Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CNO Financial Group, Inc. | form8-k03032014clic.htm |

| EX-99.1 - EXHIBIT 99.1 - CNO Financial Group, Inc. | exhibit991-03032014clic.htm |

CNO to Sell Closed Block Life Insurance Subsidiary to Wilton Re March 3, 2014 Exhibit 99.2

CNO Financial Group | OCB Solutions | March 3, 2014 2 Forward-Looking Statements Certain statements made in this presentation should be considered forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. These include statements about future results of operations and capital plans. We caution investors that these forward- looking statements are not guarantees of future performance, and actual results may differ materially. Investors should consider the important risks and uncertainties that may cause actual results to differ, including those included in our press releases, our Quarterly Reports on Form 10- Q, our Annual Report on Form 10-K and other filings we make with the Securities and Exchange Commission. We assume no obligation to update this presentation, which speaks as of today’s date.

CNO Financial Group | OCB Solutions | March 3, 2014 3 Non-GAAP Measures This presentation contains certain financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group | OCB Solutions | March 3, 2014 4 Today’s Announcements CNO announced the sale of Conseco Life Insurance Company (“CLIC”) to Wilton Reassurance Company (“Wilton Re”) The transaction is expected to result in net proceeds of approximately $237* million and encompasses ~$3.4 billion in traditional life, interest-sensitive life, and annuity statutory reserves Bankers Life will pay Wilton Re $28 million to recapture ~$160 million of traditional life reserves previously reinsured 40|86, CNO’s wholly owned investment advisor, will enter into an investment advisory agreement with Wilton Re on certain general account assets The sale of CLIC is subject to Indiana Department of Insurance approval and is expected to close mid-year 2014 CNO Doubles Quarterly Common Stock Dividend to 6 cents per Share * Assumed purchase price based on capital and surplus of CLIC as of 12-31-2013 and adjusted for $36 million intercompany ceding commission paid to CLIC prior to closing. The proceeds will be further adjusted to reflect CLIC’s actual statutory capital and surplus at the time of closing.

CNO Financial Group | OCB Solutions | March 3, 2014 5 Sale of CLIC – Strategic Rationale An Economic Exit Favorable pro forma economic impact unlocking “trapped capital” for reinvestment Reduce “Beta” Reduces exposure to low-for-long rates and natural asset leverage Streamline & Simplify Reduces complexity associated with supporting over 370,000 legacy policies Sale of CLIC Transfers $3.4bn of Run-off Reserves Leverages existing partnership with Wilton Re, enabling a smooth closing and transition in addition to a life insurance recapture and an ongoing investment management agreement Proven Partner

CNO Financial Group | OCB Solutions | March 3, 2014 6 Annuities & Deposits $705** Interest- Sensitive Life $2,232 LTC $525* Traditional Life $424 Annuities & Deposits $788 Other Health $7 Interest- Sensitive Life $166 OCB Solutions For $4bn in Run-Off Reserves 12/31/13 OCB Net Statutory Reserves Retained By CNO Ceded & Being Sold OCB – Ceded & Being Sold $550mm of statutory LTC reserves reinsured to Beechwood Re - reported in 4Q 2013 results Sale of CLIC to Wilton Re encompassing $3.4bn of interest-sensitive, traditional life and annuity reserves Business Retained by CNO Approximately $788mm of annuities and deposits, $166mm of interest-sensitive life reserves and a small amount of A&H business Upon closing, CNO will no longer report on OCB as a segment and will embed the remaining business into other reporting segments * Excludes approximately $25mm of LTC reserves previously reinsured and transferred under the reinsurance agreement ** Includes $450mm of FHLB liabilities ($ millions)

