Attached files

| file | filename |

|---|---|

| 8-K - 8-K - INTERPACE BIOSCIENCES, INC. | pdi8-kfebruary272014.htm |

INVESTOR CONTACT:

Bob East

Westwicke Partners

(443) 213-0502

bob.east@westwicke.com

PDI Reports 2013 Fourth Quarter and Full Year Financial Results

Management Will Host Conference Call Today February 27 at 5:00 pm ET

Parsippany, N.J., February 27, 2014 - PDI, Inc. (Nasdaq: PDII), today reported financial and operational results for the fourth quarter and year ended December 31, 2013. Summary financial and operational accomplishments include:

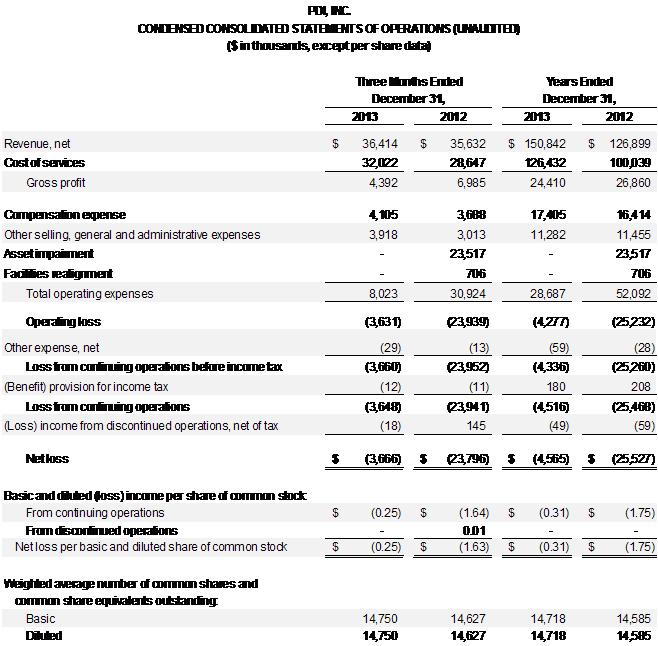

• | Revenues increased 19% to $150.8 million for the year and 2% to $36.4 million for the fourth quarter of 2013 as compared 2012 |

• | Adjusted EBITDA (a non-GAAP financial measure) of $(1.1) million for 2013 compared to $2.8 million for 2012 |

• | Entered into two collaboration agreements to commercialize molecular diagnostic tests in 2013 |

CEO Comments

“PDI was able to execute well in 2013 within the context of a challenging CSO environment, said Nancy Lurker, CEO. “During the year, we successfully completed three key strategic initiatives: significantly upgrading internal systems for our CSO business; completing and launching our innovative new software platform, PD One; and most importantly for the company’s long term success, beginning the execution of our strategy to be a commercialization partner for companies in the molecular diagnostics industry. As we head into 2014, we believe we remain very well positioned in the CSO industry and we are excited about the long-term potential from our emerging PD One and Interpace Diagnostic initiatives.”

Ms. Lurker continued, “In terms of our 2014 outlook, which assumes a reasonable level of new business wins and no early termination of existing contracts, we anticipate revenue in our core business to be down slightly compared to 2013, as a result of fewer new opportunities being available and awarded in 2013. Gross profit dollars are projected to be approximately flat compared to 2013, as profit from higher margin offerings and continued improvements in cost of services offset much of the impact of lower revenue. Operating expenses are projected to be modestly lower than 2013 resulting in the projected annual operating loss being slightly better than 2013. Finally, full year 2014 adjusted EBITDA from the core business is projected to be slightly positive. This guidance excludes the impact of our Interpace Diagnostic business. We estimate a minimum level of expenses of $3 million and we do not foresee any material revenue in 2014. Expenses will be higher if we move to phase two of either of the current opportunities or we contract for new opportunities.”

“As we’ve stated previously, we are fully committed to be a leading company in the CSO industry and plan to maintain and grow our core business,” Ms. Lurker added. “At the same time, by leveraging our core business and infrastructure, we plan to prudently, but aggressively build a presence as a leading commercialization company for the molecular diagnostics industry.”

