 1999 non-approvable letter, the FDA identified certain cGMP manufacturing deficiencies, namely stability and quality control issues, and questions regarding the comparability of the product used in the Phase 3 program versus that which was produced at commercial scale.

Since we acquired rights to Locilex™, we have worked with our third-party vendors to address the stability and purity concerns previously articulated by the FDA. However, we cannot guarantee that such deficiencies will be deemed resolved to the FDA's satisfaction, that the FDA or other regulatory agencies will not identify new manufacturing concerns, or that, once regulatory approval is granted, our manufacturers will be able to comply with applicable regulations to maintain the quality of our product. If we are unable to resolve any outstanding manufacturing issues, the cost and timing for achieving regulatory approval could materially increase and could prevent us from meeting the developmental milestones necessary to maintain the viability of our business.

Even if Locilex™ gains regulatory approval, it may never achieve market acceptance or any level of commercial success. Our failure to achieve market acceptance will prevent or delay our ability to generate material revenues.

Our future financial performance will depend, to a large extent, upon the introduction and physician and patient acceptance of our product candidate, Locilex™. Even if approved for marketing by the necessary regulatory authorities, Locilex™ may not achieve market acceptance or reimbursement by Medicare, Medicaid or third party payors.

The degree of market acceptance for Locilex™ will depend upon a number of factors, including:

- •

- regulatory clearance of marketing claims for the uses that we are developing;

- •

- demonstration of the advantages, safety and efficacy for Locilex™;

13

- •

- pricing and reimbursement policies of government and third-party payors such as insurance companies, health maintenance

organizations and other health plan administrators;

- •

- our ability to attract corporate partners, including pharmaceutical companies, to assist in commercializing our

formulation of Locilex™; and

- •

- our ability to timely and effectively manufacture and market Locilex™, either on our own or through third parties.

Physicians, various other healthcare providers, patients, payors or the medical community in general may be unwilling to accept, utilize or recommend Locilex™. If we are unable to obtain regulatory approval, or are unable (either on our own or through third parties) to manufacture, commercialize and market Locilex™ or any future product candidates we may develop or acquire when planned, we may not achieve any market acceptance or generate revenue, which could cause our business to fail.

Our failure to complete or meet key milestones relating to the development of Locilex™ or other product candidates we may develop or acquire in the future would significantly impair the viability of our company.

In order to be commercially viable, we must successfully research, develop, obtain regulatory approval for, manufacture, introduce, market and distribute Locilex™ and, if applicable, any future product candidates we may develop. With respect to Locilex™ in particular, we must meet a number of critical developmental milestones, including:

- •

- demonstration, through clinical trials, that Locilex™ is safe and effective;

and

- •

- establishment of a viable Good Manufacturing Process capable of potential scale-up.

The estimated required capital and time-frames necessary to achieve these developmental milestones as described in this prospectus or as we may state from time to time is subject to inherent risks, many of which may be beyond our control. As such, we may not be able to achieve these or similar milestones for Locilex™ or any product candidate we may develop or acquire in the future. Our failure to meet these or other critical milestones would adversely affect the viability of our company.

Conducting and completing the clinical trials necessary for FDA approval is costly and subject to intense regulatory scrutiny as well as the risk of failing to meet the primary endpoints of such trials. We will not be able to commercialize and sell Locilex™ without completing such trials.

In order to conduct clinical trials that are necessary to obtain approval by the FDA to market Locilex™ or any other product candidate we may develop or acquire in the future, it is necessary to receive clearance from the FDA to conduct such clinical trials. We must conduct two Phase 3 and two Phase 1 clinical trials for Locilex™. We have not commenced these trials as of the date of this prospectus, and we may not be able to commence, enroll sufficient patients in, properly conduct or complete such trials. If we can not achieve all of these goals, our viability will be materially impaired.

In addition, the FDA can halt clinical trials at any time during the conduct of clinical trials for safety reasons or because we or our clinical investigators did not follow the FDA's requirements for conducting clinical trials. If we commence our clinical trials and trials are permanently halted by the FDA, we would not be able to achieve any revenue from such product as it is illegal to sell any drug for human consumption or use without FDA approval. If our trials are temporarily halted by the FDA, the cost and timing for potentially achieving regulatory approval could be materially increased.

