Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Atlantic Union Bankshares Corp | v370565_8k.htm |

Exhibit 99.1

Investor Presentation March 2014

Forward - Looking Statement Certain statements in this report may constitute “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements are statements that include projections, predictions, expectations, or beliefs about future events or results or otherwise and are not statements of historical fact. Such statements are often characterized by the use of qualified words (and their derivatives) such as “expect,” “believe,” “estimate,” “plan,” “project,” “anticipate,” “intend,” “will,” or words of similar meaning or other statements concerning opinions or judgment of the Company and its management about future events. Although the Company believes that its expectations with respect to forward - looking statements are based upon reasonable assumptions within the bounds of its existing knowledge of its business and operations, there can be no assurance that actual results, performance, or achievements of the Company will not differ materially from any future results, performance, or achievements expressed or implied by such forward - looking statements. Actual future results and trends may differ materially from historical results or those anticipated depending on a variety of factors, including, but not limited to, the effects of and changes in: general economic and bank industry conditions, the interest rate environment, legislative and regulatory requirements, competitive pressures, new products and delivery systems, inflation, changes in the stock and bond markets, accounting standards or interpretations of existing standards, mergers and acquisitions, technology, and consumer spending and savings habits. More information is available on the Company’s website, http://investors.bankatunion.com and on the Securities and Exchange Commission’s website, www.sec.gov. The information on the Company’s website is not a part of this press release. The Company does not intend or assume any obligation to update or revise any forward - looking statements that may be made from time to time by or on behalf of the Company. 2

Company Overview The largest community banking organization headquartered in Virginia Holding company formed in 1993 – Banking history goes back more than 100 years Assets of $7.2 Billion Comprehensive financial services provider offering commercial and retail banking, mortgage, investment, trust and insurance products and services 3

Union’s Strengths Unique branch network across Virginia, competitive banking products and services and a loyal client base Well positioned for organic growth given commercial activity, household income levels and population growth in its footprint Strong balance sheet and solid capital base Conservative lender with improving asset quality metrics Experienced management team Successful acquirer and integrator Proven financial performance in both good and bad economic climates 4

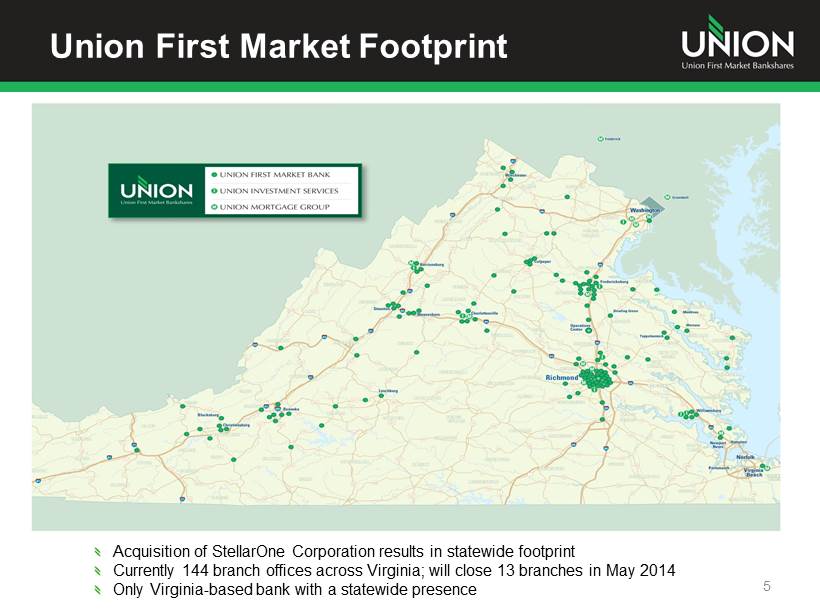

Union First Market Footprint 5 Acquisition of StellarOne Corporation results in statewide footprint Currently 144 branch offices across Virginia; will close 13 branches in May 2014 Only Virginia - based bank with a statewide presence

