Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DUKE REALTY CORP | d687608d8k.htm |

RELIABLE. ANSWERS.

Citi Global Property CEO Conference

March 3-5, 2014

Exhibit 99.1

RELIABLE. ANSWERS. |

RELIABLE. ANSWERS.

2

Contents

Asset Strategy

Operating Strategy

Capital Strategy

Why Duke Realty

4

9

17

20

26

33

37

42

Industrial Portfolio

Office Portfolio

Medical Office Portfolio

Development Capabilities

©

2014 Duke Realty Corporation |

3

Three-Pronged Strategy for Success

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation |

ASSET STRATEGY

4 |

5

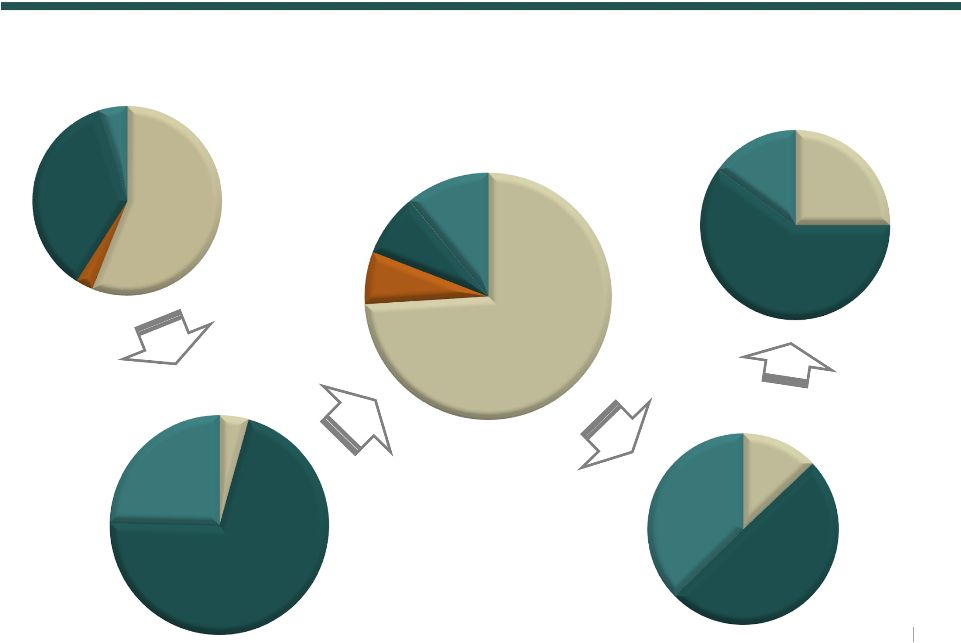

$3.0B Acquisitions

$3.3B Dispositions

Office $2,438M

(74%)

Strategic Repositioning

Targets Achieved*

December 31, 2013

$1.5B Development

Portfolio Breakdown*

September 30, 2009

The Journey –

Repositioning Goals Achieved

Office

56%

Medical

Office

5%

Industrial

36%

Retail

3%

Office

$131M

(4%)

Medical

Office

$747M

(25%)

Retail

$227M

(7%)

Industrial

$269M

(8%)

Medical

Office

$361M

(11%)

Office

25%

Medical

Office

15%

Industrial

60%

Office

$200M

(13%)

Medical

Office

$576M

(37%)

©

2014 Duke Realty Corporation

ASSET STRATEGY

Industrial

$2,159 M

(71%)

Industrial

$758 M

(50%)

*Based on NOI |

6

2009

2010

$320M Dugan JV

acquisition

$413M CBRERT

disposition

$ 465M Premier

acquisition

2011

2012

2013

$98M CapTrust

Tower disposition

$320M USAA

portfolio acquisition

$666M in new

development starts

$355M Seavest

MOB acquisition

$520M in new

development starts

Launch Asset

Repositioning

Strategy

$1.1B Blackstone

disposition

$106M TA

acquisition

(Chicago / Calif)

$130M in new

development starts

$201M in new

development starts

$210M MOB

disposition

$135M Midwest

office disposition

$188M Pembroke

retail disposition

Asset Repositioning Milestones

ASSET STRATEGY

$92M Harbin

MOB acquisition

$125M California

acquisitions

©

2014 Duke Realty Corporation |

7

Accretive to Cash Flow

6.7%

TTM

Economic

Yield

*

7.6%

In-place

Yield

6.5%

In-place

Yield

Accretive to Cash Flow!

