Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EASTON-BELL SPORTS, INC. | esbi-8k_20140305.htm |

Transaction Summary

On

February

13,

2014,

Easton-Bell

Sports,

Inc.

reached

an

agreement

to

sell

the

assets

of

its

Easton

Baseball

/

Softball business to Bauer Performance Sports (“Bauer”) for $330MM

–

Closing expected in March / April 2014

Easton-Bell Sports, Inc. also announced that it is working towards an agreement

with a third party for the sale of its Easton Hockey business

–

Easton Hockey will be an Unrestricted Subsidiary until it is sold

Proceeds from the sale will be used in conjunction with a new financing to retire

the existing Easton-Bell Sports, Inc. 2016 Senior Secured Notes, the EB

Sports Corp. HoldCo Facility, and pay transaction fees and expenses

–

$46MM of proceeds earmarked as unrestricted HoldCo cash to fund acquisitions or

capital structure changes The contemplated new financing includes the

following: –

$150MM 5-year ABL (undrawn at closing)

–

$215MM 7-year 1

st

Lien Term Loan

–

$110MM 8-year 2

nd

Lien Term Loan

The

contemplated

new

financing

represents,

on

a

pro

forma

basis,

Total

Debt

/

Adj.

EBITDA

of

5.2x,

and

Net

Debt / Adj. EBITDA of 4.9x

Upon completion of these transactions, Easton-Bell Sports, Inc. will be renamed

BRG Sports, Inc. Exhibit 99.1 |

Transaction Overview: Financing of BRG

Sources & Uses

Sources

Amount ($MM)

%

New ABL Revolver

0

0

New 1st Lien Term Loan

215

32

New 2nd Lien Term Loan

110

17

Net Proceeds from Asset Sale

337

51

Total Sources

662

100

Uses

Amount ($MM)

%

Retire ABL Facility

23

3

Retire Senior Notes

350

53

Retire HoldCo Facility

145

22

HoldCo Unrestricted Cash Allocation

46

7

Bond Breakage Costs

17

3

CIP / Transaction Costs

47

7

Illustrative Financing Fees & OID

10

2

Cash for Capitalizing Hockey

15

2

Cash for Restructuring Post-Transaction

9

1

Total Uses

662

100

PF Capitalization | Credit Statistics

Pro Forma ($MM)

12/31/2013

Cash on Balance Sheet

19

New ABL Revolver

0

New Term Loan (1st Lien)

215

New Term Loan (2nd Lien)