Diversity Supports Growth in Virginia Richmond • State Capital • Fortune 500 headquarters (6) • Finance and insurance • VCU & VCU Medical Center Fredericksburg • Defense and security contractors • Health care • Retail Charlottesville • University of Virginia & Medical College • High - tech and professional businesses Northern Virginia • Nation’s Capital • Defense and security contractors • Associations (lobbyists) • High tech Virginia Beach - Norfolk • Military • Shipbuilding • Tourism Roanoke - Blacksburg • Virginia Tech • Health care • Retail 6

Branch Franchise 7 Source: SNL Financial and MapInfo Professional Note: Fredericksburg market defined as Caroline, Fredericksburg City, King George, Spotsylvania, & Stafford counties; all oth er markets per MSA definitions in SNL Financial (1) As of 12/31/13 (2) Branches as of 2/1/14 - Union will close 13 branches in May 2014 (3) Deposit market share as of 6/30/13 NC DC VA AL CT DE GA IL IN KY MA MD MI MS NJ NY OH RI SC TN WV UBSH Counties STEL Counties Overlapping Counties UBSH (90) STEL (54) Richmond Rank: #5 Deposits: $1.6 bn Market Tot.: $73.6 bn Mkt. Share: 5.3% Blacksburg Rank: #1 Deposits: $696 mm Market Tot.: $2.7 bn Mkt. Share: 26.1% Staunton / Harrisonburg Rank: #2 Deposits: $488 mm Market Tot.: $3.4 bn Mkt. Share: 14.4% Culpeper Rank: #1 Deposits: $202 mm Market Tot.: $0.6 bn Mkt. Share: 33.5% MSA Market Share Rank Company Deposits Total Market Deposits Market Share Roanoke Deposits: $355 mm Market Tot.: $7.2 bn Mkt. Share: 4.9% Rank : #6 Charlottesville Rank: #5 Deposits: $419 mm Market Tot.: $3.6 bn Mkt. Share: 11.6% VA Fredericksburg Rank: #2 Deposits: $820mm Market Tot.: $3.4 bn Mkt. Share: 23.7% Pro Forma Highlights (1) Branches (2) FTEs Assets Loans Deposits 144 1,730 $7.2 Billion $5. 3 Billion $5.7 Billion

Competitive Positioning 8 Richmond Charlottesville Source: SNL Financial and U.S. Census Bureau; Deposit data as of 6/30/2013 Note: Small businesses have less than 100 employees; Fredericksburg market defined as Caroline, Fredericksburg City, King Geo rge , Spotsylvania, & Stafford counties; all other markets per MSA definitions in SNL Financial Staunton / Harrisonburg Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma 42 4 46 $1,585 $50 $1,634 1,258,251 488,330 29,814 $71,754 STEL Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma 7 3 10 $346 $88 $434 201,559 78,560 5,449 $3,643 STEL Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma 4 10 14 $51 $433 $484 243,730 93,064 5,583 $3,385 STEL Market Rank: 5 24 5 Market Rank: 6 8 4 Roanoke Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma 1 9 10 $15 $338 $353 308,707 128,454 7,864 $7,155 STEL Market Rank: 15 6 6 Blacksburg Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma - 9 9 - $709 $709 162,958 63,793 3,135 $2,767 STEL Market Rank: - 1 1 Market Rank: 13 2 2 Fredericksburg Population: Households: Small Businesses: Market Deposits ($mm): UBSH Branches: Deposits ($mm): Pro Forma 14 5 19 $686 $136 $822 327,773 112,048 6,326 $3,530 STEL Market Rank: 2 9 2 Deepening Expanding