Fourth Quarter Business Review

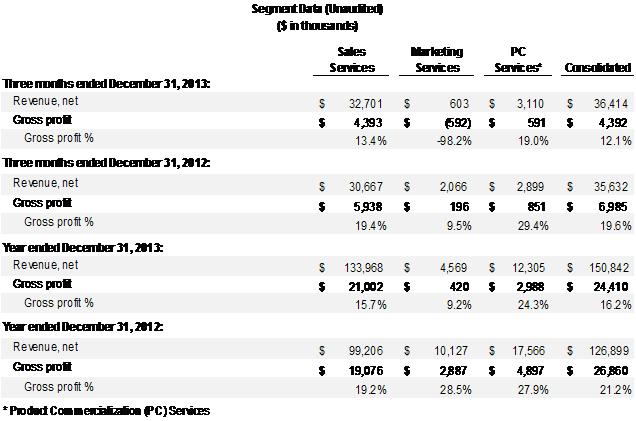

Revenue- For the fourth quarter of 2013, revenue of $36.4 million was $0.8 million or 2% higher than the fourth quarter of 2012 driven by an increase in the company’s Sales Services segment.

• | Sales Services revenue of $32.7 million was $2.0 million higher than the fourth quarter of 2012 driven by 2012 multi-year new contract wins being executed in 2013 and contracts won earlier in 2013. |

• | Marketing Services revenue of $0.6 million was $1.5 million lower than the fourth quarter of 2012 due primarily to fewer contract signings by Group DCA. |

• | Product Commercialization Services revenue of $3.1 million was $0.2 million higher than the fourth quarter of 2012. |

Gross Profit- For the fourth quarter of 2013, gross profit of $4.4 million was $2.6 million lower than the fourth quarter of 2012 and, as anticipated, the overall gross profit percentage decreased to 12% in 2013 from 20% in 2012.

• | Sales Services gross profit of $4.4 million was $1.5 million lower than the fourth quarter of 2012 due primarily to previously disclosed competitive pricing pressures. |

• | Marketing Services gross profit for the fourth quarter of 2013 was a negative $0.6 million due to the decrease in revenue and increased costs associated with the recently announced launch of our new product, PD OneTM. |

• | Product Commercialization Services gross profit of $0.6 million was $0.2 million lower compared to 2012 primarily due to expenses related to one of our collaboration agreements for a molecular diagnostic test. |

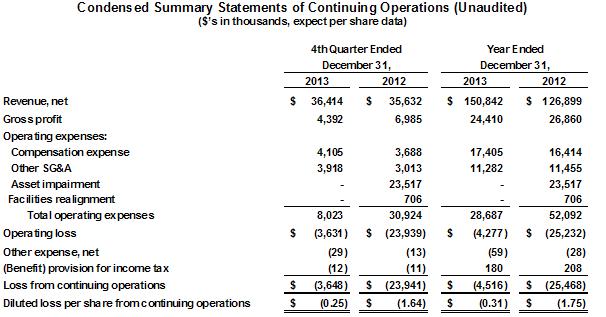

Total Operating Expenses- Total operating expenses for the fourth quarter of 2013 were $8.0 million as compared to $30.9 million for the same period in 2012. Included in fourth quarter 2012 expenses are $23.5 million of asset impairment and $0.7 million of facilities realignment charges. Excluding these items, total operating expenses for the fourth quarter of 2012 were $6.7 million; $1.3 million lower than 2013 operating expenses. The increase in 2013 operating expenses was primarily driven by costs related to our strategic initiatives, the two collaboration agreements, and an increase in incentive compensation partially offset by the company’s costs savings initiatives.

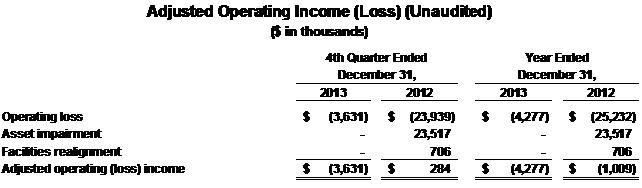

Operating Loss- The operating loss for the fourth quarter of 2013 was $3.6 million, compared to $23.9 million in the fourth quarter of 2012. Excluding the impact of the asset impairment and facility realignment charges, Adjusted Operating Income (a non-GAAP measure defined in the release) in the fourth quarter of 2012 was $0.3 million. The 2013 operating loss was primarily the result of the lower margins on new business and the company’s investment in strategic initiatives.

