Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VWR Funding, Inc. | d687053d8k.htm |

Exhibit 99.1

Goldman Sachs Leveraged Finance Healthcare Conference

Manuel Brocke-Benz & Greg Cowan

Safe Harbor / Non-GAAP Measures

Any statements made in this presentation about future operating results or other future events are forward-looking statements under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Actual results may differ materially from such forward-looking statements. A discussion of factors that could cause actual results or events to vary is contained in the Appendix to this presentation and in the SEC filings of VWR International’s parent company, VWR Funding, Inc.

During this presentation, we will be referring to certain financial measures not prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), including Adjusted EBITDA and Net Debt. Reconciliations of these non-GAAP financial measures to the most closely comparable GAAP presentation are contained in the Appendix to this presentation.

2

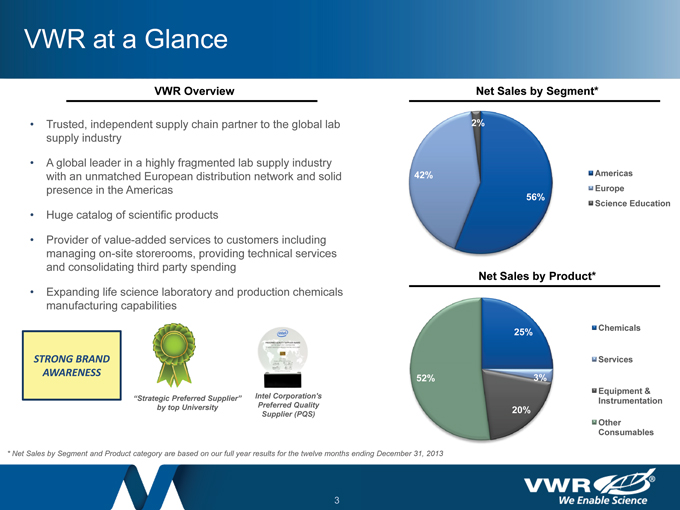

VWR at a Glance

VWR Overview Net Sales by Segment*

Trusted, independent supply chain partner to the global lab 2%

supply industry

A global leader in a highly fragmented lab supply industry

with an unmatched European distribution network and solid 42% Americas

presence in the Americas Europe

56%

Science Education

Huge catalog of scientific products

Provider of value-added services to customers including managing on-site storerooms, providing technical services and consolidating third party spending

Net Sales by Product*

Expanding life science laboratory and production chemicals manufacturing capabilities

25% Chemicals

STRONG BRAND Services

52%

AWARENESS 3%

Equipment &

“Strategic Preferred Supplier” Intel Preferred Corporation’s Quality Instrumentation

by top University 20%

Supplier (PQS)

Other

Consumables

Net Sales by Segment and Product category are based on our full year results for the twelve months ending December 31, 2013

3

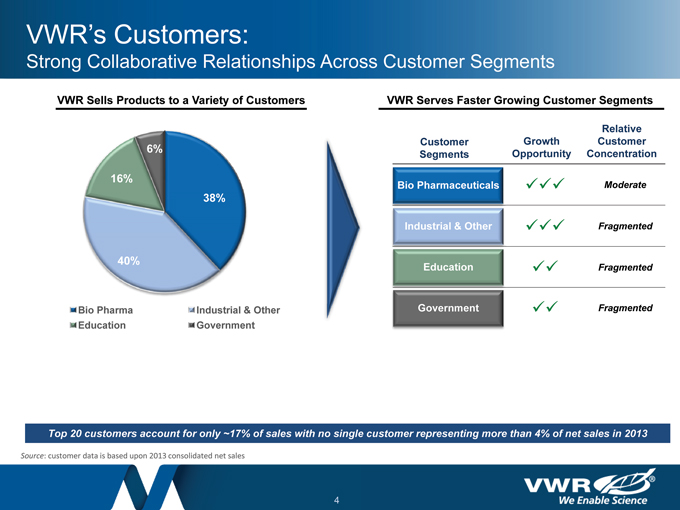

VWR’s Customers:

Strong Collaborative Relationships Across Customer Segments

VWR Sells Products to a Variety of Customers VWR Serves Faster Growing Customer Segments

Relative

Customer Growth Customer

6% Segments Opportunity Concentration

16% Bio Pharmaceuticals Moderate

38%

Industrial & Other Fragmented

40% Education Fragmented

Bio Pharma Industrial & Other Government Fragmented

Education Government

Top 20 customers account for only ~17% of sales with no single customer representing more than 4% of net sales in 2013

Source: customer data is based upon 2013 consolidated net sales

4

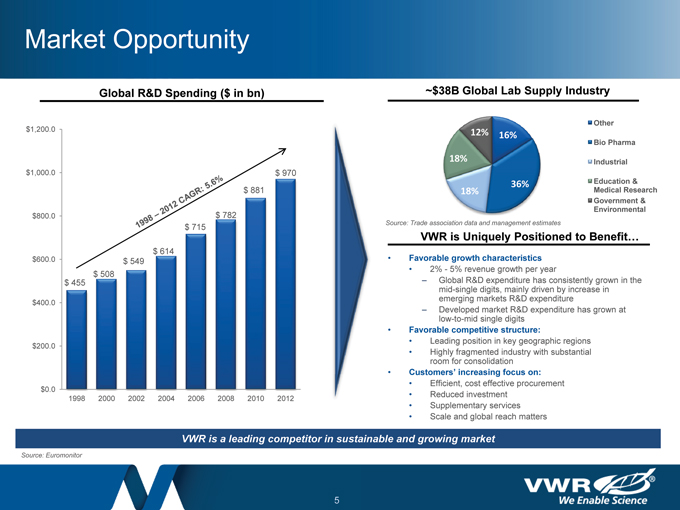

Market Opportunity

Global R&D Spending ($ in bn)

$1,200.0

$1,000.0 $ 970

$ 881

$800.0 $ 782

$ 715

$ 614

$600.0 $ 549

$ 508

$ 455

$400.0

$200.0

$0.0

1998 2000 2002 2004 2006 2008 2010 2012

~$38B Global Lab Supply Industry

Other

12% 16%

Bio Pharma

18% Industrial

36% Education &

18% Medical Research

Government &

Environmental

Source: Trade association data and management estimates

VWR is Uniquely Positioned to Benefit…

Favorable growth characteristics

2%—5% revenue growth per year

Global R&D expenditure has consistently grown in the mid-single digits, mainly driven by increase in emerging markets R&D expenditure

Developed market R&D expenditure has grown at low-to-mid single digits

Favorable competitive structure:

Leading position in key geographic regions

Highly fragmented industry with substantial room for consolidation

Customers’ increasing focus on:

Efficient, cost effective procurement

Reduced investment

Supplementary services

Scale and global reach matters

VWR is a leading competitor in sustainable and growing market

Source: Euromonitor

5

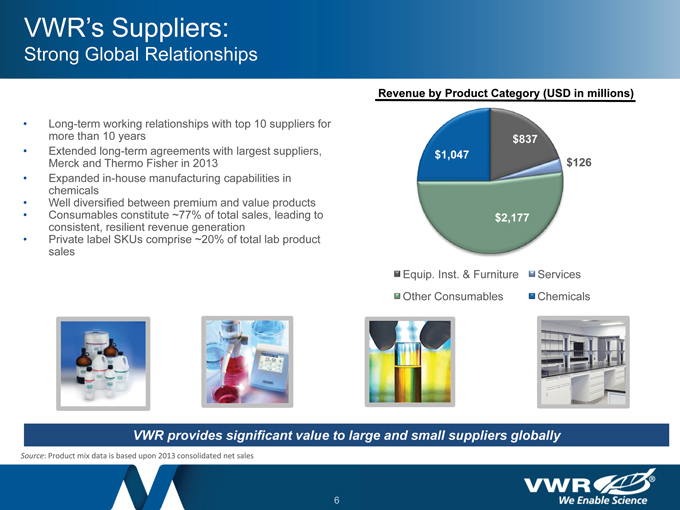

VWR’s Suppliers:

Strong Global Relationships

Revenue by Product Category (USD in millions)

Long-term working relationships with top 10 suppliers for

more than 10 years $837

Extended long-term agreements with largest suppliers, $1,047

Merck and Thermo Fisher in 2013 $126

Expanded in-house manufacturing capabilities in

chemicals

• Well diversified between premium and value products

• Consumables constitute ~77% of total sales, leading to $2,177

consistent, resilient revenue generation

• Private label SKUs comprise ~20% of total lab product

sales

Equip. Inst. & Furniture Services

Other Consumables Chemicals

VWR provides significant value to large and small suppliers globally

Source: Product mix data is based upon 2013 consolidated net sales

6

Our Value Proposition

Structured Choice for Intelligent Rationalization

Extension of customers’ procurement teams

“Independent broker” to mitigate price over time

Asset-lite operating model supports broad customer choice

Supply Chain is More Important Now than Ever

Speed and logistical expertise at a premium

Increasingly global firms demanding global supply chain partners

Focused on reducing total cost of acquisition

Innovative, Flexible, Customized Solutions

A leading comprehensive services provider

Best demonstrated practices and standard operating procedures

Enhances our overall value proposition

Excellence, Services, Choice

7

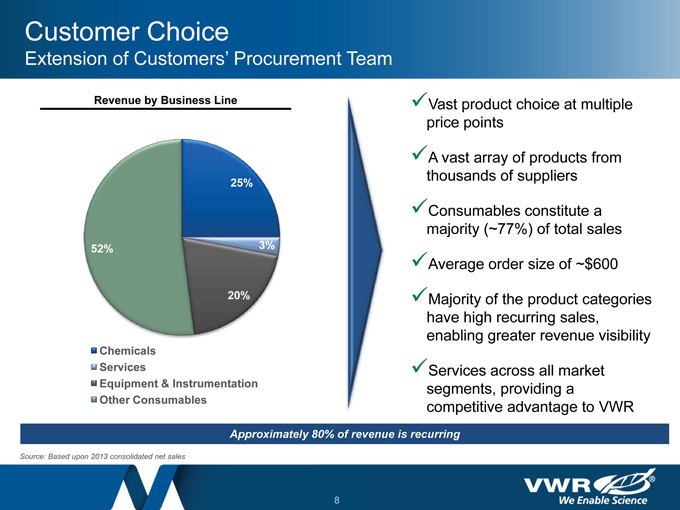

Customer Choice

Extension of Customers’ Procurement Team

Revenue by Business Line Vast product choice at multiple

price points

A vast array of products from

25% thousands of suppliers

Consumables constitute a

majority (~77%) of total sales

52% 3%

Average order size of ~$600

20% Majority of the product categories

have high recurring sales,

enabling greater revenue visibility

Chemicals

Services Services across all market

Equipment & Instrumentation segments, providing a

Other Consumables competitive advantage to VWR

Approximately 80% of revenue is recurring

Source: Based upon 2013 consolidated net sales

8

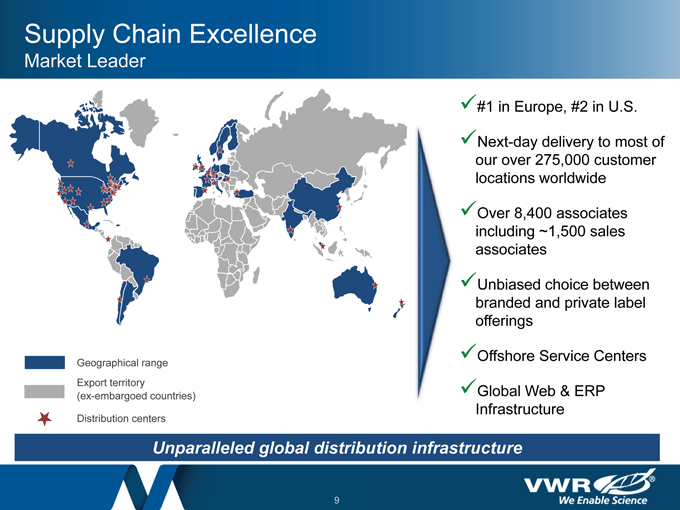

Supply Chain Excellence

Market Leader

#1 in Europe, #2 in U.S.

Next-day delivery to most of

our over 275,000 customer

locations worldwide

Over 8,400 associates

including ~1,500 sales

associates

Unbiased choice between

branded and private label

offerings

Geographical range Offshore Service Centers

Export territory Global Web & ERP

(ex-embargoed countries)

Infrastructure

Distribution centers

Unparalleled global distribution infrastructure

9

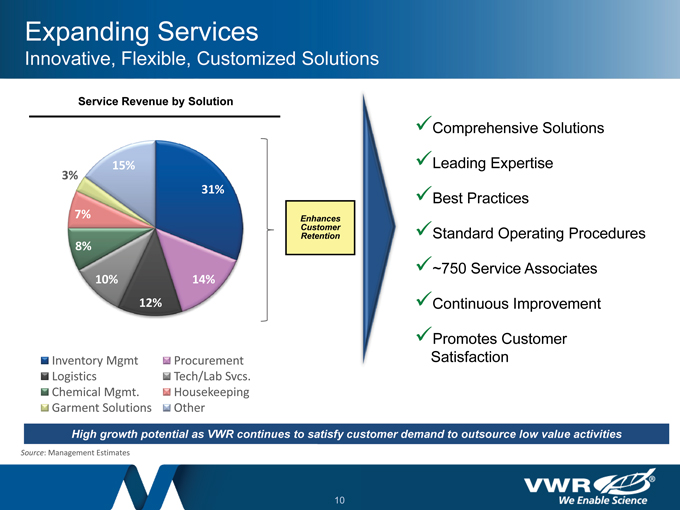

Expanding Services

Innovative, Flexible, Customized Solutions

Service Revenue by Solution

Comprehensive Solutions

15% Leading Expertise

3%

31% Best Practices

7% Enhances

Customer Standard Operating Procedures

Retention

8%

~750 Service Associates

10% 14%

12% Continuous Improvement

Promotes Customer

Inventory Mgmt Procurement Satisfaction

Logistics Tech/Lab Svcs.

Chemical Mgmt. Housekeeping

Garment Solutions Other

High growth potential as VWR continues to satisfy customer demand to outsource low value activities

Source: Management Estimates

10

Update on Financial Performance

11

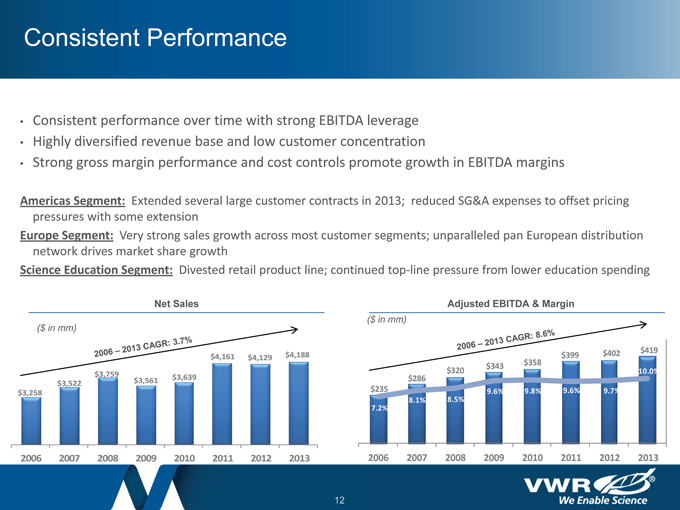

Consistent Performance

Consistent performance over time with strong EBITDA leverage

Highly diversified revenue base and low customer concentration

Strong gross margin performance and cost controls promote growth in EBITDA margins