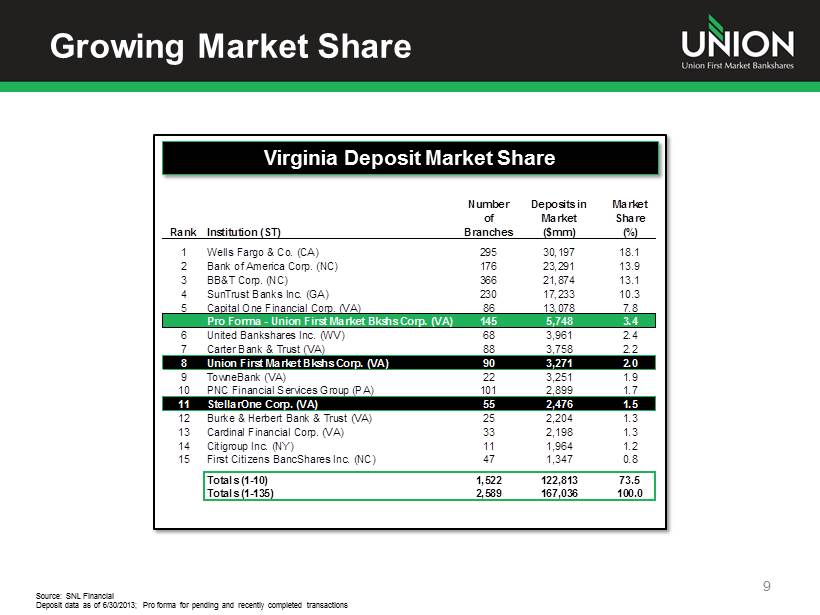

Growing Market Share 9 Virginia Deposit Market Share Source: SNL Financial Deposit data as of 6/30/2013; Pro forma for pending and recently completed transactions Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Wells Fargo & Co. (CA) 295 30,197 18.1 2 Bank of America Corp. (NC) 176 23,291 13.9 3 BB&T Corp. (NC) 366 21,874 13.1 4 SunTrust Banks Inc. (GA) 230 17,233 10.3 5 Capital One Financial Corp. (VA) 86 13,078 7.8 Pro Forma - Union First Market Bkshs Corp. (VA) 145 5,748 3.4 6 United Bankshares Inc. (WV) 68 3,961 2.4 7 Carter Bank & Trust (VA) 88 3,758 2.2 8 Union First Market Bkshs Corp. (VA) 90 3,271 2.0 9 TowneBank (VA) 22 3,251 1.9 10 PNC Financial Services Group (PA) 101 2,899 1.7 11 StellarOne Corp. (VA) 55 2,476 1.5 12 Burke & Herbert Bank & Trust (VA) 25 2,204 1.3 13 Cardinal Financial Corp. (VA) 33 2,198 1.3 14 Citigroup Inc. (NY) 11 1,964 1.2 15 First Citizens BancShares Inc. (NC) 47 1,347 0.8 Totals (1-10) 1,522 122,813 73.5 Totals (1-135) 2,589 167,036 100.0

$0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 2009 2010 2011 2012 2013 StellarOne $2,469,121 Union $1,916,364 $3,070,059 $3,175,105 $3,297,767 $3,236,842 Deposits ($M) $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 2009 2010 2011 2012 2013 StellarOne $2,283,535 Union $1,874,224 $2,837,253 $2,818,583 $2,966,847 $3,039,368 Loans ($M) $0 $1,000,000 $2,000,000 $3,000,000 $4,000,000 $5,000,000 $6,000,000 $7,000,000 $8,000,000 2009 2010 2011 2012 2013 StellarOne $3,070,652 Union $2,587,272 $3,837,139 $3,907,087 $4,095,865 $4,176,571 Assets ($M) Balance Sheet Growth 10 $5,322 $5,706 $7,247