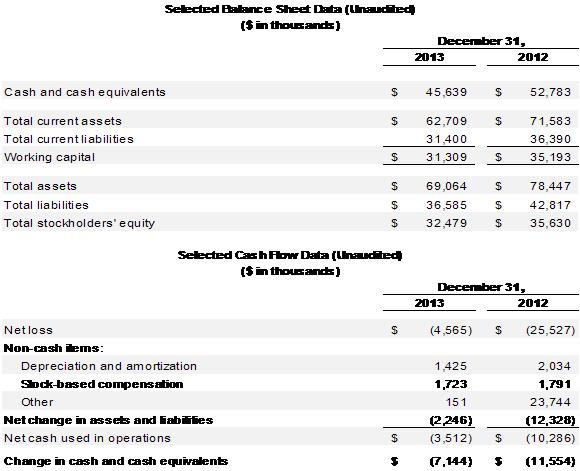

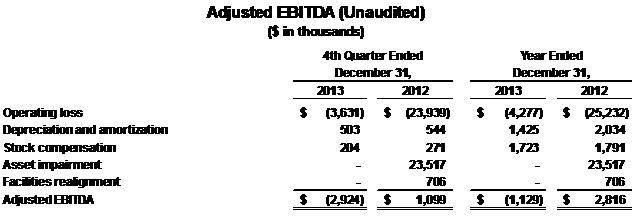

Liquidity and Cash Flow- Adjusted EBITDA (a non-GAAP measure defined in the release) for the fourth quarter of 2013 was $(2.9) million compared to $1.1 million in the fourth quarter of 2012. Cash and cash equivalents at the end of the year were $45.6 million, down $7.1 million from December 31, 2012 due primarily to working capital changes and cash used in our investments in strategic initiatives.

As of December 31, 2013, the company’s cash equivalents were predominantly invested in U.S. Treasury money market funds and the company had no commercial debt.

Non-GAAP Financial Measures

In addition to the United States generally accepted accounting principles, or GAAP, results provided throughout this document, PDI has provided certain non-GAAP financial measures to help evaluate the results of its performance. The company believes that these non-GAAP financial measures, when presented in conjunction with comparable GAAP financial measures, are useful to both management and investors in analyzing the company’s ongoing business and operating performance. The company believes that providing the non-GAAP information to investors, in addition to the GAAP presentation, allows investors to view the company’s financial results in the way that management views financial results.

In this document, the company discusses Adjusted Operating Income, a non-GAAP financial measure. Adjusted Operating Income is a metric used by management to measure the profitability of the ongoing business. Adjusted Operating Income is defined as operating loss, plus asset impairment and facilities realignment. The table below includes a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

In this document, the company also discusses Adjusted EBITDA, a non-GAAP financial measure. Adjusted EBITDA is a metric used by management to measure cash flow of the ongoing business. Adjusted EBITDA is defined as operating income or loss, plus depreciation and amortization, non-cash stock-based compensation, and other non-cash expenses. The table below includes a reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure.

Conference Call

As previously announced, PDI will hold a conference call Thursday, February 27, 2014 to discuss financial and operational results of the fourth quarter and year ended December 31, 2013. Details as follows:

Time: 5:00 PM (ET)

Dial-in numbers: (855) 592-8761 (U.S. and Canada) or (724) 924-4975

Conference ID#: 33034617

Live webcast: www.pdi-inc.com, under "Investor Relations"

The teleconference replay will be available three hours after completion through March 27, 2014 at (855) 859-2056 (U.S. and Canada) or (404) 537-3406. The replay pass code is 33034617. The archived web cast will be available for one year.

About PDI, Inc.

PDI is a leading health care commercialization company providing superior insight-driven, integrated multi-channel message delivery to established and emerging health care companies. The company is dedicated to enhancing engagement with health care practitioners and optimizing commercial investments for its clients by providing strategic flexibility, full product commercialization services, innovative multi-channel promotional solutions, and sales and marketing expertise. The Company has begun leveraging these substantial capabilities to become a commercialization partner for companies in the molecular diagnostics industry. For more information, please visit the company's website at http://www.pdi-inc.com.

Forward-Looking Statements

This press release contains forward-looking statements regarding future events and financial performance. These statements are based on current expectations and assumptions involving judgments about, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond PDI's control. These statements also involve known and unknown risks, uncertainties and other factors that may cause PDI's actual results to be materially different from those expressed or implied by any forward-looking statement. For example, with respect to statements regarding projections of future revenues, growth and profitability, actual results may differ materially from those set forth in this release based on the loss, early termination or significant reduction of any of our existing service contracts, the failure to meet performance goals in PDI's incentive-based arrangements with customers or the inability to secure additional business. Additionally, all forward-looking statements are subject to the risk factors detailed from time to time in PDI's periodic filings with the Securities and Exchange Commission, including without limitation, PDI's subsequently filed Annual Report on Form 10-K for the year ended December 31, 2013 and current reports on Form 8-K. Because of these and other risks, uncertainties and assumptions, undue reliance should not be placed on these forward-looking statements. In addition, these statements speak only as of the date of this press release and, except as may be required by law, PDI undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

(Tables to Follow)