110

Total Debt

325

PF 2013E Adj. EBITDA

62

1st Lien Debt / PF Adj. EBITDA

3.5x

2nd Lien Debt / PF Adj. EBITDA

1.8x

Bank Debt / PF Adj. EBITDA

5.2x

Total Debt / PF Adj. EBITDA

5.2x

Net Debt / PF Adj. EBITDA

4.9x

2 |

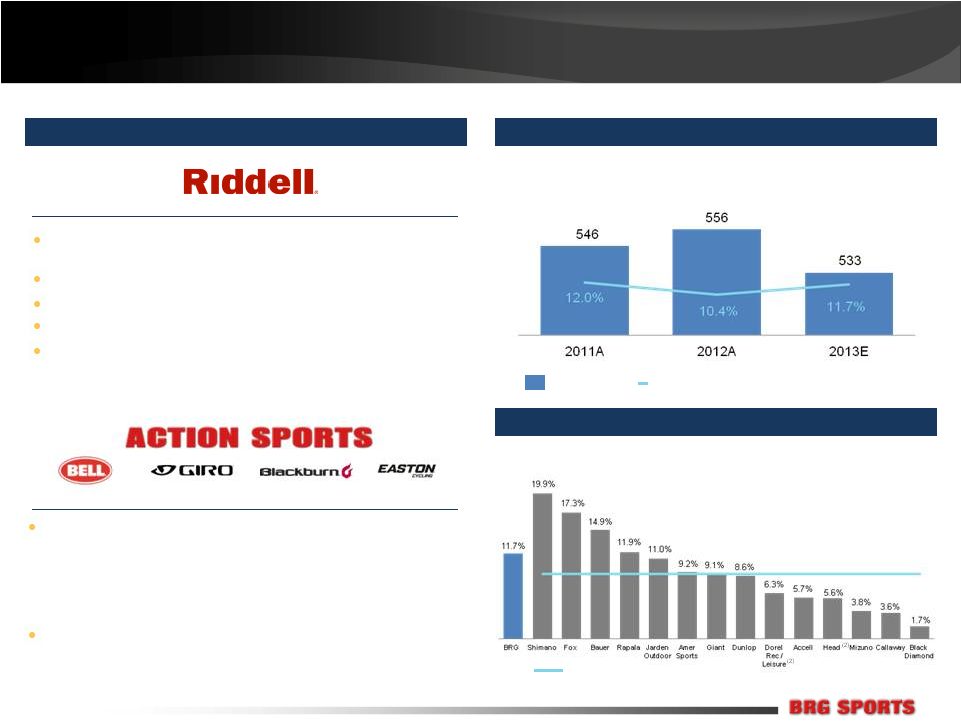

A

Top-Tier Sporting Goods Company The leading brands across helmets,

accessories, components, footwear and apparel for cycling, snowsports and

powersports –

42% share in global specialty cycling helmets

–

41% share in US snow helmets

–

56% share in US mass cycling accessories

CY2013E, %

BRG Revenue

BRG PF Adj. EBITDA Margin %

BRG Sports

(1)

Financial Performance

EBITDA Margins Above Most of Industry

Notes

1.Contribution based on 2013E Net Sales. Other brands contribute immaterial amount

2.LTM as of 9/30/2013

(39% of Net Sales)

(36% of Net Sales)

(18% of Net Sales)

(4% of Net Sales)

$MM

Industry Median = 8.9%

Sources:

Company Information, Management Estimates

(2)

(2)

Sources:

Thomson Estimates from Capital IQ as of 2/19/2014; Company Filings

(~3% of Net Sales)

Developer, manufacturer and reconditioner of football equipment,

uniforms, and accessories

A well-recognized brand at the forefront of head protection research 56% market share in

football helmets

A cash flow generator with a differentiated selling model Set all-time

record revenue performance for 4 years running

Global appeal for its

brands

3 |

BRG

Sports: Change in Management Team, Return to the Past Two

Differentiated

Businesses

with Market-

Leading

Positions

Strong brand portfolio supported by storied histories, established reputations for

innovation, and globally recognized brand names

Riddell, founded in 1929, is one of the most well-known brands in sports

Bell and Giro own the leading positions in cycling, snow, and other action

sports Bell is building a fast-growing business in powersports

Opportunity to

Further Refine

Culture and Add

Value

Encourage

a

flat,

entrepreneurial

environment;

transition

from

EBS’

“corporate”

culture

Further emphasize and reward product innovation

Foster increased collaboration among divisions through revised management

structure Swift and efficient change since Terry Lee’s return to the

company he helped build and Tim Mayhew’s shift from long-time

Board member to management Operational

Improvements

to Drive

Margins and

Cash Flow

Continue right-sizing operating expenses as a % of sales (run-rate

>$10MM costs already taken out)

Maintain prudent capital expenditures by managing as a ratio

Better leverage available from economies of scale

4 |

Attractive Market Dynamics

Resiliency Across All Key Sporting Goods Markets

2009-2012 CAGR

Sources:

SFIA,

Company

Analysis

$79.2Bn

Market

Size

$3.6Bn

$498MM

$516MM

Notes:

1.

U.S. Sporting Goods Wholesale Sales

2.

U.S. Independent Bike Dealer Sales

3.

U.S. Ski and Snowboard Equipment Wholesale Sales

4.

U.S. Football Equipment Wholesale Sales

3.4%

7.5%

4.1%

1.3%

U.S. Sporting Goods

(1)

U.S. Cycling

(2)

U.S. Snow Sports

(3)

Football Equipment

(4)

5 |

Strong, Diversified Portfolio Across Categories and Sports…

Premium brand image,

evolving cross-category

lifestyle offering

Category leader in U.S.

ski / snow helmets and

goggles (crossover

from specialty cycling

strength)

Storied heritage as an

authentic moto helmet

Strong current

momentum (40%

CAGR)

Recently acquired

global distribution rights

to expand growth

Unparalleled brand

recognition and market

position

Cutting-edge helmet

technology

The top choice of elite

athletes

250 person direct sales

organization

Football

(39% of Net Sales)

Global market leader in

specialty cycling

helmets (particularly

strong in U.S.)