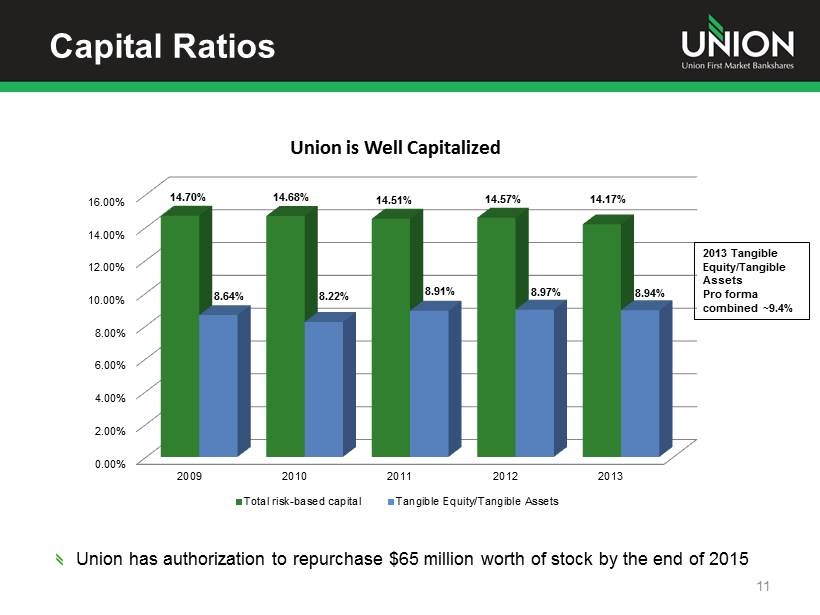

Capital Ratios 11 Union has authorization to repurchase $65 million worth of stock by the end of 2015 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2009 2010 2011 2012 2013 14.70% 14.68% 14.51% 14.57% 14.17% 8.64% 8.22% 8.91% 8.97% 8.94% Union is Well Capitalized Total risk-based capital Tangible Equity/Tangible Assets 2013 Tangible Equity/Tangible Assets Pro forma combined ~9.4%

$0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2009* 2010* 2011* 2012 2013* $9,860 $29,129 $30,722 $35,411 $36,538 $27,793 Net Income ($) Union StellarOne Net Income Trends 12 * excludes after - tax acquisition expenses; T he 2013 pro forma combined financial statements represent the sum of UBSH and StellarOne’s 2013 financial results and do not take into account purchase accounting adjustments, expected synergies, or acquisition related costs. This is for informa tio nal purposes only $64,331

ROA, ROE and ROTCE Trends 13 * excludes after - tax acquisition expenses 0.00% 0.10% 0.20% 0.30% 0.40% 0.50% 0.60% 0.70% 0.80% 0.90% 2009* 2010* 2011* 2012* 2013* 0.38% 0.78% 0.80% 0.89% 0.90% Return on Average Assets (ROA) 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 2009* 2010* 2011* 2012* 2013* 3.42% 6.99% 6.97% 8.13% 8.38% ROE 1.00% 3.00% 5.00% 7.00% 9.00% 11.00% 2009* 2010* 2011* 2012* 2013* 5.68% 9.77% 9.42% 9.89% 10.07% ROTCE 2013 Pro forma combined ~0.91% 2013 Pro forma combined ~7.43% 2013 Pro forma combined ~9.51%

Core Net Interest Margin 14 * Excludes acquisition accounting impact 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 2009 2010* 2011* 2012* 2013* 3.55% 4.24% 4.37% 4.24% 4.18% Best in Class Net Interest Margin 2013 Pro forma combined ~4%

Top - Tier Financial Performance Focus Union is committed to achieving top tier financial performance and providing our shareholders with above average returns on their investment Key financial performance metrics benchmarked against top quartile peers After cost savings realized, StellarOne acquisition accelerates the achievement of top tier financial metrics Top Tier Financial Performance targets: 15 Financial Performance Metric Union Targets Return on Assets (ROA) 1.1% - 1.3% Return on Equity (ROE) 10% - 12% Return on Tangible Equity (ROTCE) 12% - 15% Efficiency Ratio < 60%

2014 Outlook Focus on integration of StellarOne and achieving cost savings target Stable to growing economy in footprint Mid - single digit loan growth Modest net interest margin compression Continued asset quality improvement Improving ROA, ROE and Efficiency Ratio $65 million in share repurchases authorized through 2015 16

Value Proposition Statewide Branch footprint is a competitive advantage and brings a unique franchise value Strong balance sheet and capital base Best in class net interest margin Experienced management team Proven acquirer and integrator Committed to top tier financial performance Shareholder Value Driven Solid dividend yield and payout ratio with earnings upside 17

THANK YOU!