Americas Segment: Extended several large customer contracts in 2013; reduced SG&A expenses to offset pricing pressures with some extension Europe Segment: Very strong sales growth across most customer segments; unparalleled pan European distribution network drives market share growth

Science Education Segment: Divested retail product line; continued top-line pressure from lower education spending

Net Sales Adjusted EBITDA & Margin

($ in mm)

($ in mm)

$4,161 $4,129 $4,188 $399 $402 $419

$343 $358

$320 10.0%

$3,759 $3,561 $3,639 $286

2006 – 2013 CAGR: 3.7%

2006 – 2013 CAGR: 8.6%

$3,522

$3,258 $235 9.6% 9.8% 9.6% 9.7%

8.1% 8.5%

7.2%

2006 2007 2008 2009 2010 2011 2012 2013 20062007200820092010 2011 20122013

12

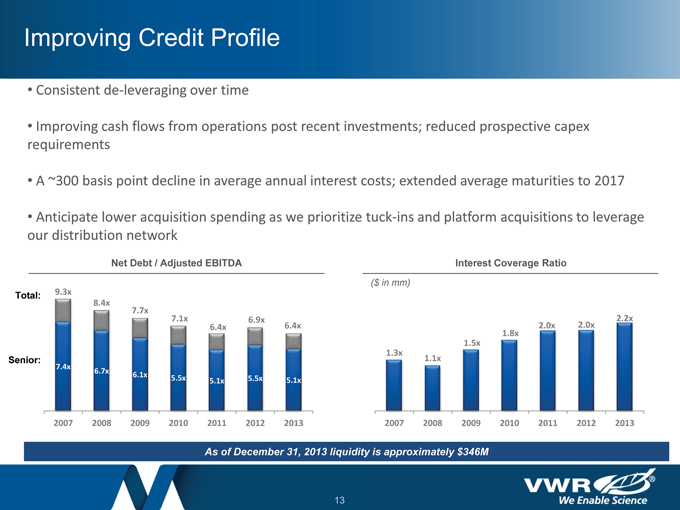

Improving Credit Profile

Consistent de-leveraging over time

Improving cash flows from operations post recent investments; reduced prospective capex

requirements

A ~300 basis point decline in average annual interest costs; extended average maturities to 2017

Anticipate lower acquisition spending as we prioritize tuck-ins and platform acquisitions to leverage

our distribution network

Net Debt / Adjusted EBITDA

Interest Coverage Ratio

($ in mm)

Total: 9.3x

8.4x

7.7x

7.1x 6.9x 2.2x

6.4x 6.4x 2.0x 2.0x

1.8x

1.5x

1.3x

Senior: 1.1x

7.4x

6.7x 6.1x 5.5x 5.5x 5.1x

5.1x

2007 2008 2009 2010 2011 2012 2013 2007 2008 2009 2010 2011 2012 2013

As of December 31, 2013 liquidity is approximately $346M

13

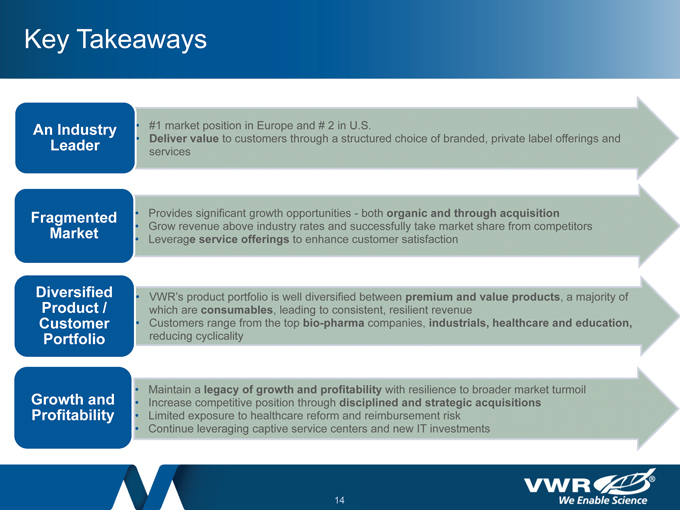

Key Takeaways

An Industry • #1 market position in Europe and # 2 in U.S.

Leader • Deliver value to customers through a structured choice of branded, private label offerings and

services

Fragmented • Provides significant growth opportunities—both organic and through acquisition

• Grow revenue above industry rates and successfully take market share from competitors

Market • Leverage service offerings to enhance customer satisfaction

Diversified • VWR’s product portfolio is well diversified between premium and value products, a majority of

Product / which are consumables, leading to consistent, resilient revenue

Customer • Customers range from the top bio-pharma companies, industrials, healthcare and education,

Portfolio reducing cyclicality

• Maintain a legacy of growth and profitability with resilience to broader market turmoil

Growth and • Increase competitive position through disciplined and strategic acquisitions

Profitability • Limited exposure to healthcare reform and reimbursement risk

• Continue leveraging captive service centers and new IT investments

14

Appendix

15

Appendix A-1—Forward-Looking Information

Statement

All statements included in or made during this presentation other than statements of historical fact may constitute forward-looking statements within the meaning of the

federal securities laws. Although we believe that our assumptions made in connection with the forward-looking statements are reasonable, there can be no assurances that the assumptions and expectations will prove to be correct.

The following are among the factors that could affect our future results and could cause those results or other outcomes to differ materially from those expressed or implied in our forward-looking statements: actions by, and our ability to maintain existing business relationships and practices with, suppliers, customers, carriers and other third parties; loss of any of our key executive officers; unexpected costs or disruptions to our business or internal controls associated with the implementation of important technology initiatives, including those relating to our enterprise resource planning and e-commerce capabilities; our ability to consummate and integrate potential acquisitions; the effect of political, economic, credit and financial market conditions, inflation and interest rates worldwide; the effect of changes in laws and regulations, including changes in accounting standards, trade, tax, price controls and other regulatory matters; increased competition from other companies in our industry and our ability to retain or increase our market shares in the principal geographical areas in which we operate; foreign currency exchange rate fluctuations; and our ability to generate sufficient funds to meet our debt obligations, capital expenditure program requirements, ongoing operating costs, acquisition financing and working capital needs.

Any such forward-looking statements should be considered in light of such important factors and in conjunction with VWR Funding, Inc.’s (the “Company”) SEC filings, including its Annual Report on Form 10-K for the year ended December 31, 2013.

16 A-1

Appendix A-2

This presentation contains a discussion of certain financial measures which are not in conformity with generally accepted accounting principles in the United States of America (“GAAP”), as described below.

References to “Adjusted EBITDA”

This presentation contains a discussion of earnings before interest, taxes, depreciation and amortization (“EBITDA”), as adjusted for certain items described below (“Adjusted EBITDA”). Adjusted EBITDA is a non-GAAP financial measure, and should not be considered as an alternative to net income or loss or any other GAAP measure of performance or liquidity.

Net income or loss is the most comparable GAAP measure of our operating results presented in the Company’s consolidated financial statements. The table presented on Appendix A-5 reconciles Adjusted EBITDA to net income or loss for the periods covered in this presentation.

Our calculation of Adjusted EBITDA eliminates the effect of charges primarily associated with financing decisions, tax regulations and capital investments and certain other items as further described on Appendix A-5. Adjusted EBITDA is a key financial

metric used by the Company’s investors and management to evaluate and measure the Company’s operating performance.

17 A-2

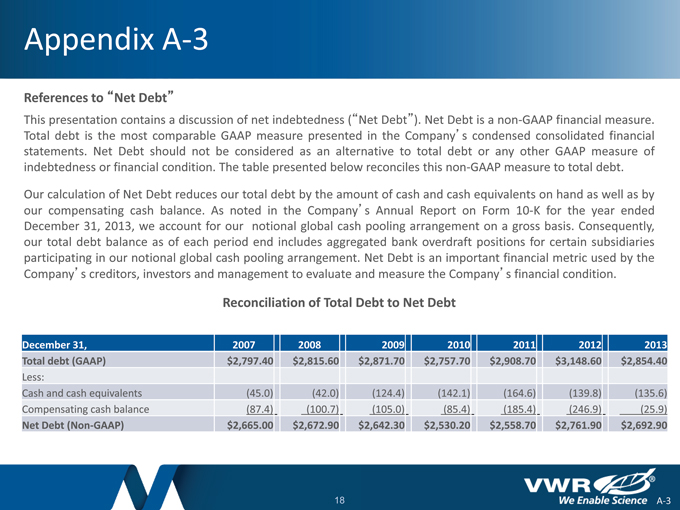

Appendix A-3

References to “Net Debt”

This presentation contains a discussion of net indebtedness (“Net Debt”). Net Debt is an on-GAAP financial measure. Total debt is the most comparable GAAP measure presented in the Company’s condensed consolidated financial statements. Net Debt should not be considered as an alternative to total debt or any other GAAP measure of indebtedness or financial condition. The table presented below reconciles this non-GAAP measure to total debt.

Our calculation of Net Debt reduces our total debt by the amount of cash and cash equivalents on hand as well as by our compensating cash balance. As noted in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013, we account for our notional global cash pooling arrangement on a gross basis. Consequently, our total debt balance as of each period end includes aggregated bank overdraft positions for certain subsidiaries participating in our notional global cash pooling arrangement. Net Debt is an important financial metric used by the Company’s creditors, investors and management to evaluate and measure the Company’s financial condition.

Reconciliation of Total Debt to Net Debt

December 31, 2007 2008 2009 2010 2011 2012 2013

Total debt (GAAP) $2,797.40 $2,815.60 $2,871.70 $2,757.70 $2,908.70 $3,148.60 $2,854.40

Less:

Cash and cash equivalents(45.0)(42.0)(124.4)(142.1)(164.6)(139.8)(135.6)

Compensating cash balance(87.4)(100.7)(105.0)(85.4)(185.4)(246.9)(25.9)

Net Debt (Non-GAAP) $2,665.00 $2,672.90 $2,642.30 $2,530.20 $2,558.70 $2,761.90 $2,692.90

18 A-3

Appendix A-4

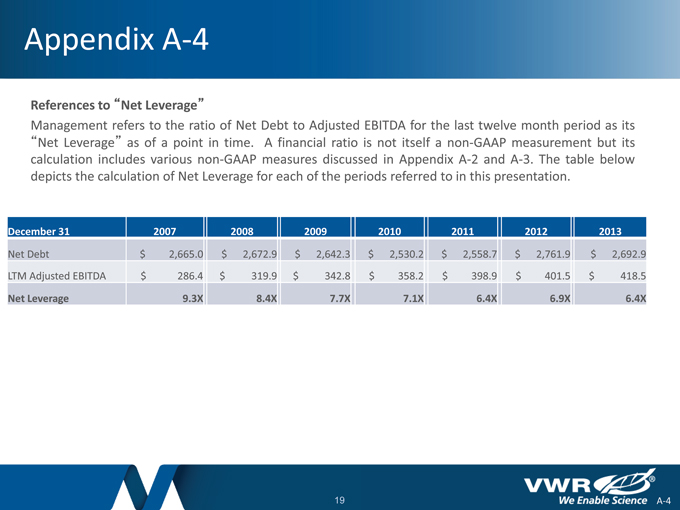

References to “Net Leverage”

Management refers to the ratio of Net Debt to Adjusted EBITDA for the last twelve month period as its

“Net Leverage” as of a point in time. A financial ratio is not itself a non-GAAP measurement but its calculation includes various non-GAAP measures discussed in Appendix A-2 and A-3. The table below depicts the calculation of Net Leverage for each of the periods referred to in this presentation.

December 31 2007 2008 2009 2010 2011 2012 2013

Net Debt $ 2,665.0 $ 2,672.9 $ 2,642.3 $ 2,530.2 $ 2,558.7 $ 2,761.9 $ 2,692.9

LTM Adjusted EBITDA $ 286.4 $ 319.9 $ 342.8 $ 358.2 $ 398.9 $ 401.5 $ 418.5

Net Leverage 9.3X 8.4X 7.7X 7.1X 6.4X 6.9X 6.4X

19 A-4

Appendix A-5

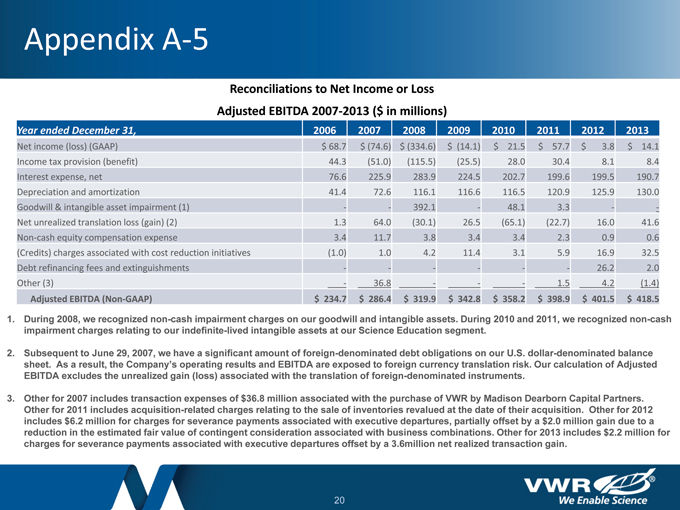

Reconciliations to Net Income or Loss

Adjusted EBITDA 2007-2013 ($ in millions)

Year ended December 31, 2006 2007 2008 2009 2010 2011 2012 2013

Net income (loss) (GAAP) $ 68.7 $ (74.6) $ (334.6) $ (14.1) $ 21.5 $ 57.7 $ 3.8 $ 14.1

Income tax provision (benefit) 44.3(51.0)(115.5)(25.5) 28.0 30.4 8.1 8.4

Interest expense, net 76.6 225.9 283.9 224.5 202.7 199.6 199.5 190.7

Depreciation and amortization 41.4 72.6 116.1 116.6 116.5 120.9 125.9 130.0

Goodwill & intangible asset impairment (1) — 392.1—48.1 3.3 —

Net unrealized translation loss (gain) (2) 1.3 64.0(30.1) 26.5(65.1)(22.7) 16.0 41.6

Non-cash equity compensation expense 3.4 11.7 3.8 3.4 3.4 2.3 0.9 0.6

(Credits) charges associated with cost reduction initiatives(1.0) 1.0 4.2 11.4 3.1 5.9 16.9 32.5

Debt refinancing fees and extinguishments — — — 26.2 2.0

Other (3)—36.8 ——1.5 4.2(1.4)

Adjusted EBITDA (Non-GAAP) $ 234.7 $ 286.4 $ 319.9 $ 342.8 $ 358.2 $ 398.9 $ 401.5 $ 418.5

During 2008, we recognized non-cash impairment charges on our goodwill and intangible assets. During 2010 and 2011, we recognized non-cash impairment charges relating to our indefinite-lived intangible assets at our Science Education segment.

Subsequent to June 29, 2007, we have a significant amount of foreign-denominated debt obligations on our U.S. dollar-denominated balance sheet. As a result, the Company’s operating results and EBITDA are exposed to foreign currency translation risk. Our calculation of Adjusted EBITDA excludes the unrealized gain (loss) associated with the translation of foreign-denominated instruments.

Other for 2007 includes transaction expenses of $36.8 million associated with the purchase of VWR by Madison Dearborn Capital Partners. Other for 2011 includes acquisition-related charges relating to the sale of inventories revalued at the date of their acquisition. Other for 2012 includes $6.2 million for charges for severance payments associated with executive departures, partially offset by a $2.0 million gain due to a reduction in the estimated fair value of contingent consideration associated with business combinations. Other for 2013 includes $2.2 million for charges for severance payments associated with executive departures offset by a 3.6million net realized transaction gain.

20