Unique multi-channel,

multi-brand strategy

Helmet of champions

$533MM 2013E Net Sales, $62MM 2013E PF. Adj. EBITDA

Cycling

(51% of Net Sales)

Snow

(6% of Net Sales)

Powersports

(4% of Net Sales)

6 |

Multiple sports with diversity of products within each

Seasonal variety

Wide range of price points

Products sold in 69 countries through numerous

distribution outlets

Unique direct institutional sales force

–

Close to 20,000 institutional customers

Network of in-house and independent sales

representatives

BRG’s top customer (mass merchant) comprises 14.6%

of sales; next largest customer drops down to 2.6%

Product Diversification

Channel Diversification

2013E Net Sales, %

2013E Net Sales, %

Notes

1.Includes Easton cycling wheels / components

2.Includes distributor and OEM sales

Football

Equipment and

Reconditioning

Services

34%

Cycling

Accessories &

Softgoods

(1)

26%

Cycling

Helmets

25%

Snowsports

6%

Football

Licensed

Products

5%

Powersports

4%

Other Products

Specialty / Big

Box Retail

(2)

44%

Institutional

31%

Mass

25%

Diversification by Product, Channel and Customer Enhances Stability 7

|

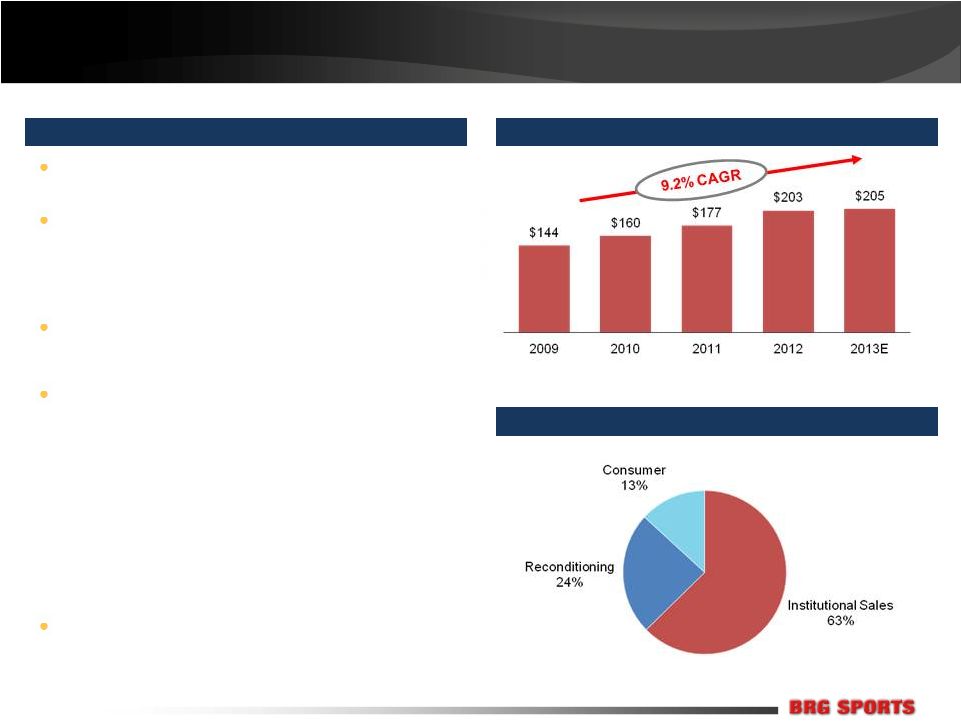

Riddell: The Football Specialty Company

A Leader in Football Equipment

Impressive and Continuous Growth

Broad Customer Base With Little Concentration

Revenue, $MM

Premier developer, manufacturer and reconditioner

of football equipment, uniforms, and accessories

Leading market positions in each category

–

56% market share by sales in helmets

–

Meaningful share increases over the past five

years

–

Majority of players wear Riddell helmets

Record revenue and EBITDA performance

–

Share-driven unit growth and consistent ASP

increases

–

High gross margins with improvement through

innovation and reconditioning relocation

–

SG&A leverage despite R&D and marketing

investments

–

Strong free cash flow profile

Industry highly concentrated, only a few key players

–

Riddell, Schutt, and Rawlings

Note:

2013E Net Sales, %

A favorite among NFL professionals

1.

Principally includes Riddell helmet and shoulder pad parts and accessories sold to

other reconditioning shops 8 |

2013E Net Sales, %

(2)

Action Sports: Global Cycling, Snow, and Powersports Leader

Growth Resuming Following Difficult 2012

A combination of two market-leading brands in Bell

and Giro

–

Helmets, accessories, footwear and apparel for

cycling, snowsports, and powersports

Segment also includes:

–

Blackburn cycling accessories

–

Easton cycling wheels and components

Recent performance impacted by:

–

Self-inflicted errors

–

Exit from non-core Mass Fitness / Football

categories, Easton wheels quality issues

–

Unfavorable 2012/2013 seasonal weather

Improvement plan in place with results starting to

show

A Winning Combination

Core

Revenue

($MM)

(1)

Notes

1.Reflects

core

operations

–

excludes

Mass

Fitness/Football

and

Easton

Cycling

2.Certain items with immaterial contribution not reflected in graph

Diversified by Both Brand and Category

Giro

Bell

Blackburn

Easton

Mass Accessories

24%

Mass Helmets

9%

Mass Juvenile Licensed

9%

Bell Cycling

9%

Powersports

7%

Giro Cycling Helmets

14%

Giro

Snow

Helmets

8%

Footwear

4%

Other Giro

4%

Easton

6%

Blackburn

6%

$291

$301

$310

$300

$306

2009

2010

2011

2012

2013E

30%

6%

6%

58%

•

•

•

•

9 |

Giro: An Evolving

Outdoor Adventure Brand Global market leader in cycling and snowsports helmets sold

through specialty retailers

–

Premium, high-quality image

–

Reputation for innovation, performance, and design

From Helmets to Lifestyle

Giro Bike

Giro Snow

Giro Air Attack

Giro Amare Women’s

Giro Combyn

Giro Blok

New Road Apparel

Waterproof jacket

Republic Shoes

% of Total Giro-Branded Net Sales

Increasing Non-Helmet Contribution

Leading U.S. Ski and Snow helmet player

Brand authenticity has allowed Giro to successfully extend

into snow, and now cycling softgoods and accessories

–

2009 launch of snow goggles and cycling gloves

–

2010 / 2011 launch of cycling footwear (fastest-growing

–

2013 / 2014 category expansion with New Road apparel

–

Little innovation in the current cycling apparel category

brand, now #4 in the market)

10 |

Strong Global Distribution Platform

…Utilizing Numerous Channels

Broad-Based Distribution Model…

Diverse customer base across mass and specialty

–

~120 North American sales representatives (14

mass, 80 specialty, 23 powersports)

–

130 international distributors

Specialty channel accounts for majority of sales

–

Ranges from big box to cycling / ski independents

–

Giro in ~12,000 specialty cycling doors and ~5,000

snowsports doors globally

–

Bell in ~8,000 specialty doors globally

–

Specialized and Trek key specialty cycling peers

–

Powersports business quickly growing doors

–

Includes mass merchandisers such as Walmart,

Target, and Costco

–

Bell in ~10,000 doors globally

–

Key mass cycling competitor is Dorel Industries

(Schwinn, Mongoose, and GT)

–

Bell’s position fortified by Disney license

2013E Net Sales, %

(1)

Note

1.Distributor and OEM sales are included in specialty channels as appropriate

Mass

41%

Specialty -

Other

16%

Specialty

US IBD

16%

Specialty -

Europe IBD

15%

Specialty -

US National

8%

Specialty -

US Powersports

4%

Mass channel: lower price point, slightly lower

margins / opex

-

11 |

Bell and Giro are the leading brands across nearly all of their product

categories –

The two brands have a combined ~42% global market share in specialty cycling

helmets Continued Market Leadership in Attractive and Growing Markets

Estimated Market Rank

Product Category

US Mass Cycling Helmets

NA

US Mass Cycling Accessories

NA

Global Specialty Cycling Helmets

Global Snow Helmets

NA

US Powersports Helmets

NA

US Specialty Cycling Footwear

NA

US Specialty Cycling Gloves

NA

Source: Leisure Trends and management estimates

Note: Product categories above exclude Easton Cycling wheels

A Formidable Presence

#1

#3

#1

#1

#4

#4

#2

#1

12 |

Improvement Plan in Motion

Exited / exiting non-core categories

Fitness accessories

Enhanced focus on mass channel in cycling after

several years of de-emphasis

Bell is now a Joint Business Planning partner to both

Walmart and Target

Re-hired top-notch head of sales

Keystone dealer margin program

“Freedom to Choose”

Stopped selling to Amazon to prevent discounting of

current-year models

Results

apparent

–

as

of

early

February,

Giro

Cycling

order book up double-digits from prior year

Recent Actions

Dealer Margins Increasing, Precursor to

Regaining Share Growth

Regained Snow Helmet Share to Solidify #1 Spot

Giro

Closest Competitor

Specialty Dollar Share, %

Source:

Leisure Trends (December season to date)

“I've been speaking with a lot of other dealers around the

country and everyone has noticed the changes EBS has

made over the past number of months, and we're throwing

more of our business your way because of that.”

Source:

Leisure

Trends

(Current

Period

–

December)

Notes

1.Weighted average peer margin based on December 2013 dollar sales

2.Weighted

average

(based

on

dollar

sales)

of

Bell

/

Giro

December

2012

margins

3.Weighted

average

(based

on

dollar

sales)

of

Bell

/

Giro

December

2013

margins

Dealer Margin, %

(1)

(2)

(3)

-

Chris Holmes, Bicycle World & Fitness

13 |

Stable Financial Performance

$MM

$MM, Margins in %

Action Sports

Riddell

Total BRG Margin

$MM, Margins in %

$MM, Margins in %

Total BRG

Notes

1.Please refer to page 41 for a reconciliation of PF Adjusted EBITDA

2.Figures may not add due to rounding

3.Capex adjusted for costs related to new distribution center (2012: $0.4MM; 2013E:

$3.6MM) and excess corporate project costs (2011: $6.4MM; 2012: $7.6MM; 2013E: $8.0MM)

BRG PF Adjustments

(2)

2011

2012

2013E

369

353

327

177

203

205

546

556

533

Net Sales

Gross Profit and Margin

193

202

195

35.3%

36.3%

36.6%

2011

2012

2013E

PF

Adj.

EBITDA

(1)

and

Margin

Capital

Expenditures

(3)

59

4

65

58

62

12.0%

10.4%

11.7%

2011

2012

2013E

12

12

13

2.2%

2.1%

2.4%

2011

2012

2013E

14 |

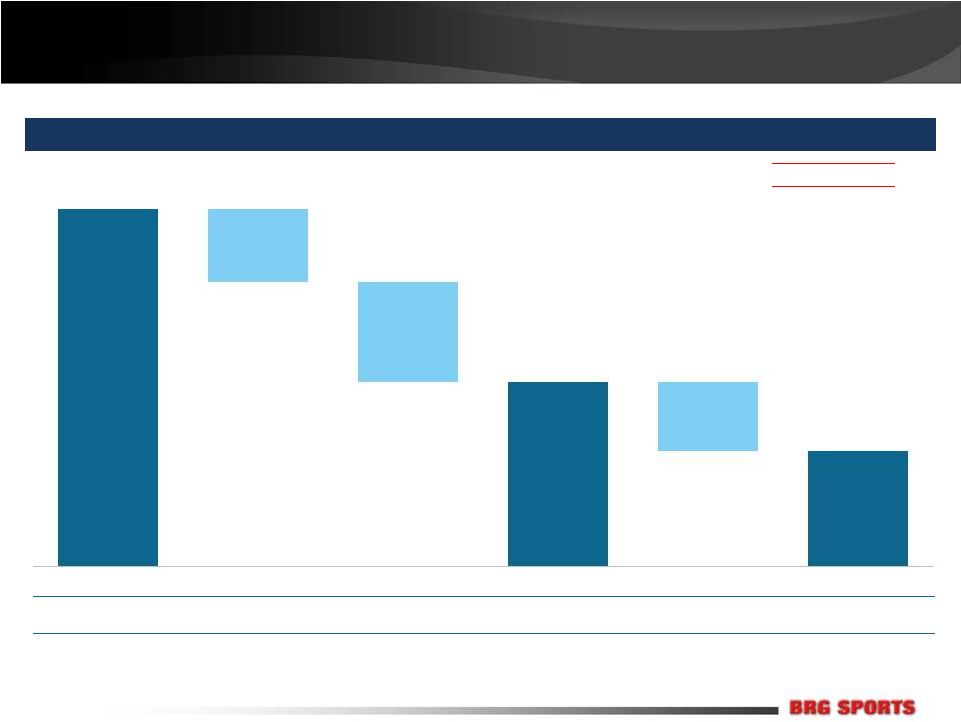

Strong Cash Flow Generation

$MM

Conversion:

51.8%

32.2%

Run-Rate

Free

Cash

Flow

Bridge

(1)(2)

Notes

1.Illustratively based on 2013E PF Adj. EBITDA

2.Assumed 45% tax rate for estimated taxes and tax-adjusted interest. Estimated

taxes calculated based on PF Adj. EBIT and pre-interest tax shield 3.Based

on 2013E capex, net of costs related to new distribution center ($3.6MM) and excess corporate project costs ($8.0MM)

(2)

(2)

(3)

ILLUSTRATIVE

62

13

17

32

12

20

PF Adj. EBITDA

Maintenance Capex

Est. Taxes

Unlevered FCF

Tax-Adj. Interest

Levered FCF

15 |

Net

Working Capital Dynamics Historical Monthly Net Working Capital

2013

2012

2011

$

Cycles reflect selling seasons

Riddell sales increase through

1

half of year with A/R

collected once high school

football season begins

Cycling category builds

inventory in Q1 for Spring

sales push

Snow category inventory

builds through Summer with

bulk of sales booked from Aug-

Oct with fill-in orders thereafter

Preliminary

($MM, unless otherwise noted)

2011A

2012A

2013E

LTM Avg. Days of Sales Outstanding

95

95

92

LTM Avg. Inventory Turns

4.6x

4.3x

4.2x

LTM Avg. Days Payable Outstanding

49

51

50

LTM Avg. Working Capital ($)

(1)

$137

$143

$132

LTM Avg. Working Capital % of Sales

25.1%

25.8%

24.8%

Actual

Total BRG

Action Sports

Riddell

Note

1.

Excludes tax related accounts, cash, and indebtedness

Jan

Mar

May

Jul

Sep

Nov

Jan

Mar

May

Jul

Sep

Nov

Jan

Mar

May

Jul

Sep

Nov

st

16 |

Product Liability Defense / Insurance

An Emphasis Within BRG

Product liability defense is a core competency of BRG Sports

–

We make great products; we fight frivolous cases and we win

“Ordinary course”

product liability suits are at an all-time low (Bell, Giro, and Riddell)

–

2014 policy recently renewed with exact coverage as prior year

–

We maintain 50+ years of substantial insurance coverage

–

>80% of our defense costs are reimbursed by insurance (no cap applies)

–

This

process

is

a

distraction

and

will

take

time

to

play

out

but

we

will

fight

and

expect

to

win

We believe NFL-related concussion suits are without merit as they pertain to

Riddell Helmet-related suits at Action Sports continue to decline,

accessories contributed bulk of new suits in 2012 and 2013

BRG Sports maintains significant insurance for helmet product liability

17 |

Pro

Forma Adjusted EBITDA Reconciliation Notes

1.

Per the audited financials (for 2012) and the preliminary unaudited financials (for

2013) of Bell Sports and Riddell Sports 2.

Revenues and expenses related to baseball/softball products sold through mass

merchandisers were historically booked through BRG Sports. This product line is being divested as part of the Easton operations being sold to Bauer Performance Sports.

3.

Revenues and expenses related to Easton cycling wheels and components were

historically booked through Easton Sports. The accounting for this was changed to be included within BRG Sports in 2013.

4.

Represents corporate costs allocated to Easton Sports subsidiary as part of the

audit that are stranded post-divestiture and will remain with BRG Sports.

5.

Represents actual expenses historically permitted to be excluded pursuant to the

Company’s Senior Secured Credit Facilities. Such amount represents: (i) charges related to the issuance of capital stock or debt, (ii) unrealized (gains)/losses relating to

hedging activities, (iii) expenses paid in connection with employee severance,

retention, relocation and contract termination, consolidation of facilities and other non-recurring expenses and charges and (iv) expense reimbursements to our financial

sponsors. In addition these amounts include other quality of earnings adjustments

made in conjunction with Ernst & Young. 6.

Excludes depreciation and amortization previously allocated from Easton-Bell

Corp. to Easton Sports 7.

Includes full-year impact of cost reductions already taken place and anticipated

cost reduction initiatives upon separation of the Easton businesses and the refinancing.

$MM

2012

2013

Preliminary GAAP Operating Income

(1)

$38.4

$26.7

Less: Inclusion / (Removal) of Profits for Certain Baseball/Softball Business

Lines (2)

(2.4)

(2.4)

Plus: Inclusion of Profits for Certain Action Sports Business Lines

(3)

5.0

–

Less: Overhead Absorption of Divested / Non Borrower Businesses

(4)

(9.1)

(5.9)

Plus: Non-Cash Stock Compensation

3.3

6.5

Plus: Non-Recurring and Extraordinary Charges, Gains and Losses

(5)

1.8

12.8

Preliminary Adjusted Operating Income

$37.0

$37.7

Plus: Depreciation and Amortization

(6)

20.7

20.9

Preliminary Adjusted EBITDA

$57.7

$58.5

Pro Forma Adjustment

(7)

3.8

Pro Forma Adjusted EBITDA

$62.3

18 |