CNO Financial Group | OCB Solutions | March 3, 2014 7 Sale of CLIC Subsidiary – Transaction Detail Washington National Insurance Company (WNIC) Sale & Transition Intercompany transactions to move A&H business out of CLIC to WNIC, increasing CLIC capital by $36mm Wilton Re purchases CLIC legal entity and pays CNO approximately $237mm* for value of in- force and capital & surplus Wilton Re and CNO enter into a transition services agreement Recapture & Advisory Agreement Bankers Life recaptures traditional life block previously reinsured to Wilton Re for $28mm 40|86 enters into an investment advisory agreement with Wilton Re on certain invested assets Sale & Transition Services Agreement Conseco Life Insurance Company (CLIC) CNO Financial Wilton Re Wilton Re Bankers Life and Casualty Company 40|86 Advisors Bankers Life Recapture & 40|86 Advisory Agreement * Assumed purchase price based on capital and surplus of CLIC as of 12-31-2013 and adjusted for $36 million intercompany ceding commission paid to CLIC prior to closing. The proceeds will be further adjusted to reflect CLIC’s actual statutory capital and surplus at the time of closing.

CNO Financial Group | OCB Solutions | March 3, 2014 8 Pro Forma Estimates Financial Metric Pro Forma Estimates Purchase Price (1) $237mm Price to Statutory Capital & Surplus (1) 1.5x Estimated Increase to Holding Company Liquidity (2) $125mm Pro Forma GAAP Loss on Sale (3) $(303)mm Pro Forma GAAP Book Value Impact (3) $(447)mm Pro Forma EPS Impact (4) $(0.04) (1) Based on CLIC capital and surplus at December 31, 2013 and adjusted for an intercompany ceding commission to be paid to CLIC prior to closing. Purchase price is subject to certain adjustments reflecting the performance of the business from December 31, 2013 through closing. Closing is anticipated mid-year 2014. (2) Increase is calculated as net proceeds after deal costs based on December 31, 2013 CLIC capital and surplus and net of mandatory prepayment* of approximately $106 million at closing. (3) Pro forma impact calculated based on the capital and surplus and the estimated fair value of CLIC’s investment portfolio as of December 31, 2013. Refer to the Appendix for additional details. (4) Calculated as the pro forma impact to 2013 operating earnings including the net impact from residual overhead, earnings from the Bankers Life reinsurance recapture and reduced interest expense and assumes an approximately 3% return on estimated increase in holding company liquidity. Refer to the Appendix for additional details. * Per CNO’s senior credit agreement, net proceeds from the sale of CLIC above $125 million are subject to a mandatory prepayment provision

CNO Financial Group | OCB Solutions | March 3, 2014 9 OCB Solutions Reduce Capital-at-Risk OCB Reserve Margins: Thin aggregate Loss Recognition Testing and Cash Flow Testing margins for OCB ISL and LTC (~1%) ISL and LTC blocks ($2.8bn in reserves) have experienced loss recognition charges and have notable statutory asset adequacy reserves established Asset Leverage: CLIC sale lowers CNO asset leverage by one full turn Liabilities require longer-duration and higher-yielding assets to support liabilities Conventional asset risk required to support liability cash flows (default risk) Interest Rate Risk CLIC Asset Leverage CFT Margin Impact Assuming 70 basis point drop in new money rate indefinitely 12/31/13 Actual 12/31/13 Pro Forma* ($250mm) ($210mm) * Reflects results giving effect for the recently reinsured LTC block in addition to the CLIC transaction. 2013 Statutory Results Invested Assets $3,694mm TAC $163mm Asset Leverage 23x

CNO Financial Group | OCB Solutions | March 3, 2014 10 Capital Targets & Excess Capital Deployment 2013 2014 Outlook (Revised) RBC 410% ~ 400% Liquidity $309mm ~ $434mm Leverage* 16.9% ~16% Investment-grade ratings dialed in while maintaining our tactical approach to deployment … 2014 Share Repurchases Guidance v High end of our expected range of $225 to $300mm absent compelling alternatives 2014 Common Stock Dividend v Debt Amortization** v Current credit agreement requires a portion of CLIC sale proceeds be used for debt retirement (~$106mm) 100% quarterly increase drives yield above 1% and payout ratio in the 20% range * A non-GAAP measure. Refer to the Appendix for the corresponding GAAP measure. Interest $45 Holdco Exp & Other $14 Debt Repayment / Financing Costs $73 Common Stock Dividends $24 Securities Repurchases $253 2013 Capital Deployment $409mm ** Pursuant to the terms of our senior secured credit facility, the mandatory prepayment will reduce scheduled amortization during the next 12 months by $37 million. Accordingly, the net debt reduction (reflecting scheduled payments during the next 12 months) is approximately $69 million.