Repositioning & Capital Deployment Activity since 2009

ASSET STRATEGY

$3.3B

of Dispositions

©

2014 Duke Realty Corporation

Average age 13 years

Primarily Midwest markets

90% pre-leased and typically

monetizing Duke Realty land

Name brand customers and

strong risk-adjusted yields

Irreplaceable bulk industrial in

major markets such as

California, New Jersey,

Pennsylvania, Chicago and

South Florida

$1.5B

of Development

$3.0B

of Acquisitions

*TTM NOI less TTM TI’s, LC’s and maintenance capex |

8

Superior Asset Quality

Highest quality portfolio of large, modern bulk industrial assets in

key distribution markets

Best in class MOB development platform and portfolio, with

newest properties and highest hospital system credit

Suburban office portfolio now less than 25%, with NOI growth

opportunities through lease up and growth in markets such as

Raleigh, South Florida and Nashville

Built-in annual rent escalations fueling same property growth

ASSET STRATEGY

©

2014 Duke Realty Corporation |

ASSET STRATEGY

INDUSTRIAL PORTFOLIO

9 |

Leverage 40 years of

industrial operating and development experience as primary driver of company growth

Focus on larger, modern bulk distribution product which results in

higher credit quality tenants with fewer overall tenants to manage

Geographic strategy focused on major markets in key trucking, rail and

shipping corridors

Growing NOI stream with contractual rent escalations and increasing

rental rates, market rent growth along with low capital expenditures

Leverage expertise in e-commerce and supply chain reconfiguration

along with key long term relationships with national tenants

Utilize land positions in existing markets to grow platform through

higher yield development

Strategically seek acquisition opportunities in higher rent growth

markets

10

Industrial Strategy

INDUSTRIAL

©

2014 Duke Realty Corporation |

©

2014 Duke Realty Corporation

64 Million

Total SF

52 Million

Total SF

10 Million

Total SF

Building Size Breakdown

I-------------Building

Size------------I Premier Quality Industrial

Portfolio 11

INDUSTRIAL

100K-500K SF:

51%

>500K SF:

41%

<100K SF: 8%

Average Tenant Size

(in square feet)

22K

92K

520K

Occupancy

93.0%

92.8%

98.3%

<100K SF

100K-500K SF

>500K SF

<100K SF

100K-500K SF

>500K SF

I-----------------Building

Size----------------I |

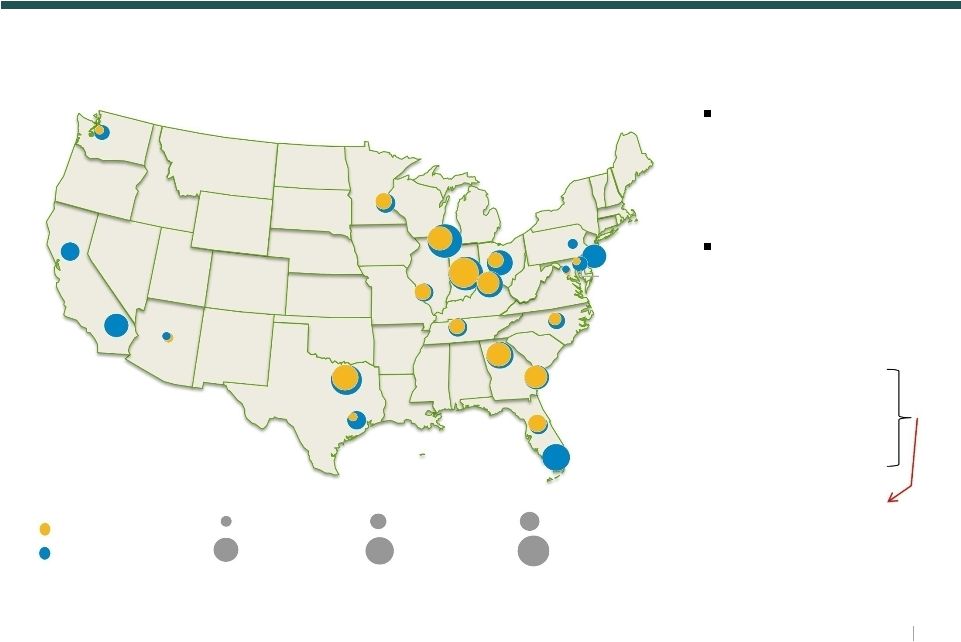

2009

Concentration Evolution

of

Industrial

Geographic

Concentration

(1)

2013 Concentration

Indianapolis

Cincinnati

South Florida

Raleigh

Atlanta

Dallas

St. Louis

Nashville

Columbus

Central Florida

Minneapolis

Savannah

Washington DC

Houston

Northern

California

Phoenix

Chicago

Baltimore

Seattle

New Jersey

Pennsylvania

Southern

California

Increased the size of

industrial portfolio by

adding $2.4B of new

industrial investments

Improved the quality and

number of regions by

expanding to crucial high

growth markets, such as:

–

South Florida

–

Southern California

–

Northern California

–

New Jersey

–

Pennsylvania

Industrial Portfolio Transformation

12

INDUSTRIAL

©

2014 Duke Realty Corporation

Now 15% of

Industrial NOI

Note

1.

Does

not

account

for

“Other

East”

and

“Other

Midwest”

markets

< $100MM

$200MM

–

$300MM

$300MM

–

$450MM

$100MM

–

$150MM

$150MM

–

$200MM

> $450MM |

Peer U.S. Industrial Exposure

(in millions of square feet¹)

Well Positioned for E-Commerce and Supply Chain Trends

(1) Estimates based on pro rata ownership % of domestic, industrial-only

facilities. Source: Q4 2013 company supplementals. Source: Per CoStar database

based on wtd avg RBA, bulk and flex categories, November 2013. LPT includes

Cabot transaction, DRE internally calculated. Source: Estimates based on domestic,

industrial-only facilities per Q4 2013 company supplementals Best in Class

Domestic Industrial Portfolio INDUSTRIAL

©

2014 Duke Realty Corporation

13

249

110

74

63

63

32

PLD

DRE

LPT

DCT

FR

EGP

89

110

148

153

166

249

FR

EGP

LPT

PLD

DCT

DRE

Average Building Size

(000’s square feet)

27

22

21

19

16

11

FR

EGP

PLD

DCT

LPT

DRE

Average Building Age

(in years) |

14

Source: CoStar and Duke Realty, as of 12/31/13

Industrial Portfolio Significantly Outperforms Market

Q4 2013 Same Property Growth of 3.2%

Q4 2013 Rental Rate Growth of 4.8% on renewal leases

INDUSTRIAL

©

2014 Duke Realty Corporation

Duke Realty Occupancy

Market Occupancy

96.1%

93.2%

98.9%

92.9%

98.7%

91.3%

97.5%

92.8%

100.0%

95.3%

92.0%

92.2%

Indianapolis

Chicago

Columbus

All DRE Markets

Cincinnati

Dallas |

Strong Market Rent Growth Momentum

E-Commerce Sales Growth Very Strong

Market rent growth continues to

accelerate. Projections are 3.3%

average annual growth through 2017

Big box continues to outperform

Duke Realty market rent growth

outperforming the PPR54

Duke Realty actual net effective rent

growth for industrial trending up: +4.8%

for Q4

E-commerce sales growth currently growing

at a double digit rate over conventional

retail

E-commerce currently 9% of all retail sales,

trending towards 20% by 2020

Duke Realty a leading national facility

operator/developer to major users of

modern bulk industrial space

Duke markets

Big Box

Duke markets

all sizes &

PPR Forecast

Duke markets

Small Box

Non-

Duke

markets Big Box

Big Box : Strong Rent Growth & E-Commerce Trends

15

INDUSTRIAL

E-commerce sales growth

Overall retail sales growth

98

100

102

104

106

108

110

11Q2

11Q4

12Q2

12Q4

13Q2

13Q4

14Q2

14Q4

(5%)

5%

15%

25%

35%

02

03

04

05

06

07

08

09

10

11

12

13

©

2014 Duke Realty Corporation

Graph

sources:

CoStar / PPR;

E-commerce

&

retail

sales

figures

are

4Q

rolling

avg,

total

retail

ex-autos,

gas

and

fuel;

*PPR54

minus

22

Duke

MSAs;

Big

Box

1990+

&

100K

SF+;

Small

Box <100K SF |

Funded from Recycling of

Asset Dispositions and Accretive to AFFO Home Depot Deployment

Center

Central Valley, CA

660,000 SF, 100% leased

JoAnne Stores

Central Valley, CA

635,000 SF, 100% leased

Redlands Commerce

Center

Inland Empire East

575,000 SF, 100% leased

Interport Building I

Houston, TX

600,000 SF, 100% leased

1130 Commerce Blvd

Southern NJ

386,000 SF, 100% leased

Sears Distribution Center

Northeast PA

1,026,000 SF, 100% leased

Crate & Barrel Distribution

Central NJ

950,000 SF, 100% leased

Electrolux

Chicago, IL

965,000 SF, 100% leased

Dade Paper

Miami, FL

226,000 SF, 100% leased

16

Select 2013 Industrial Acquisitions

INDUSTRIAL

©

2014 Duke Realty Corporation |

ASSET STRATEGY

OFFICE PORTFOLIO

17 |

Reached 25% target

at year-end 2013 according to plan Continue to sell older, non-strategic assets

Develop remaining office land bank primarily with build to

suit projects

Own highest quality assets in high growth office markets

Capitalize on improving economy and quality assets by

leasing up portfolio to historic levels

OFFICE

Office Strategy

18

©

2014 Duke Realty Corporation |

19

Evolution of Office Geographic Concentration

Reduced the size of

office portfolio by

disposing of ~$2.2B of

investments

Reduced exposure to

markets such as:

Atlanta

Cincinnati

Chicago

Columbus

Minneapolis

2009 Concentration

2013 Concentration

< $100MM

$200MM

$300MM

> $450MM

Atlanta

Chicago

St. Louis

Cincinnati

Columbus

Indianapolis

Minneapolis

Nashville

Cleveland

Dallas

Houston

Raleigh

Washington DC

Central Florida

South Florida

Note:

Does not

account for DRE

“Other

East”

markets.

Basis

at

owner

share

in

investment $ dollars basis

Office Portfolio Transformation

OFFICE

©

2014 Duke Realty Corporation

–

$300MM

$450MM

–

$100MM

$150MM

–

$150MM

$200MM

– |

ASSET STRATEGY

MEDICAL OFFICE PORTFOLIO

20 |

Growth industry,

recession resistant asset class Best in class development team able to produce consistent

development opportunities through economic cycles

Substantially all on-campus or aligned with major hospital

systems

Long term leases averaging over 12 years

Consistent NOI growth with typical leases including 2-3%

annual net rent escalations and expense increase pass-

throughs

MEDICAL OFFICE

Medical Office Platform Enhances Risk-adjusted Returns

21

©

2014 Duke Realty Corporation |

Very

Well

Positioned

for

Strong

Industry

Demand

Trends

Annual Healthcare Expenditures

Source: U.S. Bureau of the Census

Affordable Care Act

People

insured

expected

to

increase

by

30

to

50

million

–

increased

demand

for

care

Number

of

physicians

expected

to

increase

–

growing

MOB

space

demand

Patient

care

shifting

to

more

cost-efficient

MOB

settings

with

higher

acuity

of

services

Reduced

reimbursements

should

make

real

estate

efficiency

a

priority

–

larger

deals

and

floor

plates

Healthcare

system

consolidation

and

physician

practice

acquisitions

by

hospitals

grew

25%

in

the

last

5

years

–

strong

MOB

demand

and

improving

credit

Inpatient and Outpatient Trends

Source: Avalere Health, American Hospital Association

Annual Survey, U.S. Census Bureau

Outpatient Visits

22

MEDICAL OFFICE

2,500

2,000

1,500

1,000

500

0

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$0

Inpatient visits

©

2014 Duke Realty Corporation |

In-Service

Under

Development

Total

Properties

63

11

74

Investment $

$1.2 B

$204 M

$1.4 B

Square Feet

5.3 M

590 K

5.9 M

Leased Occupancy

94%

93%

94%

MOB

On-Campus

MOB

Off-Campus

MOB Aligned w/

Health System

Investment by product type

As of 12/31/13

Medical Office Portfolio

23

MEDICAL OFFICE

©

2014 Duke Realty Corporation

3%

25%

72% |

As of 12/31/13

Lease Expirations

(% of MOB In-Service Sq. Ft.)

High Quality, Growing Cash Flow and Strong Development Opportunities

Health System

Credit

Rating

(Moody's)

Rentable

SF

% of Tot

Square Feet

Veterans

Administration

Aaa

224,000

3.5%

Ascension Health

Aa1

530,000

8.2%

Health & Hospital

Corp Marion County

Aa1

274,000

4.3%

Baylor Health Care

System

Aa2

452,000

7.0%

Catholic Health

Initiatives

Aa2

250,000

3.9%

Franciscan Alliance,

Inc.

Aa3

283,000

4.4%

Scott & White

Healthcare

A1

425,000

6.6%

Adventist Health

Aa3

201,000

3.1%

Overall 56% of space leased

to “A”

or better rated tenants

Top Health System Relationships

24

MEDICAL OFFICE

©

2014 Duke Realty Corporation |

DRE

HCN

HCP

HR

HTA

VTR

Portfolio Size

Number of Properties

74

216

206

198

288

327

Square Feet

(in MM's)

5.9

14.1

14.1

13.9

14.1

18.0

Total Investment

(in $MM's)

$1,422

$3,496

$2,663

$3,062

$2,968

$3,768

Operating Statistics

Average Age

(1)

6 yrs

12 yrs

20 yrs

--

11 yrs

15 yrs

Square Feet / Property

80k SF

67k SF

68k SF

70k SF

49k SF

55k SF

Est'd Annualized NOI $ / SF

$17.4

$17.7

$15.1

$15.7

$15.9

$15.8

In-Service Occupancy

94%

95%

90%

85%

92%

92%

TTM Same Prop NOI Growth

3.3%

1.3%

2.3%

1.1%

3.0%

1.2%

% Leased to Health Systems

76%

--

--

80%

--

--

% of MOB’s On-Campus / Aligned

(2)

97.4%

89.2%

94.4%

87.4%

96.0%

96%

Peer Comparison

Sources:

Company filings as of Q4 2013

=

#1

in

metric

Bold

Best in Class Medical Office Platform

25

MEDICAL OFFICE

©

2014 Duke Realty Corporation

Notes

1.

In service portfolio per disclosure or weighted on average investment basis per

latest 10K filing 2.

On-Campus / Aligned refers to a property that is 1) located on or adjacent to a

healthcare system, 2) off-campus and leased 50% or more to a healthcare system, or 3) an ASC / specialty hospital with a hospital partnership interest |

ASSET STRATEGY

DEVELOPMENT CAPABILITIES

26 |

40 years of

experience in development Land bank in strategic locations that can support approximately 55

million square feet of development (85% bulk industrial)

$611 million pipeline that is 89% leased with 8.4% GAAP yield,

immediately accretive when complete. 2013 development starts

projected to generate 17-18% profit margins, creating over $100 million

in value

Strategic relationships with national customers, with 81% of

development starts since 2009 repeat business

Fully staffed internal team involved in all aspects of development,

including pre-construction and construction to deliver most cost effective

and profitable projects

Risk management policies in place to govern maximum development

pipeline size and speculative development starts

DEVELOPMENT

Development Strategic Advantages

27

©

2014 Duke Realty Corporation |

Strong

Relative Development Pipeline 28

DEVELOPMENT

Development Will Drive Value Creation and Immediately Accretive

©

2014 Duke Realty Corporation

PLD

DRE

LPT

DCT

FR

EGP

PLD

DRE

LPT

DCT

FR

EGP

$638

$611

$393

$222

$49

$56

64%

89%

69%

38%

29%

53%

Total US Pipeline Size

(in $ millions)

Pre-lease %

Note: Pipeline size and pre-lease % only include domestic projects under

development and exclude pre-stabilized in-service developments; however, pre-lease

%

for PLD includes pre-stabilized developments already placed in-service due to no

break-out in supplemental. Source: Q4 2013 company supplementals |

Nashville Industrial

Dallas Office

Houston Industrial

Raleigh Office

Columbus Industrial

Baltimore Industrial

Indianapolis Industrial

New Jersey Industrial

Atlanta Industrial

Select 2013 Industrial & Suburban Office Development Starts

29

DEVELOPMENT

©

2014 Duke Realty Corporation

Two build-to-suits on Duke Realty land

1.7 million total SF in 50% owned JV

100% pre-leased

Build-to-suit on Duke Realty land for

Ace Hardware

534,000 SF

100% pre-leased; 10+ year lease term

Speculative development on Duke

Realty land

Newark airport submarket

494,000 SF

Build-to-suit on Duke Realty land

200,000 SF

100% pre-leased to major healthcare

services firm; 16 year lease term

Speculative development on

Duke Realty land

Airport submarket

240,000 SF

100% pre-leased to Amazon

Two build-to-suits on Duke Realty land

for HH Gregg and Fedex

480,000 total SF

100% pre-leased

Perimeter Two & Three on Duke Realty land

452,000 total SF

97% and 53% pre-leased, respectively

Regional distribution center build-to-suit for

Starbucks on Duke Realty land

680,000 SF; 8 year lease term

100% pre-leased

Build-to-suit on Duke Realty land at Port

of Baltimore for Amazon

1 million SF

100% pre-leased, 15 year lease term

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

•

• |

Department of Veterans

Affairs Tampa, FL

117,000 SF, 100% pre-leased

Palisades Healthcare

North Bergen, NJ

57,000 SF, 70% pre-leased

Baylor Healthcare (5 Facilities)

Dallas, TX

168,000 total SF

100% pre-leased

Centerre Baptist Rehab Hospital

Germantown, TN

53,000 SF, 100% pre-leased

Centerre/Mercy

Springfield, MO

60,000 SF, 100% pre-leased

TriHealth West Chester MOB

Cincinnati, OH

49,000 SF, 100% pre-leased

St. Vincent’s Women’s MOB

Carmel, IN

86,000 SF, 72% pre-leased

Healthcare Development Pipeline

30

DEVELOPMENT

©

2014 Duke Realty Corporation |

Original Pre-lease %:

35%

87%

88%

97%

77%

86%

Current lease %:

91%

94%

99%

96%

87%

91%

Stabilized Cash Yield:

8.2%

8.6%

8.9%

7.8%

7.3%

7.7%

$373M

Total

$236M

Total

$130M

Total

$202M

Total

$520M

Total

$666M

Total

(in $ millions)

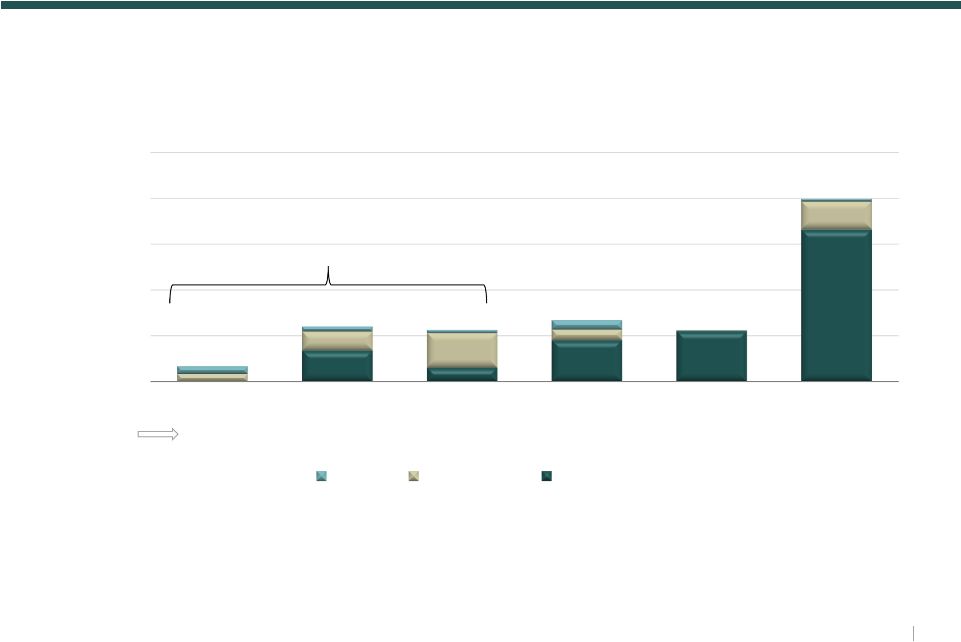

Historical Development Starts

31

DEVELOPMENT

©

2014 Duke Realty Corporation

84

16

74

19

302

372

188

220

56

120

194

179

101

63

23

114

2008

2009

2010

2011

2012

2013

Industrial

Medical

Office |

Developable Square Feet

Industrial

Office

Primary Markets

Midwest

24.4

3.1

Indianapolis, Chicago, Cincinnati, Columbus, Minneapolis, & St. Louis

East

3.3

1.7

New Jersey, Baltimore, Raleigh and Washington D.C.

Southeast

9.5

1.9

Atlanta, Central Florida, South Florida and Nashville

Southwest

10.0

1.5

Phoenix, Dallas and Houston

Total

47.1 million SF

8.0 million SF

$562

million

HELD FOR

DEVELOPMENT

1)

Includes our share of JV land ($62MM)

and excludes held for sale ($90MM)

Strategically located in key distribution markets and

vibrant commercial corridors

Cost feasibility and development strategies

completed for all land investments; Land fully zoned

for intended use

2013 sales from non-strategic parcels of $52 million

at a 20% gain over book basis; also monetized $62

million for development in 2013

Monetized on average $97 million per year from

sales and development since 2000

Strategic Land Bank to Drive Growth

32

DEVELOPMENT

Industrial

68%

Office

32%

©

2014 Duke Realty Corporation

1

|

OPERATING STRATEGY

33 |

Completed

asset

repositioning

into

higher

quality,

higher

rental

rate

growth

assets with minimal FFO per share dilution and annual growth in AFFO

per share (6% CAGR)

Proven same property NOI outperformance, well positioned for continuing

same property growth through (a) occupancy upside, (b) embedded rent

escalations, and (c) improving rental rate growth (5.1% growth on Q4

renewal rents)

Ability to push industrial rents because of occupancy and asset quality

2014 expected AFFO payout ratio of 72%, and current AFFO multiple of

approximately

17.5x

at

the

low

end

of

sector

and

well

positioned

for

continued growth

OPERATIONS

Operational Success and Future Growth Opportunities

34

©

2014 Duke Realty Corporation |

Historical Occupancy

Supports Additional Upside 35

Dec ‘06

OPERATIONS

Note: Peak occupancy represents Stabilized or In-Service properties greater than 1 year, to

adjust for merchant development program between 2005 and 2007. Q4 2013 occupancy

represents Total In-Service portfolio ©

2014 Duke Realty Corporation

Q4 2013 Occupancy

Peak Occupancy

Bulk Industrial

Medical Office

Suburban Office

Total Portfolio

95.3%

93.7%

87.8%

94.2%

96.7%

95.8%

92.6%

95.3%

June ‘07

June ‘06

June ‘07 |

Accelerating Rent Growth

(Represents growth in annual net effective rent on renewal leases)

Strong Cash Flow Growth and Payout Ratio

Steady Same Property NOI Growth

Improving Operating Performance

36

Source:

SNL,

2014

consensus,*

DRE

at

guidance

*

mid-point

Peer AFFO Payout Ratio Analysis

Industrial Average: 77%

Office Average: 83%

OPERATIONS

$0.76

$0.78

$0.82

$0.90

76%

74%

80%

86%

92%

0.70

0.76

0.82

0.88

2010

2011

2012

2013

AFFO/Share

AFFO Payout Ratio

73%

86%

90%

72%

42%

57%

82%

84%

85%

BDN

HIW

PKY

DRE

FR

PSB

DCT

EGP

PLD

+0.9%

+3.2%

+2.5%

+3.7%

2010

2011

2012

2013

-4.8%

-0.9%

1.5%

3.1%

-4.7%

-3.4%

1.8%

4.3%

2010

2011

2012

2013

Portfolio

Industrial Only

©

2014 Duke Realty Corporation

82%

89%

87% |

CAPITAL STRATEGY

37 |

Achieved original

leverage goals established in 2009 Continue to delever through assets sales and equity to fund

highly pre- leased development pipeline

Improved portfolio quality generating cash flow growth and improved

coverage metrics

Well balanced annual debt maturities

Significant liquidity with $850 million LOC with little to no borrowings and

low near-term maturities

Low percentage of secured and variable rate debt compared to peer group

Rated Baa2 by Moody’s and recent upgrade by S&P to

BBB CAPITAL STRATEGY

Balance Sheet Quality

38

©

2014 Duke Realty Corporation |

Investment grade rated debt (Baa2/BBB) for over 16 years with proven

access to multiple capital sources

Recent actions demonstrate commitment to improved leverage profile

2010

Actual

2012

Actual

2013

Actual

Debt to

Gross Assets

46%

50%

46%

Debt + Preferred

to Gross Assets

55%

56%

50%

Fixed Charge

Coverage Ratio

1.8 : 1

1.8 : 1

2.3:1

(1)

Debt + Preferred /

EBITDA

8.9

9.3

7.7

(2)

(1) Based on Q4 2013 annualized; (2) Proforma D+P

/ EBITDA based on Q4 2013 annualized EBITDA and

adjusted for asset repositioning on a full quarter basis.

Key Capital Metrics

39

CAPITAL STRATEGY

©

2014 Duke Realty Corporation |

40

CAPITAL STRATEGY

Weighted Avg

Interest Rate

6.00%

5.70%

6.15%

5.90%

4.00%

5.50%

©

2014 Duke Realty Corporation

Balanced Debt Maturities

2014

2015

2016

2017

2018

Thereafter

JV Debt

Secured Debt

Unsecured Debt

($ in millions)

$1,990

$ 559

$ 670

$565

$601

$167

Only 29% of debt matures between

12/31/13 and 12/31/2016 |

Industrial Average:

12.0% Office Average: 9.7%

Industrial Average: 44.1%

Office Average: 43.1%

Key:

Office: BDN=Brandywine; HIW=Highwoods; PKY=Parkway

Industrial: DCT=DCT Industrial Trust; EGP=Eastgroup; FR=First Industrial; LPT=Liberty; PLD=Prologis;

PSB= PS Business Parks; STAG= STAG Industrial Data source: SNL Financial, 2/21/14

Duke Realty Peer Debt Metrics

41

Low level of secured and variable rate debt

CAPITAL STRATEGY

Secured Debt / Total Debt

Variable Rate Debt / Total Debt

©

2014 Duke Realty Corporation

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

3.9%

4.1%

21.2%

8.1%

0.0%

0.0%

10.0%

12.9%

18.2%

19.7%

23.5%

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

25.0%

25.8%

78.4%

25.9%

16.8%

20.0%

21.5%

40.6%

53.6%

55.9%

100.0%

creates flexibility and lowers volatility |

WHY DUKE REALTY

42

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation |

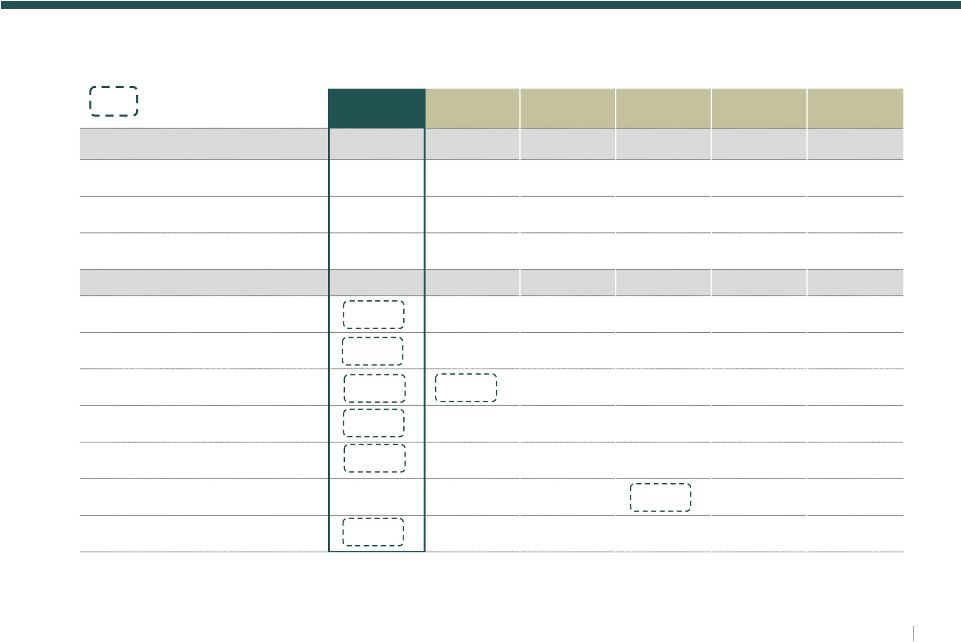

Capital Strategy

Key Metrics

2010

Q4

2013

Fixed Charge Coverage

1.8

2.3

Debt Plus Preferred to EBITDA

8.9

7.7

Debt Plus Preferred to Gross Assets

55%

50%

Asset Strategy

Asset

Concentration

2010

2013

Industrial

43%

60%

Office

50%

25%

Medical Office

5%

15%

Operations Strategy

Key Metrics

2010

2011

2012

2013

2014

Midpoint

Core FFO Per Share

$ 1.15

1.15

1.02

1.10

1.15

Core AFFO Per Share

$ 0.76

0.78

0.82

0.90

0.94

Successfully repositioned portfolio towards industrial concentration

Successfully improved all key leverage metrics

Achieved consistent growth in AFFO per share of nearly 6% per year

6% CAGR

Duke Realty Score Card

43

Note: On a Q4 NOI basis. 2010 column excludes retail exposure of 2%

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation |

KEY:

Office: BDN=Brandywine; HIW=Highwoods; PKY=Parkway; Industrial: DCT=DCT Industrial Trust; EGP=Eastgroup; FR=First Industrial; LPT=Liberty; PLD=Prologis; PSB= PS Business

Parks; STAG= STAG Industrial. Data source: SNL Financial, 2/27/14; (1)

Based on Street Research from 2/11/14 and 2/10/14. Implied Cap Rate methodology excludes non-earning assets.

Valuation Statistics –

Undervalued on Relative Basis

44

Price / 2014E FFO

Implied Cap Rate

Total Market Cap ($ in billions)

Price / 2014E AFFO

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation

13.6x

13.0x

10.0x

14.4x

23.1x

18.0x

16.7x

16.4x

16.3x

15.2x

14.7x

22.3x

18.9x

17.7x

17.6x

31.0x

23.9x

23.6x

23.4x

23.0x

19.7x

15.8x

$5.5

$5.3

$2.6

$10.4

$9.1

$4.1

$4.1

$3.5

$2.8

$1.9

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

7.2%

6.8%

6.6%

7.0%

7.1%

7.0%

6.7%

6.3%

5.8%

5.7%

5.4%

Industrial Average: 17.2x

Office Average: 12.2 x

Industrial Average: 22.9x

Industrial Average: 6.3%

Office Average: 19.6x

Office Average: 6.9%

$31.6

$32.0

Industrial Average: $8.2

Office Average: $4.5

Price / 2014E FFO

Implied Cap Rate

Total Market Cap ($ in billions)

Price / 2014E AFFO

Industrial Median: $4.1 |

2014

Range of Estimates $ in millions

45

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation

Metrics

2013

Actual

Pessimistic

Optimistic

Key Assumptions

Core FFO per share

$1.10

$1.11

$1.19

-

Continued improvement in operating fundamentals

-

Development projects

Core AFFO per share

$0.90

$0.91

$0.97

-

Continued benefits from asset repositioning strategy

Average Occupancy -

In-Service

93.3%

93.25%

94.75%

-

Positive momentum continued, although slower pace

-

Expirations only 8% of portfolio

Same Property NOI Growth

3.7%

2.0%

4.0%

-

Occupancy growth slowing

-

Improved rental rate assumptions

Building Acquisitions

$555

$150

$300

-

Remain highly selective in acquiring high quality industrial facilities

Building Dispositions

$877

$500

$700

-

Continue to prune remaining office and retail

Land Sale Proceeds

$52

$30

$50

-

Selling identified non-strategic parcels

-

Demand improving

Development Starts

$666

$350

$450

-

Comprised of industrial and medical office

-

Substantially pre-leased

Service Operations Income

$27

$16

$22

-

Consistent with fourth quarter 2013 levels

General & Administrative expense

$43

$44

$40

-

Continued efficiency gains |

Talent and

Leadership with Proven Ability to Execute Superior Asset Quality

Strategically Located Land Bank and Experienced Development Capabilities

Proven Operational Success and Future Growth Opportunities

Balance Sheet Strength

Relative Value vs. Peers

Top Tier to Corporate Governance

*

Why Duke Realty?

46

*2013 ISS “Quickscore”

rank in top 10% of the average of S&P500 companies. For REIT sector, one of the leading

REIT

research

firm’s

composite

corporate

governance

metric

ranks

DRE

in

the

97

percentile

on

avg

2008

thru

2013.

RELIABLE. ANSWERS.

©

2014 Duke Realty Corporation

th |

RELIABLE.

ANSWERS. Forward-Looking Statement

47

This slide presentation contains statements that constitute “forward-looking statements”

within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934 as

amended by the Private Securities Litigation Reform Act of 1995. These forward-looking

statements include, among others, our statements regarding (1) strategic initiatives with respect

to our assets, operations and capital and (2) the assumptions underlying our expectations.

Prospective investors are cautioned that any such forward-looking statements are not

guarantees of future performance and involve risks and uncertainties, and that actual results may differ

materially from those contemplated by such forward-looking statements. A number of important

factors could cause actual results to differ materially from those contemplated by

forward-looking statements in this slide presentation. Many of these factors are beyond

our ability to control or predict. Factors that could cause actual results to differ

materially from those contemplated in this slide presentation include the factors set forth in our

filings with the Securities and Exchange Commission, including our annual report on Form10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these

forward-looking statements are reasonable, however, undue reliance should not be placed on

any forward-looking statements, which are based on current expectations. We do not

assume any obligation to update any forward-looking statements as a result of new information

or future developments or otherwise. Certain of the financial measures appearing in this slide presentation are or may be considered to be

non-GAAP financial measures. Management believes that these non-GAAP financial measures

provide additional appropriate measures of our operating results. While we believe these

non-GAAP financial measures are useful in evaluating our company, the information should be

considered supplemental in nature and not a substitute for the information prepared in accordance

with GAAP. We have provided for your reference supplemental financial disclosure for these

measures, including the most directly comparable GAAP measure and an associated reconciliation in

our most recent quarter supplemental report, which is available on our website at

www.dukerealty.com. Our most recent quarter supplemental report also includes the information

necessary to recalculate certain operational ratios and ratios of financial position. The

calculation of these non-GAAP measures may differ from the methodology used by other REITs,

and therefore, may not be comparable.

©

2014 Duke Realty Corporation |