Moreover, there is a risk that our clinical trials will fail to meet their primary endpoints, which would make them unacceptable in having Locilex™ approved by the FDA. If this were to occur, the announcement of such an event would very likely cause our public stock price to decrease, perhaps significantly, and such event would otherwise materially and adversely affect our business, results of operations and viability.

14

Locilex™ may have undesirable side effects which may delay or prevent marketing approval, or, if approval is received, require it to be taken off the market, require it to include safety warnings or otherwise limit sales of the product.

Unforeseen side effects from Locilex™ could arise either during clinical development or, if approved, after Locilex™ has been marketed. This could cause regulatory approvals for, or market acceptance of, Locilex™ harder and more costly to obtain.

To date, no serious adverse events have been attributed to Locilex™, though approximately 12% of patients in prior clinical trials experienced serious adverse events unrelated to Locilex™. The results of our planned or any future clinical trials may show that Locilex™ causes undesirable or unacceptable side effects, which could interrupt, delay or halt clinical trials, and result in delay of, or failure to obtain, marketing approval from the FDA and other regulatory authorities, or result in marketing approval from the FDA and other regulatory authorities with restrictive label warnings.

If Locilex™ receives marketing approval and we or others later identify undesirable or unacceptable side effects caused by the use of Locilex™:

- •

- regulatory authorities may withdraw their approval of the product, which would force us to remove Locilex™

from the market;

- •

- regulatory authorities may require the addition of labeling statements, specific warnings, a contraindication or field

alerts to physicians and pharmacies;

- •

- we may be required to change instructions regarding the way the product is administered, conduct additional clinical

trials or change the labeling of the product;

- •

- we may be subject to limitations on how we may promote the product;

- •

- sales of the product may decrease significantly;

- •

- we may be subject to litigation or product liability claims; and

- •

- our reputation may suffer.

Any of these events could prevent us or our potential future collaborators from achieving or maintaining market acceptance of Locilex™ or could substantially increase commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenues from the sale of Locilex™.

We currently have no marketing and sales organization and have no experience as a company in marketing pharmaceutical products. If we are unable to establish our own marketing and sales capabilities, or enter into agreements with third parties, to market and sell our products after they are approved, we may not be able to generate product revenues.

We do not have a sales organization for the marketing, sales and distribution of any pharmaceutical products. In order to commercialize Locilex™ or any other product candidate we may develop or acquire in the future, we must develop these capabilities on our own or make arrangements with third parties for the marketing, sales and distribution of our products. The establishment and development of our own sales force would be expensive and time consuming and could delay any product launch, and we cannot be certain that we would be able to successfully develop this capability. As a result, we may seek one or more licensing partners to handle some or all of the sales and marketing of Locilex™ in the U.S. and elsewhere. There also may be certain markets within the U.S. for Locilex™ for which we may seek a co-promotion arrangement. However, we may not be able to enter into arrangements with third parties to sell Locilex™ on favorable terms or at all. In the event we are unable to develop our own marketing and sales force or collaborate with a third-party marketing and sales organization, we would not be able to commercialize Locilex™ or any other product candidates that we develop, which would negatively impact our ability to generate product revenues. Furthermore, whether we

15

commercialize products on our own or rely on a third party to do so, our ability to generate revenue will be dependent on the effectiveness of the sales force. In addition, to the extent we rely on third parties to commercialize our approved products, we will likely receive less revenues than if we commercialized these products ourselves.

We rely heavily on third parties for conducting clinical trials, marketing and distributing Locilex™.

We presently are party to, and expect that we will be required to enter into, agreements with commercial partners to perform clinical trials for us and to engage in sales, marketing and distribution efforts for Locilex™ or other product candidates we may acquire in the future. We may be unable to establish or maintain third-party relationships on a commercially reasonable basis, if at all. In addition, these third parties may have similar or more established relationships with our competitors or other larger customers. Moreover, the loss for any reason of one or more of these key partners could have a significant and adverse impact on our business. If we are unable to obtain or retain third party sales and marketing vendors on commercially acceptable terms, we may not be able to commercialize Locilex™ as planned and we may experience delays in or suspension of our marketing launch of Locilex™. The same could apply to other product candidates we may develop or acquire in the future. Our dependence upon third parties may adversely affect our ability to generate profits or acceptable profit margins and our ability to develop and deliver such products on a timely and competitive basis.

We rely on single source third-party contract manufacturing organizations to manufacture and supply Locilex™ for us. If one of our suppliers or manufacturers fails to perform adequately or fulfill our needs, or if these agreements are terminated by the third parties, we may be required to incur significant costs and devote significant efforts to find new suppliers or manufacturers. We may also face delays in the development and commercialization of Locilex™ or other product candidates that we may develop or acquire in the future.

We currently have limited experience in, and we do not own facilities for, manufacturing Locilex™ or any other product candidate we may develop or acquire in the future. We rely upon single source third-party contract manufacturing organizations to manufacture and supply large quantities of our product candidates. We currently utilize PolyPeptide Laboratories, Inc. for the bulk manufacturing of Locilex™ and DPT Laboratories, Inc. for the formulation of Locilex™. In addition, we are using Almac Group Limited to label the 15 gram tubes of Locilex™ and distribute as we direct.

The manufacture of pharmaceutical products in compliance with current good manufacturing practice (or cGMP) regulations requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products often encounter difficulties in production, including difficulties with production costs and yields, quality control, including stability of the product candidate and quality assurance testing, or shortages of qualified personnel. If our manufacturers were to encounter any of these difficulties or otherwise fail to comply with their obligations to us or under applicable regulations, our ability to provide study materials in our preclinical studies and clinical trials would be jeopardized. Any delay or interruption in the supply of clinical trial materials could delay the completion of our clinical trials, increase the costs associated with maintaining our clinical trial programs and, depending upon the period of delay, require us to commence new trials at significant additional expense or terminate the studies and trials completely.

Our suppliers and manufacturers for Locilex™ must comply with cGMP requirements enforced by the FDA through its facilities inspection program. These requirements include, among other things, quality control, quality assurance and the maintenance of records and documentation. Manufacturers of our component materials may be unable to comply with these cGMP requirements and with other FDA, state and foreign regulatory requirements. The FDA or similar foreign regulatory agencies at any time may also implement new standards, or change their interpretation and enforcement of

16

existing standards for manufacture, packaging or testing of products. We have little control over our manufacturers' compliance with these regulations and standards. A failure to comply with these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval. If the safety of any product supplied is compromised due to our manufacturers' failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize our products, and we may be held liable for any injuries sustained as a result. Any of these factors could cause a delay of clinical trials, regulatory submissions, approvals or commercialization of Locilex™ or any product candidates we may develop or acquire in the future or entail higher costs or impair our reputation.

Our current agreements with our suppliers do not provide for the entire supply of the bulk drug necessary for full-scale commercialization. In the event that we and our suppliers cannot agree to the terms and conditions for them to provide some or all of our bulk drug clinical and commercial supply needs, or if any single-source supplier terminates the agreement in response to a breach by us, we would not be able to manufacture the bulk drug on a commercial scale until a qualified alternative supplier is identified, which could also delay the development of, and impair our ability to commercialize, Locilex™ or any product candidates we may develop or acquire in the future.

The number of third-party suppliers with the necessary manufacturing and regulatory expertise and facilities for our company is limited, and it could be expensive and take a significant amount of time to arrange for alternative suppliers, which could have a material adverse effect on our business. New suppliers of any bulk drug would be required to qualify under applicable regulatory requirements and would need to have sufficient rights under applicable intellectual property laws to the method of manufacturing such ingredients. Obtaining the necessary FDA approvals or other qualifications under applicable regulatory requirements and ensuring non-infringement of third-party intellectual property rights could result in a significant interruption of supply and could require the new manufacturer to bear significant additional costs which may be passed on to us.

We will need to increase the size of our organization, and we may experience difficulties in managing growth.

As of March 6, 2014, we had seven employees and consultants, of which two are full-time employees and five are part-time employees or consultants. We will need to expand our managerial, operational, financial and other resources in order to manage our operations and clinical trials, continue our development activities and commercialize Locilex™ and any other product candidates we may develop or acquire in the future. Our management and personnel, systems and facilities currently in place are not adequate to support this future growth. Our need to effectively execute our business strategy requires that we:

- •

- manage our clinical trials effectively, including two Phase 3 clinical trials and two Phase 1 clinical

trials for Locilex™. The Phase 3 clinical trials are expected to be conducted at up to 40 trial sites in the U.S. and are expected to be managed on our behalf by RRD

International, LLC;

- •

- manage our internal development efforts effectively while carrying out our contractual obligations to licensors,

contractors, collaborators, government agencies and other third parties;

- •

- continue to improve our operational, financial and management controls, reporting systems and procedures;

and

- •

- identify, recruit, maintain, motivate and integrate additional employees.

If we are unable to expand our managerial, operational, financial and other resources to the extent required to manage our development and commercialization activities, our business will be materially adversely affected.

17

We are exposed to product liability, non-clinical and clinical liability risks which could place a substantial financial burden upon us, should lawsuits be filed against us.

Our business exposes us to potential product liability and other liability risks that are inherent in the testing, manufacturing and marketing of pharmaceutical formulations and products. We expect that such claims are likely to be asserted against us at some point. In addition, the use in our clinical trials of pharmaceutical formulations and products and the subsequent sale of these formulations or products by us or our potential collaborators may cause us to bear a portion of or all product liability risks. We currently have $3 million in insurance coverage relating to personal injury, product liability, medical expenses, and office premises. However, any claim under such insurance policies may be subject to certain exceptions, and may not be honored fully, in part, in a timely manner, or at all, and may not cover the full extent of liability we may actually face. Therefore, a successful liability claim or series of claims brought against us could have a material adverse effect on our business, financial condition and results of operations.

We and our management are parties to a lawsuit which, if adversely decided against, could impact our rights to Locilex™.

In April 2010, we acquired the worldwide rights to develop pexiganan, the active pharmaceutical ingredient in Locilex™, from Genaera Liquidating Trust, which was put in place to liquidate the assets of Genaera Corporation. In June 2012, we, along with our two senior executives and several other unrelated defendants, were sued in the Federal District Court for the Eastern District of Pennsylvania by a former shareholder of Genaera Corporation and purported to be on behalf of other Genaera Corporation shareholders, alleging, in pertinent part, that our company's acquisition of the rights to pexiganan (the active ingredient in Locilex™, and which rights included the rights to the prior formulation of Locilex™) was for what was alleged to be inadequate consideration, and as a result, it was alleged that we and our senior executives aided and abetted a breach of fiduciary duty by Genaera Corporation and the Genaera Liquidating Trust to the former shareholders of Genaera Corporation. It was also alleged that we and our senior executives aided and abetted a breach of the duty of the trustee at common law and under a certain trust agreement which was alleged to exist and which was executed by Argyce LLC (or Argyce), as trustee. The agreement called for Argyce to create the Genaera Liquidating Trust pursuant to which Argyce apparently was appointed to liquidate the assets formerly held by Genaera Corporation. One of these assets was pexiganan, which we acquired via public auction conducted by Argyce on behalf of the Genaera Liquidating Trust.

As of the date of this prospectus, the case against our company and our senior executives has been dismissed with prejudice, and a subsequent motion to reconsider such dismissal has been denied. Prior to the dismissal there was no request or action to seek class certification by the plaintiff though it was purportedly filed on behalf of other former Genaera Corporation shareholders. Plaintiff has appealed the dismissal of the suit as well as the denial of the motion to reconsider. The appeal has been filed in the United States Court of Appeals for the Third Circuit. As of the date of this prospectus, briefing is underway in the appellate court.

If the appellate court reverses the decision of the underlying federal court, a civil case would be reinstated and if we were to lose such case, our rights to the prior formulation of Locilex™ could be lost, which may impair the commercial viability of our product or the timeline to potential regulatory approval. If we were required to settle the case, we may lose certain rights to Locilex™ or be required to pay damages, which could have a material adverse effect on our company, our business plans and results of operations.

18

We may form strategic alliances in the future with respect to our Locilex™ development program and we may not realize the benefits of such alliances.