CNO Financial Group | OCB Solutions | March 3, 2014 11 CNO Moving Forward Financial Strength – Transactions improve CNO’s overall financial profile, reinforce our investment grade capital position and drive a higher quality ROE Clears the Way for Accelerated Platform Investment – Transitions complex and administratively-challenged businesses allowing us to more efficiently address enterprise infrastructure Focused on Core Franchise Growth – Investments in distribution productivity and growth yielding top-tier industry growth rates Reached 20% Dividend Payout Ratio Ahead of 2015 Goal

CNO Financial Group | OCB Solutions | March 3, 2014 12 Questions

CNO Financial Group | OCB Solutions | March 3, 2014 13 Appendix

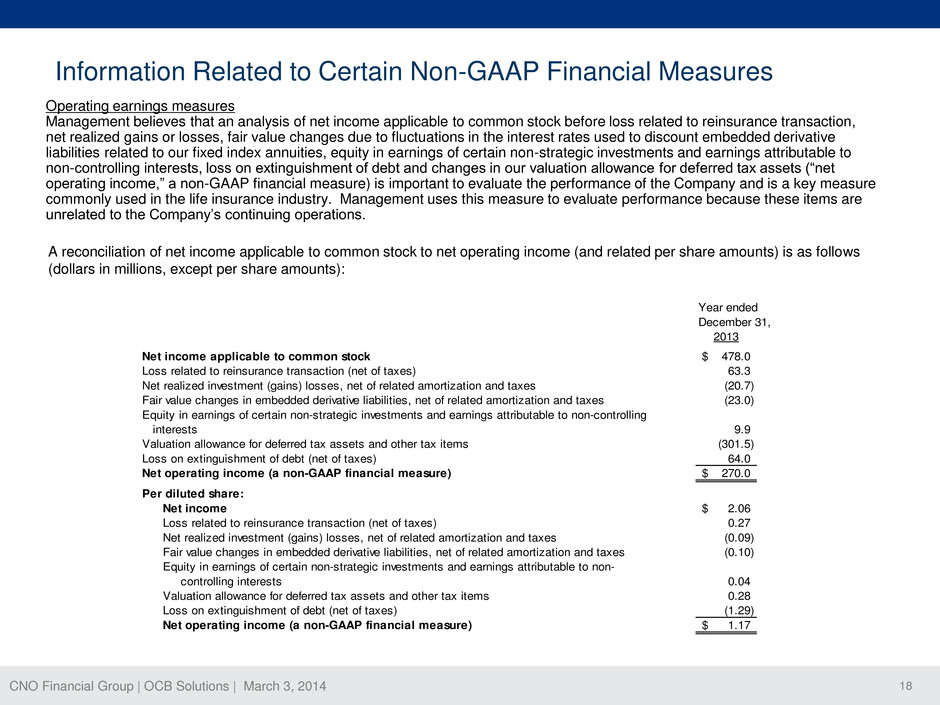

CNO Financial Group | OCB Solutions | March 3, 2014 14 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

CNO Financial Group | OCB Solutions | March 3, 2014 15 Information Related to Certain Non-GAAP Financial Measures 4Q13 Corporate notes payable 856.4$ Total shareholders' equity 4,955.2 Total capital 5,811.6$ orporate debt to capital 14.7% Corporate notes payable 856.4$ Total shareholders' equity 4,955.2 Less accumulated other comprehensive income (731.8) Total capital 5,079.8$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 16.9% Debt to capital ratio, excluding accumulated other comprehensive income (loss) The debt to capital ratio, excluding accumulated other comprehensive income (loss), differs from the debt to capital ratio because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non- GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management. A reconciliation of these ratios is as follows ($ in millions):

CNO Financial Group | OCB Solutions | March 3, 2014 16 Pro forma net loss Loss on sale of CLIC: Cash proceeds received (a) 237$ Net assets sold (527)$ Subtotal (290)$ Reinsurance recapture: Amount paid by Bankers Life (28)$ Net assets received 29$ Subtotal 1$ Transaction expenses and other (9)$ Loss before income tax (298)$ Income tax expense (b) 5$ Pro forma loss (303)$ Pro forma reduction to shareholders' equity Pro forma net loss as summarized above (303)$ (144)$ Pro forma reduction to shareholders' equity (447)$ Decrease in accumulated other comprehensive income related to the unrealized gains in CLIC's investment portfolio Pro forma impacts The pro forma impacts are calculated as if the sale of CLIC and the recapture of a traditional life block by Bankers Life had been completed on December 31, 2013. Actual results will vary based on the fair value of CLIC’s investment portfolio and its statutory capital and surplus on the closing date. The pro forma amounts were determined as follows (dollars in millions): Information Related to Certain Non-GAAP Financial Measures (a) Includes $36 million from certain intercompany transactions which will transfer accident and health business out of CLIC to Washington National Insurance Company prior to closing. (b) A tax gain will be recognized as a result of the announced transactions due to the tax basis of CLIC. The tax gain will be reduced by non-life net operating loss carryforwards which are fully offset by a valuation allowance. Accordingly the tax impacts of the announced transactions are expected to be minimal.

CNO Financial Group | OCB Solutions | March 3, 2014 17 Information Related to Certain Non-GAAP Financial Measures Pro forma impacts The following presents the pro forma impact on our operating earnings measures as if the sale of CLIC and the recapture of a traditional life block by Bankers Life had been completed on January 1, 2013 (dollars in millions, except per share data): Per diluted Amount share Operating earnings, as reported 270.0$ 1.17$ Adjustments (a) (8.0) (0.04) Pro forma operating earnings 262.0$ 1.13$ Year ended December 31, 2013 ___________________________ (a) Adjustments to operating earnings are comprised of the following (net of income taxes): Operating results of CLIC on a normalized basis (5.1)$ Operating results of the traditional life block to b recaptured 4.5 R sid al overh d expenses (13.0) Reduction in interest expense due to the mandatory prepayment of debt resulting from the proceeds of the sale of CLIC 2.8 I cr as i net investment income to reflect the assumed higher invested assets resulting from the proceeds of the sale of CLIC, net of the mandatory debt prepayment 2.8 Total adjustments (8.0)$

CNO Financial Group | OCB Solutions | March 3, 2014 18 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income applicable to common stock to net operating income (and related per share amounts) is as follows (dollars in millions, except per share amounts): Year ended December 31, 2013 Net income applicable to common stock 478.0$ Loss related to reinsurance transaction (net of taxes) 63.3 Net realized investment (gains) losses, net of related amortization and taxes (20.7) Fair value changes in embedded derivative liabilities, net of related amortization and taxes (23.0) 9.9 Valuation allowance for deferred tax assets and other tax items (301.5) Loss on extinguishment of debt (net of taxes) 64.0 Net operating income (a non-GAAP financial measure) 270.0$ Per diluted share: Net in ome 2.06$ Loss related to reinsurance transaction (net of taxes) 0.27 Net realized investment (gains) losses, net of related amortization and taxes (0.09) Fair v lu changes in embedded derivative liabilities, net of related amortization and taxes (0.10) 0.04 Valuation allowance for deferred tax assets and other tax items 0.28 Loss on extinguishment of debt (net of taxes) (1.29) Net operating income (a non-GAAP financial measure) 1.17$ Equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests Equity in earnings of certain non-strategic investments and earnings attributable to non- controlling interests Operating earnings measures Management believes that an analysis of net income applicable to common stock before loss related to reinsurance transaction, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities, equity in earnings of certain non-strategic investments and earnings attributable to non-controlling interests, loss on extinguishment of debt and changes in our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations.